UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 9, 2015

INFINERA

CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-33486 |

|

77-0560433 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

140 Caspian Court

Sunnyvale, CA 94089

(Address of principal executive offices, including zip code)

(408) 572-5200

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition. |

As previously disclosed in its Form 8-K filed on

April 9, 2015, Infinera Corporation (the “Company”) has announced its intent to combine with Sweden-based Transmode AB, a Swedish company (“Transmode”), pursuant to a public exchange offer to acquire all issued and

outstanding shares of Transmode (the “Offer”). In connection with the Offer, the Company held a conference call on April 9, 2015 at 8:30 a.m. EDT (the “Conference Call”), which included discussion of financial results for

the first quarter of 2015. The transcript of the Conference Call is furnished as Exhibit 99.1 to this Current Report.

In accordance with General

Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished under Item 2.02 and shall not be deemed “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as

amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such a filing.

As mentioned above, the Company has announced its intent to combine with Transmode. Under

the Offer, the value of consideration offered to Transmode shareholders is equal to 109 SEK per share, consisting of both cash and Infinera’s common stock. The Company discussed this and other matters relating to the Offer during the Conference

Call. The transcript of the Conference Call is furnished as Exhibit 99.1 to this Current Report.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Transcript of the Infinera Corporation Conference Call on April 9, 2015, 8:30 am EDT. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

INFINERA CORPORATION |

|

|

|

|

| Date: April 9, 2015 |

|

|

|

By: |

|

/s/ JAMES L. LAUFMAN |

|

|

|

|

|

|

James L. Laufman Senior Vice President and

General Counsel |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Transcript of the Infinera Corporation Conference Call on April 9, 2015, 8:30 am EDT. |

Exhibit 99.1

INFN - Infinera

Announces Offer to Acquire Transmode M&A Call

EVENT DATE/TIME: APRIL 09, 2015 / 12:30PM GMT

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

CORPORATE PARTICIPANTS

Jeff Hustis Infinera Corporation - IR

Tom

Fallon Infinera Corporation - CEO

Brad Feller Infinera Corporation - CFO

Dave Welch Infinera Corporation - President

CONFERENCE CALL PARTICIPANTS

Michael Genovese MKM Partners - Analyst

Rod Hall JPMC - Analyst

Dmitry Netis

William Blair & Company - Analyst

Alex Henderson Needham & Company - Analyst

Ted Moreau Barrington Research Associates, Inc. - Analyst

PRESENTATION

Operator

Thank you for joining us today for this Infinera Corporation conference call.

(Operator Instructions)

Today’s call is being recorded.

If you have any objections, you may disconnect at this time. I would like now to turn the call over to Mr. Jeff Hustis of Infinera investor relations. Jeff, you may now begin.

Jeff Hustis - Infinera Corporation - IR

Good

morning, and thank you for joining us on such short notice. We scheduled this call to discuss Infinera’s recently-announced offer to acquire Transmode. I’m joined on this call by CEO Tom Fallon, President Dave Welch, and CFO Brad Feller.

After the prepared remarks, we will open the call for your questions.

Note that during this call, we will refer to specific line numbers from the

investor briefing deck. The press release and briefing deck have been posted to our investor relations website located at www.Infinera.com, and a complete replay of today’s call will also be posted there after we conclude today.

As a reminder, any of today’s remarks that are not statements of historical facts are forward-looking statements that involve certain risks and

uncertainty that are disclosed in more detail in the Safe Harbor section of our press release announcing our offer and our SEC filing. Actual results may differ materially from such statements, and Infinera undertakes no obligation to update any

forward-looking statements. With that, I will turn the call over to the Infinera’s CEO, Tom Fallon.

Tom Fallon - Infinera

Corporation - CEO

Let me begin by saying that we’re very excited to announce our offer to acquire Transmode. Strategically, culturally, and

financially, Transmode and Infinera together will create opportunities and value for both companies’ investors, customers and employees.

