Use these links to rapidly review the document

TABLE OF CONTENTS Prospectus Supplement

Table of Contents

Filed Pursuant to Rule 424(b)(2)

Registration No. 333-196418

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Title of Each Class of Securities to be Registered

|

|

Amount to be

Registered

|

|

Proposed Maximum

Offering Price

per Share

|

|

Proposed Maximum

Aggregate

Offering Price

|

|

Amount of

Registration Fee(1)

|

| |

Common Stock, par value $0.01 per share |

|

11,500,000 |

|

20.65 |

|

$237,475,000 |

|

$27,594.60 |

|

- (1)

- Calculated

pursuant to Rule 457(r) of the Securities Act of 1933, as amended.

Table of Contents

PROSPECTUS SUPPLEMENT

(To Prospectus dated May 30, 2014)

10,000,000 Shares

Common Stock

We are offering up to 10,000,000 shares of our common stock.

Our

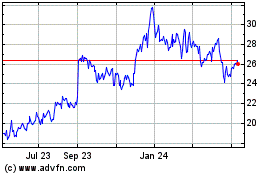

common stock is listed on The NASDAQ Global Select Market under the symbol "INSM." The last reported sale price of our common stock on The NASDAQ Global Select Market on

March 30, 2015 was $21.09 per share.

Investing in our common stock involves a high degree of risk. See "Risk Factors" beginning on page S-6 of this prospectus

supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

Per Share |

|

Total |

|

| Public offering price |

|

$ |

20.65 |

|

$ |

206,500,000 |

|

| Underwriting discounts and commissions(1) |

|

$ |

1.239 |

|

$ |

12,390,000 |

|

|

|

|

|

|

|

|

|

|

| Proceeds, before expenses, to us |

|

$ |

19.411 |

|

$ |

194,110,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- (1)

- We

have agreed to reimburse the underwriters for certain expenses in connection with this offering. See "Underwriting."

The

underwriters also may purchase up to an additional 1,500,000 shares of our common stock at the public offering price, less the underwriting discounts and commissions payable by us,

within 30 days from the date of this prospectus supplement. If the underwriters exercise this option in full, the total underwriting discounts and commissions will be $14,248,500 and our total

proceeds, after underwriting discounts and commissions but before expenses, will be $223,226,500.

The

underwriters are offering the common stock as set forth under "Underwriting." Delivery of the shares will be made on or about April 6, 2015.

Joint Book-Running Managers

|

|

|

| Citigroup |

|

Leerink Partners |

Co-Managers

|

|

|

| JMP Securities |

|

H.C. Wainwright & Co., LLC |

Prospectus Supplement dated March 31, 2015

Table of Contents

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus relate to a registration statement that we filed

with the Securities and Exchange Commission, or SEC, using a shelf registration process. Both this prospectus supplement and the accompanying prospectus include or incorporate by reference important

information about us, our common stock and other information you should know before investing in our common stock. You should read both this prospectus supplement and the accompanying prospectus as

well as the additional information described under "Where You Can Find More Information" in this prospectus supplement before making an investment decision.

We have not authorized any dealer, agent or other person to give any information or to make any representation other than those contained or incorporated by

reference in this prospectus supplement and the accompanying prospectus and any related free writing prospectus we may authorize to be delivered to you. You must not rely upon any information or

representation not contained or incorporated by reference in this prospectus supplement or the accompanying prospectus or in any related free writing prospectus authorized by us. This prospectus

supplement and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the common stock offered hereby, nor do this prospectus

supplement and the accompanying

prospectus constitute an offer to sell or the solicitation of an offer to buy securities, in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such

jurisdiction. You should not assume that the information contained in this prospectus supplement and the accompanying prospectus is accurate on any date subsequent to the date set forth on the front

of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus

supplement and any accompanying prospectus is delivered or securities are sold on a later date.

This prospectus supplement may add to, update or change the information in the accompanying prospectus and the documents incorporated by reference herein. If

information in this prospectus supplement is inconsistent with information in the accompanying prospectus or any document incorporated by reference, this prospectus supplement will apply and will

supersede that information in the accompanying prospectus or in the document incorporated by reference.

Unless otherwise indicated or unless the context requires otherwise, all references in this prospectus supplement to "Insmed", the "Company", "we", "us" and "our"

refer to Insmed Incorporated, together with its consolidated subsidiaries. ARIKACE and IPLEX are registered trademarks of Insmed Incorporated and Insmed and ARIKAYCE are trademarks of Insmed

Incorporated. Our logos and trademarks are the property of Insmed. All other brand names or trademarks appearing in this prospectus are the property of their respective holders. Use or display by us

of other parties' trademarks, trade dress, or products in this prospectus supplement is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark

or trade dress owners.

S-ii

Table of Contents

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information included or incorporated by reference in this prospectus

supplement and the accompanying prospectus and does not contain all of the information that may be important to you. You should carefully review this entire prospectus supplement and the accompanying

prospectus, including the risk factors and financial statements included and incorporated

by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision to purchase our common stock.

BUSINESS OVERVIEW

Insmed is a biopharmaceutical company dedicated to improving the lives of patients battling serious lung diseases. We are focused on

the development and commercialization of ARIKAYCE, or liposomal amikacin for inhalation (LAI), for at least two identified orphan patient populations: patients with nontuberculous mycobacteria (NTM)

lung infections and cystic fibrosis (CF) patients with Pseudomonas aeruginosa (Pseudomonas) lung infections. We are also focused on the development of

INS1009, an inhaled treprostinil prodrug. Treprostinil is a prostacyclin used in the treatment of pulmonary arterial hypertension (PAH), a chronic, life-threatening disorder characterized by

abnormally high blood pressure in the arteries between the heart and lungs.

In

March 2014, we reported top-line clinical results from the double-blind portion of our phase 2 clinical trial in the United States (US) and Canada of ARIKAYCE in patients who

had treatment-resistant lung infections caused by NTM. The randomized, double-blind, placebo-controlled phase 2 clinical trial compared ARIKAYCE (590 mg delivered once daily), added to standard

of care treatment, versus standard of care treatment plus placebo, in 90 adult patients with treatment resistant NTM lung disease. Eligibility for the study required patients to have been on the

American Thoracic Society/Infectious Disease Society of America guideline therapy for at least six months prior to screening and to continue to have persistently positive mycobacterial cultures. The

primary efficacy endpoint of the study was a semi-quantitative measurement of the change in mycobacterial density on a seven-point scale from baseline (day one) to the end of the randomized portion of

the trial (day 84). ARIKAYCE did not meet the pre-specified level for statistical significance of the primary efficacy endpoint, although there was a positive trend (p=0.148) in favor of ARIKAYCE. A

secondary efficacy endpoint of the study was proportion of subjects with culture conversion to negative. ARIKAYCE achieved statistical significance with regard to this secondary endpoint, with 11 out

of 44 patients treated with ARIKAYCE (added to standard of care treatment) demonstrating clearance of the infecting mycobacterial organism (culture negative) at day 84 of the study as compared to 3

out of 45 patients treated with placebo (added to standard of care treatment) (p=0.01).

In

May 2014, additional data from the open-label portion of the phase 2 trial were presented in a poster session at the American Thoracic Society meeting. At the conclusion of the

84-day double blind phase of the trial, 78 of the 80 patients completing the double-blind phase agreed to receive once-daily ARIKAYCE plus standard of care treatment for an additional 84 days.

