UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

April 1, 2015

UNIFIRST CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

Massachusetts |

|

001-08504 |

|

04-2103460 |

|

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

68 Jonspin Road, Wilmington, Massachusetts 01887

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (978) 658-8888

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ] |

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425) |

| |

|

|

[ ] |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12) |

| |

|

|

[ ] |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b)) |

| |

|

|

[ ] |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4(c)) |

|

Item 2.02. |

Results of Operations and Financial Condition. |

On April 1, 2015, UniFirst Corporation (the “Company”) issued a press release ("Press Release") announcing financial results for the second quarter and first half of fiscal 2015, which ended on February 28, 2015. A copy of the Press Release is attached as Exhibit 99 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02, including the exhibit attached hereto, shall not be deemed “filed” for any purpose, including for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

|

Item 9.01. |

Financial Statements and Exhibits. |

| |

|

|

(d) Exhibits |

|

| |

|

|

EXHIBIT NO. |

DESCRIPTION |

| |

|

|

99 |

Press release of the Company dated April 1, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

UNIFIRST CORPORATION

|

Date: April 1, 2015 |

By: |

/s/ Ronald D. Croatti |

|

| |

Name: |

Ronald D. Croatti |

|

| |

Title: |

Chairman of the Board, Chief

Executive Officer and President |

|

| |

|

|

|

| |

By: |

/s/ Steven S. Sintros |

|

| |

Name: |

Steven S. Sintros |

|

| |

Title: |

Senior Vice President and Chief Financial Officer |

|

EXHIBIT INDEX

|

EXHIBIT NO. |

DESCRIPTION |

| |

|

|

99 |

Press release of the Company dated April 1, 2015 |

Exhibit 99

|

|

|

|

April 1, 2015

CONTACT: Steven S. Sintros, Senior Vice President & CFO |

For Immediate Release

UniFirst Corporation

68 Jonspin Road

Wilmington, MA 01887

Phone: 978- 658-8888

Fax: 978-988-0659

Email: ssintros@UniFirst.com |

UNIFIRST ANNOUNCES FINANCIAL RESULTS FOR THE SECOND QUARTER AND FIRST HALF OF FISCAL 2015

Wilmington, MA (April 1, 2015) -- UniFirst Corporation (NYSE: UNF) today announced results for its fiscal 2015 second quarter ended February 28, 2015. Revenues were $361.5 million, up 5.1% from $344.0 million in the year ago period. Net income was $25.4 million ($1.26 per diluted share), compared to $25.6 million ($1.27 per diluted share) reported a year ago. The current quarter’s results were limited by a $3.6 million charge to selling and administrative expenses related to an increase in the Company’s environmental contingency reserves. Excluding the effect of this item, net income would have been $27.7 million ($1.37 per diluted share), an increase of 7.8% from the prior year.

Ronald D. Croatti, UniFirst President and Chief Executive Officer said, “Our solid quarterly results reflect a continued focus on maximizing the output of our professional sales and service organizations. Although Core Laundry revenues have begun to be challenged by headcount reductions at many of our energy related customers, we will continue to focus on actions within our control such as providing superior service and value to our customer base.”

Revenues in the Core Laundry Operations were $332.1 million, up 6.0% from those reported in the prior year’s second quarter. Adjusting for the effects of acquisitions and a weaker Canadian dollar, revenues grew 6.1%. Excluding the environmental charge discussed above, this segment’s income from operations increased 12.9% compared to the second quarter of fiscal 2014, while the adjusted operating margin expanded to 13.4% from 12.6% a year ago. The margin improvement was due primarily to lower energy costs during the quarter.

The increase to the Company’s environmental contingency reserves was mainly due to additional costs the Company expects to incur associated with a planned municipal project that is near one of our environmental sites. To a lesser extent, the Company’s reserves also were increased due to the effect of lower interest rates on the discounting of its environmental liabilities.

