SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14C

(Rule

14c-101)

Information

Statement Pursuant to Section 14(c) of the Securities Exchange Act of 1934

Check

the appropriate box:

| ☐ |

Preliminary

Information Statement |

| ☒ |

Definitive

Information Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5(d)(2)) |

GLOBAL

DIGITAL SOLUTIONS, INC.

(Name

of Registrant As Specified In Its Charter)

Payment

of Filing Fee (Check the Appropriate Box):

| ☐ |

Fee computed

on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

(1) |

Title of

each class of securities to which transaction applies: |

| |

(2) |

Aggregate number of securities

to which the transaction applies: |

| |

(3) |

Per unit price or other underlying

value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated

and state how it was determined): |

| |

(4) |

Proposed maximum aggregate

value of transaction: |

| ☐ |

Fee paid previously with

preliminary materials |

| ☐ |

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule

and the date of its filing. |

| |

(1) |

Amount previously paid: |

| |

(2) |

Form, Schedule or Registration

Statement No.: |

GLOBAL

DIGITAL SOLUTIONS, INC.

777

South Flagler Drive, Suite 800 West, West Palm Beach, FL 33401

NOTICE

OF ACTION BY WRITTEN CONSENT

OF

MAJORITY STOCKHOLDERS

WE

ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

To the Holders of Common Stock of Global Digital Solutions,

Inc.:

We are furnishing the attached Information

Statement to the holders of common stock of Global Digital Solutions, Inc., a New Jersey corporation (the “Company,”

“we,” “us” or “our”), pursuant to the requirements of Regulation 14C under the Securities Exchange

Act 1934, as amended (the “Exchange Act”), in connection with a Written Consent in lieu of a Special Meeting (the “Written

Consent”), dated as of March 19, 2015, executed by the holders of more than a majority of our outstanding shares of common

stock, par value $0.001 per share (the “Common Stock”), who own approximately 56.27% of the Common Stock either directly

or indirectly (the “Voting Stockholders”). A copy of the Written Consent is attached as Exhibit A to

this Information Statement.

The Written Consent contains resolutions

approving the following action, which are fully described in the accompanying Information Statement:

| · |

To amend our Amended Articles of Incorporation to increase the number of shares of our authorized Common Stock from 450,000,000 to 650,000,000 shares (the “Amendment”). |

The Certificate of Amendment to the Certificate of Incorporation

(the “Certificate of Amendment”) is attached as Exhibit B to this Information Statement.

Pursuant to Rule 14c-2 of the Exchange

Act, the Actions will become effective on or after May 14, 2015, which is 20 calendar days following the date we first mail

this Information Statement to our stockholders. As soon as practicable after such date, we intend to file the Certificate

of Amendment with the New Jersey Secretary of State.

The accompanying Information Statement

is being furnished to our stockholders for informational purposes only, pursuant to Section 14(c) of the Exchange Act and the rules

and regulations prescribed thereunder. As described in this Information Statement, the Amendment has been approved by

stockholders representing more than a majority of the voting power of our outstanding Common Stock. The Company is not soliciting

your proxy or consent in connection with the matters discussed above. You are urged to read this Information Statement

in its entirety for a description of the Amendment approved by certain stockholders holding more than a majority of the voting

power of our outstanding Common Stock.

This Information Statement is being mailed on or about April 23,

2015 to stockholders of record as of March 24, 2015.

THIS IS FOR YOUR INFORMATION ONLY.

YOU DO NOT NEED TO DO ANYTHING IN RESPONSE TO THIS INFORMATION STATEMENT. THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND

NO STOCKHOLDER MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

| |

By Order of the Board of

Directors |

| April 21, 2015 |

|

|

| |

|

/s/ Richard J. Sullivan |

| |

|

Chairman of the Board |

| |

|

Chief Executive Officer |

GLOBAL DIGITAL SOLUTIONS, INC.

