FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For the period ended December 31, 2014

Commission File Number: 001-12033

Nymox Pharmaceutical Corporation

9900 Cavendish Blvd., St. Laurent, QC, Canada, H4M 2V2

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [ X ] Form 40-F [ ]

Indicate by check mark if the registrant is submitting Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(l): [ ]

Indicate by check mark if the registrant is submitting Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes [ ] No [ X ]

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-______________

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

NYMOX PHARMACEUTICAL CORPORATION |

|

|

(Registrant) |

|

|

|

|

|

|

|

|

By: /s/ Paul Averback |

|

|

Paul Averback |

|

|

President and Chief Executive Officer |

|

Date: March 31, 2015

Exhibit 99.1

MESSAGE TO SHAREHOLDERS

On April 30, 2014 Nymox reported top-line results from the company's 146 patient NX03-0040 Phase 2 U.S. prostate cancer study. The results from the study indicate an overall benefit in terms of reduced progression in patients with low grade localized (T1c) prostate cancer treated with a single injection of NX-1207 into the area of the prostate where cancer was found. Consistent with earlier clinical trial experience with NX-1207, there were no significant safety issues or side effects associated with the drug in the new study.

On September 10, 2014 Nymox announced new positive outcome results from the Company's ongoing prospective NX03-0040 trial of NX-1207 for the treatment of low grade localized prostate cancer. Clinical outcomes were determined at 8 months from the initial treatments. A controlled comparison was conducted of patients who required and received radiation and surgery treatments for their cancer based on blinded post-treatment upgraded evaluations of their pre-treatment initially positive lower grade cancers. The study found after 8 months for NX-1207 single-injection treated patients that there was a statistically significant reduction compared to controls of more than 75% (p=.002) in the proportion of patients who had upgraded blinded biopsy and laboratory results and went on to require and receive radiation therapy and/or surgery. The new results also indicated that the NX-1207 treated patients had 67% less progression to surgery and/or radiotherapy compared to controls (p=.008) for all reasons (including elective surgery and/or radiotherapy with no biopsy or laboratory upgrades). 146 patients were enrolled in the NX03-0040 Phase 2 U.S. trial and either randomized to one of two doses of NX-1207 (2.5 mg or 15 mg) or to active surveillance. The drug was injected into the area of the prostate where the cancer was detected and repeat biopsies were then performed on all patients, drug treated and controls. The patients in the active surveillance group in the study who were eligible could elect crossover drug treatment after their first follow-up rebiopsy. Follow-up studies are being conducted of all consenting patients in the study to continue to monitor outcome and safety data.

To date, NX-1207 has had an excellent safety profile as both a treatment for benign prostatic hyperplasia (BPH) and localized low-risk prostate cancer. In the current trial, a new high dose of drug (15 mg) was safely used without drug-related adverse effects. NX-1207 has shown safety in repeat injection studies (NX02-0020 and NX02-0022). The drug does not lead to immune responses such as antibody formation which can cause significant drug toxicity and/or limit usage to single treatments due to drug neutralizing effects.

On November 2, 2014 Nymox announced that the Company’s two Phase 3 U.S. studies of NX-1207 for the treatment of BPH, NX02-0017 and NX02-0018, failed to meet their top-line primary efficacy endpoints and that full results will be reported at a later date. Drug safety was acceptable. Drug efficacy reached levels similar to earlier studies but was not statistically significant in comparison to the placebo control due to a higher placebo response than in earlier NX-1207 studies and in other placebo-controlled BPH studies. The Company is undertaking further analysis of the data and results, and development activities will continue.

On December 18, 2014 Nymox announced the closing of U.S. $1.07 million in financing, consisting of a 3 year term convertible debenture at 6% with conversion at $0.53. The proceeds will be used as additional funding for the Company's activities in the next year. Cantone Asset Management LLC of Tinton Falls NJ served as exclusive agent for the convertible offering.

Nymox sincerely thanks all shareholders for your support. We greatly look forward to important developments for your Company.

/s/ Paul Averback

Paul Averback, MD

Chief Executive Officer &

President

March 31, 2015

1

CORPORATE INFORMATION

|

|

| Directors & Corporate Officers |

|

| |

|

| Paul Averback MD, DABP |

- CEO, President and Chairman |

| Andre Monette CPA, CA, CFA |

- CFO |

| Randall Lanham Esq |

- Director and General Counsel |

| Paul McDonald |

- Director |

| Prof. David Morse PhD |

- Director |

| |

|

| Auditors |

KPMG LLP |

| |

|

| Legal Counsel |

Pillsbury Winthrop Shaw Pittman LLP

Osler, Hoskin & Harcourt LLP |

| |

|

| Transfer Agent |

Computershare Investor Services |

| |

|

| Bankers |

BMO / Harris Bank |

| |

|

| Stock Exchange Listings |

The NASDAQ Stock Market |

| |

|

| Stock Trading Symbol |

NASDAQ : NYMX |

| |

|

| Operating Facilities |

9900 Cavendish Blvd., suite 306

St.-Laurent, PQ, Canada H4M 2V2

777 Terrace Avenue, suite 301

Hasbrouck Heights, NJ, USA, 07604 |

| |

|

| Website |

www.nymox.com |

| |

|

| E-mail |

info@nymox.com |

TABLE OF CONTENTS

|

|

| Message to Shareholders |

1 |

| Corporate Information |

2 |

| Management's Discussion and Analysis |

3 |

| Management’s Report |

19 |

| Report of Independent Registered Public Accounting Firm |

21 |

| Report of Independent Registered Public Accounting Firm |

23 |

| Consolidated Statements of Financial Position |

26 |

| Consolidated Statements of Operations and Comprehensive Loss |

27 |

| Consolidated Statements of Changes in Equity |

28 |

| Consolidated Statements of Cash Flows |

30 |

| Notes to Consolidated Financial Statements |

31 |

2

MANAGEMENT'S DISCUSSION AND ANALYSIS

(in US dollars)

This Management’s discussion and analysis (“MD&A”) comments on the Corporation’s operations, performance and financial condition as at and for the years ended December 31, 2014, 2013 and 2012. This MD&A should be read together with the audited Consolidated Financial Statements and the related notes. This MD&A is dated March 31, 2015. All amounts in this report are in U.S. dollars, unless otherwise noted.

Except as otherwise indicated, all financial information contained in this MD&A and in the Consolidated Financial Statements has been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The Consolidated Financial Statements and this MD&A were reviewed by the Corporation’s Audit Committee and were approved by our Board of Directors.

Additional information about the Corporation can be obtained on EDGAR at www.sec.gov or on SEDAR at www.sedar.com.

