UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 13, 2015

VAALCO Energy, Inc.

(Exact name of registrant as specified in is charter)

|

|

|

|

|

|

Delaware |

|

1-32167 |

|

76-0274813 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

9800 Richmond Avenue, Suite 700

Houston, Texas 77042

(Address, including zip code, of principal executive offices)

Registrant's telephone number, including area code:

(713) 623-0801

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

The description of the form of Consulting Agreement described under Item 5.02 (and as defined therein) is incorporated in this Item 1.01 by reference. A copy of the form of Consulting Agreement is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On April 13, 2015, W. Russell Scheirman, VAALCO Energy, Inc.’s (the “Company”) President and Chief Operating Officer and a member of the Company’s Board of Directors (the “Board”), gave notice to the Company of his retirement, effective immediately following the Company’s 2015 Annual Meeting of Stockholders on June 3, 2015. In addition, Mr. Scheirman will not stand for re-election as a director as the 2015 Annual Meeting of Stockholders and will retire as a member of the Board immediately following the meeting.

In connection with his retirement, Mr. Scheirman and the Company plan to enter into an agreement (the “Consulting Agreement”) pursuant to which Mr. Scheirman will provide consulting services to the Company following his retirement and continuing until December 31, 2015. Mr. Scheirman will receive $8,000 per month for any month in which he provides consulting services, $3,000 per day for any day in which he is required to travel away from Houston, Texas in providing the consulting services and reimbursement of his expenses incurred under the agreement. The Company will also reimburse Mr. Scheirman for COBRA premiums under the Company’s health insurance plan during the term of the agreement. The Consulting Agreement contains releases of claims, indemnification and other provisions customary in consulting agreements for retiring executive officers.

The option awards previously made to Mr. Scheirman under the Company’s long term incentive plans will be amended so that they will expire, unless exercised, on December 31, 2015. Any unvested awards previously made under the Company’s long term incentive plans will be forfeited upon Mr. Scheirman’s retirement.

The foregoing description of the Consulting Agreement is not complete and is qualified by reference to the Form of Consulting Agreement attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

|

Exhibit Number |

|

Description |

|

10.1 |

|

Form of Consulting Agreement between the Company and W. Russell Scheirman. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

VAALCO ENERGY, INC.

|

Dated: April 16, 2015 |

|

By: |

/s/ Eric J. Christ |

|

|

|

|

Eric J. Christ |

|

|

|

|

Vice President, General Counsel and Corporate Secretary |

Exhibit Index

|

Exhibit Number |

|

Description |

|

|

|

|

|

10.1 |

|

Form of Consulting Agreement between the Company and W. Russell Scheirman. |

Exhibit 10.1

CONSULTING AGREEMENT

This CONSULTING AGREEMENT (the “Agreement”) is made and entered into effective as of June 3, 2015 (the “Effective Date”), by and between VAALCO Energy, Inc. (the “Company”) and W. Russell Scheirman (the “Executive”). The Company and Executive may be individually referred to herein as “Party” and collectively as “Parties”.

RECITALS

WHEREAS, Executive is the President and Chief Operating Officer of the Company and member of the Board of Directors of the Company (the “Board”); and

WHEREAS, Executive and Company are parties to the agreements listed in Exhibit A (the “Grant Agreements”); and

WHEREAS, the Company and Executive agree that Executive will retire from his employment with the Company and as a member of the Board effective as of June 3, 2015 (the “Retirement Date”); and

WHEREAS, the Company desires to avail itself of the experience, sources of information, advice and assistance which Executive possesses and, in turn, to give Executive certain duties as a non-employee consultant to the Company, as described in this Agreement; and

WHEREAS, the Company desires to continue to secure the services of Executive, as a non-employee consultant to the Company, subject to the terms and conditions hereafter set forth; and

WHEREAS, Executive is willing to enter into this Agreement subject to the terms and conditions hereafter set forth;

NOW, THEREFORE, in consideration of the mutual promises, covenants and obligations contained herein, the Parties hereby agree as follows:

Article I.

Retirement and Release of Claims

1.1 Definitions and Interpretation. Various terms used in this Agreement are defined in Section 5.1, and interpretative matters are described in Section 5.2.

1.2 Retirement from the Company. Executive shall voluntarily retire from all positions as a director, officer and employee of the Company and its Affiliates, effective as of the Retirement Date.

1.3 Release of Claims. As a condition to the receipt of the Consultant Compensation, Premium Payment and Extended Option Term described in Section 2.6, the Executive must first execute and return to the Company a release agreement (the “Release”) that is substantially in the same form as attached hereto as Exhibit B (together with any changes to such form as the Company may reasonably require, in its discretion, to reflect any changes in applicable law or any agreement by the Company not to require a release with respect to one or more particular claims or potential claims) following the Retirement Date. The Company will deliver the Release to Executive within five (5) days before the Retirement Date. The Executive must return the executed Release to the Company within the applicable time period specified in the Release. No Consultant Compensation or Premium Payment shall be payable by the Company and the Extended Option Term shall not be operative unless and until the Release has been executed by the Executive, has not been revoked by Executive, and is no longer subject to revocation by Executive.

The Release shall not release any claim or cause of action by or on behalf of the Executive for (a) any payment or other benefit that is required under this Agreement or any Plan or any agreement noted on Exhibit A prior to the receipt of such benefit by or on behalf of the Executive or any other vested benefit to which Executive is entitled, (b) a breach of this Agreement by the Company or (c) any claim or cause of action arising out of the Company’s obligation to indemnify the Executive in his capacity as a director, officer or employee of the Company or any Affiliate as provided in the Company’s by-laws, any agreement to which the Executive is a party or beneficiary, at law, or otherwise.

1

1.4 Post-Termination Restrictive Covenants. As an inducement to the Company to enter into this Agreement, Executive represents to, and covenants with or in favor of, the Company, his compliance with (a) Section 2.11 of this Agreement (b) any written Company policies that apply to, or cover, Executive, including, without limitation, those regarding non-disparagement, return of Company property, and confidentiality, and (c) the Company’s written policies covering the Executive as an employee, officer or director of the Company or any Affiliate.

Article II.

CONSULTING SERVICES

2.1 Post-Employment Consulting Services. Subject to satisfaction of the requirements in Section 1.3 regarding the Release, during the Consulting Term described in Section 2.3, the Company shall retain Executive as a consultant to the Company in the capacity as an independent contractor and not as an employee of the Company, and Executive agrees to serve as a non-employee consultant to the Company for the purpose of advising and assisting the Company pursuant to the terms and conditions of this Agreement.

