UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 31, 2015

SPANISH BROADCASTING SYSTEM, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

000-27823 |

|

13-3827791 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

7007 N.W. 77th Avenue, Miami, Florida |

|

33166 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(305) 441-6901

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d‑2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e‑4(c)) |

Item 2.02-Results of Operations and Financial Condition.

On March 31, 2015, Spanish Broadcasting System, Inc. (the “Company”) issued a press release announcing its financial results for the quarter- and year-ended December 31, 2014. A copy of the press release is attached hereto as Exhibit 99.1.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

99.1 |

|

Press Release of Spanish Broadcasting System, Inc., dated March 31, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SPANISH BROADCASTING SYSTEM, INC.

(Registrant) |

|

|

|

|

|

March 31, 2015 |

By: |

|

/s/ Joseph A. García |

|

|

|

|

Joseph A. García |

|

|

|

|

Chief Financial Officer, Chief Administrative

Officer, Senior Executive Vice President and Secretary |

Exhibit Index

|

Exhibit No. |

|

Description |

|

99.1 |

|

Press Release of Spanish Broadcasting System, Inc., dated March 31, 2015. |

Exhibit 99.1

SPANISH BROADCASTING SYSTEM, INC. REPORTS

RESULTS FOR THE FOURTH QUARTER AND YEAR END 2014

MIAMI, FLORIDA, March 31, 2015 – Spanish Broadcasting System, Inc. (the “Company” or “SBS”)

(NASDAQ: SBSA) today reported financial results for the quarter- and year-ended December 31, 2014.

Financial Highlights

* Please refer to the Non-GAAP Financial Measures section for a definition of OIBDA and a reconciliation from OIBDA to the most directly comparable GAAP financial measure.

Discussion and Results

“During the fourth quarter, we made continued progress in strengthening our content and executing our plan to strengthen our multi-media offerings,” commented Raúl Alarcón, Jr., Chairman and CEO. “Our AIRE Radio Networks platform continued to expand its reach, content offerings and advertising client base according to our roll-out strategy and we further strengthened our digital platform and capabilities. Our radio stations have also continued to deliver consistently strong ratings across the nation’s largest Hispanic media markets. Going forward, we remain focused on expanding our audience shares and delivering compelling multi-platform advertising opportunities that connect brands with the rapidly growing Hispanic population.”

Quarter End Results

For the quarter-ended December 31, 2014, consolidated net revenues totaled $36.3 million compared to $37.5 million for the same prior year period, resulting in a decrease of $1.2 million or 3%. Our radio segment net revenues decreased $0.6 million or 2%, due to decreases in national, local and barter sales, which were partially offset by increases in network sales and special events. Our national sales decrease occurred throughout most of our markets, with the exception of our

|

|

Spanish Broadcasting System, Inc. |

Page 2 |

Miami market. Our local sales decreased in our Puerto Rico, Los Angeles and San Francisco markets and the decrease in barter sales occurred throughout most of our markets. Our network sales increase was directly related to our new “AIRE Radio Networks” advertising platform, which we launched on January 1, 2014. Our television segment net revenues decreased $0.6 million or 13%, due to the decreases in paid-programming, national spot sales and barter sales.

Consolidated OIBDA, a non-GAAP measure, totaled $12.1 million compared to $10.7 million for the same prior year period, representing an increase of $1.4 million or 13%. Our radio segment OIBDA increased $1.2 million or 10%, primarily due to the decrease in operating expenses of $1.7 million, partially offset by the decrease in net revenues of $0.5 million. Radio station operating expenses decreased mainly due to decreases in local and national commissions, legal settlements, barter expenses, and compensation & benefits. Offsetting these decreases were special event expenses and expenses related to our new AIRE Radio Networks such as network-affiliate station compensation and employee compensation & benefits. Our television segment OIBDA increased $0.5 million, due to the decrease in operating expenses of $1.1 million, partially offset by the decrease in net revenues of $0.6 million. Television station operating expenses decreased primarily due to decreases in production costs, professional fees, taxes & licenses, compensation & benefits and ratings services. Our corporate expenses increased $0.3 million or 14%, mostly due to an increase in compensation & benefits.