INFORMATION STATEMENT

April

21, 2015

WE ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE REQUESTED NOT TO SEND US A

PROXY

INTRODUCTION

Action by Written Consent

This Information Statement is being

furnished by the Board of Directors (the ”Board”) of Global Digital Solutions, Inc., a New Jersey corporation (the

“Company,” “we,” “us” or “our”) to inform our stockholders that certain of our

stockholders (the “Voting Stockholders”) of the Company, being the owners of more than a majority of the voting power

of our outstanding shares of common stock, par value $0.001 per share (the “Common Stock”), effective as of March 19,

2015, delivered a written consent in lieu of a meeting (the “Written Consent”) to approve the Certificate of Amendment

to our Amended and Restated Articles of Incorporation, as set forth in Exhibit B attached hereto (the “Certificate

of Amendment”) to increase the number of our authorized shares of Common Stock from 450,000,000 to 650,000,000 shares (the

“Action”).

The Action is more

fully described in the accompanying Information Statement. The Written Consent was in accordance with the New Jersey

Business Corporations Act (the “BCA”), our Certificate of Incorporation, as amended, and our Bylaws, each of which

provides that any action which may be taken at a meeting of the shareholders may also be taken by the written consent of the holders

of a majority of the voting power to approve the action at a meeting. The accompanying Information Statement is being furnished

to all of our shareholders in accordance with Section 14(c) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and the rules promulgated by the U.S. Securities and Exchange Commission (“SEC”) thereunder, solely for

the purpose of informing our shareholders of the action taken by the Written Consent before it becomes effective. This information

statement will be mailed on or about April 23, 2015 to stockholders of record as March 24, 2015 (the “Record Date”). .

Pursuant to the Written

Consent, effective as of March 19, 2015, the Voting Stockholders approved the Action to increase the number of authorized

shares of Common Stock of the Company from 450,000,000 shares to 650,000,000 shares, such that, after the Action, the capital stock

of the Company will consist of 650,000,000 shares of common stock, par value $0.001 per share, and 35,000,000 shares of preferred

stock, par value $0.001 per share.

The Action was unanimously

approved by our Board of Directors on March 18, 2015.

This Information Statement

contains a brief summary of the material aspects of the Action approved by the Board and the Voting Stockholders.

WE ARE NOT ASKING

YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY

ABOUT THE INFORMATION

STATEMENT

What is the Purpose of the Information

Statement?

This Information Statement

is being furnished to you pursuant to Section 14 of the Exchange Act to notify our shareholders of certain corporate actions taken

by the Voting Stockholders pursuant to the Written Consent. In order to eliminate the costs and management time involved

in obtaining proxies and in order to effect the Action as early as possible to accomplish the purposes herein described, the Board

elected to seek the written consent of the Voting Stockholders.

Who is Entitled

to Notice?

Each holder of outstanding

shares of Common Stock of record on the Record Date will be entitled to notice of the actions to be taken pursuant to the Written

Consent.

What Vote is

Required to Approve the Action?

The affirmative vote

of stockholders of the Company holding a majority of our outstanding shares of Common Stock on the Record Date is required for

approval of the Action. As of the Record Date, the Company had 107,604,352 shares of Common Stock issued and outstanding. Each

share of Common Stock entitles its holder to one vote on each matter submitted to the shareholders. Voting Stockholders’

holding 56.27% of the total outstanding shares of our Common Stock as of the Record Date have voted in favor of the Action. Because

the Voting Stockholders, holding a majority of the voting rights of the Company as of the close of business on the Record Date,

voted in favor of the Action, no other shareholder consents will be required or obtained in connection with this Information Statement.

Do I have appraisal

rights?

Under the BCA, Company stockholders

are not entitled to dissenters’ or appraisal rights with respect to the Action.

Proposals by Security Holders

No stockholder has requested that we

include any additional proposals in this Information Statement.

Effective Dates

The Action will be effective when the

Certificate of Amendment is filed with the New Jersey Secretary of State. The Company will not make such filing until on or after

May 14, 2015, a date that is more than 20 calendar days after this Information Statement is first sent to our stockholders.

Expenses

The expenses associated with the mailing

of this Information Statement will be borne by the Company, including expenses in connection with the preparation of this Information

Statement and all documents that now accompany or may in the future supplement it. The Company contemplates that brokerage houses,

custodians, nominees, and fiduciaries will forward this Information Statement to the beneficial owners of Common Stock held of

record as of the Record Date by these persons and the Company will reimburse them for their reasonable expenses incurred in this

process.