If and when requested by the Chief Executive Officer of the Company (“CEO”) during the Consulting Term, Executive agrees to (a) advise and assist with respect to any aspect of the Company’s operations; and (b) provide other advice to the Company or its Affiliate and offer assistance on other matters as reasonably requested from time to time (everything in clauses (a) and (b) being collectively the “Consultant Services”). Executive shall not perform any Consultant Services without obtaining advance approval from the CEO or his delegates.

|

(a) |

The Parties hereby confirm and agree that the Executive shall be retained and engaged by the Company to provide Consulting Services as an independent contractor of the Company, and Executive’s relationship to the Company or any Affiliate during the Consulting Term shall be solely that of an independent contractor and not as a director, officer or employee. |

|

(b) |

The Company shall not have the right to direct, control, or supervise Executive in the performance of any of his duties during the Consulting Term. Executive possesses all the technical training, education, expertise, experience, and industry contacts that are necessary to satisfactorily complete the Consulting Services for which he is engaged by the Company. |

|

(c) |

Executive shall have no authority or power to bind the Company or any Affiliate in relation to any third party, or to represent to any third party that Executive has any authority or power to bind the Company or any Affiliate. |

|

(d) |

The level of services to be provided to the Company by Executive during the Consulting Term shall be no more than twenty percent (20%) of the average level of services that the Executive provided to the Company during the immediately preceding 36-month period prior to commencement of the Consulting Term, as determined under Code Section 409A. |

|

(e) |

Other than the Grant Agreements and as set forth in Section 2.5(b) below, Executive shall not be eligible to participate in any Plans as the result of his performance of Consulting Services and, for all purposes of such Plans, Executive shall be classified as a non-employee. |

|

(f) |

Nothing in this Agreement shall prevent Executive from serving on the boards of outside entities or undertaking other consulting engagements or employment during the Consulting Term, provided that such other board service or other engagements or employment shall not unreasonably interfere with Executive’s performance under this Agreement, and the Executive obtains the prior written consent of the Company, which consent shall not be unreasonably withheld. |

2.2 Cooperation. During the Consulting Term, the Executive shall cooperate with the Company and its Affiliates, and with the legal counsel for the Company and any Affiliate, in connection with any present and future actual or threatened litigation, governmental, or administrative proceeding involving the Company or any Affiliate that relates to events, occurrences or conduct occurring (or claimed to have been occurred) during his prior period of employment with the Company or with respect to the Consulting Services.

2.3 Term of Agreement. Unless earlier terminated (a) by the Company pursuant to this Section 2.3, (b) automatically upon the dissolution, winding-up or termination of the Company or (c) automatically upon the death or Disability of the Executive, this Agreement shall commence on the Effective Date and shall continue in effect through the end of the Consulting Term. The Consulting Term shall begin on the date that is eight (8) days after the signed Release is returned to the Company pursuant to Section 1.3, and shall end as of the close of business on December 31, 2015, unless extended as set out below in this Section 2.3.

2

Notwithstanding the foregoing, the Consulting Term may be terminated by the Company or the Executive for any reason with thirty (30) days’ advance Notice to Executive or Company, respectively.

2.4 Expenses. The Executive shall be entitled to reimbursement of all reasonable and documented out-of-pocket costs and expenses incurred by Executive in performing the Consulting Services (including, without limitation, (a) travel to and from, and accommodations for, meetings incident to performing the Consulting Services at a level consistent with executive management of the Company at that time and (b) out-of-pocket costs and expenses incurred in connection with Executive’s performance under Section 2.2 (the “Expenses”). Any Expenses submitted by Executive will be reimbursed along with the next payment of Consultant Compensation as set forth pursuant to Section 2.6(a) below, or in any event, no later than thirty (30) days after their submission.

2.5 Executive’s Standard of Care. Executive shall perform the Consulting Services with the degree of care, skill and prudence that he reasonably believes to be in the best interest of the Company.

2.6 Consultant Compensation.

|

(a) |

The Company will pay Executive $8,000 per month for any month in which Consultant Services are provided during the Consulting Term, and an additional $3,000 per day for any day that Consultant is required to travel more than fifty (50) miles from Houston, Texas on behalf of the Company in order to carry out the Consulting Services (“Consultant Compensation”) Each such payment shall be made by the Company to Executive with in the 20 day period immediately following the last day of each such month. The Consultant Compensation shall be Executive’s agreed fee for performing the Consultant Services, and shall be payable even if Executive does not actually perform any Consulting Services for that month. No payment or benefit that Executive is entitled to receive under this Agreement shall be reduced by any (a) compensation or fees earned by Executive as the result of his employment or engagement by another Person, (b) reimbursement of expenses under Section 2.4, or (c) or other sources of compensation or fees paid to or on behalf of Executive. |

|

(b) |

The Company will pay the Executive’s premiums for a health insurance policy of Executive’s choosing covering Executive and his spouse and dependents during the Consulting Term not to exceed, per month, $2,255.05 (“Premium Payment”). |

|

(c) |

Notwithstanding anything in the award grants or governing Plans to the contrary, the Parties agree that, for the following stock option awards of Executive: the March 18, 2011 option award from the 2001 Stock Incentive Plan, the March 16, 2012 option award from the 2001 Stock Incentive Plan, the March 5, 2013 option award from the 2012 Long Term Incentive Plan, the March 4, 2014 option award from the 2012 Long Term Incentive Plan and the March 3, 2015 option award from the 2014 Long Term Incentive Plan, the option term (i.e. the period of time during which the stock options are in effect and Executive can exercise the stock options) shall end on December 31, 2015 (all of such option extensions, the “Extended Option Term”), subject, in all other respects, to the other terms and conditions in such plans and stock option award agreements. |

2.7 No Tax Withholding. The Company shall classify Executive as an independent contractor of the Company during the Consulting Term. The Company shall not withhold any taxes from any of the Consultant Compensation paid to Executive. Executive agrees that he is responsible for timely paying all taxes relating to the Consultant Compensation.

2.8 Indemnification. The Company shall indemnify, to the fullest extent permitted under applicable law, defend and hold harmless the Executive from and against any and all liability, costs, expenses and damages arising from, or related to, the Consulting Services pursuant to this Section 2.8.

|

(a) |

General. The Company and its Affiliates shall, jointly and severally, indemnify, defend and hold harmless Executive from and against any and all liability, costs, expenses, damages and claims, including, without limitation, CLAIMS ALLEGING EXECUTIVE’S NEGLIGENCE, arising from his service as a consultant to the Company or any of its Affiliates. This Section 2.8 shall be in addition to, and shall not limit in any way, the rights of Executive to any other indemnification from the Company or an Affiliate, as a matter of law, contract or otherwise. The Company agrees that if Executive is made a party, or is threatened to be made a party, to any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “Proceeding”), by reason of the fact that Executive is or was a consultant to the Company or any Affiliate under this Agreement, Executive shall be indemnified and held harmless by the Company and its Affiliates, on a joint and several basis, from and against any and all Expenses (as defined below) that are incurred or suffered by Executive in connection therewith. The foregoing indemnification rights and obligations shall continue even if Executive has ceased to be a consultant for the Company or any Affiliate and shall inure to the benefit of his heirs, executors, administrators, successors and assigns. |

