UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of April, 2015

CANADIAN

PACIFIC RAILWAY LIMITED

(Commission File No. 1-01342)

(translation of Registrant’s name into English)

7550 Ogden

Dale Road S.E., Calgary, Alberta, Canada, T2C 4X9

(address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ¨ Form 40-F x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7): ¨

EXPLANATORY NOTE

On February 18, 2015, the registrant’s Performance Share Unit Plan for Eligible Employees of Canadian Pacific Railway Limited was

amended to include performance share units priced in United States dollars based on the price per share of Canadian Pacific Railway Limited common shares on the New York Stock Exchange. The Performance Share Unit Plan for Eligible Employees of

Canadian Pacific Railway Limited, dated February 18, 2015, is attached as exhibit 99.1 hereto.

This report on Form 6-K is being

filed with, and not furnished to, the Securities and Exchange Commission in order that this report on Form 6-K and the exhibits attached hereto are incorporated by reference into the registrant’s Registration Statement on Form S-8 (File

No. 333-188826) under the Securities Act of 1933, as amended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CANADIAN PACIFIC RAILWAY LIMITED |

|

|

|

|

| Date: April 24, 2015 |

|

|

|

By: |

|

/s/ Scott Cedergren |

|

|

|

|

|

|

Name: Scott Cedergren |

|

|

|

|

|

|

Title: Assistant Corporate Secretary |

DOCUMENTS FILED AS PART OF THIS REPORT ON FORM 6-K

|

|

|

|

|

| 99.1 |

|

Performance Share Unit Plan for Eligible Employees of Canadian Pacific Railway Limited, dated February 18, 2015. |

PERFORMANCE SHARE UNIT PLAN FOR ELIGIBLE EMPLOYEES

OF

CANADIAN PACIFIC

RAILWAY LIMITED

Adopted with effect from February 17, 2009, amended February 22, 2013, April 30, 2014

and February 18, 2015

| 1. |

PREAMBLE AND DEFINITIONS |

The Plan described in this document shall be called the

“Performance Share Unit Plan for Eligible Employees of Canadian Pacific Railway Limited”.

| |

1.2 |

Purposes of the Plan. |

The purposes of the Plan are:

| |

a. |

to promote a further alignment of interests between employees and the shareholders of the Corporation; |

| |

b. |

to associate a portion of employees’ compensation with the returns achieved by shareholders of the Corporation over the medium term; and |

| |

c. |

to attract and retain employees with the knowledge, experience and expertise required by the Corporation |

| |

d. |

to motivate and focus the executive’s attention on key performance drivers and indicators of the Corporation. |

| |

1.3.1 |

“Applicable Law” means any applicable provision of law, domestic or foreign, including, without limitation, applicable tax and securities legislation, together with all regulations, rules, policy

statements, rulings, notices, orders or other instruments promulgated thereunder, and Stock Exchange Rules. |

| |

1.3.2 |

“Beneficiary” means, subject to Applicable Law, an individual who has been designated by an Eligible Employee, in such form and manner as the Committee may determine, to receive benefits payable under

the Plan upon the death of the Eligible Employee, or, where no such designation is validly in effect at the time of death, the Eligible Employee’s legal representative. |

| |

1.3.3 |

“Board” means the Board of Directors of the Corporation. |

| |

1.3.4 |

“Cause” in respect of an Eligible Employee means |

| |

(a) |

the continued failure by the Eligible Employee to substantially perform his or her duties in connection with his or her employment by, or service to, the Corporation or any Subsidiary (other than as a result of physical

or mental illness) after the Corporation or any Subsidiary has given the Eligible Employee reasonable written notice of such failure and a reasonable opportunity to correct it; |

| |

(b) |

the engaging by the Eligible Employee in any act which is materially injurious to the Corporation or its reputation, financially or otherwise; |

| |

(c) |

the engaging by the Eligible Employee in any act resulting or intended to result, directly or indirectly, in personal gain to the Eligible Employee at the expense of the Corporation; |

| |

(d) |

the conviction of the Eligible Employee by a court of competent jurisdiction on any charge involving fraud, theft or moral turpitude by the Eligible Employee in connection with business of the Corporation; or