Operating income totaled $10.8 million compared to $9.4 million for the same prior year period, representing an increase of $1.4 million or 15%. This increase in operating income was primarily due to the decrease in operating expenses, which was partially offset by a decrease in net revenues.

Year End Results

For the year ended December 31, 2014, consolidated net revenues totaled $146.3 million compared to $153.8 million for the same prior year period, resulting in a decrease of $7.5 million or 5%. Our television segment net revenues decreased $4.5 million or 22%, due to the decreases in special events revenue, paid-programming and national spot sales. Our radio segment net revenues decreased $3.0 million or 2%, due to the decreases in national and barter sales, which was offset by an increase in network sales. Our national sales decrease occurred throughout all of our markets and our barter sales decrease occurred in most of our markets. Our network sales increase was directly related to our new “AIRE Radio Networks” advertising platform, which we launched on January 1, 2014.

Consolidated OIBDA, a non-GAAP measure, totaled $39.1 million compared to $44.4 million for the same prior year period, representing a decrease of $5.3 million or 12%. Our radio segment OIBDA decreased $3.8 million or 7%, primarily due to the decrease in net revenues of $3.0 million and the increase in operating expenses of $0.8 million. Radio station operating expenses increased mainly due to expenses related to our new AIRE Radio Networks such as, network-affiliate station compensation and employee compensation & benefits. Additionally, special event expenses, professional fees, and music licenses fees increased. Our television segment OIBDA decreased $1.1 million, due to the decrease in net revenues of $4.5 million, which were partially offset by the decrease in station operating expenses of $3.4 million. Television station operating expenses decreased primarily due to decreases in special event expenses, rating services, taxes & licenses, barter and commissions. Our corporate expenses increased by $0.4 million or 4%, mostly due to an increase in compensation & benefits, which was offset by a decrease in professional fees and travel & entertainment expenses.

Operating income totaled $35.3 million compared to $38.3 million for the same prior year period, representing a decrease of $3.0 million or 8%. This decrease in operating income was primarily due to the decrease in net revenues, which was partially offset by a decrease in operating expenses.

|

|

Spanish Broadcasting System, Inc. |

Page 3 |

Fourth Quarter 2014 Conference Call

We will host a conference call to discuss our fourth quarter 2014 financial results on Wednesday, April 1, 2015 at 11:00 a.m. Eastern Time. To access the teleconference, please dial 412-317-6789 ten minutes prior to the start time.

If you cannot listen to the teleconference at its scheduled time, there will be a replay available through Monday, April 16, 2015, which can be accessed by dialing 877-344-7529 (U.S.) or 412-317-0088 (Int’l), passcode: 10061028.

There will also be a live webcast of the teleconference, located on the investor portion of our corporate Web site, at www.spanishbroadcasting.com/webcasts.shtml . A seven day archived replay of the webcast will also be available at that link.

About Spanish Broadcasting System, Inc.

Spanish Broadcasting System, Inc. is the largest publicly traded Hispanic-controlled media and entertainment company in the United States. SBS owns 20 radio stations located in the top U.S. Hispanic markets of New York, Los Angeles, Miami, Chicago, San Francisco and Puerto Rico, airing the Spanish Tropical, Regional Mexican, Spanish Adult Contemporary, Top 40 and Latin Rhythmic format genres. SBS also operates AIRE Radio Networks, a national radio platform which creates, distributes and markets leading Spanish-language radio programming to over 100 affiliated stations reaching 88% of the U.S. Hispanic audience. SBS also owns MegaTV, a television operation with over-the-air, cable and satellite distribution and affiliates throughout the U.S. and Puerto Rico. SBS also produces live concerts and events and owns 21 bilingual websites, including www.LaMusica.com, an online destination and mobile app providing content related to Latin music, entertainment, news and culture. For more information, visit us online at www.spanishbroadcasting.com.

