UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

Amendment No. 1

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from_____________ to _____________.

Commission file number 000-51225

Wisdom Homes of America, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

43-2041643

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

500 North Northeast Loop 323 Tyler, TX

|

|

75708

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (800) 727-1024

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Name of each exchange on which registered

|

|

None

|

|

None

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer |

¨

|

Accelerated filer

|

¨

|

| Non-accelerated filer |

¨

|

Smaller reporting company

|

x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter. $1,491,684 based on the closing price of $0.0502 on June 30, 2014. The voting stock held by non-affiliates on March 25, 2015, consisted of 29,714,815 shares of common stock.

Applicable Only to Registrants Involved in Bankruptcy Proceedings During the Preceding Five Years:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ¨ No ¨

(Applicable Only to Corporate Registrants)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 25, 2015, there were 57,702,105 shares of common stock, par value $0.001, issued and outstanding.

Documents Incorporated by Reference

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

Explanatory Note

This Amendment No. 1 to the Annual Report on Form 10-K/A amends the Annual Report on Form 10-K for the year ended December 31, 2014 of Wisdom Homes of America, Inc. (“ Wisdom Homes ”), which was filed with the Securities and Exchange Commission on March 30 , 2015. This Form 10-K/A is being filed to correct certain immaterial typographical errors in the financial statements contained in Item 8 herein .

Except as described above, this Amendment No. 1 on Form 10-K/A is not intended to update or modify any other information presented in Wisdom Homes ’ Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as originally filed. This Amendment does not reflect events occurring after the Form 10-K’s original filing date of March 30 , 2015. Accordingly, this Form 10-K/A should be read in conjunction with our other filings made with the SEC subsequent to the filing of our Annual Repo rt on Form 10-K for the year ended December 31, 2014.

For the convenience of the reader, we have included a complete version of the Amendment, which includes all unchanged portions of the original f iling, within this report.

WISDOM HOMES OF AMERICA, INC.

FORM 10-K ANNUAL REPORT

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2014

TABLE OF CONTENTS

| |

PART I

|

|

|

|

|

|

|

|

ITEM 1

|

BUSINESS

|

3

|

|

|

ITEM 1A

|

RISK FACTORS

|

8 |

|

|

ITEM 1B

|

UNRESOLVED STAFF COMMENTS

|

19 |

|

|

ITEM 2

|

PROPERTIES

|

19 |

|

|

ITEM 3

|

LEGAL PROCEEDINGS

|

19 |

|

|

ITEM 4

|

MINE SAFETY DISCLOSURES

|

19 |

|

| |

|

|

|

| |

PART II

|

|

|

| |

|

|

|

|

ITEM 5

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

20 |

|

|

ITEM 6

|

SELECTED FINANCIAL DATA

|

25 |

|

|

ITEM 7

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

25 |

|

|

ITEM 7A

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

35 |

|

|

ITEM 8

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

36 |

|

|

ITEM 9

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

37 |

|

|

ITEM 9A

|

CONTROLS AND PROCEDURES

|

37 |

|

|

ITEM 9B

|

OTHER INFORMATION

|

39 |

|

| |

|

|

|

| |

PART III

|

|

|

| |

|

|

|

|

ITEM 10

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

|

40 |

|

|

ITEM 11

|

EXECUTIVE COMPENSATION

|

43 |

|

|

ITEM 12

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

44 |

|

|

ITEM 13

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

45 |

|

|

ITEM 14

|

PRINCIPAL ACCOUNTING FEES AND SERVICES

|

46 |

|

|

|

|

|

| |

PART IV

|

|

|

| |

|

|

|

|

ITEM 15

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

47

|

|

PART I

Cautionary Statement Regarding Forward Looking Statements

This Annual Report includes forward-looking statements within the meaning of the Securities Exchange Act of 1934 (the “Exchange Act”). These statements are based on management’s beliefs and assumptions, and on information currently available to management. Forward-looking statements include the information concerning possible or assumed future results of operations of the Company set forth under the heading “Management's Discussion and Analysis of Financial Condition or Plan of Operation.” Forward-looking statements also include statements in which words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “consider” or similar expressions are used.

Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions. The Company's future results and shareholder values may differ materially from those expressed in these forward-looking statements. Readers are cautioned not to put undue reliance on any forward-looking statements.

ITEM 1 – BUSINESS

Corporate Information

Wisdom Homes Of America, Inc. was formed on July 14, 2003 in the State of Nevada as Tora Technologies, Inc. On November 21, 2006, we changed our name to Makeup.com Limited, on January 29, 2010, we changed our name to LC Luxuries Limited, on November 5, 2010, we changed our name to General Cannabis, Inc., and on January 6, 2012, we changed our name to SearchCore, Inc. Most recently, on March 3, 2015, we changed our name to Wisdom Homes of America, Inc.

Our corporate headquarters are located at 500 North Northeast 323 Loop, Tyler, TX 75708. Our website is www.wisdomhomesofamerica.com. Information contained on our website is not incorporated into and does not constitute any part of this Form 10-K.

Description of Business

We open and operate manufactured home retail centers. We have four retail centers located in the state of Texas in the following cities: Rhome, Tyler, Mount Pleasant and Jacksboro. The retail centers are operated by our wholly owned subsidiary, Wisdom Manufactured Homes Of America, Inc. We are continuously seeking ancillary opportunities within the manufactured housing industry to increase our revenues.

Recent Developments

In early 2014 we transitioned Wisdom Homes of America, Inc. into the manufactured home retail industry. During 2014 we (i) sold our finder site www.manufacutedhomes.com and the associated intellectual property, (ii) entered into an Assignment Agreement with a third party entity pursuant to which we assigned and transferred to the assignee the premium domain names Karate.com and Rodeo.com along with the associated $400,000 in debt, and (iii) we discontinued the operations of our wholly-owned subsidiaries that had operations related to our prior finder site business. See Note 11. Discontinued Operations in the notes to the financial statements filed herewith as part of this Form 10-K.

The strategic reasons for concentrating our efforts and resources in the manufactured housing industry include a growing number of manufactured home buyers and advancements in the manufactured home building process resulting in a significantly higher quality product and affordability.

Recent Divestitures

Sale of ManufacturedHomes.com Finder Site and other URL’s

On May 19, 2014, we sold the following domain names:

www.ManufacturedHome.com,

www.ManufacturedHomes.com,

www.ManufacturedHouse.com,

www.ManufacturedHomes.net, and

www.ModularHomes.com.