Revenues for the Specialty Garments segment, which consists of nuclear decontamination and cleanroom operations, were $18.7 million, down 8.6% from $20.4 million in the second quarter of fiscal 2014. This decrease was primarily the result of reduced power reactor business in North America compared to a year ago as well as the impact of foreign currency. As a result of the revenue decline, this segment reported a loss from operations for the quarter of $0.4 million compared to income from operations of $0.3 million in the prior year quarter.

Current quarter profits were also limited by foreign exchange rate losses of $0.9 million compared to $0.2 million a year ago due to the weakening of the Canadian dollar and Euro against the US dollar.

UniFirst continues to maintain a solid balance sheet with no long term debt and increasing cash balances. Cash and cash equivalents at the end of the quarter totaled $231.5 million, up from $191.8 million at end of fiscal 2014.

Outlook

Mr. Croatti continued, “As a result of the weaker Canadian dollar as well as the negative impact that the low price of oil is having on portions of our customer base, we now believe that full year fiscal 2015 revenues will be at the lower end of our previously communicated range of $1.450 billion to $1.470 billion. We also believe that full year diluted EPS will be between $5.65 and $5.85 per share. This EPS range has been lowered from our previously communicated guidance primarily to reflect the impact of the environmental charge taken during the quarter.”

Conference Call Information

UniFirst will hold a conference call today at 10:00 a.m. (ET) to discuss its quarterly financial results, business highlights and outlook. A simultaneous live webcast of the call will be available over the Internet and can be accessed at www.unifirst.com.

About UniFirst Corporation

Headquartered in Wilmington, Mass., UniFirst Corporation is a North American leader in the supply and servicing of uniform and workwear programs, as well as the delivery of facility service programs. Together with its subsidiaries, the company also provides first aid and safety products, and manages specialized garment programs for the cleanroom and nuclear industries. UniFirst manufactures its own branded workwear, protective clothing, and floorcare products, and with over 225 service locations, 260,000 customer locations, and approximately 12,000 employee Team Partners, the company outfits more than 1.5 million workers each business day. UniFirst is a publicly held company traded on the New York Stock Exchange under the symbol UNF and is a component of the Standard & Poor's 600 Small Cap Index. For more information visit www.unifirst.com.

Forward Looking Statements

This public announcement contains forward looking statements that reflect the Company’s current views with respect to future events and financial performance, including projected revenues and earnings per share. Forward looking statements contained in this public announcement are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995 and are highly dependent upon a variety of important factors that could cause actual results to differ materially from those reflected in such forward looking statements. Such factors include, but are not limited to, uncertainties regarding the Company’s ability to consummate and successfully integrate acquired businesses, uncertainties regarding any existing or newly-discovered expenses and liabilities related to environmental compliance and remediation, any adverse outcome of pending or future contingencies or claims, including suits relating to the New England Compounding Center matter, the Company’s ability to compete successfully without any significant degradation in its margin rates, seasonal fluctuations in business levels, our ability to preserve positive labor relationships and avoid becoming the target of corporate labor unionization campaigns that could disrupt our business, the effect of currency fluctuations on our results of operations and financial condition, our dependence on third parties to supply us with raw materials, any loss of key management or other personnel, increased costs as a result of any future changes in federal or state laws, rules and regulations or governmental interpretation of such laws, rules and regulations, uncertainties regarding the price levels of natural gas, electricity, fuel and labor, the impact of turbulent economic conditions and the current tight credit markets on our customers and such customers’ workforce, the level and duration of workforce reductions by our customers, the continuing increase in domestic healthcare costs, including the ultimate impact of the Affordable Care Act, demand and prices for our products and services, rampant criminal activity and instability in Mexico where our principal garment manufacturing plants are located, our ability to properly and efficiently design, construct, implement and operate our new CRM computer system, interruptions or failures of our information technology systems, including as a result of cyber-attacks, additional professional and internal costs necessary for compliance with recent and proposed future changes in Securities and Exchange Commission, New York Stock Exchange and accounting rules, strikes and unemployment levels, the Company’s efforts to evaluate and potentially reduce internal costs, economic and other developments associated with the war on terrorism and its impact on the economy, general economic conditions and other factors described under “Item 1A. Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended August 30, 2014 and in other filings with the Securities and Exchange Commission. When used in this public announcement, the words “anticipate,” “optimistic,” “believe,” “estimate,” “expect,” “intend,” and similar expressions as they relate to the Company are included to identify such forward looking statements. The Company undertakes no obligation to update any forward looking statements to reflect events or circumstances arising after the date on which such statements are made.

