UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

__________

FORM 11-K

__________

(Mark One):

|

| |

[X] | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

|

| |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

_______________________________

Commission file number 1-13270

_____________________________________

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

Flotek Industries, Inc. 2012

Employee Stock Purchase Plan

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

Flotek Industries, Inc.

10603 W. Sam Houston Pkwy N., Suite 300

Houston, Texas 77064

FLOTEK INDUSTRIES, INC. 2012

EMPLOYEE STOCK PURCHASE PLAN

TABLE OF CONTENTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Administrator and Participants of the

Flotek Industries, Inc. 2012 Employee Stock Purchase Plan

We have audited the accompanying statements of net assets available for benefits of Flotek Industries, Inc. 2012 Employee Stock Purchase Plan (the “Plan”) as of December 31, 2014 and 2013, and the related statements of changes in net assets available for benefits for the years ended December 31, 2014 and 2013 and for the period from May 18, 2012 (inception) through December 31, 2012. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2014 and 2013, and the changes in net assets available for benefits for the years ended December 31, 2014 and 2013 and for the period from May 18, 2012 (inception) through December 31, 2012, in conformity with U.S. generally accepted accounting principles.

/s/ Hein & Associates LLP

Houston, Texas

March 31, 2015

FLOTEK INDUSTRIES, INC. 2012

EMPLOYEE STOCK PURCHASE PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS |

| | | | | | | |

| December 31, |

| 2014 | | 2013 |

ASSETS: | | | |

Participant contributions due from Flotek Industries, Inc. | $ | 260,680 |

| | $ | 223,475 |

|

Total assets | 260,680 |

| | 223,475 |

|

| | | |

LIABILITIES: | | | |

Stock purchase payable | 254,642 |

| | 221,808 |

|

Refunds due to participants | 6,038 |

| | 1,667 |

|

Total liabilities | 260,680 |

| | 223,475 |

|

| | | |

NET ASSETS AVAILABLE FOR BENEFITS | $ | — |

| | $ | — |

|

See accompanying Notes to Financial Statements.

2

FLOTEK INDUSTRIES, INC. 2012

EMPLOYEE STOCK PURCHASE PLAN

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

|

| | | | | | | | | | | |

| Year ended December 31, | | May 18, 2012 (inception) through December 31, 2012 |

| 2014 | | 2013 | |

ADDITIONS: | | | | | |

Participant contributions | $ | 927,578 |

| | $ | 760,290 |

| | $ | 160,286 |

|

| | | | | |

DEDUCTIONS: | | | | | |

Stock purchases for participants | (899,212 | ) | | (724,541 | ) | | (156,522 | ) |

Refund of contributions to participants | (28,366 | ) | | (35,749 | ) | | (3,764 | ) |

| | | | | |

CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS | — |

| | — |

| | — |

|

| | | | | |

NET ASSETS AVAILABLE FOR BENEFITS: | | | | | |

Beginning of period | — |

| | — |

| | — |

|

End of period | $ | — |

| | $ | — |

| | $ | — |

|

See accompanying Notes to Financial Statements.

3

FLOTEK INDSUTRIES, INC. 2012

EMPLOYEE STOCK PURCHASE PLAN

NOTES TO FINANCIAL STATEMENTS

Note 1 - DESCRIPTION OF THE PLAN

The following description of the Flotek Industries, Inc. 2012 Employee Stock Purchase Plan (the “Plan”) is provided for general informational purposes only. Plan participants should refer to the Plan document for a complete description of Plan provisions.

General

The Plan is designed to provide eligible employees of Flotek Industries, Inc. (the "Company") and its subsidiaries with an opportunity to purchase shares of the Company's common stock (“Flotek Stock”) at a discounted price through payroll deductions. The Plan was approved by the Company’s stockholders on May 18, 2012 and commenced operation on October 1, 2012. A total of 500,000 shares of Flotek Stock may be acquired by participants under the terms of the Plan.

The Plan has offering periods lasting three months. The first three-month offering period began October 1, 2012. Subsequent continuous offering periods commence on January 1, April 1, July 1, and October 1 of each year.

Administration

The Plan is administered by the Company's Board of Directors (the "Board"), unless the Board appoints a committee to administer the Plan. The Board has selected a third party administrator, Computershare Shareholder Services, Inc. (“Computershare”), to maintain the accounts of the Plan. The Board has selected Bank of America Merrill Lynch (“BAML”) to serve as the custodian of employee accounts. Computershare and BAML use information regarding employees’ payroll deductions to credit an account in each participant’s name with the number of full and fractional shares of Flotek Stock purchased by that participant’s contributions to the Plan.

Shares acquired by participants under the Plan may be shares issued by the Company from its authorized but unissued stock, treasury stock or shares purchased on the open market.

Eligibility

All employees who are customarily employed for at least twenty (20) hours per week by the Company or one of its subsidiaries are eligible to participate in the Plan, except that no employee may participate in the Plan if the employee owns or would own 5% or more of the outstanding shares of Flotek Stock.

There were approximately 194 and 164 participants in the Plan at December 31, 2014 and 2013, respectively.

Contributions

If an employee elects to participate in the Plan, the employee contributes to the Plan through payroll deductions an amount not less than one percent (1%) and not more than ten percent (10%) of such participants compensation, on an after tax basis, on each payday during the offering period. Employees may increase or decrease the deduction rate at the start of each offering period. A participant may withdraw from any offering period by providing written notice to the Company and any accumulated payroll deductions will be returned to him or her.

