UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ____)

|

Filed by Registrant

|

þ

|

|

| |

|

|

|

Filed by Party other than Registrant

|

¨

|

|

| |

|

|

|

Check the appropriate box:

|

|

|

| o |

Preliminary Proxy Statement

|

¨

|

Confidential, for Use of the Commission

|

| |

|

|

Only (as permitted by Rule 14a-6(e)(2))

|

| |

|

|

|

|

Definitive Proxy Statement

|

¨

|

Definitive Additional Materials

|

| |

|

|

|

¨

|

Soliciting Materials Pursuant to §240.14a-12

|

|

|

FUSE SCIENCE, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

| |

|

|

þ

|

No fee required.

|

| |

|

|

¨

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| |

|

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

$_____ per share as determined under Rule 0-11 under the Exchange Act.

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

| |

(5)

|

Total fee paid:

|

| |

|

|

¨

|

Fee paid previously with preliminary materials.

|

|

¨

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

(1)

|

Amount previously paid:

|

| |

(2)

|

Form, Schedule or Registration Statement No.:

|

| |

(3)

|

Filing Party:

|

| |

(4)

|

Date Filed:

|

Fuse Science, Inc.

5510 Merrick Rd.

Massapequa, NY 11758

(516) 659-7558

To The Shareholders of Fuse Science, Inc.:

We are pleased to invite you to attend the Special Meeting of the Shareholders of Fuse Science, Inc., which will be held at 9:30 a.m. on May 6, 2015 at Nason, Yeager, Gerson, White & Lioce, 1645 Palm Beach Lakes Blvd, Suite 1200, West Palm Beach, FL 33401, in order to approve an amendment to our Articles of Incorporation to effectuate a one-for-100 reverse stock split.

Fuse’s Board of Directors has fixed the close of business on March 19, 2015 as the record date for a determination of shareholders entitled to notice of, and to vote at, this Special Meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Shareholders to Be Held on May 6, 2015: This Proxy Statement is available at: https://www.proxyvote.com.

If You Plan to Attend

Please note that space limitations make it necessary to limit attendance to shareholders. Registration and seating will begin at 9:00 a.m. Shares can be voted at the meeting only if the holder is present in person or by valid proxy.

For admission to the meeting, each shareholder may be asked to present valid picture identification, such as a driver’s license or passport, and proof of stock ownership as of the record date, such as the enclosed proxy card or a brokerage statement reflecting stock ownership. Cameras, recording devices and other electronic devices will not be permitted at the meeting.

If you do not plan on attending the meeting, please vote your shares via the Internet, by phone or by signing and dating the enclosed proxy and return it in the business envelope provided. Your vote is very important.

| |

By the Order of the Board of Directors

|

| |

|

| |

/s/ Ezra Green

|

| |

Ezra Green

|

| Dated: March 24, 2015 |

Chief Executive Officer

|

Whether or not you expect to attend in person, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares via the Internet, by phone or by signing, dating, and returning the enclosed proxy card will save us the expenses and extra work of additional solicitation. An addressed envelope for which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares at the meeting if you desire to do so, as your proxy is revocable at your option. Your vote is important, so please act today!

Fuse Science, Inc.

5510 Merrick Rd.

Massapequa, NY 11758

(516) 659-7558

PROXY STATEMENT

Why am I receiving these materials?

These proxy materials are being sent to the holders of shares of the voting stock of Fuse Science, Inc., a Nevada corporation, which we refer to as “Fuse” or the “Company,” in connection with the solicitation of proxies by our Board of Directors, which we refer to as the “Board,” for use at the Special Meeting of Shareholders to be held at 9:30 a.m. on May 6, 2015 at Nason, Yeager, Gerson, White & Lioce, 1645 Palm Beach Lakes Blvd, Suite 1200, West Palm Beach, FL 33401. The proxy materials relating to the Special Meeting are first being mailed to shareholders entitled to vote at the meeting on or about March 26, 2015.

Who is Entitled to Vote?

Our Board has fixed the close of business on March 19, 2015 as the record date for a determination of shareholders entitled to notice of, and to vote at, this Special Meeting or any adjournment thereof. On the record date, there were 80,000,000 shares of common stock outstanding. Each share of Fuse common stock represents one vote that may be voted on each matter that may come before the Special Meeting. In addition, holders of the Company’s Series C Convertible Preferred Stock, which votes on an as-converted-to-common-stock basis together with the holders of the Company’s common stock as a single class, are entitled to an aggregate of 11,730,192 votes as of the record date. The Company’s other outstanding series of preferred stock are not entitled to vote on any of the matters at the meeting.