The domain names were sold to Platinum Technology Ventures, LLC, an entity owned and controlled by Brad Nelms, formerly our Chief Strategy Officer. As consideration for the sale of the domain names, we received a non-recourse secured promissory note in the amount of One Million Dollars ($1,000,000), and Platinum assumed all of our obligations under the Lease Agreement we had with Domain Capital, LLC, with the exception of our responsibility to make monthly lease payments for the first six months after the closing of the transaction. We also received lifetime “gold” or equivalent membership levels on any manufactured home website owned or operated by Platinum. In connection with the transaction, Brad Nelms’ employment with us ceased. In order to assist Platinum in its operations, we agreed to loan it Ninety Thousand Dollars ($90,000) over six months. After making payments to Platinum in the sum of Forty Five Thousand Dollars ($45,000), on October 28, 2014, we entered into a Waiver and Mutual Release, pursuant to which both parties agreed to release one another from any and all rights and liabilities arising under the promissory note pertaining to the operating expense payments. Accordingly, we have no continuing obligation to make operating expense payments to Platinum, and Platinum has no obligation to repay the monies already paid.

Two additional domain names are subject to the Lease Agreement with Domain Capital, LLC, namely www.TravelTrailer.com and www.ToyHaulers.com. Upon satisfaction of the payment obligations under the Lease Agreement, those domains will be transferred back to us.

Sale of WeedMaps

On December 11, 2012, we entered into an Agreement and Plan of Reorganization by and among us and our wholly owned subsidiary, WeedMaps Media, Inc., a Nevada corporation, on the one hand, and RJM BV, a Dutch corporation, on the other hand. Pursuant to the Reorganization Agreement, upon the closing of the transaction, we sold WeedMaps to RJM in exchange for (a) Three Million Dollars ($3,000,000), represented by a secured promissory note, (b) the assumption by RJM of all of our various obligations to Douglas Francis, Justin Hartfield, and Keith Hoerling, and the assumption of our office lease in Newport Beach, California, and (c) Seven Hundred Fifty Thousand Dollars ($750,000) in cash (of which we withheld Five Hundred Thousand Dollars ($500,000) from the WeedMaps cash balance at the closing and Two Hundred Fifty Thousand Dollars ($250,000) of which was to be paid to us on January 15, 2013, before the due date was extended to January 31, 2013, which payment we did receive). The closing of the sale took place on December 31, 2012.

As partial consideration under the Reorganization Agreement, RJM delivered a Secured Promissory Note in the original principal amount of Three Million Dollars ($3,000,000). The Note is secured by certain assets according to the terms of a Pledge and Security Agreement, which assets include all of the assets of WeedMaps Media, including but not limited to the URL known as www.weedmaps.com. Pursuant to the Note RJM will make the following payments: (1) Two Hundred Fifty Thousand Dollars ($250,000) on January 15, 2013 (which payment date was extended to January 31, 2013 and which payment we did receive); One Hundred Thousand Dollars ($100,000) each month beginning February 25, 2013 and continuing on the twenty fifth (25th) of each month thereafter for a total of twenty eight (28) months, which payments we have received timely as they came due. We negotiated with the Noteholder and accelerated one payment of $100,000 in exchange for eliminating the last payment of $16,500. Interest shall accrue on the outstanding principal amount on an annual basis at a rate of One and One Hundredth Percent (1.01%).

As further consideration under the Reorganization Agreement, RJM delivered documents sufficient (i) to transfer all of the obligations that we owed to Justin Hartfield arising out of the Global Securities Purchase, Consulting, and Resignation Agreement by and between us, WeedMaps, and Hartfield dated as of July 31, 2012, to RJM and to release us from all said obligations thereunder; (ii) to transfer all of the obligations that we owed to Douglas Francis arising out of the Global Securities Purchase and Resignation Agreement by and between us, WeedMaps, and Francis dated as of July 31, 2012, to RJM and to release us from all said obligations thereunder; (iii) to transfer all of the obligations that we owed to Keith Hoerling arising out of the Global Securities Purchase Agreement by and between us, WeedMaps, and Hoerling dated August 14, 2012, to RJM and to release us from all said obligations thereunder; (iv) for RJM to assume all of our obligations under that certain Office Lease Agreement by and between us and Redstone Plaza, LLC dated January 17, 2011; and (v) for RJM to assume all of our obligations under certain additional material agreements set forth on Schedule 2.1.16 of the Reorganization Agreement.

As further consideration under the Reorganization Agreement, we, along with our President and Chief Executive Officer James Pakulis, and Brad Nelms, an employee of Wisdom Homes, entered into a Non-Competition Agreement whereby the bound parties agreed that they (i) will not disclose certain confidential information regarding the business of WeedMaps; (ii) will not compete with the business of WeedMaps; (iii) will not solicit, advise, provide or sell, directly or indirectly, any services or products of the same or similar nature to services or products of the business of WeedMaps, to any client or prospective client of WeedMaps; (iv) will not solicit, request or otherwise attempt to induce or influence, directly or indirectly, any present client, distributor or supplier, or prospective client, distributor or supplier, of WeedMaps, to cancel, limit or postpone their business with WeedMaps, or otherwise take action which might be to the disadvantage of WeedMaps; and (v) will not hire or solicit for employment, directly or indirectly, or induce or actively attempt to influence, any employee, officer, director, agent, contractor or other business associate of WeedMaps (excluding employees prior to December 31, 2012), to terminate his or her employment or discontinue such person’s consultant, contractor or other business association with WeedMaps. The business of WeedMaps is defined in the Non-Competition Agreement as internet search and website operation for the medicinal cannabis industry.

Similarly, RJM, Douglas Francis, Justin Hartfield, and Keith Hoerling entered into a Non-Competition Agreement whereby they agreed not to compete with our business, described in the Non-Competition Agreement as internet search, internet advertising, and website operation for (a) the recreational sports industry, (b) the prefabricated housing industry, (c) the tattoo industry, and (d) other industries in which Wisdom Homes and/or its affiliates operates, at the time of the Agreement or thereafter.

In the aggregate, the transactions represented by the Reorganization Agreement resulted in a reduction of over $8,000,000 in liabilities.

Sale of Certain Assets

On December 11, 2012, in connection with the transactions contemplated by the sale of WeedMaps Media, Inc., we entered into an Asset Purchase Agreement by and among us and our wholly owned subsidiary, General Marketing Solutions, Inc., a California corporation, on the one hand, and RJM, on the other hand, pursuant to which, upon the closing of the transaction, we sold certain assets (primarily those assets we acquired from Revyv, LLC in January 2011) to RJM for the sum of Ten Dollars ($10.00). The closing of the sale took place on December 31, 2012.

In connection with the Purchase Agreement, GMS entered into an Assignment of Domain Names whereby GMS assigned certain domain names to RJM.

Intellectual Property

Our intellectual property consists of approximately 150 Internet domain names. We use intellectual property law that may include a combination of copyright, trade secret and confidentiality agreements to protect our intellectual property. Our former employees and independent contractors are required to sign agreements acknowledging that all inventions, trade secrets, works of authorship, developments and other processes generated by them on our behalf are our property, and assigning to us any ownership that they may claim in those works. Despite our precautions, it may be possible for third parties to obtain and use without consent intellectual property that we own. Unauthorized use of our intellectual property by third parties, and the expenses incurred in protecting our intellectual property rights, may adversely affect our business.

