| As filed with the Securities

and Exchange Commission on April 22, 2015 |

Registration

No. 333-203284 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________

Amendment No. 1 to

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_________________

Lion Biotechnologies, Inc.

(Exact name of registrant as specified

in its charter)

_________________

|

Nevada

(State or other jurisdiction

of

incorporation or organization) |

75-3254381

(I.R.S. Employer

Identification Number) |

21900 Burbank Blvd, Third Floor,

Woodland Hills, California 91367

(818) 992-3126

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

_________________

Elma Hawkins, Ph.D.

Lion Biotechnologies, Inc.

21900 Burbank Boulevard, Third Floor

Woodland Hills, California 91367

(818) 992-3126

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

_________________

With copies to:

Istvan Benko

TroyGould PC

1801 Century Park East, 16th Floor

Los Angeles, California 90067

(310) 553-4441

_________________

Approximate date of commencement of proposed sale to the

public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans, check the following box. ¨

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. þ

If this Form is filed to register additional securities for

an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General

Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to

Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated

filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

| Large accelerated

filer ¨ |

Accelerated

filer þ |

Non-accelerated

filer ¨ |

Smaller

reporting company ¨ |

| |

|

(Do not check if a smaller reporting company) |

|

CALCULATION OF REGISTRATION FEE

| Title of each class

of securities to be registered | |

Amount

to be registered(1) | | |

Proposed

maximum offering price per share(2) | | |

Proposed

maximum aggregate offering price(2) | | |

Amount of

registration fee | |

| Common Stock, $0.000041666 par value per share | |

| 9,586,879 | | |

$ | 11.84 | | |

$ | 113,271,850

| | |

$ | 13,163

| |

| (1) | Pursuant to Rule 416 under the Securities Act of 1933, the shares being registered on this registration statement include such

indeterminate number of shares of common stock as may be issuable with respect to the shares being registered on this registration

statement as a result of stock splits, stock dividends or similar transactions. |

| (2) | The amount of the registration fee

consists of (i) $13,004, previously paid on April 8, 2015, in respect of 9,471,879

shares based on a proposed maximum offering price of $11.82 per share, which was the

price per share based upon the average of the high and low sale prices of the common

stock as reported on The NASDAQ Global Market on March 31, 2015, and (ii) $159,

in respect of an additional 115,000 shares registered hereunder based on a proposed maximum

offering price of $11.84 per share, which was the average of the high and low sale prices

of the common stock as reported on The NASDAQ Global Market on April 20, 2015.

|

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment

which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant

to said Section 8(a), may determine.

The information in this prospectus is not complete

and may be changed. We may not sell these securities until the registration statement filed with Securities and Exchange Commission

is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in

any state where the offer or sale is not permitted.

Subject To Completion, Dated April

22, 2015

PROSPECTUS

LION BIOTECHNOLOGIES, INC.

9,586,879 Shares of Common Stock

Offered By Selling Stockholders

This prospectus relates to shares of

our common stock to offered for resale by the selling stockholders listed under “Selling Stockholders” on page 4 of

this prospectus.

We are not selling any shares of common

stock under this prospectus, and will not receive any proceeds from the sale of the shares offered by the selling stockholders.

We will pay all fees and expenses incurred in connection with the registration of the shares of common stock offered by this prospectus,

and the selling stockholders will pay any brokerage or underwriting commissions or discounts or other expenses relating to the

sale of these shares.

The selling stockholders or their donees,

pledgees or other transferees may sell or otherwise transfer the shares of common stock offered by this prospectus from time to

time in the public market or in privately negotiated transactions, either directly or through broker-dealers or underwriters, at

fixed prices, at prevailing market prices at the time of sale, at prices relating to the prevailing market prices, at varying prices

determined at the time of sale or at negotiated prices. See “Plan of Distribution” beginning on page 6 of this prospectus

for more information about how the selling stockholders may sell or otherwise transfer their shares of common stock.

Our common stock is traded on The NASDAQ

Global Market under the symbol “LBIO.” On April 21, 2015, the last reported sale price of our common stock on The

NASDAQ Global Market was $12.00 per share.

Investing in our securities involves risks. See the “Risk

Factors” beginning on page 4 of this prospectus.

Neither the Securities and Exchange Commission nor any

state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus.

Any representation to the contrary is a criminal offense.

The date of this prospectus is ______,

2015.

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed on behalf of the selling stockholders with the Securities and Exchange Commission, or the SEC, to permit

the selling stockholders to sell the shares described in this prospectus in one or more transactions. The selling stockholders

and the plan of distribution of the shares being offered by them are described in this prospectus under the headings “Selling

Stockholders” and “Plan of Distribution.”

As permitted by the rules and regulations

of the SEC, the registration statement filed by us includes additional information not contained in this prospectus. You may read

the registration statement and the other reports we file with the SEC at the SEC’s web site or its offices described below

under the heading “Where You Can Find More Information.”

You should rely only on the information

that is contained in this prospectus or that is incorporated by reference into this prospectus. We and the selling stockholders

have not authorized anyone to provide you with information that is in addition to or different from that contained in, or incorporated

by reference into, this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it.

The shares of common stock offered by this

prospectus are not being offered in any jurisdiction where the offer or sale of such common stock is not permitted. You should

not assume that the information contained in, or incorporated by reference into, this prospectus is accurate as of any date other

than the date of this prospectus or, in the case of the documents incorporated by reference, the date of such documents, regardless

of the date of delivery of this prospectus or any sale of the common stock offered by this prospectus. Our business, financial

condition, liquidity, results of operations and prospects may have changed since those dates.

Unless the context otherwise requires, references

in this prospectus to “the company,” “we,” “us” and “our” refer to Lion Biotechnologies,

Inc.

