FirstService Shareholders Overwhelmingly Approve Plan to Separate Into Two Independent Public Companies

April 22 2015 - 9:12AM

FirstService Corporation (TSX:FSV) (Nasdaq:FSRV)

("

FirstService") today announced that the

previously announced spin-off transaction, to be implemented

through a tax efficient statutory plan of arrangement (the

"

Arrangement"), has received the requisite

shareholder approval at FirstService's annual and special meeting

of shareholders held on April 21, 2015 (the

"

Meeting"). The Arrangement was approved by 99.60%

of the Subordinate Voting Shares of FirstService voted at the

Meeting and 100% of the Multiple Voting Shares of FirstService

voted at the Meeting. As required under Canadian securities laws,

the Arrangement was also approved by 99.56% of the Subordinate

Voting Shares of FirstService voted at the Meeting, excluding

shares held by "interested parties" and "control persons" of

FirstService.

Completion of the Arrangement remains subject to certain

conditions, including final court approval. If the final court

order is granted and all other conditions precedent to the

Arrangement are satisfied or waived, FirstService expects to

complete the Arrangement on June 1, 2015.

At the Meeting, the nine director nominees listed in

FirstService's management information circular dated March 16, 2015

(the "Circular") were elected as directors.

Directors have been elected to serve until the close of the next

annual meeting of shareholders. The detailed results of the vote

are set out below.

| |

| |

|

|

|

% Votes |

| Nominee |

Votes

For |

% Votes

For |

Votes

Withheld |

Withheld |

| David R. Beatty |

53,917,142 |

97.67% |

1,285,073 |

2.33% |

| Brendan Calder |

54,590,695 |

98.89% |

611,520 |

1.11% |

| Peter F. Cohen |

53,927,887 |

97.69% |

1,274,328 |

2.31% |

| John (Jack) P. Curtin, Jr. |

55,183,123 |

99.97% |

19,092 |

0.03% |

| Bernard I. Ghert |

54,781,504 |

99.24% |

420,711 |

0.76% |

| Michael D. Harris |

53,732,883 |

97.34% |

1,469,332 |

2.66% |

| Jay S. Hennick |

54,781,434 |

99.24% |

420,781 |

0.76% |

| Frederick F. Reichheld |

54,871,015 |

99.40% |

331,053 |

0.60% |

| Michael Stein |

54,825,345 |

99.32% |

376,870 |

0.68% |

* As a vote for each motion was taken by a show of hands, the

number of votes disclosed reflects only those proxies received by

management in advance of the Meeting.

In addition, at the Meeting, FirstService shareholders approved,

by a vote by show of hands, the appointment of

PricewaterhouseCoopers LLP as the auditor of FirstService for the

ensuing year, an amendment to the existing FirstService stock

option plan and the adoption of the "new" FirstService Corporation

stock option plan, all as described in the Circular.

About FirstService

FirstService is a global leader in the rapidly growing real

estate services sector, one of the largest markets in the world.

FirstService manages more than 2.5 billion square feet of

residential and commercial properties through its three

industry-leading service platforms: Colliers

International - one of the largest global players in

commercial real estate services; FirstService

Residential - North America's largest manager of

residential communities; and FirstService Brands –

one of North America's largest providers of essential property

services delivered through individually branded franchise systems

and company-owned operations.

FirstService generates more than US$2.7 billion in annual

revenues and has more than 24,000 employees world-wide. With

significant insider ownership and an experienced management team,

FirstService has a long-term track record of creating value and

superior returns for shareholders since becoming a publically

listed company in 1993. The Subordinate Voting Shares of

FirstService trade on NASDAQ under the symbol "FSRV" and on the TSX

under the symbol "FSV". More information is available at

www.firstservice.com.

Advisory Regarding Forward-Looking

Information

Information in this press release that is not a historical fact

is "forward-looking information". Words such as "plans", "intends",

"outlook", "expects", "anticipates", "estimates", "believes",

"likely", "should", "could", "will", "may" and similar expressions

are intended to identify statements containing forward-looking

information. Forward-looking information in this press release is

based on current objectives, strategies, expectations and

assumptions which management considers appropriate and reasonable

at the time. The forward-looking information in this press release

include, but are not limited to, statements with respect to: the

proposed Arrangement and expected future attributes of each of

"new" FirstService Corporation and Colliers International following

the completion of the Arrangement; the timing and expectations with

respect to the granting of the final court order; and the expected

completion date of the Arrangement.

By its nature, forward-looking information is subject to risks

and uncertainties which may be beyond the ability of FirstService

to control or predict. The actual results, performance or

achievements of Colliers International or "new" FirstService

Corporation could differ materially from those expressed or implied

by forward-looking information. Factors that could cause actual

results, performance, achievements or events to differ from current

expectations include, among others, risks and uncertainties related

to: obtaining approvals, waivers, rulings, court orders and

consents, or satisfying other requirements, necessary or desirable

to permit or facilitate completion of the Arrangement (including

regulatory approvals and a Canadian tax ruling); future factors

that may arise making it inadvisable to proceed with, or advisable

to delay, all or part of the Arrangement; the operations and

financial condition of Colliers International and "new"

FirstService Corporation as separately traded public companies,

including the reduced industry and geographical diversification

resulting from this separation; the impact of the Arrangement on

the trading prices for, and market for trading in, the shares of

FirstService, Colliers International and "new" FirstService

Corporation; the potential for significant tax liability for a

violation of the tax-deferred spinoff rules; the potential benefits

of the Arrangement; business cycles, including general economic

conditions in the countries in which Colliers International and

"new" FirstService Corporation operate, which will, among other

things, impact demand for services and the cost of providing

services; the ability of each of Colliers International and "new"

FirstService Corporation to implement its business strategy,

including their ability to acquire suitable acquisition candidates

on acceptable terms and successfully integrate newly acquired

businesses with its existing businesses; changes in or the failure

to comply with government regulations; changes in foreign exchange

rates; increased competition; credit of third parties; changes in

interest rates; and the availability of financing. Additional

information on certain of these factors and other risks and

uncertainties that could cause actual results or events to differ

from current expectations can be found in FirstService's Annual

Information Form for the year ended December 31, 2014 under the

heading "Risk Factors" (which factors are adopted herein and a copy

of which can be obtained at www.sedar.com). Certain risks and

uncertainties specific to the proposed Arrangement, Colliers

International and "new" FirstService Corporation are further

described in the Circular. Other factors, risks and uncertainties

not presently known to FirstService or that FirstService currently

believes are not material could also cause actual results or events

to differ materially from those expressed or implied by statements

containing forward-looking information.

Readers are cautioned not to place undue reliance on statements

containing forward-looking information that are included in this

press release, which are made as of the date of this press release,

and not to use such information for anything other than their

intended purpose. FirstService disclaims any obligation or

intention to update or revise any forward-looking information,

whether as a result of new information, future events or otherwise,

except as required by applicable law.

CONTACT: COMPANY CONTACTS:

Jay S. Hennick

Founder & CEO

(416) 960-9500

John B. Friedrichsen

Senior Vice President & CFO

(416) 960-9500

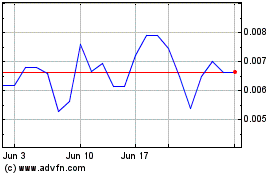

Nexus Energy Services (PK) (USOTC:IBGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

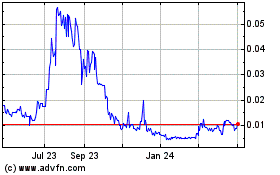

Nexus Energy Services (PK) (USOTC:IBGR)

Historical Stock Chart

From Apr 2023 to Apr 2024