What is the difference between holding shares as a record holder and as a beneficial owner?

If your shares are registered in your name with our transfer agent, Equity Stock Transfer, you are the “record holder” of those shares. If you are a record holder, these proxy materials have been provided directly to you by Fuse.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials have been forwarded to you by that organization. As the beneficial owner, you have the right to instruct that organization on how to vote your shares.

Who May Attend the Meeting?

Record holders and beneficial owners may attend the Special Meeting. If your shares are held in street name, you will need to bring a copy of a brokerage statement or other documentation reflecting your stock ownership as of the record date. Please see below for instructions on how to vote at the Special Meeting if your shares are held in street name.

How Do I Vote?

Record Holder

|

|

1.

|

Vote by Internet. The website address for Internet voting is on your proxy card.

|

|

|

2.

|

Vote by phone. Call 1 (800) 690-6903 and follow the instructions on your proxy card.

|

|

|

3.

|

Vote by mail. Mark, date, sign and mail promptly the enclosed proxy card (a postage-paid envelope is provided for mailing in the United States).

|

|

|

4.

|

Vote in person. Attend and vote at the Special Meeting.

|

If you vote by Internet or phone, please DO NOT mail your proxy card.

Beneficial Owner (Holding Shares in Street Name)

|

|

1.

|

Vote by Internet. The website address for Internet voting is on your vote instruction form.

|

|

|

2.

|

Vote by mail. Mark, date, sign and mail promptly the enclosed vote instruction form (a postage-paid envelope is provided for mailing in the United States).

|

|

|

3.

|

Vote in person. Obtain a valid legal proxy from the organization that holds your shares and attend and vote at the Special Meeting.

|

What Constitutes a Quorum?

To carry on the business of the Special Meeting, we must have a quorum. A quorum is present when a majority of the outstanding shares of stock entitled to vote, as of the record date, are represented in person or by proxy. Shares owned by Fuse are not considered outstanding or considered to be present at the Special Meeting. Abstentions are counted as present for the purpose of determining the existence of a quorum.

What happens if Fuse is unable to obtain a Quorum?

If a quorum is not present to transact business at the Special Meeting or if we do not receive sufficient votes in favor of the proposals by the date of the Special Meeting, the holders of a majority of the shares represented may adjourn the meeting until a quorum is present or represented.

Is the Proposal Considered “Routine” or “Non-Routine”?

The proposal is considered routine. Therefore, there will be no “broker non-votes” in connection with the Special Meeting.

How are abstentions treated?

Abstentions only have an effect on the outcome of any matter being voted on that requires the approval based on our total voting stock outstanding. Thus, abstentions will have an effect on the proposal.

How Many Votes are Needed for The Proposal to Pass, is Broker Discretionary Voting Allowed and what is the effect of an abstention?

|

Proposals

|

Vote Required

|

Broker Discretionary Vote Allowed

|

Effect of Abstentions on the Proposal

|

|

To approve the amendment to the Articles of Incorporation to effect a reverse stock split

|

Majority of the outstanding voting shares

|

Yes

|

Vote against

|

What Are the Voting Procedures?

You may vote in favor of or against the proposal, or you may abstain from voting on the proposal. You should specify your choice on the accompanying proxy card or your vote instruction form.

Is My Proxy Revocable?

You may revoke your proxy and reclaim your right to vote up to and including the day of the Special Meeting by giving written notice to the Corporate Secretary of Fuse, by delivering a proxy card dated after the date of the proxy or by voting in person at the Special Meeting. All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: Fuse Science, Inc., Ezra Green, Attention: Corporate Secretary.

Who is Paying for the Expenses Involved in Preparing and Mailing this Proxy Statement?

All of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by Fuse. In addition to the solicitation by mail, proxies may be solicited by our officers and regular employees by telephone or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in so doing. We may hire an independent proxy solicitation firm.

What Happens if Additional Matters are Presented at the Special Meeting?

Other than the items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the Special Meeting. If you submit a signed proxy card, the persons named as proxy holders, Messrs. Ezra Green and Michael D. Harris, Esq, will have the discretion to vote your shares on any additional matters properly presented for a vote at the Special Meeting.

What is “householding” and how does it affect me?

Record holders who have the same address and last name will receive only one copy of their proxy materials, unless we are notified that one or more of these record holders wishes to continue receiving individual copies. This procedure will reduce our printing costs and postage fees. Shareholders who participate in householding will continue to receive separate proxy cards.

