|

|

Prospectus Supplement No. 33

(to Prospectus dated May 30, 2013)

|

Filed pursuant to Rule 424(b)(4)

Registration No. 333-187508

|

125,000 Shares of Series A Convertible Preferred Stock

12,500,000 Shares of Common Stock Underlying the Preferred Stock

Warrants to Purchase up to 6,250,000 Shares of Common Stock and

6,250,000 Shares of Common Stock Underlying the Warrants

ARCA biopharma, Inc.

This prospectus supplement supplements the prospectus dated May 30, 2013 (the “Prospectus”), as supplemented by that certain Prospectus Supplement No. 1 dated July 17, 2013 (“Supplement No. 1”), by that certain Prospectus Supplement No. 2 dated July 19, 2013 (“Supplement No. 2”), by that certain Prospectus Supplement No. 3 dated July 24, 2013 (“Supplement No. 3”), by that certain Prospectus Supplement No. 4 dated July 30, 2013 (“Supplement No. 4”), by that certain Prospectus Supplement No. 5 dated August 6, 2013 (“Supplement No. 5”), by that certain Prospectus Supplement No. 6 dated September 4, 2013 (“Supplement No. 6”), by that certain Prospectus Supplement No. 7 dated September 23, 2013 (“Supplement No. 7”), by that certain Prospectus Supplement No. 8 dated October 29, 2013 (“Supplement No. 8”), by that certain Prospectus Supplement No. 9 dated November 6, 2013 (“Supplement No. 9”), by that certain Prospectus Supplement No. 10 dated November 13, 2013 (“Supplement No. 10”), by that certain Prospectus Supplement No. 11 dated November 21, 2013 (“Supplement No. 11”), by that certain Prospectus Supplement No. 12 dated December 5, 2013 (“Supplement No. 12”), by that certain Prospectus Supplement No. 13 dated January 8, 2014 (“Supplement No. 13”), by that certain Prospectus Supplement No. 14 dated February 10, 2014 (“Supplement No. 14”), by that certain Prospectus Supplement No. 15 dated February 12, 2014 (“Supplement No. 15”), by that certain Prospectus Supplement No. 16 dated February 18, 2014 (“Supplement No. 16”), by that certain Prospectus Supplement No. 17 dated March 3, 2014 (“Supplement No. 17”), by that certain Prospectus Supplement No. 18 dated March 20, 2014 (“Supplement No. 18”), by that certain Prospectus Supplement No. 19 dated May 13, 2014 (“Supplement No. 19”), by that certain Prospectus Supplement No. 20 dated June 9, 2014 (“Supplement No. 20”), by that certain Prospectus Supplement No. 21 dated August 13, 2014 (“Supplement No. 21”), by that certain Prospectus Supplement No. 22 dated August 18, 2014 (“Supplement No. 22”), by that certain Prospectus Supplement No. 23 dated November 12, 2014 (“Supplement No. 23”), by that certain Prospectus Supplement No. 24 dated December 1, 2014 (“Supplement No. 24”), by that certain Prospectus Supplement No. 25 dated December 10, 2014 (“Supplement No. 25”), by that certain Prospectus Supplement No. 26 dated December 11, 2014 (“Supplement No. 26”), by that certain Prospectus Supplement No. 27 dated December 30, 2014 (“Supplement No. 27”), by that certain Prospectus Supplement No. 28 dated February 4, 2015 (“Supplement No. 28”), by that certain Prospectus Supplement No. 29 dated February 17, 2015 (“Supplement No. 29”), by that certain Prospectus Supplement No. 30 dated February 23, 2015 (“Supplement No. 30”), by that certain Prospectus Supplement No. 31 dated March 16, 2015 (“Supplement No. 31”), and by that certain Prospectus Supplement No. 32 dated March 19, 2015 (“Supplement No. 32”, together with Supplement No. 1, Supplement No. 2, Supplement No. 3, Supplement No. 4, Supplement No. 5, Supplement No. 6, Supplement No. 7, Supplement No. 8, Supplement No. 9, Supplement No. 10, Supplement No. 11, Supplement No. 12, Supplement No. 13, Supplement No. 14, Supplement No. 15, Supplement No. 16, Supplement No. 17, Supplement No. 18, Supplement No. 19, Supplement No. 20, Supplement No. 21, Supplement No. 22, Supplement No. 23, Supplement No. 24, Supplement No. 25, Supplement No. 26, Supplement No. 27, Supplement No. 28, Supplement No. 29, Supplement No. 30, and Supplement No. 31, the “Supplements”), which form a part of our Registration Statement on Form S-1 (Registration No. 333-187508). This prospectus supplement is being filed to update and supplement the information in the Prospectus and the Supplements with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission (the “Commission”) on April 13, 2015 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus, the Supplements and this prospectus supplement relate to the offer and sale of up to 125,000 shares of Series A Convertible Preferred Stock (“Preferred Stock”) which are convertible into 12,500,000 shares of Common Stock, warrants to purchase up to 6,250,000 shares of our Common Stock and 6,250,000 shares of Common Stock underlying the warrants.