|

| |

(e) |

any other conduct that constitutes “cause” at common law. |

| |

1.3.5 |

“Change in Control” means the occurrence of any of the following events: |

| |

(a) |

the initial acquisition by any person, or any persons acting jointly or in concert (as determined by the Securities Act (Alberta)), whether directly or indirectly, of voting securities of the Corporation which,

together with all other voting securities of the Corporation held by such person or persons, constitutes, in the aggregate, more than 20% of all outstanding voting securities of the Corporation; |

| |

(b) |

an amalgamation, arrangement, or other form of business combination of the Corporation with another corporation which results in the holders of voting securities of that other corporation holding, in the aggregate, more

than 50% of all outstanding voting securities of the corporation resulting from the business combination; |

| |

(c) |

a sale, disposition, lease or exchange to or with another person or persons (other than a Subsidiary) of property of the Corporation representing 50% or more of the net book value of the assets of the Corporation,

determined as of the date of the most recently published audited annual or unaudited quarterly interim financial statements of the Corporation; or |

| |

(d) |

a change in the composition of the Board over any twelve month period commencing after the applicable Grant Date such that more than 50% of the persons who were directors of the Corporation at the beginning of the

period are no longer directors at the end of the period, unless such change is as a result of normal attrition |

| |

1.3.6 |

“Committee” means the Management Resources and Compensation Committee of the Board or such other committee of the Board which may

|

be appointed by the Board to, among other things, interpret, administer and implement the Plan.

| |

1.3.7 |

“Corporation” means Canadian Pacific Railway Limited and any successor corporation whether by amalgamation, merger or otherwise. |

| |

1.3.8 |

“Disability” means an Eligible Employee’s physical or mental incapacity that prevents him from substantially fulfilling his duties and obligations on behalf of the Corporation or, if applicable, a

Subsidiary, and in respect of which the Eligible Employee commences receiving, or is eligible to receive, disability benefits under the Corporation’s or a Subsidiary’s short-term or long-term disability plan. |

| |

1.3.9 |

“Disability Date” means, in relation to an Eligible Employee, that date on which the Corporation determines that the Eligible Employee is suffering from Disability. |

| |

1.3.10 |

“Eligible Employee” means such employee of the Corporation or a Subsidiary as the Committee may designate as eligible to participate in the Plan. |

| |

1.3.11 |

“Employed” means, with respect to an Eligible Employee: |

| |

(a) |

who is granted PSUs under the Plan with a Grant Date prior to January 1, 2014: |

| |

(i) |

that he is performing work at a workplace of the Corporation or a Subsidiary or at one or more locations approved by the Corporation or a Subsidiary (in this Section 1.3.11, an “approved workplace”); or

he is not actively at work at an approved workplace due to an approved leave of absence where the period of leave is less than three months; or |

| |

(ii) |

that he is not actively at work at an approved workplace due to an approved leave of absence where the period of leave is or is expected to be at least three months, maternity or parental leave or Disability.

|

| |

(b) |

who is granted PSU’s under the Plan with a Grant Date of January 1, 2014 or later: |

| |

(i) |

that he is performing work at a workplace of the Corporation or a Subsidiary or at one or more locations approved by the Corporation or a Subsidiary;

or he is not actively at work at an approved workplace due to an approved leave of absence where (A) the period of leave is |

with pay (including Disability); or (B) where the period of leave is without pay and is 12 months or less; or

| |

(ii) |

that he is not actively at work at an approved workplace due to an approved leave of absence without pay where the period of leave is or is expected to be greater than twelve months; |

For greater certainty, except as expressly provided herein, an individual whose employment has been terminated without Cause by the

Corporation or a Subsidiary shall not be considered to be “Employed” for purposes of the Plan during any statutory, contractual or common law notice period and shall be considered to have ceased to be “Employed” for purposes of

the Plan on the date on which he or she receives notice of termination of employment from the Corporation or a Subsidiary, as the case may be. Notwithstanding the foregoing, an individual who receives a notice of termination of employment from the

Corporation or a Subsidiary shall continue to be considered “Employed” for the purposes of the Plan while he continues to perform work at a workplace of the Corporation or a Subsidiary during a working notice period.

