SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

April 8, 2015

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name

into English)

Sarmiento 447

Buenos Aires C1 1041

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether by furnishing the information

contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

INDEX

| 1. | Translation of a submission from Banco Macro to the CNV dated

on April 8, 2015. |

Buenos Aires, 8 April 2015

To

Comisión Nacional de Valores (Argentine

Securities Exchange Commission)

Please find attached hereto the notice

sent on the date hereof to Ministerio de Economía y Finanzas Públicas answering its request of information

regarding the general and special shareholders’ meeting of Banco Macro S.A. to be held on April 23rd 2015.

Sincerely,

Luis Carlos Cerolini

Director

Banco Macro S.A.

Buenos Aires, April 8th 2015

Dirección Nacional de

Empresas con Participación del

Estado

Lic. Federico Gosman

Hipólito Yrigoyen 250 Piso 8º

Of. 819

S __________/___________D

Re.: NOTE DNEPE N° 144/15

Dear Sir,

We write to you in reply to your request

of information regarding the General and Special Shareholders’ Meeting called for next April 23rd In that respect

please be advised as follows:

1. Executed copy of the Minutes of the

Board of Directors’ Meeting calling the General and Special Shareholders’ Meeting.

Please be advised that the wording of the

minutes of the Board of Directors’ Meeting calling a General and Special Shareholders’ Meeting for April 23trd

2015 is available in the Financial Information Highway (or AIF for its acronym in Spanish) of the CNV or Securities Exchange

Commission of the Republic of Argentina.

2. Copy of the last version of the revised

By-laws.

Please be advised that the last version

of the revised By-laws is available on the AIF.

3. Current composition of the Board

of Directors (regular and alternate members) including the designation dates and effective term of office.

Please be advised that in the AIF you may

access the list of members of the Board of Directors and the minutes of the shareholders’ meetings by which each member was

designated to hold office as director, including the designation dates and term of office of each member of the Board.

4. Detailed description of the shareholders

structure to date.

Please be advised that last February 18th

we published in the AIF the note provided for in section 62 of the Rules and Regulations of the Buenos Aires Stock Exchange, for

the financial statements ended December 31st 2014, which includes a detailed description of the shareholders structure

of Banco Macro S.A.

5. As to the following items of the

Agenda, please be advised as follows:

a. (Item 2) “Evaluate the documentation

provided for in section 234, subsection 1 of Law No. 19550, for the fiscal year ended December 31st 2014.” Copy

of the accounting documents provided for in section 234 of Law No. 19550 as approved and executed by the Board, Syndics and Independent

Auditor, as well as any other supporting information that may accompany this item.

The documentation provided for in section

234, subsection 1 of Law 19550 to be submitted to and evaluated by the next General and Special Shareholders’ Meeting was

unanimously approved by the members of the Board at the meetings held last February 18th, in which the Board members approved the

financial statements for the year 2014, and on March 10th 2014, in which the Board members approved the annual report for the above

mentioned fiscal year.

In addition, please be advised that the

financial statements and annual report mentioned in the preceding paragraph were made available to the public in due time and manner

according to law, through its publication on the AIF.

b. (Item 3) “Evaluate both the

management of the Board of Directors and the Supervisory Committee. Please provide information regarding this item.

The proposal shall be submitted

by the shareholders after the commencement of the General and Special Shareholders’ Meeting called for next April 23rd.

c. (Item 4) “Evaluate the application

of the unappropriated earnings for the fiscal year ended 31 December 2014. Total Unappropriated Earnings: AR$ 3,584,937,063.98

which the Board proposes may be applied as follows: a) AR$ 695,907,205.55 to Legal Reserve Fund; b) AR$ 125,073,000

to Statutory Reserve Fund – Special Statutory Reserve Fund for Subordinated Corporate Bonds under the global program of Negotiable

Obligations approved by the General Shareholders’ Meeting held on September 1st 2006; c) AR$ 27,902,515.49

to personal assets tax on shares and interests; d) AR $ 2,736,054,342.94 to the voluntary reserve fund for future distributions,

pursuant to Communication “A” 5273 issued by the Central Bank of the Republic of Argentina.” Please provide information

regarding this item.

Unappropriated earnings for the

year 2014 arise from the financial statements prepared for such fiscal year, which, as expressed in item 5.a. above, were unanimously

approved by the directors at the Board’s meeting held last February 18th and published in the Financial Information

Highway in due time and manner according to law.