This prospectus supplement should be read in conjunction with the Prospectus and the Supplements. This prospectus supplement updates and supplements the information in the Prospectus and the Supplements. If there is any inconsistency between the information in the Prospectus, the Supplements and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our common stock is traded on the Nasdaq Global Market under the trading symbol “ABIO.” On April 13, 2015, the last reported sale price of our common stock was, rounded to the nearest penny, $0.95 per share.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” beginning on page 5 of the Prospectus and beginning on page 15 of our annual report on Form 10-K for the period ended December 31, 2014 before you decide whether to invest in shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is April 13, 2015

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 13, 2015 (April 10, 2015)

ARCA biopharma, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware |

000-22873 |

36-3855489 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

11080 CirclePoint Road, Suite 140, Westminster, CO 80020

(Address of Principal Executive Offices) (Zip Code)

(720) 940-2200

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

£ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

£ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

£ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

£ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 8 — Other Events

On April 13, 2015, ARCA biopharma, Inc. (“ARCA”) announced that the U.S. Food and Drug Administration (FDA) has designated as a Fast Track development program the investigation of GencaroTM for the prevention of atrial fibrillation/atrial flutter in a genetically modified heart failure population (heart failure patients with reduced left ventricular ejection fraction, HFREF). The press release is furnished as Exhibit 99.1 hereto, the contents of which are incorporated herein by reference.

Section 9 — Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

|

|

Exhibit Number |

|

Description |

|

|

|

|

99.1 |

|

Press Release titled “ARCA biopharma Receives FDA Fast Track Designation For GencaroTM Atrial Fibrillation Development in a Genetically Targeted Heart Failure Population” dated April 13, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Dated: April 13, 2015 |

|

|

|

|

|

|

ARCA biopharma, Inc. |

|

|

(Registrant) |

|

|

|

|

|

|

By: |

/s/ Brian L. Selby |

|

|

|

Name: |

Brian L. Selby |

|

|

|

Title: |

VP, Finance and Chief Accounting Officer |

INDEX TO EXHIBITS

|

|

|

|

|

Exhibit Number |

|

Description |

|

|

|

|

99.1 |

|

Press Release titled “ARCA biopharma Receives FDA Fast Track Designation For GencaroTM Atrial Fibrillation Development in a Genetically Targeted Heart Failure Population” dated April 13, 2015.

|

|

|

|

|

Exhibit 99.1

ARCA Biopharma receives FDA FAST TRACK DESIGNATION

FOR gencaroTM atrial fibrillation DEVELOPMENT in a

genetically targeted heart failure population

Westminster, CO, April 13, 2015 – ARCA biopharma, Inc. (Nasdaq: ABIO), a biopharmaceutical company developing genetically-targeted therapies for cardiovascular diseases, today announced that the U.S. Food and Drug Administration (FDA) has designated as a Fast Track development program the investigation of GencaroTM for the prevention of atrial fibrillation/atrial flutter in a genetically modified heart failure population (heart failure patients with reduced left ventricular ejection fraction, HFREF). Gencaro is the Company’s investigational, pharmacologically unique beta-blocker and mild vasodilator.

According to the FDA’s Fast Track Guidance document, Fast Track programs are designed to facilitate the development and expedite the review of new drugs that are intended to treat serious or life-threatening conditions and that demonstrate the potential to address unmet medical needs.

Gencaro is currently being evaluated as a potential treatment for atrial fibrillation in a genetically-defined heart failure (HFREF) population in GENETIC-AF, a Phase 2B/3 adaptive design clinical trial. ARCA anticipates that enrollment of approximately 200 patients in the Phase 2B portion of the trial will be completed by the end of 2016.

“We view Fast Track designation for the Gencaro development program as an important acknowledgement of the need for advancements in the treatment of atrial fibrillation in heart failure patients,” said Michael R. Bristow, President and Chief Executive Officer of ARCA. “Atrial fibrillation afflicts over 2.7 million people in the United States with 250,000 to 500,000 new cases diagnosed each year. We believe we have a significant opportunity to improve the treatment options for heart failure patients living with atrial fibrillation.”

