UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 10, 2015

ODYSSEY MARINE EXPLORATION, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Nevada |

|

001-31895 |

|

84-1018684 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

5215 West Laurel Street

Tampa, Florida 33607

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (813) 876-1776

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01. |

Entry Into a Material Definitive Agreement. |

General

On April 10, 2015, Odyssey Marine Exploration, Inc. (“Odyssey”) and Odyssey Marine Enterprises, Ltd., an indirect, wholly owned

subsidiary of Odyssey (“Enterprises”), entered into the following amendments:

| |

• |

|

Amendment No. 1 to Stock Purchase Agreement (the “Purchase Agreement Amendment”) among Odyssey, Penelope Mining LLC (the “Investor”), and Minera del Norte S.A. de C.V. (“MINOSA”);

|

| |

• |

|

Amendment No. 1 to Promissory Note (the “Note Amendment”) between Odyssey and MINOSA; and |

| |

• |

|

Amendment No. 1 to Call Option Agreement (the “Option Amendment”) between Enterprises and MINOSA. |

Purchase Agreement Amendment

The

Purchase Agreement Amendment amends certain provisions of the Stock Purchase Agreement dated as of March 11, 2015 (the “Purchase Agreement”), among Odyssey, the Investor, and MINOSA to:

| |

• |

|

modify the deliveries to be made by Odyssey at the Initial Closing; |

| |

• |

|

delete one of the requirements relating to the Proxy Statement; |

| |

• |

|

add a representation and warranty of the Company relating to Nevada law; |

| |

• |

|

add two conditions to the Investor’s obligation to consummate the Initial Closing; |

| |

• |

|

add a circumstance that provides the Investor the right to terminate the Purchase Agreement prior to the Initial Closing; and |

| |

• |

|

modify the circumstances in which Company is required to pay the Termination Fee to the Investor. |

Note

Amendment

The Note Amendment amends certain provisions of the Promissory Note dated as of March 11, 2015, between Enterprises and

MINOSA to provide that, in specified circumstances, the Maturity Date will be the date on which the Purchase Agreement is terminated by the Investor.

Option Amendment

The Option Amendment

amends certain provisions of the Call Option Agreement dated as of March 11, 2015 (the “Option Agreement”), between Enterprises and MINOSA to:

| |

• |

|

extend, in specified circumstances, the Expiration Date of the Option Agreement to two years from the date of the Option Agreement; and |

| |

• |

|

decrease, in specified circumstances, the Option Consideration to $20.0 million. |

Related Matters

All capitalized terms used above but not otherwise defined in this Form 8-K have the respective meanings ascribed to them in the Purchase

Agreement Amendment, the Note Amendment, and the Option Amendment, as applicable. The foregoing descriptions of the Purchase Agreement Amendment, the Note Amendment, and the Option Amendment do not purport to be complete and are qualified in their

entirety by reference to the full text of such documents, which are attached hereto as Exhibit 10.1, 10.2, and 10.3 and incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

| |

(a) |

Financial Statements of Businesses Acquired. |

Not applicable.

| |

(b) |

Pro Forma Financial Information. |

Not applicable.

| |

(c) |

Shell Company Transactions. |

Not applicable.

|

|

|

| 10.1 |

|

Amendment No. 1 to Stock Purchase Agreement |

|

|

| 10.2 |

|

Amendment No. 1 to Promissory Note |

|

|

| 10.3 |

|

Amendment No. 1 to Call Option Agreement |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ODYSSEY MARINE EXPLORATION, INC. |

|

|

|

|

| Dated: April 15, 2015 |

|

|

|

By: |

|

/s/ Philip S. Devine |

|

|

|

|

|

|

Philip S. Devine |

|

|

|

|

|

|

Chief Financial Officer |

Exhibit 10.1

EXECUTION VERSION

AMENDMENT NO.