Data from 68 of these patients who completed the visits during the additional open label phase were available for inclusion in the poster. These results collected from the open label phase show that

21 of these patients were culture negative for NTM at Day 168. This data reflects 10 patients who were culture negative at Day 84 as well as 5 additional patients from the ARIKAYCE arm and 6

additional patients who were initially on placebo and switched to ARIKAYCE during the open-label phase.

In

June 2014, the US Food and Drug Administration (FDA) granted ARIKAYCE Breakthrough Therapy Designation for the treatment of adult patients with NTM lung disease who are treatment

refractory. This designation is based on findings from our U.S. phase 2 clinical trial of ARIKAYCE to treat NTM lung infections. ARIKAYCE has already received Orphan Drug, Qualified Infectious

Disease Product (QIDP) and Fast Track designations from the FDA for the treatment of NTM lung

S-1

Table of Contents

infections

and has also received Orphan Drug Designation from the European Medicines Agency (EMA).

In

the fourth quarter of 2014, we filed a Marketing Authorization Application (MAA) with the EMA for ARIKAYCE for the treatment of NTM lung infections as well as Pseudomonas lung infections in CF patients.

The MAA for ARIKAYCE was validated in February 2015 after the EMA's pediatric committee approved the

Pediatric Investigation Plan (PIP) for ARIKAYCE. The validation of the MAA filing is the start of the formal review process by the EMA.

In

addition, following discussions with the FDA, we have commenced a phase 3 randomized, open-label, global study which is designed to confirm the positive culture conversion

results seen in our phase 2 clinical trial. This phase 3 study is investigating ARIKAYCE for use in non-CF patients 18 years and older with Mycobacterium

avium complex (MAC) NTM lung infections who have thus far failed to achieve culture conversion on a multi-drug treatment regimen. This subgroup of patients in the

phase 2 trial responded particularly well to treatment with ARIKAYCE. We believe this clinical trial will confirm the previous study results and could provide a path to filing and approval for

an indication in patients with NTM who are refractory to treatment. Following discussions with the FDA, the primary efficacy endpoint will be proportion of patients achieving culture conversion, with

additional goals of demonstrating sustainability and safety. The protocol for the phase 3 trial was finalized following dialogue with the FDA and was approved by the U.S. Central Institutional

Review Board (IRB). We initiated the global trial in early 2015 and expect to complete enrollment within one year. We anticipate having preliminary top-line clinical results from the phase 3

study in mid-2016. If the study meets the primary endpoint of culture conversion, we believe we would be eligible to submit a new drug application pursuant to 21 CFR 314 Subpart H (Accelerated

Approval of New Drugs for Serious or Life-Threatening Illnesses) which permits FDA to approve a drug based on a "surrogate endpoint"

provided the sponsor commits to post-market studies to verify and describe the drug's clinical benefit. We expect to conduct the trial at over eighty sites including the United States, Europe,

Australia, Japan and Canada with enrollment of approximately 300 patients.

In

addition to ARIKAYCE, we believe that we can apply our proven design and development expertise to advance INS1009, an investigational sustained-release inhaled treprostinil prodrug

that has the potential to address certain of the current limitations of existing inhaled prostanoid therapies in PAH. We believe that INS1009 may prolong duration of effect and may provide greater

consistency in pulmonary arterial pressure reduction over time. Current inhaled prostanoid therapies must be dosed four to nine times per day. Reducing dose frequency therefore has the potential to

ease patient burden and to positively impact compliance. Additionally, we believe that INS1009 over time may reduce side effects, including elevated heart rate, low blood pressure, and severity and/or

frequency of cough, associated with high initial drug levels when using current inhaled prostanoid therapies.

In

late 2014, we had a pre-investigational new drug (pre-IND) meeting with the FDA for INS1009 and clarified that, subject to final review of the pre-clinical data, INS1009 could be

eligible for approval under Section 505(b)(2) of the Federal Food, Drug, and Cosmetic Act (FDCA) ("505(b)(2) approval"). Like a traditional NDA that is submitted under Section 505(b)(1)

of the FDCA, a 505(b)(2) NDA must include full safety and effectiveness reports, but unlike a traditional NDA the applicant may rely at least in part on studies not conducted by or for the applicant.

The ability to rely on existing data to support safety and/or effectiveness can reduce the time and cost associated with traditional NDAs. We are conducting preclinical work and toxicology evaluations

related to the unique formulation and route of administration and if results from these studies support continued product development, we may continue advancing the program with the goal of submitting

an investigational new drug (IND) application and commencing a phase 1 trial in the second half of 2015.

We

also plan to develop, acquire, in-license or co-promote other products that address orphan or rare diseases possibly in the fields of pulmonology and infectious disease. Our current

primary

S-2

Table of Contents

development

focus is to obtain regulatory approval for ARIKAYCE in the U.S. for the NTM indication and in Europe for the NTM and CF indications, enroll and complete our global phase 3 NTM

study, and prepare for commercialization, assuming regulatory approval, in the US, Europe, Canada and Japan. We anticipate that, if approved, ARIKAYCE would be the first once-a-day inhaled antibiotic

treatment option available for the CF indication and the NTM indication in the US, Europe or Canada.

The

following table summarizes the current status of ARIKAYCE and INS1009 development:

|

|

|

|

|

Product Candidate/Target

Indications

|

|

Status |

|

Next Expected Milestones |

| ARIKAYCE Non-tuberculous mycobacteria (NTM) lung infections |

|

• We commenced a phase 3 global study (the

"212 study") which is designed to confirm the positive culture conversion results seen in our phase 2 clinical trial. This phase 3 study is primarily investigating ARIKAYCE for use in the non CF, treatment failure population with MAC NTM

lung infections. • We have filed a MAA with the EMA, which was validated in February 2015. • We reported top line clinical results from our phase 2 clinical trial which stated

that ARIKAYCE did not meet the pre specified level for statistical significance with respect to the primary endpoint, but did achieve statistical significance with regard to the clinically relevant key secondary endpoint of culture conversion.

• Granted Breakthrough Therapy designation by the FDA. • Granted Orphan Drug designation by the FDA and EMA. • Granted Qualified Infectious Disease Product (QIDP) designation, which includes Priority Review, by the FDA. • Granted Fast Track designation by the FDA which permits a rolling submission of an

NDA. |

|

• We expect to file an application in Canada

during the second half of 2015 for the treatment of both NTM lung infections and Pseudomonas lung infections in CF patients.

• We expect to complete enrollment in the 212

study in approximately twelve months from the initiation of the trial. • If approved, we expect ARIKAYCE would be the first approved inhaled antibiotic treatment in

the US, Canada and Europe for NTM lung infections.

• We are developing plans to commercialize ARIKAYCE, if approved, in certain countries in Europe, in the US, and Canada, and eventually Japan and certain other

countries. |

S-3

Table of Contents

|

|

|

|

|

Product Candidate/Target

Indications

|

|

Status |

|

Next Expected Milestones |

ARIKAYCE Pseudomonas aeruginosa lung infections in CF patients |

|

• We have filed a MAA with the EMA, which was

validated in February 2015. • We reported top line clinical results from our phase 3 clinical trial conducted in Europe and Canada, in which once daily ARIKAYCE achieved its primary endpoint of non-inferiority

when compared to twice-daily tobramycin inhaled solution. • We are conducting a two year, open label safety study in patients who completed the phase 3 clinical trial. We expect to complete this study in

mid-2015. • We reported top line results from the patients who completed the first year of the two year open label extension study.