3

|

(b) |

Expenses. As used in this Section 2.8, the term “Expenses” shall include, without limitation, damages, losses, judgments, liabilities, fines, penalties, excise taxes, settlements, costs, reasonable attorneys' and accountants' fees, costs of attachment or similar bonds, investigations, and any expenses of establishing a right to indemnification under this Agreement. |

|

(c) |

Advances of Expenses. Expenses that are incurred, or reasonably expected to be incurred, by Executive in connection with any Proceeding shall be paid by the Company or an Affiliate in advance upon the request of Executive that the Company pay such Expenses, but only in the event that Executive shall have delivered in writing to the Company an undertaking to reimburse the Company for Expenses with respect to which it is determined that Executive is not entitled to indemnification hereunder. |

|

(d) |

Notice of Claim. Executive shall give timely Notice to the Company of any claim made against him for which indemnification will, or could be, sought under this Agreement after Executive has direct knowledge of such a claim. In addition, with respect to such a claim, Executive shall give the Company such information and cooperation, as it may reasonably require, except to the extent that Executive's interest in such claim is directly adverse to the Company. |

|

(e) |

Defense of Claim. With respect to any Proceeding as to which Executive notifies the Company of the commencement thereof: |

(1) The Company and its Affiliates will be entitled to participate therein at their own expense.

(2) Except as otherwise provided below, to the extent that it may desire, the Company or any Affiliate will be entitled to assume the defense thereof, which in the Company's or Affiliate’s discretion may be regular counsel to the Company or an Affiliate or may be counsel to officers and directors of the Company or an Affiliate. Executive also shall have the right to employ his own counsel in such Proceeding if he reasonably concludes that failure to do so would involve a conflict of interest between the Company and Executive and, in such circumstances, the reasonable fees and expenses of such counsel shall be at the expense of the Company.

(3) The Company and its Affiliates shall not be liable to indemnify Executive under this Agreement for any amounts paid in settlement of any action or claim effected without the written consent of the Company. The Company or an Affiliate shall not settle any action or claim in any manner that would impose any (a) penalty that would not be paid directly or indirectly by the Company or an Affiliate or (b) limitation, judgment, or liability on Executive, without first obtaining Executive's written consent. Neither the Company nor Executive will unreasonably withhold or delay its reasonable consent to any proposed settlement.

|

(f) |

Non-exclusivity. The right to indemnification and the payment of Expenses incurred in defending a Proceeding in advance of its final disposition, as conferred in this Section 2.8, shall not be exclusive of any other right that Executive may have or hereafter may acquire under any law or governing document of the Company or any Affiliate, agreement or otherwise. Nothing in this Agreement shall alter or limit the Company’s obligation to indemnify the Executive in his capacity as a director, officer, or employee of the Company or any Affiliate as provided in the Company’s by-laws, any agreement to which the Executive is a party or beneficiary, at law, or otherwise. Furthermore, nothing in this Agreement shall alter or limit any coverage of Executive under the Company’s applicable directors and officers insurance. |

2.9 Confidential Information. For purposes of this Section 2.9, the term “Company” shall refer to and include the Company and its Affiliates. During the Consulting Term, the Company will (a) disclose or entrust to the Executive, and provide the Executive with access to, Confidential Information, (b) place the Executive in a position to develop business goodwill belonging to the Company, and (c) disclose or entrust to the Executive business opportunities to be developed for the Company.

|

(a) |

Executive acknowledges that Confidential Information has been and will be developed or acquired by the Company through the expenditure of substantial time, effort and money and provides the Company with an advantage over competitors who do not know or use such Confidential Information. |

|

(b) |

Executive acknowledges and agrees that all Confidential Information about the Company that was previously provided in the course of employment with the Company, and Confidential Information that will be provided during the Consulting Term, is and will continue to be, the exclusive property of the Company. The Executive agrees to keep all Confidential Information in strict confidence, not disclosing any Confidential Information to any third person except as permitted hereunder. |

|

(c) |

During and following the Consulting Term, Executive shall hold in confidence and not directly or indirectly disclose, use, copy, or make any list of any Confidential Information, except to the extent necessary to carry |

4

|

out the Consulting Services hereunder. Executive agrees to give the Notice to Company of any attempts to compel disclosure of any Confidential Information within three (3) Business Days after the Executive is informed that such disclosure is being, or will be, compelled. This Notice shall contain a copy of the subpoena, order or other process used to compel disclosure. |

|

(d) |

Following the expiration of Consulting Term for whatever reason, Executive agrees that: (1) he will not take with him, copy, alter, destroy, or delete any files, documents or other materials whether or not embodying or recording any Confidential Information, including copies, without obtaining the advance written consent of an authorized Company representative; and (b) he will promptly return to the Company all Confidential Information, documents, files, and records (written or electronically stored) that are in his possession or under his control, and he will not use or disclose such materials in any way or in any format including, without limitation, written information in any form, information stored by electronic means, and all copies of materials containing any Confidential Information, without the written consent of the Company. |

|

(e) |

The Executive shall continue to abide by the Company’s confidentiality policies during and following the Consulting Term. Executive shall not at any time disclose to any unauthorized Person, or publish, or use for any purpose, any Confidential Information, except as the Company the Company directs and authorizes, or as subject to compulsion of law. Executive shall take all reasonable measures to protect the secrecy of and avoid disclosure and unauthorized use of any Confidential Information. This confidentiality covenant shall be in addition to, and not limit or restrict in any way, any other confidentiality or post-employment agreement or covenant between the Executive and the Company or any of its Affiliates. |

2.10 Non-Disparagement. Executive agrees not to, directly or indirectly, disclose, communicate, or publish any disparaging, negative, intentionally harmful, or disapproving information, written communications, oral communications, electronic or magnetic communications, writings, oral or written statements, comments, opinions, facts, or remarks, of any kind or nature whatsoever (collectively, “Disparaging Information”), concerning or related to the Company or any of its Affiliates, or its and their directors, officers, employees and partners (individually and collectively, the “Covered Persons”). Executive understands and acknowledges that this non-disparagement clause prevents him from disclosing, communicating, or publishing, directly or indirectly, any Disparaging Information concerning or related to the Covered Persons including, without limitation, information regarding the Covered Persons’ businesses, customers or clients, proprietary or technical information, documents, operations, inventions, trade secrets, product ideas, technical information, know‑how, processes, plans (including, without limitation, marketing plans and strategies), specifications, designs, methods of operation, human resources department or operations, employee salaries, employee benefits, techniques, technology, formulas, software, improvements, internal or external audits, internal controls, or any financial, marketing or accounting information of any nature whatsoever. Further, Executive acknowledges that in executing this Agreement, he has knowingly, voluntarily, and intelligently waived any free speech, free association, free press or First Amendment to the United States Constitution (including, without limitation, any counterpart or similar provision or right under the Texas Constitution or any other state constitution which may be deemed to apply) rights to disclose, communicate, or publish Disparaging Information concerning or related to the Covered Persons.