Vote Required and Information on Voting Stockholders

We are not seeking consents, authorizations or proxies from

you.

As of the date of the Written Consent

and the Record Date, the Company had 107,604,352 shares of Common Stock issued and outstanding and entitled to vote, which are

entitled to one vote per share. As of March 19, 2015, and as of the Record Date, the following consenting Voting Stockholders owning

a total of 60,549,984 shares of our Common Stock, which represented approximately 56.27% of the total number of voting shares outstanding

on the Record Date, delivered the executed Written Consent authorizing the Action described herein. The consenting Voting Stockholders’

names, affiliation with the Company and holdings are as follows:

| Name | |

Affiliation With Company | |

Number of Voting Shares | | |

% of Total Voting Shares | |

| Richard J Sullivan | |

Chairman and CEO of the Company | |

| 23,710,000 | | |

| 22.03 | % |

| David A. Loppert | |

Former Chief Financial Officer of the Company* | |

| 8,000,000 | | |

| 7.43 | % |

| Cross Pacific Partners, LLC | |

Edwin J. Wang, the managing member, is Chairman of the Company's Advisory Board | |

| 4,000,000 | | |

| 3.72 | % |

| Three Rivers Investments, LLC | |

William J. Delgado, an Executive Vice President of the Company, is a member of this entity | |

| 3,985,523 | | |

| 3.70 | % |

| Bronco Communications LLC | |

William J. Delgado, an Executive Vice President of the Company, is a member of this entity | |

| 3,221,032 | | |

| 2.99 | % |

| Bay Acquisition Corp. | |

Controlled by Richard J. Sullivan, our Chairman & CEO | |

| 3,000,000 | | |

| 2.79 | % |

| Western Financial | |

Affiliated with William J. Delgado | |

| 2,200,000 | | |

| 2.04 | % |

| Tara S. Delgado | |

Related to William J. Delgado | |

| 1,536,000 | | |

| 1.43 | % |

| Brittney Delgado | |

Related to William J. Delgado | |

| 1,500,000 | | |

| 1.39 | % |

| Gary A. Gray | |

Vice President of the Company | |

| 1,500,000 | | |

| 1.39 | % |

| K. Brett Thackston | |

Consultant to the Company | |

| 1,500,000 | | |

| 1.39 | % |

| Jennifer S. Carroll | |

Former president of North American Custom Specialty Vehicles, Inc., a subsidiary of the Company, and a former member of the Company's Advisory Board | |

| 1,250,000 | | |

| 1.16 | % |

| Vox Equity Holdings, LLC | |

Matthew Kelley, the managing member, is a member of the Company's Advisory Board | |

| 1,250,000 | | |

| 1.16 | % |

| E. Eldredge Floyd | |

None | |

| 1,046,000 | | |

| 0.97 | % |

| Contstantino Galaxidas | |

None | |

| 821,429 | | |

| 0.76 | % |

| Evan Sullivan | |

Related to Richard J. Sullivan | |

| 530,000 | | |

| 0.49 | % |

| Marlene Faye Gray | |

Former wife of an officer of the Company | |

| 500,000 | | |

| 0.46 | % |

| Stephanie Sullivan | |

Director of the Company, Related to Richard J. Sullivan | |

| 500,000 | | |

| 0.46 | % |

| Ross L. Trevino | |

Vice President of the Company | |

| 500,000 | | |

| 0.46 | % |

| TOTAL | |

| |

| 60,549,984 | | |

| 56.27 | % |

* - Mr. Loppert retired as CFO of the Company on April 10, 2015.

ACTION TO BE TAKEN

AMENDMENT TO CERTIFICATE

OF INCORPORATION, AS AMENDED, TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK FROM 450,000,000 SHARES TO 650,000,000 SHARES

Regarding the authorized capital structure of the Company,

Article IV(a) of the Company's Amended Certificate of Incorporation currently provides as follows:

(a) Authorized Shares. The

aggregate number of shares which the corporation shall have the authority to issue is Four Hundred Eighty Five Million (485,000,000)

shares. Four Hundred Fifty Million (450,000,000) shares shall be designated "Common Stock", and shall have a par value

of $.001. Thirty Five Million (35,000,000) shares shall be designated "Preferred Stock", and shall have a par value of

$.001 per share.