| |

1.3.12 |

“Grant” means a grant of PSUs made pursuant to Section 4.1. |

| |

1.3.13 |

“Grant Agreement” means an agreement between the Corporation and an Eligible Employee under which a PSU is granted, as contemplated by Section 4.1, together with such schedules, amendments,

deletions or changes thereto as are permitted under the Plan. |

| |

1.3.14 |

“Grant Date” means the effective date of a Grant. |

| |

1.3.15 |

“Market Value” means, with respect to any particular date, the average closing price per Share on the Stock Exchange during the immediately preceding 30 Trading Days. |

| |

1.3.16 |

“Performance Criteria” means such financial and/or personal performance criteria as may be determined by the Committee in respect of a Grant to any Eligible Employee or Eligible Employees and set out in

a Grant Agreement. Performance Criteria may apply to the Corporation, a Subsidiary, the Corporation and its Subsidiaries as a whole, a business unit of the Corporation or group comprised of the Corporation and some of its Subsidiaries or a group of

Subsidiaries, either individually, alternatively or in any combination, and measured in total, incrementally or cumulatively over a specified performance period, on an absolute basis or relative to a pre-established target, to previous years’

results or to a designated comparator group, or otherwise. |

| |

1.3.17 |

“Performance Period” means, with respect to a Grant, the period commencing on January 1 of the year that includes the Grant Date of the Grant and ending on December 31 of the second calendar

year after the year that includes the Grant Date of the Grant. |

| |

1.3.18 |

“Plan” means this Performance Share Unit Plan for Eligible Employees of Canadian Pacific Railway Limited, including any schedules or appendices hereto, as amended from time to time. |

| |

1.3.19 |

“PSU” means a right, granted to an Eligible Employee in accordance with Section 4 hereof, to receive the Market Value of one Share, that becomes Vested, if at all, subject to the attainment of

Performance Criteria and satisfaction of such other conditions to Vesting, if any, as may be determined by the Committee. |

| |

1.3.20 |

“PSU Account” has the meaning set out in Section 5.1. |

| |

1.3.21 |

“Retirement” means the Eligible Employee’s cessation of employment with the Corporation or a Subsidiary, as applicable, at or after the normal or early retirement age established by the Corporation

or a Subsidiary from time to time, where the Eligible Employee gives notice to the Corporation or a Subsidiary in accordance with the retirement policy established by the Corporation or a Subsidiary form time to time. |

| |

1.3.22 |

“Settlement Date” means, with respect to a Grant, the date following the end of the Performance Period for such Grant fixed by the Committee for settlement of PSUs covered by such Grant that have

Vested. |

| |

1.3.23 |

“Share” means a common share of the Corporation and such other share as may be substituted for it as a result of amendments to the articles of the Corporation, arrangement, reorganization or otherwise,

including any rights that form a part of the common share or substituted share. |

| |

1.3.24 |

“Stock Exchange” means the Toronto Stock Exchange with respect to PSUs granted to Eligible Employees paid in Canadian dollars, and the New York Stock Exchange with respect to PSUs granted to

Eligible Employees paid in United States dollars, or if the Shares are not listed on the Toronto Stock Exchange or the New York Stock Exchange, such other stock exchange on which the Shares are listed, or if the Shares are not listed on any stock

exchange, then on the over-the-counter market. |

| |

1.3.25 |

“Stock Exchange Rules” means the applicable rules of any stock exchange upon which shares of the Corporation are listed. |

| |

1.3.26 |

“Subsidiary” means any corporation that is a subsidiary of the Corporation as defined in the Securities Act (Alberta). |

| |

1.3.27 |

“Termination” or “Date of Termination” (or any derivative thereof) shall mean (i) the date of termination of an Eligible Employee’s active employment with the Corporation or a

Subsidiary (other than in connection with the Participant’s transfer to employment with the Corporation or another Subsidiary), being the date on which the Eligible Employee ceases to render services to the Corporation or Subsidiary, as

applicable, whether such termination is lawful or otherwise, without giving effect to any period of notice or compensation in lieu of notice, but not including any period during which the Eligible Employee remains Employed within the meaning of