If you are eligible for householding, but you and other record holders with whom you share an address, receive multiple copies of these proxy materials, or if you hold Fuse stock in more than one account, and in either case you wish to receive only a single copy of each of these documents for your household, please contact our Transfer Agent, Equity Stock Transfer (in writing: 237 W 37th St Suite 601 New York, NY 10018, Attention: Nora Marckwordt; or by telephone: (917-746-4595).

If you participate in householding and wish to receive a separate copy of these proxy materials, or if you do not wish to continue to participate in householding and prefer to receive separate copies of these documents in the future, please contact our Corporate Secretary as indicated above. Beneficial owners can request information about householding from their brokers, banks or other holders of record.

Do I Have Dissenters’ (Appraisal) Rights?

Appraisal rights are not available to Fuse shareholders with any of the proposals brought before the Special Meeting.

Interest of Officers and Directors in Matters to Be Acted Upon

None of the officers or directors have any interest in any of the matters to be acted upon at the Special Meeting.

The Board Recommends that Shareholders Vote “For” the Proposal

PROPOSAL

APPROVAL OF AN AMENDMENT TO THE ARTICLES OF INCORPORATION TO EFFECT A REVERSE STOCK SPLIT.

Our Board has adopted a resolution declaring it advisable and in the best interests of Fuse and its shareholders to amend our Articles to effectuate a one-for-100 reverse stock split (the “Reverse Stock Split”). Until one year from the Special Meeting, our Board will have the sole discretion to elect, as it determines to be in the best interests of Fuse and our shareholders, whether or not to effect the Reverse Stock Split. Our Board may elect not to implement the approved Reverse Stock Split at its sole discretion, even if the Reverse Stock Split is approved by our shareholders.

To effect the reverse stock split, our Board would authorize our management to file an amendment to our Articles with the Nevada Secretary of State. The proposed form of amendment to our Articles is attached to this Proxy Statement as Annex A.

Purpose of the Reverse Stock Split

The Company is seeking to effect the Reverse Split because it requires more shares of common stock to effect future conversions of its Series A Convertible Preferred Stock (“Series A”). The Series A Certificate of Designations filed in Nevada provides that the conversion price, after giving effect to the reverse common stock split effectuated on December 9, 2014 (the “Prior Reverse Split”), is the lower of (i) $0.20 per share and (ii) 20% of the lowest volume weighted average price of the common stock during the prior 20-day period. In other words, there is no floor on the conversion price, which creates significant downward pressure on the price of the Company’s common stock and has essentially placed the Company in a position where the Company presently has no authorized shares of common stock available to issue. Thus, in order to comply with the contractual rights of the holders of the Series A, the Company is seeking to effect the Reverse Split. Fuse shareholders should note that the Prior Reverse Split did not solve this problem and was undertaken solely in order to reduce the par value and eliminate any legal issues resulting from the fact that the conversion prices were lower than par value. Under Nevada law, shareholder approval is not required to effect a reverse split if the number of shares of authorized common stock are reduced proportionately, which is why the Prior Reverse Split was not submitted to shareholders for approval. The proposed Reverse Stock Split is seeking to reduce the number of shares of common stock outstanding without reducing the authorized number of shares of common stock, which requires shareholder approval.

Following the effectiveness of the Reverse Stock Split, the Company intends to enter into a written agreement with each holder of Series A which will provide that the conversion price (giving effect to the Reverse Stock Split) shall be fixed at $0.10 per share, subject to adjustment for any further stock splits, stock dividends and combinations, and which will eliminate the ratchet and anti-dilution provisions of the Series A. While this will eliminate the pressure on our stock price, the Company will need the flexibility to use common stock and permit future conversions of all series of convertible preferred stock. In addition, while the Company has engaged in preliminary discussions with certain Series A shareholders, it cannot offer any assurances that it will successfully enter into any agreement with such shareholders. In the event the Company is unable to reach an agreement with the Series A shareholders, the conversion price of the Series A will continue to have no floor.

The Company presently has no specific plans, nor has it entered into any arrangements or understandings (other than the preliminary discussions with Series A shareholders described above) regarding the shares of common stock that will be newly available for issuance upon effectiveness of the Reverse Stock Split. However, the Company expects that holders of the Series A will resume conversions of the Series A into shares of common stock upon effectiveness of the Reverse Stock Split. Assuming the proposed agreement with Series A shareholders described above is executed, the Series A will be convertible into approximately 50.1 million shares of common stock, giving effect to the Reverse Stock Split. In addition, holders of the Company’s Series B Convertible Preferred Stock (the “Series B”) and Series C Convertible Preferred Stock (the “Series C”) may also choose to convert some or all of their shares upon effectiveness of the Reverse Stock Split. The Series B and Series C are convertible into 6,400 and approximately 117,000 shares of common stock, respectively, giving effect to the Reverse Stock Split.