2

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

For those of you who know us well, you know that we have a history of making the right investments at the right time. We launched the DTN-X in 2012, just as

the 100-gig long-haul market started to accelerate. A few months ago, we launched the Cloud Xpress, coinciding with the metro cloud market’s acceleration.

With the expected growth in the 100-gig metro market in 2016, the next opportunity is upon us. I believe that Transmode’s services-rich metro platforms,

coupled with our announced plans to launch a product for the metro core by the end of 2015, will position us very well to again take significant market share as a major market transition occurs.

Combined, our companies’ complementary product offering of long-haul, cloud and metro will address the breadth of the DWDM market, which is forecasted by

Infonetics to reach $15 billion by 2019. Infinera’s vision has always been to provide a comprehensive end-to-end solution, to enable our customers to run highly scalable, agile, and efficient networks. With Transmode, we have an opportunity to

accelerate our offerings for the Metro aggregation portion of the market, in order to maximize our share as this market transitions to 100-gig.

As

detailed on slide 9, the addition of the Transmode team and its suite of metro core access and edge products, will enable Infinera to deliver on a vision of an end-to-end DWDM portfolio. Furthermore, Transmode products provide a rich set of

application-specific metro-speed features including broadband aggregation, mobile backhaul, and business ethernet services, each having specific requirements. Plus, as the broader transition to 100-gig evolves, an optical transport infrastructure

becomes more strategic to the cloud, Transmode’s packet-optical experience will greatly benefit us as we design simplified next generation network that encompass scalable optics, integrated packet-optical switching and SDN control.

Transmode is not just a company that enables us to provide an end-to-end solution, it is completely complementary to Infinera. From a customer standpoint,

there is minimal customer overlap between the two companies, and where there is overlap, we currently offer different solutions to those customers. Being armed with an end-to-end offering will open up new opportunities with our existing customers,

as well as opportunities with new ones.

Slides 9 and 10 detail the complementary natures of each company’s product offering and customers. We

believe there is a great opportunity to sell Transmode’s product into Infinera’s customer base, as well as to sell our product into Transmode accounts. We expect these successes to span all geographies, and particularly taking advantage of

Transmode’s strength in Europe, and Infinera’s strength in North America. Plus, as mentioned previously, we expect our ability to offer a full suite of solutions to open up new opportunities.

Culturally, both Transmode and Infinera share philosophies of putting the customer first, delivering technology and product excellence, and generating

profitability. As the number one metro optical provider in Europe per Infonetics, Transmode has an excellent reputation in the market, and like Infinera, is positioned well to succeed as a transition to 100-gig moves into the metro.

Though we are not at a point yet where we can detail integration plans, I do want to share that we intend to have Transmode’s current CEO, Karl Thedeen,

lead the metro aggregation business operations of the combined company. In addition, we intend to incorporate our leadership technologies, such as our photonic integrated circuit and SDN, wherever they are applicable, into Transmode’s product

set.

Those of you who are familiar with Infinera know that we believe photonic integration is going to be required for the future of optical networking.

This belief extends beyond long-haul, particularly as 100-gig hits the metro. Ultimately, we expect that PICs and our other vertically-owned technologies will provide us with the same technological, operational, and financial advantages in metro, as

they do currently in the long-haul and cloud markets. I am now going to turn the call over to Brad to discuss the financial aspects of the transaction.

Brad Feller - Infinera

Corporation - CFO

Thanks, Tom. As detailed on slide 18, I will take you through some of the transaction details. Consideration is SEK109 per share,

comprised of both Infinera shares and cash. For every 10 shares of Transmode tendered as part of the offer, the holder will receive approximately 4.7 Infinera shares and SEK300 in cash.

3

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

In USD, the total equity value is approximately $350 million. We will use $96 million in cash from our balance sheet, and issue approximately 13 million

shares to finance the transaction. Ultimately, Transmode shareholders will own 8.7% of the combined company.