Executive also confirms and agrees that he has had a reasonable period of time to consider these non-disparagement covenants, to review such covenants with his attorney, and to consent to such covenants knowingly and voluntarily. Executive further acknowledges that this Section 2.10 is a material term of this Agreement. If Executive breaches any provision of this Section 2.10, the Company will not be limited to a damages remedy, but may seek all other equitable and legal relief including, without limitation, a temporary restraining order, temporary injunctive relief, a permanent injunction, and its attorneys’ fees and costs, against Executive and any other Person acting by, through, under, or in concert with him. Nothing in this Agreement shall, however, be deemed to prevent Executive from testifying fully and truthfully in response to a subpoena from any court or from responding to an investigative inquiry from any governmental agency for purposes of complying with the law.

2.11 Non-Recruitment. Executive agrees that during the Consulting Term and for a period of one year following the end of the Consulting Term, he will not, directly or indirectly, hire, solicit, induce, recruit, engage, go into business with, encourage to leave their employment or contractor relationship with the Company or any Affiliate, or otherwise cease their employment or contractor relationship with the Company or any Affiliate, or otherwise contract for services with, any employee or contractor of the Company or any Affiliate. Executive hereby covenants and agrees that he will not, directly or indirectly, either individually or as a principal, owner, agent, consultant, contractor, employee, or a director of any Person, or in any other manner or capacity whatsoever, except on behalf of the Company or an Affiliate, solicit business, or attempt to solicit business, in products or services competitive with any products or services provided by the Company or any Affiliate, from the Company’s or Affiliate’s partners, clients, customers, property owners, or royalty interest owners, or any other Person with whom the Company or Affiliate did business, or had a business relationship with as of, or within the one year period preceding the Retirement Date.

5

2.12 Return of Company Property. Following the termination of the Consulting Term for any reason, Executive agrees to immediately return to the Company all equipment or other property of the Company or any Affiliate that is in his possession or under his control upon termination of the Consulting Term for whatever reason.

2.13 Disclosure of Business Opportunities. During the Consulting Term and for a period of six (6) months thereafter, Executive acknowledges and agrees that he owes a fiduciary duty of loyalty, fidelity, and allegiance to use his best efforts to act at all times in the best interests of the Company and its Affiliates. In keeping with these duties, the Executive shall make full disclosure to the Company of all business opportunities pertaining to the business of the Company or any Affiliate, and he shall not appropriate for the Executive’s own benefit any business opportunity that is subject to such fiduciary relationship without the prior written consent of the CEO or the Board.

2.15 Attorney’s Fees. The Company shall reimburse Executive for all reasonable legal fees and expenses incurred by Executive in connection with the review, preparation and execution of this Agreement.

Article III.

Enforcement

3.1 Choice of Law. This Agreement shall be governed by, and construed and interpreted in accordance with, the laws of the State of Texas without regard to principles of conflict of laws.

3.2 Choice of Forum. Jurisdiction and venue of any action or proceeding relating to this Agreement or any dispute hereunder shall be exclusively in the federal or state courts of competent jurisdiction in Harris County, Texas, and the Parties hereby waive any objection to such jurisdiction or venue, or to the effect that it is inconvenient.

3.3 Injunctive Relief. The Executive acknowledges and agrees that (a) the covenants, obligations and agreements of the Executive in this Agreement concern special, unique and extraordinary matters and (b) a violation of any of these covenants, obligations or agreements could cause the Company irreparable injury for which adequate remedies at law are not available. Therefore, the Executive agrees that Company alone will be entitled to an injunction, restraining order, or all other equitable relief (with any bond requirement not to exceed $20,000.00) as a court of competent jurisdiction may deem necessary or appropriate to restrain the Executive from committing any violation of the covenants, obligations or agreements of Executive in this Agreement. These injunctive remedies are cumulative and in addition to any other rights and remedies that the Company may have against the Executive. Company and the Executive irrevocably submit to the exclusive jurisdiction of the courts under Section 3.2 regarding the injunctive remedies set forth in this Section 3.3, and each Party waives all objections and defenses based on service of process, forum, venue, or personal or subject matter jurisdiction, as these defenses may relate to an application for injunctive relief in a suit or proceeding under this Section 3.3.

Article IV.

Miscellaneous Provisions

4.1 Notice. Each Notice or other communication required or permitted under this Agreement shall be in writing and transmitted or delivered by personal delivery, prepaid courier or messenger service (whether overnight or same-day), prepaid telecopy or facsimile, or prepaid certified United States mail (with return receipt requested), addressed (in any case) to the other Party at the address for that Party set forth below, or at such other address as the recipient has designated by Notice to the other Party.

W. Russell Scheirman

VAALCO Energy, Inc.

9800 Richmond Avenue

Suite 700

Houston, TX 77042

Attn: Legal Department

6

|

(c) |

Deemed Delivery. Each Notice or other communication so transmitted, delivered, or sent in person, by courier or messenger service, or by certified United States mail, shall be deemed given, received, and effective on the date delivered to or refused by the intended recipient (with the return receipt, or the equivalent record of the courier or messenger, being deemed conclusive evidence of delivery or refusal.) Nevertheless, if the date of delivery is after 5:00 p.m. (local time of the recipient) on a Business Day, the Notice or other communication shall be deemed given, received, and effective on the next Business Day. |

4.2 Limitations on Assignment. Except as expressly provided in this Agreement, Executive may not assign this Agreement or any of his rights or obligations hereunder without the express written consent of the CEO or the Board; provided, however, that the Executive may make a limited assignment such that the Consultant Services are performed by Executive through, and the payment of the Consultant Compensation may be made to, an entity that is wholly-owned by Consultant. Any other attempted assignment by Executive in violation of this Section 4.2 shall be void. Notwithstanding the foregoing, this Agreement shall inure to the benefit of and be enforceable by Executive's personal or legal representative, executors, administrators, and heirs. In the event of the death of Executive while any benefit is payable hereunder, such benefit shall be promptly provided by the Company to the Executive’s Beneficiary.