From time to time, we may encounter disputes over rights and obligations concerning intellectual property. While we believe that our product and service offerings do not infringe the intellectual property rights of any third party, we cannot assure you that we will prevail in any intellectual property dispute. If we do not prevail in such disputes, we may lose some or all of our intellectual property protection, be enjoined from further sales of the applications determined to infringe the rights of others, and/or be forced to pay substantial royalties to a third party.

Competition

There is significant competition in the manufactured home retail industry. Competition includes, but is not limited to, small independent retail centers, regional and national center owners. Our competition may have more inventory and more capital for inventory, and greater financial ability to market their products and brands. Some of our competition are also vertically integrated which includes the ownership of the manufacturing facilities as well as the retail sales centers and, at times, mortgage products that are offered to home buyers.

The following is a list of known competitors that own and operate manufactured home retail centers in the same geographic areas as us:

Clayton Homes

Oakwood Homes

Titan

Pratt Homes

Brewer Homes

Tilleys Homes

American Mobile Homes

Universal Homes

Wholesale Home Brokers

Tandem Homes

King Mobile Homes

Seasonality

In general, the sale of manufactured homes experiences higher volume during the months of March through October with sales volume decreasing during the winter months. Furthermore, any time there are moments of particularly harsh weather conditions or prolonged harsh weather condition, sales volume may be significantly lower, or non-existent, and deliveries of manufactured homes can be delayed or canceled.

Our Staffing

As December 31, 2014 we employed 3 individuals on a full time basis and 4 individuals on a part-time basis.

Organization Within the Last Five Years

Wisdom Homes of America, Inc. was formed on July 14, 2003 in the State of Nevada as Tora Technologies, Inc. On November 21, 2006, we changed our name to Makeup.com Limited, on January 29, 1010, we changed our name to LC Luxuries Limited, on November 5, 2010, we changed our name to General Cannabis, Inc., and on January 6, 2012, we changed our name to SearchCore, Inc. Most recently, on March 3, 2015, we changed our name to Wisdom Homes of America, Inc.

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those Reports filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through our website www.wisdomhomesofamerica.com. The filings are made available on our website as soon as reasonably practicable after they are filed electronically with the Securities and Exchange Commission.

ITEM 1A. – RISK FACTORS.

As a smaller reporting company we are not required to provide a statement of risk factors. Nonetheless, we are voluntarily providing risk factors herein.

Any investment in our common stock involves a high degree of risk. You should consider carefully the following information, together with the other information contained in this Annual Report, before you decide to buy our common stock. If one or more of the following events actually occurs, our business will suffer, and as a result our financial condition or results of operations will be adversely affected. In this case, the market price, if any, of our common stock could decline, and you could lose all or part of your investment in our common stock.

We face risks in developing our products and services and eventually bringing them to market. We also face risks that we will lose some, or all, of our market share in existing businesses to competition, or we risk that our business model becomes obsolete. This includes not only our retail manufactured home retail centers, but also our real estate development activities. The following risks are material risks that we face. If any of these risks occur, our business, our ability to achieve revenues, our operating results and our financial condition could be seriously harmed.

Risk Factors Related to the Business of the Company

We have a limited operating history and limited historical financial information upon which you may evaluate our performance.

You should consider, among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like us, are in their early stages of operations. We may not successfully address all of the risks and uncertainties or successfully implement our existing and new products and services. If we fail to do so, it could materially harm our business and impair the value of our common stock, resulting in a loss to shareholders. Even if we accomplish these objectives, we may not generate the positive cash flows or profits we anticipate. We were incorporated in Nevada in 2003, and the vast majority of the business that we conducted in 2011 and 2012 was started or acquired in 2010. Now, the vast majority of that business has been sold, and we started a similar online business in the tattoo industry that generated very little revenue and that we eventually closed. Our current retail manufactured home business is starting to generate revenue, but still operates at a loss. Unanticipated problems, expenses and delays are frequently encountered in establishing a new business and developing new products and services. These include, but are not limited to, inadequate funding, lack of consumer acceptance, competition, product development, the inability to employ or retain talent, inadequate sales and marketing, and regulatory concerns. The failure by us to meet any of these conditions would have a materially adverse effect upon us and may force us to reduce, curtail, or discontinue operations. No assurance can be given that we can or will ever be successful in our operations and operate profitably.

We operate in an industry that is currently experiencing a prolonged and significant downturn.

Since mid-1999, the manufactured housing industry has experienced a prolonged and significant downturn. This downturn has resulted in part from the fact that, beginning in 1999, consumer lenders in the sector began to tighten underwriting standards and curtail credit availability in response to higher than anticipated rates of loan defaults and significant losses upon the repossession and resale of the manufactured homes securing defaulted loans. From 2004 to 2007, the industry’s downturn was exacerbated by the aggressive financing methods available to customers of developers and marketers of standard stick-built homes, which had the effect of diverting potential manufactured housing buyers to more expensive stick-built homes. Since 2008, the global credit crisis and general deterioration of economic conditions have extended the depressed market conditions. These factors have resulted in reduced wholesale shipments and excess manufacturing and retail locations.

If current industry conditions continue or get materially worse, we may be required to take steps in an attempt to mitigate the effect of unfavorable industry conditions, such as the closure of retail locations. These steps could impair our ability to conduct our business and could make it more difficult for us to expand our operations as industry conditions improve. Furthermore, some of these steps could lead to fixed asset, goodwill or other impairment charges.

Our entry into new lines of business, such as consumer asset financing to help facilitate the sale of manufactured homes at our retail locations, exposes us to additional risks.

In November 2014, we formed a wholly-owned subsidiary named Alpine Creek, Inc., which borrowed $200,000 from third-party investors. We guaranteed the promissory notes. The funds will be loaned as short-term financing in order to expedite and/or assist customers of our wholly-owned subsidiary, Wisdom Homes of America, Inc., in purchasing a manufactured home from Wisdom.

In December 2014, we formed a wholly-owned subsidiary named White Mountain River, Inc., which borrowed $200,000 from third-party investors. We guaranteed the promissory notes. The funds will be used to acquire land and manufactured homes for improvement and resale to customers of our wholly-owned subsidiary, Wisdom Homes of America, Inc.

Both Alpine Creek and White Mountain River provide us with an opportunity to increase sales at our retail locations. However, in the event of a default on any loans made to customers, or unprofitable transactions, we will be required to repay the loans to third-party investors. This could impair our ability to conduct our business and operations.

Tightened credit standards, curtailed lending activity by home-only lenders and increased government lending regulations have contributed to a constrained consumer financing market.