UniFirst Corporation and Subsidiaries

Consolidated Statements of Income

| |

|

Thirteen

weeks ended

February 28, |

|

|

Thirteen

weeks ended

March 1, |

|

|

Twenty-six

weeks ended

February 28, |

|

|

Twenty-six

weeks ended

March 1, |

|

|

(In thousands, except per share data) |

|

2015 (2) |

|

|

2014 (2) |

|

|

2015 (2) |

|

|

2014 (2) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

361,462 |

|

|

$ |

343,967 |

|

|

$ |

731,823 |

|

|

$ |

690,671 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues (1) |

|

|

223,874 |

|

|

|

215,560 |

|

|

|

443,227 |

|

|

|

423,697 |

|

|

Selling and administrative expenses (1) |

|

|

77,245 |

|

|

|

69,853 |

|

|

|

149,627 |

|

|

|

135,482 |

|

|

Depreciation and amortization |

|

|

18,792 |

|

|

|

17,830 |

|

|

|

36,829 |

|

|

|

35,128 |

|

|

Total operating expenses |

|

|

319,911 |

|

|

|

303,243 |

|

|

|

629,683 |

|

|

|

594,307 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

|

41,551 |

|

|

|

40,724 |

|

|

|

102,140 |

|

|

|

96,364 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other (income) expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

239 |

|

|

|

216 |

|

|

|

427 |

|

|

|

424 |

|

|

Interest income |

|

|

(944 |

) |

|

|

(877 |

) |

|

|

(1,748 |

) |

|

|

(1,642 |

) |

|

Foreign exchange loss |

|

|

880 |

|

|

|

161 |

|

|

|

1,251 |

|

|

|

2 |

|

|

Total other (income) expense |

|

|

175 |

|

|

|

(500 |

) |

|

|

(70 |

) |

|

|

(1,216 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

41,376 |

|

|

|

41,224 |

|

|

|

102,210 |

|

|

|

97,580 |

|

|

Provision for income taxes |

|

|

15,930 |

|

|

|

15,577 |

|

|

|

39,351 |

|

|

|

37,471 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

25,446 |

|

|

$ |

25,647 |

|

|

$ |

62,859 |

|

|

$ |

60,109 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income per share – Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

$ |

1.33 |

|

|

$ |

1.34 |

|

|

$ |

3.29 |

|

|

$ |

3.15 |

|

|

Class B Common Stock |

|

$ |

1.06 |

|

|

$ |

1.08 |

|

|

$ |

2.63 |

|

|

$ |

2.52 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income per share – Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

$ |

1.26 |

|

|

$ |

1.27 |

|

|

$ |

3.11 |

|

|

$ |

2.98 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income allocated to – Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

$ |

20,182 |

|

|

$ |

20,267 |

|

|

$ |

49,834 |

|

|

$ |

47,479 |

|

|

Class B Common Stock |

|

$ |

5,041 |

|

|

$ |

5,041 |

|

|

$ |

12,472 |

|

|

$ |

11,836 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income allocated to – Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

$ |

25,235 |

|

|

$ |

25,326 |

|

|

$ |

62,335 |

|

|

$ |

59,357 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding – Basic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