4.3 Successors of Company. This Agreement shall be binding upon and inure to the benefit of the Company and any successor of the Company (whether direct or indirect, by purchase, merger, consolidation or otherwise). The Company shall require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or assets of the Company to assume expressly and agree to perform this Agreement in the same manner and to the same extent that the Company would be required to perform it if no such succession had taken place. As used in this Agreement, the term “Company” shall mean the Company as previously defined and any successor by operation of law or otherwise, as well as any successor to its business and/or assets which assumes and agrees to perform this Agreement. Except as provided in Section 4.2 and Section 4.3, this Agreement, and the rights and obligations of the Parties hereunder, are personal in nature and neither this Agreement, nor any right, benefit, or obligation of either Party, shall be subject to voluntary or involuntary assignment, alienation or transfer, whether by operation of law or otherwise, without the written consent of the other Party.

4.4 Severability and Reformation. It is the desire of the Parties that this Agreement be enforced to the maximum extent permitted by law, and should any provision contained herein be held invalid or otherwise unenforceable by a court of competent jurisdiction, the Parties hereby agree and confirm that such provision shall be reformed to create a valid and enforceable provision to the maximum extent permitted by law; provided, however, if such provision cannot be reformed, it shall be deemed ineffective and deleted herefrom without affecting any other provision of this Agreement which shall remain fully enforceable. In such event, this Agreement shall be construed by limiting and reducing it only to the minimum extent necessary to be enforceable under then applicable law. Any such determination or reformation shall not be binding on any court or other governmental authority not otherwise bound to follow such conclusions pursuant to applicable law.

4.5 No Third Party Beneficiaries. This Agreement shall be binding upon and inure to the benefit of the Parties hereto, and to their respective successors and permitted assigns hereunder, but otherwise this Agreement shall not be for the benefit of any third parties.

4.6 Entire Agreement. This Agreement, together with the Release substantially in the form attached hereto as Exhibit B, sets forth the entire agreement of the Parties and fully supersedes and replaces any and all prior agreements or understandings, written or oral, between the Parties pertaining to the subject matter of this Agreement. The Parties have made no agreements, representations, or warranties regarding the subject matter of this Agreement that are not set forth in this Agreement. Each Party acknowledges and agrees that in executing this Agreement, the Party did not rely, and has not relied, on any communications, promises, statements, inducements or representations, oral or written, except as expressly contained in this Agreement.

4.7 Waiver and Amendment. No term or condition of this Agreement shall be deemed waived other than by a writing signed by the Party against whom or which enforcement of the waiver is sought. Without limiting the generality of the preceding sentence, a Party’s failure to insist upon the other Party’s strict compliance with any provision of this Agreement, or to assert any right that a Party may have under this Agreement, shall not be deemed a waiver of that provision or that right. Any written waiver shall operate only as to the specific term or condition waived under the specific circumstances, and shall not constitute a waiver of that term or condition for the future or a waiver of any other term or condition. No amendment, termination or other modification of this Agreement shall be effective unless stated in a writing that refers to this Agreement and is signed by both Parties.

4.8 Executive Acknowledgment. Executive acknowledges that (a) he is knowledgeable and sophisticated as to business matters, including the subject matter of this Agreement, (b) he has read this Agreement and understands its terms and conditions, (c) he is being provided ample opportunity to discuss this Agreement with his own legal counsel prior to execution, and (d) no strict rules of construction shall apply for or against the drafter or any other Party. Executive represents that he is free to enter into this

7

Agreement including, without limitation, that he is not subject to any restrictive covenant that would conflict with his rights or duties under this Agreement.

4.9 Code Section 409A Compliance. In light of the uncertainty surrounding the proper application of Code Section 409A, the Parties agree to cooperate to make any mutually agreed upon amendments to this Agreement that do not otherwise change the substance of the material terms of this Agreement, in order to minimize or avoid the imposition of any penalties or additional taxes that could be imposed under Code Section 409A. Notwithstanding the foregoing, if the Parties cannot agree to such amendments, the terms and conditions of the Agreement shall remain in full force and effect. The Company represents to Executive that it believes that the payments and benefits provided under this Agreement are intended to be exempt from, or comply with, Code Section 409A and, absent any relevant guidance issued by the Internal Revenue Service following the Effective Date, shall report (to the extent legally required) all such payments and benefits accordingly.

4.10 Survival of Certain Provisions. Wherever appropriate to the intention of the Parties, the respective rights and obligations of the Parties hereunder shall survive any termination or expiration of this Agreement.

4.11 Counterparts. This Agreement and any amendments thereto will be in writing and may be executed in counterparts and by facsimile with the same effect as if both Parties had signed the same document. Each counterpart will be deemed an original, and all counterparts shall be construed together to constitute one, and the same, document.

Article V.

Definitions and Interpretive Matters

5.1 Defined Terms. In this Agreement, the following terms have the corresponding meanings which are incorporated into the Agreement:

|

(a) |

“Affiliate” means, with respect to the Company, any Person, directly or indirectly controlling, controlled by, or under common control with the Company. For the purposes of this definition, the terms “controlling, controlled by, or under common control” means the possession, directly or indirectly, of the power to direct or cause the direction of management or policies (whether through ownership of securities or any partnership or other ownership interest, by contract or otherwise) of a Person, as determined by the Board. |

|

(b) |

“Beneficiary” means the Executive’s surviving spouse, if any. If there is no surviving spouse at the time of Executive’s death, then the Beneficiary shall be the Executive’s estate. |

|

(c) |

“Board” means the then-current board of Directors of the Company. |

|

(d) |

“Business Day” means any Monday through Friday, excluding any such day on which banks are authorized to be closed in Texas. |

|

(e) |

“Code” means the Internal Revenue Code of 1986, as amended, and the regulations and other authority issued thereunder by the appropriate governmental authority. |

|

(f) |

“Confidential Information” means any and all confidential or proprietary information and materials, as well as all trade secrets, belonging to the Company or its Affiliate, and its and their owners, customers, or third parties who furnished such information, materials, and/or trade secrets to the Company or its Affiliate with expectations of confidentiality. Confidential Information includes, regardless of whether such information or materials are expressly identified or marked as confidential or proprietary, and whether or not patentable: (1) technical information and materials of the Persons referenced above; (2) business information and materials of the Persons referenced above; (3) any information or material that gives the Company or an Affiliate an advantage with respect to its competitors by virtue of not being known by those competitors; and (4) other valuable, confidential information and materials and/or trade secrets of the Persons referenced above. Notwithstanding the foregoing, Confidential Information shall not include information that (A) is already properly in the public domain or enters the public domain with the express consent of the Company or an Affiliate, or (B) is intentionally made available by the Company or an Affiliate to a third party without any reasonable expectation of confidentiality. |

For all purposes of the Agreement, Confidential Information includes, but is not limited to, the following: all trade secrets of the Company or an Affiliate; all non-public information that the Company or an Affiliate has marked as confidential or has otherwise described to Executive (either in writing or orally) as confidential; all non-public information concerning the Company’s or Affiliate’s products, services, prospective products or services, research, prospects, leases, surveys, seismic data, drilling data, designs,