Risks of the Reverse Stock Split

The Reverse Stock Split may adversely affect the capitalization of our Company based on a number of factors which may be unrelated to the number of shares outstanding. These factors may include our performance, general economic and market conditions and other factors, many of which are beyond our control. The market price per share may not rise, or it may remain constant in proportion to the reduction in the number of shares outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split. In the future, the market price of common stock following the Reverse Stock Split may not equal or exceed the market price prior to the Reverse Stock Split.

Effects of the Reverse Stock Split

Reduction of Shares Held by Individual Shareholders. After the effective date of the Reverse Stock Split, each common shareholder will own fewer shares of our common stock. However, the Reverse Stock Split will affect all of our common shareholders uniformly and will not affect any common shareholder’s percentage ownership interests in us, except to the extent that the Reverse Stock Split results in any of our shareholders owning a fractional share. As discussed further below, we will pay cash in lieu of fractional shares. The number of shareholders of record will not be affected by the Reverse Stock Split (except to the extent that any shareholder holds only a fractional share interest and receives cash for such interest after the Reverse Stock Split). However, if the Reverse Stock Split is approved, it will increase the number of shareholders who own “odd lots” of less than 100 shares of our common stock. Brokerage commissions and other costs of transactions in odd lots may be higher than the costs of transactions of more than 100 shares of common stock.

Reduction in Total Outstanding Shares. The proposed Reverse Stock Split will reduce the total number of outstanding shares of common stock by a factor of 100. As of the Record Date, there were 80,000,000 shares outstanding. If the Reverse Stock Split were effectuated as of the Record Date, there would be 800,000 shares outstanding.

Change in Number and Exercise Price of Employee and Equity Awards. The Reverse Stock Split will reduce the number of shares of common stock available for issuance under our equity plans and agreements in proportion to the split ratio. Under the terms of our outstanding equity and option awards, the Reverse Stock Split will cause a reduction in the number of shares of common stock issuable upon exercise or vesting of such awards in proportion to the split ratio of the Reverse Stock Split and will cause a proportionate increase in the exercise price of such awards to the extent they are stock options. The number of shares authorized for future issuance under our equity plans will also be proportionately reduced. The number of shares of common stock issuable upon exercise or vesting of stock option awards will be rounded to the nearest whole share and no cash payment will be made in respect of such rounding. Warrant and other convertible security holders, if any, will also see a similar reduction of the number of shares that such instruments are convertible into as stock option holders described above.

Regulatory Effects. Our common stock is currently registered under Section 12(g) of the Exchange Act and we are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Stock Split will not affect the registration of the common stock under the Exchange Act or our obligation to publicly file financial and other information with the Securities and Exchange Commission. If the Reverse Stock Split is implemented, our common stock will continue to trade on the OTCPK. The Company intends to seek listing on the OTCQB but cannot offer assurances that it will attain such listing.

In addition to the above, the Reverse Stock Split will have the following effects upon our common stock:

|

|

·

|

The number of shares owned by each holder of common stock will be reduced;

|

|

|

·

|

The per share loss and net book value of our common stock will be increased because there will be a lesser number of shares of our common stock outstanding;

|

|

|

·

|

The authorized common stock and the par value of the common stock will remain $0.0001 per share;

|

|

|

·

|

The stated capital on our balance sheet attributable to the common stock will be decreased and the additional paid-in capital account will be credited with the amount by which the stated capital is decreased;

|

|

|

·

|

All outstanding options, warrants, and convertible securities entitling the holders thereof to purchase shares of common stock, if any, will enable such holders to purchase, upon exercise thereof, a fewer number of shares of common stock which such holders would have been able to purchase upon exercise thereof immediately preceding the Reverse Stock Split, at the same total price (but a higher per share price) required to be paid upon exercise thereof immediately preceding the Reverse Stock Split; and

|

|

|

·

|

As mentioned above, the Reverse Stock Split may result in some shareholders owning “odd lots” of less than 100 shares of common stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares.

|

Shares of common stock after the Reverse Stock Split will be fully paid and non-assessable. The amendment will not change any of the other terms of our common stock. The shares of common stock after the Reverse Stock Split will have the same voting rights and rights to dividends and distributions, and will be identical in all other respects to the shares of common stock prior to the Reverse Stock Split.