1 TO

STOCK PURCHASE AGREEMENT

This AMENDMENT NO. 1 TO STOCK PURCHASE AGREEMENT (this “Amendment”) is made and entered into as

of April 10, 2015, by and among Odyssey Marine Exploration, Inc., a Nevada corporation (the “Company”), Penelope Mining LLC, a Delaware limited liability company (the “Investor”),

and Minera del Norte S.A. de C.V., a Mexican societe anonime (“Minosa”). The Company, Investor and Minosa are referred to herein from time to time collectively as the “Parties”, and each

individually, as a “Party”. Capitalized terms used in this Amendment and not otherwise defined shall have the meanings ascribed to them in the Agreement.

WHEREAS, the Parties entered into a Stock Purchase Agreement, dated as of March 11, 2015 (the “Agreement”);

WHEREAS, the Parties desire to amend certain terms set forth in the Agreement;

WHEREAS, pursuant to Section 12.6 of the Agreement, the Agreement may only be amended by an agreement in writing signed by the Parties.

NOW, THEREFORE, in consideration of the premises, covenants, agreements, representations and warranties set forth herein, and for other

good and valuable consideration, the Parties to this Amendment, intending to be legally bound, agree as follows:

| 1. |

Amendment of Section 1.3(a)(vi) of the Agreement. Section 1.3(a)(vi) of the Agreement is hereby deleted in its entirety and replaced with the following provision: |

“(vi) evidence reasonably satisfactory to Investor that the conditions set forth in Section 6.2(j) and (k) shall have been

satisfied.”

| 2. |

Amendment of Section 1.4(b) of the Agreement. Section 1.4(b) of the Agreement is hereby deleted in its entirety. |

| 3. |

Amendment of Section 3.5 of the Agreement. Section 3.5 of the Agreement is hereby amended by adding a new paragraph (f) thereof as follows: |

“(f). The Company is not an “Issuing Corporation” as such term is defined in Section 78.3788 of the Nevada

Revised Statutes by virtue of the fact that either it has less than 200 holders of record and/or it has less than 100 stockholders of record who have addresses in the State of Nevada, in either case, appearing on the stock ledger of the

Company.”

| 4. |

Amendment of Section 6.2 of the Agreement. Section 6.2 of the Agreement is hereby amended by inserting at the end of such section: |

“(j) Election of Directors. The slate proposed by the Company for election as directors as set forth in the draft

preliminary proxy statement, dated April 9, 2015 shall have been elected as directors of the Company at the Stockholders Meeting.

(k) Appointment of Investor Designees. Both (i) Messrs. Saul and Sawyer (or their successors if other than Investor

Designees) shall have resigned as directors of the Company, and (ii) designees of Investor, reasonably acceptable to the Board of Directors (the “Investor Designees”), it being understood that Mr. Alonso Ancira and

Mr. Daniel Chapman are reasonably acceptable, shall have been appointed to the Company’s Board of Directors as a Class II and a Class III director.”

| 5. |

Amendment of Section 8.1(d) of the Agreement. Section 8.1(d) of the Agreement is hereby amended by deleting “or” at the end of clause (iii), deleting the period at the end of clause

(iv) and inserting “; or” in its place and by inserting at the end of such section: |

“(v) at any time, if

both (x) the conditions to the Initial Closing set forth in Section 6.2 (other than (A) paragraph (k) and (B) those conditions that by their terms are to be satisfied at the Initial Closing) have been satisfied

or are reasonably capable of being satisfied if the Initial Closing were to occur at such time, and (y) the condition to the Initial Closing set forth in Section 6.2(k) is not satisfied at such time.”

| 6. |

Amendment of Section 8.2(a)(i) of the Agreement. Section 8.2(a)(i) of the Agreement is hereby deleted in its entirety and replaced with the following provision: |

“(i) Termination Fee. In the event that this Agreement is terminated by the Company pursuant to

Section 8.1(c)(i) or by the Investor pursuant to Section 8.1(d)(i), Section 8.1(d)(ii) or Section 8.1(d)(v), then the Company shall pay to the Investor the Termination Fee by wire transfer of

immediately available funds concurrent with such termination and the written designation by the Investor of the account to which such Termination Fee shall be paid.”

| 7. |

Full Force and Effect. From and after the date hereof, all references in the Agreement to “this Agreement,” “hereof” or words of similar import shall mean the Agreement as amended by this

Amendment. Except as expressly set forth herein, the Agreement shall remain in full force and effect on the terms and conditions set forth therein. |

| 8. |

Miscellaneous. All terms and provisions contained in Article XII of the Agreement, including all related definitions, are incorporated herein by reference to the same extent as if expressly set forth herein.

|

[The remainder of this page is intentionally left blank.]

