UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 2, 2015

NORTHWEST BIOTHERAPEUTICS, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

001-35737 |

94-3306718 |

|

(State or other jurisdiction of

incorporation or organization) |

(Commission File Number) |

(IRS Employer

Identification No.) |

4800 Montgomery Lane, Suite 800 Bethesda, MD 20814

(Address of principal executive offices)

(204) 497-9024

(Registrant’s telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule

425 under the Securities Act

¨ Soliciting material pursuant to Rule 14a-12

under the Exchange Act

¨ Pre-commencement communications pursuant

to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

| Item 1.01 | Entry into a Material Definitive Agreement. |

On April 2, 2015, Northwest

Biotherapeutics, Inc., a Delaware corporation (the “Company”), entered into a stock purchase agreement (the

“Agreement”) with Woodford Investment Management LLP as agent for the CF Woodford Equity Income Fund and other

clients (collectively, “Woodford”). Pursuant to the Agreement, the Company has agreed to sell, and Woodford has

agreed to purchase, 5,405,405 shares of the Company’s unregistered common stock, par value $0.001 per share (the

“Shares”), at a purchase price of $7.40 per Share for an aggregate purchase price of $40,000,000. The sale of the

Shares is taking place in two separate closings as follows: (i) 1,554,054 shares for a purchase price of $11,500,000 which

closed on April 8, 2015; and (ii) an additional 3,851,351 shares for a purchase price of $28,500,000 which will close on

or before April 30, 2015 (or such other date as mutually agreed by the parties). There are no warrants, pre-emptive rights

or other rights or preferences.

Further, pursuant to the terms of the Agreement,

the Company has agreed to register the Shares in a registration statement on Form S-3 (the “Registration Statement”)

no later than two weeks after the second closing, and to use commercially reasonable best efforts to complete the registration

of the Shares within 60 days after filing the Registration Statement with the U.S. Securities and Exchange Commission.

The foregoing description of the Agreement

does not purport to be complete and is qualified in its entirety by reference to the Agreement, which is filed as Exhibit 10.1

to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 3.02 | Unregistered Sales of Equity Securities. |

The information required to be disclosed

in this Item 3.02 is incorporated herein by reference from Item 1.01.

The securities described in Item 1.01 above

were offered and sold in reliance upon exemptions from registration pursuant to Section 4(2) under the Securities Act of 1933,

as amended (the “Securities Act”), and Rule 506 of Regulation D promulgated thereunder. The offering was made to an

“accredited investor” (as defined by Rule 501 under the Securities Act). In addition, the sale of securities did not

involve a public offering; the Company made no solicitation in connection with the sale other than communications with the investor;

the Company obtained representations from the investor regarding its investment intent, experience and sophistication; and the

investor either received or had access to adequate information about the Company in order to make an informed investment decision.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit No. |

|

Description |

| |

|

|

| 10.1 |

|

Stock Purchase Agreement, dated April 2, 2015, by and between Northwest Biotherapeutics, Inc. and Woodford Investment Management LLP |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

|

NORTHWEST BIOTHERAPEUTICS, INC. |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Date: April 8, 2015 |

|

By: |

/s/ Linda Powers |

|

| |

|

|

|

Name: Linda Powers |

|

| |

|

|

|

Title: Chief Executive Officer |

|

EXHIBIT 10.1

NORTHWEST BIOTHERAPEUTICS,

INC.

STOCK PURCHASE AGREEMENT

This

Stock Purchase Agreement (this “Agreement”) is made and entered into as of April 2, 2015 (the

“Effective Date”), by and between Northwest Biotherapeutics, Inc.,

a Delaware corporation (the “Company”) and Woodford Investment Management LLP as agent for

the CF Woodford Equity Income Fund and other clients (the “Purchaser”).

Recitals

Whereas,

the Company desires to issue and sell common stock of the Company on the terms and conditions set forth herein (the “Common

Stock”), and has authorized such sale and issuance; and

Whereas,

the Purchaser desires to purchase such Common Stock on the terms and conditions set forth herein.

Agreement

Now,

Therefore, in consideration of the foregoing recitals and the mutual promises, representations, warranties, and covenants

hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged,

the parties hereto agree as follows:

1. Agreement

To Sell And Purchase.