Section 1.3.11, and (ii) in the case of an Eligible Employee who does not return to active employment with the Corporation or a Subsidiary immediately following a period of absence due to vacation, temporary illness, authorized leave of

absence or Disability, the last day of such period of absence. |

| |

1.3.28 |

“Trading Day” means any date on which both the Toronto Stock Exchange and the New York Stock Exchange are open for the trading of Shares and on which Shares are actually traded. |

| |

1.3.29 |

“Vested” (or any applicable derivative term) shall mean, with respect to a PSU, that the applicable conditions with respect to continued employment, passage of time, achievement of Performance Criteria

as determined by the Committee and/or any other conditions established by the Committee have been satisfied or, to the extent permitted under the Plan, waived, whether or not the Eligible Employee’s rights with respect to such PSUs may be

conditioned upon prior or subsequent compliance with any confidentiality, non-competition or non-solicitation obligations. |

| 2. |

CONSTRUCTION AND INTERPRETATION |

| |

2.1 |

Gender, Singular, Plural. In the Plan, references to the masculine include the feminine; and references to the singular shall include the plural and vice versa, as the context shall require.

|

| |

2.2 |

Governing Law. The Plan shall be governed and interpreted in accordance with the laws of the Province of Alberta and any actions, proceedings or claims in any way pertaining to the Plan shall be commenced

in the courts of the Province of Alberta. |

| |

2.3 |

Severability. If any provision or part of the Plan is determined to be void or unenforceable in whole or in part, such determination shall not affect the validity or enforcement of any other provision or

part thereof. |

| |

2.4 |

Headings, Sections. Headings wherever used herein are for reference purposes only and do not limit or extend the meaning of the provisions herein contained. A reference to a section or schedule shall,

except where expressly stated otherwise, mean a section or schedule of the Plan, as applicable. |

| 3. |

EFFECTIVE DATE AND EMPLOYMENT RIGHTS |

| |

3.1 |

Effective Date. The Corporation is establishing the Plan effective on February, 17, 2009. |

| |

3.2 |

No Employment Rights. Nothing contained in the Plan shall be deemed to give any person the right to be retained as an employee of the Corporation or of a Subsidiary. |

| 4. |

GRANTS AND PERFORMANCE CRITERIA |

| |

4.1 |

Grant of PSUs. Each Eligible Employee may receive a Grant of PSUs in such number as may be specified by the Committee, with effect from such date(s) as the Committee may specify. Each grant and the

participation of an Eligible Employee in the Plan shall be evidenced by a Grant Agreement between the Corporation and the Eligible Employee in the form approved by the Committee. Each Grant Agreement shall set forth, at a minimum, the type and Grant

Date of the Grant evidenced thereby, the number of PSUs subject to such Grant, the applicable Vesting conditions, the applicable Performance Criteria, the applicable Performance Period(s) and the treatment of the Grant upon Termination and may

specify such other terms and conditions consistent with the terms of the Plan as the Committee shall determine or as shall be required under any other provision of the Plan. The Committee may include in a Grant Agreement terms or conditions

pertaining to confidentiality of information relating to the Corporation’s operations or businesses which must be complied with by an Eligible Employee including as a condition of the grant or Vesting of PSUs. |

| |

4.2 |

Vesting Terms. PSUs shall become Vested at such times, in such installments and subject to such terms and conditions as may be determined by the Committee and set forth in the applicable Grant Agreement,

provided that the conditions to Vesting of PSUs shall be based on the satisfaction of Performance Criteria either alone or in addition to any other Vesting conditions as may be determined by the Committee and may be graduated such that different

percentages (which may be greater or less than 100%) of the PSUs credited to an Eligible Employee’s PSU Account on a particular Grant Date will become Vested depending upon the extent to which one or more such conditions are satisfied.

|

| |

4.3 |

Administration. The Committee shall administer the Plan in accordance with its terms. Subject to and consistent with the terms of the Plan, in addition to any authority of the Committee specified under any

other terms of the Plan, the Committee shall have full and complete discretionary authority to: |

| |

(i) |

interpret the Plan and Grant Agreements; |

| |

(ii) |

prescribe, amend and rescind such rules and regulations and make all determinations necessary or desirable for the administration and interpretation of the Plan and Grant Agreements; |

| |

(iii) |

determine those Eligible Employees who may be granted PSUs, grant one or more PSUs to such Eligible Employees and approve or authorize the applicable form and terms of the related Grant Agreements; |

| |

(iv) |

determine the terms and conditions of PSUs granted to any Participant, including, without limitation, (A) the number of PSUs subject to a Grant, (B) the Performance Period(s) applicable to a Grant,