• Granted orphan drug designation by the EMA and

FDA. |

|

• We expect to file an application in Canada

during the second half of 2015 for the treatment of both NTM lung infections and Pseudomonas lung infections in CF patients.

• We expect to announce final results from the two

year open label extension study in the second half of 2015. • We are developing plans to commercialize ARIKAYCE, if approved, in certain countries in Europe and Canada where we expect it would be the only once a day

treatment for Pseudomonas lung infections in CF patients. • We plan to initiate new studies in pediatric patients, however we currently do not plan to initiate any further studies in adult CF patients with

Pseudomonas lung infections. |

| |

|

|

|

|

|

INS1009 (inhaled treprostinil prodrug) for pulmonary arterial hypertension (PAH) |

|

• We completed a pre-investigational new drug

(IND) meeting with the FDA for INS1009, and we have clarified that, subject to final review of the pre-clinical data, we could be eligible for a 505(b)(2) approval pathway. |

|

• We expect to file an IND in the second half of

2015. • We expect to commence a phase 1 trial in the second half of 2015. |

Amikacin

sulfate is an FDA-approved antibiotic with proven efficacy in the treatment of a broad range of gram-negative infections, including Pseudomonas and NTM. ARIKAYCE is in the aminoglycoside class of

antibiotics. We believe there is no drug currently approved in the U.S., Europe or

Canada for treatment of NTM lung infections, and as a result all current drug treatments for NTM are used off-label. Patients are often treated with the same antibiotics that are used to treat TB.

Such treatments usually consist of lengthy multi-drug antibiotic regimens, which are often poorly tolerated and not very effective, especially in patients with severe disease and patients who have

failed prior treatments. NTM patients average 7.6 antibiotic courses per year (SDI Healthcare Database, July 2009). Treatment guidelines published in 2007 in the American

Journal of Respiratory and Critical Care Medicine reported that few clinical trials were under way to identify treatment recommendations, and no new antibiotics had been

studied for the treatment of NTM lung infections in multi-center, randomized clinical trials since the late 1990s.

Although

approved for other indications, amikacin sulfate is not approved by the FDA for NTM lung infections. In practice, however, it is often recommended by physicians as part of the

multi-drug treatment regimen for some NTM patients. Amikacin is delivered most commonly by intravenous administration and, less often, by inhalation. Because the drug is delivered for months at a

time, resulting in sustained high systemic (blood) levels of amikacin, there can be considerable toxicity,

including ototoxicity and nephrotoxicity, associated with intravenous treatment. There are few prior studies to support what doses should be administered to effectively treat NTM patients even with

these existing medications and they are often titrated on a patient by patient basis. If approved for NTM patients, we expect ARIKAYCE would be the first and only approved inhaled antibiotic for the

treatment of NTM lung infections in the US, Europe or Canada.

S-4

Table of Contents

THE OFFERING

|

|

|

Common stock offered by us |

|

10,000,000 shares. |

Common stock to be outstanding after this offering |

|

59,806,131 shares. |

Use of proceeds |

|

We intend to use the net proceeds from this offering to fund further clinical development of ARIKAYCE for patients with NTM lung disease and for CF patients with Pseudomonas lung infections, to fund our efforts to obtain regulatory approvals and commercialize ARIKAYCE for NTM and Pseudomonas in CF, to invest in increased

third-party manufacturing capacity in anticipation of possible commercial launch of ARIKAYCE in Europe and the United States, to fund further clinical development of INS1009 for patients with pulmonary arterial hypertension, and the balance to fund

working capital, potential debt repayment, capital expenditures, general research and development, and other general corporate purposes, which may include the acquisition or in-license of additional compounds, product candidates, technology or

businesses. |

Risk Factors |

|

An investment in our common stock involves a high degree of risk. See "Risk Factors" beginning on page S-6 of this prospectus supplement, as well as the sections entitled "Risk Factors" contained in

the accompanying prospectus and in our Annual Report on Form 10-K for the year ended December 31, 2014, as amended by the Form 10-K/A filed with the SEC on March 30, 2015, incorporated by reference in this prospectus supplement

and the accompanying prospectus, before deciding to invest in shares of our common stock. |

Option to purchase additional shares |

|

We have granted the underwriters an option for a period of 30 days from the date of this prospectus supplement to purchase up to 1,500,000 additional shares of our common stock. |

NASDAQ Global Select Market symbol |

|

Our common stock is listed on the NASDAQ Global Select Market under the symbol "INSM." |

The

number of shares of our common stock to be outstanding after this offering is based on 49,806,131 actual shares of our common stock outstanding as of December 31, 2014.

The

number of shares of our common stock to be outstanding after this offering excludes:

- •

- 4,400,106 shares of our common stock issuable upon the exercise of stock options outstanding as of December 31, 2014 at a

weighted average exercise price of $10.59 per share; and

- •

- 20,502 shares of our common stock issuable pursuant to unvested restricted stock units outstanding as of December 31, 2014 at a

weighted average grant price of $19.47.

Unless

otherwise stated, all information in this prospectus supplement assumes no exercise by the underwriters of their option to purchase additional shares.

S-5

Table of Contents

RISK FACTORS

An

investment in our common stock involves significant risks. Before making an investment in our common stock, you should carefully read all of the information contained in this

prospectus supplement, the accompanying prospectus and in the documents incorporated by reference herein. For a discussion of risk factors that you should carefully consider before deciding to

purchase any of our common stock, please review the risk factors Item 1A. Risk Factors in our Annual Report on Form 10-K for the year ended December 31, 2014, as amended by the

Form 10-K/A filed with the SEC on March 30, 2015, as well as the additional risk factors disclosed below. In addition, please read "About This Prospectus Supplement" and "Forward-Looking

Statements" in this prospectus supplement, where we describe additional uncertainties associated with our business and the forward-looking statements included or incorporated by reference in this

prospectus supplement and the accompanying prospectus. Please note that additional risks not currently known to us or that we currently deem immaterial also may adversely affect our business, results

of operations, financial condition and prospects.

Risks Related to Development and Commercialization of our Product Candidates

Our near term prospects are highly dependent on the success of our most advanced product candidate,

ARIKAYCE. If we are unable to successfully complete the development of, obtain regulatory approval for, and successfully commercialize ARIKAYCE, our business and the value of our common stock may be

materially adversely affected.

We are investing substantially all of our efforts and financial resources in the development of ARIKAYCE, our most advanced product

candidate. Our ability to generate product revenue from ARIKAYCE, which may not occur for at least the next year or two, if ever, will depend heavily on the successful completion of development of,

receipt of regulatory approval for and commercialization of, ARIKAYCE.

Positive

results from preclinical studies of a drug candidate may not be predictive of similar results in human clinical trials, and promising results from earlier clinical trials of a

drug candidate may not be replicated in later clinical trials. Many companies in the pharmaceutical and biotechnology industries have suffered significant setbacks in late-stage clinical trials even

after achieving promising results in earlier stages of development. Accordingly, the results of the completed clinical trials for ARIKAYCE may not be predictive of the results we may obtain in our

clinical trials currently in progress or other trials.