Overview

Corporate Profile

Nymox Pharmaceutical Corporation is a biopharmaceutical company focused on developing its drug candidate, NX-1207, for the treatment of BPH and the treatment of low-grade localized prostate cancer. Since 1989, the Corporation’s activities and resources have been directed primarily on developing certain pharmaceutical technologies. Since 2002, Nymox has been developing its novel proprietary drug candidate, NX-1207, for the treatment of benign prostatic hyperplasia (“BPH”). In December 2010, the Corporation signed a license and collaboration agreement with Recordati, a European pharmaceutical group, for the development and commercialization of NX-1207 for BPH in Europe including Russia and the CIS, the Middle East, the Maghreb area of North Africa and South Africa. After the top-line statistical failure of Nymox’s U.S. Phase 3 studies NX02-0017 and NX02-0018 at 12 months post-treatment, Recordati has terminated development and commercialization efforts for NX-1207 in the licensed territories. NX-1207 showed positive results for the treatment of BPH in Phase 1 and 2 clinical trials in the U.S. and in follow-up studies of available subjects from the completed clinical trials. In 2009, Nymox started two pivotal double blind placebo controlled Phase 3 trials for NX-1207, NX02-0017 and NX02-0018, that were conducted at investigational sites across the U.S. with a total enrollment of approximately 1,000 patients. Nymox also initiated subsequent open-label U.S. re-injection Phase 3 safety studies, NX02-0020 and NX02-0022. The NX02-0017 study completed patient enrollment and participation in December 2013 and the NX02-0018 study in May 2014. Top-line results of the Phase 3 NX02-0017 and NX02-0018 U.S. clinical trials of NX-1207 for BPH at 12 months post-treatment were not statistically significant compared to placebo. The Corporation is in the process of further data analysis and assessments of the two studies, and expects to continue its efforts to work on the development program. Nymox is also developing NX-1207 for the treatment of low-grade localized prostate cancer. A Phase 2 study of NX-1207 for low grade localized prostate cancer was started in 2012 with positive results reported in 2014. The Corporation is in the process of working towards definitive studies for this indication. The Corporation also has an extensive patent portfolio covering its marketed products, its investigational drug as well as other therapeutic and diagnostic indications. Nymox developed the AlzheimAlert™ test, which is certified with a CE Mark in Europe. Nymox developed and markets NicAlert™ and TobacAlert™; which are tests that use urine or saliva to detect use of and exposure to tobacco products. NicAlert™ has received clearance from the FDA and is also certified with a CE Mark in Europe. TobacAlert™ is the first test of its kind to accurately measure second and third hand smoke exposure in individuals.

The Corporation is subject to a number of risks, including the successful development and marketing of its technologies and its ability to finance its research and development programs and operations through the sale of its common shares. Since 2003, the Corporation has relied on the Common Stock Private Purchase Agreement (the ‘Agreement’) (referred to in note 12 (a) to the Consolidated Financial Statements), private placements and other types of financings collaboration agreements, and revenues from product sales to fund its operations and research programs. In order to achieve its business plan and the realization of its assets and liabilities in the normal course of operations, the Corporation anticipates the need to raise additional debt or capital in the near term and/or achieve sales and other revenue-generating activities. Management has taken steps to reduce expenditures going forward in the short term by staff reductions, deferral of management salaries, and operational changes.

The top-line failure of the two Phase 3 studies of NX-1207 for BPH materially affects the Corporation’s current ability to fund its operations, meet its cash flow requirements, realize its assets and discharge its obligations. Under the Common Stock Private Purchase Agreement, the Corporation must adhere to general covenants in order to draw on its facility, including maintaining its stock exchange listing and registration requirements and having no material adverse effects, as defined in the Agreement, with respect to the business and operations of the Corporation. In the past, the Corporation has been successful in obtaining the required financing pursuant to the Agreement. As of the date of the financial statements, the Corporation has not received any communication from the counterparty in the Agreement that it will not honor the Corporation`s future draw-

3

down notices under the Agreement or that it intends to terminate the Agreement. On November 12, 2014, the Corporation completed a drawdown of $100,000 pursuant to this Agreement.

Management believes that current cash balances as at December 31, 2014 and anticipated funds from product sales are not sufficient to fund substantially all of its planned business operations and research and development programs over the next year. The Corporation intends to access financing through the existing Common Stock Private Purchase Agreement and/or other sources of capital in order to fund these operations and activities over the next year.

If the purchaser does not purchase the Corporation`s common shares as provided for under the Agreement, the Corporation will have to seek other sources of financing in order to be able to pay its obligations as they become due, which could have an impact on its ability to continue as a going concern. Considering recent developments and the need for additional financing, there exists a material uncertainty that casts substantial doubt about the Corporation’s ability to continue as a going concern. These financial statements do not reflect adjustments that would be necessary if the going concern assumption was not appropriate. If the going concern assumption is not appropriate, then adjustments may be necessary to the carrying value and classification of assets and liabilities and reported results of operations and such adjustments could be material.

We have incurred operating losses throughout our history. Management believes that such operating losses will continue for at least the next few years as a result of expenditures relating to research and development of our potential therapeutic products.

Risk Factors

The business activities of the Corporation since inception have been devoted principally to research and development. Accordingly, the Corporation has had limited revenues from sales and has not been profitable to date. We refer to the Risk Factors section of our Form 20-F filed on EDGAR and on SEDAR for a discussion of the management and investment issues that affect the Corporation and our industry. The risk factors that could have an impact on the Corporation’s financial results are summarized as follows:

-

Our Clinical Trials for Our Therapeutic Products in Development, Such as NX-1207, May Not be Successful and We May Not Receive the Required Regulatory Approvals Necessary to Commercialize These Products

-

Our Clinical Trials for Certain Of Our Therapeutic Products May Be Delayed, Making it Impossible to Achieve Anticipated Development or Commercialization Timelines And Our Development of NX-1207 Has Been Delayed Due to Negative Results In Phase III Clinical Trials

-

A Setback in Any of Our Clinical Trials Would Likely Cause a Drop in the Price of our Shares

-

We May Not be Able to Make Adequate Arrangements with Third Parties for the Commercialization of our Product Candidates, such as NX-1207

-

We May Not Achieve our Projected Development Goals in the Time Frames We Announce and Expect

-

Even If We Obtain Regulatory Approvals for Our Product Candidates, We Will be Subject to Stringent Ongoing Government Regulation

-

It is Uncertain When, if Ever, We Will Make a Profit

-

We Will Require Additional Funding to Continue as a Going Concern

-

Our Ability to Draw on the Common Stock Private Purchase Agreement, Which Expires in November 2015, is Dependent on Adhering to General Covenants

-

We Have Identified a Material Weakness in our Internal Control over Financial Reporting. Although We Expect to Make Every Effort to Address this Material Weakness, We May Find that We are Unable to Remediate this Deficiency in our Control Environment, Which Could Reduce the Reliability of Our Financial Reporting, Harm Investor Confidence in our Company and Affect the Value of our Common Stock.

-

We Face Challenges in Developing, Manufacturing and Improving Our Products

-

Our Products and Services May Not Receive Necessary Regulatory Approvals

-

We Face Significant and Growing Competition

-

We May Not Be Able to Successfully Market Our Products

-

Protecting Our Patents and Proprietary Information is Costly and Difficult

-

We Face Changing Market Conditions

-

Health Care Plans May Not Cover or Adequately Pay for Our Products and Services

-

We Are Subject to Continuing Potential Product Liability Risks, Which Could Cost Us Material Amounts of Money

-

We Have Become Involved in Securities Class Action Litigation That is Expected to Divert Management’s Attention and

Could Harm our Business

-

The Issuance of New Shares May Dilute Nymox’s Stock

-

If We Fail to Regain Compliance With the Requirements for Continued Listing on The NASDAQ Stock Market, Our Common Shares Could be Delisted from Trading on the NASDAQ Stock Market, Which Would Adversely Affect the Liquidity of Our Common Shares and Our Ability to Raise Additional Capital

4

Critical Accounting Policies

The Consolidated Financial Statements of the Corporation have been prepared under International Financial Reporting Standards as issued by the International Accounting Standards Board. The Corporation’s functional and presentation currency is the United States dollar. Our accounting policies are described in the notes to our annual audited consolidated financial statements. We consider the following policies to be the most critical in understanding the judgments that are involved in preparing our financial statements and the matters that could impact our results of operations, financial conditi on and cash flows.

The going concern basis of presentation

The Consolidated Financial Statements have been prepared under the going concern assumption. Refer to ‘Corporate Profile’ and note 1 to the consolidated financial statements for a detailed discussion of this matter.

