UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

10-K

[X]

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the fiscal year ended December 31, 2014

or

[ ]

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For

the transition period from _________ to _________

Commission

file number: 000-52444

PLASTIC2OIL,

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

90-0822950 |

| (State

or other jurisdiction of |

|

(IRS

Employer |

| incorporation

or organization) |

|

Identification

No.) |

20

Iroquois Street

Niagara

Falls, NY 14303

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number: (716) 278-0015

Securities

registered pursuant to Section 12(b) of the Act: None.

Securities

registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001 per share.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ]

No [X]

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes

[ ] No [X]

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report(s)),

and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not

be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference

in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller

reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer [ ] |

|

Accelerated

filer [ ] |

| Non-accelerated

filer [ ] |

|

Smaller reporting

company [X] |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No

[X]

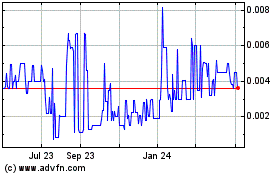

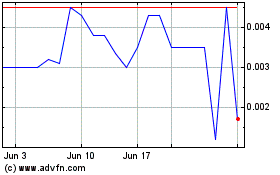

The

aggregate market value of the voting and non-voting common equity held by non-affiliates of the Registrant was approximately $11.1

million as of June 30, 2014 based upon the closing price of $0.10 per share on June 30, 2014.

As

of March 31, 2015, there were 120,244,157 shares of the Registrant’s common stock, $0.001 par value, outstanding.

Documents

Incorporated by Reference

Portions

of the registrant’s definitive Proxy Statement for the 2014 Annual Meeting of Stockholders (the “2015 Proxy Statement”),

which the registrant plans to file with the Securities and Exchange Commission within 120 days after December 31, 2014, are incorporated

by reference in Part III of this Form 10-K to the extent described herein.

PLASTIC2OIL,

INC.

Table

of Contents

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

annual report on Form 10-K (“Report”) contains “forward looking statements” within the meaning of applicable

securities laws. Such statements include, but are not limited to, statements with respect to management’s beliefs, plans,

strategies, objectives, goals and expectations, including expectations about the future financial or operating performance of

our Company and its projects, capital expenditures, capital needs, government regulation of the industry, environmental risks,

limitations of insurance coverage, and the timing and possible outcome of regulatory matters, including the granting of patents

and permits. Words such as “expect”, “anticipate”, “intend”, “attempt”, “may”,

“will”, “plan”, “believe”, “seek”, “estimate”, and variations of such

words and similar expressions are intended to identify such forward looking statements. These statements are not guarantees of

future performance and involve assumptions, risks and uncertainties that are difficult to predict.

These

statements are based on and were developed using a number of factors and assumptions including, but not limited to: stability

in the U.S. and other foreign economies; stability in the availability and pricing of raw materials, energy and supplies; stability

in the competitive environment; the continued ability of our Company to access cost effective capital when needed; and no unexpected

or unforeseen events occurring that would materially alter the Company’s current plans. All of these assumptions have been

derived from information currently available to the Company including information obtained by our Company from third party sources.

Although management believes that these assumptions are reasonable, these assumptions may prove to be incorrect in whole or in

part. As a result of these and other factors, actual results may differ materially from those expressed, implied or forecasted

in such forward looking information, which reflect our Company’s expectations only as of the date hereof.

Factors

that could cause actual results or outcomes to differ materially from the results expressed, implied or forecasted by the forward-looking

statements include risks associated with general business, economic, competitive, political and social uncertainties; risks associated

with changes in project parameters as plans continue to be refined; risks associated with failure of plant, equipment or processes

to operate as anticipated; risks associated with accidents or labor disputes; risks associated in delays in obtaining governmental

approvals or financing, or in the completion of development or construction activities; risks associated with financial leverage

and the availability of capital; risks associated with the price of commodities and the inability of our Company to control commodity

prices; risks associated with the regulatory environment within which our Company operates; risks associated with litigation including

the availability of insurance; and risks posed by competition. These and other factors that could cause actual results or outcomes

to differ materially from the results expressed, implied or forecasted by the forward looking statements are discussed in more

detail in the section entitled “Risk Factors” Part I, Item 1A of this Report and in “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of this Report.

Some

of the forward-looking statements may be considered to be financial outlooks for purposes of applicable securities legislation

including, but not limited to, statements concerning capital expenditures. These financial outlooks are presented to allow the

Company to benchmark the results of our Company’s Plastic2Oil business. These financial outlooks may not be appropriate

for other purposes and readers should not assume they will be achieved.

Our

Company does not intend to, and the Company disclaims any obligation to, update any forward-looking statements (including any

financial outlooks), whether written or oral, or whether as a result of new information, future events or otherwise, except as

required by law.

Unless

otherwise noted, references in this Report to “P2O” the “Company,” “we,” “our”

or “us” means Plastic2Oil, Inc., a Nevada corporation.

GLOSSARY

OF TECHNICAL TERMS

In

this filing, the technical terms, phrases, and abbreviations set forth below have the following meanings:

“ASTM”

means American Society for Testing and Materials, the entity responsible for the development and delivery of international

voluntary consensus standards.

“distillate”

means a product derived from petroleum-based hydrocarbons

“Fuel

Oil” means various ranges of Number 1 to 6 fuels distilled from crude oil, or inP2O’s case, distilled from plastic;

“Fuel

Oil No. 2” means a distillate heating oil similar to diesel fuel with the same cetane number, or measurement of combustibility

quality, as diesel fuel. This is generally obtained in the crude oil distillation process from the lighter cuts of crude oil.

In our process, it is the second fuel made in the conversion from plastic to oil;

“Fuel

Oil No. 6” means a high viscosity residual oil that requires preheating to 104 – 127 degree Celsius. It is generally

the material remaining after the more valuable cuts of crude oil have been boiled off. In our process, it is the first fuel made

in the conversion from plastic to oil;

“hydrocarbon”

means an organic compound consisting entirely of hydrogen and carbon;

“MACT”

means Maximum Achievable Control Technology, which are various degrees of emissions reductions that the EPA determines to

be achievable;

“Naphtha”

means a flammable liquid mixture of hydrocarbons covering the lightest and most volatile fraction of the liquid hydrocarbons

in petroleum with a boiling range of 60 to 200 degrees Celsius. In our process, it is the last liquid fuel made in the conversion

from plastic to oil;

“NESHAP”

means the National Emissions Standards for Hazardous Pollutants which are emissions standards set by the EPA for an air pollutant

that may cause an increase in fatalities or in serious irreversible and incapacitating illnesses; and

“Stack

Test” means a procedure for sampling a gas stream from a single sampling location at a facility, used to determine a

pollutant emission rate, concentration or parameter while the facility equipment is operating at conditions that result in the

measurement of the highest emission values approved by regulatory authorities;

“tipping

fees” means the charge levied on a given quantity of waste received at a landfill, recycling center or waste transfer

facility.