(C) the conditions to the Vesting of any PSUs granted hereunder, including terms relating to the Performance Period for PSUs and the conditions, if any, upon which Vesting of any PSU will be waived or accelerated without any further action by

the Committee, (D) the circumstances upon which a PSU shall be forfeited, cancelled or expire and (E) the consequences of a Termination with respect to a PSU; |

| |

(v) |

determine whether and the extent to which any Performance Criteria or other conditions applicable to the Vesting of an PSU have been satisfied or shall be waived or modified; |

| |

(vi) |

amend the terms of any outstanding PSU granted under the Plan or Grant Agreement provided that such amendment shall not materially adversely affect the rights of any Eligible Employee, without the consent of the

Eligible Employee or except as provided in Section 4.3(v), with respect to PSUs that have been granted as of the date on which the amendment is made; |

| |

(vii) |

determine whether, and the extent to which, adjustments shall be made pursuant to Section 5.3 and the terms of any such adjustments. |

| |

4.4 |

Discretion of the Committee. Notwithstanding any other provision hereof or of any applicable instrument of grant, the Committee may accelerate or waive any condition to the Vesting of any Grant, all

Grants, any class of Grants or Grants held by any group of Eligible Employees |

| |

4.5 |

Effects of Committee’s Decision. Any interpretation, rule, regulation, determination or other act of the Committee hereunder shall be made in its sole discretion and shall be conclusively binding upon

all persons. |

| |

4.6 |

Liability Limitation. No member of the Committee or the Board of Directors shall be liable for any action or determination made in good faith pursuant to the Plan or any instrument of grant evidencing any

PSU granted under the Plan. To the fullest extent permitted by law, the Corporation and its Subsidiaries shall indemnify and save harmless each person made, or threatened to be made, a party to any action or proceeding in respect of the Plan by

reason of the fact that such person is or was a member of the Committee or is or was a member of the Board of Directors. |

| |

4.7 |

Delegation and Administration. The Committee may, in its discretion, delegate such of its powers, rights and duties under the Plan, in whole or in part, to any committee or any one or more directors,

officers or employees of the Corporation as it may determine from time to time, on terms and conditions as it may determine, except the Committee shall not, and shall not be permitted to, delegate any such powers, rights or duties to the extent such

delegation is not consistent with Applicable Law. The Committee may also appoint or engage a trustee, custodian or administrator to administer or implement the Plan or any aspect of it, except that the Committee shall not, and shall not be permitted

to, appoint or engage such a trustee, custodian or administrator to the extent such appointment or engagement is not consistent with Applicable Law. |

| 5. |

ACCOUNTS, DIVIDEND EQUIVALENTS AND REORGANIZATION |

| |

5.1 |

PSU Account. An account, called a “PSU Account”, shall be maintained by the Corporation, or a Subsidiary, as specified by the Committee, for each Eligible Employee and will be credited with such

notional grants of PSUs as are received by an Eligible Employee from time to time pursuant to Section 4.1 and any dividend equivalent PSUs pursuant to Section 5.2. PSUs that fail to vest pursuant to Section 6, or that are paid out to

the Eligible Employee or his Beneficiary, shall be cancelled and shall cease to be recorded in the Eligible Employee’s PSU Account as of the date on which such PSUs are forfeited or cancelled under the Plan or are paid out, as the case may be.

|

| |

5.2 |

Dividend Equivalent PSUs. Unless otherwise specified in the Grant Agreement each Grant shall be deemed to provide for the accrual of dividend equivalent amounts for the account of an Eligible Employee as

hereinafter provided with respect to cash dividends paid in the ordinary course to shareholders in respect of outstanding Shares. Subject to the terms of the Grant Agreement, if and when cash dividends are paid with respect to Shares (other than any

extraordinary dividend) to shareholders of record as of a record date occurring during the period from the Grant Date to the Settlement Date under the Grant Agreement, a number of additional PSUs shall be granted to the Eligible Employee who is a

party to such Grant Agreement equal to the product of (i) the cash dividend paid with respect to a Share multiplied by (ii) the number of PSUs subject to such Grant as of the record date for the dividend, divided by the closing price of a

