UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 19, 2015

ACELRX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

DELAWARE |

|

001-35068 |

|

41-2193603 |

|

(State of incorporation) |

|

(Commission File No.) |

|

(IRS Employer Identification No.) |

351 Galveston Drive

Redwood City, CA 94063

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (650) 216-3500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.05. Costs Associated with Exit or Disposal Activities

On March 19, 2015, the Board of Directors of AcelRx Pharmaceuticals, Inc., or the Company, in connection with its efforts to reduce operating costs, conserve capital resources and focus the Company's financial and development resources on working with the U.S. Food and Drug Administration, or FDA, to seek marketing approval for Zalviso, as well as to continue development of ARX-04, committed to implementing a cost reduction plan. The cost reduction plan will reduce the Company’s workforce by 19 employees, approximately 36% of total headcount, in the first quarter of 2015. The Company expects to complete the cost reduction plan by the end of March 2015 and anticipates incurring pre-tax non-recurring charges of approximately $0.9 million. The aggregate projected restructuring charges represent one-time termination benefits, comprised principally of severance, benefit continuation costs and outplacement services, associated with the elimination of 19 positions. The majority of these charges are expected to be recognized in the first quarter of 2015. The Company may incur other charges and will record these expenses in the appropriate period as they are determined.

The estimates of the charges and costs that the Company expects to incur in connection with the cost reduction plan, and the timing thereof, are subject to a number of assumptions and actual results may materially differ.

Certain statements in Item 2.05 of this Form 8-K are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995 and are subject to risks, uncertainties and other factors, including risks and uncertainties related to the anticipated time required to implement the cost reduction plan; risks and uncertainties related to the amount of non-recurring charges anticipated and the risk they might be greater than currently estimated, as well as the amount of annual net cost savings anticipated and the risk they might be lower than currently estimated; and risks and uncertainties related to the impact of the cost reduction plan on the Company’s business and unanticipated charges not currently contemplated that may occur as a result of the cost reduction plan. These risks and uncertainties could cause actual results to differ materially from those referred to in these forward-looking statements. The reader is cautioned not to rely on these forward-looking statements. Investors should read the risk factors set forth in AcelRx Pharmaceuticals, Inc.’s Form 10-K for the year ending December 31, 2014, and periodic reports filed with the Securities and Exchange Commission. The Company does not undertake an obligation to update or revise any forward-looking statements.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

As previously reported on the Form 8-K/A filed with the Securities and Exchange Commission on December 16, 2014, the Company and Mr. King entered into a separation agreement (the “Separation Agreement”) on December 15, 2014. Mr. King’s separation was not the result of any disagreement with the Company on any matter relating to the Company’s operations, policies or practices. Under the terms of the Separation Agreement, Mr. King will remain employed with the Company in his current position of Chief Executive Officer and act as a principal executive officer, until March 31, 2015.

On March 19, 2015, the Board of Directors of the Company appointed Howard B. Rosen, a member of the Company’s Board of Directors, as interim Chief Executive Officer effective April 1, 2015, or the Effective Date. As of the Effective Date, Mr. Rosen will assume the duties of the Company’s principal executive officer on an interim basis.

Mr. Rosen, age 56, has served as our director since 2008. Since 2008, Mr. Rosen has served as a consultant to several companies in the biotechnology industry. He has also served as a lecturer at Stanford University in Chemical Engineering since 2008 and in Management since 2011. Mr. Rosen served as interim President and Chief Executive Officer of Pearl Therapeutics, Inc., a company focused on developing combination therapies for the treatment of highly prevalent chronic respiratory diseases, from June 2010 to March 2011. From 2004 to 2008, Mr. Rosen was Vice President of Commercial Strategy at Gilead Sciences, Inc., a biopharmaceutical company. Mr. Rosen was President of ALZA Corporation, a pharmaceutical and medical systems company that merged with Johnson & Johnson, a global healthcare company, in 2001, from 2003 until 2004. Mr. Rosen is a member of the board of directors of Alcobra, Ltd., a public pharmaceutical company. Mr. Rosen is also a member of the board of directors of a number of private biotechnology companies as follows: PaxVax, Inc., Entrega, Inc., Kala Pharmaceuticals, Inc. and ALDEA Pharmaceuticals. Mr. Rosen holds a B.S. in Chemical Engineering from Stanford University, an M.S. in Chemical Engineering from the Massachusetts Institute of Technology and an M.B.A. from the Stanford Graduate School of Business.

The Board intends to review and approve the compensation arrangements for Mr. Rosen in an upcoming meeting of the Board or the Compensation Committee of the Board. There are no family relationships between Mr. Rosen and any previous or current officers or directors of the Company, and there are no related party transactions reportable under Item 404(a) of Regulation S-K.

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date: March 20, 2015 |

ACELRX PHARMACEUTICALS, INC.

|

|

|

|

By: |

/s/ Timothy E. Morris |

|

|

|

|

Timothy E. Morris

Chief Financial Officer |

|

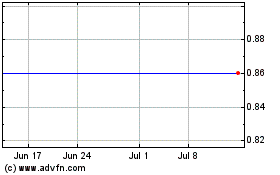

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

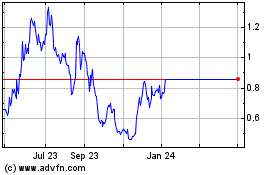

AcelRX Pharmaceuticals (NASDAQ:ACRX)

Historical Stock Chart

From Apr 2023 to Apr 2024