Transmode’s Board of Directors has

unanimously recommended that shareholders accept the deal. Additionally, Transmode’s largest shareholder, Pod Investments, which owns approximately 33% of Transmode’s total shares, has undertaken to accept the offer, subject to customary

conditions. The transaction is expected to close in Infinera’s third quarter of 2015, subject to acceptance by the shareholders of at least 90% of the shares of Transmode, and other customary closing conditions.

Considering expected top line synergies, and our expectation that the combined company will continue to generate some of the highest gross margins in the

industry, we expect the combination to be accretive to EPS in 2016. We expect the combination to be neutral to slightly dilutive to EPS in the second half of 2015, driven by integration costs and dependent on how quickly we are able to realize

revenue synergies.

An end-to-end product offering expands the TAM we can pursue. Combining this expanded market with complementary customer bases and

geographies has the potential to unlock significant synergies for the combined company. As a finance guy, the prospect of acquiring a company that has a shared culture of deal discipline is also compelling.

As you hear from us all the time, we evaluate all customer deals based on whether we can make money over time. Transmode in this respect is just like us. They

design valuable products with a focus on cost, and ensure they are fairly compensated for them.

In addition, we believe that with the added volumes of

the combined company, we will be able to drive strong cost synergies through negotiating leverage with third-party suppliers. Further, over time, we expect additional leverage from our manufacturing assets as we integrate our PIC technology into

certain Transmode products. Operationally, we expect to realize some cost efficiencies as a result of scale and from the avoidance of duplicative activities. To be clear, we expect the synergies of this deal to be predominantly realized from market

expansion as opposed to from large operating expense synergies.

Considering we have just completed our first quarter, and are less than two weeks from

our Q1 earnings call, I would be remiss to not share some information about our Q1 results. For Q1, we expect revenue to be slightly above our guidance midpoint of $185 million. We expect non-GAAP gross margin, operating margin, and EPS to be higher

than the top end of our guidance range, as we continue to demonstrate the leverage in our operating model, and deliver strong profitability. We will not go into further detail or answer any questions on our Q1 results, as we are still in the process

of finalizing the numbers. We look forward to providing you with all the details regarding our Q1 results during our upcoming call on Tuesday, April 21. I now going to turn the call back over to Tom for some closing remarks.

Tom Fallon - Infinera Corporation - CEO

It is hard to imagine a better fit for Infinera than Transmode. Our two companies combined are in a fantastic position to capitalize on the impending

opportunities in the 100-gig metro market. Our product portfolio, team cultures, and customers are natural fits.

Financially, we are in an advantageous

position to drive revenue growth and to do so profitably. While Infinera is much more inclined to build from within than to acquire, we believe that with Transmode, we have an unique opportunity to build one of the leading packet optical forces in

the industry. With that, I would like to open it up for questions.

QUESTIONS AND ANSWERS

Operator

(Operator Instructions)

Michael Genovese, MKM Partners.

4

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

Michael Genovese - MKM Partners - Analyst

Congratulations on the deal. Before I ask my question, which is about how the portfolio of products fit together in a network, I have to ask about the XTC-4,

which is on the slide. Is that the metro aggregation product? Is that the PIC-based metro aggregation product that you guys are planning on putting out later this year?

Tom Fallon - Infinera

Corporation - CEO

Hi, Michael; Tom here. The XTC-4 is already a platform we have. We sell it today in certain long-haul and regional applications. It

is not the new platform that we have talked about coming up later in the year.

Michael Genovese - MKM

Partners - Analyst

Okay. And then, Brad said integrating the PIC in certain Transmode products — it seems to me that — well, basically, is

the strategy here to have PIC-based in the 100G metro core you want to have a PIC-based product on the network side? But then going out to the client, you don’t necessarily need PICs, and you probably need lower speed granularly below 100G? So,

would the idea be to have the new Infinera PIC-based product on the network side, and then these Transmode products on the client side?