PART

I

ITEM

1. BUSINESS

Overview

We

manufacture processors which produce fuel products mainly from unsorted, unwashed waste plastics for distribution across a number

of markets. We continue to execute on our business strategy with the goal of becoming a leading manufacturer of processors and

other related equipment that transform waste plastic into ultra-clean, ultra-low sulphur fuel.

Our

P2O business has begun the transition from research and development to a commercial manufacturing and production business. We

plan to grow mainly from sale of processors first, and fuel seller second.

We

provide environmentally-friendly solutions through our processors and technologies. Our primary offering is our Plastic2Oil®,

or P2O®, solution, which is our proprietary process that converts waste plastic into fuel through a series of chemical reactions

(our “P2O business”). We collect mainly mixed plastics from commercial and industrial enterprises that generate large

amounts of waste plastic for use in our process. Generally, this waste plastic would otherwise be sent to landfills and its disposal

potentially can be quite costly for companies. We use this waste plastic as feedstock to produce Fuel Oil No. 2, Naphtha, and

Fuel Oil No. 6 for various uses by our customers. We own and operate our P2O processors and have the capability to produce and

store the fuels at, and ship from, our facilities in Niagara Falls, NY. We sell the fuels we produce to customers through two

main distribution channels, fuel wholesalers and directly to commercial and industrial end-users.

At

March 30, 2015, we had three fully-permitted operational P2O processors, one dedicated to research & development and two dedicated

to fuel production. All three processors are located at our Niagara Falls, NY facility, and our fourth and fifth processors were

in process of assembly for sale. For the reasons described in Item 7, Management’s Discussion and Analysis of Financial

Condition and Results of Operations, the three operational P2O processors have been idle since late December 2013.

For

financial reporting purposes, we operate in two business segments, (i) our P2O solution, which manufactures and sells processors

as well as sells the fuel produced through our processors (ii) data storage and recovery (the “Data Business”). As

part of our P2O business segment, we recently began to offer for sale built-to-order P2O processors for use at a customer’s

site, agreements have been executed on January 2, 2015, although no such sales have been completed to date. Previously, we operated

a chemical processing and cleaning business, known as Pak-It and a retail and wholesale distribution business known as Javaco,

Inc. As of December 31, 2012, we had exited both of these businesses and their results in all periods presented are classified

as discontinued operations. Our P2O business has been operating in a limited commercial capacity since December 2010 and we anticipate

that this line of business will account for a majority of our revenues in 2015 and periods thereafter. Historically, however,

our revenues have been partially derived from our other lines of business and products, Javaco and Pak-It, which are classified

in this Annual Report as discontinued operations. In the year ended December 31, 2014, we had total sales of approximately $59,017,

of which $46,111 were derived from our P2O business and $12,906 were derived from our Data Business. In the year ended December

31, 2013, we had total sales of $693,125 from our P2O business and $93,712 from our Data Business.

We

conduct our P2O business at our facilities located in Niagara Falls, New York. Our corporate address is 20 Iroquois Street, Niagara

Falls, NY 14303.

Organizational

History

We

were incorporated on April 20, 2006 under the laws of the State of Nevada under the name 310 Holdings Inc. (“310”).

On April 24, 2009, the Company’s founder, former CEO and Chief of Technology, John Bordynuik, purchased 63% of the issued

and outstanding shares of 310 and became our chairman and chief executive officer. On June 25, 2009, we purchased certain assets

from John Bordynuik, Inc., a corporation founded by Mr. Bordynuik. The assets acquired included tape drives, computer hardware,

servers and a mobile data recovery container to read and transfer data from magnetic tapes. From inception until August 2009,

we were a shell company within the meaning of the rules of the Securities and Exchange Commission. On August 24, 2009, we acquired

all of the outstanding shares of Javaco, Inc., a wholly owned subsidiary of Domark International, Inc. On September 30, 2009,

we acquired 100% of the issued and outstanding equity interests of Pak-It, LLC. We formed JBI (Canada) Inc. on February 9, 2010

for purposes of distributing Pak-It products in Canada. We formed Plastic2Oil of NY, #1, LLC on May 4, 2010, for the development

and commercialization of our Plastic2Oil business in Niagara Falls, NY.

On

October 5, 2009, we changed our corporate name to JBI, Inc.

On

August 24, 2009, the Company acquired Javaco, Inc. (“Javaco”), a distributor of electronic components, including home

theater and audio video products. On July 9, 2012, we announced the closure of our Javaco operations and sold substantially all

of its assets to an unrelated third party. In July 2012, the Company closed Javaco and sold substantially all its inventory and

fixed assets. The operations of Javaco have been classified as discontinued operations for all periods presented (See Note 15).

In

September 2009, the Company acquired Pak-It, LLC (“Pak-It”). Pak-It operated a bulk chemical processing, mixing, and

packaging facility. It also developed and patented a delivery system that packages condensed cleaners in small water-soluble packages.

During 2011, the Company initiated a plan to sell certain operating assets of Pak-It and subsequently sold Pak-It in February

2012, with an effective date of January 1, 2012. On February 10, 2012, we sold substantially all the assets of Pak-It. The operations

of Pak-It have been classified as discontinued operations for all periods presented (See Note 15).

In

December 2010, the Company entered into a twenty year lease for a recycling facility in Thorold, Ontario. During the period ended

December 31, 2013, the Company determined that it would no longer operate the facility and shut down all operations. The assets

and operations related to the recycling facility have been reclassified as discontinued operations for all periods presented (See

Note 16).

On

July 31, 2014, we changed our corporate name to Plastic2Oil, Inc. On January 6. 2015, we changed the names of our Canadian subsidiaries

from JBI (Canada) Inc. to Plastic2Oil (Canada), Inc. and from JBI RE ONE, Inc. to Plastic2Oil RE ONE, Inc.

Our

common stock is quoted on the OTCQB Market under the symbol “PTOI”.

Organizational

Chart

The

following chart outlines our corporate structure, as of March 31, 2015, and identifies the jurisdiction of organization of each

of our material subsidiaries. Each material subsidiary is wholly-owned by the company

| Plastic2Oil,

Inc. |

- |

Operates

our Data Recovery and Migration business and Parent company with corporate office in Niagara Falls, NY. |

| |

|

|

| Plastic2Oil

of NY #1, LLC |

- |

Operates our P2O

business in Niagara Falls, NY. |

| |

|

|

| Plastic2Oil

(Canada) Inc. |

- |

Conducts our P2O

business in Canada, including management of our fuel blending site. |

| |

|

|

| JBI

CDE, Inc. |

|

Non operating

subsidiary with no activity. |

| |

|

|

| Javaco,

Inc. |

|

Dicontinued non-operating

subsidiary. |

| |

|

|

| Pak-IT,

LLC |

|

Discontinued non-operating

subsidiary |

| |

|

|

| Plastic2Oil

Marine, Inc. |

|

Non-operating

subsidiary with no activity. |

Our

Primary Business - Plastic2Oil

P2O

Overview

Our

business focus is to sell processors that produce fuel products mainly from unsorted, unwashed plastics. We operate our processors

to test potential customer feedstock. We have years of significant operating data and have solved numerous challenges that vexed

the plastics-to-oil industry. Since inception we have produced approximately 670,000 gallons of fuel. Our P2O processors have

evolved into a modular solution with the completion of our third P2O processor in 2013. We use third party contract manufacturers

to supply us with many of the key modular components of our processors, including the kilns, distillation towers and other key

components that require specialized machining and fabrication.