Because the number of authorized shares of our common stock will not be reduced, an overall effect of the Reverse Stock Split will be an increase in authorized but unissued shares of our common stock. These shares may be issued by our Board in its sole discretion. See “Anti-Takeover Effects of the Reverse Stock Split” below. Any future issuance will have the effect of diluting the percentage of stock ownership and voting rights of the present holders of our common stock and preferred stock.

Once we implement a Reverse Stock Split, the share certificates representing the shares of common stock will continue to be valid. In the future, new share certificates will be issued reflecting the Reverse Stock Split, but this in no way will affect the validity of your current share certificates. The Reverse Stock Split will occur without any further action on the part of our shareholders. After the effective date of the Reverse Stock Split, each share certificate representing the shares prior to the Reverse Stock Split will be deemed to represent the number of shares shown on the certificate, divided by 100. Certificates representing the shares after the Reverse Stock Split will be issued in due course as share certificates representing shares prior to the Reverse Stock Split are tendered for exchange or transfer to our transfer agent. We request that shareholders do not send in any of their stock certificates at this time.

As applicable, new share certificates evidencing new shares following the Reverse Stock Split that are issued in exchange for share certificates issued prior to the Reverse Stock Split representing old shares that are restricted shares will contain the same restrictive legend as on the old certificates. Also, for purposes of determining the term of the restrictive period applicable to the new shares after the Reverse Stock Split, the time period during which a shareholder has held their existing pre-Reverse Stock Split old shares will be included in the total holding period.

Procedure for Implementing the Reverse Stock Split

The Reverse Stock Split would become effective upon approval of the Reverse Stock Split by the Financial Industry Regulatory Authority and the filing of an amendment to our Articles with the Secretary of State of the State of Nevada. The exact date of the filing of the amendment that will effectuate the Reverse Stock Split will be determined by our Board based on its evaluation as to when such action will be the most advantageous to us and our shareholders. In addition, our Board reserves the right, notwithstanding shareholder approval and without further action by the shareholders, to elect not to proceed with the Reverse Stock Split if, at any time prior to filing the amendment to our Articles, our Board, in its sole discretion, determines that it is no longer in our best interest and the best interests of our shareholders to proceed with the Reverse Stock Split. If an amendment effecting the Reverse Stock Split has not been filed with the Secretary of State of the State of Nevada by the close of business one year from the date of this Special Meeting, our Board will abandon the Reverse Stock Split.

After the filing of the amendment, our common stock will have a new CUSIP number, which is a number used to identify our equity securities, and stock certificates with the older CUSIP number will need to be exchanged for stock certificates with the new CUSIP number by following the procedures described below.

As soon as practicable after the Reverse Stock Split, our transfer agent will act as exchange agent for purposes of implementing the exchange of stock certificates for record holders (i.e., shareholders who hold their shares directly in their own name and not through a broker). Record holders of pre-Reverse Stock Split shares will be asked to surrender to the transfer agent certificates representing pre-Reverse Stock Split shares in exchange for a book entry with the transfer agent or certificates representing post-Reverse Stock Split shares in accordance with the procedures to be set forth in a letter of transmittal to be sent by us. No new certificates will be issued to a shareholder until such shareholder has surrendered such shareholder’s outstanding certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent.

For street name holders of pre-Reverse Stock Split shares (i.e., shareholders who hold their shares through a broker), your broker will make the appropriate adjustment to the number of shares held in your account following the effective date of the Reverse Stock Split.

SHAREHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

No service charges, brokerage commissions or transfer taxes will be payable by any shareholder, except that if any new stock certificates are to be issued in a name other than that in which the surrendered certificate(s) are registered it will be a condition of such issuance that (1) the person requesting such issuance pays all applicable transfer taxes resulting from the transfer (or prior to transfer of such certificate, if any) or establishes to our satisfaction that such taxes have been paid or are not payable, (2) the transfer complies with all applicable federal and state securities laws, and (3) the surrendered certificate is properly endorsed and otherwise in proper form for transfer.

Payment for Fractional Shares

No fractional shares of common stock will be issued as a result of the Reverse Stock Split. Instead, shareholders who otherwise would be entitled to receive fractional shares, upon surrender to the exchange agent of such certificates representing such fractional shares, will be entitled to receive cash in an amount equal to the product obtained by multiplying (a) the closing price of our common stock on the record date as reported on OTCPK Market by (b) the number of shares of our common stock held by such shareholder that would otherwise have been exchanged for such fractional share interest.