The Board’s proposal as

to the application of unappropriated earnings for the fiscal year ended December 31st 2014 was submitted in compliance

with the rules of the Central Bank of the Republic of Argentina applicable to this matter.

d. (Item 5) “Separate a portion

of the voluntary reserve fund for future distributions for a total amount of AR$ 4,929,218,496.62, out of which AR $ 596,254,288.56

shall be applied to the payment of cash dividend, subject to prior authorization of the Central Bank of the Republic of Argentina.”

Please provide proposal and information regarding this item. In particular, please identify the source of the separated portion

of the optional reserve fund, providing detailed information of all the activity from the creation thereof to date. Additionally,

please accompany cash account position, liquidity and solvency index, working capital and changes in shareholders’ equity,

before and after payment of cash dividends.

As evidenced by the minutes of the General

and Special Shareholders’ Meeting dated April 16th 2012 and duly published in the AIF, we created an “Voluntary Reserve

for Future Distributions” for the amount of AR$ 2,443,140,742.68. In addition, please be advised that the “Optional

Reserve Fund for Future Distributions” account was increased as a result of the resolutions adopted at the General Shareholders’

Meeting held on April 11th 2013 and the General and Special Shareholders’ Meeting held on April 29th 2014, in AR$ 1,170,680,720

and AR$ 1,911,651,322.50. At the same time, the last Shareholders’ Meeting decided to separate a portion of the voluntary

reserve fund for future distributions for a total amount of AR$ 596,254,288.56. All resolutions were published on the AIF

in due time and manner according to law.

Furthermore, there is a chart which contains

the information exposed in the previous paragraph:

| Detail | |

Amount in AR$ | |

| Approved by the Shareholders’ Meeting held on April 16th 2012 | |

| 2,443,140,742.68 | |

| Approved by the Shareholders’ Meeting held on April 11th 2013 | |

| 1,170,680,720.00 | |

| Approved by the Shareholders’ Meeting held on April 29th 2014 | |

| 1,911,651,322.50 | |

| Payment of cash dividends approved by the Shareholders’ Meeting held on April 29th 2014 | |

| -596,254,288.56 | |

| Total | |

| 4,929,218,496.62 | |

As to the “cash account position,

liquidity and solvency index, working capital and changes in shareholders’ equity, before and after payment of the cash dividend”,

such information arises from the Financial Statements for the period ended December 31st 2014, as available in the AIF,

as well as in the Web page of the Central Bank of the Republic of Argentina and from the Investors Relations link in the Web site

of Banco Macro S.A. (www.macro.com.ar).

e. (Item 6) “Evaluate the remunerations

of the members of the Board of Directors for the fiscal year ended December 31st 2014 within the limits as to profits, pursuant

to section 261 of Law No. 19550 and the Rules of the Comisión Nacional de Valores (Argentine Securities Exchange

Commission).” Please provide proposal and information regarding this item. In addition, please provide the amounts paid as

remuneration to the members of the Board in the years 2013, 2012 and 2011; breaking such amounts (as per directors’ remunerations,

remunerations to the members of the audit committee, fees paid for executive functions, etc.) and per each director. Also please

inform whether there are Directors employed by the Bank and the salary amount paid in each case. Finally, provide a breakdown of

the amounts advanced to each director during the year 2014 and the proposal of advance payments for the year 2015, as well as any

other information supporting this item.

The proposed remuneration for the directors

for the above mentioned fiscal year was made available to the public in due time and manner according to law through the publication

of the proposed remuneration in the AIF, pursuant to the Rules of the Argentine Securities Exchange Commission. Such proposed remuneration,

like previous years, does not exceed limits set forth in section 261 of Law No. 19550.

The remuneration of the directors for the

fiscal years 2013, 2012 and 2011 are evidenced in the minutes of the shareholders’ meetings that evaluated all aspects of

such fiscal years, which were duly published in the AIF.

No member of the Board is employed by the

Bank.

As to the breakdown of the amount to be

paid separately to each director, we shall comply with all the provisions set forth in section 75 of Decree No. 1023/2013, as provided

under the Interpretation Criterion No. 45 of the CNV.

There is no proposal as the advance payments

for the year ending December 31st 2015, which will be considered by the shareholders’ meeting evaluating the remunerations

of the directors for that same fiscal year.

f. (Item 7) “Evaluate the remunerations

of the members of the Supervisory Committee for the fiscal year ended December 31st 2014.” Please provide

proposal and information regarding this item, with express identification of the members of the Supervisory Committee. In addition,

please inform the amounts paid as remuneration to the Supervisory Committee during the fiscal years 2013, 2012 and 2011, as well

as any other information supporting this item.

The financial statements for the year ended

December 31st 2014 contemplate a provision of AR$ 852,879 for the payment of remunerations to the members of the Supervisory Committee

for the services rendered during the above mentioned fiscal year.