PROSPECTUS SUMMARY

This summary highlights selected information

appearing elsewhere in this prospectus or incorporated by reference in this prospectus and does not contain all of the information

that may be important to you or that you should consider before investing in our common stock. This prospectus includes or incorporates

by reference information about the common stock being offered by the selling stockholders, as well as information regarding our

business and industry and detailed financial data. Before making an investment decision, you should read this prospectus and the

information incorporated by reference herein in their entirety, including “Risk Factors” beginning on page 4 of this

prospectus.

All references to the number of shares

issued or outstanding in this prospectus, and all per share and other similar data, reflect a 1-for-100 reverse stock split that

we effected on September 26, 2013.

About Lion Biotechnologies

Lion Biotechnologies, Inc. (“we,”

“us,” “our,” “Lion Biotechnologies” or the “company”) is a clinical-stage biopharmaceutical

company focused on the development and commercialization of novel cancer immunotherapy products designed to harness the power of

a patient's own immune system to eradicate cancer cells. Our lead program is an adoptive cell therapy utilizing tumor-infiltrating

lymphocytes (TIL), which are T cells derived from patients’ tumors, for the treatment of metastatic melanoma. TIL therapy

is being developed in collaboration with Steven Rosenberg, M.D., Ph.D., Chief of Surgery Branch at the National Cancer Institute

(NCI). Dr. Rosenberg is a recognized pioneer in immuno-oncology and adoptive cell therapy.

A patient's immune system, particularly

their TIL, plays an important role in identifying and killing cancer cells. TIL consist of a heterogeneous population of T cells

that can recognize a wide variety of cancer-specific mutations and can overcome tumor escape mechanisms. TIL therapy involves growing

a patient's TIL in special culture conditions outside the patient's body, or ex vivo, and then infusing the T cells back into the

patient in combination with interleukin-2 (IL-2). By taking TIL away from the immune-suppressive tumor microenvironment in the

patient, the T cells can rapidly proliferate. Billions of TIL, when infused back into the patient, are more able to search out

and eradicate the tumor.

We have a Cooperative Research and Development

Agreement (CRADA) with the U.S. Department of Health and Human Services, as represented by the NCI, through which we are funding

the research and development of TIL-based product candidates for the treatment of advanced solid tumors. Pursuant to the CRADA,

we fund NCI clinical trials with TIL therapy that are being conducted in collaboration with Dr. Rosenberg. In a 101-patient, Phase

2 clinical trial conducted at the NCI, about half of the patients with relapsed/refractory metastatic melanoma treated with TIL

therapy achieved an objective response. An objective response occurs when there is a complete remission or a partial remission

of the tumor. A complete remission requires a complete disappearance of all detectable evidence of disease, and a partial remission

typically requires at least approximately 50% regression of measurable disease without new sites of disease. As of November 2014,

14 out of the 101 patients had experienced a complete remission and continue to remain in remission. Severe and life threatening

toxicities occurred mostly in the first week after cell infusion and generally resolved within a few weeks. We are also funding

an NCI-sponsored, Phase 2 clinical trial of a TIL therapy utilizing enriched tumor-reactive T cells to treat patients with metastatic

melanoma. In addition to melanoma, we expect to fund multiple NCI-sponsored clinical trials involving TIL therapy to treat a variety

of solid tumors, including, cervical, head and neck, bladder, breast, and lung cancers. Dr. Rosenberg has filed or intends to file

investigational new drug applications (INDs) with the FDA in order to conduct these trials. Depending on the availability of funding,

our evaluation of commercial viability of some of these product candidates and other factors, our goal is to submit separate INDs

to conduct our own clinical trials relating to some or all of these product candidates. The CRADA provides us with an option to

negotiate commercialization licenses from the NIH for additional intellectual property relating to certain TIL-based product candidates

developed by the NCI under the CRADA.

We have a worldwide, exclusive patent license

from the National Institutes of Health (NIH) for intellectual property to develop, manufacture and commercialize TIL therapy for

the treatment of melanoma, and a worldwide, non-exclusive license to this intellectual property for the treatment of ovarian cancer,

breast cancer, and colorectal cancer. We also have an exclusive license from the NIH for intellectual property relating to a TIL-based

therapy utilizing enriched tumor reactive T cells patients with metastatic melanoma.

In January 2015 our IND for a company-sponsored,

Phase 2 clinical trial designed to establish the feasibility of our lead product candidate, LN-144, and assess its overall safety

in patients with metastatic melanoma was allowed by the U.S. Food and Drug Administration (FDA). We expect to initiate this trial

later this year. The trial's primary objective is to determine the safety and feasibility of the administration of TIL therapy.

Our company-sponsored, Phase 2 trial will use a protocol that is nearly identical to one which is currently being used at the NCI

to treat patients. However, we believe we have streamlined and improved the NCI's manufacturing process of TIL production for our

LN-144 product candidate. Assuming that the trial results meet our expectations, we plan to initiate a pivotal trial for regulatory

approval for LN-144 in 2016. If the data from this pivotal trial are compelling, we intend to discuss with the FDA the filing of

a Biologics License Application (BLA) for accelerated approval of LN-144 as a therapy for refractory metastatic melanoma.

We also intend to apply for an orphan drug

designation for LN-144 in the United States and Europe to treat metastatic melanoma. This designation may provide seven years of

market exclusivity in the United States, subject to certain limited exceptions. However, the orphan drug designation does not convey

any advantage in or shorten the duration of the regulatory review or approval process.

We are pursuing relapsed/refractory metastatic

melanoma as our first target indication because of the promising initial NCI results and the commercial opportunity inherent in

the significant unmet need of this patient population. Melanoma is a common type of skin cancer, accounting for approximately 76,000

patients diagnosed and 9,700 deaths each year in the United States according to the NCI. About 4% of patients with melanoma have

metastatic disease. Patients with relapsed/refractory metastatic melanoma following treatment under the current standards of care

have a particularly dire prognosis with very few curative treatment options.