In

the fourth quarter of 2014, we filed a MAA with the EMA for ARIKAYCE for the treatment of NTM lung infections as well as Pseudomonas

lung infections in CF patients. The MAA for ARIKAYCE was validated in February 2015 after the EMA's pediatric committee approved the PIP for ARIKAYCE.

In

addition, based on discussions with the FDA, we have commenced with a global phase 3 study which is designed to confirm the positive culture conversion results seen in our

phase 2 clinical trial. This phase 3 study is primarily investigating ARIKAYCE for use in non-CF patients with MAC NTM lung infections who have thus far failed their multi-drug treatment

regimen.

We

do not expect ARIKAYCE or any other drug candidates we may develop to be commercially available for at least the next year or two, if at all.

S-6

Table of Contents

We have not completed the research and development stage of ARIKAYCE or any other product candidates

other than IPLEX, which we no longer market. If we are unable to successfully commercialize ARIKAYCE or any other products, it may materially adversely affect our business, financial condition,

results of operations and our prospects.

Our long-term viability and growth depend on the successful commercialization of ARIKAYCE and potentially other product candidates that

lead to revenue and profits. Pharmaceutical product development is an expensive, high risk, lengthy, complicated, resource intensive process. In order to conduct the development programs for our

products, we must, among other things, be able to successfully:

- •

- Identify potential drug product candidates;

- •

- Design and conduct appropriate laboratory, preclinical and other research;

- •

- Submit for and receive regulatory approval to perform clinical studies;

- •

- Design and conduct appropriate preclinical and clinical studies according to good laboratory and good clinical practices and

disease-specific expectations of FDA and other regulatory bodies;

- •

- Select and recruit clinical investigators;

- •

- Select and recruit subjects for our studies;

- •

- Collect, analyze and correctly interpret the data from our studies;

- •

- Submit for and receive regulatory approvals for marketing;

- •

- Submit for and receive reimbursement approvals for market access: and

- •

- Manufacture the drug product candidates and device components according to cGMP.

The

development program with respect to any given product will take many years and thus delay our ability to generate profits. In addition, potential products that appear promising at

early stages of development may fail for a number of reasons, including the possibility that the products may require significant additional testing or turn out to be unsafe, ineffective, too

difficult or expensive to develop or manufacture, too difficult to administer or unstable. If we do not proceed with the development of our ARIKAYCE program in the NTM or CF indications, certain

organizations that provided funding to us for such developmental efforts may elect to proceed with the development of these indications. Even if we are successful in obtaining regulatory approval for

our product candidates, including ARIKAYCE, we may not obtain labeling that permits us to market them with commercially viable claims because the final wording of the approved indication may be

restrictive, or the available clinical data may not

provide adequate comparative data with other products. Failure to successfully commercialize our products will adversely affect our business, financial condition, results of operations and prospects.

If regulatory agencies limit our proposed NTM or CF treatment population for ARIKAYCE, our clinical

studies do not produce positive results or our clinical trials are delayed, or if serious side effects are identified during drug development, we may experience delays, incur additional costs and

ultimately be unable to commercialize our product candidates in the US, Europe or other countries.

Before obtaining regulatory approval for the sale of our product candidates, we must conduct, at our own expense, extensive preclinical

tests to demonstrate the safety of our product candidates in animals, and clinical trials to demonstrate the safety and efficacy of our product candidates in humans. Significant preclinical or

clinical trial delays also could shorten the patent protection period during which we may have the exclusive right to commercialize our product candidates. Such delays could allow our competitors to

bring products to market before we do and impair our ability to commercialize our products or product candidates.

S-7

Table of Contents

Preclinical

and clinical testing is expensive, difficult to design and implement and can take many years to complete. Our product development costs have and may continue to increase if

we experience further delays in testing or approvals. A failure of one or more of our preclinical studies or clinical trials can occur at any stage of testing. We may experience numerous unforeseen

events during, or as a result of, preclinical testing and the clinical trial process that could delay or prevent our ability to obtain regulatory approval or commercialize our product candidates,

including:

- •

- Our preclinical tests or clinical trials may produce negative or inconclusive results, and we may decide, or regulators may require

us, to conduct additional preclinical testing or clinical trials or we may abandon projects that we expect to be promising;

- •

- Regulators or institutional review boards may prevent us from commencing a clinical trial or conducting a clinical trial at a

prospective trial site;

- •

- Enrollment in the clinical trials may take longer than expected or the clinical trials as designed may not allow for sufficient

patient accrual to complete enrollment of the trial;

- •

- We may decide to limit or abandon our commercial development programs;

- •

- Conditions imposed on us by the FDA or any non-US regulatory authority regarding the scope or design of our clinical trials may

require us to collect and submit information to regulatory authorities, ethics committees, institutional review boards or others for review and approval;

- •

- The number of patients required for our clinical trials may be larger than we anticipate or participants may drop out of our clinical

trials at a higher rate than we anticipate;

- •

- Our third party contractors, contract research organizations, which we refer to as CROs, clinical investigators, clinical

laboratories, product supplier or inhalation device supplier may fail to comply with regulatory requirements or fail to meet their contractual obligations to us in a timely manner;

- •

- We may have to suspend or terminate one or more of our clinical trials if we, the regulators or the institutional review boards

determine that the participants are being exposed to unacceptable health risks or for other reasons;

- •

- We may not be able to claim that a product candidate provides an advantage over current standard of care or future competitive

therapies in development because our clinical studies may not have been designed to support such claims;

- •

- Regulators or institutional review boards may require that we hold, suspend or terminate clinical research for various reasons,

including potential safety concerns or noncompliance with regulatory requirements;

- •

- The cost of our clinical trials may be greater than we anticipate;

- •

- The supply or quality of product used in clinical trials or other materials necessary to conduct our clinical trials may be

insufficient or inadequate or we may not be able to reach agreements on acceptable terms with prospective contract manufacturers or CROs; and

- •

- The effects of our product candidates may not be the desired effects or may include undesirable side effects or the product candidates

may have other unexpected characteristics.

For

example, results from our rodent carcinogenicity study showed that when rats were given ARIKAYCE daily by inhalation for two years, 2 of the 120 rats receiving the highest dose

developed lung tumors. These rats received ARIKAYCE doses that were within two-fold of those in clinical studies (normalized on a body surface area basis or a lung weight basis). Based on these

results, in 2011 the FDA placed clinical holds on our phase 3 clinical trials for ARIKAYCE, which holds were lifted in 2012. Approvability or labeling of ARIKAYCE may be negatively affected by

these results. In

S-8

Table of Contents

2013,

we concluded a 9 month dog inhalation toxicity study. The final report from the study stated that the lung macrophage response in dogs was similar to that seen in our previous

3 month dosing dog study, and there was no evidence of neoplasia, squamous metaplasia or proliferative changes.

If

we are required to conduct additional clinical trials or other testing of our product candidates beyond those that we currently contemplate, if we are unable to successfully complete

our clinical trials or other testing, if the results of these trials or tests are not positive or are only modestly positive or if there are safety concerns, we

may:

- •

- Be delayed in obtaining, or may not be able to obtain, marketing approval for one or more of our product candidates;

- •

- Obtain approval for indications that are not as broad as intended or entirely different than those indications for which we sought

approval; or

- •

- Have the product removed from the market after obtaining marketing approval.