Since 1999, home-only lenders have tightened the credit underwriting standards and increased interest rates for loans to purchase manufactured homes, which could reduce lending volumes and negatively impacted our revenue. Most of the national lenders who have historically provided home-only loans have exited this sector of the industry.

Consumers who buy manufactured homes have historically secured retail financing from third-party lenders. Home-only financing is at times more difficult to obtain than financing for stick-built homes. The availability, terms and costs of retail financing depend on the lending practices of financial institutions, governmental policies and economic and other conditions, all of which are beyond our control.

Changes in laws or other events that adversely affect liquidity in the secondary mortgage market could hurt our business. The GSEs and the FHA play significant roles in insuring or purchasing home mortgages and creating or insuring investment securities that are either sold to investors or held in their portfolios. These organizations provide significant liquidity to the secondary market. Any new federal laws or regulations that restrict or curtail their activities, or any other events or conditions that alter the roles of these organizations in the housing finance market could affect the ability of our customers to obtain mortgage loans or could increase mortgage interest rates, fees, and credit standards, which could reduce demand for our homes and/or the loans that we originate and adversely affect our results of operations.

In 2010, the Dodd-Frank Act was passed into law, and the financial services industry is still assessing its implications and implementing necessary changes in procedures and business practices. Although Congress detailed some significant changes, and new rules have been implemented, the full impact will not be fully known for years, as regulations that are intended to implement the Dodd-Frank Act are adopted by the appropriate agencies, and the text of the Dodd-Frank Act is analyzed by impacted stakeholders and possibly the courts. The Dodd-Frank Act established the CFPB to regulate consumer financial products and services.

On January 10, 2013, the CFPB released certain mortgage finance rules required under the Dodd-Frank Act. These rules define standards for origination of "Qualified Mortgages," establish specific requirements for lenders to prove borrowers' ability to repay loans and outline the conditions under which Qualified Mortgages are subject to safe harbor limitations on liability to borrowers. The rules became effective January 10, 2014, and apply to consumer credit transactions secured by a dwelling, including real property mortgages and chattel loans (financed without land) secured by manufactured homes. The rules also establish interest rate and other cost parameters for determining which Qualified Mortgages fall under safe harbor protection. Among other issues, Qualified Mortgages with interest rates and other costs outside the limits are deemed "rebuttable" by borrowers and expose the lender and its assignees (including investors in loans, pools of loans, and instruments secured by loans or loan pools) to litigation and penalties.

While many manufactured homes are currently financed with agency-conforming mortgages in which the ability to repay is verified and at interest rates and other costs that are within the safe harbor limits, a significant amount of loans to finance the purchase of manufactured homes, especially chattel loans and non-conforming land-home loans, fall outside the safe harbor limits. The rules have caused some lenders to curtail underwriting such loans, and some investors may be reluctant to own or participate in owning such loans because of the uncertainty of potential litigation and other costs. If so, some prospective buyers of manufactured homes may be unable to secure financing necessary to complete purchases. In addition, compliance with the law is causing lenders to incur additional costs to implement new processes, procedures, controls and infrastructure required to comply with the regulations. Compliance is also creating constraints in some lender's ability to profitably price certain loans. Failure to comply with these regulations, changes in these or other regulations or the imposition of additional regulations could affect our earnings, limit our access to capital and have a material adverse effect on our business and results of operations.

The availability of wholesale financing for retailers is limited due to a reduced number of flooring lenders and reduced lending limits.

Manufactured housing retailers generally finance their inventory purchases with wholesale flooring financing provided by lending institutions or, in some cases, the manufacturer. The availability of wholesale financing is significantly affected by the number of floor plan lenders and their lending limits. Since 1999, a substantial number of wholesale lenders have exited the industry or curtailed their floor plan operations. Reduced availability of flooring lending negatively affects our inventory levels, the number of retail sales center locations that we can open, and adversely affects the availability of and access to capital on an ongoing basis.

Our results of operations could be adversely affected by significant warranty and construction defect claims.

In some situations, we could be subject to home warranty and construction defect claims. While these claims are primarily against the manufacturer, we could have that arise during a significant period of time after product sale. Although we maintain general liability insurance for such claims, there can be no assurance that warranty and construction defect claims will remain at current levels or that such insurance will continue to be adequate. A large number of warranty and construction defect claims exceeding our current levels could have a material adverse effect on our results of operations.

Our operating results could be affected by market forces and declining housing demand.

As a participant in the housing industry, we are subject to market forces beyond our control. These market forces include employment and employment growth, interest rates, consumer confidence, land availability and development costs, apartment vacancy levels, inflation and the health of the general economy. Because all of our retail locations are in Texas, we are subject to market forces related to the oil and natural gas business as well. Unfavorable changes in any of the above factors or other issues could have an adverse effect on our revenue and earnings.

The cyclical and seasonal nature of the manufactured housing industry could cause our revenues and operating results to fluctuate, and we expect this cyclicality and seasonality to continue in the future.

The manufactured housing industry is highly cyclical and seasonal and is influenced by many national and regional economic and demographic factors, including the availability of consumer financing for home buyers, the availability of wholesale financing for retailers, seasonality of demand, consumer confidence, interest rates, demographic and employment trends, income levels, housing demand, general economic conditions, including inflation and recessions, and the availability of suitable home sites.

As a result of the foregoing economic, demographic and other factors, our revenues and operating results may fluctuate, and we expect them to continue to fluctuate in the future.

Our business and operations are concentrated in Texas, which could be impacted by market declines.

Our operations are concentrated in Texas. Due to the concentrated nature of our operations, there could be instances where this region is negatively impacted by economic, natural or population changes that could, in turn, negatively impact the results of the business, more than other companies that are more geographically dispersed.

The cost of our operations could be adversely impacted by increased costs of healthcare benefits provided to employees.

In 2010, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act (collectively, the "Health Reform Law"), was passed into law. As enacted, the Health Reform Law reforms, among other things, certain aspects of health insurance. The Health Reform Law could increase our healthcare costs, adversely impacting the Company’s earnings.

If we are unable to meet our future capital needs, we may be required to reduce or curtail operations, or shut down completely.

To date we have relied on cash flow from operations and the subsequent sale of our WeedMaps Media subsidiary to fund operations. On December 31, 2012, we sold WeedMaps Media, and we now have limited cash liquidity and capital resources.

Our cash on hand as of December 31, 2014 was approximately $411,000. For the year ended December 31, 2014, our total revenue was approximately $1,046,000 and our operating loss was $1,785,000. During the year ended December 31, 2014, we received a total of $1,300,000 in payments from the sale of WeedMaps Media, which helped sustain our cash flow. We expect to receive a total of approximately $400,000 in payments on the note through April 2015.