In addition to the research and development

being conducted under the CRADA, in 2014 we established our own significant internal research and development capabilities in Tampa,

Florida, near the H. Lee Moffitt Cancer & Research Institute (Moffitt) on the campus of the University of South Florida, to

explore the next-generation of TIL technology and new product candidates, as well as generate new intellectual property.

Company History

We filed our original Articles of Incorporation

with the Secretary of State of Nevada on September 17, 2007. Until March 2010, we were an inactive company known as Freight Management

Corp. On March 15, 2010, we changed our name to Genesis Biopharma, Inc., and in 2011 we commenced our current business. In May

2013 we completed a restructuring of our outstanding debt and equity securities (the “Restructuring”) and raised $1.25

million through the sale of our common stock. As part of the Restructuring, we converted $7.2 million of senior secured promissory

notes, $1.7 million of bridge promissory notes, and $0.3 million in other outstanding debt into shares of common stock at a conversion

price of $1.00 per share. In connection with, and shortly after the Restructuring, we replaced our Chief Executive Officer and

most of our directors. On July 24, 2013, we acquired Lion Biotechnologies, Inc., a Delaware corporation. On September 26, 2013,

we amended and restated our Articles of Incorporation to, among other things, change our name to Lion Biotechnologies, Inc., effect

a 1-for-100 reverse stock split (pro-rata reduction of outstanding shares) of our common stock, increase (after the reverse stock

split) the number of our authorized number of shares of common stock to 150,000,000 shares, and authorize the issuance of 50,000,000

shares of “blank check” preferred stock, $0.001 par value per share.

Our principal executive offices are located

at 21900 Burbank Boulevard, 3rd Floor, Woodland Hills, California 91367, and our telephone number at that address is (818) 992-3126.

Our website is located at www.lionbio.com. Information on our website is not, and should not be considered, part of this prospectus.

| |

The Offering |

| |

|

| Issuer |

Lion Biotechnologies, Inc. |

| |

|

| Selling stockholders |

The selling stockholders who are offering shares of common stock for sale under this prospectus are named under “Selling

Stockholders” beginning on page 4 of this prospectus. See, “Selling Stockholders.” |

| Common stock offered by the selling security holders |

Up to an aggregate of 9,586,879 currently issued and outstanding shares

of our common stock.

|

| |

|

| Common stock outstanding |

44,762,388 shares, without giving effect to any other issuances of common stock subsequent

to the date of this prospectus.

|

| |

|

| Use of proceeds |

We will not receive any proceeds from the sale of our common stock by the selling stockholders. |

| |

|

| Risk factors |

Investing in our common stock involves a high degree of risk. See “Risk Factors” on page 4 of this prospectus. |

| |

|

| NASDAQ Global Market listing |

Our common stock is listed on The NASDAQ Global Market under the symbol “LBIO.” |

| |

|

The number of outstanding shares of common

stock shown above is based on 44,762,388 shares outstanding as of April 20, 2015 and excludes as of that date the following:

| · | 1,907,877

shares of common stock issuable upon exercise of stock options outstanding as of April

20, 2015, at a weighted average exercise price of $6.62 per share; |

| · | 1,847,000

shares of common stock issuable upon the conversion of shares of Series A Convertible

Preferred Stock outstanding as of April 20, 2015; |

| · | 2,163,873

shares of common stock reserved for issuance under our 2014 Equity Incentive Plan as

of April 20, 2015; and |

| · | 10,272,226

shares of common stock issuable upon exercise of warrants outstanding as of April 20,

2015 at a weighted average exercise price of $2.50 per share. |

RISK FACTORS

Investing in our common stock involves certain

risks. Before you decide whether to purchase any shares of our common stock, in addition to the other information in this prospectus,

you should carefully consider the risks described under the heading “Risk Factors” in our most recent Annual Report

on Form 10-K and Quarterly Report on Form 10-Q, which are incorporated by reference into this prospectus, as such risk factors

may be updated from time to time by our future filings with the SEC. If one or more of these risks materializes, our business,

financial condition and results of operations may be adversely affected. In that event, the value of our common stock could decline.

The risks that are described in this prospectus or in any document that is incorporated by reference into this prospectus are not

the only risks that we face. Additional risks not presently known to us or that we currently believe to be immaterial may also

adversely affect our business, financial condition and results of operations.

SPECIAL NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus, any related prospectus

supplement and the documents incorporated by reference into this prospectus contain forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts that are contained

in this prospectus, any related prospectus supplement and the documents incorporated by reference into this prospectus, including

statements regarding our future results of operations, financial condition, business strategy and business prospects, should be

considered forward-looking statements. In some cases, you can identify forward-looking statements by the use of words such as “believe,”

“anticipate,” “intend,” “plan,” “estimate,” “may,” “could,”

“anticipate,” “predict,” or “expect” and similar expressions.

These forward-looking statements involve

known and unknown risks, uncertainties, assumptions and other factors that may cause our actual results to be materially different

from any future results expressed or implied by the forward-looking statements. You should not place undue reliance on forward-looking

statements since they involve known and unknown risks, uncertainties, assumptions and other factors that are, in many cases, beyond

our control. Forward-looking statements are not promises or guarantees of future performance. Actual events or results may differ

materially from those discussed in the forward-looking statements as a result of various factors. Except to the extent expressly

required by applicable law, we do not undertake any obligation to publicly update any forward-looking statements, whether as a

result of new information, future developments or otherwise.

All forward-looking statements attributable

to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements and risk factors

set forth under “Risk Factors” and elsewhere in this prospectus and set forth in our Form 10-K for the year ended

December 31, 2014, as amended, and subsequent Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q filed with the SEC.

See “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference” in this

prospectus for information on how to access or obtain our reports filed with the SEC.