Revenue Recognition

The Corporation has generally derived its revenue from product sales and collaboration agreements. Revenue from product sales is recognized when the product has been delivered and obligations as defined in the agreement are performed. Collaboration agreements that include multiple deliverables are considered to be multiple-element arrangements. Under this type of arrangement, the identification of separate units of accounting is required and revenue is allocated among the separate units based on their relative fair values.

Payments received under a collaboration agreement may include upfront payments, milestone payments, sale of goods, royalties and license fees. Revenue for each unit of accounting are recorded as described below:

| (i) |

Upfront payments: |

| |

|

| |

Upfront payments are deferred and recognized as revenue on a systematic basis over the estimated service period. Changes in estimates are recognized prospectively when changes to the expected term are determined. |

| (ii) |

Milestone payments: |

| |

|

| |

Revenue subject to the achievement of milestones is recognized only when the specified events have occurred and collectability is reasonably assured. |

| |

|

| |

Specifically, the criteria for recognizing milestone payments are that (i) the milestone is substantive in nature, (ii) the achievement was not reasonably assured at the inception of the agreement, and (iii) the Corporation has no further involvement or obligation to perform associated with the achievement of the milestone, as defined in the related collaboration arrangement. |

| |

|

| (iii) |

Sale of goods: |

| |

|

| |

Revenue from the sale of goods is recognized when the Corporation has transferred to the buyer the significant risks and rewards of ownership of the goods, there is no continuing management involvement with the goods, and the amount of revenue can be measured reliably. |

| |

|

| (iv) |

Royalties and license fees: |

| |

|

| |

Royalties and license fees are recognized when conditions and events under the license agreement have occurred and collectability is reasonably assured. |

Revenue recognition is subject to critical judgments, particularly in the collaboration agreement described above. Management uses judgment in estimating the service period over which revenue is recognized for upfront payments received.

Stock-based Compensation

Stock-based compensation is recorded using the fair value based method for stock options issued to employees and non-employees. Under this method, compensation cost related to employee awards is measured at fair value at the date of grant, net of forfeitures, and is expensed over the award’s vesting period. The Corporation uses the Black-Scholes options pricing model to calculate stock option values, which requires certain assumptions, including the future stock price volatility and expected time to exercise. There is estimation uncertainty with respect to selecting inputs to the Black-Scholes pricing model used to determine the fair value of the stock options. Changes to any of these assumptions, or the use of a different option pricing model, could produce different fair values for stock-based compensation, which could have a material impact on the Corporation’s earnings.

5

Contingent liabilities

Subsequent to the press release dated November 2, 2014 referred to in the ‘Corporate Profile’ section, a plaintiff is seeking certification of a class action suit against the Corporation and an officer of the Corporation. Refer to note 13 to the Consolidated Financial Statements. Assessing the recognition of contingent liabilities requires judgement in evaluating whether it is probable that economic benefits will be required to settle the matters subject to litigation.

Compound financial instruments

Compound financial instruments issued by the Corporation comprise convertible notes that can be converted to share capital at the option of the holder, and the number of shares to be issued does not vary with changes in their fair value.

The liability component of a compound financial instrument is recognized initially at the fair value of a similar liability that does not have an equity conversion option. The model used to measure the fair value of the liability component comprises estimation uncertainty in determining the interest rate applicable to a similar liability that does not have an equity conversion option. The equity component is recognized initially at the difference between the fair value of the compound financial instrument as a whole and the fair value of the liability component. Any directly attributable transaction costs are allocated to the liability and equity components in proportion to their initial carrying amounts.

Subsequent to initial recognition, the liability component of a compound financial instrument is measured at amortized cost using the effective interest method. The equity component of a compound financial instrument is not remeasured subsequent to initial recognition.

Results of Operations

|

|

|

|

| Selected Annual Information |

2014 |

2013 |

2012 |

| Total revenues |

$2,949,509 |

$3,359,010 |

$3,072,587 |

| Net loss |

$(4,594,093) |

$(4,908,603) |

$(7,627,589) |

| Loss per share (basic & diluted) |

$(0.13) |

$(0.14) |

$(0.23) |

| Total assets |

$1,422,566 |

$966,385 |

$1,754,179 |

| Non-current financial liabilities |

$1,118,831 |

$400,000 |

$400,000 |

|

|

|

|

|

| Quarterly Results |

Q4 – 2014 |

Q3 – 2014 |

Q2 – 2014 |

Q1 – 2014 |

| Total revenues |

$729,136 |

$735,529 |

$752,280 |

$732,564 |

| Net loss |

$(492,799) |

$(688,206) |

$(820,272) |

$(2,592,816) |

| Loss per share (basic & diluted) |

$(0.02) |

$(0.02) |

$(0.02) |

$(0.07) |

| |

Q4 – 2013 |

Q3 – 2013 |

Q2 – 2013 |

Q1 – 2013 |

| Total revenues |

$937,490 |

$743,288 |

$839,586 |

$838,646 |

| Net loss |

$(1,316,921) |

$(1,020,387) |

$(1,477,389) |

$(1,093,906) |

| Loss per share (basic & diluted) |

$(0.04) |

$(0.03) |

$(0.04) |

$(0.03) |

The revenues in 2014, 2013 and 2012 include the recognition of revenue related to the upfront payment of €10 million (US$13.1 million) received from Recordati in December 2010. The net loss during the first quarter of 2014 includes a stock compensation charge in the amount of $1,420,185 which explains the increase in net losses for that quarter compared to other quarters presented.

Results of Operations – 2014 compared to 2013

Net losses were $492,799, or $0.02 per share, for the quarter, and $4,594,093, or $0.13 per share, for the year ended December 31, 2014, compared to $1,316,921, or $0.04 per share, for the quarter, and $4,908,603, or $0.14 per share, for the year ended December 31, 2013. Net loss includes stock compensation charges of $1,579,914 in 2014 and $ 307,326 in 2013. The decrease in net loss for the twelve months ended December 31, 2014 compared to the same period in 2013 is primarily due to decreases of $1,223,142 in net research and development expenditures, and $95,439 in marketing expenses, net of increases of $1,061,315 in general and administrative expenses, $85,874 in finance costs and a non-recurring gain on settlement of agreement of $189,575 in 2014. The decrease in net losses for the quarter ended December 31, 2014 compared to same period in 2013 is mainly due to a decrease of $942,219 in research and development, an increase of $72,358 in finance costs and a non-recurring gain on settlement of agreement of $189,575 in 2014, net of a decrease of $54,458 in research tax credits. The weighted average number of common shares outstanding for the year ended December 31, 2014 was 35,253,879 compared to 34,147,666 for the same period in 2013.

6

Revenues

For the quarter and year ended December 31, 2014, amounts of $654,400 and $2,617,600 respectively, were recognized as revenue relating to the upfront payment received from Recordati in December 2010. At December 31, 2014, the deferred revenue related to this transaction recorded in the statement of financial position amounted to $2,508,533 (2013 -$5,126,133). Refer to ‘Subsequent Events’.

Revenues from sales of goods amounted to $74,736 for the quarter and $331,909 for the year ended December 31, 2014, compared with $283,090 for the quarter and $741,410 for the year ended December 31, 2013. The decrease for the year ended December 31, 2014 compared to the same period in 2013 is primarily due to the non-recurrence in 2014 of the sale of goods of $333,249 for the year ended December 31, 2013 under our licensing agreement with Recordati. The development of therapeutic candidates and of moving therapeutic product candidates through clinical trials is a priority for the Corporation at this time. The growth of sales will become more of a priority once these candidates have reached the marketing stage. The Corporation expects that revenues will increase if and when product candidates pass clinical trials and are launched on the market.