- 2 -

IN WITNESS WHEREOF, the Parties have caused this Agreement to be executed as of the date first

above written.

|

|

|

|

|

| ODYSSEY MARINE EXPLORATION, INC. |

|

|

| By: |

|

/s/ Mark D. Gordon |

|

|

Name: |

|

Mark D. Gordon |

|

|

Title: |

|

Chief Executive Officer |

|

| PENELOPE MINING LLC |

|

|

| By: |

|

/s/ Andres Gonzalez Saravia |

|

|

Name: |

|

Andres Gonzalez Saravia |

|

|

Title: |

|

Attorney in Fact |

|

| MINERA DEL NORTE S.A. DE C.V. |

|

|

| By: |

|

/s/ Alonso Ancira Elizondo |

|

|

Name: |

|

Alonso Ancira Elizondo |

|

|

Title: |

|

Authorized Person |

[Signature Page to

Amendment No. 1 to Stock Purchase Agreement]

Exhibit 10.2

EXECUTION VERSION

AMENDMENT NO.

1 TO

PROMISSORY NOTE

This AMENDMENT NO. 1 TO PROMISSORY NOTE (this “Amendment”) is made and entered into as of

April 10, 2015, by and between Odyssey Marine Enterprises, Ltd., a Bahamas company (the “Company”), whose address is Lyford Financial Centre, Lyford Cay, P.O. Box N-7776, Nassau, and Minera del Norte, S.A. de C.V.

(the “Lender”). The Company and the Lender are referred to herein from time to time collectively as the “Parties”, and each individually, as a “Party”.

Capitalized terms used in this Amendment and not otherwise defined shall have the meanings ascribed to them in the Note.

WHEREAS,

the Parties entered into a Promissory Note, dated as of March 11, 2015 (the “Note”);

WHEREAS, the Parties desire to

amend certain terms set forth in the Note;

WHEREAS, pursuant to Section 9 of the Note, the Note may only be modified with the

written consent of the Company and the Holder; and

WHEREAS, the Lender is currently the Holder of the Note.

NOW, THEREFORE, in consideration of the premises, covenants, agreements, representations and warranties set forth herein, and for other good

and valuable consideration, the Parties to this Amendment, intending to be legally bound, agree as follows:

| 1. |

Amendment of Section 2(a) of the Note. Section 2(a) of the Note is hereby deleted in its entirety and replaced with the following provision: |

“(a) Unless otherwise converted as provided herein, the Adjusted Principal Balance will be due and payable in full on

(i) September 30, 2015, (ii) if and only if the Investor shall have terminated the Stock Purchase Agreement pursuant to Section 8.1(d)(iii) thereof, March 30, 2016 or (iii) if and only if the Investor shall have

terminated the Stock Purchase Agreement pursuant to Section 8.1(d)(v) thereof, on the date of such termination (the “Maturity Date”).”

| 2. |

Full Force and Effect. From and after the date hereof, all references in the Note to “this Note,” “hereof” or words of similar import shall mean the Note as amended by this Amendment. Except

as expressly set forth herein, the Note shall remain in full force and effect on the terms and conditions set forth therein. |

| 3. |

Miscellaneous. All terms and provisions contained in Section 7 through Section 19 of the Note, including all related definitions, are incorporated herein by reference to the same extent as if expressly

set forth herein. |

[The remainder of this page is intentionally left blank.]

IN WITNESS WHEREOF, the Parties have caused this Amendment to be executed as of the date first

above written.

|

|

|

|

|

| ODYSSEY MARINE ENTERPRISES, LTD. |

|

|

| By: |

|

/s/ Mark D. Gordon |

|

|

Name: |

|

Mark D. Gordon |

|

|

Title: |

|

Vice President |

|

| MINERA DEL NORTE S.A. DE C.V. |

|

|

| By: |

|

/s/ Alonso Ancira Elizondo |

|

|

Name: |

|

Alonso Ancira Elizondo |

|

|

Title: |

|

Authorized Person |

[Signature Page to

Amendment No. 1 to Promissory Note]

Exhibit 10.3

EXECUTION VERSION

AMENDMENT NO.