8

prices, costs, marketing plans, marketing techniques, studies, test data, leasehold and royalty owners, investors, suppliers and contracts; all business records and plans; all personnel files; all financial information of or concerning the Company or an Affiliate; all information relating to the Company’s operating system software, application software, software and system methodology, hardware platforms, technical information, inventions, computer programs and listings, source codes, object codes, copyrights and other intellectual property; all technical specifications; any proprietary information belonging to the Company or an Affiliate; all computer hardware or software manuals of the Company or an Affiliate; all Company or Affiliate training or instruction manuals; all Company or Affiliate electronic data; and all computer system passwords and user codes.

|

(g) |

“Consulting Term” means the time period following the Retirement Date during which the Executive is engaged to perform Consulting Services under this Agreement. |

|

(h) |

“Disability” shall mean that the Executive is unable to substantially perform the Consultant Services for a period of at least 30 days during any period of 60 consecutive days due to his physical or mental impairment, as determined by the Board (or any committee thereof) or by the CEO. Executive agrees to submit to any examinations that are reasonably required by an attending physician or other healthcare service provider to determine whether he has a Disability hereunder. All health service provider costs relating solely to the determination of whether Executive has a Disability shall be paid by the Company upon request by Executive. |

|

(i) |

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the regulations and other authority issued thereunder by the appropriate governmental authority. |

|

(j) |

“Notice” means a written communication complying with Section 4.1 of the Agreement (“Notify” has the correlative meaning). |

|

(k) |

“Person” means any individual, firm, corporation, partnership, company, joint venture, association, joint-stock company, limited liability company, trust, unincorporated organization, or other entity. |

|

(l) |

“Plan” means any bonus, incentive compensation, savings, pension, retirement, stock option, stock appreciation, stock ownership or purchase, deferred compensation, or health or other welfare benefits, plan, policy, practice, program or arrangement (including any separate contract or agreement) that the Company or an Affiliate maintains for its employees or former employees, including, without limitation, any “employee benefit plan” as defined in Section 3(3) of ERISA. |

5.2 Interpretive Matters. In the interpretation of the Agreement, except where the context otherwise requires:

|

(a) |

The Agreement headings are for reference purposes only and will not affect in any way the meaning or interpretation of this Agreement. |

|

(b) |

The terms “including” and “include” do not denote or imply any limitation. |

|

(c) |

The conjunction “or” has the inclusive meaning “and/or”. |

|

(d) |

The singular includes the plural, and vice versa, and each gender includes each of the others. |

|

(e) |

The term “month” refers to a calendar month. |

|

(f) |

A reference to any statute, rule, or regulation includes any amendment thereto or any statute, rule, or regulation enacted or promulgated in replacement thereof. |

[Signature page follows.]

9

Article VI.

Execution

As evidenced by my signature below, I hereby certify that I have read the Agreement and agree to its terms and conditions.

|

Executive: |

|

Company: |

|

|

|

|

|

|

|

|

|

|

|

|

|

W. Russell Scheirman |

|

By: |

|

|

|

Steve Guidry,

Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VAALCO Energy, Inc.

9800 Richmond Avenue, Suite 700

Houston, TX 77042

Attn: Legal Department |

10

EXHIBIT A

TO

CONSULTING AGREEMENT

LIST OF OTHER AGREEMENTS

Grant Agreements:

|

1. |

2001 Long Term Incentive Plan |

Grant Date: March 18, 2011

Options Granted: 179,115

Option Price: $6.97

Vested Shares: 179,115

Expiration Date: March 18, 2016

|

2. |

2001 Long Term Incentive Plan |

Grant Date: March 16, 2012

Options Granted: 100,000

Option Price: $8.81

Options Vested: 100,000

Expiration Date: March 16, 2017

|

3. |

2012 Long Term Incentive Plan |

Grant Date: March 5, 2013

Options Granted: 100,000

Option Price: $7.75

Options Vested: 100,000

Expiration Date: March 5, 2018

|

4. |

2012 Long Term Incentive Plan |

Grant Date: March 4, 2014

Options Granted: 100,000

Option Price: $6.98

Options Vested: 66,666

Options Unvested: 33,334

Expiration Date: March 4, 2019

|

5. |

2014 Long Term Incentive Plan |

Grant Date: March 3, 2015

Options Granted: 115,800

Option Price: $4.98

Options Vested: 38,600

Options Unvested: 77,200

Expiration Date: March 3, 2020

|

6. |

2012 Long Term Incentive Plan |

Grant Date: March 4, 2014

Restricted Stock Granted: 17,000

Restricted Stock Vested: 5,666

Restricted Stock Unvested: 11,334

|

7. |

2014 Long Term Incentive Plan |

Grant Date: March 3, 2015

Restricted Stock Granted: 29,900

Restricted Stock Vested: 0

Restricted Stock Unvested: 29,900

A-1

EXHIBIT B

TO

CONSULTING AGREEMENT

RELEASE AGREEMENT

In consideration of the Consultant Compensation, Premium Payment and Extended Option Term set forth in that certain Consulting Agreement (the “Consulting Agreement”) dated effective as of June 3, 2015, and as it may be amended thereafter, by and between VAALCO Energy, Inc. (the “Company”) and W. Russell Scheirman (“Executive”), this Release Agreement (the “Agreement”) is made and entered into by the Company and the Executive (each a “Party” and together, the “Parties”).

By signing this Agreement, Executive and the Company hereby agree as follows:

|

1. |

Purpose. The purpose of this Agreement is to provide for the orderly termination of the employment relationship between the Parties, and to voluntarily resolve any actual or potential disputes or claims that Executive has, had or may ever have, as of the date of Executive’s execution of this Agreement, against the Company and all of its parents, predecessors, successors, Affiliates (as defined in the Consulting Agreement), divisions, related companies and organizations, and its and their present and former agents, employees, managers, officers, directors, attorneys, stockholders, plan fiduciaries, assigns, agents, representatives, and all other Persons (as defined in the Consulting Agreement) acting by, through or in concert with any of them (collectively, the “Released Parties”). Neither the fact that this Agreement has been proposed or executed, nor the terms of this Agreement, are intended to suggest, or should be construed as suggesting, that the Released Parties have acted unlawfully or violated any federal, state or local law or regulation, or any other duty, policy or contract involving Executive. |

|

2. |

Termination of Employment. Effective June 3, 2015 (the “Retirement Date”), Executive’s employment with the Company and all of its Affiliates has voluntarily terminated. |

|

3. |

Termination Benefits. In consideration for Executive’s execution of, and required performance under, this Agreement, the Company shall provide Executive with the Consulting Compensation, the Premium Payments and the Extended Option Term (as defined in the Consulting Agreement, which definition and other terms in the Consulting Agreement are incorporated herein by this reference). Executive confirms and agrees that he would not otherwise have received, or been entitled to receive, the Consulting Compensation the Premium Payments or the Extended Option Term if he did not enter into this Agreement. |