Our

proprietary P2O process converts waste plastic into fuel through a series of chemical reactions. We developed this process in

2009 and began very limited commercial production in 2010 following our receipt of a consent order from the New York State Department

of Environmental Conservation (“NYSDEC”) allowing us to commercially operate our first large-scale P2O processor at

our Niagara Falls, New York facility. Currently, we have three fully-permitted operational P2O processors, which are capable of

producing Naphtha, Fuel Oil No. 2 and Fuel Oil No. 6, all of which are fuels produced to the specifications published by ASTM.

One fully-permitted P2O processor is dedicated to research & development activities. We have two additional processors in

the process of assembly offsite. Our P2O process is capable of producing two by-products, an off-gas similar to natural gas and

a petcoke carbon residue. We primarily use our off-gas product in our operations to fuel the burners in our P2O processors. We

sell our fuel products through two main distribution channels comprised of fuel wholesalers and directly to commercial and industrial

end-users.

We

shut down our fuel production late in the fourth quarter of 2013 due to severe cold weather that caused damage to condensers and

other components of our processors and we have not resumed fuel production due to the repair costs as well as our shift in strategy

toward manufacturing processors for sale, as opposed to producing and selling fuel products. Management estimates that the repair

of the processors will require the expenditure of between $175,000 and $200,000. At March 30, 2015, we lacked the working capital

or access to bank credit to make these repairs. We are reviewing our financing options, including the sale of shares of our common

stock or other securities, in order to allow us to obtain sufficient funds to make the required repairs and resume pilot operation

of our processors to support processor sales. Management currently anticipates that the processors will remain idle at least until

the third quarter of 2015 other than pilot runs to support processor sales. During the idle period, we significantly reduced our

headcount by furloughing our operations personnel but retained a small team to perform general repairs and maintenance on the

processors. Once the processors are 100% repaired, we expect a small increase in our headcount in order to resume fuel production.

We

believe our P2O process offers a cost-effective solution for businesses that currently have to pay to dispose of these types of

waste. Our P2O process accepts mainly unsorted, unwashed waste plastics. Although many sources of plastic waste are available,

we have focused our feedstock sources on primarily post-commercial and industrial waste plastic. Generally, we believe that this

waste stream is more costly for companies to dispose of, making it more readily available in large quantities and cheaper for

us to acquire than other potential types of feedstock.

Currently,

we understand that there are several plastic-to-oil processes operational globally. These other processes employ a wide range

of technologies and yield varying purities of fuel output. We believe that our process has many advantages over other commercially

available processes in that our P2O solution requires a comparatively lesser initial capital investment and yields high-quality,

ultra-low sulphur fuel, with no need for further refinement. Additionally, our process uses comparatively little energy and physical

space, which, in our view, makes it better suited for high-volume production and expansion to multiple sites.

P2O

Process and Operations

There

are various processes in existence for converting plastic and other hydrocarbon materials into products for use in the production

of fuels, chemicals and recycled items. These processes include: pyrolysis (conversion using dry materials at high pressure and

temperature in the absence of oxygen), catalytic conversion (conversion using a catalyst for stimulating a chemical reaction),

depolymerization (conversion using superheated water and high pressure and temperature) and gasification (conversion at high temperature

using oxygen or steam). Our patent-pending P2O conversion process involves the cracking of the plastic hydrocarbon chains at ambient

pressure and comparatively low temperature using a catalyst.

We

have developed our Plastic2Oil processors to be continuously running, energy-efficient and environmentally-friendly while converting

waste plastics into end-user ready, and ultra-clean, ultra-low sulfur fuels. The processors are periodically shut-down for maintenance

and residue removal. The fuels produced can be used directly by our customers without further refining or processing. Over a three

year period, we have scaled our processing operations from a one gallon processor to three processors, each permitted to feed

up to 4,000 pounds of feedstock per hour. Some of the milestones that we have reached include:

| |

● |

Manufacturing

and operating multiple processors at our Niagara Falls, NY site; |

| |

|

|

| |

● |

From

inception, the processors were designed with safety and green emissions as top priorities; |

| |

|

|

| |

● |

Standardization

and modularization of the components of our processors; |

| |

|

|

| |

● |

Ability

to continuously feed waste plastic 24 hours a day; |

| |

|

|

| |

● |

Approximately

86% of waste plastic by weight is converted to liquid fuel conversion; |

| |

|

|

| |

● |

Approximately

8% of waste plastic by weight is converted to gas and is used to fuel the process; |

| |

|

|

| |

● |

Operating

at atmospheric pressure, not susceptible to pinhole leaks and other problems with pressure and vacuum-based systems; |

| |

|

|

| |

● |

No

requirement for incinerators, thermal oxidizers or scrubbers and no stack monitoring is necessary; |

| |

|

|

| |

● |

Three

stack tests (two on the initial processor and one on the second processor) conducted by Conestoga-Rovers & Associates

(“CRA”), prove emissions are extremely low; |

| |

|

|

| |

● |

Process

validation by SAIC Energy, Environment & Infrastructure, LLC and IsleChem, LLC; and |

| |

|

|

| |

● |

Permitted

to operate three processors commercially in New York by the NYSDEC. |

Processor

Input

Waste

Plastics: We are able to feed mainly mixed unwashed waste plastics into the Plastic2Oil processors. Waste plastic is widely

available and we are focused on maximizing the types and densities of the plastic we procure for optimal processor performance.

Heat

Transfer Fluid: We are also able to include hydrocarbon based transfer fluid as feed into the Platic2Oil processors.

Processor

Output

We

are currently permitted to feed two tons, or 4,000 pounds, of waste plastic per hour into each processor by a continuous conveyor

belt where it is heated by a burner that mainly burns off-gases produced from the P2O process. Plastic hydrocarbons are cracked

into various shorter hydrocarbon chains and exit in a gaseous state. Any residue, metals and or non-usable substances remain in

the reactor and are periodically removed. Through our proprietary process, Fuel Oil No. 6, Fuel Oil No. 2, and Naphtha are condensed

from the reactor through the remainder of the process. The fuel output is then transferred to storage tanks automatically by the

system. Our process is mainly operated by an automated computer system that controls the conveyor feed rate, system temperatures,

off-gas systems and the pumping out of newly created fuel to storage tanks. The plastic to liquid fuel conversion is approximately

86% by weight. Therefore, 20 tons of plastic can be processed into approximately 4,100 gallons of fuel. At March 30, 2015, we

had three operational processors at our Niagara Falls, NY facility. One processor was dedicated to research & development

and the other two processors remained idle due to maintenance and repair issues.

Fuel

Produced: The fuel produced in our processors is ultra-low sulfur fuel and is ready for end-users without the need for further

refinement.