We may not have, or may be unable to obtain, sufficient quantities of our product candidates to meet

our required supply for clinical studies or commercialization requirements.

We do not have any in-house manufacturing capability other than for development and characterization and depend completely on a small

number of third-party manufacturers and suppliers for the manufacture of our product candidates on a clinical or commercial scale. ARIKAYCE and the nebulizer each are supplied by a sole manufacturer.

We are dependent on Althea for the production of ARIKAYCE. We do not have a supply agreement with Althea and there is no assurance that we will enter into an agreement or that we will enter into an

agreement on terms

favorable to us. We are dependent upon PARI for the production and supply of the eFlow Nebulizer System. The inability of a supplier to fulfill our supply requirements could materially adversely

affect our ability to obtain and maintain regulatory approvals and future operating results. A change in the relationship with any supplier, or an adverse change in their business, could materially

adversely affect our future operating results.

We

are dependent upon PARI being able to provide an adequate supply of nebulizers both for our clinical trials and for commercial sale in the event ARIKAYCE receives marketing approval.

These nebulizers must be in good working order and meet specific performance characteristics. We intend to work closely with PARI to coordinate efforts regarding regulatory requirements.

We

are dependent upon Althea being able to provide an adequate supply of ARIKAYCE both for our clinical trials and for commercial sale in the event ARIKAYCE receives marketing approval.

Althea currently manufactures ARIKAYCE at a relatively small scale. In order to meet potential commercial demand if ARIKAYCE is approved, we will need to work with Althea and others, including

Therapure, to increase the scale of our manufacturing activities. We intend to work closely with Althea and Therapure to coordinate efforts regarding regulatory requirements and our supply needs. In

February 2014, we entered into a contract manufacturing agreement with Therapure for the manufacture of ARIKAYCE at the larger scales necessary to support commercialization.

We

do not have long-term commercial agreements with all of our suppliers, including Althea, and if any of our suppliers are unable or unwilling to perform for any reason, we may not be

able to locate suppliers or enter into favorable agreements with them. Any inability to acquire sufficient quantities of our components in a timely manner from these third parties could delay clinical

trials or commercialization and prevent us from developing and distributing our products in a cost-effective manner or on a timely basis.

In

addition, manufacturers of our components are subject to cGMP and similar standards and we do not have control over compliance with these regulations by our manufacturers. If one of

our

S-9

Table of Contents

contract

manufacturers fails to maintain compliance, the production of our products could be interrupted, resulting in delays and additional costs. In addition, if the facilities of such manufacturers

do not pass a pre-approval or post-approval plant inspection, the FDA, as well as other regulatory authorities in jurisdictions outside the US, will not grant approval and may institute restrictions

on the marketing or sale of our products. We are reliant on third-party manufacturers and suppliers to meet our clinical supply demands and any future commercial products. Delays in receipt of

materials, scheduling, release, custom's control and regulatory compliance issues may adversely impact our ability to initiate, maintain or complete clinical trials that we are sponsoring or may

adversely impact

commercialization. Issues arising from scale-up, facility construction, environmental controls, equipment requirements, local and federal permits and allowances or other factors may have an adverse

impact on our ability to manufacture our product candidates.

We have limited experience in conducting and managing the preclinical development activities and

clinical trials necessary to obtain regulatory approvals, including approval by the FDA and EMA and other regulatory agencies.

We have limited experience in conducting and managing the preclinical development activities and clinical trials necessary to obtain

regulatory approvals, including approval by the FDA and EMA. Since our merger with Transave, we have not completed a regulatory filing and review process for, obtained regulatory approval of or

commercialized any of our product candidates. Our limited experience might prevent us from successfully designing, implementing, or completing a clinical trial. The application processes for FDA, EMA

and other regulatory agencies are complex and difficult and vary by regulatory agency. We have limited experience in conducting and managing the application processes necessary to obtain regulatory

approvals in the various countries and we might not be able to demonstrate that our product candidates meet the appropriate standards for regulatory approval. If we are not successful in conducting

and managing our preclinical development activities or clinical trials or obtaining regulatory approvals, we might not be able to commercialize ARIKAYCE, or might be significantly delayed in doing so,

which may materially harm our business.

We may not be able to enroll enough patients to complete our clinical trials.

The completion rate of our global phase 3 clinical study of ARIKAYCE for NTM and other future clinical studies of our products

is dependent on, among other factors, the patient enrollment rate. Patient enrollment is a function of many factors, including:

- •

- Investigator identification and recruitment;

- •

- Regulatory approvals to initiate study sites;

- •

- Patient population size;

- •

- The nature of the protocol to be used in the trial;

- •

- Patient proximity to clinical sites;

- •

- Eligibility criteria for the study;

- •

- The patients' willingness to participate in the study;

- •

- Competition from other companies' clinical studies for the same patient population; and

- •

- Ability to obtain any necessary comparator drug or medical device.

We

believe our procedures for enrolling patients to date have been appropriate. However, delays in patient enrollment for future clinical trials could increase costs and delay ultimate

commercialization and sales, if any, of our products.

S-10

Table of Contents

If

any of our products meet the criteria for approval pursuant to Subpart H (accelerated approval), such approval will be subject to our carrying out, with due diligence, adequate

and well-controlled post market studies to verify and describe their clinical benefit. If we fail to complete such studies with due diligence, or if the results of such studies fail to demonstrate

clinical benefit, FDA may, following a hearing, withdraw product approval.

The commercial success of ARIKAYCE or any other product candidates that we may develop will depend

upon many factors, including the degree of market acceptance by physicians, patients, third-party payers and others in the medical community.

Even if we are able to successfully complete development of, obtain regulatory approval for, and bring ARIKAYCE to market, ARIKAYCE may

not gain market acceptance by physicians, patients, third-party payers and others in the medical community. If ARIKAYCE, or any other products we bring to market, do not achieve an adequate level of

acceptance, we may not generate significant product revenue and we may not become profitable. The degree of market acceptance of ARIKAYCE and any other product candidates, if approved for commercial

sale, will depend on a number of factors, including:

- •

- The prevalence and severity of any side effects, including any limitations or warnings contained in a product's approved labeling;

- •

- The efficacy and potential advantages over alternative treatments;

- •

- The pricing of our product candidates;

- •

- Relative convenience and ease of administration;

- •

- The willingness of the target patient population to try new therapies and of physicians to prescribe these therapies;

- •

- The strength of marketing and distribution support and timing of market introduction of competitive products;

- •

- Publicity concerning our products or competing products and treatments, including competing products becoming subject to generic

pricing; and

- •

- Sufficient third party insurance coverage or reimbursement.

Even

if a potential product displays a favorable efficacy and safety profile in preclinical and clinical trials, market acceptance of the product will not be known until after it is

launched. For example, if a clinical trial is not designed to demonstrate advantages over alternative treatments, we may be prohibited from promoting our product candidates on any such advantages. Our

efforts to educate the medical community and third-party payers on the benefits of our product candidates may require significant resources and may never be successful. Such efforts to educate the

marketplace may require more resources than are required by more established technologies marketed by our competitors.