Our future capital requirements will depend on many factors, including our ability to market our products successfully, cash flow from operations, locating and retaining talent, and competing market developments. Our business model requires that we spend money (primarily on advertising and marketing) in order to generate revenue, and that we keep an inventory of manufactured homes which are financed with a credit facility. Based on our current financial situation, we may have difficulty continuing our operations at their current level, or at all, if we do not raise additional financing in the near future. Additionally, we would like to continue to acquire assets and operating businesses, which will likely require additional cash. Although we currently have no specific plans or arrangements for acquisitions or financing, we intend to raise funds through private placements, public offerings or other financings. Any equity financings would result in dilution to our then-existing stockholders. Sources of debt financing may result in higher interest expense. Any financing, if available, may be on unfavorable terms. If adequate funds are not obtained, we may be required to reduce, curtail, or discontinue operations. There is no assurance that our existing cash flow will be adequate to satisfy our existing operating expenses and capital requirements.

Because we face intense competition, we may not be able to operate profitably in our markets.

The market for the products and services that we offer is highly competitive. We may not have the resources, expertise or other competitive factors to compete successfully in the future. We expect to face additional competition from existing competitors and new market entrants in the future. Some of our competitors will have greater resources than we do. As a result, these competitors may be able to:

|

·

|

develop and expand their product and service offerings more rapidly;

|

|

·

|

adapt to new or emerging changes in customer requirements more quickly;

|

|

·

|

take advantage of acquisition and other opportunities more readily; and

|

|

·

|

devote greater resources to the marketing and sale of their products and adopt more aggressive pricing policies than we can. See “The Company - Competition.”

|

If we are unable to attract and retain key personnel, we may not be able to compete effectively in our market.

Our success will depend, in part, on our ability to attract and retain key management, including primarily sales and marketing personnel. We attempt to enhance our management and sales and marketing expertise by recruiting qualified individuals who possess desired skills and experience in certain targeted areas. In the past, we have employed management from companies that we have acquired. Our inability to retain employees and attract and retain sufficient additional employees could have a material adverse effect on our business, financial condition, results of operations and cash flows. The loss of key personnel could limit our ability to develop and market our products.

Because our officers and directors control a large percentage of our common stock, they have the ability to influence matters affecting our shareholders.

Our officers and directors beneficially own approximately 48.5% of our outstanding common stock. As a result, they have the ability to influence matters affecting our shareholders, including the election of our directors, the acquisition or disposition of our assets, and the future issuance of our shares. Because they control such shares, investors may find it difficult to replace our directors and management if they disagree with the way our business is being operated. Because the influence by these insiders could result in management making decisions that are in the best interest of those insiders and not in the best interest of the investors, you may lose some or all of the value of your investment in our common stock. See “Principal Shareholders.”

Because our Chief Financial Officer does not provide his services to us on a full-time basis, he may not be able to devote a sufficient amount of time to our business operations or our reporting obligations pursuant to U.S. securities laws, which may cause our business to fail or cause non-compliance with our reporting obligations.

Munjit Johal, our Chief Financial Officer and a member of our Board of Directors, devotes approximately fifty percent (50%) of his time to our business. The remainder of his time is devoted to unrelated outside employment. Accordingly, he may not be able to devote sufficient time to the management of our business, as and when needed. While we do not believe there is a present conflict of interest with respect to Mr. Johal’s outside employment or the amount of time that he devotes to our business, it is possible that a conflict of interest could arise in the future. If a conflict of interest were to arise, it would be addressed by the remaining member or members of our Board of Directors.

We may not be able to effectively manage our growth and operations, which could materially and adversely affect our business.

We have experienced, and may in the future experience, rapid growth and development in a relatively short period of time. The management of this growth will require, among other things, continued development of our financial and management controls and management information systems, the possible expansion of our credit facility to purchase inventory, stringent control of costs, increased marketing activities, the ability to attract and retain qualified management personnel and the training of new personnel. We may utilize outsourced resources, and hire additional personnel, in order to manage our expected growth and expansion. Failure to successfully manage our possible growth and development could have a material adverse effect on our business and the value of our common stock.

Our industry is experiencing consolidation that may cause us to lose key relationships and intensify competition.

The manufactured home industry is undergoing substantial change. This has resulted in increasing consolidation and formation of strategic relationships. A cancellation of our relationship with any group with whom we have a current relationship, or any relationship we may form in the future, may have a negative impact on the company because it could limit our advertising exposure or the number of customers that visit our retail centers. We make no assurance that any relationship we have established will continue.

Acquisitions or other consolidating transactions that don’t involve us could nevertheless harm us in a number of ways, including:

|

·

|

we could lose strategic relationships if our strategic partners are acquired by or enter into relationships with a competitor (which could cause us to lose access to distribution, content, technology and other resources);

|

|

·

|

the relationship between us and the strategic partner may deteriorate and cause an adverse effect on our business;

|

|

·

|

we could lose customers if competitors or users of competing technologies consolidate with our current or potential customers; and

|

|

·

|

our current competitors could become stronger, or new competitors could form, from consolidations.

|

Any of these events could put us at a competitive disadvantage, which could cause us to lose customers, revenue and market share. Consolidation could also force us to expend greater resources to meet new or additional competitive threats, which could also harm our operating results.

We may be unable to adequately protect our proprietary rights.

Our ability to compete partly depends on the superiority, uniqueness and value of our intellectual property. To the extent we are able to do so, in order to protect our proprietary rights, we will rely on a combination of trademark, copyright and trade secret laws, confidentiality agreements with our employees and third parties, and protective contractual provisions. Despite these efforts, any of the following occurrences may reduce the value of our intellectual property:

|

·

|

our copyrights relating to our business may be challenged or invalidated;

|

|

·

|

registered copyrights may not provide us with any competitive advantages;

|

|

·

|

our efforts to protect our intellectual property rights may not be effective in preventing misappropriation of our marks or copyrighted materials;

|

|

·

|

our efforts may not prevent the development and design by others of products or materials similar to or competitive with, or superior to those we develop; or

|

|

·

|

another party may obtain a blocking patent and we would need to either obtain a license or design around the patent in order to continue to offer the contested feature or service in our products.

|

We may be forced to litigate to defend our intellectual property rights, or to defend against claims by third parties against us relating to intellectual property rights.

We may be forced to litigate to enforce or defend our intellectual property rights, to protect our trade secrets or to determine the validity and scope of other parties’ proprietary rights. Any such litigation could be very costly and could distract our management from focusing on operating our business. The existence and/or outcome of any such litigation could harm our business.

Because the business activities of some of our former customers was illegal under the Federal Controlled Substances Act, we may be deemed to have been aiding and abetting illegal activities through the services that we provided to those customers. As a result, we may be subject to enforcement actions by law enforcement authorities, which would materially and adversely affect our business.