Off-gas:

Approximately 8-10% of waste plastics fed into the processors are converted to a mixture of hydrogen, methane, ethane, butane

and propane gas, which we call “off-gas”. Once our processors are in a state to begin the P2O process, they use their

own off-gas to fuel the burners in the process.

Residue:

There is approximately 2-4% residue from our process, which is petroleum coke or carbon black (which we call “petcoke”)

that needs to be removed on a periodic basis.

Feedstock

Our

P2O process primarily uses post-commercial and industrial waste plastic that might otherwise be sent to a landfill by the commercial

and industrial producers of such waste plastic. We believe that this can be costly for these producers due to the large volumes

of plastic waste that they generate. As such, our business model is premised on the processor’s ability to accept numerous

types of waste plastics from such sources at a relatively low cost. We believe that our processor ability to accept mainly mixed,

unwashed waste plastics is a significant advantage of our P2O process compared to similar operations in our industry.

Fuel

Products

Our

P2O process makes both light and heavy fuel products which are Naphtha, Fuel Oil No. 2 and Fuel Oil No. 6, as defined by ASTM.

Our process also generates two main by-products, a reusable off-gas similar to natural gas and a carbon residue known as petcoke.

Naphtha

is a very light fuel product that is used as a cutting component for both high and regular grade gasoline. Fuel Oil No. 2 is a

mid-range fuel commonly known as diesel and has numerous transportation, manufacturing and industrial uses. Fuel Oil No. 6 is

a heavy fuel generally used in industrial boilers and ships. Our process produces high quality, ultra-low sulphur fuels, without

the need for further refinement which enables fuel sales directly from the processors to the end-user.

The

reusable off-gas that is produced by the P2O process is used to fuel the burner that heats the entire processor.

P2O

Facilities

We

currently have one main operating facility (located in Niagara Falls, NY) that we use in our P2O business, as well as a second

facility, our fuel blending site (located in Thorold, Canada), for use in the future. These are briefly described below. Additional

information on our properties can be found in Item 2 of this report.

Niagara

Falls, NY facility: Our Niagara Falls, NY facility currently has two operating buildings, a 10,000 square foot building that currently

houses one commercial-scale P2O processor and one P2O processor devoted to research & development activities, and a 7,200

square foot building housing the third commercial-scale P2O processor. Our Niagara Falls operations are situated on eight acres

that can accommodate expansion of our operations. This facility also serves as the center of our research and development operations

and our administrative offices.

Blending

Site: We own a 250,000 gallon fuel-blending facility in Thorold, Ontario, Canada, which, when in use, would allow us to blend

and self-certify certain fuels that are produced from our process to meet government specifications.

Sales

and Distribution

Our

P2O business has begun the transition from research and development to a commercial manufacturing and production business. We

plan to grow mainly from sale of processors first, and fuel seller second.

We

sell our fuel products through two main channels: fuel brokers and direct to end-users. We have no long-term contracts for fuel

sales; rather, we sell our fuel through the issuance of routine purchase orders.

During

the years ended December 31, 2014 and 2013, 89.0%, and 81.0.0%, respectively, of total net revenues were generated from two and

four customers. As of December 31, 2014, and 2013 two, and three customers, respectively, accounted for 100.0%, and 77.0% of accounts

receivable.

Suppliers

The

principal goods that we require for our P2O business are the waste plastic that we use as feedstock for production of our fuels.

We collect waste plastics from commercial and industrial businesses that generate large amounts of this waste stream. As of March

30, 2015 we had approximately 327,000 pounds of waste plastic and approximately 10,000 gallons of heat transfer fluid available

in inventory as feedstock, to support the resumption of operations upon the repairs, as mentioned above.

We

also rely on third party manufacturers for the manufacture of many components of our processors including kilns and distillation

towers. During the years ended December 31, 2014, and 2013, 27.6%, and 26.4%, of total net purchases were made from four vendors.

As of December 31, 2014 and 2013, four suppliers, respectively, accounted for 38.0%, and 27.9% respectively, of accounts payable.

Licenses,

Permits and Testing

We

maintain the following permits and licenses in connection with the operation of our P2O business.

| License/Permit | |

Issuing

Authority | |

| Registration

Number | | |

Issue

date |

| Air Permit | |

NYSDEC | |

| 9-2911-00348/00002 | | |

06/30/2014 |

| Solid Waste Permit | |

NYSDEC | |

| 9-2911-00348/00003 | | |

06/30/2014 |

| Bulk Fuel Blending License | |

Ontario Technical Standards & Safety Authority | |

| 000184322 | | |

10/12/2014 |

| Waste Disposal Site | |

Ontario Ministry of the Environment | |

| A121029 | | |

Perpetual (subject to annual Environment reviews) |

In

2010, our P2O process and processors were tested by IsleChem, LLC, an independent chemical firm providing contract research and

development, manufacturing and scale-up services, using two small prototypes of our P2O processor. The IsleChem test results indicated

that our process is both repeatable and scalable. Following this testing, we assembled a large-scale P2O processor capable of

processing at least 20 metric tons of plastic per day. In September 2010, we had a Stack Test performed by Conestoga-Rovers &

Associates (“CRA”), an independent engineering and consulting firm, which concluded that, with a feed rate of 2,000

pounds of plastic per hour, our processor’s emissions were below the maximum emissions levels allowed by the NYSDEC simple

air permit, which is needed to commercially operate the P2O processor at that location. We used the CRA test results to apply

for the required operating permits and in June 2011 we received an Air State Facility Permit (“Air Permit”) and Solid

Waste Management Permit (“Solid Waste Permit”) for up to three processors at the Niagara Falls, NY facility. In December

2011, we had a second stack test performed by CRA for an increased rate of 4,000 pounds per hour. In January 2012, we received

a final emissions report from CRA confirming that emissions were considerably decreased with an increased feed rate. In December

2012, we had a stack test performed on the second processor.

The

emissions tests conducted by CRA on our processors are summarized in the following table:

| Emissions | |

Units[1] | | |

Original

Stack Test

(2010) – Processor #1 | | |

Final

Stack Test

(Dec. 2011) – Processor #1 | | |

Stack

Test

(Dec. 2012) – Processor #2 | |

| CO – Carbon Monoxide | |

| ppm | | |

| 3.16 | | |

| 3.1 | | |

| 3.7 | |

| SO 2 - Sulphur Dioxide | |

| ppm | | |

| 0.23 | | |

| 0.02 | | |

| 0.39 | |

| NOx – Oxides of Nitrogen | |

| ppm | | |

| 86.4 | | |

| 15.1 | | |

| 21.3 | |

| TNMHC – Total Non-Methane Hydrocarbons | |

| ppm | | |

| 0.25 | | |

| 3.92 | | |

| 0.62 | |

| PM – Particulate Matter | |

| Lbs./hr. | | |

| 0.016 | | |

| 0.002 | | |

| 0.012 | |

| Hexane | |

| Lbs./hr. | | |

| Not

tested | | |

| 0.00001 | | |

| 0.0013 | |

1“ppm”

means parts per million

Industry

Background

Alternative

fuels are generally considered to be any substances that can be used as fuel, other than conventional fossil fuels such as naturally

occurring oil, gas and coal. There have been many approaches taken to producing alternative fuels, including conversion of corn

oil, vegetable oil and non-food-based materials. These approaches have demonstrated varying degrees of commercial potential. Some

of the challenges that alternative fuel producers have faced include high feedstock supply costs, lower perceived value of fuel

product, higher capital costs and dependence on government regulations for economic viability.