Fast Track drug development designation was included in the FDA Modernization Act of 1997 (FDAMA) as a formal process to enhance interactions with the FDA during drug development. A drug development program with Fast Track designation is eligible for consideration for some or all of the following programs for expediting development and review: scheduled meetings to seek FDA input into development plans, priority review of the New Drug Application (NDA), the option of submitting portions of an NDA for review prior to submission of the complete application and potential accelerated approval.

Atrial Fibrillation (AF)

Atrial fibrillation, the most common sustained cardiac arrhythmia, is considered an epidemic cardiovascular disease and a major public health burden. The estimated number of individuals with AF globally in 2010 was 33.5 million. According to the 2015 American Heart Association report on Heart Disease and Stroke Statistics, the estimated number of individuals with AF in the U.S. in 2010 ranged from 2.7 million to 6.1 million people. Hospitalization rates for AF increased by 23% among US adults from 2000 to 2010 and hospitalizations account for the majority of the economic cost burden associated with AF.

AF is a disorder in which the normally regular and coordinated contraction pattern of the heart’s two small upper chambers (the atria) becomes irregular and uncoordinated. The irregular contraction pattern associated with AF causes blood to pool in the atria, predisposing the formation of clots potentially resulting in stroke. AF increases the risk of mortality and morbidity due to stroke, congestive heart failure and impaired quality of life. The approved therapies for the treatment or prevention AF have certain disadvantages in patients with heart failure and/or reduced left ventricular ejection fraction (HFREF) patients. These include toxic or cardiovascular adverse effects, and most of the approved drugs for AF are contra indicated or have warnings in their prescribing information for such patients. The Company believes there is an unmet medical need for new AF treatments that have fewer side effects than currently available therapies and are more effective, particularly in HFREF patients.

About Pharmacogenomics

Pharmacogenomics is the study of genetic polymorphisms that underlie individual differences in responses to therapeutics drugs. Pharmacogenomics includes identifying candidate genes and polymorphisms, correlating these polymorphisms with possible therapies, predicting drug response and clinical outcomes, reducing adverse events and selection, and selecting dosing of therapeutic drugs on the basis of genotype. One goal of pharmacogenomics is to customize drugs for defined sub-populations of patients.

A DNA sub-study of patients from the BEST Phase 3 heart failure mortality trial of Gencaro indicated that the combinations of beta-1 389 and alpha-2C polymorphisms in individual patients in the trial appeared to influence the response to Gencaro.

About ARCA biopharma

ARCA biopharma is dedicated to developing genetically-targeted therapies for cardiovascular diseases. The Company's lead product candidate, GencaroTM (bucindolol hydrochloride), is an investigational, pharmacologically unique beta-blocker and mild vasodilator being developed for atrial fibrillation. ARCA has identified common genetic variations that it believes predict individual patient response to Gencaro, giving it the potential to be the first genetically-targeted atrial fibrillation prevention treatment. ARCA has a collaboration with Medtronic, Inc. for support of the GENETIC-AF trial. For more information please visit www.arcabiopharma.com.

Safe Harbor Statement

This press release contains "forward-looking statements" for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, statements regarding, potential timing for patient enrollment in the GENETIC-AF trial, potential timeline for GENETIC-AF trial activities, the sufficiency of the Company’s capital to support its operations, the potential for genetic variations to predict individual patient response to Gencaro, Gencaro’s potential to treat atrial fibrillation, future treatment options for patients with atrial fibrillation, and the potential for Gencaro to be the first genetically-targeted atrial fibrillation prevention treatment. Such statements are based on management's current expectations and involve risks and uncertainties. Actual results and performance could differ materially from those projected in the forward-looking statements as a result of many factors, including, without limitation, the risks and uncertainties associated with: the Company's financial resources and whether they will be sufficient to meet the Company's business objectives and operational requirements; results of earlier clinical trials may not be confirmed in future trials, the protection and market exclusivity provided by the Company’s intellectual property; risks related to the drug discovery and the regulatory approval process; and, the impact of competitive products and technological changes. These and other factors are identified and described in more detail in ARCA’s filings with the SEC, including without limitation the Company’s annual report on Form 10-K for the year ended December 31, 2014, and subsequent filings. The Company disclaims any intent or obligation to update these forward-looking statements.

Investor & Media Contact:

Derek Cole

720.940.2163

derek.cole@arcabiopharma.com

###

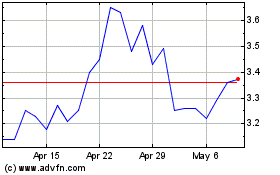

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

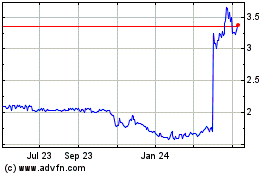

ARCA Biopharma (NASDAQ:ABIO)

Historical Stock Chart

From Apr 2023 to Apr 2024