Wabash National Corporation Closes New Senior Secured Term Facility

March 23 2015 - 8:30AM

Wabash National Corporation ("Wabash" or "the Company") (NYSE:WNC)

today announced that it has closed on a new, $192.8 million Senior

Secured Term Facility with a maturity in March, 2022. The proceeds

from the new facility have been used to repay in full the

outstanding balance on the Company's previous Senior Secured Term

Facility which was scheduled to mature in May, 2019. The new

facility was issued without any financial covenants and an interest

rate reduction of 25 basis points compared to the previous

facility.

"We are extremely pleased that our strong business performance,

financial position, and industry outlook were recognized by the

capital markets and allowed us the opportunity to refinance the

term loan under these favorable terms which included extending the

maturity date, removing the last financial covenant, and lowering

the interest rate," said Jeff Taylor, Wabash National Senior Vice

President and Chief Financial Officer. "This action is another step

of our overall strategy to manage the capital structure and provide

maximum flexibility for the Company."

The issuance of the new Senior Secured Term Facility was

arranged by Wells Fargo Securities, LLC, and Morgan Stanley Senior

Funding, Inc., as joint lead arrangers and joint bookrunners.

Safe Harbor Statement

This press release contains certain forward-looking statements

as defined by the Private Securities Litigation Reform Act of 1995.

Forward-looking statements convey the Company's current

expectations or forecasts of future events. All statements

contained in this press release other than statements of historical

fact are forward-looking statements. These forward-looking

statements include statements about the ability to enter into a new

senior secured term facility and the terms of that

facility. These and the Company's other forward-looking

statements are subject to certain risks and uncertainties that

could cause actual results to differ materially from those implied

by the forward-looking statements, including factors specific to

the Company and to the credit market generally. Readers should

review and consider the various disclosures made by the Company in

this press release and in the Company's reports to its stockholders

and periodic reports on Forms 10-K and 10-Q.

About Wabash National Corporation

Headquartered in Lafayette, Indiana, Wabash National Corporation

(NYSE:WNC) is a diversified industrial manufacturer and North

America's leading producer of semi-trailers and liquid

transportation systems. Established in 1985, the Company

specializes in the design and production of dry freight vans,

refrigerated vans, platform trailers, liquid tank trailers,

intermodal equipment, engineered products, and composite

products. Its innovative products are sold under the following

brand names: Wabash National®, Transcraft®, Benson®, DuraPlate®,

ArcticLite®, Walker Transport, Walker Defense Group, Walker Barrier

Systems, Walker Engineered Products, Brenner® Tank, Beall®,

Garsite, Progress Tank, TST®, Bulk Tank International and Extract

Technology®. To learn more, visit www.wabashnational.com.

CONTACT: Media Contact:

Dana Stelsel

Corporate Communications Manager

(765) 771-5766

dana.stelsel@wabashnational.com

Investor Relations:

Mike Pettit

Vice President, Finance and Investor Relations

(765) 771-5581

michael.pettit@wabashnational.com

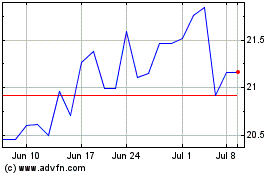

Wabash National (NYSE:WNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

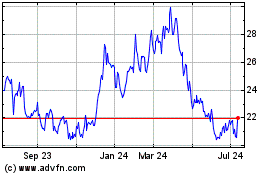

Wabash National (NYSE:WNC)

Historical Stock Chart

From Apr 2023 to Apr 2024