USE OF PROCEEDS

The selling stockholders will receive all

proceeds from the sale of shares under this prospectus. We will not receive any proceeds from the sale of the shares by the selling

stockholders. We will pay all fees and expenses incurred in connection with the registration of the shares of common stock covered

by this prospectus (including, without limitation, SEC filing fees and the fees and expenses of our attorneys and accountants),

and the selling stockholders will pay any brokerage or underwriting commissions or discounts or other expenses relating to the

sale of these shares.

SELLING STOCKHOLDERS

The selling stockholders are offering

under this prospectus up to 9,586,879 shares of our outstanding common. All of the shares offered by the selling stockholders

are “restricted securities” under applicable federal and state securities laws, rules and regulations. On March 3,

2015 we closed an underwritten public offering of 9,200,000 shares of our common stock. In connection with the public offering,

Ayer Capital Management LP and Bristol Investment Fund Ltd. each entered into a lock-up agreement with one of the underwriters

of the public offering. Pursuant to the lock-up agreements, Ayer Capital Management LP and Bristol Investment Fund Ltd. agreed

not to offer or sell any of their shares until April 27, 2015, and The Hillsberg Trust agreed not to offer or sell any of his

shares until May 27, 2015. Pursuant to the terms of such lock-up agreements, Jefferies LLC may, however, agree to release the

selling stockholders from their lock-up agreements prior to the foregoing dates.

We are registering the shares under the

Securities Act of 1933, as amended (the “Securities Act”), to give the selling stockholders the opportunity, if they

so desire, to publicly sell the shares for their own accounts in such amounts and at such times and prices as each may choose.

Whether sales of shares will be made, and the timing and amount of each such sale, is within the sole discretion of each selling

stockholder, and the selling stockholders will act independently of us in making decisions with respect to the sale of their shares.

Registration of the shares under the Securities Act does not require that any of the shares be offered or sold by the selling stockholders,

and there is no assurance that the selling stockholders will sell any or all of the shares offered by this prospectus.

In certain circumstances, a donee, pledgee

or other transferee who receives shares of common stock offered by this prospectus from a selling stockholder may become entitled

to use this prospectus to sell such shares of common stock. In such event, we will file a supplement to this prospectus that amends

the following table of selling stockholders to include the donee, pledgee or other transferee as a selling stockholder under this

prospectus.

List of Selling Stockholders

The table below sets forth the name

of each selling stockholder, the number of shares owned by each selling stockholder as of April 20, 2015, the number of shares

offered by each selling stockholder under this prospectus and the number of shares of common stock that will be owned by each

selling stockholder assuming that the selling stockholder sells all of the shares that are offered under this prospectus. An asterisk

(*) denotes beneficial ownership of less than 1%.

The information in the table is based

in part upon information that we were provided by the selling stockholders, and the percentages in the table were calculated based

upon 44,762,388 shares of our common stock being outstanding as of April 20, 2015. Beneficial ownership of shares is determined

in accordance with SEC rules and includes voting or investment power with respect to the shares. Shares of common stock subject

to options, warrants and convertible securities, if any, currently exercisable or convertible, or exercisable or convertible within

60 days after April 20, 2015, are deemed to be outstanding for purposes of computing the percentage ownership of the selling stockholder

who holds the option, warrant or convertible security, but not for purposes of computing the percentage ownership of any other

selling stockholder.

| | |

Shares

of Common Stock Beneficially Owned Prior to this Offering | | |

| | |

Shares

of Common Stock Beneficially Owned After Completion of this Offering | |

| Selling Stockholder | |

Number

of Shares | | |

Percent | | |

Number

of Shares Being Offered | | |

Number

of Shares | | |

Percent | |

| Bristol Investment Fund, Ltd.(1) | |

| 3,867,863 | | |

| 8.64 | % | |

| 3,867,863 | | |

| -0- | | |

| -0- | |

| Ayer Capital Partners Master Fund, L.P (2) | |

| 5,160,000 | | |

| 11.53 | % | |

| 5,160,000 | | |

| -0- | | |

| -0- | |

| Ayer Capital Partners Kestrel Fund, LP (2) | |

| 125,326 | | |

| * | | |

| 125,326 | | |

| -0- | | |

| -0- | |

| Epworth-Ayer Capital (2) | |

| 318,689 | | |

| * | | |

| 318,689 | | |

| -0- | | |

| -0- | |

| The Hillsberg Trust (3) | |

| 269,000 | (4) | |

| * | | |

| 115,000 | | |

| 154,000 | | |

| * | |

____________

(1) Bristol Capital Advisors, LLC is

the investment advisor of Bristol Investment Fund, Ltd. Paul Kessler is manager of Bristol Capital Advisor, LLC and as such has

voting and dispositive power over the securities held by Bristol Investment Fund, Ltd.

(2) The investment advisor of this selling

stockholder is Ayer Capital Management, LP (the "Advisor"). ACM Capital Partners, LLC ("ACM") is the general

partner of the Advisor, and Ayer Capital Partners, LLC is the general partner of the selling stockholder. Jay Venkatesan is the

managing member of ACM and Ayer Capital Partners LLC.

(3) The Hillsberg Trust is a revocable

family trust of which Sanford J. Hillsberg is a trustee.

(4) Excludes options to purchase

65,000 shares of common stock that are held by Sanford J. Hillsberg, which options are exercisable currently or within 60 days

of April 20, 2015.

Relationships with Selling Stockholders

Except as follows, no selling stockholder

currently has, or within the three years preceding the date of this prospectus has had, any position, office or other material

relationship with us:

Bristol Capital Advisors, LLC. Bristol

Capital Advisors, LLC is the investment advisor of Bristol Investment Fund, Ltd., and Paul Kessler is manager of Bristol Capital

Advisor, LLC. Accordingly, Paul Kessler has voting and dispositive power over the securities held by Bristol Investment Fund, Ltd.