We currently have a very small marketing or sales organization, and we have limited experience as a

company in marketing drug products. If we are unable to establish our own marketing and sales capabilities, or are unable to enter into agreements with third parties, to market and sell our products

after they are approved, we may not be able to generate product revenues.

We have a very small commercial organization for the marketing, market access, sales and distribution of any drug products. In order to

commercialize ARIKAYCE or any other product candidates, we must develop these capabilities on our own or make arrangements with third parties for the marketing, sales and distribution of our products.

The establishment and development of our own sales force would be expensive and time consuming and could delay any product launch, and we cannot

S-11

Table of Contents

be

certain that we would be able to successfully develop this capability. As a result, we may seek one or more partners to handle some or all of the sales and marketing of ARIKAYCE. However, we may

not be able to enter into arrangements with third parties to sell ARIKAYCE on favorable terms or at all. In the event we are unable to develop our own marketing, market access, and sales force or

collaborate with a third-party marketing, market access, and sales organization, we may not be able to successfully commercialize ARIKAYCE or any other product candidates that we develop, which would

adversely affect our ability to generate product revenues. Further, whether we commercialize products on our own or rely on a third party to do so, our ability to generate revenue will be dependent on

the effectiveness of the sales force.

Promotional

materials for our approved drug products must be submitted, along with Form 2253, to FDA's Office of Prescription Drug Products (OPDP) at the time of initial

dissemination or publication. For products approved pursuant to Subpart H, promotional materials intended to be used during product launch must be submitted during the pre-approval review

period, at least 30 days prior to the intended time of initial dissemination or publication. For other products, OPDP encourages pre-launch review, and will provide advisory comments in

response to such submissions upon request. There is no guarantee that OPDP will agree that the proposed promotional materials comply with applicable FDA requirements. A negative response in OPDP

Advisory Comments may require us to revise planned promotional materials and may limit the claims we can use in such materials. If OPDP considers promotional materials already disseminated or

published to violate applicable FDA requirements, OPDP may initiate enforcement action, including Untitled Letters/Notices of Violation, Warning Letters, Injunction/Consent decree, Seizures/Criminal

action, and/or Civil and monetary penalties.

We have limited experience operating internationally, are subject to a number of risks associated

with our international activities and operations and may not be successful in our efforts to expand internationally.

We have manufacturing, collaboration, clinical trial and other relationships outside the United Sates but we currently have very

limited operations outside of the United States. In order to meet our long-term goals, we will need to grow our international operations over the next several years. Consequently, we are and will

continue to be subject to additional risks related to operating in foreign countries, including:

- •

- the fact that we have limited experience operating our business internationally;

- •

- we may not achieve the optimal pricing and reimbursement for ARIKAYCE;

- •

- there may be fewer addressable NTM and/or CF patients than were originally forecasted;

- •

- unexpected adverse events related to ARIKAYCE or our other product candidates that occur in foreign markets that we have not

experienced in the United States;

- •

- local, economic and political conditions, including geopolitical events, such as war and terrorism, foreign currency fluctuations,

which could result in increased or unpredictable operating expenses and reduced revenues and other obligations incident to doing business in, or with a company located in, another country;

- •

- unexpected changes in reimbursement and pricing requirements, tariffs, trade barriers and regulatory requirements;

- •

- economic weakness, including foreign currency exchange risks, inflation or political instability in particular foreign economies and

markets; and

S-12

Table of Contents

- •

- compliance with foreign or U.S. laws, rules and regulations, including data privacy requirements, labor relations laws, tax laws,

anti-competition regulations, import, export and trade restrictions, anti-bribery/anti-corruption laws, regulations or rules, which could lead to actions by us or our licensees, distributors,

manufacturers, other third parties who act on our behalf or with whom we do business in foreign countries or our employees who are working abroad that could subject us to investigation or prosecution

under such foreign or U.S. laws.

These

and other risks associated with our international operations may materially adversely affect our business and results of operations.

Risks Related to Our Reliance on Third Parties

We rely on third parties including clinical research organizations, or CROs, clinical laboratories,

analytical laboratories and other providers for many services. If we are unable to form and sustain these relationships, or if any third-party arrangements that we may enter into are unsuccessful, our

ability to develop and commercialize our products may be materially adversely affected.

We currently rely, and expect that we will in the future continue to rely, on third parties for significant research, analytical

services, preclinical development and clinical development. For example, almost all of our clinical trial work is done by CROs and clinical laboratories. Reliance on these third parties poses a number

of risks, including the following:

- •

- We may face significant competition in seeking appropriate partners;

- •

- These arrangements are complex and time consuming to negotiate, document and implement;

- •

- We may not be successful in our efforts to establish and implement collaborations or other alternative arrangements that we might

pursue on favorable terms;

- •

- We may not be able to effectively control whether the CROs or other third parties will devote sufficient resources to our programs or

products;

- •

- We are not able to control the regulatory compliance of CROs, third- party suppliers, contractors and collaborators, including their

processes and procedures, systems utilized to collect and analyze data, and equipment used to test drug product and/or clinical supplies;

- •

- Disagreements with third parties and CROs may be difficult to resolve and could result in a dispute over and loss of intellectual

property rights, delay or termination of the research, development, or commercialization of product candidates or result in litigation or arbitration;

- •

- Contracts with our collaborators may fail to provide sufficient protection of our intellectual property; and

- •

- We may have difficulty enforcing the contracts if one of these collaborators fails to perform.

A

great deal of uncertainty exists regarding the success of any current and future third-party efforts on which we might depend. Failure of these efforts could delay, impair, or prevent

the development and commercialization of our products and adversely affect our business, financial condition, results of operations and prospects.

We rely on PARI, a third party manufacturer, to supply the nebulizer that is exclusively used for

ARIKAYCE. Any disruption in supply of the nebulizer will have a material adverse effect on our business.

We are dependent upon PARI being able to provide an adequate supply of nebulizers both for our clinical trials and for commercial sale

in the event ARIKAYCE receives marketing approval. These nebulizers must be in good working order, meet specific performance characteristics and be approved by FDA and other regulatory agencies along

with ARIKAYCE. We have no alternative supplier for the

S-13

Table of Contents

nebulizer

and we do not intend to seek an alternative or secondary supplier of nebulizers. Significant effort and time were expended in the optimization of the nebulizer for use with ARIKAYCE. In the

event PARI cannot provide devices replication of the optimized device by another party may require considerable time and additional regulatory approval. PARI has the right to terminate this agreement

upon written notice for our uncured material breach, if we are the subject of specified bankruptcy or liquidation events, if we assign or otherwise transfer the agreement to a third party that does

not agree to assume all of our rights and obligations set forth in the agreement, or if we fail to reach certain specified milestones, including the requirement that we use commercially reasonable

efforts to develop, commercialize, market, and sell ARIKAYCE for use in CF indications in one or more countries (and at least in the US). In the event PARI terminates the supply agreement and ceases

to manufacture the nebulizer, we cannot be certain that we would be able identify another willing supplier for the nebulizer on terms we require. A disruption in the supply of nebulizers could delay,

impair, or prevent the development and commercialization of our products and adversely affect our business, financial condition, results of operations and prospects.

We rely on Althea, a third party manufacturer, to supply ARIKAYCE. Any disruption in the supply of

ARIKAYCE could have a material adverse effect on our business.