15,185 |

|

|

|

15,077 |

|

|

|

15,156 |

|

|

|

15,053 |

|

|

Class B Common Stock |

|

|

4,741 |

|

|

|

4,687 |

|

|

|

4,741 |

|

|

|

4,690 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding – Diluted |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

20,065 |

|

|

|

19,924 |

|

|

|

20,028 |

|

|

|

19,897 |

|

(1) Exclusive of depreciation on the Company’s property, plant and equipment and amortization on its intangible assets

(2) Unaudited

UniFirst Corporation and Subsidiaries

Condensed Consolidated Balance Sheets

|

(In thousands) |

|

February 28,

2015 (1) |

|

|

August 30,

2014 |

|

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

231,461 |

|

|

$ |

191,769 |

|

|

Receivables, net |

|

|

159,102 |

|

|

|

152,523 |

|

|

Inventories |

|

|

84,817 |

|

|

|

78,858 |

|

|

Rental merchandise in service |

|

|

144,839 |

|

|

|

146,449 |

|

|

Prepaid and deferred income taxes |

|

|

3,188 |

|

|

|

13,342 |

|

|

Prepaid expenses and other current assets |

|

|

15,979 |

|

|

|

6,349 |

|

| |

|

|

|

|

|

|

|

|

|

Total current assets |

|

|

639,386 |

|

|

|

589,290 |

|

| |

|

|

|

|

|

|

|

|

|

Property, plant and equipment: |

|

|

|

|

|

|

|

|

|

Land, buildings and leasehold improvements |

|

|

397,004 |

|

|

|

393,584 |

|

|

Machinery and equipment |

|

|

529,849 |

|

|

|

512,842 |

|

|

Motor vehicles |

|

|

171,049 |

|

|

|

166,573 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

1,097,902 |

|

|

|

1,072,999 |

|

|

Less - accumulated depreciation |

|

|

602,732 |

|

|

|

586,717 |

|

| |

|

|

495,170 |

|

|

|

486,282 |

|

| |

|

|

|

|

|

|

|

|

|

Goodwill |

|

|

310,909 |

|

|

|

303,648 |

|

|

Customer contracts and other intangible assets, net |

|

|

41,449 |

|

|

|

41,477 |

|

|

Deferred income taxes |

|

|

1,235 |

|

|

|

1,403 |

|

|

Other assets |

|

|

2,418 |

|

|

|

2,061 |

|

| |

|

|

|

|

|

|

|

|

| |

|

$ |

1,490,567 |

|

|

$ |

1,424,161 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and shareholders' equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Loans payable and current maturities of long-term debt |