The Voting Stockholders have approved

that Article IV(a) be deleted in its entirety and be replaced by the following paragraph:

(a) Authorized Shares. The

aggregate number of shares which the corporation shall have the authority to issue is Six Hundred Eighty Five Million (685,000,000)

shares. Six Hundred Fifty Million (650,000,000) shares shall be designated "Common Stock", and shall have a par value

of $.001. Thirty Five Million (35,000,000) shares shall be designated "Preferred Stock", and shall have a par value of

$.001 per share.

Purposes of the Action

The general purpose and effect of the

amendment to the Company’s Certificate of Incorporation in authorizing 650,000,000 shares of Common Stock is to facilitate

future acquisitions, if any, and existing and future financing agreements, if any, which often include the requirement to provide

an irrevocable reserve of common shares in excess of shares currently issuable under the financing agreements, which will enable

the Company to continue its current business operations. Our Board is constantly looking for acquisition candidates. Notwithstanding

the foregoing, the Company has no obligation to issue such additional shares and there are presently no plans, proposals or arrangements

by the Company that would involve the issuance of the additional shares to acquire another company or its assets, or for any other

corporate purpose.

Our Board of Directors believes that

the increased number of authorized shares of common stock contemplated by the proposed amendment is desirable to provide us with

the flexibility to meet our business needs as they arise, to take advantage of favorable opportunities and to respond to a changing

environment, and is in the best interests of the Company and its stockholders.

As of the Record Date, our capitalization is as follows:

| Shares of our preferred stock authorized for issuance | |

| 35,000,000 | |

| Shares of our preferred stock issued and outstanding as of the Record Date | |

| 0 | |

| Shares of our common stock authorized for issuance | |

| 450,000,000 | |

| Shares of our common stock issued and outstanding as of the Record Date | |

| 107,604,352 | |

| Shares of our common stock issuable upon the exercise of outstanding stock options having a weighted exercise price of $0.64 per share | |

| 5,500,000 | |

| Shares of our common stock issuable upon exercise of outstanding warrants having a weighted average exercise price of $0.37 per share | |

| 4,250,000 | |

| Shares of our common stock held in reserve for issuance under our 2014 Equity Incentive Plan not accounted for elsewhere | |

| 12,000,000 | |

| Shares of our common stock held in reserve for issuance under restricted stock awards or restricted stock unit awards outside of our equity incentive plan | |

| 3,500,000 | |

| Shares of our common stock held in reserve for issuance under price protection plans * | |

| 2,132,616 | |

| Shares of our common stock held in reserve for issuances on conversion of convertible notes ** | |

| 121,092,187 | |

| Total number of common shares available for issuance as of the Record Date | |

| 193,920,845 | |

*

In connection with our acquisition of North American Custom Specialty Vehicles, Inc. we granted the sellers price protection for

certain shares of our Common Stock that they received as consideration. If those shares of Common Stock are sold by the sellers

in arm’s length transaction(s) within twelve months following June 16, 2014, the Company shall deliver to the sellers

a number of registered shares equal to the excess, if any, of (x) the sales price the sellers would have received if the shares

had sold for $0.31 per share minus the actual sales price received by the sellers; divided by (y) the actual price

per share received by the sellers.

**

This number reflects current contractually reserved shares held for future conversions of existing convertible notes. Most convertible

notes require that share reserves be established equal to between three and 6.5 times the number of shares to be issued upon conversion,

based on current market prices of our common stock.

The additional shares of authorized

Common Stock would be available for issuance from time to time as determined by the Board for any proper corporate purpose. Such

purposes might include, without limitation, issuance in public or private sales for cash as a means of obtaining additional capital

for use in the Company's business and operations, and issuance as part or all of the consideration required to be paid by the Company

for acquisitions of other businesses or assets. Notwithstanding the foregoing, the Company has no obligation to issue such

additional shares and there are presently no plans, proposals or arrangements by the Company that would involve the issuance of

the additional shares to acquire another company or its assets, or for any other corporate purpose.