That would

suggest to me that there wouldn’t be a need for integration, or is there a need for integration? And do you need PIC to put the PICs in their products? Can you just talk about those issues?

Tom Fallon - Infinera Corporation - CEO

Dave, can you take point on this?

Dave Welch - Infinera

Corporation - President

Sure. Photonic integration has been exercised to this point in applications that require high bandwidth and high capacity. We

have used that for our 500-gig PICs. We’ve talked about it for higher; and we’ve most recently, at OFC, talked about using it to create benefits at 100-gig granular applications.

When you get out to the client access side, there is less of an opportunity to use the photonic integration technology. When you get up to the aggregated

ring, sort of capacities increase, and there is a greater opportunity to do so.

So, what we want to do is we want to use our suite of technologies, of

which photonic integration is one of them, and be able to draw that into the layers of the network appropriately to drive added value from that pen. And PICs being those that — where the bandwidths have aggravated up to 100-gigabits or higher.

Michael Genovese - MKM Partners - Analyst

Just one follow-up there: If a customer, in the second half of this year, wanted to build a — well, okay, your product won’t be out yet. But

let’s say early next year, if a customer wants to put a network together here, what integration work would need to be done to have your product in the core of the metro, and their product on the metro access? Could you do that very, very

quickly, or is there a lot of R&D work that needs to be done in software, et cetera?

5

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

Dave Welch - Infinera Corporation - President

There is a number of layers in that. The first one is to have network management software, to be able to manage the services across the box. It would also be

appropriate to develop our SDN strategy to be able to reach across multiple boxes — to be able to create a common control plane for the user. And for them to be able to tie a service from the access points through the network, through the metro

core or long-haul, and back to access points. That’s the first layer.

Then, as you get into the integration of hardware infrastructure, then

you’re really looking a little further out. That’s a year or 18 months, maybe 24 months, depending on the complexity, on how to create the full product integration.

Michael Genovese - MKM

Partners - Analyst

Okay, I appreciate it. I will cede the floor, and give other people a chance to ask other questions. Thanks.

Operator

Rod Hall, JPMC.

Rod Hall - JPMC - Analyst

A couple

of questions for you: The first one is — I guess the over $15 billion of TAM — can you guys comment on how much of that is added by this, from your point of view? Just curious what you think the TAM of this additional market that

you’re bolting on is?

And then secondly, I noticed that the — we know Transmode pretty well from our time in Europe, but I haven’t been

tracking it lately. I noticed the operating margin is just 7.6% in 2014; down from the average of 13.4% over the last several years. So, can you comment on the — is that 7.6% in 2014, from your point of view, a blip, or have their operating

margins been deteriorating over that period? And then I have one follow-up to those.

Tom Fallon - Infinera

Corporation - CEO

Dave, why don’t you take the first one, and Brad, the second, if you don’t mind?

Dave Welch - Infinera Corporation - President

Okay. From a TAM perspective, the metro access through metro core markets are roughly about the same size as the long-haul markets have been historically

— slightly larger. It adds on to — and, again, the $15 billion is a 2019 number. But it adds on to it, in 2014 numbers, about $4.6 billion of added — I’m sorry, about $5.5 billion or so of added market share for us.

Some of that metro core, we have — the Infinera product line has been applicable to, and we have sold some into those metro — a very high-capacity

metro rings. However, the majority of it will be added on with the addition of Transmode’s portfolio.

Brad? (multiple speakers)

Rod Hall - JPMC - Analyst

Are you

saying that you believe the add-on of metro is more or less 100%? Because I thought you guys addressed at least some of that metro market. But you are saying a good chunk of the metro market, maybe 80%, 90% of it, you think you’re adding by

adding this company?