We are dependent upon Althea being able to provide an adequate supply of ARIKAYCE both for our clinical trials and for commercial sale

in the event ARIKAYCE receives marketing approval. We do not have a supply agreement with Althea and are currently purchasing under a purchase order basis. There can be no assurance that we will enter

into a supply agreement or that we will enter into an agreement on terms favorable to us. In 2013, Althea was acquired by Ajinomoto Co., a global manufacturing company based in Japan and now

operates as Ajinomoto Althea, Inc.

Althea

currently manufactures ARIKAYCE at a relatively small scale. In order to meet potential commercial demand, if ARIKAYCE is approved, we have entered into a Contract Manufacturing

Agreement with Therapure in Canada as an alternate site of manufacture that operates at a larger scale. Therapure may not be able to successfully transfer the ARIKAYCE manufacturing process to their

site, or we may not be able to obtain regulatory approvals for ARIKAYCE produced at Therapure's facility. We may not be able to secure an alternative source of ARIKAYCE at an adequate scale of

production.

We currently depend on third parties to conduct the operations of our clinical trials.

We rely on third parties, such as CROs, medical institutions, clinical investigators and contract laboratories to oversee some of the

operations of our clinical trials and to perform data collection and analysis. As a result, we may face additional delays outside of our control if these parties do not perform their obligations in a

timely fashion or in accordance with regulatory requirements. If these third parties do not successfully carry out their contractual duties or obligations and meet expected deadlines, if they need to

be replaced, or if the quality or accuracy of the clinical data they obtain is compromised due to the failure to adhere to our clinical protocols or for other reasons, our financial results and the

commercial prospects for ARIKAYCE or our other potential product candidates could be materially harmed, our costs could increase and our ability to obtain regulatory approval and commence product

sales could be delayed.

We

also rely on third parties to select and enter into agreements with clinical investigators to conduct clinical trials to support approval of our products and the failure of these

third parties to carry out such evaluation and selection can adversely affect the quality of the data from these studies and, potentially, the approval of our products. In particular, as part of our

new drug approval submissions, we must disclose any financial interests of investigators who participated in any of the clinical studies being submitted in support of approval, or must certify to the

absence of such financial interests. FDA evaluates the information contained in such disclosures to determine whether disclosed interests may

S-14

Table of Contents

have

an impact on the reliability of a study. If FDA determines that financial interests of any clinical investigator raise serious questions of data integrity, FDA can institute a data audit, request

that we submit further data analyses, conduct additional independent studies to confirm the results of the questioned study, or refuse to use the data from the questioned study as a basis for

approval. A finding by FDA, that a financial relationship of an investigator raise serious questions of data integrity, could delay or otherwise adversely affect approval of our products.

Risks Related to Our Financial Condition and Capital Requirements

We have a history of operating losses. We expect to incur operating losses for the foreseeable

future and may never achieve or maintain profitability.

We are a biopharmaceutical company focused on developing and commercializing inhaled therapies for patients battling serious lung

diseases that are often life threatening. We have incurred losses each previous year of our operation, except in 2009, when we sold our manufacturing facility and certain other assets to Merck. We

expect to continue incurring operating losses for the foreseeable future. The process of developing and commercializing our products requires significant pre-clinical and clinical testing as well as

regulatory approvals for commercialization and marketing before we are allowed to begin product sales. In addition, commercialization of our drug candidates likely would require us to establish a

sales and marketing organization and contractual relationships to enable product manufacturing and other related activities. We expect that our activities, together with our general and administrative

expenses, will continue to result in substantial operating losses for the foreseeable future. As of December 31, 2014, our accumulated deficit was $470.8 million. For the year ended

December 31, 2014, our consolidated net loss was $79.2 million.

To

achieve and maintain profitability, we need to generate significant revenues from future product sales. This will require us to be successful in a range of challenging activities,

including:

- •

- Successfully completing development of and obtaining regulatory approval for the marketing of ARIKAYCE and possibly other product

candidates which have yet to be developed and which would also require marketing approval;

- •

- Commercializing ARIKAYCE and any other product candidates for which we obtain marketing approval; and

- •

- Achieving market acceptance and reimbursement of ARIKAYCE and any other product candidates for which we obtain marketing approval in

the medical community and with patients and third-party payers.

ARIKAYCE

will require marketing approval and significant investment in commercial capabilities, including manufacturing and sales and marketing efforts, before its product sales can

generate any revenues for us. Because of the numerous risks and uncertainties associated with drug development and commercialization, we are unable to predict the extent of any future losses. We may

never successfully commercialize ARIKAYCE or any other products, generate significant future revenues or achieve and sustain profitability.

We expect that we will need additional funds in the future to continue our operations, but we face

uncertainties with respect to our ability to access capital.

Our operations have consumed substantial amounts of cash since our inception. We expect to continue to incur substantial research and

development expenses, and we expect to expend substantial financial resources to complete development of, seek regulatory approval for, and prepare for commercialization of ARIKAYCE. We may need to

seek additional funding in order to complete any clinical trials related to ARIKAYCE, seek regulatory approvals of ARIKAYCE, and commercially launch ARIKAYCE. We also may require additional future

capital in order to continue our other

S-15

Table of Contents

research

and development activities or to acquire complementary technology. As of December 31, 2014, we had $159.2 million of cash and cash equivalents on hand. If adequate funds are not

available to us when needed, we may be required to reduce or eliminate research and development programs or commercial efforts.

Our

future capital requirements will depend on many factors, including factors associated with:

- •

- Phase 2 and phase 3 clinical trials and commercialization of ARIKAYCE;

- •

- Early access programs;

- •

- Non-clinical and clinical testing;

- •

- Process development and scale up for manufacturing;

- •

- Manufacturing;

- •

- Performance of our third-party suppliers and manufacturers;

- •

- Obtaining marketing, sales and distribution capabilities;

- •

- Obtaining regulatory approvals;

- •

- Research and development, including formulation development;

- •

- Retaining employees and consultants;

- •

- Global expansion efforts;

- •

- Filing and prosecuting patent applications and enforcing and defending patent claims;

- •

- Establishing strategic alliances and collaborations with third-parties; and

- •

- Current and potential future litigation.

We

also may need to spend more funds than currently expected because we may further change or alter drug development plans, acquire additional drugs or drug candidates or we may misjudge

our costs. As of December 31, 2014, we had no committed sources of capital and do not know whether additional financing will be available when needed, or, if available, that the terms will be

favorable. We cannot assure that our cash reserves together with any subsequent funding will be sufficient for our capital requirements. The failure to satisfy our capital requirements will adversely

affect our business, financial condition, results of operations and prospects.

We

may seek additional funding through strategic alliances, private or public sales of our securities, debt financing or licensing all or a portion of our technology or through other

means. Such funding

may significantly dilute existing shareholders, subject us to contractual restrictions such as operating or financial covenants or limit our rights to our technology.

We currently have no meaningful source of revenue.

In 2014 and 2012, we generated no revenue. In 2013, we generated other revenue from the modification of a previously granted license of

our IPLEX technology. Unless we can execute one or more revenue generating transactions or successfully obtain regulatory approval for and commercialize ARIKAYCE, we will have no material sources of

operating revenue. We expect to continue to incur substantial additional operating losses for at least the next several years as we continue to develop and seek to commercialize ARIKAYCE.