Mr. Kessler was a director on our Board of Directors from May 24, 2013 until September 3, 2013. On July 24, 2013, we entered into

a Director Stock Award Agreement with each of our directors and with Bristol Capital Advisors, LLC (on behalf of Paul Kessler)

whereby each of those directors and Bristol Capital Advisors, LLC each received 133,532 shares of common stock as consideration

of services rendered as directors.

On May 22, 2013, both Bristol Investment

Fund, Ltd. and Bristol Capital Advisors, LLC participated in the Restructuring that was completed on May 22, 2013. In the Restructuring,

Bristol Investment Fund, Ltd. and Bristol Capital Advisors, LLC collectively converted approximately $2.92 million of senior secured

promissory notes and other indebtedness (including accrued interest and penalties) into shares of our common stock, purchased additional

shares of common stock for $1.00 per share, received additional shares for no additional consideration, and exchanged warrants

for the purchase of 45,325 shares of capital stock into shares of common stock. For the foregoing, Bristol Investment Fund, Ltd.

and Bristol Capital Advisors, LLC collectively received 3,088,137 shares of our common stock.

Ayer Capital Ayer Capital Management,

LP is the general partner of each of Ayer Capital Partners Master Fund, L.P, Ayer Capital Partners Kestrel Fund, LP, and Epworth-Ayer

Capital. Ayer Capital Partners LLC. is the general partner of Ayer Capital Management, LP. Dr. Venkatesan has been a member of

our Board of Directors since September 3, 2013.

In the May 22, 2013 Restructuring, Ayer

Capital Partners Master Fund, L.P, Ayer Capital Partners Kestrel Fund, LP, and Epworth-Ayer Capital (collectively, “Ayer”)

converted approximately $5.32 million of senior secured promissory notes and other indebtedness (including accrued interest

and penalties) into shares of our common stock, purchased additional shares of common stock for $1.00 per share, received additional

shares for no additional consideration, and exchanged warrants for the purchase of 33,604 shares of capital stock into shares of

common stock. For the foregoing, Ayer collectively received the 5,604,015 shares of our common stock included in this prospectus.

Sanford J. Hillsberg.

Sanford J. Hillsberg is the trustee of The Hillsberg Trust. He also is one of our directors. Mr. Hillsberg also is an attorney

at TroyGould PC, one of our law firms. TroyGould PC rendered legal services to our company in 2014 and has rendered legal services

in 2015, including in this offering. We paid TroyGould PC $393,230 in fees in 2014.

Based on representations made to us by the

selling stockholders, except as noted below, no selling stockholder is a registered broker-dealer or an affiliate of a registered

broker-dealer.

PLAN OF DISTRIBUTION

The selling stockholders may, from time

to time, sell or otherwise transfer any or all of the shares that are covered by this prospectus on The NASDAQ Global Market or

on any other stock exchange, market or trading facility on which the shares are traded or in private transactions. Sales of the

shares may be at fixed prices, at prevailing market prices at the time of sale, at prices relating to the prevailing market prices,

at varying prices determined at the time of sale or at negotiated prices.

The selling stockholders may use any one

or more of the following methods when selling or otherwise transferring the shares:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the

block as principal to facilitate the transaction; |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| · | privately negotiated transactions; |

| · | transactions in which the broker-dealer agrees with the selling stockholders to sell a specified number of the shares at a

stipulated price per share; |

| · | a combination of any such methods of sale; or |

| · | any other method permitted by applicable law. |

To the extent permitted by applicable law,

the selling stockholders may enter into hedging transactions. For example, the selling stockholders may:

| · | enter into transactions involving short sales of the shares by a broker-dealer; |

| · | sell shares short themselves and redeliver the shares to close out their short positions; |

| · | enter into option or other types of transactions that require the selling stockholders to deliver shares to a broker-dealer,

who will then resell or otherwise transfer the shares under this prospectus; or |

| · | loan or pledge the shares to a broker-dealer, who may sell the loaned shares or, in the event of default, sell the pledged

shares. |

We have provided the selling stockholders

with copies of this prospectus. If the selling stockholders use this prospectus for any sale of the shares, they will be subject

to the prospectus delivery requirements of the Securities Act, including by compliance with Rule 172 under the Securities Act.

Any shares covered by this prospectus that

qualify for resale in accordance with the terms and conditions of Rule 144 under the Securities Act may be sold by the selling

stockholders under Rule 144 rather than under this prospectus.

We will pay all fees and expenses incurred

in connection with the registration of the shares of common stock covered by this prospectus (including, without limitation, SEC

filing fees and the fees and expenses of our attorneys and accountants), and the selling stockholders will pay any brokerage or

underwriting commissions or discounts or other expenses relating to the sale of these shares.

The selling stockholders may from time to

time pledge or grant a security interest in some or all of the shares covered by this prospectus and, if they default in the performance

of their secured obligations, the secured parties may offer and sell such shares from time to time under this prospectus after

we have filed a supplement to this prospectus that amends the list of selling stockholders to include the secured parties as selling

stockholders under this prospectus.

The selling stockholders may from time to

time transfer some or all of the shares covered by this prospectus by gifts, by distributions of the shares to stockholders, partners

or members of selling stockholders that are corporations, partnerships or limited liability companies, respectively, or by other

similar distributions. In such event, the donees or other transferees of such shares may offer and sell such shares from time to

time under this prospectus after we have filed a supplement to this prospectus that amends the list of selling stockholders to

include the donees or other transferees as selling stockholders under this prospectus.

The selling stockholders and any broker-dealers

or agents that are involved in selling the shares covered by this prospectus might be deemed to be “underwriters” within

the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. The selling stockholders may agree to indemnify any agent, dealer or broker-dealer that participates

in transactions involving sales of shares if liabilities are imposed on that person under the Securities Act.