Share on the Stock Exchange on the date on which the dividend is paid. The additional PSUs granted to a Participant shall be subject to the same terms and conditions, including Vesting and settlement terms, as the corresponding PSUs.

|

| |

5.3 |

Adjustments. In the event of any stock dividend, stock split, combination or exchange of Shares, merger, consolidation, spin-off or other distribution (other than normal cash dividends) of the

Corporation’s assets to shareholders, or any other change in the capital of the Corporation affecting the Shares, such proportionate adjustments, if any, as the Committee in its discretion may deem appropriate to reflect such change, shall be

made with respect to the number of PSUs outstanding under the Plan. |

| 6. |

VESTING AND SETTLEMENT OF SHARE UNITS |

| |

6.1 |

Settlement. Subject to Section 6.7, PSUs relating to a Performance Period shall be settled upon or as soon as reasonably practicable following the end of the Performance Period applicable to such

PSUs, and in any event prior to December 31 of the calendar year immediately following the Performance Period, subject to the Committee’s determination of the extent to which the Performance Criteria or other Vesting conditions, if any,

for such Performance Period have been satisfied. Settlement of Vested PSUs shall be made by payment in cash or in CP Common Shares at the discretion of the Chief Executive Officer, subject to payment or other satisfaction of all related withholding

obligations in accordance with Section 9.2 and the terms of the applicable Grant Agreement, of an aggregate amount equal to the product of: |

| |

A |

the Market Value on the last day of the Performance Period, |

multiplied by

| |

B |

the number of PSUs then being settled. |

| |

6.2 |

Failure to Vest and Minimum Participation Period. For greater certainty, an Eligible Employee must be Employed in accordance with Section 1.3.11(a)(i) or 1.3.11(b)(i), as applicable, (rounded up to

the nearest whole number of months) for a minimum participation period of six (6) months during a Performance Period to receive a cash payment or any other compensation for Vested PSUs. Any period of a leave of absence, with or without pay,

will not count towards such minimum participation period. Further, an Eligible Employee shall have no right to receive a cash payment or any other compensation with respect to any PSUs that do not Vest. |

| |

6.3 |

Continued Employment. Subject to Sections 4.3, 6.4, 6.5, 6.6 and Section 6.7, Vested PSUs relating to a Grant shall be settled in accordance with Section 6.1 provided that the Eligible Employee

is Employed on the Settlement Date in respect of such Grant. For greater certainty, an Eligible Employee shall not be considered to be Employed on a Settlement Date if, prior to such Settlement Date, such Eligible Employee received a payment in lieu

of notice of Termination of employment, whether under a contract of employment, as damages or otherwise. Further, in the event an Eligible Employee has been Employed in accordance with Section 1.3.11(a)(ii) or 1.3.11(b)(ii), as applicable,

during the Performance Period in respect of a Grant, the number of PSUs relating to such Grant that become Vested shall be determined by the formula A x B/C, where: |

| |

A |

equals the total number of PSUs relating to such Grant that would have Vested had the Eligible Employee been Employed in accordance with Section 1.3.11(a)(i) or 1.3.11(b)(i), as applicable, throughout such

Performance Period; |

| |

B |

equals the total number of months during such Performance Period in which the Eligible Employee was actively Employed in accordance with Section 1.3.11(a)(i) or 1.3.11(b)(i), as applicable, (rounded up to the

nearest whole number of months); and |

| |

C |

equals total number of months in the Performance Period relating to such Grant. |

| |

6.4 |

Termination of Employment for Cause and Resignation. In the event an Eligible Employee’s employment is Terminated for Cause by the Corporation, or a Subsidiary, as applicable, or the Eligible Employee

otherwise ceases to be Employed for any reason other than as provided in Section 6.5 prior to the Settlement Date relating to a Grant, no PSUs relating to such Grant and no dividend equivalent PSUs in respect of such PSUs shall Vest.

|

| |

6.5 |

Termination of Employment without Cause, Death or Disability. Unless otherwise determined by the Committee, subject to Section 6.7, in the event an Eligible Employee ceases to be Employed by reason of