We

believe our company is distinguishable from other producers of alternative or renewable fuels because our P2O solution represents

a process and product that is commercially viable and designed to provide immediate benefit for industries, communities and government

organizations with waste plastic recycling challenges. Our business model is premised on the need for a more efficient and cost-effective

alternative to disposing of waste plastic in jurisdictions where the cost of transporting and landfilling large amounts of plastic

is quite costly.

Competition

Our

P2O business has elements of both a recycling business and a fuel refiner/ production business, which makes it difficult to identify

and make direct comparisons to competitors. Both the recycling and energy sectors are characterized by rapid technological change.

Our future success will depend on our ability to achieve and maintain a competitive position with respect to technological advances

in both of these sectors. We believe that our business currently faces competition in the plastics-to-energy market, including

competition from Vadxx and Agilyx, each of which has developed alternative methods for obtaining and generating fuel from plastics.

See “Risk Factors—Risks Related to Our Business”. Because P2O solution end products include a variety of fuels,

we also face competition from the broader petroleum industry.

Business

Model

We

believe that our Plastic2Oil business model provides a unique proposition for both the supply side and the end-user side of the

waste-to-fuel value chain. Our P2O technology is positioned to link these two sides by offering economic incentives in both directions.

We believe P2O offers value to suppliers of waste plastic by saving transport and landfill tipping fees, and value to fuel end-users

by providing ultra-low sulphur green fuel. Given these incentives, we believe that our Plastic2Oil business will be sought after

by those industries that can benefit from the added value that we provide, thus allowing the potential for our company’s

growth through sale of processors.

Business

Strategy

Our

long-term strategy is to become the leading plastic-to-oil processor manufacturer. We operate our processors to demonstrate our

technology and processor capabilities for process improvement, for research and development activities and to test potential customer

feedstock. The key elements of our strategy to achieve this goal are as follows:

Marketing

Strategy

We

target post-commercial and industrial waste plastic partners. We believe this allows us to identify sources of large plastic waste

streams, such as industrial sites and material recovery facilities and recycling centers.. We also seek to partner with businesses

and municipalities that collect waste plastics. Our vision is to help redirect these waste plastic streams, preventing them from

entering landfills.

Manufacturing

and Procurement Strategy

Our

P2O business model allows us to simultaneously pursue sales to multiple commercial opportunities (partners) across the waste plastic

and fuel markets. Our P2O processors have evolved to be modular solutions with the completion of processor #3 in 2013. We use

third party contract manufacturers for the manufacture of many of the key modular components of our processors, including the

kilns, distillation towers as well as other key components that require specialized machining and fabrication. We will license

our P2O technology, including construction operation and maintenance of processors for operation at our partners’ sites.

Our strategy is to have our partners construct clusters of P2O processors at sources of large plastic waste streams, such as industrial

sites, material recovery facilities and recycling centers.

Feedstock

Procurement Strategy

Our

feedstock strategy is as follows:

| |

● |

Get

the Right Material to Maximize Throughput. Although the P2O processor can process many different types of plastic and

create consistent fuels, we will focus on the types of plastic that will maximize the machine’s productivity. This is

typically high density material. |

| |

|

|

| |

● |

Contract

for Long-Term Consistent Feedstock Supply. By contracting with our suppliers, we are able to gain commitments for consistent

flows of feedstock. This also allows us to more accurately forecast our feedstock supply and fuel outputs. An additional benefit

of contracting with suppliers is that we are able to rely on this material flow as it relates to our continued growth planning. |

| |

|

|

| |

● |

Cost

to the Processor. We look at all feedstock opportunities considering the “cost to the processor”. This means

we consider including the cost is the price we pay to the supplier, the cost of transportation or our costs to pre-process

the feedstock material, the critical thing is the total cost incurred for “ready to process” material. |

Competitive

Strengths

We believe

that our competitive strengths are as follows:

Our

processors convert unwashed waste plastics into “in specification fuels” ready for use by the customer. Our

process does not generate any waste water. The fuel is Halide free and there is no further need for refinement. The process does

not produce any hazardous waste.

In

addition to producing fuel, our P2O solution simultaneously addresses the problem of disposing of waste plastic. We offer

an alternative to disposing of waste plastic in a landfill. Our processors can accept mainly mixed, unwashed plastic feedstock.

In the United States and Canada, a substantial amount of plastic is currently considered waste and is disposed of in landfills,

resulting in tipping fees levied by the landfill or other waste disposal facility fees. We believe that the current low landfill

diversion rates for waste plastic in the United States and Canada, together with the costs of transporting and disposing of plastic

in bulk, present a significant opportunity to provide an alternative to conventional recycling and waste disposal.

The

P2O process provides a highly efficient means of converting plastic into fuel. Our proprietary P2O process and catalyst

provide a highly efficient means of converting plastic into fuel. Our business model depends on us being able to provide both

a cost-competitive means of disposing of waste plastic and an efficient and non-energy intensive means of producing fuel. Our

process requires comparatively minimal electricity to operate, and the energy balance of the process is positive, meaning that

more energy can be produced than is consumed by the process.

Low

capital costs and small footprint. We have designed the processors with a modular design with standardized components,

making construction of our processors relatively simple and cost effective. We have designed our processors to take up approximately

3,000 square feet of space, giving the processors a relatively small footprint. We believe that this design facilitates the construction

and operation of multiple processors on a single site. We estimate that the costs of constructing our processors on industrial

partner sites will be substantially less than the cost of constructing waste-to-fuel facilities offered by our competitors.

Lower

emissions

In

the United States, businesses and other producers of emissions are subject to various regulatory requirements, including the National

Emission Standards for Hazardous Air Pollutants, or “NESHAP.” These emission standards may be established according

to Maximum Achievable Control Technology requirements set by the EPA, often referred to as “MACT standards”. MACT

standards apply to a number of sources of emissions, including operators of boilers, process heaters and certain solid waste incinerators.

Because our P2O fuel products have ultra-low sulphur content, we believe that our P2O fuel can assist industrial partners with

meeting MACT requirements through reduced hazardous emissions.

Our

processors produce fuels that have very low sulphur content, which allows the end-user to potentially lower the emissions generated

by its operations while using our fuels. These lower emissions potentially could save the end-user from expensive environmental

compliance costs, stemming from such initiatives as the NESHAP regulations and more specifically the MACT standards for each pollution

source.

Validation

of repeatability and scalability of P2O processors.

Our

P2O business has been validated for repeatability and scalability by extensive testing by our customers and multiple independent

tests by outside consultants and third party laboratories.

Other

Businesses

Data

Recovery & Migration

In

June 2009, we purchased certain assets from John Bordynuik, Inc., a corporation founded by John Bordynuik, our former Chief Executive

Officer and former Chief of Technology. The assets acquired from John Bordynuik, Inc. included tape drives, computer hardware,

servers and a mobile data recovery lab to read and transfer data from magnetic tapes and these assets are used in our Data Recovery

& Migration business.