Research and Development

Research and development expenditures were $738,989 for the quarter and $4,761,557 for the year ended December 31, 2014, compared with $1,681,208 for the quarter and $6,274,903 for the year ended December 31, 2013. Research and development expenditures include costs incurred mainly for advancing Nymox’s BPH and prostate cancer product candidate NX-1207 through clinical trials. Research and development expenditures also include stock compensation charges of $1,119 for the quarter and $631,217 for the year ended December 31, 2014 and $2,611 for the quarter and $12,679 for the year ended December 31, 2013. On November 2, 2014, the Corporation announced that the two Phase 3 U.S. studies of NX-1207 for the treatment of BPH, NX02-0017 and NX02-0018, failed to meet their primary efficacy endpoints. The decrease in expenses for the quarter ended December 31, 2014 is mainly attributable to a reduction of $672,924 in clinical trial expenditures and a decrease of $140,517 in salaries and payroll related expenses. For the year ended December 31, 2014, a decrease of $1,696,384 in clinical trial expenditures, a decrease of $165,543 in professional fees and a decrease of $184,431 in other expenditures combined with an increase of $618,538 in stock compensation charges and a decrease of $85,527 in salaries and payroll related expenses explained the reduction of expenses compared to the same period in 2013. In 2014, research tax credits amounted to $264,827 compared to $555,031 in 2013. The decrease of $290,204 in 2014 is mainly attributable by the receipt, in 2013, of amounts totaling $194,695 which were realized but related to prior years, as well as less activities due to the fact that the U.S. BPH 12 month trials were completed in November 2014 and a reduction, in June 2014, of the research tax credit rate from 37.5% to 30.0%. The Corporation expects that research and development expenditures will decrease as a result of the Corporation’s U.S. BPH trial activity reduction, pending the evaluation of the data. Because of the early stage of development and the uncertainty related to the Corporation’s R&D projects, it is impossible to outline the nature, timing or estimated costs of the efforts necessary to complete these projects, nor the anticipated completion dates for these projects. The facts and circumstances indicating the uncertainties that preclude us from making a reasonable estimate of the costs and timing necessary to complete projects include the risks inherent in any field trials, the uncertainty as to the nature and extent of regulatory requirements both for safety and efficacy, and the ability to manufacture the products in accordance with current good manufacturing requirements (cGMP) and in sufficient quantities both for large scale trials and for commercial use as further described in the section entitled “Risk Factors”. A drug candidate that shows efficacy can take a long period (7 years or more) to achieve regulatory approval. There is also uncertainty whether we will be able to successfully adapt our patented technologies or whether any new products we develop will pass proof-of-principle testing both in the laboratory and in clinical trials, and whether we will be able to manufacture such products at a commercially competitive price. In addition, given the very high costs of development of therapeutic products, we anticipate having to partner with larger pharmaceutical companies to bring therapeutic products to market. The terms of such partnership arrangements along with our related financial obligations cannot be determined at this time and the timing of completion of the approval of such products will likely not be within our sole control.

Marketing Expenses

Marketing expenditures were $63,963 for the quarter and $186,616 for the year ended December 31, 2014 compared with $44,356 for the quarter and $282,055 for the year ended December 31, 2013. Marketing expenses for the quarter were relatively stable. The decrease in expenses for the year ended December 2014 is attributable to stock compensation charges recorded in the second quarter of 2013 which amounted to $123,700 compared to nil for the same period in 2014.The Corporation expects that marketing expenditures will increase if and when new products are launched on the market.

General and Administrative Expenses

General and administrative expenses were $614,075 for the quarter and $2,817,201 for the year ended December 31, 2014, compared with $401,038 for the quarter and $1,755,886 for the year ended December 31, 2013. General and administrative expenditures also include stock compensation charges of $948,697 for the year ended December 31, 2014 and $170,947 in the comparative period in 2013. The increase of $1,061,315 in expenses for the year ended December 31, 2014 is primarily

7

attributable to an increase of $777,750 in stock compensation charges, an increase of $73,247 in salaries and payroll related expenses, other charges of $121,000 related to operational changes, an increase of $61,839 in professional fees and a decrease of $68,818 in investor relations compared to the same period in 2013. The increase of $213,037 for the quarter ended December 31, 2014 is mainly attributable to an increase of $98,143 in professional fees, other charges of $121,000 related to operational changes offset by a decrease of $62,984 in investor relations compared to 2013. The Corporation expects that general and administrative expenditures will increase if and when product development leads to expanded operations.

Finance Costs - Foreign Exchange

Finance costs were $79,343 for the quarter and $ 112,922 for the year ended December 31, 2014, compared with $3,141 and $27,048 for the year ended December 31, 2013. The increase of $85,874 for the year ended December 31, 2014 is primarily due to financial costs of $71,009 incurred in connection with a bridge loan that was repaid before year-end and $26,148 in accretion of liabilities incurred in connection with the departure of the former Chief Financial Officer. The increase of $72,358 for the quarter ended December 31, 2014 is mainly attributable to the finance costs of $71,009 incurred in connection with a bridge loan that was repaid before year-end.

The Corporation incurs expenses in the local currency of the countries in which it operates, which include the United States and Canada. Approximately 56% of 2014 expenses (2013 - 59%; 2012 - 57%) were in U.S. dollars. Foreign exchange fluctuations had no meaningful impact on the Corporation’s results in 2014, 2013 or 2012.

Gain on settlement

This gain relates to the settlement agreement for the departure of the former Chief Financial Officer. Refer to note 8 to the Consolidated Financial Statements.

Inflation

The Corporation does not believe that inflation has had a significant impact on its results of operations.

Results of Operations – 2013 compared to 2012

Net losses were $1,316,921, or $0.04 per share, for the quarter, and $4,908,603, or $0.14 per share, for the year ended December 31, 2013, compared to $2,813,922, or $0.08 per share, for the quarter, and $7,627,589, or $0.23 per share, for the year ended December 31, 2012. Net losses include stock compensation charges of $307,326 in 2013 and $1,962,085 in 2012. The decrease in net losses for the quarter and the year ended December 31, 2013 compared to the same periods in 2012 is primarily attributable to lower stock compensation. The balance of the decrease for the year ended December 31, 2013 compared to the year ended December 31, 2012 is related to reductions in many areas of expenditures mainly due to a reduction in clinical trial expenditures as patient participation in the NX-1207 studies reach or near completion. Patient participation in NX02-0020 was completed in 2012 and in NX02-0017 in 2013. The weighted average number of common shares outstanding for the year ended December 31, 2013 was 34,147,666 compared to 33,176,185 for the same period in 2012.

Revenues

Revenues from sales of goods amounted to $283,090 for the quarter and $741,410 for the year ended December 31, 2013, compared with $135,150 for the quarter and $454,987 for the year ended December 31, 2012. The increase for the quarter and the year ended December 31, 2013 compared to the same periods in 2012 is due to new revenue relating to the sale of goods under our licensing agreement.

For the three months and year ended December 31, 2013, amounts of $654,400 and $2,617,600 respectively were recognized as revenue relating to the upfront payment received from Recordati in December 2010, compared to $654,400 and $2,617,600 respectively for the three months and year ended December 31, 2012. At December 31, 2013, the deferred revenue related to this transaction recorded in the statement of financial position amounted to $5,126,133 (2012 -$7,743,733).