6

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

Dave Welch - Infinera Corporation - President

I would say there’s probably 70%, 75% to 80% of the current metro spend will be additional to that, that we haven’t been able to access because of

both the types of services, the MEF services that are pervasive throughout that, that our products to date haven’t been well matched for. When we’ve been in metro core, high-capacity, and certainly metro cloud types of applications, our

products have been well served by that.

Rod Hall - JPMC - Analyst

Okay.

Brad Feller - Infinera Corporation - CFO

Rod, to address your question on the operating margin — so, yes, the 7.6% that Transmode put up in 2014 is a blip. It’s a low point on the map.

Basically, their revenues declined a little bit last year; they had a couple of larger customers that slowed down their spend.

That said, they have

consistently put up 50-plus points of gross margin. They have consistently put up double-digit operating margins.

In fact, they put out a press release

today, this morning, talking about their Q1 results. And as you will see from their Q1 results, their op margins are very strong.

The 7.6% is a blip on

the map. We absolutely expect them to drive significant operating margins going forward.

Tom Fallon - Infinera

Corporation - CEO

And we believe it will be in 2016 and on.

Rod Hall - JPMC - Analyst

I got that part of it. Okay, thanks, Brad.

Tom, one

more question for you: There are a bunch of these little — we have talked about the fact that there are a bunch of these little companies around, before, and there’s ADVA, there’s all kinds of — but why did you pick these guys?

Is it a technology-driven decision mainly? What’s different about them from some of the other optical aggregation companies that are out there?

Tom Fallon - Infinera

Corporation - CEO

I think there’s a number of things that we found Transmode fit uniquely. First of all, we really like their portfolio —

their services-rich portfolio.

Second of all, we found that the match of their business today, both from a customer and a geography perspective versus

ours, creates a huge leverage opportunity. It really is a mirror image. They are vastly in Europe; we are vastly in North America. They have a lot of customers we don’t have, and vice versa; and we think that there is a great cross-selling

opportunity. Don’t even talk about new customers, just cross-selling within our current customer base; we found that mix to be ideal.

Don’t

underestimate what I consider the most important aspect, which is the cultural aspect. I think it’s very important, when you look at integrating companies, that if you find cultures that are compatible. They have a very engineering-driven

culture. They are exceptionally good at designing

7

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

for cost. They are exceptionally good for designing for power. They are exceptionally good at designing for footprint. Those things, we value a great deal.

If you look at their financial performance, their gross margin, their consistency of making profitability, their culture of expecting to get paid and earn a

fair return — we found nobody in the industry like them. And I think that when you integrate companies, cultural integration over the medium to long term is the most important thing, and we found great cultural compatibility.

Rod Hall - JPMC - Analyst

Great.

All right, thanks, guys.

Operator

Dmitry Netis, William Blair & Company.

Dmitry Netis - William Blair & Company - Analyst

Let me add my congratulations on doing this deal. I have a couple of questions. One, if timing of your roadmap for this metro aggregation PIC that you had

slated by the end of this year, or the product using this metro aggregation PIC later this year — changes by any means or constrained by this acquisition? That’s number one.

Number two, if you guys could give an estimate of any R&D synergies that you might see from this deal, or do you plan to run these two businesses —

one with the PIC for metro aggregation to a completely different product using the PIC? And the sort of design architecture of Transmode targeting the potential markets that you’re going after in the metro? What is that potentially synergy

number on the R&D side, if there is such?

Tom Fallon - Infinera Corporation - CEO

I will take the first part, and I will ask Dave to finish it.

First of all, we are pursuing our metro aggregation product, just like we were before. We anticipate delivering that product later this year, and we believe

it is a complement to what the Transmode portfolio provides to us, and is a great integration point between their portfolio and our portfolio. So, I don’t see any constraints to that, and we are marching down that path as hard and as fast as we

possibly can.

In regard to PICs, I will let Dave answer that question.