During the years ended December 31, 2014 and 2013 and the period from May 18, 2012 (inception) through December 31, 2012, participants purchased 42,570 shares, 44,313 shares and 15,139 shares, respectively, of Flotek Stock.

FLOTEK INDSUTRIES, INC. 2012

EMPLOYEE STOCK PURCHASE PLAN

NOTES TO FINANCIAL STATEMENTS

Purchases

Participant contributions are used to purchase Flotek Stock on the last business day of the quarterly offering period at 85% of the closing market price of the stock on that day. During any one offering period, participants may not purchase more than 1,000 shares of common stock. In addition, for each calendar year, an employee may not be granted purchase rights for Flotek Stock valued over $25,000, as determined at the time such purchase right is granted. Any payroll deductions collected from an employee that cannot be applied to the purchase of Flotek Stock because of limitations will be refunded to the employee.

Expenses

The Company pays all administrative expenses related to the purchase, custody and record keeping of the Flotek Stock held as part of the Plan. These expenses may include brokers’ commissions, transfer fees, administrative costs and other similar expenses. Expenses related to the disposition or transfer of shares from a participants’ account are borne by that participant.

Withdrawals and Termination of Employment

The Plan provides that a participant may withdraw from the Plan at any time and receive a refund of contributions for that offering period by completing a withdrawal form provided by the Company and submitting it to Human Resources. If an employee’s employment ends for any reason, whether voluntary or involuntary, including retirement or death, participation in the Plan automatically ends, and the Company will refund any payroll deductions under the Plan that have not yet been used to purchase shares.

Plan Termination

The Plan will terminate at the earliest of the following:

| |

• | the date the Board acts to terminate the Plan in accordance with the Plan provisions; or |

| |

• | the date when all of the shares available under the Plan have been purchased (as of December 31, 2014, the Company had approximately 398,000 shares available for future issuance). |

Upon termination of the Plan, all unapplied cash credits not already used to purchase Flotek Stock remaining in participants’ accounts will be refunded in cash to the participants. The Board may terminate or amend the Plan as deemed necessary or appropriate.

Employee Accounts

Computershare serves as the Plan's record keeper. Flotek Stock is held in custodial accounts by BAML. BAML maintains a separate account for each participant adding the number of full and fractional shares of Flotek Stock purchased with contributions and reflecting the total number of shares held. Each participant holding shares at BAML has the right to vote, receive dividends, transfer and dispose of his or her shares.

Note 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The Plan's financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America.

FLOTEK INDSUTRIES, INC. 2012

EMPLOYEE STOCK PURCHASE PLAN

NOTES TO FINANCIAL STATEMENTS

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities, and changes in net assets during the reporting period. Actual results could differ from these estimates.

Tax Status

The Plan is intended to qualify as an "Employee Stock Purchase Plan" within the meaning of Section 423 of the Code. The Plan is not intended to be a qualified pension, profit-sharing or stock bonus plan under Section 401 (a) of the Code, nor is it intended to be subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended ("ERISA"). The Plan does not provide for withholding or payment of income taxes. Participants are not taxed on the 15% stock price discount at the time of purchase. Upon the sale of Flotek Stock purchased under the Plan, participants are subject to income taxes. The amount of any tax depends on how long the shares are held and the disposition price.

The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2014 and 2013, there are no uncertain tax positions taken or expected to be taken, that would require recognition of a liability or asset, or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits in progress for any tax period.

|

| | |

Exhibit Number | | Exhibit Title |

23 | | Consent of Hein & Associates LLP. |

Flotek Industries, Inc. 2012 Employee Stock Purchase Plan. Pursuant to the requirements of the Securities Exchange Act of 1934, the Administrator of the Plan has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | |

| Flotek Industries, Inc. 2012 |

| Employee Stock Purchase Plan |

| (Name of Plan) |

| | |

Date: March 31, 2015 | By: | /s/ H. Richard Walton |

| H. Richard Walton Chief Financial Officer |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Administrator and Participants of the

Flotek Industries, Inc. 2012 Employee Stock Purchase Plan:

We hereby consent to the incorporation by reference in the Registration Statements (Nos. 333-129268, 333-157276, 333-172596, 333-174983, 333-183617 and 333-198757) on Form S-8 of Flotek Industries, Inc. and subsidiaries (the “Company”) of our report dated March 31, 2015, relating to our audits of the financial statements of the Flotek Industries, Inc. 2012 Employee Stock Purchase Plan which appears in this Annual Report on Form 11-K for the years ended December 31, 2014 and 2013 and for the period from May 18, 2012 (inception) through December 31, 2012.

/s/ Hein & Associates LLP

Houston, Texas

March 31, 2015

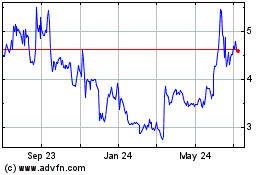

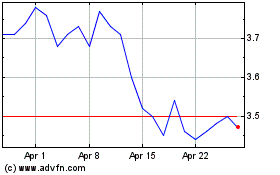

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Flotek Industries (NYSE:FTK)

Historical Stock Chart

From Apr 2023 to Apr 2024