Research and Development

Research and development expenditures were $1,681,208 for the quarter and $6,274,903 for the year ended December 31, 2013, compared with $3,218,858 for the quarter and $8,572,528 for the year ended December 31, 2012. Research and development expenditures include costs incurred in advancing Nymox’s BPH product candidate NX-1207 through clinical trials, as well as costs related to its R&D pipeline in development. Research and development expenditures also include stock compensation charges of $2,611 for the quarter and $12,679 for the year ended December 31, 2013 and $1,653,428 for the quarter and $1,686,310 for the year ended December 31, 2012. The decrease in expenses for the quarter and for the year ended December 31, 2013 compared to the same periods in 2012 is primarily attributable to lower stock compensation. The

8

balance of the decrease for the year ended December 31, 2013 compared to the year ended December 31, 2012 is due to a reduction in clinical trial expenditures as patient participation in the NX-1207 studies reach or near completion. Patient participation in NX02-0020 was completed in 2012 and in NX02-0017 in 2013. In 2013, research tax credits amounted to $555,031 compared to $289,766 in 2012. The increase in 2013 reflects the receipt of amounts totaling $194,695 which were reserved as provisions in prior years. No provisions were reserved on research tax credits in 2013, which explains the balance of the increase.

Marketing Expenses

Marketing expenditures were $44,356 for the quarter and $282,055 for the year ended December 31, 2013, in comparison to expenditures of $36,756 for the quarter and $158,431 for the year ended December 31, 2012. The increase in expenses for the year is attributable to stock compensation expenses recorded in 2013 which amounted to $123,700 compared to $389 in 2012.

General and Administrative Expenses

General and administrative expenses were $401,038 for the quarter and $1,755,886 for the year ended December 31, 2013, compared with $356,341 for the quarter and $1,972,120 for the year ended December 31, 2012. General and administrative expenditures also include stock compensation charges of $170,947 for the year ended December 31, 2013 and $275,386 in 2012. The increase for the quarter is due to higher expenditures on shareholder relations compared to the same quarter in 2012. The decrease in expenses for the year ended December 31, 2013 is primarily attributable to a reduction in stock compensation expenses and professional fees in 2013 compared to 2012.

Contractual Obligations

Nymox has no contractual obligations of significance other than its accounts payable, accrued liabilities and the following:

|

|

|

|

|

| Contractual Obligations |

Total |

Less than 1 year |

1-3 years |

4-5 years |

| Rent for laboratory and office space |

$362,730 |

$272,658 |

$90,072 |

$0 |

| Insurance premium installments |

$61,406 |

$61,406 |

$0 |

$0 |

| Operating leases |

$28,102 |

$16,262 |

$11,840 |

$0 |

| Convertible notes |

$1,070,000 |

$0 |

$1,070,000 |

$0 |

| Interest and fees on convertible notes |

$249,667 |

$85,600 |

$164,067 |

$0 |

| Total Contractual Obligations other than accounts payable and accrued liabilities |

$1,771,905 |

$435,926 |

$1,335,979 |

$0 |

The redeemable preferred shares for the Corporation’s subsidiary Serex, Inc. in the amount of $400,000 have no specific terms of repayment.

Off-Balance Sheet Arrangements

The Corporation has no binding commitments for the purchase of property, equipment or intellectual property. The Corporation has no commitments that are not reflected in the statement of financial position except for operating leases and insurance premium installments.

Contingent liabilities

On November 24, 2014, a shareholder of the Corporation, filed a proposed class action suit in the United States District Court, District of New Jersey, against the Corporation and the President and CEO of the Corporation. The motion was heard on January 26, 2015, and was the first procedural step before any class action could be instituted. The plaintiff seeks certification of a class action on behalf of all persons, wherever they reside, who acquired the Corporation’s common stock between January 31, 2011 and November 2, 2014. The plaintiff alleges that certain of the Corporation’s disclosures failed to disclose material adverse facts that raised serious questions as to the ability to achieve significant results for NX-1207 in Phase 3 trials in light of difficulty of enrolling candidates, obtaining objective and measured results, and the placebo effe ct. On March 10, 2015, we were served with a class-action lawsuit. The Corporation believes that the allegations made against it in these actions are meritless and will vigorously defend the matter, although no assurance can be given with respect to the ultimate outcome of such proceedings. No provision has been recognized in these financial statements for this matter.

In November 2011, two former directors of the Corporation, who ceased to be directors in 2006, served the Corporation with a Motion to Institute Proceedings filed with the Quebec Superior Court seeking an order that they are entitled to exercise options to purchase a total of 125,000 shares of the Corporation at a price of US$4.33 or, in the alternative, damages for lost profit. On February 18, 2014, the claim by one of the former directors against Nymox was dismissed. On December 3, 2014, the Corporation and the other director signed an agreement and settled the claim out of court.

9

Transactions with Related Parties

The Corporation had no transactions with related parties in 2014, 2013 and 2012 other than those disclosed for key management personnel to note 21 of the Consolidated Financial Statements.

Financial Position

Liquidity and Capital Resources

As of December 31, 2014, cash and receivables including tax credits totalled $1,307,501 compared with $876,489 at December 31, 2013. A decrease of $168,680 in accounts receivable is primarily due to the non-recurrence in 2014 of the sales of goods of $144,623 during the fourth quarter of 2013, under our licensing agreement with Recordati. An increase of $254,324 in tax credits receivable represents the amount earned for the year ended December 31, 2014. The increase of $336,749 in cash is due to the difference in the drawing amounts received under our Common Stock Private Purchase Agreement as well as funds received from the issuance of convertible notes and private placement, and the timing differences in payments of our expenditures. In November 2013, the Corporation signed a Common Stock Private Purchase Agreement, whereby Lorros-Greyse Investments, Ltd. (the “Purchaser”) was committed to purchase up to $15 million of the Corporation’s common shares over a twenty-four month period. The agreement became effective December 3, 2013. As at December 31, 2014, twenty-four drawings were made under the Common Stock Private Purchase Agreement, for total proceeds of $5,450,000. On December 18, 2013, 48,544 common shares were issued at a price of $6.18 per share. On January 14, 2014, 69,686 common shares were issued at a price of $5.74 per share. On February 4, 2014, 61,533 common shares were issued at a price of $5.69 per share. On February 28, 2014, 62,297 common shares were issued at a price of $5.62 per share. On March 25, 2014, 65,408 common shares were issued at a price of $5.35 per share. On April 11, 2014, 28,468 common shares were issued at a price of $5.27 per share. On April 25, 2014, 29,487 common shares were issued at a price of $5.09 per share. On May 7, 2014, 63,573 common shares were issued at a price of $4.72 per share. On May 16, 2014, 59,595 common shares were issued at a price of $5.03 per share. On May 28, 2014, 29,132 common shares were issued at a price of $5.15 per share. On June 10, 2014, 31,062 common shares were issued at a price of $4.83 per share. On June 23, 2014, 31,302 common shares were issued at a price of $4.79 per share. On July 3, 2014, 21,501 common shares were issued at a price of $4.65 per share. On July 8, 2014, 52,312 common shares were issued at a price of $4.78 per share. On July 24, 2014, 31,672 common shares were issued at a price of $4.74 per share. On August 5, 2014, 31,179 common shares were issued at a price of $4.81 per share. On August 8, 2014, 60,926 common shares were issued at a price of $4.92 per share. On August 27, 2014, 60,048 common shares were issued at a price of $5.00 per share. On September 9, 2014, 61,703 common shares were issued at a price of $4.86 per share. On September 15, 2014, 31,049 common shares were issued at a price of $4.83 per share. On September 30, 2014, 37,406 common shares were issued at a price of $4.01 per share. On October 9, 2014, 33,791 common shares were issued at a price of $4.44 per share. On October 24, 2014, 50,040 common shares were issued at a price of $5.00 per share. On November 12, 2014, 138,889 common shares were issued at a price of $0.72 per share. Since November 12, 2014, the Corporation has not executed any new drawing amounts under the Common Stock Private Purchase Agreement. At March 31, 2015, the Corporation can require the Purchaser to purchase up to $9,550,000 of common shares over the remaining term of the Agreement subject to the conditions therein. As at the date of this MD&A, the Common Stock Private Purchase Agreement, set to expire in November 2015, has not been renewed. In prior years the Corporation typically has renewed the Common Stock Private Purchase Agreement approximately one year prior to its scheduled expiry date.