The selling stockholders have advised us

that, as of the date of this prospectus, they have not entered into any agreements or arrangements with any underwriters or broker-dealers

regarding the sale of the shares that are covered by this prospectus and that there is no underwriter or coordinating broker acting

in connection with a proposed sale of any such shares by any selling stockholder. If we are subsequently notified by any selling

stockholder that any material arrangement has been entered into with an underwriter or a broker-dealer for the sale of any of the

shares, if required by applicable law we will file a supplement to this prospectus that discusses such arrangement.

Broker-dealers engaged by the selling stockholders

may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling

stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated.

The selling stockholders do not expect these commissions and discounts to exceed what is customary in the types of transactions

involved. Any profits on the resale of the shares by a broker-dealer acting as principal may be deemed to be underwriting discounts

or commissions under the Securities Act.

The anti-manipulation rules of Regulation

M under the Securities Exchange Act of 1934, as amended, may apply to sales of the shares covered by this prospectus and to the

related activities of the selling stockholders. Regulation M generally provides, among other things, that any selling stockholder

engaged in the distribution of securities may not concurrently purchase such securities during the period of distribution described

in Regulation M.

We have agreed to indemnify the selling

stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act. Each selling

stockholder has agreed to indemnify us against certain losses, claims, damages and liabilities arising out of or based on any untrue

statement of material fact made by such selling stockholder or any material omission of material fact by such selling stockholder,

but only to the extent such material fact is contained in or omitted from written information furnished by the selling stockholder

to us for use in connection with this prospectus or other document filed with or furnished to the SEC. We have been advised that,

in the opinion of the SEC, indemnification for liabilities arising under the Securities Act is against public policy as expressed

in the Securities Act and is, therefore, unenforceable.

DESCRIPTION OF COMMON

STOCK

The following summary of the terms of our

common stock is subject to and qualified by reference to our articles of incorporation, as amended, and bylaws, copies of which

are on file with the SEC as exhibits to previous SEC filings. Please refer to “Where You Can Find More Information”

below for directions on obtaining these documents.

As of April 20, 2015, we were authorized

to issue 150,000,000 shares of common stock and had 44,762,388 shares of common stock outstanding.

We have only one class of common stock.

Holders of our common stock are entitled to one vote per share on all matters to be voted upon by stockholders and do not have

cumulative voting rights in the election of directors. Holders of shares of common stock are entitled to receive on a pro rata

basis such dividends, if any, as may be declared from time to time by our board of directors in its discretion from funds legally

available for that use, subject to any preferential dividend rights of outstanding preferred stock. They are also entitled to share

on a pro rata basis in any distribution to our common stockholders upon our liquidation, dissolution or winding up, subject to

the prior rights of any outstanding preferred stock. Common stockholders do not have preemptive rights to subscribe to any additional

stock issuances by us, and they do not have the right to require the redemption of their shares or the conversion of their shares

into any other class of our stock. The rights, preferences and privileges of holders of common stock are subject to, and may be

adversely affected by, the rights of the holders of any series of preferred stock that we may designate and issue in the future.

The following provisions of our articles

of incorporation and bylaws could have the effect of delaying or discouraging another party from acquiring control of us and could

encourage persons seeking to acquire control of us to first negotiate with our board of directors:

| · | our bylaws permit stockholders to call a special meeting of stockholders only if the holders of a majority of the voting power

of our outstanding stock request such a meeting; |

| · | our bylaws provide that our board of directors will establish the authorized number of directors from time to time; |

| · | our articles of incorporation do not permit cumulative voting in the election of directors; and |

| · | our articles of incorporation permit our board of directors to determine the rights, privileges and preferences of any new

series of preferred stock, some of which could impede the ability of a person to acquire control of our company. |

Our common stock is traded on The NASDAQ

Global Market under the symbol “LBIO.”

Transfer Agent and Registrar

The transfer agent and registrar of our

common stock is Corporate Stock Transfer, Inc. The address of our transfer agent and registrar is 3200 Cherry Creek Drive South,

Suite 430, Denver, CO 80209, and its telephone number is (303) 282-4800.

LEGAL MATTERS

TroyGould PC, Los Angeles, California,

has rendered an opinion with respect to the validity of the shares of common stock offered by the selling stockholders by this

prospectus. Sanford J. Hillsberg, a member of the Board of Directors of our company, is an attorney with TroyGould PC. As of April

20, 2015, Mr. Hillsberg and certain other attorneys and of counsel of that firm beneficially owned in the aggregate 595,610 shares

and options or warrants to acquire shares of our common stock. The beneficial ownership of our shares described above includes

all options that may be exercised within 60 days from April 20, 2015.

EXPERTS

The financial statements and management’s

assessment of the effectiveness of internal control over financial reporting of Lion Biotechnologies, Inc. included in this prospectus

and registration statement by reference to the Annual Report on Form 10-K for the year ended December 31, 2014 filed with the Securities

and Exchange Commission, have been so incorporated in reliance on the reports of Weinberg & Company, P.A. an independent registered

public accounting firm, given on the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND

MORE INFORMATION

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s

website at http://www.sec.gov. The SEC’s website contains reports, proxy and information statements and other information

regarding issuers, such as us, that file electronically with the SEC. You may also read and copy any document we file with the

SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington D.C. 20549. You may also obtain copies

of these documents at prescribed rates by writing to the SEC. Please call the SEC at 1-800-SEC-0330 for further information on

the operation of its Public Reference Room.

INCORPORATION OF

CERTAIN DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus the information we have filed with the SEC. The information we incorporate by reference

into this prospectus is an important part of this prospectus. Any statement in a document we incorporate by reference into this

prospectus will be considered to be modified or superseded to the extent a statement contained in this prospectus or any other

subsequently filed document that is incorporated by reference into this prospectus modifies or supersedes that statement. The modified

or superseded statement will not be considered to be a part of this prospectus, except as modified or superseded.