Dave Welch - Infinera

Corporation - President

If I understand the question right, Dmitry, it was about whether the PIC roadmap changes at all. We rolled out, earlier in

March, the oPIC and the ePIC, being the ability to manage 100-gigabit granular waves, however, being generated by high-capacity photonic integration. Those are all on target. They are on target to integrate both into Infinera’s product line

— current and future product lines — as well as we look forward to the opportunity to integrate those into appropriate pieces of the current Transmode product line.

(multiple speakers) On the R&D synergy question, I will answer at least the technical side of that. What the customer wants to see is an end-to-end

application served, which means that you have these physical piece of boxes that sit throughout the network, and they bring information. Where the Transmode product line starts off with cell back-haul, cell front-haul, ethernets — business

ethernet servicers — customer premise equipment. They bring that through a variety of aggregation layers on up. And then, the transition into high-capacity networks with integrated high-capacity switching, chassis-level switching in there, it

works into the Infinera platform.

8

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

It’s really about making those products work together as one network. So, we aren’t going to operate Transmode as an independent company, because we

present one network to the customer.

There are portions of the market that are going to — that will still fall into the categories of a long-haul

transaction, metro transactions, and metro cloud transactions. And from that aspect, we look for the leadership of Transmode to help drive the metro business opportunities from that. But ultimately the products need to look like and migrate towards

a common network from that.

Brad Feller - Infinera Corporation - CFO

Dmitry, just to follow on, on the financial side of that, as I mentioned in my prepared remarks, the main driver of the deal is really the revenue synergy side

of the equation. There will be some cost synergies, as well. It wasn’t done on an operating expense synergy type of model.

Tom Fallon - Infinera

Corporation - CEO

Let me ask one thing about the synergies. There are going to be synergies, but not in the classic sense. If you think about what we

do, one of the things we do is create technology tools. The PIC is a technology tool; our coherent technology is a tool; our SDN is a tool.

We’re

now going to be able to take those same investments in the technology, and spread them across more revenue, across more product offerings, and we will create synergies that way. My anticipation is, we’re going to continue to invest more in

R&D on a gross dollar basis, because we’re going to be able to, as Brad pointed out, create upside revenue opportunity, and that should flow down to our current target of 20% R&D budget. So, my expectation is, we will create synergies

by leveraging tools across many more platforms, and many more revenue opportunities, but the R&D dollars will probably grow.

Dmitry Netis - William

Blair & Company - Analyst

Great, thanks for the perspective.

Just another, if I may — a quick follow up. In terms of just looking at the customer base of Transmode, if you can comment on how many customers, for

example, they have on 100G? What percentage of their revenue is exposed to 100G versus 10G or legacy technology?

And maybe some of the areas where they

are strong at — I don’t know if you want to break it out by revenue contribution or not, but I am thinking of back-haul broadband access, ethernet access. If you could give a perspective on those areas, that would be great. Thank you.

Tom Fallon - Infinera Corporation - CEO

Dave, if you could take that?

Dave Welch - Infinera

Corporation - President

I can certainly take part of it. Their businesses — there’s lots — most of their customers and their

high-capacity customers — let me restart.

If you look at the financial contribution of their various customers, their large customers absolutely are

in the transitions of complementing the network with 100G capability. But understand that this is not like the long-haul, where all ways are 100G throughout their network. This is where their aggregated bandwidths require 100G.

As we have stated before, 10G is going to live in the metro sector for quite a long time. However, you need to have the 100G capability and technologies at

the higher-aggregated sectors.

9

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

Liberty Global/Virgin Media was a great example of that. They are going to want to transition to 100-gig capability. They also have a lot of customers that are

point systems; but from a dollar perspective, that adds up to a smaller fraction of their total business. That’s where the 100-gig aspect is.

And,

frankly, maybe I missed the second half of your question.

Brad Feller - Infinera Corporation - CFO

If you said areas of strength, similar for us, they do very well in the cable space. As we do in North America, they are very strong in cable throughout Europe

as well.