Advantages, Disadvantages and Principal Effects of the

Increase in Authorized Shares

The Company's stockholders will not

realize any dilution in their ownership or voting rights as a result of the increase in authorized shares of Common Stock, but

will experience dilution to the extent additional shares are issued in the future.

Having an increased number of authorized

but unissued shares of Common Stock would allow the Company to take prompt action with respect to corporate opportunities that

develop, without the delay and expense of convening a special meeting of stockholders for the purpose of approving an increase

in the Company's capitalization. The issuance of additional shares of Common Stock may, if such shares are issued at prices below

what current stockholders’ equity per share, reduce stockholders’ equity per share and dilute the value of current

stockholders’ shares. It is not the present intention of the Board to seek stockholder approval prior to any issuance of

shares of Common Stock that would become authorized by the Action unless otherwise required by law or regulation. Frequently, opportunities

arise that require prompt action, and it is the belief of the Voting Stockholders that the delay necessitated for stockholder approval

of a specific issuance could be to the detriment of the Company and its stockholders.

When issued, the additional shares of

Common Stock authorized by the Action will have the same rights and privileges as the shares of Common Stock currently authorized

and outstanding. Holders of Common Stock have no preemptive rights and, accordingly, stockholders would not have any preferential

rights to purchase any of the additional shares of Common Stock when such shares are issued.

Shares of authorized and unissued Common

or Preferred Stock could be issued in one or more transactions that could make it more difficult, and therefore less likely, that

any takeover of the Company could occur. Issuance of additional Common or Preferred Stock could have a deterrent effect on persons

seeking to acquire control of the Company. The Board also could, although it has no present intention of so doing, authorize the

issuance of shares of Common or Preferred Stock to a holder who might thereby obtain sufficient voting power to ensure that any

proposal to effect certain business combinations or amendment to the Company's Articles of Incorporation or Bylaws would not receive

the required stockholder approval. Accordingly, the power to issue additional shares of Common or Preferred Stock could enable

the Board to make it more difficult to replace incumbent directors and to accomplish business combinations opposed by the incumbent

Board.

Dissenter’s Rights of Appraisal

Neither the BCA nor

our Certificate of Incorporation or Bylaws provide our stockholders with dissenters’ or appraisal rights in connection with

the Action discussed in this Information Statement.

INTEREST

OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

The Company’s current officers

and directors are among the largest holders of shares of our Common Stock. As of the Record Date, they beneficially own or control

approximately 37% of our issued and outstanding shares of common stock, and they have voting control over approximately 35% of

the outstanding voting shares of the Company as reflected in the table in the following section. The difference between the beneficial

ownership percentage and the voting control percentage are securities that can be acquired by such person within 60 days whether

upon the exercise of options or otherwise.

Except for

the foregoing and disclosed elsewhere in this Information Statement, since January 1, 2014, being the commencement of our prior

financial year, none of our the following persons has any substantial interest, direct or indirect, by security holdings or otherwise

in any matter to be acted upon:

| |

1. |

Any director or officer of our corporation; |

| |

2. |

Any proposed nominee for election as a director of the Company; and |

| |

3. |

Any associate or affiliate of any of the foregoing persons. |

The shareholdings

of our directors and officers are listed below in the section entitled “Security Ownership Of Certain Beneficial Owners And

Management.”

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain

information known to us regarding beneficial ownership of shares of our common stock as of the Record Date by:

| |

· |

each of our directors; |

| |

· |

each of our named executive officers; |

| |

· |

all of our executive officers and directors as a group; and |

| |

· |

each person, or group of affiliated persons, known to us to be the beneficial owner of more than 5% of our outstanding shares of common stock. |

Except as otherwise indicated, the address of each stockholder

listed below is: c/o Global Digital Solutions, Inc. 777 South Flagler Drive, Suite 800W, West Palm Beach, FL 33401.