Accounting Matters

The par value per share of our common stock will remain unchanged at $0.001 per share after the Reverse Stock Split. As a result, on the effective date of the Reverse Stock Split, the stated capital on our consolidated balance sheet attributable to common stock will be reduced and the additional paid-in-capital account will be increased by the amount by which the stated capital is reduced. Per share net income or loss will be increased because there will be fewer shares of our common stock outstanding. We do not anticipate that any other accounting consequences, including changes to the amount of stock-based compensation expense to be recognized in any period, will arise as a result of the Reverse Stock Split.

Certain Federal Income Tax Consequences

Each shareholder is advised to consult their own tax advisor as the following discussion may be limited, modified or not apply based on your own particular situation.

The following is a summary of important tax considerations of the Reverse Stock Split. It addresses only shareholders who hold the pre-Reverse Stock Split shares and post- Reverse Stock Split shares as capital assets. It does not purport to be complete and does not address shareholders subject to special rules, such as financial institutions, tax-exempt organizations, insurance companies, dealers in securities, mutual funds, foreign shareholders, shareholders who hold the pre-Reverse Stock Split shares as part of a straddle, hedge, or conversion transaction, shareholders who hold the pre-Reverse Stock Split shares as qualified small business stock within the meaning of Section 1202 of the Internal Revenue Code of 1986, as amended (the “Code”), shareholders who are subject to the alternative minimum tax provisions of the Code, and shareholders who acquired their pre-Reverse Stock Split shares pursuant to the exercise of employee stock options or otherwise as compensation. This summary is based upon current law, which may change, possibly even retroactively. It does not address tax considerations under state, local, foreign, and other laws. Furthermore, we have not obtained a ruling from the Internal Revenue Service or an opinion of legal or tax counsel with respect to the consequences of the Reverse Stock Split.

The Reverse Stock Split is intended to constitute a reorganization within the meaning of Section 368 of the Code. Assuming the Reverse Stock Split qualifies as a reorganization, a shareholder generally will not recognize gain or loss on the Reverse Stock Split, except to the extent of cash, if any, received in lieu of a fractional share interest in the post-Reverse Stock Split shares. The aggregate tax basis of the post-Reverse Stock Split shares received will be equal to the aggregate tax basis of the pre-Reverse Stock Split shares exchanged (excluding any portion of the holder’s basis allocated to fractional shares), and the holding period of the post-Reverse Stock Split shares received will include the holding period of the pre-Reverse Stock Split shares exchanged.

A holder of the pre-Reverse Stock Split shares who receives cash will generally recognize gain or loss equal to the difference between the portion of the tax basis of the pre- Reverse Stock Split shares allocated to the fractional share interest and the cash received. Such gain or loss will be a capital gain or loss and will be short term if the pre-Reverse Stock Split shares were held for one year or less and long term if held more than one year. No gain or loss will be recognized by us as a result of the Reverse Stock Split.

PLEASE CONSULT YOUR OWN TAX ADVISOR REGARDING THE U.S. FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT IN YOUR PARTICULAR CIRCUMSTANCES UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION.

No Appraisal Rights

Shareholders have no rights under Nevada law or under our charter documents to exercise dissenters’ rights of appraisal with respect to the Reverse Stock Split.

Anti-Takeover Effects of the Reverse Stock Split

The overall effect of the Reverse Stock Split may be to render more difficult the accomplishment of mergers or the assumption of control by a principal shareholder and thus make the removal of management more difficult.

The effective increase in our authorized and unissued shares as a result of the Reverse Stock Split could potentially be used by our Board to thwart a takeover attempt. The over-all effects of this might be to discourage, or make it more difficult to engage in, a merger, tender offer or proxy contest, or the acquisition or assumption of control by a holder of a large block of our securities and the removal of incumbent management. The Reverse Stock Split could make the accomplishment of a merger or similar transaction more difficult, even if it is beneficial to shareholders. Our Board might use the additional shares to resist or frustrate a third-party transaction, favored by a majority of the independent shareholders that would provide an above-market premium, by issuing additional shares to frustrate the takeover effort.

This Reverse Stock Split is not the result of management’s knowledge of an effort to accumulate the Company’s securities or to obtain control of the Company by means of a merger, tender offer, solicitation or otherwise.