Under United States federal law, and more specifically the Federal Controlled Substances Act, the possession, use, cultivation, and transfer of cannabis is illegal. Our WeedMaps Media, Inc. business provided services to customers that were engaged in the business of possession, use, cultivation, and/or transfer of cannabis. As a result, law enforcement authorities, in their attempt to regulate the illegal use of cannabis, may seek to bring an action or actions against us, including, but not limited to, a claim of aiding and abetting another’s criminal activities. The federal aiding and abetting statute provides that anyone who “commits an offense against the United States or aids, abets, counsels, commands, induces or procures its commission, is punishable as a principal.” 18 U.S.C. §2(a).

Our prior business, and specifically the advertisements we sold for activities that may be deemed to have been illegal under federal law, may be found to be in violation of this law, and the federal government could decide to bring an action against us. As a result of such an action, we may be forced to cease operations and our investors could lose their entire investment. Such an action would have a material negative effect on our business and operations.

Because we hold a promissory note secured by the domain name www.weedmaps.com, if the borrower defaults on the note, and we foreclose on the collateral, we could temporarily hold and operate assets in the medicinal cannabis industry, which may expose us to aiding and abetting risk.

On December 31, 2012, we sold our WeedMaps Media, Inc. subsidiary to a third party, and part of the purchase price was a secured promissory note in the principal amount of $3,000,000, pursuant to which the buyer’s assignee will be making payments to us through April 2015. That note is secured by the assets of WeedMaps Media, including the domain name and website www.weedmaps.com. If the obligated party on the note were to default, and we were to foreclose on the collateral, we would temporarily hold and operate certain assets that may be considered illegal. In such an event, we would continue to operate the assets in order to keep them viable, seek a buyer, and sell the assets. During this time, the assets would be considered held-for-sale by us. In addition, as per the secured promissory note, should the obligated party be forced to cease operations as a direct result of law enforcement actions, then the obligated party will no longer be responsible for the outstanding debt owed to us on the promissory note.

Because we were previously service providers to companies in the medicinal cannabis industry, we had and may continue to have a difficult time obtaining the various insurances that are desired to operate our business, which may expose us to additional risk and financial liabilities.

Insurance that is otherwise readily available, such as workers compensation, general liability, and directors and officers insurance, is more difficult for us to find, and more expensive, because we were service providers to companies in the medicinal cannabis industry. Thus far, we have been successful in finding such policies, however it is at a cost that is higher than other businesses. There are no guarantees that we will be able to find such insurances in the future, or that the cost will be affordable to us. If we are forced to go without such insurances, it may prevent us from entering into certain business sectors, may inhibit our growth, and may expose us to additional risk and financial liabilities.

Risks Related To Our Common Stock

Our common stock is listed for quotation on the OTCQB tier of the marketplace maintained by OTC Markets Group, Inc., which may make it more difficult for investors to resell their shares due to suitability requirements.

Our common stock is currently quoted on the OTCQB tier of the marketplace maintained by OTC Markets Group, Inc. Broker-dealers often decline to trade in over the counter stocks given the market for such securities are often limited, the stocks are more volatile, and the risk to investors is greater. These factors may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of their shares. This could cause our stock price to decline.

If we are unable to pay the costs associated with being a public, reporting company, we may not be able to continue trading on the OTCQB and/or we may be forced to discontinue operations.

We expect to have significant costs associated with being a public, reporting company, which may raise substantial doubt about our ability to continue trading on the OTCQB and/or continue as a going concern. These costs include compliance with the Sarbanes-Oxley Act of 2002, which will be difficult given the limited size of our management, and we will have to rely on outside consultants. Accounting controls, in particular, are difficult and can be expensive to comply with.

Our ability to continue trading on the OTCQB and/or continue as a going concern will depend on positive cash flow, if any, from future operations and on our ability to raise additional funds through equity or debt financing. If we are unable to achieve the necessary product sales or raise or obtain needed funding to cover the costs of operating as a public, reporting company, our common stock may be deleted from the OTCQB and/or we may be forced to discontinue operations.

We do not intend to pay dividends in the foreseeable future.

We do not intend to pay any dividends in the foreseeable future. We do not plan on making any cash distributions in the manner of a dividend or otherwise. Our Board presently intends to follow a policy of retaining earnings, if any.

We have a significant amount of outstanding convertible debt, which, if repaid will require a significant amount of capital, or if converted into our common stock could have a material adverse effect on our stock price.

As of December 31, 2014, we had a total of 21 convertible notes outstanding with a combined outstanding principal and accrued interest balance of $1,333,811. Repayment of these notes must be done at a premium to the then-outstanding balance, resulting in the need for approximately $1.9 million in liquid capital. If, rather than repay these notes, we allow them to convert into our common stock, which conversion would be done at a discount to the market price of our common stock, resulting in the issuance of approximately 19.1 million shares of our common stock (based on a conversion price of $0.07 per share), all of which could be sold into the open market at the time of conversion.

Subsequent to December 31, 2014, we repaid several of the convertible notes. As of March 25, 2015, the outstanding balance on outstanding convertible notes was $1,292,500, which would require approximately $1.81 million to repay, and approximately 18.5 million shares of our common stock if converted at $0.07 per share.

We have the right to issue additional common stock and preferred stock without consent of stockholders. This would have the effect of diluting investors’ ownership and could decrease the value of their investment.

Our certificate of incorporation, as amended in March 2015, has authorized the issuance of up to 300,000,000 shares of common stock. As a result, we have additional authorized but unissued shares of our common stock that may be issued by us for any purpose without the consent or vote of our stockholders that would dilute stockholders’ percentage ownership of our company.

In addition, our certificate of incorporation authorizes the issuance of shares of preferred stock, the rights, preferences, designations and limitations of which may be set by the Board of Directors. Our certificate of incorporation has authorized issuance of up to 20,000,000 shares of preferred stock in the discretion of our Board. The shares of authorized but undesignated preferred stock may be issued upon the filing of an amended certificate of incorporation and the payment of required fees; no further stockholder action is required. If issued, the rights, preferences, designations and limitations of such preferred stock would be set by our Board and could operate to the disadvantage of the outstanding common stock. Such terms could include, among others, preferences as to dividends and distributions on liquidation.

Our President and Chief Executive Officer can sell some of his stock, which may have a negative effect on our stock price and ability to raise additional capital, and may make it difficult for investors to sell their stock at any price.

James Pakulis, our President and Chief Executive Officer, is the owner of 27,967,290 shares of our common stock, representing over 48.5% of our total issued shares. Mr. Pakulis may be able to sell up to 1% of our outstanding stock (currently approximately 577,000 shares) every 90 days in the open market pursuant to Rule 144, which may have a negative effect on our stock price and may prevent us from obtaining additional capital. In addition, if Mr. Pakulis is selling his stock into the open market, it may make it difficult or impossible for investors to sell their stock at any price.

Our common stock is governed under The Securities Enforcement and Penny Stock Reform Act of 1990.