We incorporate by reference into this prospectus

the information contained in the documents listed below, which is considered to be a part of this prospectus:

| · | our

Annual Report on Form 10-K for the year ended December 31, 2014 filed with the SEC on

March 16, 2015, as amended by Amendment No. 1 on Form 10-K/A filed with the SEC on April

20, 2015;

|

| · | our

Current Reports on Form 8-K filed with the SEC on January 27, 2015, February 12, 2015,

February 18, 2015, February 25, 2015, March 3, 2015 and April 17, 2015; and

|

| · | the description of our stock contained in our registration statement on Form 8-A filed on February 25, 2015 pursuant to Section 12

of the Exchange Act, as such statement may be amended from time to time. |

We also incorporate by reference into this

prospectus all documents filed pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this prospectus

and prior to the termination of the offering by the selling stockholders; provided, however, that we are not incorporating any

information furnished under Item 2.02 or Item 7.01 of any Current Report on Form 8-K we may subsequently file.

You may request a copy of the documents

incorporated by reference into this prospectus, at no cost, by writing or telephoning us at the following address: Lion Biotechnologies,

Inc., 21900 Burbank Boulevard, 3rd Floor, Woodland Hills, California 91367, and our telephone number at that address

is (818) 992-3126.

Copies of these documents are also available,

without charge, through the “Investors” section of our website (www.lbio.com)

as soon as reasonably practicable after they are filed with the SEC. The information contained on our website is not a part of

this prospectus.

PROSPECTUS

________________

LION BIOTECHNOLOGIES, INC.

9,586,879 Shares

of Common Stock

Offered by the Selling Stockholders

The date of this

prospectus is ______, 2015

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

The following table sets forth the expenses

to be paid in connection with the offering of securities described in this registration statement, excluding any brokerage and

underwriting discounts and commissions, which will be paid by the selling stockholders. All amounts shown are estimates except

for the SEC registration fee.

| Securities and Exchange Commission registration

fee | |

$ | 13,163 | |

| Printing and engraving expenses | |

$ | 5,000 | |

| NASDAQ Global Market listing fees | |

$ | -0- | |

| Legal fees and expenses | |

$ | 20,000 | |

| Accounting fees and expenses | |

$ | 5,000 | |

| Transfer agent and registrar fees | |

$ | 1,000 | |

| Miscellaneous expenses | |

$ | -0- | |

| TOTAL | |

$ | 44,163 | |

| | |

| | |

Item 15. Indemnification of Directors and Officers.

Pursuant to our amended and restated articles

of incorporation, none of our directors or officers will have any personal liability to us or our stockholders for damages for

breach of fiduciary duty as a director or officer, except for damages for breach of fiduciary duty resulting from (1) acts or omissions

which involve intentional misconduct, fraud or a knowing violation of law or (2) the payment of dividends in violation of the applicable

statutes of Nevada.

Section 78.7502 of the Nevada Revised Statutes

permits a corporation to indemnify a present or former director, officer, employee or agent of the corporation, or of another entity

or enterprise for which such person is or was serving in such capacity at the request of the corporation, who was or is a party

or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, except an action by or

in the right of the corporation, against expenses, including attorneys’ fees, judgments, fines and amounts paid in settlement

actually and reasonably incurred in connection therewith, arising by reason of such person’s service in such capacity if

such person (1) is not liable pursuant to Section 78.138 of the Nevada Revised Statutes, which sets forth standards for the conduct

of directors and officers, or (2) acted in good faith and in a manner which he or she reasonably believed to be in or not opposed

to the best interests of the corporation and, with respect to a criminal action or proceeding, had no reasonable cause to believe

his or her conduct was unlawful. In the case of actions brought by or in the right of the corporation, however, no indemnification

may be made for any claim, issue or matter as to which such person has been adjudged by a court of competent jurisdiction, after

exhaustion of all appeals therefrom, to be liable to the corporation or for amounts paid in settlement to the corporation, unless

and only to the extent that the court in which the action or suit was brought or other court of competent jurisdiction determines

upon application that in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity

for such expenses as the court deems proper.

Section 78.751 of the Nevada Revised Statutes

permits any discretionary indemnification under Section 78.7502 of the Nevada Revised Statutes, unless ordered by a court or advanced

to a director or officer by the corporation in accordance with the Nevada Revised Statutes, to be made by a corporation only as

authorized in each specific case upon a determination that indemnification of the director, officer, employee or agent is proper

in the circumstances. Such determination must be made (1) by the stockholders, (2) by the board of directors by majority vote of

a quorum consisting of directors who were not parties to the action, suit or proceeding, (3) if a majority vote of a quorum consisting

of directors who were not parties to the action, suit or proceeding so orders, by independent legal counsel in a written opinion,

or (4) if a quorum consisting of directors who were not parties to the action, suit or proceeding cannot be obtained, by independent

legal counsel in a written opinion.

Our amended and restated bylaws require

us to indemnify our directors and officers in a manner that is consistent with the provisions of Nevada law described in the preceding

two paragraphs.

We maintain a general liability insurance

policy that covers certain liabilities of directors and officers of our corporation arising out of claims based on acts or omissions

in their capacities as directors or officers. Furthermore, we have entered into indemnification agreements with our directors that

among other things, to indemnify them against certain liabilities that may arise by reason of their status or service as directors.

Item 16. Exhibits.

A list of exhibits filed with this Registration

Statement on Form S-3 is set forth in the Exhibit Index and is incorporated by reference into this Item 16.

Item 17. Undertakings.

(a) The undersigned registrant hereby

undertakes:

(1) To file, during any period in which

offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required

by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any

facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof)

which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement;

notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering

range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if,

in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information

with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such

information in the registration statement; provided, however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) above do not

apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed

with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus

filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining

any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide offering thereof.

(3) To remove from registration by means

of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining

liability under the Securities Act of 1933 to any purchaser, each prospectus filed pursuant to Rule 424(b) as part of a registration

statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in

reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used

after effectiveness; provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus

that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede

or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or

made in any such document immediately prior to such date of first use.