| | |

| Number of | | |

| | | |

| | |

| | |

|

Shares of

Common | | |

| Percent of | | |

| Percent of | |

| | |

| Stock | | |

| Outstanding | | |

| Voting | |

| | |

| Beneficially | | |

| Shares | | |

| Rights | |

| Name and Address of Beneficial Owner | |

| Owned (1) | | |

| (%) | | |

| (%) | |

| | |

| | | |

| | | |

| | |

| Five Percent Stockholders: | |

| | | |

| | | |

| | |

| Richard J. Sullivan (2) | |

| 29,710,000 | | |

| 27.6 | % | |

| 24.8 | % |

| David A. Loppert (3) | |

| 9,500,000 | | |

| 8.8 | % | |

| 7.4 | % |

| William J. Delgado (4) | |

| 7,307,555 | | |

| 6.8 | % | |

| 6.8 | % |

| | |

| | | |

| | | |

| | |

| Named Executive Officers and Directors: | |

| | | |

| | | |

| | |

| Richard J. Sullivan (2) | |

| 29,710,000 | | |

| 27.6 | % | |

| 24.8 | % |

| Jerome J. Gomolski (6) | |

| - | | |

| - | % | |

| - | % |

| William J. Delgado (4) | |

| 7,307,555 | | |

| 6.8 | % | |

| 6.8 | % |

| Arthur F. Noterman (5) | |

| 500,000 | | |

| 0.5 | % | |

| 0.0 | % |

| Stephanie C. Sullivan (5) | |

| 1,000,000 | | |

| 0.9 | % | |

| 0.5 | % |

| Gary A. Gray | |

| 1,500,000 | | |

| 1.4 | % | |

| 1.4 | % |

| All Directors and Officers as a group (6 persons) (7) | |

| 40,017,555 | | |

| 37.2 | % | |

| 33.5 | % |

| (1) | | Applicable percentages are based on 107,604,352 shares outstanding as of March 24,

2015 and includes issued and outstanding shares of common stock as well as vested but unissued restricted shares. Beneficial ownership

is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. A person

is deemed to be the beneficial owner of securities that can be acquired by such person within 60 days whether upon the exercise

of options or otherwise. Shares of Common Stock subject to options and warrants currently exercisable, or exercisable

within 60 days after the date of this report, are deemed outstanding for computing the percentage of the person holding such securities

but are not deemed outstanding for computing the percentage of any other person. Unless otherwise indicated in the footnotes to

this table, the Company believes that each of the shareholders named in the table has sole voting power. |

| (2) | | Includes (a) 3,000,000 currently exercisable stock options, (b) 3,000,000 shares owned

by Bay Acquisition Corp., an entity controlled by Mr. Sullivan, and (c) 530,000 shares owned by Mr. Sullivan's minor son. |

| (3) | | Mr. Loppert retired as Chief Financial Officer of the Company on April 10, 2015. Includes 1,500,000 currently exercisable stock options. |

| (4) | | Includes (a) 3,985,523 shares owned by Three Rivers Investments, LLC and (b) 3,221,032

shares owned by Bronco Communications, LLC. Mr. Delgado is a member of both these entities and may be deemed to have voting control.

Also includes 101,000 shares owned by Mr. Delgado's minor daughter. |

| (5) | | Includes 500,000 currently exercisable stock options. |

| (6) | | Mr. Gomolski was appointed CFO on April 10, 2015. |

| (7) | | Includes shares of our common stock beneficially owned by current executive officers

and directors and shares issuable upon the exercise of stock options that are currently exercisable or exercisable within 60 days

of March 24, 2015, in each case as set forth in the footnotes to this table. |

On April 10, 2015 David Loppert

retired as our CFO and Jerome J. Gomolski, sixty seven years old, was appointed Chief Financial Officer. Mr. Gomolski has

for the past 30 years specialized in auditing, corporate and individual income tax, and, forensic accounting. He began

his financial career in the corporate accounting department of International Harvester in Chicago. After graduating from

DePaul University in Chicago with a BSC in Accounting he passed the Illinois CPA exam and began working for several large

accounting firms. Several years later, he returned to International Harvester as Manager of Financial Planning and Analysis.