The Corporation believes its current cash balance as at December 31, 2014 and anticipated funds from product sales are not sufficient to fund substantially all of its planned business operations and research and development programs over the next year. The Corporation intends to access financing through the existing Common Stock Private Purchase Agreement and/or other sources of capital in order to fund these operations and activities over the next year. The Corporation cannot assure you that it will be able to secure additional financing on favorable terms or at all.

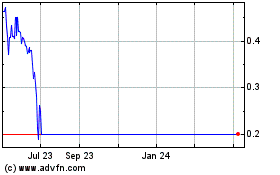

The top-line failure of the two Phase 3 studies of NX-1207 for BPH, announced by the Corporation on November 2, 2014, materially affects the Corporation’s current ability to fund its operations, meet its cash flow requirements, realize its assets and discharge its obligations. The Corporation’s ability to raise capital through the Common Stock Private Purchase Agreement is subject to the Corporation complying with general covenants in the Agreement in order to draw on its facility including maintaining its stock exchange listing and registration requirements and having no material adverse effects, as defined in the Agreement, with respect to the business and operations of the Corporation. On November 2, 2014, the Corporation announced that the Corporation’s Phase 3 trials of its investigational drug product, NX-1207, for the treatment of benign prostatic hyperplasia (BPH), NX02-0017 and NX02-0018, had failed to meet their primary endpoints. On November 3, 2014, the Corporation’s stock price fell from its previous close of $5.14 to a closing price of $0.93 equaling, an 82% decline. As of March 31, 2015, the Corporation has not received any communications from the Purchaser that it will not honor the Corporation’s future drawdown notices under the agreement or that it intends to terminate the agreement. On November 12, 2014, the Corporation completed a drawdown of $100,000 pursuant to the agreement. The Corporation has not executed any new drawing amounts since that date.

10

If the Purchaser does not purchase the Corporation`s common shares as provided for under the agreement, or if the agreement is not renewed, the Corporation will have to seek other sources of financing in order to be able to pay its obligations as they become due, which could have an impact on its ability to continue as a going concern.

The Corporation’s ability to raise capital through the Agreement and other sources of financing will be impacted by the market price and trading volumes of its common shares. The results of the NX02-0017 and NX02-0018 clinical trials may adversely affect the Corporation’s ability to raise capital on a timely basis, requiring the Corporation to reduce its cash requirements by eliminating or deferring spending on research, development and corporate activities. In addition, other sources of financing may not be available or may be available only at a price or on terms that are not favorable to the Corporation.

In addition to financing operations through the issuance of equity, the Corporation may also secure additional funding through the issuance of debt, licensing or partnering products in development, increasing revenue from our products, or realizing on intellectual property and other assets. There can be no assurances that the Corporation will be successful in realizing on any such potential opportunities for additional funding at a price or on terms that are favorable to the Corporation.

On December 16, 2014, the Corporation issued secured convertible notes through a private placement for aggregate gross proceeds of $1,070,000 which bear interest at 6% per annum, payable quarterly with a maximum term of 3 years. The Corporation will also pay an administrative fee of 2% per annum on the outstanding principal amount, calculated quarterly and paid at the same time that the interest are paid on these notes. The notes are convertible by the holder at any time into common shares of the Corporation at a conversion price of $0.533 per share.

On January 23, 2015, the Corporation completed a $200,000 private placement financing. A total of 383,058 units were issued at an average price of $0.52 per share and on March 12, 2015, the Corporation completed a $200,000 private placement financing. A total of 500,000 units were issued at an average price of $0.40 per share. Each Unit is comprised of one common share and one-half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder to acquire one common share of the Corporation at a price per share equal to U.S. $2.00 for a period 24 months following the subscription date.

Other than the financing discussed above, the Corporation does not have arranged sources of financing.

We have incurred substantial operating losses since our inception due in large part to expenditures for our research and development activities. As at December 31, 2014, we had an accumulated deficit of $100,039,579, and we have negative cash flows from operations. Excluding the non-cash deferred revenue amount, the Corporation’s working capital deficiency is $580,375 at December 31, 2014. Our current level of annual expenditures exceeds the anticipated revenues from sales of goods and may not be covered by additional sources of funds.

In response to the top-line twelve month failure of the two Phase 3 trials of NX-1207 for BPH, Management has taken steps to reduce expenditures going forward in the short term by staff reductions for the U.S. BPH development program for NX-1207, deferral of management salaries, and other operational changes. Management is exploring other options, including the securing of additional sources of financing. While management believes the use of the going concern assumption is appropriate, there is no assurance the above actions will be successful. The Consolidated Financial Statements for the year ended December 31, 2014, do not include any adjustments or disclosures that may be necessary should the Corporation not be able to continue as a going concern. If the going concern assumption is not appropriate for the Consolidated Financial Statements for the year ended December 31, 2014, then adjustments may be necessary to the carrying value and classification of assets and liabilities and reported results of operations and such adjustments could be material.

Capital disclosures

The Corporation's objective in managing capital is to ensure a sufficient liquidity position to finance its research and development activities, general and administrative expenses, working capital and overall capital expenditures, including thos e associated with patents. The Corporation makes every attempt to manage its liquidity to minimize shareholder dilution when possible.

The Corporation defines capital as total equity. To fund its activities, the Corporation has followed an approach that relies almost exclusively on the issuance of common shares and, during 2010, entered into a collaboration agreement. Since inception, the Corporation has financed its liquidity needs primarily through private placements and, since 2003, through a financing agreement with an investment company that has been replaced annually by a new agreement with the same purchaser (see note 12 (a) - Common Stock Private Purchase Agreement of the Consolidated Financial Statements). The Corporation intends to access financing under this agreement when appropriate to fund its research and development activities. Since 2003 through to December 2014, Lorros-Greyse has always complied with the drawdowns made pursuant to the agreement. The Corporation must comply with general covenants in order to draw on its facility including maintaining its stock exchange listing and registration requirements and having no material adverse effects, as defined in the agreement, with respect to the business and operations of the Corporation. As at the date of the MD&A, the Common Stock Private Purchase Agreement, set to expire in November 2015, has not been renewed.

11

On December 16, 2014, the Corporation issued secured convertible notes through a private placement for aggregate gross proceeds of $1,070,000 which bear interest at 6% per annum, payable quarterly with a maximum term of 3 years (see note 9 of the Consolidated Financial Statements). On January 23, 2015 and on March 12, 2015, the Corporation completed two $200,000 private placement financing for a total of $400,000 (see note 23(a) of the Consolidated Financial Statements).

As part of its business plan, the Corporation anticipates the need to raise financing to pursue its planned business operations and research and development programs over the next year. The Corporation intends to access financing through the existing Common Stock Private Purchase Agreement and/or other sources of capital in order to fund these operations and activities over the next year.

If the Purchaser does not purchase the Corporation`s common shares as provided for under the existing Common Stock Private Purchase Agreement, or if the agreement is not renewed, the Corporation will have to seek other sources of financing in order to be able to pay its obligations as they become due, which could have an impact on its ability to continue as a going concern.