The remuneration of the members of the

Supervisory Committee for the fiscal years 2013, 2012 and 2011 are evidenced in the minutes of the shareholders’ meetings

that evaluated all aspects of such fiscal years, which were duly published in the AIF.

g. (Item 8) “Evaluate the remuneration

of the independent auditor for the fiscal year ended December 31st 2014.” Please inform the estimated amount of this remuneration

as well as the amounts paid as remuneration during the fiscal years ended 12/31/2013, 12/31/2012 and 12/31/2011.

The remuneration of the independent auditor

for the fiscal year ended December 31st 2014 totals AR$ 7,440,000. The amounts paid as remuneration of independent auditor during

the years ended December 31st 2013, 2012 and 2011 arise from the minutes of the shareholders’ meetings that evaluated

such matters, which are available in the AIF.

h. (Item 9) “Appoint five regular

directors and five alternate directors who shall hold office for three fiscal years.” Please provide information regarding

this item.

The proposal shall be made by the shareholders

after the commencement of the General and Special Shareholders’ Meeting called for next April 23rd.

i. (Item 10) “Determine the number

of members who shall form the Supervisory Committee and designate the new regular and alternate members of the Supervisory Committee

who shall hold office for one fiscal year.” Please provide information regarding this item.

The proposal shall be made by the shareholders

after the commencement of the General and Special Shareholders’ Meeting called for next April 23rd.

j. (Item 11) “Appoint the independent

auditor for the fiscal year to end December 31st 2015.” Please inform the proposed independent auditor for the

current fiscal year and the amount of the Budget in connection herewith.

Pursuant to the sworn statements published

in the AIF, the Accountant Norberto N. Nacuzzi shall be proposed as regular independent auditor and the Accountant Ernesto Mario

San Gil shall be nominated as alternate independent auditor, both of them partners at the audit firm Pistrelli, Henry Martin y

Asociados S.R.L.

Not having been approved by the Shareholders’

Meeting the remuneration of the independent auditor for the fiscal year ended December 31st 2014, we still no have the amount budgeted

for his performance during the current financial year.

k. (Item 12) “Define the audit

committee’s budget.” Please inform the amount of the Budget in connection herewith, as well as the amounts paid under

this description during the fiscal years ended 12/31/2014, 12/31/2013 and 12/31/2012.

The proposal shall be made by the shareholders

after the commencement of the General and Special Shareholders’ Meeting called for next April 23rd.

The audit committee’s budget for

each of the fiscal years 2012 and 2013 was fixed in the amount of AR$ 600,000 and in the amount of AR$ 720,000 for the fiscal year

2014.

l. (Item 13) “Defer the delegation

to the Board of the necessary powers to (i) determine and establish all terms and conditions of the Global Program of Negotiable

Obligations approved by Resolution No. 15480 dated September 28th, 2006 and Resolution No. 16616 dated July 28th

2011 issued by the Argentine Securities Exchange Commission, of each of the series to be issued at the appropriate time and of

the negotiable obligations to be issued under such Program and (ii) perform any act in connection with such Program or the negotiable

obligations to be issued thereunder. Authorize the Board to sub-delegate to one or more of its members, or to the person they consider

appropriate, the exercise of the powers described in the preceding paragraph.” Proposal and foundation regarding this item.

The General and Special Shareholders’

Meeting held on April 11th 2013 resolved the delegation to the Board of Directors of the powers described under item 13 of the

Agenda for the General Shareholders’ Meeting called for next April 23rd.

The deferral of the delegation to the Board

that is being proposed to the next Shareholders’ Meeting is made in compliance with the provisions of section 9 of Law 23576

which establish that the powers delegated may be exercised within two years from the date of the relevant meeting.

m. (Punto 14) Authorization to carry

out all acts and filings that are necessary to obtain the administrative approval and registration of the resolutions adopted by

the Shareholders’ Meeting. Please inform the names of the people to be authorized to carry out the mentioned tasks.

The proposal shall be made by the shareholders

after the commencement of the General and Special Shareholders’ Meeting called for next April 23rd.

Sincerely,

Luis Carlos Cerolini

Director

Banco Macro S.A.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: April 8, 2015

| |

MACRO BANK INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ Luis Carlos Cerolini |

| |

Name: Luis Carlos Cerolini |

| |

Title: Director |

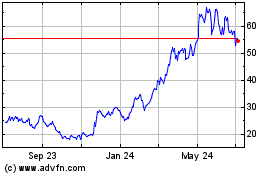

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

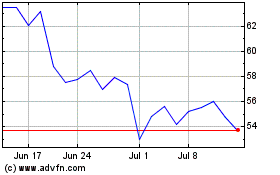

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Apr 2023 to Apr 2024