S-16

Table of Contents

If we are not successful in our efforts to evaluate potential future IPLEX initiatives and to

identify and engage in possible out-licensing opportunities for IPLEX, we may not derive any future revenues from IPLEX.

IPLEX is no longer a development priority for us. We no longer have protein development capability or the in-house capability to

manufacture IPLEX. Accordingly, we continue to evaluate possible out-licensing opportunities for IPLEX. We may have difficulty identifying possible markets and prospective partners for out-licensing.

Even if we are able to enter into out-licensing arrangements, we may not derive any revenue from those arrangements.

Our loan agreement with Hercules Technology Growth Capital, Inc. ("Hercules") contains

covenants that impose restrictions on our operations that may adversely affect our ability to optimally operate our business or to maximize shareholder value.

Our loan agreement with Hercules contains various restrictive covenants, including restrictions on our ability to incur additional

debt, transfer or place a lien or security interest on our assets, including our intellectual property, merge with or acquire other companies, redeem or repurchase any shares of our capital stock or

pay cash dividends to our stockholders. The loan

agreement also contains certain other covenants (including limitations on other indebtedness, liens, acquisitions, investments and dividends), and events of default (including payment defaults,

breaches of covenants following any applicable cure period, a material impairment in the perfection or priority of the lender's security interest or in the collateral, and events relating to

bankruptcy or insolvency). Upon the occurrence of an event of default, a default interest rate of an additional 5% may be applied to the outstanding loan balances, and the lender may terminate its

lending commitment, declare all outstanding obligations immediately due and payable, and take such other actions as set forth in the Loan Agreement. In addition, pursuant to the Loan Agreement, the

lender has the right to participate, in an amount of up to $1.0 million, in certain future private equity financing(s).

Under

our loan agreement with Hercules, we have borrowed $25.0 million as of December 31, 2014, bearing interest of 9.25%. The maturity date for the outstanding debt is

January 1, 2016, provided, however, that if a "Financing Event" occurs prior to December 31, 2015, we may elect to extend such maturity date to January 1, 2018. A "Financing

Event" means that we have (1) received unrestricted and unencumbered (other than liens or encumbrances evidenced by subordinated indebtedness) net cash proceeds in an amount equal to or greater

than Ninety Million Dollars ($90 million), resulting from (a) the issuance and sale by us of our equity securities, and/or (b) subordinated indebtedness, and/or (c) upfront

cash payments paid to us in conjunction with a development and/or commercial partnership(s) and/or other corporate transactions, and (2) paid Hercules a fully-earned, non-refundable fee in the

amount of Two Hundred Fifty Thousand Dollars ($250,000). There is no guarantee we will be able to raise sufficient funds by December 31, 2015 to constitute a "Financing Event." Our borrowings

under the Loan Agreement are secured by a lien on our assets, excluding our intellectual property, and in the event of a default on the loan, the lender may have the right to seize our assets securing

our obligations under the Loan Agreement. The terms and restrictions provided for in the Loan Agreement may inhibit our ability to conduct our business and to provide distributions to our

stockholders. Future debt securities or other financing arrangements could contain negative covenants similar to, or even more restrictive than, the Hercules loan.

In process research and development (IPRD) currently comprises approximately 25% of our total

assets. A reduction in the value of our IPRD could impact our results of operations and financial condition.

As a result of the merger with Transave we recorded an intangible IPRD asset of $77.9 million and goodwill of

$6.9 million on our balance sheet. As a result of our clinical hold announced in late 2011 we recorded a charge of $26.0 million in the fourth quarter of 2011 and reduced the value of

IPRD to $58.2 million and reduced goodwill to zero. Other potential future activities or results could result in additional write-downs of IPRD, which would adversely affect our results of

operations.

S-17

Table of Contents

We may be unable to use our net operating losses.

We have substantial tax loss carry forwards for US federal income tax purposes. Our ability to fully use certain carry forwards

generated prior to December 2010 to offset future income or tax liability is limited under section 382 of the Internal Revenue Code of 1986, as amended. Changes in the ownership of our stock,

including those resulting from the issuance of shares of our common stock in this or future offerings or upon exercise of outstanding warrants or options, may limit or eliminate our ability to use

certain net operating losses in the future.

Risks Related to Regulatory Matters

We may not be able to obtain regulatory approvals for ARIKAYCE or any other products we develop in

the US, Europe or other countries. If we fail to obtain such approvals, we will not be able to commercialize our products.

We are required to obtain various regulatory approvals prior to studying our products in humans and then again before we market and

distribute our products. The regulatory review and approval processes in both the US and Europe require evaluation of preclinical studies and clinical studies, as well as the evaluation of our

manufacturing process. These processes are complex, lengthy, expensive, resource intensive and uncertain. Securing regulatory approval to market our products requires the submission of much more

extensive preclinical and clinical data, manufacturing information regarding the process and facility, scientific data characterizing our product and other supporting data to the regulatory

authorities in order to establish its safety and effectiveness. This process also is complex, lengthy, expensive, resource intensive and uncertain. We have limited experience in submitting and

pursuing applications necessary to gain these regulatory approvals.

Data

submitted to the regulators is subject to varying interpretations that could delay, limit or prevent regulatory agency approval. We may also encounter delays or rejections based on

changes in regulatory agency policies during the period in which we develop a product and the period required for review of any application for regulatory agency approval of a particular product. For

example, FDA has designated ARIKAYCE for Fast Track, Breakthrough Therapy and QIDP status, all programs intended to expedite or simplify the development and regulatory review of the drug. If we were

to lose the current designation under one or more of those programs, we could face delays in the FDA review and approval process.

The

Generating Antibiotic Incentives Now (GAIN) Act established incentives for the development of new therapies for serious and life-threatening infections by making streamlined priority

review and fast track processes available for drugs which the FDA designates as QIDPs. To qualify for designation as a QIDP according to the criteria established in the GAIN Act a product must be an

antibacterial or anti-fungal drug for human use intended to treat serious or life-threatening infections, including: those caused by an anti-fungal resistant pathogen, including novel or emerging

infectious pathogens; or caused by qualifying pathogens listed by the FDA in accordance with the GAIN Act. Under the fast track program generally, the sponsor of an IND may request FDA to designate

the drug candidate as a fast track drug if it is intended to treat a serious condition and fulfill an unmet medical need. FDA must determine if the drug candidate qualifies for fast track designation

within 60 days of receipt of the sponsor's request. Once FDA designates a drug as a fast track candidate, it is required to facilitate the development and expedite the review of that drug by

providing more frequent communication with and guidance to the sponsor.

Delays

in obtaining regulatory agency approvals could adversely affect the development and marketing of any drugs that we or any third parties develop. Resolving such delays could force

us or third parties to incur significant costs, could limit our allowed activities or the allowed activities of third parties, could diminish any competitive advantages that we or our third parties

may attain or could

S-18

Table of Contents

adversely

affect our ability to receive royalties, any of which could materially adversely affect our business, financial condition, results of operations or prospects.

To

market our products outside of the U.S. and Europe, we and any potential third parties must comply with numerous and varying regulatory requirements of other countries. The approval

procedures vary among countries and can involve additional product testing and administrative review periods. The time required to obtain approval in these other territories might differ from that