|

4. |

Waiver of Additional Compensation or Benefits. The Consulting Compensation to be paid to Executive, the Premium Payments, and the Extended Option Term (subject to the terms of the applicable plans and stock option award agreements) constitute the entire amount of compensation and consideration due to Executive under the Consulting Agreement and this Agreement, and Executive acknowledges that he has no right to seek, and will not seek, any additional or different compensation or consideration for executing or performing under the Consulting Agreement or this Agreement. |

|

5. |

Executive Representations. Executive expressly acknowledges and represents, and intends for the Company to rely upon his representations, that he: |

|

(a) |

Has not filed any complaints, claims or actions against the Company or any of the other Released Parties with any court, agency, or commission regarding the matters encompassed by this Agreement and, by executing this Agreement, Executive hereby waives the right to recover monetary damages in any proceeding that (1) Executive may bring before the EEOC or any state or local human rights commission or (2) may be brought by the EEOC or any state or local human rights commission by or on Executive’s behalf. |

|

(b) |

Understands that he is, by entering into this Agreement, and subject to the terms and provisions set forth herein, releasing the Released Parties, including the Company, from any and all claims he has, had or may ever have against them under federal, state or local laws, which have arisen on or before the execution date of this Agreement. |

|

(c) |

Understands that he is, by entering into this Agreement, waiving all claims that he has, had or may ever have against the Released Parties under the federal Age Discrimination in Employment Act of 1967, as amended, which have arisen on or before the execution date of this Agreement. |

|

(d) |

Agrees that this Agreement shall be binding on him and his heirs, administrators, representatives, executors, successors, and assigns, and shall inure to the benefit of his heirs, administrators, representatives, executors, successors and assigns. |

|

(e) |

Has reviewed all aspects of this Agreement, and has carefully read and fully understands all of the provisions and effects of this Agreement. |

1

|

(f) |

Has been, and is hereby, advised in writing to consult with an attorney of his own choice before signing this Agreement. |

|

(g) |

Is knowingly and voluntarily entering into this Agreement, and has relied solely and completely upon his own judgment and, if applicable, the advice of his own attorney in entering into this Agreement. |

|

(h) |

Is not relying upon any representations, promises, predictions, projections or statements made by or on behalf of the Company or any of the other Released Parties, other than those that are specifically stated in this Agreement. |

|

(i) |

Does not waive rights or claims that may arise after the date this Agreement is signed below. |

|

6. |

Release. Executive, on behalf of himself and his heirs, executors, administrators, successors and assigns, irrevocably and unconditionally releases, waives and forever discharges the Released Parties from and against any and all claims, demands, actions, causes of action, charges, complaints, liabilities, obligations, promises, sums of money, agreements, representations, controversies, disputes, damages, suits, right, sanctions, costs (including attorneys’ fees), losses, debts and expenses of any nature whatsoever, whether known or unknown, fixed or contingent, which Executive has, had or may ever have against the Released Parties arising out of, concerning, or related to, his employment or separation from employment with the Company and its Affiliates, from the beginning of time and up to and including the date Executive executes this Agreement below. This Agreement includes, without limitation, (a) law or equity claims; (b) contract (express or implied) or tort claims; (c) claims arising under any federal, state or local laws of any jurisdiction that prohibit age, sex, race, national origin, color, disability, religion, veteran, military status, sexual orientation or any other form of discrimination, harassment, hostile work environment or retaliation (including, without limitation, the Age Discrimination in Employment Act of 1967, the Older Workers Benefit Protection Act, the Americans with Disabilities Act of 1990, the Americans with Disabilities Act Amendments Act of 2008, Title VII of the Civil Rights Act of 1964, the Civil Rights Act of 1991, the Civil Rights Acts of 1866 and/or 1871, 42 U.S.C. Section 1981, the Rehabilitation Act, the Family and Medical Leave Act, the Sarbanes-Oxley Act, the Employee Polygraph Protection Act, the Worker Adjustment and Retraining Notification Act, the Equal Pay Act of 1963, the Lilly Ledbetter Fair Pay Act, the Uniformed Services Employment and Reemployment Rights Act of 1994, the Genetic Information and Nondiscrimination Act of 2008, the Texas Labor Code, Section 1558 of the Patient Protection and Affordable Care Act of 2010, the Consolidated Omnibus Budget Reconciliation Act of 1985, and any other federal, state or local laws of any jurisdiction); (d) claims under any other federal, state, local, municipal or common law whistleblower protection, discrimination, wrongful discharge, anti-harassment or anti-retaliation statute or ordinance; (e) claims arising under ERISA; or (f) any other statutory or common law claims related to Executive’s employment or separation from employment with the Company and its Affiliates. Executive further represents that, as of the date of his execution of this Agreement, he has not been the victim of any illegal or wrongful acts by any of the Released Parties, including, without limitation, discrimination, retaliation, harassment or any other wrongful act based on sex, age, race, religion, or any other legally protected characteristic. |

Notwithstanding the foregoing, this Agreement specifically does not release any claim or cause of action by or on behalf of Executive (or his Beneficiary) (i) for any payment or other benefit that is required under the terms of either the Consulting Agreement or pursuant to any Plan (as defined in the Consulting Agreement) prior to the receipt thereof by or on behalf of Executive, (ii) arising out of the Company’s obligation to indemnify the Executive in his capacity as a director, officer or employee of the Company or any Affiliate thereof, or as a former director, officer or employee of the Company or any Affiliate as provided in the Company’s by-laws, any agreement to which the Executive is a party or beneficiary, at law, or otherwise or (iii) for any matters relating to Executive’s status as a holder of the Company’s common stock generally.

|

7. |

Twenty-One Calendar Days to Consider Offer of Termination Benefits. Executive shall have, and by signing this Agreement Executive acknowledges and represents that he has been given, a period of twenty-one (21) calendar days to consider whether to elect to sign this Agreement, and to thereby waive and release the rights and claims addressed in this Agreement. Although Executive may sign this Agreement prior to the end of the twenty-one (21) calendar day period, Executive may not sign this Agreement on or before the Retirement Date. In addition, if Executive signs this Agreement prior to the end of the twenty-one (21) calendar day period, Executive shall be deemed, by doing so, to have certified and agreed that the decision to make such election prior to the expiration of the twenty-one (21) calendar day period is knowing and voluntary and was not induced by the Company through: (a) fraud, misrepresentation or a threat to withdraw or alter the offer prior to the end of the twenty-one (21) calendar day period; or (b) an offer to provide different terms or benefits in exchange for signing the Agreement prior to the expiration of the twenty-one (21) calendar day period. |

|

8. |

Seven Day Revocation Period. Executive understands and acknowledges that he may revoke this Agreement at any time within seven (7) calendar days after he signs this Agreement. To revoke this Agreement, Executive must deliver written notification of such revocation to the attention of Steven Guidry, Chief Executive Officer, within seven (7) calendar days after the date that he signs this Agreement. Executive further understands that if he does not revoke this Agreement within seven (7) calendar days following his execution of the Agreement (excluding the date of execution), the Agreement will become effective, binding and enforceable on both Parties. |