Operator

(Operator Instructions)

Alex Henderson, Needham.

Alex Henderson -

Needham & Company - Analyst

Congratulations, it looks like a pretty good fit for your Company.

I guess I have a couple questions on the operations of Transmode. It is pretty clear that there was some pretty big dividends, CY13 to CY14, and you did say

that was driven by a couple of key customers. Are those customers coming back? Is that why we are seeing the 23% increase in revenues in 1Q?

Second, is

there any product cycle-related issues around that — the timing of products that they introduced that might have impacted the timing of revenue recognition at those customers?

Tom Fallon - Infinera Corporation - CEO

Alex, I will start with that, and, Brad, you can add anything that I miss. We believe that it was mostly just due to two things: one, the economic challenge in

Europe. As you know, Europe, in general, has not been spending in DWDM growth over the last couple of years.

Second of all, it was a couple of fairly

significant customers who had slowing buying patterns, based upon their own internal budgets and network needs. We have obviously done a reasonable amount of diligence with those customers, and believe that it was a temporary piece of time; there

was not a loss of market share. There was not a loss of position within those customers. And we believe that those customers’ spending patterns should go back to more historic norms.

Brad, anything you want to add?

Brad Feller - Infinera

Corporation - CFO

Alex, we are probably not in a position to break down the upside in their Q1. But Tom is right that their big customers that were

down a little bit in spend last year, very much like Transmode; we did talk to them as part of the diligence. They very much are excited about the prospects going forward.

10

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

Alex Henderson - Needham & Company - Analyst

What about the product cycle issue? Was there any major product announcements that we should be factoring in to the timing of revenue generation that might

have impacted last year? Or create an improved outlook for next year, as there’s always a lag from the time you launch products to the time you recognize revenues.

Brad Feller - Infinera

Corporation - CFO

Alex, they started to ramp their 100-gig product towards the tail end of last year, but the reason that the revenue was off a bit

last year wasn’t a product cycle transition. That being said, I think you’re going to see more and more of their customers transition to 100-gig as we go forward. So, they will have a good opportunity, or we will have a good opportunity

with those products to catch the 100-gig transition.

Alex Henderson - Needham & Company - Analyst

Okay. And then, in terms of backlog or any other metrics like that, book to bill or anything of that sort, did they give any commentary around that? It sounds

like they had some pent-up demand here, as they roll into the new year.

Brad Feller - Infinera

Corporation - CFO

Alex, we probably can’t get into a lot of detail on their actual results. I would say their —

Alex Henderson - Needham & Company - Analyst

Well, even their year-end results. We don’t have that much background here.

Brad Feller - Infinera

Corporation - CFO

Their Q4 results were very good. I think they commented about exiting the year with significantly higher backlog than they have had

in the past. So, I think, similar to us, they are in a really good position for 2015, and obviously going forward from there.

Alex Henderson -

Needham & Company - Analyst

Okay.

Operator

Ted Moreau, Barrington Research.

Ted Moreau - Barrington

Research Associates, Inc. - Analyst

Thanks, and congrats on doing the deal.

I just had a question about the — I think, Brad, you talked a little bit about eventually transferring or transitioning the Transmode manufacturing into

Infinera facilities. Can you talk a little bit about how that might impact or benefit your gross margin trajectory in the future? Obviously, you’re going to have some benefit on simply — it sounds like Transmode’s gross margins are

higher gross margin products, but then also how that flows through the — your facility. So, how that impacts that? And then also, why is it that Transmode is able to get gross margins north of 50%?

11

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

Tom Fallon - Infinera Corporation - CEO

This is Tom; I’m going to take the first half of that. We did not say that we would be moving Transmode products to Infinera manufacturing facilities. We

did not comment on that at all.