The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The Securities and Exchange Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Such exceptions include any equity security listed on NASDAQ and any equity security issued by an issuer that has (i) net tangible assets of at least $2,000,000, if such issuer has been in continuous operation for three years, (ii) net tangible assets of at least $5,000,000, if such issuer has been in continuous operation for less than three years, or (iii) average annual revenue of at least $6,000,000, if such issuer has been in continuous operation for less than three years. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated therewith.

The forward looking statements contained in this Annual Report may prove incorrect.

This Annual Report contains certain forward-looking statements, including among others: (i) anticipated trends in our financial condition and results of operations; (ii) our business strategy for expanding distribution; and (iii) our ability to distinguish ourselves from our current and future competitors. These forward-looking statements are based largely on our current expectations and are subject to a number of risks and uncertainties. Actual results could differ materially from these forward-looking statements. In addition to the other risks described elsewhere in this “Risk Factors” discussion, important factors to consider in evaluating such forward-looking statements include: (i) changes to external competitive market factors or in our internal budgeting process which might impact trends in our results of operations; (ii) anticipated working capital or other cash requirements; (iii) changes in our business strategy or an inability to execute our strategy due to unanticipated changes in the pharmaceutical industry; and (iv) various competitive factors that may prevent us from competing successfully in the marketplace. In light of these risks and uncertainties, many of which are described in greater detail elsewhere in this “Risk Factors” discussion, there can be no assurance that the events predicted in forward-looking statements contained in this Annual Report will, in fact, transpire.

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

We have made forward-looking statements in this Annual Report, including the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements include the information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, the effects of future regulation, and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. These statements are only predictions and involve known and unknown risks and uncertainties, including the risks outlined under “Risk Factors” and elsewhere in this Annual Report.

Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee future results, events, levels of activity, performance or achievement. We are not under any duty to update any of the forward-looking statements after the date of this Annual Report to conform these statements to actual results, unless required by law.

ITEM 1B – UNRESOLVED STAFF COMMENTS

This Item is not applicable to us as we are not an accelerated filer, a large accelerated filer, or a well-seasoned issuer; however, we are voluntarily disclosing that we have not received any written comments from the Commission staff within the 180 days before the end of our fiscal year to which this Annual Report relates regarding our periodic or current reports under the Securities Exchange Act of 1934.

ITEM 2 – PROPERTIES

Our corporate headquarters are located at our retail facility in Tyler, Texas. We lease that facility pursuant to a lease agreement that commenced on May 1, 2014 and ends on May 31, 2017, at a rent of $2,500 per month.

On February 2, 2014, we entered into a Commercial Lease Agreement for a two acre lot, in Rhome, Texas. The rent is $1,300 per month, and the lease is for a period of twenty four (24) months.

On May 7, 2014, we entered into a Memorandum of Understanding to acquire certain assets from a manufactured home retail center in Jacksboro, Texas. Pursuant to that Memorandum, we agreed to assume the lease of the 1.5 acre lot. The rent is $750 per month, and the lease is month to month.

On July 1, 2014, we entered into a Lease Agreement for a two acre lot, including office and parking, in Mt. Pleasant, Texas. The base rent is $2,500 per month, and the lease is for a period of twenty four (24) months.

ITEM 3 – LEGAL PROCEEDINGS

In the ordinary course of business, we are from time to time involved in various pending or threatened legal actions. The litigation process is inherently uncertain and it is possible that the resolution of such matters might have a material adverse effect upon our financial condition and/or results of operations. However, in the opinion of our management, other than as set forth herein, matters currently pending or threatened against us are not expected to have a material adverse effect on our financial position or results of operations.

In April 2014, a former employee filed a complaint against us, several of our wholly-owned subsidiaries, and James Pakulis, one of our Directors and our President and Chief Executive Officer, in the Orange County Superior Court. The claims include disability discrimination, failure to accommodate, retaliation, wrongful termination, unpaid wages, overtime, failure to provide meal and rest periods, failure to provide accurate wage statements, unfair business practices and failure to reimburse for reasonable business expenses. Since then all claims against James Pakulis have been dropped or dismissed by the defendant and several of the claims against the company have been dropped or dismissed. Discovery is underway. Under California law, an employee is entitled to recover legal fees and costs if a claim for overtime and/or minimum wage is successful, and thus the claim is currently in excess of $200,000. We believe most, if not all, of the remaining claims are without merit and are vigorously defending the case. The suit has been tendered to our insurance carrier.

ITEM 4 – MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

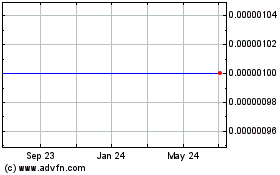

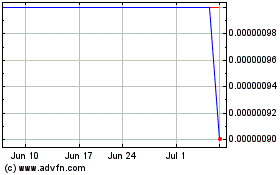

Our common stock is quoted on the OTCQB tier of the marketplace maintained by OTC Markets Group, Inc. under the symbol “WOFA.” Our stock has traded there since July 26, 2011, and traded prior to that on the Pink Sheets marketplace maintained by OTC Markets Group, Inc. Our common stock trades on a limited or sporadic basis and should not be deemed to constitute an established public trading market. There is no assurance that there will be liquidity in the common stock.

The following table sets forth the high and low transaction price for each quarter within the fiscal years ended December 31, 2014 and 2013, as provided by OTC Markets Group, Inc. The information reflects prices between dealers, and does not include retail markup, markdown, or commission, and may not represent actual transactions.

|

Fiscal Year Ended

|

|

|

|

|

Transaction Prices |

|

|

December 31,

|

|

Period

|

|

|

High |

|

|

Low |

|

|

|

|

|

|

|

|

|

|

|

|

2013

|

|

First Quarter

|

|

|

$

|

0.52

|

|

|

$

|

0.225

|

|

|

|

Second Quarter

|

|

|

$

|

0.28

|

|

|

$

|

0.17

|

|

|

|

|

Third Quarter

|

|

|

$

|

0.215

|

|

|

$

|

0.12

|

|

|

|

|

Fourth Quarter

|

|

|

$

|

0.17

|

|

|

$

|

0.09

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2014

|

|

First Quarter

|

|

|

$

|

0.10

|

|

|

$

|

0.04

|

|

|

|

Second Quarter

|

|

|

$

|

0.08

|

|

|

$

|

0.04

|

|

|

|

|

Third Quarter

|

|

|

$

|

0.065

|

|

|

$

|

0.04

|

|

|

|

|

Fourth Quarter

|

|

|

$

|

0.13

|

|

|

$

|

0.04

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2015

|

|

First Quarter (through March 6, 2015)

|

|

|

$

|

0.17

|

|

|

$

|

0.0352

|

|

The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to a few exceptions which we do not meet. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated therewith.

Holders

As of March 25, 2015, there were 57,702,105 shares of our common stock issued and outstanding and held by 81 holders of record, not including shares held in “street name” in brokerage accounts which is unknown.