The Purchaser hereby

agrees to purchase, and the Company hereby agrees to sell and issue to the Purchaser, an aggregate total of Forty Million Dollars

(US$40,000,000) of initially unregistered common stock of the Company (being 5,405,405 shares) (the “Shares”), at a

purchase price per Share (the “Purchase Price”) equal to Seven Dollars and Forty Cents ($7.40). The purchase of Shares

will take place in two closings (the “Closings”), in the amount of Eleven Million Five Hundred Thousand Dollars ($11,500,000)

(the “First Closing”) and Twenty-Eight Million, Five Hundred Thousand Dollars ($28,500,000) (the “Second Closing”),

respectively, as provided in Section 2 hereof. As set forth in Section 3, the Company has authorized the sale and issuance of the

Shares to the Purchaser.

2. Closing,

Delivery And Payment.

The First Closing will take place on or

before April 8, 2015. The Second Closing will take place on or before April 30, 2015, or on such other date as the parties may

mutually agree. At each Closing, the Company will deliver the applicable Shares to the Purchaser against payment of the applicable

purchase price by wire transfer of immediately available funds to such account as may be designated by the Company.

3. Representations

and Warranties of the Company.

The Company hereby

represents and warrants to the Purchaser that as of the Closing hereunder:

(a) The Company

is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware and has all necessary

corporate power and authority to (i) own, operate and occupy its properties and to carry on its business as presently conducted

and (ii) enter into this Agreement and the other agreements, instruments and documents contemplated hereby, and to consummate the

transactions contemplated hereby and thereby. The Company is qualified to do business and is in good standing in each jurisdiction

in which the failure to so qualify would have a Material Adverse Effect.

(b) All necessary

corporate proceedings, votes, resolutions and approvals relating to the issuance and sale of the Shares hereunder have been completed

by the Company. Upon execution, this Agreement will constitute a valid and legally binding obligation of the Company, enforceable

in accordance with its terms except (i) as limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other

laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by laws relating to

the availability of specific performance, injunctive relief or other equitable remedies.

(c) The Shares purchased pursuant to this Agreement

will be, upon payment by the Purchaser in accordance with this Agreement, duly authorized, validly issued, fully paid and non-assessable.

In the event that the Company fails to obtain approval by the U.S. SEC of a new shelf registration on Form S-3 in accordance with

this Agreement, the Shares will automatically become free trading six (6) months after issuance pursuant to applicable U.S. securities

laws (Rule 144).

4. Warranties

of the Purchaser.

The Purchaser hereby

warrants to the Company that as of the Closing hereunder:

(a) The Purchaser

has full power and authority to enter into this Agreement. All necessary corporate or other proceedings, votes, resolutions and

approvals relating to the purchase of the Shares hereunder have been completed by the Purchaser. Upon execution, this Agreement

will constitute a valid and legally binding obligation of the Purchaser, enforceable in accordance with its terms except (i) as

limited by applicable bankruptcy, insolvency, reorganization, moratorium, and other laws of general application affecting enforcement

of creditors’ rights generally, and (ii) as limited by laws relating to the availability of specific performance, injunctive

relief or other equitable remedies.

(b) The Shares

will be acquired for investment for the Purchaser’s own account or for the account of funds under management, and not with

a view to the resale or distribution of any part thereof, and the Purchaser has no present intention of selling, granting any participation

in or otherwise distributing the same except in compliance with applicable U.S. securities laws. The purchase of the Shares hereunder

complies with applicable UK laws.

(c) The Purchaser

is an “accredited investor” within the meaning of Rule 501 of Regulation D promulgated under the Securities

Act.

(d) The Purchaser

is an experienced investor in securities of companies in the development stage, can bear the economic risk of its investment, including

a total loss, and has such knowledge and experience in financial or business matters that it is capable of evaluating the merits

and risks of the investment in the Shares. The Purchaser has conducted its own due diligence review of the Company and received

copies or originals of all documents it has requested from the Company.

5. Legends.

The parties understand

and agree that the Shares will not be registered at the time of issuance, but will be registered as promptly as practicable after

the Closing. Subject to the provisions of Section 6 hereof, until the Shares have been registered, the certificates evidencing

the Shares will bear the following legend (or a substantially similar legend) and such other legends as may be required by applicable

laws of any state or foreign jurisdiction:

“THESE SECURITIES

HAVE NOT BEEN REGISTERED UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”). THEY MAY NOT BE SOLD, OFFERED

FOR SALE, PLEDGED OR HYPOTHECATED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT AS TO SUCH SECURITIES UNDER THE ACT OR

UNLESS SUCH TRANSACTION IS IN COMPLIANCE WITH APPLICABLE FEDERAL AND STATE SECURITIES LAWS.”