In 1982, Mr. Gomolski was offered an opportunity to relocate to South Florida and return to public accounting. There he

brought his experience and talent to work with two large accounting firms. His increasing responsibility led to a

partnership. He continues to maintain his own practice. Mr. Gomolski currently serves as the Chief Financial Officer for a

Private Equity Fund and for North American Custom Specialty Vehicles, Inc., a subsidiary of the Company.

On April 1, 2015, the Company granted

Mr. Gomolski an option to acquire 500,000 shares of its common stock at an exercise price of $.10 per share. The options vest

1/3 after six months, one third after 12 months and 1/3 after 18 months, and are exercisable for a period of 10 years from the

grant date.

ANNUAL REPORT

ON FORM 10-K AND ADDITIONAL INFORMATION

Information Available

The Company is subject to the information

and reporting requirements of the Exchange Act and in accordance with the Exchange Act, the Company files periodic reports, documents

and other information with the SEC relating to its business, financial statements and other matters, including the Company’s

annual report on Form 10-K for the year ended December 31, 2014, and any reports prior to or subsequent to that date.

These reports and other information

filed by the Company with the SEC may be inspected and are available for copying at the public reference facilities maintained

at the Securities and Exchange Commission at 100 F Street NW, Washington, D.C. 20549.

The Company’s filings with the

Securities and Exchange Commission are also available to the public from the SEC’s website, http://www.sec.gov. The

Company’s Annual Report on Form 10-K for the year ended December 31, 2014, and other reports filed under the Exchange Act,

are also available to any stockholder at no cost upon written request to the Company, Attn: Secretary, 777 South Flagler Drive,

Suite 800 West, West Palm Beach, FL 33401.

Delivery of Documents to Security Holders Sharing an Address

If hard copies of the materials are

requested, we will send only one Information Statement and other corporate mailings to stockholders who share a single address

unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,”

is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a

separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement

was delivered. You may make such a written or oral request by sending a written notification stating (i) your name, (ii) your shared

address and (iii) the address to which the Company should direct the additional copy of the Information Statement, to the Company

at 777 South Flagler Drive, Suite 800 West, West Palm Beach, FL 33401.

If multiple stockholders sharing an

address have received one copy of this Information Statement or any other corporate mailing and would prefer the Company to mail

each stockholder a separate copy of future mailings, you may send notification to or call the Company’s principal executive

offices. Additionally, if current stockholders with a shared address received multiple copies of this Information Statement or

other corporate mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared address,

notification of such request may also be made by mail or telephone to the Company’s principal executive offices.

| |

By Order of the Board of Directors |

| April 21, 2015 |

|

| |

|

| |

|

/s/ Richard J. Sullivan |

| |

|

Richard J. Sullivan

Chairman of the Board |

| |

|

Chief Executive Officer |

EXHIBIT A

MAJORITY CONSENT IN LIEU OF

A SPECIAL MEETING OF THE SHAREHOLDERS

OF

GLOBAL DIGITAL SOLUTIONS, INC.

A New Jersey Corporation

The undersigned, being

the holders of the majority of the voting shares of GLOBAL DIGITAL SOLUTIONS INC., a New Jersey corporation (the "Corporation"),

do hereby authorize and approve the actions set forth in the following resolutions without the formality of convening a meeting,

and do hereby consent to the following action of this Corporation, which actions are hereby deemed effective as of the date hereof:

WHEREAS, the undersigned

shareholders of the Corporation find it advisable and in the best interest of the Corporation and its stockholders to increase

the number of authorized shares of common stock from 450,000,000 shares to 650,000,000 shares, par value $0.001 per share (the

"Common Stock”); and

WHEREAS, the undersigned

shareholders desire to adopt a Certificate of Amendment to Certificate of Incorporation of the Corporation in accordance with Section

14A:9-1 of the New Jersey Business Corporation Act in order to increase the aggregate number of shares of common stock which the

Corporation has authority to issue; and

WHEREAS, the Directors

have approved the Certificate of Amendment to Certificate of Incorporation of the Corporation, attached hereto as Exhibit A

(the "Charter Amendment"), and have directed that it be submitted to the shareholders for approval.