The Corporation’s ability to raise capital through the Agreement and other sources of financing will be impacted by the market price and trading volumes of its common shares. The results of the NX02-0017 and NX02-0018 clinical trials may adversely affect the Corporation’s ability to raise capital on a timely basis, requiring the Corporation to reduce its cash requirements by eliminating or deferring spending on research, development and corporate activities. In addition, other sources of financing may not be available or may be available only at a price or on terms that are not favorable to the Corporation.

The capital management objectives remain the same as for the previous fiscal year. When possible, the Corporation tries to optimize its liquidity needs by non-dilutive sources, including sales, collaboration agreements, research tax credits and interest income. The Corporation's general policy on dividends is to retain cash to keep funds available to finance its research and development and operating expenses.

Other than the financing discussed above, the Corporation does not have arranged sources of financing.

The Corporation is not subject to any capital requirements imposed by external parties other than the Nasdaq Capital Market requirements related to the Listing Rules. On December 16, 2014, the Corporation was notified, by the Nasdaq Listing Qualifications department, that the Corporation’s Nasdaq Capital Market requirements were currently deficient for the preceding 30 consecutive business days.

However, the Listing Rules provide the Corporation a compliance period of 180 calendar days in which to regain compliance. In order to regain compliance, the Corporation must maintain a minimum market value of $35 million for a minimum of ten consecutive business days and the closing bid price of the Corporation’s common share must be at least $1 for a minimum of ten consecutive business days. Failure to meet the listing requirements may lead to delisting from the Nasdaq Capital Market in which case the Corporation will consider an alternate trading platform for its common shares.

Financial risk management

This section provides disclosures relating to the nature and extent of the Corporation’s exposure to risks arising from financial instruments, including foreign currency risk, credit risk, interest rate risk and liquidity risk, and to how the Corporation manages those risks.

Foreign currency risk

The Corporation uses the US dollar as its measurement currency because a substantial portion of revenues, expenses, assets and liabilities of its Canadian and US operations are denominated in US dollars. The Corporation’s equity financing facility is also in US dollars. Foreign currency risk is limited to the portion of the Corporation’s business transactions denominated in currencies other than the US dollar. The Canadian operation has transactions denominated in Canadian dollars, principally relating to salaries and rent. Additional variability arises from the translation of monetary assets and liabilities denominated in currencies other than the US dollar at each statement of financial position date. Fluctuations in the currency used for the payment of the Corporation’s expenses denominated in currencies other than the US dollar (primarily Canadian dollars) could cause unanticipated fluctuations in the Corporation’s operating results, but would not impair or enhance its ability to pay its Canadian dollar denominated obligations. The Corporation’s objective in managing its foreign currency risk is to minimize its net exposures to foreign currency cash flows by transacting with parties in US dollars to the maximum extent possible. The Corporation does not engage in the use of derivative financial instruments to manage its currency exposures.

Approximately 56% of expenses that occurred during the year ended December 31, 2014 (2013 - 59%; 2012 - 57%) were denominated in US dollars. Foreign exchange fluctuations had no meaningful impact on the Corporation’s results in 2014, 2013 or 2012.

12

The following table provides significant items exposed to foreign exchange:

|

|

|

| CA$ |

December 31, 2014 |

December 31, 2013 |

| Cash |

$5,840 |

$128,117 |

| Trade accounts receivable and other receivables |

$55,239 |

$41,477 |

| Trade accounts payable and accrued liabilities |

$(595,411) |

$(272,011) |

| |

$(534,332) |

$(102,417) |

The following exchange rates were applied for the years ended December 31, 2014, 2013 and 2012:

|

|

|

| |

Average rate (twelve months) |

Reporting date rate |

| US$ - CA$ - December 31, 2014 |

1.1047 |

1.1601 |

| US$ - CA$ - December 31, 2013 |

1.0299 |

1.0636 |

| US$ - CA$ - December 31, 2012 |

0.9996 |

0.9949 |

Based on the Corporation’s foreign currency exposures noted above, varying the above foreign exchange rates to reflect a 5% strengthening of the US dollar against the Canadian dollar would have decreased the net loss for the year ended December 31, 2014 by less than $31,000, assuming that all other variables remained constant.

An assumed 5% weakening of the US dollar against the Canadian dollar would have had an equal but opposite effect on the amount shown above, on the basis that all other variables remained constant.

Credit risk

Credit risk results from the possibility that a loss may occur from the failure of another party to perform according to the terms of the contract. Financial instruments that potentially subject the Corporation to concentrations of credit risk consist primarily of cash and trade accounts receivable. Cash is maintained with high-credit quality financial institutions. For trade accounts receivable, the Corporation performs periodic credit evaluations and typically does not require collateral. Allowances are maintained for potential credit losses consistent with the credit risk, historical trends, general economic conditions and other information.

The Corporation has a limited number of customers. Included in the consolidated statement of financial position are trade accounts receivable of $12,959 (December 31, 2013 - $181,639), all of which were aged under 45 days. Two customers (December 31, 2013 - three customers) accounted for 86.8% (December 31, 2013 – 95.6%) of the trade receivables balance at December 31, 2014, all of whom have a good payment record with the Corporation. No bad debt expense on trade accounts receivable was recorded for the year ended December 31, 2014, nor for the year ended December 31, 2013.

At December 31, 2014, the Corporation’s maximum credit exposure corresponded to the carrying amount of cash, trade accounts receivable and other receivables.

Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in market interest rates. Cash bears interest at a variable rate. Trade accounts receivable, other receivables, trade accounts payable and accrued liabilities bear no interest. The convertible notes bear interest at 6% per annum. In addition, the Corporation pays an administrative fee of 2% per annum under the terms of the convertible notes. An account payable of $20,201 (CA$23,435) bears interest at 12.99%. The Corporation has no other interest-bearing financial instruments.

Based on the value of variable interest-bearing cash during the year ended December 31, 2014, an assumed 0.5% increase or 0.5% decrease in interest rates during such period would have had no significant effect on the net loss.

Liquidity risk

Liquidity risk is the risk that the Corporation will not be able to meet its financial obligations as they fall due. The Corporation manages liquidity risk through the management of its capital structure, as outlined in Capital Disclosures above. The Corporation does not have an operating credit facility and has historically financed its activities primarily through an equity financing agreement with an investment company and the issuance of convertible notes, as described in Liquidity and Capital Resources above.

13

The following are the contractual maturities of financial liabilities:

|

|

|

|

| Trade accounts payable and accrued liabilities: |

Carrying Amount |

Less than 1 year |

1 year to 5 years |

| December 31, 2014 |

$1,976,145 |

$1,976,145 |

– |

| December 31, 2013 |

$1,498,622 |

$1,498,622 |

– |

| |

|

|

|

| Convertible notes (1) : |

|

|

|

| December 31, 2014 |

$718,831 |

– |

$1,070,000 |

| December 31, 2013 |

– |

– |

– |

(1) Before financing costs

The redeemable preferred shares for the Corporation’s subsidiary Serex, Inc. in the amount of $400,000 have no specific terms of repayment.

If purchases of the Corporation`s common shares as provided for under the Common Share Purchase Agreement are not made in a timely fashion or at all, the Corporation will have to seek other sources of financing in order to be able to pay its obligations as they become due, which could have an impact on its liquidity.

The Corporation’s ability to raise capital through the Common Share Purchase Agreement and other sources of financing will be impacted by the market price and trading volumes of its common shares. The results of the NX02-0017 and NX02-0018 clinical trials may adversely affect the Corporation’s ability to raise capital on a timely basis, requiring the Corporation to reduce its cash requirements by eliminating or deferring spending on research, development and corporate activities. In addition, other sources of financing may not be available or may be available only at a price or on terms that are not favorable to the Corporation.