This press release contains certain forward-looking statements. These forward-looking statements, which are included in accordance with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, may involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results and performance in future periods to be materially different from any future results or performance suggested by the forward-looking statements in this press release. Although the Company believes the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that actual results will not differ materially from these expectations. Forward-looking statements, which are based upon certain assumptions and describe future plans, strategies and expectations of the Company, are generally identifiable by use of the words “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” “might,” or “continue” or the negative or other variations thereof or comparable terminology. Factors that could cause actual results, events and developments to differ are included from time to time in the Company’s public reports filed with the Securities and Exchange Commission. All forward-looking statements made herein are qualified by these cautionary statements and there can be no assurance that the actual results, events or developments referenced herein will occur or be realized. The Company undertakes no obligation to update or revise forward-looking statements to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results.

(Financial Table Follows)

Contacts:

|

Analysts and Investors |

|

Analysts, Investors or Media |

|

|

José I. Molina |

|

Brad Edwards |

|

|

Vice President of Finance |

|

Brainerd Communicators, Inc. |

|

|

(305) 441-6901 |

|

(212) 986-6667 |

|

|

|

Spanish Broadcasting System, Inc. |

Page 4 |

Below are the Unaudited Condensed Consolidated Statements of Operations for the quarter- and year-ended December 31, 2014 and 2013.

|

|

Spanish Broadcasting System, Inc. |

Page 5 |

Non-GAAP Financial Measures

Operating Income (Loss) before Depreciation and Amortization, (Gain) Loss on the Disposal of Assets, net, and Impairment Charges and Restructuring Costs (“OIBDA”) is not a measure of performance or liquidity determined in accordance with Generally Accepted Accounting Principles (“GAAP”) in the United States. However, we believe that this measure is useful in evaluating our performance because it reflects a measure of performance for our stations before considering costs and expenses related to our capital structure and dispositions. This measure is widely used in the broadcast industry to evaluate a company’s operating performance and is used by us for internal budgeting purposes and to evaluate the performance of our stations, segments, management and consolidated operations. However, this measure should not be considered in isolation or as a substitute for Operating Income, Net Income, Cash Flows from Operating Activities or any other measure used in determining our operating performance or liquidity that is calculated in accordance with GAAP. In addition, because OIBDA is not calculated in accordance with GAAP, it is not necessarily comparable to similarly titled measures used by other companies.

Included below are tables that reconcile OIBDA to operating income (loss) for each segment and consolidated operating income (loss), which is the most directly comparable GAAP financial measure.

|

|

Spanish Broadcasting System, Inc. |

Page 6 |

|

|

Spanish Broadcasting System, Inc. |

Page 7 |

Non-GAAP Reporting Requirement under our Senior Secured Notes Indenture

Under our Senior Secured Notes Indenture, we are to provide our Senior Secured Noteholders a statement of our “Station Operating Income for the Television Segment,” as defined by the Indenture, for the twelve-month period ended December 31, 2014 and 2013, and a reconciliation of “Station Operating Income for the Television Segment” to the most directly comparable financial measure calculated in accordance with GAAP. In addition, we are to provide our “Secured Leverage Ratio,” as defined by the Indenture, as of December 31, 2014.

Included below is the table that reconciles “Station Operating Income for the Television Segment” to the most directly comparable GAAP financial measure. Also included is our “Secured Leverage Ratio” as of December 31, 2014.

|

|

Spanish Broadcasting System, Inc. |

Page 8 |

Unaudited Segment Data

We have two reportable segments: radio and television. The following summary table presents separate financial data for each of our operating segments:

|

|

Spanish Broadcasting System, Inc. |

Page 9 |

Selected Unaudited Balance Sheet Information and Other Data:

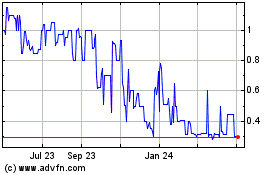

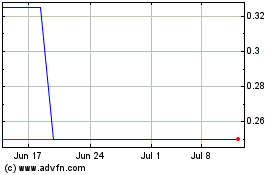

Spanish Broadcasting Sys... (PK) (USOTC:SBSAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Spanish Broadcasting Sys... (PK) (USOTC:SBSAA)

Historical Stock Chart

From Apr 2023 to Apr 2024