Magnetic

tapes were previously a primary media for data storage. Because of its cost effectiveness, magnetic tape was widely used by government,

scientific, educational and commercial organizations for decades. Over time, these tapes can become vulnerable to deterioration

when exposed to natural elements, which can render the tapes difficult to read or unreadable using the original tape-reading equipment.

Our Data Business involves reading old magnetic tapes, interpreting and restoring the data where necessary and transferring the

recovered data to storage formats used in current systems. The recovered data is verified for accuracy and returned to customers

in the media storage format of their choice. Our process gives customers the ability to conveniently catalogue and safely archive

difficult-to-retrieve data on readily accessible, contemporary storage media. Users of these services generally include businesses

or organizations that have historically stored information on magnetic tape, such as government agencies, oil and gas companies

and academic institutions.

The

process for data recovery was developed and is very highly dependent on Mr. John Bordynuik. The Data Business’s reliance

on Mr. Bordynuik has been a key driver to achieving revenue in 2014 and 2013. In light of our business strategy focus on our P2O

business, we anticipate that revenues and profits generated from our Data Business operations will represent a decreasing share,

if any, of our total revenues and profits in future reporting periods. Due to these factors, all related to the assets of the

Data Business was recorded as impaired in 2012.

Pak-It

From

September 2009 until February 2012, through Pak-It, we were engaged in the manufacture of cleaning chemicals. As previously reported,

we sold substantially all of the assets of this business in February 2012 because management felt that Pak-It’s business

was no longer aligned with our strategic focus on our P2O business. For all years reported, the results of operations of Pak-It

have been recorded as discontinued operation, as recorded in Footnote 16 of our Consolidated Financial Statements.

Javaco

From

August 2009 until July 2012, through Javaco, we were a retailer and wholesale distributor of equipment, hardware and tools for

the safety, maintenance and construction industries. As previously reported, in July 2012, we closed Javaco and liquidated substantially

all of the fixed assets and inventory because management felt that Javaco’s business was no longer aligned with our strategic

focus on our P2O business. For all years reported, the results of operations of Javaco have been recorded as discontinued operations,

as recorded in Footnote 16 of our Consolidated Financial Statements.

Intellectual

Property

To

ensure the protection of our proprietary technology, we have applied for patent protection for both the P2O process and P2O processor.

As of March 31, 2015, no patents have been issued. Management anticipates filing additional patent applications for various aspects

of our P2O process in the near future. A lack of patent protection could have a material adverse effect on our ability to gain

a competitive advantage for our process and processors, since it is possible that our competitors may be able to duplicate the

P2O process for their own purposes. We also rely on our trade secrets to provide protection from portions of our process and proprietary

catalyst. See “Risk Factors—Risks Related to Our Business”.

We

also hold a U.S. patent relating to our Data Business for the recovery of tape information.

Research

and Development

Given

our strategic focus on developing our P2O business, we anticipate that our research and development activities related to our

P2O processors and the construction, operation and systems management of those processors. Specifically, we will seek to increase

the operational capabilities and performance of our P2O processors as opportunities arise. Research and development expenditures

were $20,999, and $465,671 in 2014 and 2013, respectively.

Employees

As

of March 30, 2015, we employed 10 persons on a full-time basis, of which two were executive management, two were in finance and

administration, one was in procurement, sales and marketing, four were in operations and one was in technology/ research and development.

None of our employees are subject to a collective bargaining agreement and we believe that our labor relations are good.

Environmental

and Other Regulatory Matters

As

we further develop and commercialize our P2O business, we will be subject to extensive and frequently developing federal, state,

provincial and local laws and regulations, including, but not limited to those relating to emissions requirements, fuel production,

fuel transportation, fuel storage, waste management, waste storage, composition of fuels and permitting. Compliance with current

and future regulations could increase our operational costs. Management believes that the company is currently in substantial

compliance with applicable environmental regulations and permitting.

Our

operations require various governmental permits and approvals. We believe that we have obtained, or are in the process of obtaining,

all necessary permits and approvals for the operations of our P2O business; however, any of these permits or approvals may be

subject to denial, revocation or modification under various circumstances. Failure to obtain or comply with the conditions of

permits and approvals or to have the necessary approvals in place may adversely affect our operations and may subject us to penalties.

Company

Information

We

are a reporting company and file annual, quarterly and current reports, proxy statements and other information with the SEC. You

may read and copy these reports, proxy statements and other information at the SEC’s Public Reference Room at 100 F Street

N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 or e-mail the SEC at publicinfo@sec.gov for more information

on the operation of the public reference room. Our SEC filings are also available at the SEC’s website at http://www.sec.gov.

Our Internet address is http://www.plastic2oil.com. There we make available, free of charge, our Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports, as soon as reasonably practicable

after we electronically file such material with, or furnish such material to, the SEC.

ITEM

1A. RISK FACTORS

The

following risk factors should be considered in evaluating our businesses and future prospects. These risk factors represent what

we believe to be the known material risk factors with respect to our business and our company. Our businesses, operating results,

cash flows and financial condition are subject to these risks and uncertainties, any of which could cause actual results to vary

materially from recent results or from anticipated future results.

Risks

Related to our Business

We

are an early stage company with a history of net losses, and we may not achieve or maintain profitability.

We

have incurred net losses since our inception, including losses of $6,801,519 and $13,234,265 in 2014 and 2013, respectively. We

expect to incur losses and potentially have negative cash flow from operating activities for the near future. We have divested

of our significant non-core businesses, which historically had generated revenues for the Company and have transitioned our focus

solely on the development of our P2O business. To date, our revenues from our P2O business have been limited and we expect to

invest significant additional capital in the further development and expansion of our P2O business and for marketing and general

and administrative expenses associated with our planned growth and management of operations as a public company. As a result,

even if our revenues increase substantially, we expect that our expenses could exceed revenues for the foreseeable future. It

is not certain when we will achieve profitability. If we fail to achieve profitability, or if the time required to achieve profitability

is longer than we anticipate, we may not be able to continue our business. Even if we do achieve profitability, we may not be

able to sustain or increase profitability on a quarterly or annual basis. We may experience significant fluctuations in our revenues,

significantly driven in part by the long negotiation periods, market price of fuel and we may incur losses from period to period.

The impact of the foregoing may cause our operating results to be below the expectations of investors and securities analysts,

which may result in a decrease in the market value of our securities.

We

have a limited operating history and are focused on our P2O business, which may make it difficult to evaluate our current business

and predict our future performance.

After

divesting certain non-core business lines, we are solely focused on our P2O business and our limited operating history may make

it difficult to evaluate our current business and predict future performance as we continue to expand and grow, as well as modify

the current processors to become more efficient. Additionally, with the shutdown of our regional recycling center in 2013 and

the divestitures of Pak-It and Javaco in 2012, our historical results are not indicative of future revenues. Any assessment of

our current business and predictions about our future success or viability may not be as accurate as otherwise possible if we

had a longer operating history. We have encountered, and may continue to encounter risks and difficulties frequently experienced

by growing companies in rapidly changing industries. If we do not address these risks successfully, our business could be harmed.