Dividend Policy

We have not paid any dividends on our common stock and do not expect to do so in the foreseeable future. We intend to apply our earnings, if any, in expanding our operations and related activities. The payment of cash dividends in the future will be at the discretion of the Board of Directors and will depend upon such factors as earnings levels, capital requirements, our financial condition and other factors deemed relevant by the Board of Directors.

Securities Authorized for Issuance under Equity Compensation Plans

We do not currently have a stock option or grant plan.

Recent Sales of Unregistered Securities

The following sales of equity securities by the Company occurred during the three month period ended December 31, 2014.

KBM Worldwide, Inc.

On October 20, 2014, we entered into a Securities Purchase Agreement with KBM Worldwide, Inc., pursuant to which we sold to KBM a 8% Convertible Promissory Note in the original principal amount of $83,000 (the “Note”). The Note has a maturity date of July 22, 2015, and is convertible after 180 days into our common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 58% multiplied by the Market Price (representing a discount rate of 42%). “Market Price” means the average of the lowest three (3) Trading Prices for the Common Stock during the ten (10) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Trading Price” means the closing bid price on the applicable day. The “Fixed Conversion Price” shall mean $0.00005. The shares of common stock issuable upon conversion of the Note will be restricted securities as defined in Rule 144 promulgated under the Securities Act of 1933. The Note can be prepaid by us at a premium as follows: (a) between 0 and 30 days after issuance – 109% of the principal amount and any accrued and unpaid interest; (b) between 31 and 60 days after issuance – 114% of the principal amount and any accrued and unpaid interest; (c) between 61 and 90 days after issuance – 120% of the principal amount and any accrued and unpaid interest; (d) between 91 and 120 days after issuance – 124% of the principal amount and any accrued and unpaid interest; and (e) between 121 days and 180 days after issuance – 130% of the principal amount and any accrued and unpaid interest. The purchase and sale of the Note closed on October 28, 2014, the date that the purchase price was delivered to us.

The issuance of the Note was exempt from the registration requirements of the Securities Act of 1933 pursuant to Section 4(a)(2) thereof. The purchaser was an accredited and sophisticated investor, familiar with our operations, and there was no solicitation.

LG Capital Funding, LLC

On October 29, 2014, we entered into a Securities Purchase Agreement with LG Capital Funding, LLC (“LG Capital”), pursuant to which we sold to LG Capital an 8% Convertible Promissory Note in the original principal amount of $105,000 (the “Note”). The Note has a maturity date of October 29, 2015, and is convertible after 180 days into our common stock at a forty two percent (42%) discount from the lowest trading price of our common stock, as reported by any exchange upon which our common stock is then traded, for the ten (10) trading days prior to our receipt of notice from the Note holder to exercise this conversion feature. The conversion price shall be subject to a minimum conversion price of $0.0001 per share (the “floor price”), but in the event that the floor price is triggered, the conversion discount shall increase from forty two percent (42%) to fifty two (52%), calculated against the floor price. Interest accrued on the Note shall be payable in shares of our common stock, calculated using the same conversion formula. The Note can be prepaid by us at a premium as follows: (a) between 0 and 90 days after issuance – 120% of the principal amount; (b) between 91 and 150 days after issuance – 130% of the principal amount; (c) between 151 and 180 days after issuance – 140% of the principal amount. There is no right to prepay the Note after 180 days. The purchase and sale of the Note closed on October 31, 2014, the date that the purchase price was delivered to us.

The issuance of the Note was exempt from the registration requirements under the Securities Act of 1933 pursuant to Rule 506 of Regulation D thereof. The purchaser was an accredited and sophisticated investor, familiar with our operations, and there was no solicitation.

Investor Relations Agreement

On November 13, 2014, we issued a total of three hundred and seventy five thousand (375,000) shares of our common stock to a third-party as consideration for services to be rendered pursuant to an Investors Relations Agreement. Ninety three thousand seven hundred and fifty (93,750) of those shares shall be earned and delivered upon execution of the Agreement. The remaining shares will be earned and delivered on a monthly basis in consideration for services rendered during the previous month. The issuance of the shares was exempt from registration requirements of the Securities Act of 1933 pursuant to Section 4(a)(2) thereof. The purchaser was sophisticated investor, familiar with our operations, and there was no solicitation.

KBM Worldwide, Inc.

On November 10, 2014, we entered into a Securities Purchase Agreement with KBM Worldwide, Inc., pursuant to which we sold to KBM a 8% Convertible Promissory Note in the original principal amount of $54,000 (the “Note”). The Note has a maturity date of August 12, 2015, and is convertible after 180 days into our common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 58% multiplied by the Market Price (representing a discount rate of 42%). “Market Price” means the average of the lowest three (3) Trading Prices for the Common Stock during the ten (10) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Trading Price” means the closing bid price on the applicable day. The “Fixed Conversion Price” shall mean $0.00005. The shares of common stock issuable upon conversion of the Note will be restricted securities as defined in Rule 144 promulgated under the Securities Act of 1933. The Note can be prepaid by us at a premium as follows: (a) between 0 and 30 days after issuance – 109% of the principal amount and any accrued and unpaid interest; (b) between 31 and 60 days after issuance – 114% of the principal amount and any accrued and unpaid interest; (c) between 61 and 90 days after issuance – 120% of the principal amount and any accrued and unpaid interest; (d) between 91 and 120 days after issuance – 124% of the principal amount and any accrued and unpaid interest; and (e) between 121 days and 180 days after issuance – 130% of the principal amount and any accrued and unpaid interest. The purchase and sale of the Note closed on November 14, 2014, the date that the purchase price was delivered to us.

The issuance of the Note was exempt from the registration requirements of the Securities Act of 1933 pursuant to Section 4(a)(2) thereof. The purchaser was an accredited and sophisticated investor, familiar with our operations, and there was no solicitation.

Alpine Creek, Inc.

On November 20, 2014, we entered into four Promissory Note and Stock Purchase Agreements, by and between us and our wholly owned subsidiary, Alpine Creek, Inc., a Texas corporation, on the one hand, and third-party investors, on the other hand. Pursuant to the Agreements, each of the investors tendered Fifty Thousand Dollars ($50,000) in exchange for (i) a senior 15% promissory note in the principal amount of Fifty Thousand Dollars ($50,000) issued by Alpine Creek and (ii) fifty thousand (50,000) shares of our common stock. Wisdom Homes guaranteed payment of the notes. The issuance of the notes and shares was exempt from the registration requirements of the Securities Act of 1933 pursuant to Section 4(a)(2) thereof. The purchasers were accredited and sophisticated investors, familiar with our operations, and there was no solicitation.

The funds will be loaned as short-term financing in order to expedite and/or assist customers of our wholly-owned subsidiary, Wisdom Manufactured Homes of America, Inc., in purchasing a manufactured home from Wisdom Homes.

KBM Worldwide, Inc.