Neither our Articles nor our Bylaws presently contain any provisions having anti-takeover effects and the Reverse Stock Split Proposal is not a plan by our Board to adopt a series of amendments to our Articles or Bylaws to institute an anti-takeover provision. We do not have any plans or proposals to adopt other provisions or enter into other arrangements that may have material anti-takeover consequences.

The Board recommends a vote “For” this proposal.

Fuse has no knowledge of any other matters that may come before the Special Meeting and does not intend to present any other matters. However, if any other matters shall properly come before the Meeting or any adjournment, the persons soliciting proxies will have the discretion to vote as they see fit unless directed otherwise.

If you do not plan to attend the Special Meeting, in order that your shares may be represented and in order to assure the required quorum, please sign, date and return your proxy promptly. In the event you are able to attend the Special Meeting, at your request, Fuse will cancel your previously submitted proxy.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT

The following table sets forth the number of shares of our common stock beneficially owned as the record date by (i) those persons known by us to be owners of more than 5% of our common stock, (ii) each director, (iii) our named executive officers for 2014 and (iv) all of our executive officers and directors as a group. The number of shares of the common stock outstanding used in calculating the percentage for each listed person includes the shares of common stock underlying options or convertible securities held by such persons that are exercisable within 60 days of the date of this report, but excludes shares of common stock underlying options or other convertible securities held by any other person. The number of shares of common stock outstanding as of the record date was 80,000,000. Except as noted otherwise, the amounts reflected below are based upon information provided to the Company and filings with the SEC. Unless otherwise specified in the notes to this table, the address for each person is: c/o Fuse Science, Inc. at the address on the cover page of this proxy statement.

| |

|

Number of Shares

|

|

|

|

|

| |

|

Of Common Stock

|

|

|

|

|

|

Name of Beneficial Owner

|

|

Beneficially Owned

|

|

Percent of Class (%)

|

|

| |

|

|

|

|

|

|

|

|

Directors and Executive Officers:

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Ezra Green (1)

|

|

|

1,000,987

|

|

|

1.3

|

|

| |

|

|

|

|

|

|

|

|

Brian Tuffin (2)

|

|

|

4,887,623

|

|

|

6.0

|

|

| |

|

|

|

|

|

|

|

|

David Rector (3)

|

|

|

-

|

|

|

*

|

|

| |

|

|

|

|

|

|

|

|

Gelvin Stevenson (4)

|

|

|

-

|

|

|

*

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

All directors and executive officers as a group (4 persons)

|

|

|

5,888,610

|

|

|

7.2

|

|

| |

(1) Mr. Green was appointed an officer of the Company effective October 1, 2014 and as a director of the Company effective October 27, 2014. The shares include 650 stock options.

|

| |

(2) Mr. Tuffin resigned as an officer of the Company effective October 1, 2014 and as a director of the Company effective October 27, 2014. On October 1, 2014, he became the Company’s Principal Executive, Financial and Accounting Officer for a period terminating with the filing of the Company’s Annual Report, as amended, on January 16, 2015. The shares include 750 stock options and 250 warrants. The shares do not include shares of Series A Preferred stock which cannot currently be converted because of a blocker. Based on the last information provided to us by Mr. Tuffin, which we have not independently verified, his address is 6135 NW 167th Street, Suite E-21, Miami Lakes, FL 33015.

|

| |

(3) Mr. Rector was appointed a director of the Company on November 13, 2014.

|

| |

(4) Mr. Stevenson was appointed a director of the Company effective October 27, 2014.

|

| |

|

| |

|

* Represents less than 1%.

Annex A

AMENDMENT TO ARTICLES OF INCORPORATION

OF FUSE SCIENCE, INC.

Article IV of the Company's Articles of Incorporation shall be amended by adding the following section to the end of sub-section B of Article IV as sub-section B(5) of the Articles of Incorporation, that reads as follows, subject to compliance with applicable law:

Upon the filing and effectiveness (the “Effective Time”) pursuant to the Nevada Revised Statutes of this amendment to the Corporation’s Articles of Incorporation, each 100 shares of common stock issued and outstanding immediately prior to the Effective Time (referred to in this paragraph as the ‘‘Old Common Stock’’) automatically and without any action on the part of the holder thereof will be reclassified and changed into one share of new common stock, par value $0.0001 per share (referred to in this paragraph as the ‘‘New Common Stock’’), subject to the treatment of fractional share interests as described below. Each holder of a certificate or certificates that immediately prior to the Reverse Split Date represented outstanding shares of Old Common Stock (the ‘‘Old Certificates’’) will be entitled to receive, upon surrender of such Old Certificates to the Company for cancellation, a certificate or certificates (the ‘‘New Certificate’’, whether one or more) representing the number of whole shares (rounded down to the nearest whole share) of the New Common Stock into which and for which the shares of the Old Common Stock formerly represented by such Old Certificates so surrendered are reclassified under the terms hereof. From and after the Effective Time, Old Certificates shall represent only the right to receive New Certificates pursuant to the provisions hereof. No certificates or scrip representing fractional share interests in New Common Stock will be issued. In lieu of any such fractional shares of New Common Stock, each shareholder with a fractional share will be entitled to receive, upon surrender of Old Certificates to the Company for cancellation, an amount in cash equal to the product of (i) the average of the closing trading prices (as adjusted to reflect the reverse stock split) of the Company’s common stock, as reported on the OTCPK Market, during the 20 consecutive trading days ending on the trading day immediately prior to the Effective Time and (ii) such fraction. If more than one Old Certificate shall be surrendered at one time for the account of the same shareholder, the number of full shares of New Common Stock for which New Certificates shall be issued shall be computed on the basis of the aggregate number of shares represented by the Old Certificates so surrendered. In the event that the Company determines that a holder of Old Certificates has not tendered all his, her or its certificates for exchange, the Company shall carry forward any fractional share until all certificates of that holder have been presented for exchange. The Old Certificates surrendered for exchange shall be properly endorsed and otherwise in proper form for transfer. From and after the Effective Time, the amount of capital represented by the shares of the New Common Stock into which and for which the shares of the Old Common Stock are reclassified under the terms hereof shall be an amount equal to the product of the number of issued and outstanding shares of New Common Stock and the $0.0001 par value of each such share.

|

FUSE SCIENCE, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

SPECIAL MEETING OF SHAREHOLDERS – MAY 6, 2015 AT 9:30 AM

|

|

VOTING INSTRUCTIONS

|

|

If you vote by phone or internet, please DO NOT mail your proxy card.

|

|

|

|

|

MAIL:

|

Please mark, sign, date, and return this Proxy Card promptly using the enclosed envelope.

|

|

|

PHONE:

|

Call 1 (800) 690-6903

|

|

|

INTERNET:

|

https://www.proxyvote.com

|

Control ID:

Proxy ID:

Password:

|

MARK “X” HERE IF YOU PLAN TO ATTEND THE MEETING: ¨

|

|

MARK HERE FOR ADDRESS CHANGE New Address (if applicable):

____________________________

____________________________

____________________________

IMPORTANT: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person.

Dated: ________________________, 201___

|

|

|

|

(Print Name of Shareholder and/or Joint Tenant)

|

|

|

|

(Signature of Shareholder)

|

|

|

|

(Second Signature if held jointly)

|

The shareholder(s) hereby appoints Ezra Green and Michael D. Harris, Esq., or either of them, as proxies, each with the power to appoint his substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of voting stock of FUSE SCIENCE, INC. that the shareholder(s) is/are entitled to vote at the Special Meeting of Shareholder(s) to be held at 9:30 a.m., New York time on May 6, 2015 at Nason, Yeager, Gerson, White & Lioce, 1645 Palm Beach Lakes Blvd, Suite 1200, West Palm Beach, FL 33401, and any adjournment or postponement thereof.

This proxy, when properly executed, will be voted in the manner directed herein. If no such direction is made, this proxy will be voted “FOR” the Proposal. If any other business is presented at the meeting, this proxy will be voted by the above-named proxies at the direction of the Board of Directors. At the present time, the Board of Directors knows of no other business to be presented at the meeting.

Proposal:

|

1. To approve the amendment to Fuse’s Articles of Incorporation

to effectuate a 1-for-100 split.

|

FOR ¨ AGAINST ¨ ABSTAIN ¨

|

Control ID:

Proxy ID:

Password:

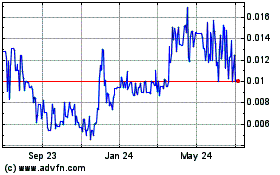

Fuse Science (PK) (USOTC:DROP)

Historical Stock Chart

From Mar 2024 to Apr 2024

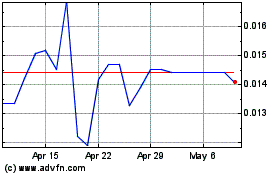

Fuse Science (PK) (USOTC:DROP)

Historical Stock Chart

From Apr 2023 to Apr 2024