Our

process and processors may fail to produce fuel at the volumes we expect.

A

key component of our business strategy is to market our processors that produce a viable high quality fuel to wholesalers and

industrial end users. Even with a reliable supply of sufficient volumes of waste plastic, our and ours customer processors may

fail to perform due to mechanical failure or unscheduled maintenance resulting in potentially significant downtime. Our processors

do not have a long operating history, and accordingly the equipment and systems in any given processor may not operate as planned

or for as long as expected based on preliminary testing and trials.

We

may be required to replace parts more often than expected due to excessive wear and tear or malfunction due to their use during

the evolution of our process. Replacement of parts or components of the processor could result in additional unplanned downtime,

resulting in lower fuel volume productions.

Different

feedstock may result in different fuel yields including potentially higher production of off-gas or petcoke residue, which would

proportionately reduce the amount of salable fuels produced. The presence of contaminants in our feedstock could reduce the purity

of the fuel that we produce and require further investment in more costly separation processes or equipment. Additionally, contaminants

that are present in the feedstock could result in damage to the processor which would cause unplanned downtime and lower than

expected fuel volumes.

Unexpected

problems with either the processor or our feedstock supplies may force us to cease or delay production and the time and costs

involved with such delays may be significant. Any or all of these risks could prevent us from achieving the production volumes

and yields, and producing fuel at the costs, necessary to achieve profitability from our business. Failure to achieve expected

production volumes and yields, or achieving them only after significant additional expenditures, could substantially harm our

financial condition and operating results.

We

need substantial additional capital in the future in order to develop our business.

Our

future capital requirements will be substantial, particularly as we continue to develop our P2O business. We believe that our

current cash and cash equivalents will not allow us to expand commercial operations at the Niagara Falls, NY Facility. Because

the costs of developing the P2O business on a commercial scale are highly contingent on our approach to commercialization, and

are subject to many variables, including site-specific development costs and the number of processors to be placed at a given

location, we cannot reliably reasonably estimate the amount of capital required to expand the P2O business beyond the Niagara

Falls, NY facility; thus processor manufacturer first, and fuel seller second. If we are successful in achieving our plans to

enter into other P2O industrial partnerships, we may require significant additional funding to execute such partnerships and may

not be able to rely on funding through our own earnings. Funding would be required for constructing P2O processors, site specific

build-outs and developing other aspects of our business with our industrial partners.

To

date, we have funded our operations primarily through private offerings of equity securities. If future financings involve the

issuance of equity securities, our existing stockholders could suffer dilution. If we were able to raise debt financing to expand

our operations, we may be subject to restrictive covenants that could limit our ability to conduct our business. Our plans and

expectations may change as a result of factors currently unknown to us, and we may need additional funds sooner than planned.

We may also choose to seek additional capital sooner than required due to favorable market conditions or strategic considerations.

Our future

capital requirements will depend on many factors, including:

| |

● |

the

financial success of our P2O business and sale of processors; |

| |

|

|

| |

● |

the

timing of, and costs involved in, entering into agreements with suitable industrial partners, and the timing and terms of

those agreements; |

| |

|

|

| |

● |

the

cost of constructing P2O processors and the amount of other capital expenditures related to site development; |

| |

|

|

| |

● |

our

ability to negotiate distribution or further sale agreements for the processors we manufacture, and the timing and terms of

those agreements; and |

| |

|

|

| |

● |

the

timing of, and costs involved in obtaining, the necessary government or regulatory approvals and permits by our customers. |

Additional

funds may not be available when we need them, on terms that are acceptable to us, or at all. If funds are necessary or required

and are not available to us on a timely basis, we may delay, limit, reduce or terminate:

| |

● |

our research and

development activities; |

| |

|

|

| |

● |

our plans to expand

our business through industrial partnerships; |

| |

|

|

| |

● |

our activities

in negotiating agreements necessary in connection with the commercial scale operation of the P2O business; and |

| |

|

|

| |

● |

the development

of the P2O business, generally. |

If

we fail to raise sufficient funds and continue to incur losses, our ability to fund our operations, construct processors, enter

into agreements with suitable industrial partners, take advantage of other strategic opportunities and otherwise develop our business

could be significantly limited. We may not be able to raise sufficient additional funds on terms that are favorable or acceptable

to us, if at all. If adequate funds are required for operations and are not available, we may not be able to successfully execute

our business plan or continue our business.

Our

future success is dependent on being able to attract and retain qualified management and personnel.

We

will require additional expertise in specific areas applicable to our P2O business and will require the addition of new personnel,

and the development of additional expertise by existing personnel. The inability to attract talented personnel with appropriate

skills or to develop the necessary expertise could impair our ability to develop and grow our business.

The

loss of any key members of our management team or the failure to attract or retain qualified management and personnel who possess

the requisite expertise for the conduct of our business could prevent us from further developing our businesses according to our

current strategy. We may be unable to attract or retain qualified personnel in the future due to the intense competition for qualified

personnel amongst technology-based businesses, or due to the unavailability of personnel with the qualifications or experience

necessary for our business. Competition for business, financial, technical and other personnel from numerous companies and academic

and other research institutions may limit our ability to attract and retain such personnel on acceptable terms. If we are unable

to attract and retain the necessary personnel to accomplish our business objectives, we may experience staffing constraints that

will adversely affect our ability to meet the demands of our industrial partners and customers in a timely fashion or to support

continued development of our P2O business.

Competitors

and potential competitors who have greater resources and experience than we do may develop processors and technologies that make

ours obsolete or may use their greater resources to gain market share at our expense.

Our

P2O business has elements of both a recycling business and a fuel sales business. The recycling and energy sectors are characterized

by rapid technological change. Our future success will depend on our ability to maintain a competitive position with respect to

technological advances. Our P2O business faces mild competition in the plastics-to-energy market, including competition from Vadxx,

and Agilyx, who have each developed alternative methods for obtaining and generating fuel from plastics.

Our

P2O business faces competition in acquiring feedstock, mainly because there are other technologies and processes that are being

developed and/or commercialized to offer recycling solutions for plastic. Additionally, there is significant competition from

businesses in the energy sector that sell fuel, including both traditional producers and alternative fuel producers. Companies

in the fuel sales industry may be able to exert economies of scale in the fuels market to limit the success of our fuel sales

business. We believe that our business is more appealing in both the recycling sector and the fuel sector due to its green aspect.

Technological developments by any form of competition could result in our processors and technologies becoming obsolete.

In

addition, various governments have recently announced a number of spending programs focused on the development of clean technologies,

including alternatives to petroleum-based fuels and the reduction of carbon emissions. Such spending programs could lead to increased

funding for our competitors or a rapid increase in the number of competitors within these markets.

Our

limited resources relative to many of our competitors may cause us to fail to anticipate or respond adequately to new developments

and other competitive pressures. This failure could reduce our competiveness and market share, adversely affect our results of

operations and financial position and prevent us from obtaining or maintaining profitability.