|

$ |

5,637 |

|

|

$ |

7,704 |

|

|

Accounts payable |

|

|

57,241 |

|

|

|

59,177 |

|

|

Accrued liabilities |

|

|

107,847 |

|

|

|

100,818 |

|

|

Accrued and deferred income taxes |

|

|

22,964 |

|

|

|

23,342 |

|

| |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

193,689 |

|

|

|

191,041 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term liabilities: |

|

|

|

|

|

|

|

|

|

Long-term debt, net of current maturities |

|

|

— |

|

|

|

155 |

|

|

Accrued liabilities |

|

|

56,899 |

|

|

|

50,235 |

|

|

Accrued and deferred income taxes |

|

|

54,516 |

|

|

|

48,271 |

|

| |

|

|

|

|

|

|

|

|

|

Total long-term liabilities |

|

|

111,415 |

|

|

|

98,661 |

|

| |

|

|

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

1,528 |

|

|

|

1,519 |

|

|

Class B Common Stock |

|

|

486 |

|

|

|

486 |

|

|

Capital surplus |

|

|

67,788 |

|

|

|

59,415 |

|

|

Retained earnings |

|

|

1,136,996 |

|

|

|

1,075,572 |

|

|

Accumulated other comprehensive (loss) income |

|

|

(21,335 |

) |

|

|

(2,533 |

) |

| |

|

|

|

|

|

|

|

|

|

Total shareholders' equity |

|

|

1,185,463 |

|

|

|

1,134,459 |

|

| |

|

|

|

|

|

|

|

|

| |

|

$ |

1,490,567 |

|

|

$ |

1,424,161 |

|

(1) Unaudited

UniFirst Corporation and Subsidiaries

Detail of Operating Results

Revenues

| |

|

Thirteen

weeks ended February 28, |

|

|

Thirteen

weeks ended

March 1, |

|

|

Dollar |

|

|

Percent |

|

|

(In thousands, except percentages) |

|

2015 (1) |

|

|

2014 (1) |

|

|

Change |

|

|

Change |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core Laundry Operations |

|

$ |

332,068 |

|

|

$ |

313,181 |

|

|

$ |

18,887 |

|

|

|

6.0 |

% |

|

Specialty Garments |

|

|

18,661 |

|

|

|

20,406 |

|

|

|

(1,745 |

) |

|

|

-8.6 |

|

|

First Aid |

|

|

10,733 |

|

|

|

10,380 |

|

|

|

353 |

|

|

|

3.4 |

|

|

Consolidated total |

|

$ |

361,462 |

|

|

$ |

343,967 |

|

|

$ |

17,495 |

|

|

|

5.1 |

% |

| |

|

Twenty-six

weeks ended February 28, |

|

|

Twenty-six

weeks ended

March 1, |

|

|

Dollar |

|

|

Percent |

|

|

(In thousands, except percentages) |

|

2015 (1) |

|

|

2014 (1) |

|

|

Change |

|

|

Change |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core Laundry Operations |

|

$ |

667,915 |

|

|

$ |

625,187 |

|

|

$ |

42,728 |

|

|

|

6.8 |

% |

|

Specialty Garments |

|

|

41,137 |

|

|

|

44,849 |

|

|

|

(3,712 |

) |

|

|

-8.3 |

|

|

First Aid |

|

|

22,771 |

|

|

|

20,635 |

|

|

|

2,136 |

|

|

|

10.4 |

|

|

Consolidated total |

|

$ |

731,823 |

|

|

$ |

690,671 |

|

|

$ |

41,152 |

|

|

|

6.0 |

% |

Income from Operations

| |

|

Thirteen

weeks ended February 28, |

|

|

Thirteen

weeks ended

March 1, |

|

|

Dollar |

|

|

Percent |

|

|

(In thousands, except percentages) |

|

2015 (1) |

|

|

2014 (1) |

|

|

Change |

|

|

Change |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core Laundry Operations |

|

$ |

40,924 |

|

|

$ |

39,443 |

|

|

$ |

1,481 |

|

|

|

3.8 |

% |

|

Specialty Garments |

|

|

(435 |

) |

|

|

312 |

|

|

|

(747 |

) |

|

|

-239.1 |

|

|

First Aid |

|

|

1,062 |

|

|

|

969 |

|

|

|

93 |

|

|

|

9.5 |

|

|

Consolidated total |

|

$ |

41,551 |

|

|

$ |

40,724 |

|

|

$ |

827 |

|

|

|

2.0 |

% |

| |

|

Twenty-six

weeks ended February 28, |

|

|

Twenty-six

weeks ended

March 1, |

|

|

Dollar |

|

|

Percent |

|

|

(In thousands, except percentages) |

|

2015 (1) |

|

|

2014 (1) |

|

|

Change |

|

|

Change |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core Laundry Operations |