What we did say was we would move certain Infinera technologies, like the PIC and others, into appropriate parts of the

Transmode portfolio. The opportunity on margin there is pretty distinct. We believe the PIC and our own vertical technologies, whether it is PIC or Coherent, is much less — or much more cost effective than buying merchant silicon. And we

believe we can incorporate that cost advantage into that portfolio. And anything that drives more volume of the PIC, obviously consumes more capacity within the current fixed infrastructure of the PIC, lowering the overall cost structure of the

Company.

So, we talked about a technology integration versus integrating manufacturing facilities, which we did not comment on. And I don’t think we

are, at this point, ready to talk about any kind of integration activities.

Brad, if you could take the second part?

Brad Feller - Infinera Corporation - CFO

Sure. Ted, the biggest things on why they have been able to deliver 50-plus points of gross margin is they have a very good mechanism in designing for costs.

As Tom mentioned, low power, low footprint, and very similar to us as well. They’re disciplined on the deals they take, and the way they price their product.

So, it’s a great opportunity, as Tom mentioned before, to merge two very similar cultures. So, a great opportunity for the historic margins they have

had, will continue. Tom is right on the — we did not say we’re going to move the operations. Over time, as we put PICs into products, that obviously increases the volume of our facilities, which obviously spreads fixed cost.

Ted Moreau - Barrington Research Associates, Inc. - Analyst

Right, okay. That sounds great. Thank you for clarifying that for me.

Are there any regulatory risks to closing the deal, given they’re European-based? Are there any things to be aware of?

Brad Feller - Infinera Corporation - CFO

Yes, so, the biggest hurdle, I would say, Ted, is just getting 90% of their shareholders signed up to the deal. The actually core regulatory issues are there,

but given there is not a lot of overlap in the two businesses, we don’t expect many challenges from a core regulatory perspective. But we will have to go through the process.

Ted Moreau - Barrington Research Associates, Inc. - Analyst

Okay, great. Thanks again, and congrats.

Operator

(Operator Instructions)

12

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

Rod Hall of JPMC.

Rod Hall - JPMC - Analyst

Sorry for the extra question, but just a quick one for you, Brad. What about currency exposure in the deal? You are saying that it’s closing in

Q3. Do you have any way to hedge away currency exposure, or are you pretty much just fully exposed to whatever happens to the SEK over the time period?

Brad Feller - Infinera

Corporation - CFO

I am assuming, Rod, you are talking about the cash portion of the deal?

Rod Hall - JPMC - Analyst

Right.

Brad Feller - Infinera Corporation - CFO

So, we will lock that down. We are obviously very mindful of the — where the exchange rate is today. So, we will lock that down as part of the

transaction, so that there is not additional exposure.

Rod Hall - JPMC - Analyst

Okay, so,

we just assume that whatever happens to the currency, it will be — the SEK portion will be static?

Brad Feller - Infinera

Corporation - CFO

Correct.

Rod Hall - JPMC - Analyst

Okay, thank you.

Jeff Hustis - Infinera

Corporation - IR

I think that’s all the questions. Operator?

Tom Fallon - Infinera

Corporation - CEO

Thank you all very much. We look forward to talking to you in the near term. Have a great day.

Jeff Hustis - Infinera Corporation - IR

Thanks.

13

|

| APRIL 09, 2015 / 12:30PM, INFN -

Infinera Announces Offer to Acquire Transmode M&A Call |

Operator

That concludes today’s conference. Thank

you for participating. You may now disconnect.

14

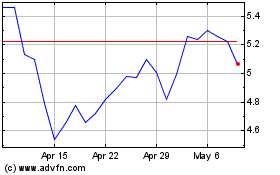

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Mar 2024 to Apr 2024

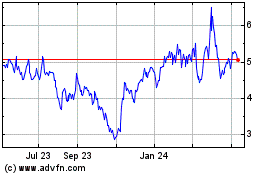

Infinera (NASDAQ:INFN)

Historical Stock Chart

From Apr 2023 to Apr 2024