The

effectiveness of our business model may be limited by the availability or potential cost of plastic feedstock sources.

Our

P2O business model depends on sale of processors. However, our customers may delay procurement due to the availability of waste

plastic obtained at relatively low cost to be used as a feedstock to produce o fuel products. If the availability of feedstock

decreases, or if our customers are required to pay substantially more than is reasonable to become profitable for feedstock, this

could reduce their fuel production and/or potentially reduce theirr profit margins if they are forced to use alternative, more

costly measures to procure feedstock. It is possible that an adequate supply of feedstock may not be available for the customerprocessors

to meet daily processing capacity. This could have a materially adverse effect on our customers financial condition and operating

results.

Our

P2O financial results will also be dependent on the operating costs of our processors, including costs for feedstock and the prices

at which we are able to sell our end products. Volatility in both the pricing of feedstock as well as the market price for fuels

could have an impact on this relationship. General economic, market, and regulatory factors may influence the availability and

potential cost of waste plastic. These factors include the availability and abundance of waste plastic, government policies and

subsidies with respect to waste management and international trade and global supply and demand. The significance and relative

impact of these factors on the availability of plastic is difficult to predict.

We

will, for the very near future, depend on one production facility for revenues related to our business. Therefore, any operational

disruption could result in a reduction of our fuel production volumes.

A

significant portion of our anticipated revenue for fiscal 2015 will be derived from processor sales, as well as from the sale

of fuel that we produce at our Niagara Falls, NY Facility. We will incur additional expenses to increase production at that facility

and any failure to produce fuel at anticipated volumes and costs would adversely affect our revenues, free cash flow and potential

ability to build other planned production facilities. Such failure would adversely affect our business, financial condition and

results of operations.

Unforeseen

manufacturing issues or processor downtime could have significant adverse impact on our business.

Our

business and strategic growth plans rely on assumptions of processor uptime reaching certain levels in which ample fuel can be

produced to meet the needs of our customers and provide us with adequate operating cash flow to cover our cost of operating. Unforeseen

manufacturing issues with the processors or unscheduled downtime due to mechanical failure, low quality feedstock, severe weather

conditions or unexpected issues with the processors could have a material adverse impact on our fuel production and operating

results. In addition, manufacturing and/ or fabrication delays with respect to additional processors could cause our revenues

and fuel production to be lower than anticipated.

We

may have difficulties gaining market acceptance and successfully marketing our processors or fuel to our customers.

A

key component of our business strategy is to market our processors and fuel as a viable high quality fuel to wholesalers and industrial

end users. If we fail to successfully market our processors or fuel or the targeted customers do not accept it, our business,

financial condition and results of operations will be materially adversely affected.

To

gain market acceptance and successfully market our processors and fuel, we must effectively demonstrate the advantages of using

P2O fuel over other fuels, including conventional fossil fuels, biofuels and other alternative fuels and blended fuels. We must

show that P2O fuel is a direct replacement for fossil fuels. We must also overcome marketing and lobbying efforts by producers

of other fuels, many of whom have greater resources than we do. If the markets for our processors and fuel do not develop as we

currently anticipate, or if we are unable to penetrate these markets successfully, our revenue and revenue growth rate could be

materially and adversely affected.

Pre-existing

contractual commitments and skepticism of new production methods for fuels may hinder market acceptance of our processors and

fuel.

Adverse

public opinions concerning the alternative fuel industry in general could harm our business.

The

plastic-to-fuel industry is new, and general public acceptance of this method of recycling and fuel generation is uncertain. Public

acceptance of P2O fuel as a reliable, high-quality alternative to traditionally refined petroleum fuels may be limited or slower

than anticipated due to several factors, including:

| |

● |

public

perception issues associated with the fact that P2O fuel is produced from waste plastics; |

| |

|

|

| |

● |

public

perception that the use of P2O fuel will require excessive burner, boiler or engine modifications; |

| |

|

|

| |

● |

actual

or perceived problems with P2O fuel quality or performance; and |

| |

|

|

| |

● |

to

the extent that P2O fuel is used in transportation applications, concern that using P2O fuel will void engine warranties. |

Such

public perceptions or concerns, whether substantiated or not, may adversely affect the demand for our fuels, which in turn could

decrease our sales, harm our business and adversely affect our financial condition.

A

decline in the price of petroleum products may reduce demand for our P2O fuels and may otherwise adversely affect our business.

We

anticipate that our fuels will be marketed as alternatives to their corresponding conventional petroleum product counterparts,

such as heating oil, diesel fuel and naphtha. If the prices of these products fall, we may be unable to produce products that

are cost-effective alternatives to conventional petroleum products. Declining oil prices, or the perception of a future decline

in oil prices, may adversely affect the prices we can obtain from our potential customers or prevent potential customers from

entering into agreements with us to buy our products. During sustained periods of lower oil prices, we may be unable to sell some

of our fuel products, which could materially and adversely affect our operating results.

In

addition, recent discoveries and drilling of shale gas deposits has caused a general decrease in natural gas prices which could

cause commercial and industrial fuel users to switch from using petroleum-based products to natural gas to power their equipment,

machinery and operations. In such case, demand for our fuel products may decline. Any decline in demand for petroleum-based products

could materially and adversely affect our results from operation.

Our

operations are subject to various regulations, and failure to obtain necessary renewed permits, licenses or other approvals, or

failure to comply with such regulations, could harm our business, results of operations and financial condition.

We

are, and may become subject to, various federal, state, provincial, local and foreign laws, regulations and approval requirements

in the United States, Canada and other jurisdictions, including those relating to the discharge of materials or pollutants into

the air, water and ground, the generation, storage, handling, use, transportation and disposal of waste materials, and the health

and safety of our employees.

The

Company currently possesses an Air Permit and Solid Waste Permit for up to three processors at the Niagara Falls, NY facility.

Failure to maintain these permits on terms and conditions acceptable to and achievable by us, or at all, could affect the commercial

viability of the Niagara Falls, NY facility, which could have a material adverse effect on our business, financial condition and

results of operations.

As

we implement our growth strategy, our planned P2O business will require additional permits, licenses or other approvals from various

governmental authorities. Our ability to obtain, amend, comply with, sustain or renew such permits, licenses or other approvals

on acceptable, commercially viable terms may change, as could the regulations and policies of applicable governmental authorities.

Our inability to obtain, amend, comply with, sustain or renew such permits, licenses or other approvals may have a material adverse

effect on our business, financial condition and results of operations.

Any

fuels developed using our P2O process will be required to meet applicable government regulations and standards. Any failure to

meet these standards and/or future regulations and standards could prevent or delay the commercialization or sale of any fuels

developed using our P2O process or subject us to fines and other penalties.

All

phases of designing, constructing and operating fuel production facilities present environmental risks and hazards. Among other

things, environmental legislation provides for restrictions and prohibitions on spills and discharges, as well as emissions of

various substances produced in association with fuel operations. Legislation also requires that sites be operated, maintained,

abandoned and reclaimed in such a way that would satisfy applicable regulatory authorities. Compliance with such legislation can