NOW, THEREFORE, BE IT:

RESOLVED, that the

undersigned stockholders hereby consent to ratify, adopt, approve and confirm the Charter Amendment; and it is further

RESOLVED, that the

undersigned stockholders hereby consent to ratify, adopt, approve and confirm an increase in the number of authorized shares of

common stock of the Corporation from 450,000,000 shares of common stock, $0.001 par value, to 650,000,000 shares of common stock,

$0.001 par value; and it is further

RESOLVED,

that the Chief Executive Officer or the Chief Financial Officer of the Corporation be, and they hereby are, authorized and directed

to prepare, execute and file with the Secretary of State of the State of New Jersey, the Charter Amendment in accordance with the

applicable provisions of the New Jersey Business Corporation Act and to take

all other actions that they deem necessary or appropriate to effectuate the Charter Amendment; and it is further

RESOLVED, that the

Charter Amendment will be effective upon filing with the Secretary of State of the State of New Jersey.

[SIGNATURE PAGE FOLLOWS]

[SIGNATURE

PAGE TO WRITTEN

CONSENT OF SHAREHOLDERS]

IN WITNESS WHEREOF, the undersigned, by

affixing his or her signature hereto, does hereby consent to, authorize and approve the foregoing actions in his or her capacity

as a shareholder of the Corporation.

| |

|

|

| |

«Name» |

|

| Dated: __________ |

Number of Shares Held: «Shares» |

|

| |

Shares of Common Stock Outstanding: 107,604,352 |

|

| |

Percent of Outstanding Shares Consenting: «Percent» |

|

| |

|

|

| |

|

|

STATE OF __________________________ )

) SS

COUNTY OF ________________________ )

SWORN TO AND SUBSCRIBED before me this

_____ day of ___________, 2015 by «Name», who is personally known to me or has produced the following identification

__________________________________ which is current or has been issued within the past five years and bears a serial or other identifying

number.

__________________________________________

Print Name

__________________________________________

Signature

NOTARY PUBLIC – STATE OF _________________

Commission Number:

My commission expires: _______________________

(Notarial Seal)

EXHIBIT B

(Exhibit A to Written Consent)

Certificate of Amendment to

the Certificate of Incorporation

(Third Amendment)

Pursuant to the provisions of Section

14A:9-2 (4) and Section 14A:9-4 (3), Corporations, General, of the New Jersey Statutes, the undersigned corporation executes the

following Certificate of Amendment to its Certificate of Incorporation:

1. The name of the corporation is:

Global Digital Solutions, Inc.

| 2. | The following amendment to the Certificate of Incorporation was approved by the directors and thereafter

duly adopted by a majority of the shareholders of the corporation acting by written consent dated as of the 19th day

of March, 2015: |

Resolved, that Article

IV(a) of the Certificate of Incorporation be amended to read as follows:

(a)

Authorized Shares. The aggregate number of shares which the corporation shall have the authority to issue is Six Hundred Eighty

Five Million (685,000,000) shares. Six Hundred Fifty Million (650,000,000) shares shall be designated "Common Stock",

and shall have a par value of $.001. Thirty Five Million (35,000,000) shares shall be designated "Preferred Stock", and

shall have a par value of $.001 per share.

| 3. | The number of shares outstanding at the time of the adoption of the amendment was: 107,604,352.

The total number of shares entitled to vote thereon was: 107,604,352. |

| 4. | The number of shares voting for and against such amendment is as follows: (If the shares of any

class or series are entitled to vote as a class, set forth the number of shares of each such class and series voting for and against

the amendment, respectively). |

|

Number of Shares Voting

for Amendment |

|

Number of Shares Voting

Against Amendment |

| 60,549,984 |

|

0 |

Dated

this ___ day of ____, 2015.

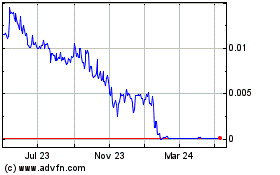

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

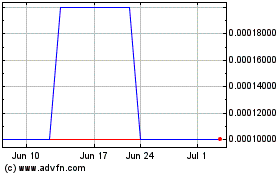

Global Digital Solutions (CE) (USOTC:GDSI)

Historical Stock Chart

From Apr 2023 to Apr 2024