(b) The undersigned registrant hereby

undertakes that, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s

annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and (and, where applicable, each filing

of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated

by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities

arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant

to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange

Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant

will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate

jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933

and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the

Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the City of Los Angeles, California, on April 20, 2015.

| |

LION BIOTECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/ ELMA HAWKINS |

| |

|

Elma Hawkins |

| |

|

Chief Executive Officer |

Pursuant to the requirements of the

Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates

indicated on April 20, 2015:

| Signature |

|

Title |

| |

|

|

| /s/ ELMA

HAWKINS |

|

Chief Executive Officer |

| Elma Hawkins |

|

(Principal Executive Officer) |

| |

|

|

| |

|

|

| /s/MICHAEL

HANDELMAN |

|

Chief Financial Officer |

| Michael Handelman |

|

(Principal Financial and Accounting Officer) |

| |

|

|

| |

|

|

| /s/ * |

|

Director |

| Merrill A. McPeak |

|

|

| |

|

|

| |

|

|

| /s/ * |

|

Director |

| Jay Venkatesan |

|

|

| |

|

|

| |

|

|

| /s/ * |

|

Director |

| Sanford J. Hillsberg |

|

|

| |

|

|

| /s/ * |

|

Director |

| Ryan D. Maynard |

|

|

| *By/s/ ELMA HAWKINS |

|

|

| Elma Hawkins, as Attorney-in-Fact |

|

|

EXHIBIT INDEX

The following exhibits are filed with this

registration statement or are incorporated by reference as part of this registration statement:

| Exhibit Number |

|

Description |

| |

|

|

| 3.1 |

|

Amended and Restated Articles of Incorporation filed with the Nevada Secretary of State on September 24, 2013 (incorporated

herein by reference to the Registrant’s Definitive Information Statement on Schedule 14C filed with the Commission on

August 20, 2013). |

| |

|

|

| 3.2 |

|

Bylaws (incorporated herein by reference to the Registrant’s Registration Statement on Form SB-2 filed with the

Commission on January 29, 2008) |

| |

|

|

| 3.3 |

|

Amendment to Bylaws (incorporated herein by reference to the Registrant’s Form 8-K filed with the Commission

on May 29, 2013). |

| |

|

|

| 5.1 |

|

Opinion of TroyGould PC |

| |

|

|

| 23.1 |

|

Consent of TroyGould PC (included in Exhibit 5.1) |

| |

|

|

| 23.2 |

|

Consent of Weinberg & Company |

| |

|

|

| 24.1 |

|

Power of Attorney*

|

| |

|

|

EXHIBIT 5.1

TroyGould PC

1801 Century Park East, 16th

Floor

Los Angeles, California 90067

April 22, 2015

Lion Biotechnologies, Inc.

21900 Burbank Boulevard, Third Floor

Woodland Hills, California 91367

| Re: | Registration Statement on Form S-3 |

Ladies and Gentlemen:

This

opinion is furnished to you in connection with a Registration Statement on Form S-3 (the “Registration Statement”)

to be filed with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended

(the “Securities Act”), with respect to the resale by the selling stockholders named therein of an aggregate of up

to 9,586,879 currently issued and outstanding shares (the “Shares”) of common stock, par value $0.000041666

per share of Lion Biotechnologies, Inc., a Nevada corporation (the “Company”). This opinion letter is furnished to

you at your request and in connection with the requirements of Item 601(b)(5) of Regulation S-K.

As counsel, we have examined such matters

of fact and questions of law as we have considered appropriate for purposes of this letter. With your consent, we have relied upon

certificates and other assurances of officers of the Company and others as to factual matters without having independently verified

such factual matters. We are opining herein as to the general corporation law of the State of Nevada as set forth in Chapter 78

of the Nevada Revised Statutes (the “NRS”), and we express no opinion with respect to any other laws.

Based upon and subject to the foregoing,

we are of the opinion that the Shares were validly issued and are fully paid and nonassessable.

Please note that we are opining only as

to the matters expressly set forth herein, and no opinion should be inferred as to any other matters. This opinion is based upon

currently existing statutes, rules, regulations and judicial decisions, and we disclaim any obligation to advise you of any change

in any of these sources of law or subsequent legal or factual developments which might affect any matters or opinions set forth

herein.

We hereby consent to the filing of this

opinion with the Commission as an exhibit to the Registration Statement in accordance with the requirements of Item 601(b)(5) of

Regulation S-K under the Securities Act and to the use of our name therein and in the related Prospectus under the caption “Legal

Matters.” In giving such consent, we do not hereby admit that we are in the category of persons whose consent is required

under Section 7 of the Securities Act or the rules and regulations of the Commission.

| |

Very truly yours, |

| |

|

| |

/s/ TROYGOULD PC |

EXHIBIT 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this

Registration Statement on Form S-3 of Lion Biotechnologies, Inc. of our reports dated March 16, 2015, relating to the financial

statements and the effectiveness of internal control over financial reporting, which appear in the Company’s Annual Report

on Form 10-K for the year ended December 31, 2014 filed with the Securities and Exchange Commission. We also consent to the reference

to us under the caption “Experts” in the Prospectus.

/s/ Weinberg & Company. P.A.

Los Angeles, California

April 22, 2015

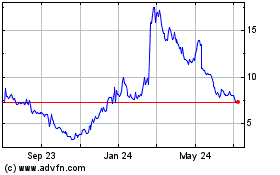

Iovance Biotherapeutics (NASDAQ:IOVA)

Historical Stock Chart

From Mar 2024 to Apr 2024

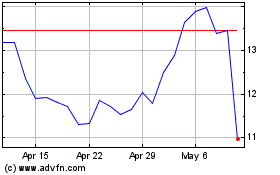

Iovance Biotherapeutics (NASDAQ:IOVA)

Historical Stock Chart

From Apr 2023 to Apr 2024