2

|

9. |

Agreement not to Sue. Except as set forth in Section 6(i) and (ii) of this Agreement or required by law that cannot be waived, Executive agrees that he will not commence, maintain, initiate, or prosecute, or cause, encourage, assist, volunteer, advise or cooperate with any other Person (as defined in the Consulting Agreement) to commence, maintain, initiate or prosecute, any action, lawsuit, proceeding, charge, petition, complaint or claim before any court, agency or tribunal against the Company or any Affiliate arising from, concerned with, or otherwise relating to, in whole or in part, Executive’s employment or separation from employment with the Company, or any of the matters discharged and released in this Agreement. Notwithstanding the preceding sentence or any other provision of this Agreement or the Consulting Agreement, this release and the Consulting Agreement are not intended to interfere with Executive’s right to file a charge with the Equal Employment Opportunity Commission (the “EEOC”) or a state or local human rights commission in connection with any claim that Executive believes he may have against the Company or its Affiliates, or to cooperate or provide truthful testimony to the EEOC or a state or local human rights commission with respect to any investigation. However, by executing this Agreement, Executive hereby waives the right to recover monetary damages in any proceeding he may bring before the EEOC or any state or local human rights commission or in any proceeding brought by the EEOC or any state or local human rights commission (or any other agency) on Executive’s behalf. |

|

10. |

Confidentiality of Agreement. Executive agrees to keep this Agreement and its terms confidential. Executive agrees and understands that he is prohibited from disclosing any terms of this Agreement to anyone, except that he may disclose the terms of this Agreement to his attorney, his spouse, his financial advisor or as otherwise required by compulsion of law. The Company acknowledges and agrees that it is prohibited from disclosing any terms of this Agreement to any third parties, except that the Company may disclose the terms of this Agreement to its attorneys, accountants, and other Persons (as defined in the Consulting Agreement) with a need to know, or as otherwise required by compulsion of law. |

|

11. |

Agreement to Return Company Property/Documents at end of Consulting Term. Following the termination of the Consulting Term for any reason, Executive agrees that: (i) he will not take with him, copy, alter, destroy or delete any files, documents or other materials whether or not embodying or recording any Confidential Information (as defined in the Consulting Agreement), including copies, without obtaining in advance the written consent of an authorized Company representative; and (ii) he will promptly return to the Company all Confidential Information, documents, and files, (written or electronically stored) that are in Executive’s possession or under his control. Executive further agrees to immediately return to the Company all Company equipment or other property of the Company or any Affiliate that is in his possession or under his control upon termination of the Consulting Term for whatever reason. Executive shall be entitled to remove any and all of his personal possessions from the Company’s offices. |

|

12. |

Waiver. A Party’s waiver of any breach or violation of any provision of this Agreement shall not operate as, or be construed to be, a waiver of any later breach of the same or other provision by such Party. |

|

13. |

Entire Agreement. This Agreement and the Consulting Agreement set forth the entire agreement between the Parties and fully supersedes and replaces any and all prior agreements or understandings, written or oral, between the Parties pertaining to the subject matter of this Agreement and the Consulting Agreement. |

|

14. |

Severability. Should any provision of this Agreement be declared or be determined by any court of competent jurisdiction to be illegal, invalid or unenforceable, all remaining provisions of this Agreement shall otherwise remain in full force and effect and shall be construed as if such illegal, invalid or unenforceable provision has not been included herein. |

|

15. |

Miscellaneous. The Parties understand and agree that if a violation of any term of this Agreement is asserted, the Party who asserts such violation shall have the right to seek specific performance of that term and/or any other necessary and proper relief as permitted by law or equity, including but not limited to, damages awarded by any court of competent jurisdiction, and the prevailing Party shall be entitled to recover its reasonable costs and attorneys’ fees. |

Nothing in this Agreement will be construed to prevent Executive from challenging the validity of this Agreement under the Age Discrimination in Employment Act or Older Workers Benefit Protection Act. Executive further understands and agrees that if he, or someone acting on his behalf, files, or causes to be filed, any such claim, charge, complaint or action against the Company, an Affiliate or any other Released Party, Executive hereby expressly fully waives and relinquishes any right to recover any damages or other relief, whatsoever, from the Company, its Affiliates and/or other Persons, including costs and attorneys’ fees.

|

16. |

Choice of Law. This Agreement shall be governed by, and construed and interpreted in accordance with, the laws of the State of Texas without regard to principles of conflict of laws. Jurisdiction and venue of any action or proceeding relating to this Agreement, or any dispute hereunder, shall be exclusively in a federal or state court of competent jurisdiction in Harris County, Texas, and the Parties hereby waive any objection to such jurisdiction or venue including, without limitation, to the effect that it is inconvenient. |

|

17. |

Counterparts. The Parties agree that this Agreement may be executed in any number of counterparts, each of which shall be deemed an original, but all of which together shall be deemed one and the same instrument. |

3

[Signature page follows.]

4

Please review this document carefully as it includes a release of claims.

IN WITNESS WHEREOF, Executive has executed and entered into this Agreement, and the Company has caused this Agreement to be executed in its name and on its behalf by its duly authorized officer, to be effective as of the date this Agreement is executed by Executive as set forth beneath his signature below.

This document was presented to Executive on ___________, 2015.

|

COMPANY: |

|

|

|

|

|

|

By: |

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

Title: |

|

|

|

|

|

|

|

Dated this ________ day of May, 2015 |

|

|

|

|

|

|

EXECUTIVE: |

|

WITNESS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

|

|

|

|

|

|

|

Witness signature |

|

|

|

|

|

|

|

|

|

Name: |

|

|

Name: |

|

|

|

|

|

|

|

|

|

|

Dated this ____ day of _____________ 20 ____ |

|

Dated this ____ day of _____________ 20 ____ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address for Executive: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5

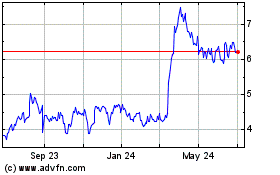

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Mar 2024 to Apr 2024

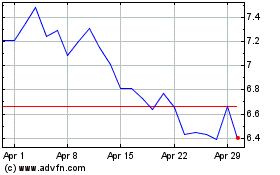

Vaalco Energy (NYSE:EGY)

Historical Stock Chart

From Apr 2023 to Apr 2024