Termination of employment without Cause, death or Disability prior to the end of the Performance Period relating to a Grant, a number of PSUs (in this Section 6.5 such PSUs referred to as the “Pro-Rated PSUs”) determined by the

formula A x B/C, where |

| |

A |

equals the total number of PSUs relating to such Grant, being the number of PSUs credited to the Eligible Employee’s PSU Account as at the Grant Date in respect of such Grant, without giving effect to any potential

increase or decrease in such number as a result of graduated Vesting conditions pursuant to clause (iv) of Section 4.3; |

| |

B |

equals the total number of months between the first day of the Performance Period for such Grant and the date the Eligible Employee ceases to be Employed (rounded up to the nearest whole number of months); and

|

| |

C |

equals total number of months in the Performance Period relating to such Grant, |

together

with any dividend equivalent PSUs relating to such Pro-Rated PSUs shall be eligible to become Vested PSUs subject to satisfaction or waiver by the Committee of the Performance Criteria relating to such Grant. Pro-Rated PSUs together with any

dividend equivalent PSUs relating to such Pro-Rated PSUs under this Section 6.5 that become Vested PSUs shall be settled in accordance with Section 6.1.

| |

6.6 |

Retirement Unless otherwise determined by the Committee, subject to Section 6.7, in the event an Eligible Employee ceases to be Employed by reason of Retirement prior to the end of the Performance

Period relating to a Grant: |

| |

(a) |

with respect to a Grant with a Grant Date prior to January 1, 2014, a number of PSUs (in this Section 6.6 such PSUs referred to as the “Pro-Rated PSUs”) determined by the formula A x B/C, where

|

| |

A |

equals the total number of PSUs relating to such Grant, being the number of PSUs credited to the Eligible Employee’s PSU Account as at the Grant Date in respect of such Grant, without giving effect to any potential

increase or decrease in such number as a result of graduated Vesting conditions pursuant to clause (iv) of Section 4.3; |

| |

B |

equals the total number of months between the first day of the Performance Period for such Grant and the date of Retirement (rounded up to the nearest whole number of months); and |

| |

C |

equals total number of months in the Performance Period relating to such Grant, |

together

with any dividend equivalent PSUs relating to such Pro-Rated PSUs shall be eligible to become Vested PSUs subject to satisfaction or waiver by the Committee of the Performance Criteria relating to such Grant. Pro-Rated PSUs together with any

dividend equivalent PSUs relating to such Pro-Rated PSUs that become Vested PSUs shall be settled in accordance with Section 6.1; and

| |

(b) |

with respect to a Grant with a Grant Date of January 1, 2014 or later, a number of PSUs together with any dividend equivalent PSUs relating to such PSUs, shall become Vested PSUs on the last day of such Performance

Period that would have vested pursuant to the Plan and the Grant Agreement applicable to such Grant had the Eligible Employee remained Employed until the end of such Performance Period. All such Vested PSUs shall be settled in accordance with

Section 6.1. |

| |

6.7 |

Change in Control. . In the event of a Change in Control prior to the end of the Performance Period for a Grant, PSUs subject to such Grant shall not be affected and shall continue to vest as per the terms

hereof, unless an Eligible Employee ceases to be Employed by reason of a termination of employment without Cause after such Change in Control. If this occurs a number of PSUs determined by the formula A x B/C, where |

| |

A |

equals the total number of PSUs relating to such Grant; |

| |

B |

equals the total number of months between the first day of the Performance Period for such Grant and the Termination Date (rounded up to the nearest whole number of months); and |

| |

C |

equals total number of months in the Performance Period relating to such Grant, |

shall become

Vested PSUs on the applicable vesting date provided that, for the purpose of factor A, the total number of PSUs relating to such Grant shall be the number of PSUs credited to the Eligible Employee’s PSU Account as at the Grant Date in respect

of such Grant, without giving effect to any potential increase or decrease in such number as a result of graduated Vesting conditions pursuant to clause (iv) of Section 4.2, together with any related dividend equivalent PSUs credited to

the Eligible Employee’s PSU Account at the effective date of the Change in Control. PSUs that become Vested PSUs in connection with a Change in Control shall be settled by payment in cash, subject to payment or other satisfaction of all related

withholding obligations in accordance with Section 9.2 and the terms of the applicable Grant Agreement, of an aggregate amount equal to the product of:

| |

A |

the Market Value on the effective date of the Change in Control, |

multiplied by

| |

B |

the number of Vested PSUs determined in accordance with this Section 6.7. |

| |

7.1 |

Currency. Except where expressly provided otherwise, all references in the Plan to currency refer to lawful Canadian currency. |

| |

8.1 |

No Rights to Shares. PSUs are not Shares and the grant of PSUs will not entitle an Eligible Employee to any shareholder rights, including, without limitation, voting rights, dividend entitlement or rights

on liquidation. |

| |

9.1 |

Compliance with Laws and Policies. The Corporation’s issuance of any PSUs and its obligation to make any payments is subject to

compliance with Applicable Law. Each Eligible Employee shall acknowledge and agree (and shall be conclusively deemed to have so acknowledged and agreed by participating in the Plan) that the Eligible Employee will, at all times, act in strict

compliance with Applicable Law and all other laws and any policies of the Corporation applicable to |

the Eligible Employee in connection with the Plan including, without limitation, furnishing to the Corporation all information and undertakings as may be required to permit compliance with

Applicable Law.

| |

9.2 |

Withholdings. So as to ensure that the Corporation or a Subsidiary, as applicable, will be able to comply with the applicable provisions of any federal, provincial, state or local law relating to the

withholding of tax or other required deductions, including on the amount, if any, includable in the income of an Eligible Employee, the Corporation, or a Subsidiary, as applicable, shall withhold or cause to be withheld from any amount payable to an

Eligible Employee, either under this Plan, or otherwise, such amount as may be necessary to permit the Corporation or the Subsidiary, as applicable, to so comply. |

| |

9.3 |

No Additional Rights. Neither the designation of an employee as an Eligible Employee nor the grant of any PSUs to any Eligible Employee entitles any person to the grant, or any additional grant, as the

case may be, of any PSUs under the Plan. |

| |

9.4 |

Amendment, Termination. The Plan may be amended or terminated at any time by resolution of the Board in whole or in part, without the consent of any Eligible Employee, provided that no such amendment or

termination may materially adversely affect the rights of any such Eligible Employee, without the consent of the Eligible Employee, with respect to PSUs that have been granted as of the date on which the amendment or termination resolution is made.

|

| |

9.5 |

Administration Costs. The Corporation will be responsible for all costs relating to the administration of the Plan. |

| |

9.6 |

Unfunded Obligation. The obligation to make payments that may be required to be made under the Plan will be an unfunded and unsecured obligation of the Corporation or a Subsidiary, as applicable unless

otherwise determined by the Corporation. The Plan, or any provision thereunder, shall not create (or be construed to create) any trust or other obligation to fund or secure amounts payable under the Plan in whole or in part. |

| |

10.1 |

Assignment. The assignment or transfer of the PSUs, or any other benefits under this Plan, shall not be permitted other than by operation of law. |

February 18, 2015

/s/ Peter Edwards

Peter Edwards

Vice-President, Human Resources and Labour

Relations

Canadian Pacific Railway Company

Appendix A

Supplemental Provisions Applicable to U.S. Taxpayers

To the extent an Eligible Employee is granted PSUs that are subject to taxation under the U.S. Internal Revenue Code of 1986, as amended (the “U.S.

Code”), such PSUs shall be subject to the provisions set forth in this Appendix A.

A-1. Notwithstanding Section 6.1 of the Plan, PSUs relating

to a Performance Period and settled pursuant to Section 6.1 shall in all events be settled during the first calendar year beginning after the last day of the Performance Period.

A-3. All PSUs that are subject to this Appendix A are intended to comply with the requirements of Section 409A of the U.S. Code, and the Plan and this

Appendix A shall be interpreted and construed consistently with such intent; provided that in no event shall the Corporation be responsible for any taxes or penalties under Section 409A of the U.S. Code that arise in connection with any amounts

payable under this Plan.

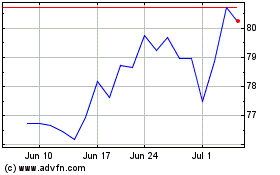

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Mar 2024 to Apr 2024

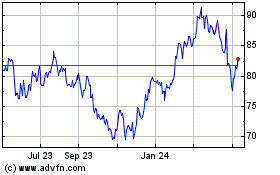

Canadian Pacific Kansas ... (NYSE:CP)

Historical Stock Chart

From Apr 2023 to Apr 2024