6. Registration.

6.1 Registration: The Company hereby agrees to file

with the U.S. SEC, no later than two weeks after the Second Closing, a registration on Form S-3 which will include registration

of the Shares issued pursuant to this Agreement (the “Registration”). The Company further agrees to use commercially

reasonable best efforts to complete the Registration within sixty (60) days after the filing. Notwithstanding the foregoing and

the provisions of Section 5 hereof, if the Company fails to complete the Registration as provided in this Section 6, the Shares

will automatically become free trading six (6) months after issuance if the holder is not deemed to be an affiliate of the Company,

or one (1) year after issuance if the holder is deemed to be an affiliate of the Company, pursuant to applicable U.S. securities

laws (Rule 144).

6.2 Costs: The Company will bear all reasonable and

customary expenses relating to the preparation and filing of the Registration pursuant to Section 6.1 hereof.

7. Miscellaneous

7.1 Governing Law.

This Agreement will be governed by and construed in accordance with the laws of England and Wales, without regard to principles

of conflicts of law. The parties hereby agree that any legal action, suit or proceeding arising out of or relating to this Agreement

will be brought in federal or state court located in London.

7.2 Entire Agreement;

Amendments. This Agreement constitutes the full and entire understanding and agreement between the parties with regard to the

subject matter hereof. Except as otherwise expressly provided herein, neither this Agreement nor any term hereof may be amended,

waived, discharged or terminated, except by a written instrument signed by the Company and the Purchaser.

7.3 Notices.

Any notices, consents, waivers or other communications required or permitted to be given under the terms of this Agreement must

be in writing and will be deemed to be effective upon delivery when delivered (a) personally; (b) by email, provided a positive

electronic delivery receipt is received and a copy is mailed by overnight delivery service no later than the next business day

through a nationally recognized overnight delivery service; or (c) by overnight delivery through a nationally recognized overnight

delivery service, in each case properly addressed to the party to receive the same. The addresses and facsimile numbers for such

communications will be,

in the case of the Purchaser:

Woodford Investment Management LLP

9400 Garsington Rd.

Oxford,

OX4 2HN

United Kingdom

Attention:

and in the case of the Company:

Northwest Biotherapeutics

4800 Montgomery Lane

Suite 800

Bethesda, MD 20814

USA

Attention: Linda F. Powers

or at such other address and facsimile number as the receiving

party will have furnished to the sending party in writing.

7.4 Severability.

The representations, warranties, covenants and agreements made and incorporated by reference herein will survive any investigation

made by or on behalf of the Purchaser or the Company, and will survive for two years after the Effective Date.

7.5 Successors

and Assigns. Except as otherwise expressly provided herein, the provisions hereof will inure to the benefit of, and be binding

upon, the respective successors, assigns, heirs, executors and administrators of the parties hereto. The Purchaser may transfer

or assign all or any portion of its rights under this Agreement to any person or entity permitted under applicable securities laws.

7.6 Interpretations.

All pronouns and any variations thereof will be deemed to refer to the masculine, feminine, neuter, singular or plural, as the

identity of the person or persons or entity or entities may require. All references to “$” or dollars herein will be

construed to refer to United States dollars. The titles of the Sections and subsections of this Agreement are for convenience or

reference only and are not to be considered in construing this Agreement. All references to “including” will be deemed

to mean “including, without limitation.”

7.7 Severability.

In case any provision of this Agreement is determined to be invalid, illegal or unenforceable, the validity, legality and enforceability

of the remaining provisions will not in any way be affected or impaired thereby.

7.8 Counterparts.

This Agreement may be executed in counterparts, each of which when so executed and delivered will constitute a complete and original

instrument but all of which together will constitute one and the same agreement, and it will not be necessary when making proof

of this Agreement or any counterpart thereof to account for any counterpart other than the counterpart of the party against whom

enforcement is sought.

[signatures on following page]

In

Witness Whereof, the parties hereto have executed this Stock

Purchase Agreement as of the date set forth in the first paragraph hereof.

| COMPANY: |

|

|

|

|

| |

|

|

|

|

| Northwest Biotherapeutics, Inc. |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| By: Linda F. Powers |

|

|

|

|

| Title: Chief Executive Officer |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| PURCHASER: |

|

|

|

|

| |

|

|

|

|

| Woodford Investment Management LLP |

|

|

|

| As agent for the CF Woodford Equity Income Fund and other clients |

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| By: |

|

|

|

|

| Title: |

|

|

|

|

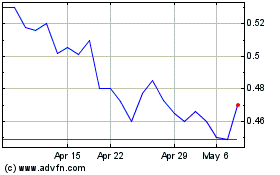

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Apr 2023 to Apr 2024