In addition to financing operations through the issuance of equity, the Corporation may also secure additional funding throug h the issuance of debt, licensing or partnering products in development, increasing revenue from our products, or realizing on intellectual property and other assets. There can be no assurances that the Corporation will be successful in realizing on any such potential opportunities for additional funding at a price or on terms that are favorable to the Corporation.

Outstanding Share Data

As at March 31, 2015, there were 36,755,503 common shares of Nymox issued and outstanding, as well as, 5,104,500 share options are outstanding, of which 5,042,000 are currently vested. There are 548,529 warrants outstanding. In addition, the convertible notes are convertible into 2,007,504 common shares.

Subsequent Events

In December 2014, the Corporation received aggregate proceeds of $200,000 under a private placement financing that was completed in January 2015. A total of 383,058 Units were issued at an average price of $0.52 per share. Each Unit is comprised of one common share and one-half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder to acquire one common share of the Corporation at a price per share equal to U.S. $2.00 for a period 24 months following the subscription date.

After the top-line statistical failure of Nymox’s U.S. Phase 3 studies NX02-0017 and NX02-0018 at 12 months post-treatment, Recordati has terminated development and commercialization efforts for NX-1207 in the licensed territories. Consequently, in the first quarter of 2015, the Corporation will recognize, as revenue, the amount of $2,508,533 which represents the remaining deferred revenue as of December 31, 2014.

In February 2015, the Corporation received aggregate proceeds of $200,000 under a private placement financing that was completed in March 2015. A total of 500,000 Units were issued at an average price of $0.40 per share. Each Unit is comprised of one common share and one-half of one common share purchase warrant (each whole warrant, a “Warrant”). Each Warrant entitles the holder to acquire one common share of the Corporation at a price per share equal to U.S. $2.00 for a period 24 months following the subscription date.

Disclosure Controls and Procedures

Disclosure controls and procedures are designed to provide reasonable assurance that information required to be disclosed is accumulated and communicated to senior management on a timely basis so that appropriate decisions can be made regarding public disclosure. The Corporation’s Chief Executive Officer and its Chief Financial Officer are responsible for establishing and maintaining disclosure controls and procedures. They are assisted in this responsibility by the Corporation’s audit committee. Based on an evaluation of the Corporation’s disclosure controls and procedures (as defined in Rule 13a-15(e) of the Securities Exchange Act of 1934 and National Instrument 52-109), the Chief Executive Officer and Chief Financial Officer have concluded that the disclosure controls and procedures were not effective as of December 31, 2014

14

because of the material weakness in our internal control over financial reporting that is described below in “Management’s Annual Report on Internal Control Over Financial Reporting.”

However, giving full consideration to the material weakness, the Corporation’s management has concluded that the Consolidated Financial Statements as of and for the year ended December 31, 2014 present fairly, in all material respects, the Corporation’s financial position, results of operations and cash flows for the periods disclosed in conformity with International Financial Reporting Standards as issued by the International Accounting Standards Board.

KPMG LLP has issued its report dated March 26, 2015, which expressed an unqualified opinion on those Consolidated Financial Statements

Internal Control over Financial Reporting

Management’s Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that: (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of our assets; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of our management and directors; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements.

Under the supervision and with the participation of our Chief Executive Officer and our Chief Financial Officer, management conducted an evaluation of the effectiveness of our internal control over financial reporting, as of December 31, 2014, based on the framework set forth in Internal Control-Integrated Framework (1992) issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the Corporation’s annual financial statements will not be prevented or detected on a timely basis. Based on its evaluation under this framework, the Chief Executive Officer and the Chief Financial Officer concluded that our internal control over financial reporting (as defined in Rules 13a-15(f) of the Securities Exchange Act and National Instrument 52-109) was not effective as of December 31, 2014 due to the material weakness described below.

Following the announcement made on November 2, 2014 concerning the results of the two U.S. Phase 3 clinical trials, Management took steps to reduce expenditures going forward, including operational staff reductions. As a result, the Corporation did not employ a sufficient complement of finance and accounting personnel at December 31, 2014 to ensure that there was proper segregation of incompatible duties related to certain processes, primarily impacting the expenditures/disbursements processes and information technology general controls (“ITGC”), and sufficient compensating controls did not exist in these areas. Specifically, because of the limited number of qualified personnel, review controls of expenditures and disbursements were not effective to ensure that expenditures and disbursements were properly authorized and recorded in the financial information system, and certain ITGCs that potentially impact two applications used for expenditures and disbursements were not effective to monitor activities of individuals with access to modify data.

While the control deficiency identified did not result in any misstatements, a reasonable possibility exists that a material misstatement to the annual consolidated financial statements will not be prevented or detected on a timely basis.

Internal control over financial reporting has inherent limitations. Internal control over financial reporting is a process that involves human diligence and compliance and is subject to lapses in judgment and breakdowns resulting from human failures. Internal control over financial reporting also can be circumvented by collusion or improper management override. Because of such limitations, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore it is possible to design into the process safeguards to reduce, though not eliminate, this risk.

Attestation report of independent registered public accounting firm

KPMG LLP, an independent registered public accounting firm, which audited and reported on our financial statements, has issued an adverse opinion on the effectiveness of our internal control over financial reporting as at December 31, 2014, which is included herein.

15

Remediation Plan for Material Weakness in Internal Control over Financial Reporting

Management believes that a lack of segregation of duties is typical of companies with limited personnel and resources. Nonetheless, in response to the material weakness identified above, the Corporation, in the immediate future, intends to develop a plan with oversight from the Audit Committee of the Board of Directors to remediate the material weakness. The Corporation does not currently intend to hire additional finance personnel or engage external experts until the size and operations warrant such additional resources.

The remediation efforts expected to be implemented include the following:

|

i) |

Evaluate staffing levels and responsibilities to enhance appropriate segregation of duties where possible amongst our personnel. |

|

|

|

| |

ii) |

Establishing a more comprehensive review and approval process for authorizing user access to financial information systems and monitoring user access to ensure that all information technology controls designed to restrict access to applications and data are operating in a manner that provides the Corporation with assurance that such access is properly restricted to the appropriate personnel. |

Changes in Internal Controls Over Financial Reporting

Other than the material weakness described above, there have been no changes since December 31, 2013 in our internal control over financial reporting that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Changes in accounting policies:

New accounting standards and interpretations:

Adopted during the period:

On January 1, 2014, the Corporation adopted IFRIC 21, Levies. IFRIC 21 provides guidance on accounting for levies in accordance with IAS 37, Provisions, Contingent Liabilities and Contingent Assets. The interpretation defines a levy as an outflow of resources from an entity imposed by a government in accordance with legislation, other than income taxes within the scope of IAS 12, Income Taxes, and confirms that an entity recognizes a liability for a levy only when the triggering event specified in the legislation occurs. The adoption of IFRIC 21 did not have an impact on the Corporation’s consolidated financial statements.

Issued but not yet adopted:

A number of new standards, interpretations and amendments to existing standards were issued by the IASB or International Financial Reporting Standards Interpretations Committee (“IFRS IC”). They are mandatory but not yet effective for the period ended December 31, 2014, and have not been applied in preparing these consolidated financial statements. Many of these are not applicable or are inconsequential to the Corporation and have been excluded from the discussion below.

The following standards and interpretations have been issued by the IASB and the IFRS IC and the Corporation is currently assessing their impact on the financial statements:

(a) IFRS 9, Financial Instruments: