UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-K

(Mark One)

| [X] |

ANNUAL

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the fiscal year ended December 31, 2014

Or

| [ ] |

TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For

the transition period from __________ to __________

Commission

file number: 000-19001

VAPOR

CORP.

(Exact

name of Registrant as specified in its charter)

| Delaware |

|

84-1070932 |

| (State

or other jurisdiction of |

|

(I.R.S.

Employer |

| incorporation

or organization) |

|

Identification

No.) |

| |

|

|

3001

Griffin Road

Dania

Beach, FL |

|

33312 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 888-482-7671

Securities

registered pursuant to Section 12(b) of the Act: Common Stock, par value $0.001

(Title

of class)

Securities

registered pursuant to Section 12(g) of the Act: None

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

[ ] No [X]

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes

[ ] No [X]

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Yes

[X] No [ ]

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes

[X] No [ ]

Indicate

by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (section 229.405 of this chapter) is not

contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information

statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

(check

one:)

| Large

accelerated filer [ ] |

|

Accelerated filer [ ] |

|

Non-accelerated

filer [ ]

(Do not check if a smaller reporting company) |

|

Smaller

reporting company [X] |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes

[ ] No [X]

The

aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2014, based

upon the closing sale price of such equity on the Nasdaq Capital Markets on such date, was $56,301,711.

As

of March 30, 2015, there were 33,635,758 shares of the registrant’s common stock outstanding.

Documents

Incorporated by Reference: The information required by Part III of this Report, to the extent not set forth herein, is incorporated

herein by reference from the registrant’s definitive proxy statement relating to the Annual Meeting of Shareholders to be

held in 2015, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after

the end of the fiscal year to which this Report relates.

VAPOR.

CORP.

TABLE OF CONTENTS

In

this Annual Report on Form 10-K, unless the context otherwise requires, the terms “Vapor Corp.,” “Vapor,”

“we,” “us,” “our” and the Company refer to Vapor Corp. and its consolidated wholly-owned subsidiaries

Smoke Anywhere USA, Inc. and IVGI Acquisition, Inc. and the terms “Smoke Anywhere USA” and “Smoke” refer

to our wholly-owned subsidiary Smoke Anywhere USA, Inc.

We

effected a reverse stock split of our common stock at a ratio of 1-for-5, which became effective in the marketplace at the opening

of business December 27, 2013. Unless otherwise indicated, all information in this Annual Report on Form 10-K gives effect to

such reverse stock split.

PART

I

Item

1. Business

Company

Background

We

design, market, and distribute vaporizers, e-liquids, electronic cigarettes and accessories under the emagine vaporTM,

Krave®, Fifty-One® (also known as Smoke 51), VaporX®, Hookah Stix® and Alternacig® brands. We operate eight

retail kiosks under the emagine vaporTM name. We also design and develop private label brands for our distribution

customers. Third party manufacturers manufacture our products to meet our design specifications. We market our products as alternatives

to traditional tobacco cigarettes and cigars. In 2014, as a response to market product demand changes, Vapor began to shift its

primary focus from electronic cigarettes to vaporizers.

On

March 4, 2015, we completed our acquisition of Vaporin, Inc. (“Vaporin”) pursuant to an Agreement and Plan of Merger

(the “Merger Agreement”) dated December 17, 2014 by us and Vaporin. Pursuant to the terms of the Merger Agreement,

we issued Vaporin 13,591,533 shares of our common stock in exchange for 100% of the outstanding common stock of Vaporin. Vapor

is the surviving entity after giving effect to the Merger and now owns 16 retail stores, including kiosks.

Vaporizers

and Electronic Cigarettes

“Vaporizers”

and “electronic cigarettes,” or “e-cigarettes,” are battery-powered products that enable users to inhale

nicotine vapor without smoke, tar, ash, or carbon monoxide. Electronic cigarettes look like traditional cigarettes and, regardless

of their construction are comprised of three functional components:

| ● | a

mouthpiece, which is a small plastic cartridge that contains a liquid nicotine solution; |

| | | |

| ● | the

heating element that vaporizes the liquid nicotine so that it can be inhaled; and |

| | | |

| ● | the

electronics, which include: a lithium-ion battery, an airflow sensor, a microchip controller

and an LED, which illuminates to indicate use. |

When

a user draws air through the electronic cigarette and/or vaporizer, the air flow is detected by a sensor, which activates a heating

element that vaporizes the solution stored in the mouthpiece/cartridge, the solution is then vaporized and it is this vapor that

is inhaled by the user. The cartridge contains either a nicotine solution or a nicotine free solution, either of which may be

flavored.

Our

Vaporizers and Electronic Cigarettes

Vaporizers

feature a tank or chamber, a heating element and a battery. The vaporizer user fills the tank with e-liquid or the chamber with

dry herb or leaf. The vaporizer battery can be recharged and the tank and chamber can be refilled.

We

also offer disposable electronic cigarettes in multiple sizes, puff counts, styles, flavors and nicotine strengths; rechargeable

electronic cigarettes that use replaceable cartridges (also known as “atomizers or cartomizers”); and rechargeable

vaporizers for use with either electronic cigarette solution (“e-liquid”) or dry herbs or leaf. Disposable electronic

cigarettes feature a one-piece construction that houses all the components and is utilized until the nicotine or nicotine free

solution is depleted. Rechargeable electronic cigarettes feature a rechargeable battery and replaceable cartridge (also known

as an “atomizer or cartomizer”). The atomizers or cartomizers are changed when the solution is depleted from use.

Our

Brands

We

sell our vaporizers, electronic cigarettes and e-liquids under several different brands, including emagine vaporTM,

Krave®, Fifty-One® (also known as Smoke 51), VaporX®, Stix® and Alternacig® brands. We also design and develop

private label brands for our distribution customers. Our in-house engineering and graphic design team’s work to provide

aesthetically pleasing, technologically advanced affordable vaporizers and e-cigarette options. We are in the process of preparing

to commercialize additional brands which we intend to market to new customers and demographics.

Our

Improvements and Product Development

We

have developed and trademarked or are preparing to commercialize additional products. We include product development expenses

as part of our operating expenses. Product development expenses for the years ended December 31, 2014 and 2013 were approximately

$312,000 and $174,000, respectively.

Flavor

Profiles

We

are developing new flavor profiles that are distinct to our brands. We believe that as the vaporizer and electronic cigarette

industry matures, users of vaporizers and electronic cigarettes will develop, if they have not already, preferences for the product

based not only on their quality, ability to successfully deliver nicotine, their battery capacity, smoke volume they generate,

but on taste and flavor, like smokers do with their preferred brand of conventional tobacco cigarettes.

Soft

Tip Filter

We

have a patent pending for a soft-tip electronic cigarette filter, which more closely resemble the tactile experience of a traditional

tobacco cigarette in a user’s mouth. There is no assurance that we will be awarded a patent for this filter. To date electronic

cigarettes have been made of metal and hard plastic and do not offer users the same malleable feel as the cellulose filters of

conventional tobacco cigarettes.

Dynamo

Powered Electronic Cigarette

We

hold rights to a patent pending for the first electronic cigarette that can be re-charged by shaking the product. This Dynamo

charging technology may eventually allow for continued use without having to recharge the electronic cigarette by plugging it

into an electrical outlet. There is no assurance that a patent will be awarded for this technology.

Universal

Fit Mouthpiece

We

have a patent pending for a universal fit mouthpiece that can be used in conjunction with the battery section of most other popular

electronic cigarette brands, allowing users of competing electronic cigarette products an easy way to try and transition to our

cartridges. There is no assurance that a patent will be awarded for this technology.

Electronic

Cigarette Air Flow Sensor Patent

We

have a patent pending on a new configuration for the airflow sensors currently used in electronic cigarettes. The new configuration

will allow the battery to be sealed to enhance the reliability and performance of the electronic cigarette. There is no assurance

that we will be awarded a patent for this configuration.

Vaporizer

Biometric Fingerprint Lock Sensor Patent

We

have a patent pending for a biometric fingerprint lock sensor that can be used in vaporizers. The biometric fingerprint lock sensor

will allow the owner of the vaporizer to keep the device locked and turned off unless the authorized user unlocks the device via

fingerprint scan, protecting the device from use by another individual. This technology may be used to protect against minors

being able to turn on the device and will also deem the devices unusable in the event the device is lost or stolen. There is no

assurance that we will be awarded a patent for this technology.

Our

Kits and Accessories

Our

vaporizer and electronic cigarettes are available in kits that contain everything a user needs to begin enjoying their “vaping”

experience. In addition to kits we sell replacement parts including batteries, refill cartridges or cartomizers that contain the

liquid solution, atomizers, tanks and e-liquids. Our refill cartridges and e-liquids are available in various assorted flavors

and nicotine levels (including 0.0% nicotine). In addition to our electronic cigarette and vaporizer products we sell an assortment

of accessories, including various types of chargers (including USB chargers), carrying cases and lanyards.

The

Market for Vaporizers and Electronic Cigarettes

We

market our vaporizers and electronic cigarettes as an alternative to traditional tobacco cigarettes and cigars. We offer our products

in multiple nicotine strengths, flavors and puff counts. Because vaporizers and electronic cigarettes offer a “smoking”

experience without the burning of tobacco leaf, vaporizers and electronic cigarettes offer users the ability to satisfy their

nicotine cravings without smoke, tar, ash or carbon monoxide. In many cases vaporizers and electronic cigarettes may be used where

tobacco-burning cigarettes may not. Vaporizers and electronic cigarettes may be used in some instances where for regulatory or

safety reasons tobacco burning cigarettes may not be used. However, certain states, cities, businesses, providers of transportation

and public venues in the U.S. have already banned the use of vaporizers and electronic cigarettes, while others are considering

banning the use of vaporizers and electronic cigarettes. We cannot provide any assurances that the use of vaporizers and electronic

cigarettes will be permitted in places where traditional tobacco burning cigarette use is banned.

According

to the U.S. Centers for Disease Control and Prevention, in 2012, an estimated 42.1 million people, or 18.1% of adults, in the

United States smoke cigarettes. According to the Tobacco Vapor Electronic Cigarette Association, an industry trade group, more

than 3.5 million people currently use electronic cigarettes in the United States. In 2011, about 21% of adults who smoke traditional

tobacco cigarettes had used electronic cigarettes, up from about 10% in 2010, according to the U.S. Centers for Disease Control

and Prevention. Annual sales of electronic cigarettes in the United States were estimated to increase to $1.7 billion in 2014

from $1 billion in 2013. Annual sales of traditional tobacco cigarettes, according to industry estimates, were $80 billion in

2012.

Advertising

Currently,

we advertise our products primarily on the Internet, through trade magazine ads and through point of sale materials and displays

at retail locations. We also attempt to build brand awareness through innovative social media marketing activities, price promotions,

in-store and on-premise promotions, slotting fees (i.e., fees payable based on the number of stores at which our products

are carried and sold), public relations and trade show participation. Our advertising expense as a percentage of sales for the

year ended December 31, 2014 and 2013 has been approximately 15.5% and 8.8%, respectively. We intend to continue to strategically

expand our advertising activities in 2015 and also increase our public relations campaigns to gain editorial coverage for our

brands. Some of our competitors promote their brands through print media and television commercials, and through celebrity endorsements,

and have substantial resources to devote to such efforts. We believe that our and our competitors’ efforts have helped increase

our sales, our product acceptance and general industry awareness.

Distribution

and Sales

We

offer our vaporizers and electronic cigarettes and related products through our eight retail kiosks, Vape stores, online stores,

to retail channels through our direct sales force, and through third party wholesalers, retailers and value-added resellers. Retailers

of our products include small-box discount retailers, big-box retailers, gas stations, drug stores, convenience stores, tobacco

shops and kiosk locations in shopping malls throughout the United States. We previously offered our vaporizers and electronic

cigarettes and related products through our direct response television marketing efforts.

When

first introduced to the U.S. market, electronic cigarettes were predominantly sold online. In the past year brick and mortar sales

of electronic cigarettes and vaporizers have eclipsed the on-line sales volumes in the U.S. market. Tobacco products, most notably

cigarettes are currently sold in approximately 400,000 retail locations. We believe that future growth of electronic cigarettes

is dependent on either higher volume, lower margin sales channels, like the broad based distribution network through which cigarettes

are sold or through company owned kiosks. Thus, we are focusing on growing our retail distribution reach by opening retail stores

and kiosks and entering into distribution agreements with large and established value added resellers. We currently have eight

retail kiosks located in Florida (2), Texas (2), Maryland (3) and New Jersey (1). We currently have established relationships

with several large retailers and national chains and in connection therewith we have agreed to pay slotting fees based on the

number of stores our products will be carried in. These existing relationships are “at-will” meaning that either party

may terminate the relationship for any reason or no reason at all. We believe that these higher volume lower margin opportunities

are critical towards broadening the reach and appeal of vaporizers and electronic cigarettes and we believe that as vaporizers

and electronic cigarettes become more widely known and available, the market for our products will grow.

Distribution

of our Products in Canada

Under

our private label production and supply agreement with Spike Marks Inc./Casa Cubana, we have agreed to produce and supply to this

customer such quantities of our electronic cigarettes bearing the customer’s trademark and other brand attributes as the

customer orders for resale by the customer within the country of Canada. For the years ended December 31, 2014 and 2013, we had

sales for distribution in Canada of $2,912,525 and $3,847,310, respectively.

The

customer’s right to be the exclusive reseller of our products in Canada is conditioned upon the customer satisfying specified

minimum annual and quarterly performance requirements.

Business

Strategy

Our

business strategy leverages our ability to design market and develop multiple vaporizer and e-cigarette brands and to bring those

brands to market through our multiple distribution channels.

We

believe we were among the first distributors of vaporizers and electronic cigarettes in the U.S. Thus, we believe that our reputation

and our experience in the electronic cigarette industry, both from a development, customer service and production perspective

give us an advantage in attracting customers, specifically re-sellers who require ongoing support, reliable and consistent supply

chains and mechanisms in place for supporting broad based distributors and big box retailers.

Moreover,

we believe that our history with our suppliers, including the volume of products we source, gives us an advantage over other market

participants as it relates to favorable pricing, priority as to inventory supply and delivery and first access to new products,

including first access to next generation electronic cigarette products and technology.

Our

goal is to achieve a position of sustainable leadership in the electronic cigarette industry. Our strategy consists of the following

key elements:

| |

● |

develop

new brands and engineer product offerings; |

| |

|

|

| |

● |

invest

in and leverage our new and existing brands through marketing and advertising; |

| |

|

|

| |

● |

increase

our presence in national and regional retailers; |

| |

● |

expand

our brand awareness through our web presence; |

| |

|

|

| |

● |

introduce

our products to the consumer through increased infomercial broadcasts; |

| |

|

|

| |

● |

develop

continuity programs for our end user customers; |

| |

|

|

| |

● |

scale

our distribution through strategic resale partnerships; and |

| |

|

|

| |

● |

align

our product offerings and cost with market demand. |

Recent

Developments

On

November 14, 2014, Vapor entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain accredited

investors providing for the sale of $1,250,000 in aggregate principal amount of Vapor’s Convertible Notes (the “Notes”).

The Notes were issued and sold through an exempt private securities offering to certain accredited investors. The Notes accrue

interest on the outstanding principal at an annual rate of 7%. The principal and accrued interest on the Notes is due and payable

on November 14, 2015. Vapor also issued warrants (the “Warrants”, and collectively with the Purchase Agreement, Notes,

and the other documents, agreements and instruments referred to therein, the “Transaction Documents”) to the Note

purchasers to acquire an aggregate of 1,136,364 shares of Vapor common stock with an exercise price of $2.00 per share.

On

March 3, 2015, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with certain accredited

investors providing for the sale of $3,500,960 in shares of our Common Stock (“Common Stock”) at a price of $1.02

per share. We also issued warrants to purchasers of the Shares to acquire an aggregate of 3,432,314 shares of our Common Stock

with an exercise price of $1.28 per share. The Shares and Warrants were issued and sold through an exempt private securities offering

to certain accredited investors.

On

March 4, 2015, we completed our acquisition of Vaporin, See Item 1. “Business – Company Background.”

Corporate

Information

We

were originally incorporated as Consolidated Mining International, Inc. in 1985 as a Nevada corporation, and changed our name

in 1987 to Miller Diversified Corporation whereupon we operated in the commercial cattle feeding business until October 31, 2003

when the company sold substantially all of its assets and became a discontinued operation. On November 5, 2009, we acquired Smoke

Anywhere USA, Inc., a distributor of electronic cigarettes. As a result of the merger, Smoke Anywhere USA, Inc. became our sole

operating business. On January 7, 2010, we changed our name to Vapor Corp. On December 31, 2013, we reincorporated in the State

of Delaware from the State of Nevada. Our fiscal year is a calendar year ending December 31. As discussed above, on March 4, 2015,

we completed our merger with Vaporin.

Our

principal executive offices are located at 3001 Griffin Road, Dania Beach, Florida 33312, and our telephone number is (888) 766-5351.

Our website is located at www.vapor-corp.com. Information on our website is not, and should not be considered, part of this report.

Competition

Competition

in the electronic cigarette industry, including the vaporizer and e-liquid segments, is intense. We compete with other sellers

of electronic cigarettes, most notably Lorillard, Inc., Altria Group, Inc. and Reynolds American, Inc., which are big tobacco

companies that have electronic cigarette business segments. The nature of our competitors is varied as the market is highly fragmented

and the barriers to entry into the business are low. Our direct competitors sell products that are substantially similar to ours

and through the same channels through which we sell our electronic cigarette products. We compete with these direct competitors

for sales through distributors, wholesalers and retailers, including but not limited to national chain stores, tobacco shops,

gas stations, travel stores, shopping mall kiosks, in addition to direct to public sales through the Internet, mail order and

telesales.

As

a general matter, we have access to market and sell the similar vaporizers and electronic cigarettes as our competitors and we

sell our products at substantially similar prices as our competitors; accordingly, the key competitive factors for our success

is the quality of service we offer our customers, the scope and effectiveness of our marketing efforts, including media advertising

campaigns and, increasingly, the ability to identify and develop new sources of customers.

Part

of our business strategy focuses on the establishment of contractual relationships with distributors. We are aware that e-cigarette

competitors in the industry are also seeking to enter into such contractual relationships. In many cases, competitors for such

contracts may have greater management, human, and financial resources than we do for entering into such contracts and for attracting

distributor relationships. Furthermore, certain of our electronic cigarette and vaporizer competitors may have better control

of their supply and distribution, be better established, larger and better financed than our Company.

As

discussed above, we compete against “big tobacco”, U.S. cigarette manufacturers of both conventional tobacco cigarettes

and electronic cigarettes like Altria Group, Inc., Lorillard, Inc. and Reynolds American, Inc. We compete against “big tobacco”

who offers not only conventional tobacco cigarettes and electronic cigarettes but also smokeless tobacco products such as “snus”

(a form of moist ground smokeless tobacco that is usually sold in sachet form that resembles small tea bags), chewing tobacco

and snuff. “Big tobacco” has nearly limitless resources, global distribution networks in place and a customer base

that is fiercely loyal to their brands. Furthermore, we believe that “big tobacco” will devote more attention and

resources to developing and offering electronic cigarettes as the market for electronic cigarettes grows. Because of their well-established

sales and distribution channels, marketing expertise and significant resources, “big tobacco” is better positioned

than small competitors like us to capture a larger share of the electronic cigarette market.

Manufacturing

We

have no manufacturing capabilities and do not intend to develop any manufacturing capabilities. Third party manufacturers manufacture

our products to meet our design specifications. We depend on third party manufacturers for our vaporizers, electronic cigarettes

and accessories. Our customers associate certain characteristics of our products including the weight, feel, draw, unique flavor,

packaging and other attributes of our products to the brands we market, distribute and sell. Any interruption in supply and or

consistency of our products may harm our relationships and reputation with customers, and have a material adverse effect on our

business, results of operations and financial condition. In order to minimize the risk of supply interruption, we currently utilize

several third party manufacturers to manufacture our products to our specifications.

We

currently utilize 13 different manufacturers, all of which are based in China. We contract with our manufacturers on a purchase

order basis. We do not have any output or requirements contracts with any of our manufacturers. Our manufacturers provide us with

finished products, which we hold in inventory for distribution, sale and use. Certain Chinese factories and the products they

export have recently been the source of safety concerns and recalls, which is generally attributed to lax regulatory, quality

control and safety standards. Should Chinese factories continue to draw public criticism for exporting unsafe products, whether

those products relate to our products or not, we may be adversely affected by the stigma associated with Chinese production, which

could have a material adverse effect on our business, results of operations and financial condition.

Although

we believe that several alternative sources for our products are available, any failure to obtain the components, chemical constituents

and manufacturing services necessary for the production of our products would have a material adverse effect on our business,

results of operations and financial condition.

Source

and Availability of Raw Materials

We

believe that an adequate supply of product and raw materials will be available to us as needed and from multiple sources and suppliers.

Intellectual

Property

We

do not currently own any domestic or foreign patents relating to vaporizers and electronic cigarettes, though we do have several

patent applications pending in the United States as described below. There is no assurance that we will be awarded patents for

of any of these pending patent applications.

Soft

Tip Filters

We

have a patent pending for a soft-tip electronic cigarette filter, which more closely resembles the tactile experience of a conventional

tobacco cigarette in a user’s mouth. To date electronic cigarettes have been made of metal and hard plastic and do not offer

users the same malleable feel as the cellulose filters of conventional tobacco cigarettes.

Dynamo

Powered Electronic Cigarette

We

hold rights to a patent pending for the first electronic cigarette that can be re-charged by shaking the product. This Dynamo

charging technology may eventually allow for continued use without having to recharge the electronic cigarette by plugging it

in to an electrical outlet.

Universal

Fit Mouthpiece

We

have a patent pending for a universal fit mouthpiece that can be used in conjunction with the battery section of most other popular

electronic cigarette brands, allowing users of competing electronic cigarette products an easy way to try and transition to our

cartridges.

Electronic

Cigarette Air Flow Sensor Patent

We

have a patent pending on a new configuration for the air flow sensors currently used in electronic cigarettes. The new configuration

will allow the battery to be sealed to enhance the reliability and performance of the electronic cigarette.

Vaporizer

Biometric Fingerprint Lock Sensor Patent

We

have a patent pending for a biometric fingerprint lock sensor that can be used in vaporizers. The biometric fingerprint lock sensor

will allow the owner of the vaporizer to keep the device locked and turned off unless the authorized user unlocks the device via

fingerprint scan, protecting the device from use by another individual. This technology may be used to protect against minors

being able to turn on the device and will also deem the devices unusable in the event the device is lost or stolen.

Trademarks

We

own trademarks on certain of our brands, including: Fifty-One®, Krave®, VaporX®,

Alternacig®, EZ Smoker®, Green Puffer®, Americig®, Hookah Stix®

and Smoke Star® brands. We have also filed additional trademarks, which have yet to be awarded.

Patent

Litigation

We

are a defendant in a certain patent lawsuit described in the section entitled “Item 3. Legal Proceedings” in

this report.

Such

patent lawsuit as well as any other third party lawsuits alleging our infringement of patents, trade secrets or other intellectual

property rights could force us to do one or more of the following:

| |

● |

stop

selling products or using technology that contains the allegedly infringing intellectual property; |

| |

|

|

| |

● |

incur

significant legal expenses; |

| |

● |

pay

substantial damages to the party whose intellectual property rights we may be found to be infringing; |

| |

|

|

| |

● |

redesign

those products that contain the allegedly infringing intellectual property; or |

| |

|

|

| |

● |

attempt

to obtain a license to the relevant intellectual property from third parties, which may not be available to us on reasonable

terms or at all. |

Third

party lawsuits alleging our infringement of patents, trade secrets or other intellectual property rights could have a material

adverse effect on our business, results of operations and financial condition.

We

may be required to obtain licenses to patents or proprietary rights of others. We cannot assure you that any licenses required

under any such patents or proprietary rights would be made available on terms acceptable to us or at all. If we do not obtain

such licenses, we could encounter delays in product market introductions while we attempt to design around such patents, or could

find that the development, manufacture, or sale of products requiring such licenses could be foreclosed. Litigation may be necessary

to defend against claims of infringement asserted against us by others, or assert claims of infringement to enforce patents issued

to us or exclusively licensed to us, to protect trade secrets or know-how possessed by us, or to determine the scope and validity

of the proprietary rights of others. In addition, we may become involved in oppositions in foreign jurisdictions, reexaminations

declared by the United States Patent and Trademark Office, or interference proceedings declared by the United States Patent and

Trademark Office to determine the priority of inventions with respect to our patent applications or those of our licensors. Litigation,

opposition, reexamination or interference proceedings could result in substantial costs to and diversion of effort by us, and

may have a material adverse impact on us. In addition, we cannot assure you that our efforts to maintain or defend our patents

will be successful.

Government

Regulation

Since

a 2010 U.S. Court of Appeals decision, the United States Food and Drug Administration (the “FDA”) is permitted to

regulate electronic cigarettes as “tobacco products” under the Family Smoking Prevention and Tobacco Control Act of

2009 (the “Tobacco Control Act”). Under this decision, the FDA is not permitted to regulate electronic cigarettes

as “drugs” or “devices” or a “combination product” under the Federal Food, Drug and Cosmetic

Act unless they are marketed for therapeutic purposes. This is contrary to anti-smoking devices like nicotine patches, which undergo

more extensive FDA regulation. Because Vapor does not market Vapor’s electronic cigarettes for therapeutic purposes, Vapor’s

electronic cigarettes are subject to being classified as “tobacco products” under the Tobacco Control Act. The Tobacco

Control Act grants the FDA broad authority over the manufacture, sale, marketing and packaging of tobacco products, although the

FDA is prohibited from issuing regulations banning all cigarettes or all smokeless tobacco products, or requiring the reduction

of nicotine yields of a tobacco product to zero.

On

April 24, 2014, the FDA released proposed rules that would extend its regulatory authority to electronic cigarettes and certain

other tobacco products under the Tobacco Control Act. The proposed rules would require that electronic cigarette manufacturers

(i) register with the FDA and report electronic cigarette product and ingredient listings; (ii) market new electronic cigarette

products only after FDA review; (iii) only make direct and implied claims of reduced risk if the FDA confirms that scientific

evidence supports the claim and that marketing the electronic cigarette product will benefit public health as a whole; (iv) not

distribute free samples; (v) implement minimum age and identification restrictions to prevent sales to individuals under age 18;

(vi) include a health warning; and (vii) not sell electronic cigarettes in vending machines, unless in a facility that never admits

youth. The proposed rules were subject to a 75-day public comment period, following which the FDA will finalize the proposed rules.

It is not known how long this regulatory process to finalize and implement the rules may take. Accordingly, Vapor cannot predict

the content of any final rules from the proposed rules or the impact they may have.

In

this regard, total compliance and related costs are not possible to predict and depend substantially on the future requirements

imposed by the FDA under the Tobacco Control Act. Costs, however, could be substantial and could have a material adverse effect

on Vapor’s business, results of operations and financial condition. In addition, failure to comply with the Tobacco Control

Act and with FDA regulatory requirements could result in significant financial penalties and could have a material adverse effect

on Vapor’s business, financial condition and results of operations and ability to market and sell Vapor’s products.

At present, it is difficult to predict whether the Tobacco Control Act will impact Vapor to a greater degree than competitors

in the industry, thus affecting Vapor’s competitive position.

State

and local governments currently legislate and regulate tobacco products, including what is considered a tobacco product, how tobacco

taxes are calculated and collected, to whom and by whom tobacco products can be sold and where tobacco products may or may not

be smoked. State and local regulation of the e-cigarette market and the usage of e-cigarettes is beginning to accelerate.

As

local regulations expand, electronic cigarettes and vaporizers may lose their appeal as an alternative to cigarettes, which may

have the effect of reducing the demand for Vapor’s products and as a result have a material adverse effect on Vapor’s

business, results of operations and financial condition.

At

present, neither the Prevent All Cigarette Trafficking Act (which prohibits the use of the U.S. Postal Service to mail most tobacco

products, which would require individuals and businesses that make interstate sales of cigarettes or smokeless tobacco to comply

with state tax laws) nor the Federal Cigarette Labeling and Advertising Act (which governs how cigarettes can be advertised and

marketed) apply to electronic cigarettes. The application of either or both of these federal laws to electronic cigarettes would

have a material adverse effect on Vapor’s business, results of operations and financial condition.

Vapor

expects that the tobacco industry will experience significant regulatory developments over the next few years, driven principally

by the World Health Organization’s Framework Convention on Tobacco Control (“FCTC”). The FCTC is the first international

public health treaty on tobacco, and its objective is to establish a global agenda for tobacco regulation with the purpose of

reducing initiation of tobacco use and encouraging cessation. Regulatory initiatives that have been proposed, introduced or enacted

include:

| |

● |

the

levying of substantial and increasing tax and duty charges; |

| |

|

|

| |

● |

restrictions

or bans on advertising, marketing and sponsorship; |

| |

|

|

| |

● |

the

display of larger health warnings, graphic health warnings and other labelling requirements; |

| |

|

|

| |

● |

restrictions

on packaging design, including the use of colors and generic packaging; |

| |

|

|

| |

● |

restrictions

or bans on the display of tobacco product packaging at the point of sale, and restrictions or bans on cigarette vending machines; |

| |

|

|

| |

● |

requirements

regarding testing, disclosure and performance standards for tar, nicotine, carbon monoxide and other smoke constituents levels; |

| |

|

|

| |

● |

requirements

regarding testing, disclosure and use of tobacco product ingredients; |

| |

|

|

| |

● |

increased

restrictions on smoking in public and work places and, in some instances, in private places and outdoors; |

| |

|

|

| |

● |

elimination

of duty free allowances for travellers; and |

| |

|

|

| |

● |

encouraging

litigation against tobacco companies. |

If

electronic cigarettes, including vaporizers and e-liquids, are subject to one or more significant regulatory initiates enacted

under the FCTC, Vapor’s business, results of operations and financial condition could be materially and adversely affected.

Employees

As

of March 15, 2015, we had 120 full-time employees and 19 part-time employees, none of which are represented by a collective bargaining

agreement. We believe that our employee relations are good.

Item

1A. Not applicable to smaller reporting companies

Item

2. Properties.

We

lease approximately 13,323 square feet of office and warehouse facilities located at 3001 and 3091 Griffin Road, Dania Beach Florida,

under a 24 month lease agreement terminating in March 2016. The lease provides for annual rental payments of $158,760 in the 12-months

ended in March 2015 and $174,636 during the following year. The lease requires us to pay all applicable state and municipal sales

tax as well as all operating expenses relating to the premises. In October 2013, we amended the master lease to include an additional

approximately 2,200 square feet for an additional annual rental payment of $18,000 subject to the same renewal options and other

terms and conditions set forth in the master lease.

During

the year ended December 31, 2014, we entered into nine real estate leases for eight new retail kiosks and one new retail store

that we assumed from the Sellers under the Asset Purchase Agreement that we and the Sellers mutually terminated on August 26,

2014 pursuant to the Termination Letter. The kiosks opened during the fourth quarter of 2014 and the store is scheduled to open

during 2015. The kiosks are located in malls in Florida, Maryland, New Jersey and Texas. The retail store is located in Ft. Lauderdale,

FL. Under these leases, the initial lease terms range from one to five years, the Company is required to pay base and percentage

rents and the Company is required to pay for common area and maintenance charges and utilities.

In

connection with the March 2015 merger with Vaporin, we have eight real estate leases for retail stores and one lease for a warehouse

all located in west and central Florida. In addition, we have a lease for administrative offices in Miami, Florida.

Item

3. Legal Proceedings.

From

time to time we may be involved in various claims and legal actions arising in the ordinary course of our business. There were

no pending material claims or legal matters as of the date of this report other than one of the two following matters.

On

May 15, 2011, the Company became aware that Ruyan Investment (Holdings) Limited (“Ruyan”) had named the Company, along

with three other sellers of electronic cigarettes in a lawsuit filed in the U.S. District Court for the Central District of California

alleging infringement of U.S. Patent No. 7,832,410, entitled “Electronic Atomization Cigarette” against the Company’s

Fifty-One Trio products. In that lawsuit, which was initially filed on January 12, 2011, Ruyan was unsuccessful in bringing suit

against the Company due to procedural rules of the court. Subsequent thereto, on July 29, 2011, Ruyan filed a new lawsuit in which

it named the Company, along with seven other sellers of electronic cigarettes, alleging infringement of the same patent. On March

1, 2013, the Company and Ruyan settled this multi-defendant federal patent infringement lawsuit as to them pursuant to a settlement

agreement by and between them. Under the terms of the settlement agreement:

| |

● |

The

Company acknowledged the validity of Ruyan’s U.S. Patent No. 7,832,410 for “Electronic Atomization Cigarette”

(the “410 Patent”), which had been the subject of Ruyan’s patent infringement claim against the Company;

|

| |

|

|

| |

● |

The

Company paid Ruyan a lump sum payment of $12,000 for the Company’s previous sales of electronic cigarettes based on

the 410 Patent; and |

| |

|

|

| |

● |

On

March 1, 2013, in conjunction with releasing one another (including their respective predecessors, successors, officers, directors

and employees, among others) from claims related to the 410 Patent, the Company and Ruyan filed a Stipulated Judgment and

Permanent Injunction with the above Court dismissing with prejudice all claims which have been or could have been asserted

by them in the lawsuit. |

On

June 22, 2012, Ruyan filed a second lawsuit against the Company alleging infringement of U.S. Patent No. 8,156,944, entitled “Aerosol

Electronic Cigarette” (the “944 Patent”). Ruyan also filed separate cases for patent infringement against nine

other defendants asserting infringement of the ‘944 Patent. Ruyan’s second lawsuit against the Company known as Ruyan

Investment (Holdings) Limited v. Vapor Corp., No. 12-cv-5466, is pending in the United States District Court for the Central District

of California. All of these lawsuits have been consolidated for discovery and pre-trial purposes. The Company intends to vigorously

defend against this lawsuit.

On

February 25, 2013, Ruyan’s second patent infringement lawsuit against the Company as well as all of the other consolidated

lawsuits were stayed as a result of the Court granting a stay in one of the consolidated lawsuits. The Court granted the motion

to stay Ruyan’s separate lawsuits against the Company and the other defendants based on the filing of a request for inter

partes reexamination of the 944 Patent at the U.S. Patent and Trademark Office.

As

a result of the stay, all of the consolidated lawsuits involving the 944 Patent have been stayed until the reexamination is completed.

As a condition to granting the stay of all the lawsuits, the Court required any other defendant who desires to seek reexamination

of the 944 Patent and potentially seek another stay (or an extension of the existing stay) based on any such reexamination to

seek such reexamination no later than July 1, 2013. Two other defendants sought reexamination of the 944 Patent before expiration

of such Court-imposed deadline of July 1, 2013. All reexamination proceedings of the 944 Patent have been stayed by the United

States Patent and Trademark Office Patent Trial and Appeal Board pending its approval of one or more of them. On December 24,

2014, the Patent Trial and Appeal Board issued its ruling that all of the challenged claims in the reexamination proceedings of

the ‘944 patent were invalid except for one claim. To the extent claim 11 is asserted against the Company, the Company will

vigorously defend itself against such allegations. Currently, the case remains stayed.

On

March 5, 2014, Fontem Ventures, B.V. and Fontem Holdings 1 B.V. (the successors to Ruyan) filed a complaint against the Company

in the U.S. District Court for the Central District of California, captioned Fontem Ventures B.V., et al. v. Vapor Corp., No.

14-cv-1650. The complaint alleges infringement of U.S. Patent No. 8,365,742, entitled “Aerosol Electronic Cigarette”,

U.S. Patent No. 8,375,957, entitled “Electronic Cigarette” (the “957 Patent”), U.S. Patent No. 8,393,331,

entitled “Aerosol Electronic Cigarette” (the “331 Patent”) and U.S. Patent No. 8,490,628, entitled “Electronic

Atomization Cigarette” (the “628 Patent”). On April 8, 2014, plaintiffs amended their complaint to add U.S.

Patent No. 8,689,805, entitled “Electronic Cigarette” (the “805 Patent”). The products accused of infringement

by plaintiffs are various Krave, Fifty-One and Hookah Stix products and parts. Nine other companies were also sued in separate

lawsuits alleging infringement of one or more of the patents listed above. The Company filed its Answer and Counterclaims on May

1, 2014 and believes the claims are without merit. Other defendants have filed petitions for inter partes reexamination of the

331, 628 and 805 Patents at the U.S. Patent and Trademark Office, which petitions are pending.

On

October 21, 2014, Fontem Ventures B.V. and Fontem Holdings 1 B.V. filed a complaint against the Company in the U.S. District Court

for the Central District of California, captioned Fontem Ventures B.V., et al. v. Vapor Corp., No. 14-cv-8155. The complaint alleges

infringement of United States Patent No. 8,863,752, entitled “Electronic Cigarette”. The products accused of infringement

by plaintiffs are various Krave and Fifty-One products and parts. The Company has not yet been served with the complaint. On January

15, 2015, the Company filed its Answer and Counterclaims. The Company will vigorously defend itself against such allegations.

On

December 2, 2014, Fontem Ventures B.V. and Fontem Holdings 1 B.V. filed a complaint against the Company in the U.S. District Court

for the Central District of California, captioned Fontem Ventures B.V., et al. v. Vapor Corp., No. 14-cv-09267. The Compliant

alleges infringement by plaintiffs are various Krave, Vapor X and Fifty-One products and parts. Fontem amended its compliant on

December 16, 2014, to allege infringement of United States Patent No. 8,910,641, entitled “Electronic Cigarette” against

the same products. On January 15, 2015, the Company filed its Answer and Counterclaims. The Company will vigorously defend itself

against such allegations.

All

of the above referenced cases filed by Fontem have been consolidated and are currently scheduled for trail in November 2014. The

parties are currently in active fact discovery and claim construction.

PART

II

Item

5. Market for Registrant’s Common Equity, Related Stockholder

Matters and Issuer Purchases of Equity Securities

Market

Information

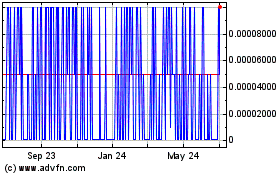

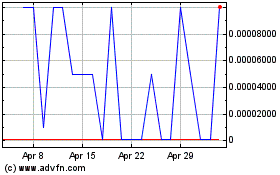

Our

common is listed on the NASDAQ Capital Market under the symbol VPCO. Prior to listing on the NASDAQ Capital Market on May 30,

2014, our common stock was quoted on the OTC Bulletin Board and the OTC Markets-OTCQB tier under the symbol VPCO. The following

table sets forth the high and low sale prices per share of our common stock on the NASDAQ Capital Market, and the high and low

bid prices per share of our common stock as quoted on the OTC Bulletin Board and the OTC Markets-OTCQB tier for the periods indicated,

as applicable.

| | |

Fiscal 2014 | | |

Fiscal 2013 | |

| | |

High | | |

Low | | |

High | | |

Low | |

| First Quarter | |

$ | 9.05 | | |

$ | 5.63 | | |

$ | 4.00 | | |

$ | 1.15 | |

| Second Quarter | |

$ | 6.75 | | |

$ | 3.90 | | |

$ | 6.60 | | |

$ | 1.95 | |

| Third Quarter | |

$ | 5.09 | | |

$ | 1.33 | | |

$ | 5.85 | | |

$ | 3.80 | |

| Fourth Quarter | |

$ | 2.81 | | |

$ | 1.02 | | |

$ | 9.80 | | |

$ | 4.00 | |

Holders

As

of March 30, 2015, there were 3,380 shareholders of record. However, we believe that there are significantly more beneficial holders

of our common stock as many beneficial holders hold their stock in “street” name.

Dividends

We

did not pay any cash dividends on our common stock during 2014 or 2013 and have no intention of doing so in the foreseeable future.

We intend to retain any earnings for use in our operations and the expansion of our business. Any future determination to declare

and pay cash dividends will be made at the discretion of our board of directors, subject to applicable laws and will depend on

our financial condition, results of operations, liquidity, capital requirements, general business conditions, any contractual

restriction on the payment of dividends and other factors that our board of directors may deem relevant.

Securities

Authorized for Issuance Under Equity Compensation Plans

Reference

is made to “Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters—Securities

Authorized for Issuance under Equity Compensation Plans” for the information required by this item.

Forward-Looking

Statements

In

addition to historical information, this report contains forward-looking statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended. Forward-looking statements are those that predict or describe future events or trends and that

do not relate solely to historical matters. You can generally identify forward-looking statements as statements containing the

words “believe,” “expect,” “will,” “anticipate,” “intend,” “estimate,”

“project,” “assume” or other similar expressions, although not all forward-looking statements contain

these identifying words. All statements in this report regarding our future strategy, future operations, projected financial position,

estimated future revenue, projected costs, future prospects, and results that might be obtained by pursuing management’s

current plans and objectives are forward-looking statements. You should not place undue reliance on our forward-looking statements

because the matters they describe are subject to known and unknown risks, uncertainties and other unpredictable factors, many

of which are beyond our control. Important risks that might cause our actual results to differ materially from the results contemplated

by the forward-looking statements are contained in “Item 7. Management’s Discussion and Analysis of Financial Condition

and Results of Operations” of this report. Our forward-looking statements are based on the information currently available

to us and speak only as of the date on which this report was filed with the SEC. We expressly disclaim any obligation to issue

any updates or revisions to our forward-looking statements, even if subsequent events cause our expectations to change regarding

the matters discussed in those statements. Over time, our actual results, performance or achievements will likely differ from

the anticipated results, performance or achievements that are expressed or implied by our forward-looking statements, and such

difference may be significant and materially adverse to our stockholders.

ITEM

6. SELECTED FINANCIAL DATA.

Not

applicable.

ITEM

7. Management’s Discussion and Analysis of Financial

Condition and Results of Operations

The

following management’s discussion and analysis of financial condition and results of operations should be read in conjunction

with our audited consolidated financial statements and related notes thereto included elsewhere in this report.

Executive

Overview

The

Company designs, markets, and distributes electronic cigarettes, vaporizers, e-liquids and accessories, under the emagine vaporTM,

Krave®, VaporX®, Hookah Stix®, and Fifty-One® (also known as Smoke 51) brands. “Vaporizers” and “Electronic

cigarettes” or “e-cigarettes,” are battery-powered products that enable users to inhale nicotine vapor without

smoke, tar, ash, or carbon monoxide. Electronic cigarettes look like traditional cigarettes and, regardless of their construction,

are comprised of three functional components: (i) a mouthpiece, which is a small plastic cartridge that contains a liquid nicotine

solution; (ii) a heating element that vaporizes the liquid nicotine so that it can be inhaled; and (iii) the electronics, which

include: a lithium-ion battery, an airflow sensor, a microchip controller and an LED, which illuminates to indicate use.

The

Company participates directly in the highly competitive and fragmented vaporizer and e-cigarette market, but also faces competition

from big tobacco companies. Vaporizers and electronic cigarettes are relatively new products and the Company is continually working

to introduce its products and brands to customers. The Company believes increased investment in marketing and advertising programs

is critical to increasing product and brand awareness and that sales of its innovative and differentiated products are enhanced

by knowledgeable salespersons who can convey the value and benefits vaporizers and electronic cigarettes have to offer over traditional

tobacco burning cigarettes.

The

Company’s business strategy leverages its ability to design market and develop vaporizers and e-cigarettes and to bring

those products to market through its multiple distribution channels. The Company sells its products through its company owned

retail kiosks, retail stores, online stores, to retail channels through its direct sales force, and through third-party wholesalers,

retailers, and value-added resellers.

Critical

Accounting Policies and Estimates

This

discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements,

which have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial

statements, and the reported amounts of net revenue and expenses during the reporting periods. Actual results could differ from

those estimates. These estimates and assumptions include allowances, reserves and write-downs of receivables and inventories,

stock-based payment arrangements, deferred taxes and related valuation allowances. Certain of our estimates could be affected

by external conditions, including those unique to our industry, and general economic conditions. It is possible that these external

factors could have an effect on our estimates that could cause actual results to differ from our estimates. The Company re-evaluates

all of its accounting estimates at least quarterly based on these conditions and records adjustments when necessary.

Revenue

Recognition

Net

sales consist primarily of revenue from the sale of vaporizers, electronic cigarettes, e-liquids, replacement cartridges, components

and related accessories. We recognize revenue from product sales when the persuasive evidence of an arrangement exists, selling

price has been fixed and determined, delivery has occurred and collectability is reasonably assured. Product sales and shipping

revenues, net of promotional discounts, rebates, and return allowances, are recorded when the products are shipped and title passes

to customers. Retail items sold to customers are made pursuant to sales contracts that generally provide for transfer of both

title and risk of loss upon our delivery to the carrier. Customer allowances and product returns, which reduce product revenue

by our best estimate of these expected allowances and product returns, are estimated using historical experience. Revenue from

product sales and services rendered is recorded net of sales taxes.

Accounts

Receivable

Accounts

receivable, net are stated at the amount the Company expects to collect. The Company provides a provision for allowances that

includes returns, allowances and doubtful accounts equal to the estimated uncollectible amounts. The Company estimates its provision

for allowances based on historical collection experience and a review of the current status of trade accounts receivable. It is

reasonably possible that the Company’s estimate of the provision for allowances will change.

Inventories

Inventories

are stated at the lower of cost (determined by the first-in, first-out method) or market. If the cost of the inventories exceeds

their market value, provisions are recorded to write down excess inventory to its net realizable value. The Company’s inventories

consist primarily of merchandise available for resale.

Stock-Based

Compensation

We

account for stock-based compensation under Accounting Standard Codification Topic (“ASC”) 718, “Compensation-Stock

Compensation” (“ASC 718”). These standards define a fair value based method of accounting for stock-based

compensation. In accordance with ASC 718, the cost of stock-based compensation is measured at the grant date based on the value

of the award and is recognized over the vesting period. The value of the stock-based award is determined using the Black-Scholes-Merton

valuation model, whereby compensation cost is the estimated fair value of the award as determined by the valuation model at the

grant date or other measurement date. The resulting amount is charged to expense on the straight-line basis over the period in

which we expect to receive the benefit, which is generally the vesting period.

Income

Taxes

The

Company uses the asset and liability method of accounting for income taxes in accordance with ASC 740, “Income Taxes”

(“ASC 740.”) Under this method, income tax expense is recognized as the amount of: (i) taxes payable or refundable

for the current year and (ii) future tax consequences attributable to differences between financial statement carrying amounts

of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted

tax rates expected to apply to taxable income in the years which those temporary differences are expected to be recovered or settled.

The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the results of operations in the period

that includes the enactment date. A valuation allowance is provided to reduce the deferred tax assets reported if based on the

weight of available evidence it is more likely than not that some portion or all of the deferred tax assets will not be realized.

Convertible

Debt Instruments

The

Company accounts for convertible debt instruments when the Company has determined that the embedded conversion options should

not be bifurcated from their host instruments in accordance with ASC 470-20 “Debt with Conversion and Other Options”.

The Company records, when necessary, discounts to convertible notes for the intrinsic value of conversion options embedded in

debt instruments based upon the differences between the fair value of the underlying common stock at the commitment date of the

note transaction and the effective conversion price embedded in the note. The Company amortizes the respective debt discount over

the term of the notes, using the straight-line method, which approximates the effective interest method.

Other

Contingencies

In

the ordinary course of business, we are involved in legal proceedings regarding contractual and employment relationships, product

liability claims, trademark rights, and a variety of other matters. We record contingent liabilities resulting from claims against

us, including related legal costs, when a loss is assessed to be probable and the amount of the loss is reasonably estimable.

Assessing probability of loss and estimating probable losses requires analysis of multiple factors, including, in some cases,

judgments about the potential actions of third party claimants and courts. Recorded contingent liabilities are based on the best

information available and actual losses in any future period are inherently uncertain. If future adjustments to estimated probable

future losses or actual losses exceed our recorded liability for such claims, we would record additional charges as other (income)

expense, net during the period in which the actual loss or change in estimate occurred. In addition to contingent liabilities

recorded for probable losses, we disclose contingent liabilities when there is a reasonable possibility that the ultimate loss

will materially exceed the recorded liability. Currently, we do not believe that any of our pending legal proceedings or claims

will have a material impact on our financial position or results of operations.

The

information contained under Results of Operations and Liquidity and Capital Resources reflects only Vapor during the years ended

December 31, 2013 and 2014 and does not reflect the same information for Vaporin.

Results

of Operations for the Year Ended December 31, 2014 Compared to the Year Ended December 31, 2013

Net

sales for the year ended December 31, 2014 and 2013 were $15,279,860 and $25,990,227, respectively, a decrease of $10,710,367

or approximately 41.2%. The decrease in sales is primarily attributable to decreased sales of our television direct marketing

campaign for our Alternacig® brand, a decrease in sales of our on-line stores and distributor inventory buildup in the e-cigarette

category that existed in 2013 and continued during 2014. This is a result of the increasing prevalence of vaporizers, tanks and

open system vapor products that are dramatically marginalizing the e-cigarette category and increased our customer returns of

e-cigarette products. We have increased our purchases of vaporizers, tanks and open system vapor products as we shift our inventory

mix to align with products in high customer demand. Sales were also negatively impacted by new national competitors’ launches

of their own branded products during the second quarter of 2014. Due to low conversion rates of our Alternacig® and VaporX®

branded direct marketing campaign, we limited the direct marketing campaign, resulting in lower sales of direct marketing products.

In addition, sales decreased due to certain wholesale and distribution customers selling off their current inventory of electronic

cigarette products so they can switch to e-vapor products. During the second half of 2014 we introduced several new e-vapor products

under the Vapor X brand, including premium USA manufactured e-liquids. We anticipate that the demand for e-vapor products will

continue to increase, as users want products that have more advanced technology with higher performance and longer battery life.

During the fourth quarter of 2014 we opened eight new emagine vaporTM retail kiosks to expand our distribution channels

for vaporizer and e-cigarette products. In addition we are altering our product mix to include more e-vapor products e-liquids

and vaporizer accessories and transitioning our customer base to these favorable demand products.

Cost

of goods sold for the year ended December 31, 2014 and 2013 was $14,497,254 and $16,300,333, respectively, a decrease of $1,803,077,

or approximately 11.1%. The decrease is primarily due to the overall decrease in sales, offset by write downs of $1,834,619 for

obsolete and slow moving inventory that primarily consisted of e-cigarettes. As customers complete the migration to vaporizers,

tanks and open vaporizer systems, our sales incentives should decrease.

Our

gross margins decreased to 5.1% from 37.3% primarily due to write downs of $1,834,619 for obsolete and slow moving inventory,

increase in sales returns, discounts, incentives and allowances that primarily resulted from the customer demand shift from e-cigarettes

to e-vapor products.

Selling,

general and administrative expenses for the year ended December 31, 2014 and 2013 were $11,126,759 and $6,464,969, respectively,

an increase of $4,661,790 or approximately 72.1%. The increase is primarily attributable to increases in non-cash stock compensation

expense of $1,631,340 primarily attributable to the consulting agreement with Knight Global Services, professional fees of $3,281,388

due to implementing the corporate actions we agreed to take in connection with the private placement of common stock we completed

in October 2013, including registering the shares for resale with the SEC, reincorporating in the State of Delaware from the State

of Nevada, effecting the 1-for-5 reverse stock split of our common stock and uplisting to the NASDAQ Capital Market, costs of

$576,138 incurred in connection with the initiation and termination of the previously contemplated acquisition of International

Vapor Group, Inc.’s online, wholesale and retail operations, consulting and recruiting fees of $882,590 related to the development

of the emagine vaporTM retail kiosk and store distribution channel, and costs incurred in connection with the merger

of Vaporin, Inc. We also incurred additional filing and listing fees related to our uplisting to The NASDAQ Capital Market, business

insurance due to the increases in coverage limits and increases in travel due to increased presence at trade shows and conferences,

net of decreased personnel costs attributable to decreased payroll net of the accrued severance related to the resignation of

our former Chief Executive Officer, merchant card processing fees due to lower transaction volumes.

Advertising

expense for the years ended December 31, 2014 and 2013 was $2,374,329 and $2,264,807, respectively, an increase of $109,522 or

4.8%. As a percentage of sales advertising expense increased to 15.5% for the year ended December 31, 2014 from 8.7% for the year

ended December 31, 2013. During the year ended December 31, 2014, we decreased our Internet advertising and television direct

marketing campaign for our Alternacig brand, increased our print advertising programs, participation at trade shows, initiated

several new marketing campaigns in which we sponsored several music concerts and we continued various other advertising campaigns.

Other

expense for the years ended December 31, 2014 and 2013 was $366,433 and $683,558, respectively, a decrease of $317,125. Included

in other expense is interest expense which was $348,975 and $383,981, for the years ended December 31, 2014 and 2013 respectively,

a decrease of $35,006 or 9.1%. The decrease was attributable to lower amounts of outstanding debt throughout 2014 compared to

2013. In addition, the Company incurred an induced conversion expense during the year ended December 31, 2013 of $299,577 related

to the reduction in the conversion price for the $350,000 Senior Convertible Notes and $75,000 Senior Convertible Notes in order

to induce the holders to convert the notes. Such inducement did not reoccur in 2014.

Income

tax expense (benefit) for the years ended December 31, 2014 and 2013 was $767,333 and $(524,791), respectively, an increase of

$1,292,124 or 246.2%. The Company determined, based on the weight of the available evidence, that a valuation allowance of $5,695,446

(or 100% of the Company’s net deferred tax assets) is required at December 31, 2014, which is the cause of the significant

increase in income tax expense compared to the year ended December 31, 2013. At December 31, 2013, the Company had determined

that a valuation allowance against its net deferred tax assets was not necessary and recorded an income tax benefit.

Net

(loss) income for the years ended December 31, 2014 and 2013 was $(13,852,249) and $801,352, respectively, a decrease of $14,653,601

as a result of the items discussed above.

Liquidity

and Capital Resources

Our

net cash used in operating activities was $6,291,027 and $4,120,152 for the years ended December 31, 2014 and 2013, respectively,

an increase of $2,170,875. Our net cash used in operating activities for the year ended December 31, 2014 resulted primarily from

our net losses, purchases of new inventories to meet future customer demand, and changes in accounts receivable, prepaid expenses,

accounts payable, accrued expenses and due from merchant credit card processor, which are attributable to our efforts to accommodate

anticipated future sales growth.

Our

net cash used in investing activities was $1,987,505 and $14,779 for the years ended December 31, 2014 and 2013, respectively.

Our net cash used in investing activities for the year ended December 31, 2014 resulted primarily from entering into loans receivable

with International Vapor Group, Inc. and Vaporin and for purchases of property and equipment utilized in connection with the opening

of eight retail kiosks.

Our

net cash provided by financing activities was $2,269,481 and $10,528,738 for the years ended December 31, 2014 and 2013, respectively,

a decrease of $8,259,256. These financing activities relate to the Company’s sale of $1,250,000 Senior Convertible Notes

entered into in November 2014, $1,000,000 Loan Payable to Related Party entered into in December 2014, and the $1,000,000 Term

Loan entered into in September 2014 and proceeds from the exercise of stock options net of principal repayments under the $750,000

and $1,000,000 Term Loans and principle repayments of capital lease obligations.

Our

financial statements for the year ended December 31, 2014 indicate there is substantial doubt about our ability to continue as

a going concern as we require additional equity and/or debt financing to continue our operations. We must ultimately generate

sufficient cash flow to meet our obligations on a timely basis, attain profitability in our business operations and be able to

fund our long term business development and growth plans. Our business will require significant amounts of capital to sustain

operations and make the investments we need to execute our longer-term business plan. Our liquidity and capital resources have

decreased as a result of the net operating loss of $13,852,249 that we incurred during the year ended December 31, 2014. At December

31, 2014 our accumulated deficit amounted to $15,231,903. At December 31, 2014, we had working capital of $127,874 compared to

$11,657,615 at December 31, 2013, a decrease of $11,529,741. On March 4, 2015, we and institutional and individual accredited

investors entered in a securities purchase pursuant to which we sold in a $3.5 million private placement ($2.9 million net proceeds

received) 3,432,314 shares of common stock and warrants to purchase up to 2,735,132 shares of our common stock. In addition, the

Merger with Vaporin also provides an additional financing to occur subsequent to the closing of the Merger for up to $25 million

of our common stock and warrants subject to us complying with financial covenants and performance-based metrics.

In

the ordinary course of our business, we enter in to purchase orders for components and finished goods, which may or may not require

vendor deposits and may or may not be cancellable by either party. At December 31, 2014 and 2013, we had $319,563 and $782,363

in vendor deposits, respectively, which are included in prepaid expenses on the consolidated balance sheets included elsewhere

in this report. At December 31, 2014 and 2013, we do not have any material financial guarantees or other contractual commitments

that are reasonably likely to have an adverse effect on liquidity.

As

of March 30, 2015, we had approximately $2 million of cash on hand. Our existing liquidity is not sufficient to fund our operations,

anticipated capital expenditures, working capital and other financing requirements for the foreseeable future. We believe we will

need to raise additional debt or equity financing to maintain and expand the business. Any equity financing or the issuance of

equity equivalents including convertible debt could be dilutive to our shareholders. If either such additional capital is not

available on terms acceptable to us or at all then we may need to curtail our operations and/or take additional measures to conserve