|

$ |

97,797 |

|

|

$ |

91,815 |

|

|

$ |

5,982 |

|

|

|

6.5 |

% |

|

Specialty Garments |

|

|

1,833 |

|

|

|

3,071 |

|

|

|

(1,238 |

) |

|

|

-40.3 |

|

|

First Aid |

|

|

2,510 |

|

|

|

1,478 |

|

|

|

1,032 |

|

|

|

69.8 |

|

|

Consolidated total |

|

$ |

102,140 |

|

|

$ |

96,364 |

|

|

$ |

5,776 |

|

|

|

6.0 |

% |

(1) Unaudited

UniFirst Corporation and Subsidiaries

Consolidated Statements of Cash Flows

|

(In thousands) |

|

Twenty-six

weeks ended

February 28,

2015 (1) |

|

|

Twenty-six

weeks ended

March 1,

2014 (1) |

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

62,859 |

|

|

$ |

60,109 |

|

|

Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

32,495 |

|

|

|

30,465 |

|

|

Amortization of intangible assets |

|

|

4,334 |

|

|

|

4,663 |

|

|

Amortization of deferred financing costs |

|

|

104 |

|

|

|

104 |

|

|

Share-based compensation |

|

|

3,369 |

|

|

|

3,388 |

|

|

Accretion on environmental contingencies |

|

|

302 |

|

|

|

358 |

|

|

Accretion on asset retirement obligations |

|

|

316 |

|

|

|

362 |

|

|

Deferred income taxes |

|

|

7,040 |

|

|

|

(190 |

) |

|

Changes in assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

|

|

|

Receivables |

|

|

(11,048 |

) |

|

|

(9,545 |

) |

|

Inventories |

|

|

(6,578 |

) |

|

|

5,173 |

|

|

Rental merchandise in service |

|

|

718 |

|

|

|

(4,960 |

) |

|

Prepaid expenses and other current assets |

|

|

(7,187 |

) |

|

|

(1,504 |

) |

|

Accounts payable |

|

|

(1,384 |

) |

|

|

4,340 |

|

|

Accrued liabilities |

|

|

11,605 |

|

|

|

6,248 |

|

|

Prepaid and accrued income taxes |

|

|

10,092 |

|

|

|

10,094 |

|

|

Net cash provided by operating activities |

|

|

107,037 |

|

|

|

109,105 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

|

Acquisition of businesses |

|

|

(15,086 |

) |

|

|

(681 |

) |

|

Capital expenditures |

|

|

(45,542 |

) |

|

|

(44,087 |

) |

|

Other |

|

|

(202 |

) |

|

|

401 |

|

|

Net cash used in investing activities |

|

|

(60,830 |

) |

|

|

(44,367 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Proceeds from loans payable and long-term debt |

|

|

4,937 |

|

|

|

4,927 |

|

|

Payments on loans payable and long-term debt |

|

|

(6,887 |

) |

|

|

(107,620 |

) |

|

Proceeds from exercise of Common Stock options, including excess tax benefits |

|

|

4,975 |

|

|

|

2,005 |

|

|

Payment of cash dividends |

|

|

(1,433 |

) |

|

|

(1,428 |

) |

|

Net cash provided by (used in) financing activities |

|

|

1,592 |

|

|

|

(102,116 |

) |

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash |

|

|

(8,107 |

) |

|

|

(2,859 |

) |

| |

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

|

39,692 |

|

|

|

(40,237 |

) |

|

Cash and cash equivalents at beginning of period |

|

|

191,769 |

|

|

|

197,479 |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

|

$ |

231,461 |

|

|

$ |

157,242 |

|

(1) Unaudited

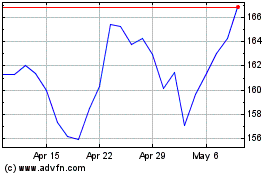

UniFirst (NYSE:UNF)

Historical Stock Chart

From Mar 2024 to Apr 2024

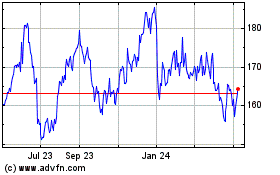

UniFirst (NYSE:UNF)

Historical Stock Chart

From Apr 2023 to Apr 2024