1 TO

CALL OPTION AGREEMENT

This AMENDMENT NO. 1 TO CALL OPTION AGREEMENT (this “Amendment”) is made and entered into as of

April 10, 2015, by and between Odyssey Marine Enterprises, Ltd. (the “Holder”) and Minera del Norte, S.A. de C.V. (the “Purchaser”). The Holder and the Purchaser are referred to

herein from time to time collectively as the “Parties”, and each individually, as a “Party”. Capitalized terms used in this Amendment and not otherwise defined shall have the meanings

ascribed to them in the Call (as defined below).

WHEREAS, the Parties entered into a Call Option Agreement, dated as of

March 11, 2015 (the “Call”);

WHEREAS, the Parties desire to amend certain terms set forth in the Call; and

WHEREAS, pursuant to Section 7.4 of the Call, the Call may only be amended by an agreement in writing signed by the Parties.

NOW, THEREFORE, in consideration of the premises, covenants, agreements, representations and warranties set forth herein, and for other good

and valuable consideration, the Parties to this Amendment, intending to be legally bound, agree as follows:

| 1. |

Amendment of Section 2.1 of the Call. Section 2.1 of the Call is hereby amended by deleting the period at the end of the first sentence and inserting at the end of such sentence: |

“; provided further, that if Investor (as defined in the Purchase Agreement) terminates the Purchase Agreement pursuant to

Section 8.1(d)(v) thereof, the Expiration Date of this Agreement shall be the date that is two years from the date of hereof.”

| 2. |

Amendment of Section 2.2 of the Call. Section 2.2 of the Call is hereby amended by deleting the period at the end of the such Section and inserting: |

“; provided, however, if Investor (as defined in the Purchase Agreement) terminates the Purchase Agreement pursuant to

Section 8.1(d)(v) thereof, the Option Consideration shall be equal to $20,000,000 less any amounts paid or payable to Holder or any of its Affiliates following the date hereof upon the exercise of the Monaco Option less if Monaco

has foreclosed on any of the Subject Securities, $10,000,000.”

| 3. |

Full Force and Effect. From and after the date hereof, all references in the Call to “this Agreement,” “hereof” or words of similar import shall mean the Call as amended by this Amendment.

Except as expressly set forth herein, the Call shall remain in full force and effect on the terms and conditions set forth therein. |

| 4. |

Miscellaneous. All terms and provisions contained in Article 7 of the Call, including all related definitions, are incorporated herein by reference to the same extent as if expressly set forth herein.

|

[The remainder of this page is intentionally left blank.]

- 2 -

IN WITNESS WHEREOF, the Parties have caused this Agreement to be executed as of the date first

above written.

|

|

|

|

|

| ODYSSEY MARINE ENTERPRISES, LTD. |

|

|

| By: |

|

/s/ Mark D. Gordon |

|

|

Name: |

|

Mark D. Gordon |

|

|

Title: |

|

Vice President |

|

| MINERA DEL NORTE S.A. DE C.V. |

|

|

| By: |

|

/s/ Alonso Ancira Elizondo |

|

|

Name: |

|

Alonso Ancira Elizondo |

|

|

Title: |

|

Authorized Person |

[Signature Page to

Amendment No. 1 to Call Option Agreement]

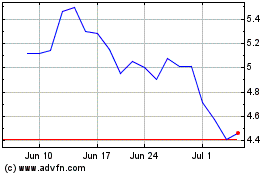

Odyssey Marine Exploration (NASDAQ:OMEX)

Historical Stock Chart

From Mar 2024 to Apr 2024

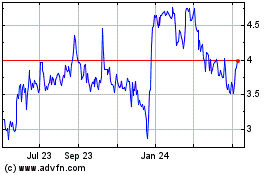

Odyssey Marine Exploration (NASDAQ:OMEX)

Historical Stock Chart

From Apr 2023 to Apr 2024