UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Pursuant to Section

13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date

of earliest event reported): June 4, 2012

Trimax Corp

(Exact name of registrant as specified in its

charter)

| Nevada |

000-32479 |

76-0616468 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

1007 N Federal Hwy

#275 Ft Lauderdale, FL 33304

(Address of Principal Executive Officers) (Zip

Code)

Registrant's telephone

number, including area code: 302-261-3660

________________________________________

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

[_] Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[_] Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

[_] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Cautionary Notice

Regarding Forward-Looking Statements

This Current Report on Form 8-K (“Form

8-K”) and other reports filed by the Registrant from time to time with the Securities and Exchange Commission (collectively

the “Filings”) contain or may contain forward-looking statements and information that are based upon beliefs of, and

information currently available to, the Registrant’s management as well as estimates and assumptions made by the Registrant’s

management. When used in the filings the words “anticipate,” “believe,” “estimate,” “expect,”

“future,” “intend,” “plan” or the negative of these terms and similar expressions as they relate

to the Registrant or the Registrant’s management identify forward-looking statements. Such statements reflect the current

view of the Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including

the risks contained in the section of this report entitled “Risk Factors”) relating to the Registrant’s industry,

the Registrant’s operations and results of operations and any businesses that may be acquired by the Registrant. Should one

or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ

significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Registrant believes that

the expectations reflected in the forward-looking statements are reasonable, the Registrant cannot guarantee future results, levels

of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States,

the Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The

following discussion should be read in conjunction with the Registrant’s financial statements and pro forma financial statements

and the related notes filed with this Form 8-K.

Unless

otherwise indicated, in this Form 8-K, references to “we,” “our,” “us,” “TMXN,”

the “Company” or the “Registrant” refer to Trimax Corporation., a Nevada corporation and its wholly owned

subsidiaries 1719702 Ont. Inc. an Ontario Canada corporation doing business as Bayern Industries , Trimax Yachts, Magellan

1 Import and Export

1.01 Entry

into a Material Definitive Agreement

Company entered in an agreement July 2012 to provide agro commerce

and time share. Company entered into an agreement to provide white label custom made yachts with a China boat manufacturer in

September 2014. In November 2014 company entered in an agreement to import and export fresh water watercraft from N America to

EU market.

1.02 Termination

of a Material Definitive Agreement

In July 2012 Company abandoned its mining and energy explorations

to nil.

2.01 Completion of Acquisition

or Disposition of Assets

Effective July 2012 all assets on mining and all rights written

down to nil.

On June 27 2012 (the “Closing Date”), Trimax Corp.,

a Nevada corporation, closed a voluntary share exchange transaction pursuant to a Share Exchange Agreement agreed to between the

parties on February 15, 2013 (the “Exchange Agreement”) by and among The Company ex CEO and Director Gordon Lee , and

as the representative for stockholders of Zeibright Property, California.

In accordance with the terms

of the Exchange and Purchase Agreement, on the Closing Date, we recovered a total of 35,000,000 shares of common stock out of

90,000,000 issued by the Company and 10,000,000 shares of preferred convertible stock with 10,000-1 super voting rights of the

Selling Stockholders in exchange for payment of $100,000.00.

New Trimax management and Board of Directors wrote down the mining

venture assets to nil.

On June 4 2012 we secured a line of credit through EMRY GROUP Corp

for $3,500,000.00 through a series of convertible promissory notes, and a pledge of the recovered 35,000,000 shares as security for

the loan. The purpose of the loan is to seek out suitable merger candidates and recalibrate Trimax into a new direction of timeshare

yacht and watercraft sales, timeshare of real estate agro business commerce and import and export of watercrafts from N America

to the EU market. The loan bears interest at the rate of 10% per annum, payable monthly.

On July

11 2012 we acquired 100% of the issued and outstanding capital stock of 1719702 Ont. Inc. (171) an Ontario

Canada corporation doing business as Bayern Industries , Trimax Yachts, Magellan 1 Import and Export . As

a result of the Transaction, the Selling Stockholders received an undertaking from Trimax that they will be

issued 350,000,000 shares of Trimax common stock within 30 months of the closing date or as soon as 171 can fulfill the

majority of the benchmark threshold tasks as agreed upon between Trimax management and 171.

On March 3, 2015 Trimax Board Members reviewed

the progress of 171 and a decision was made that in fact 171 did meet and surpass the threshold levels agreed upon back in July

2012. A Board Members vote was held to increase Trimax share structure from 120,000,000 million authorized shares to 500,000,000

The majority of the share increase or 350,000,000 will be used to settle the undertaking of the merger between 171 and Trimax.

Notwithstanding that no stock was issued

to 171 since July 2012, 171 became our wholly-owned subsidiary, and has assisted both us and themselves with the acquired business

and operations, with integration infrastructure resource sharing and transformation of Trimax from a resource based company to

a tourism and agro commerce company.

Prior to the Transaction, we were a public reporting company. Trimax

is not a “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended and the rules

and regulations promulgated thereunder (“Exchange Act”). Accordingly, pursuant to the requirements of Item

2.01(f) of Form 8-K, set forth below is the information that would be required if the Registrant were filing a general form for

registration of securities on Form 10 under the Exchange Act, for the Registrant’s common stock, which is the only class

of its securities subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act upon consummation of

the Transaction.

The following description of the terms and conditions of the Exchange

Agreement and the transactions contemplated thereunder that are material to the Registrant does not purport to be complete and

is qualified in its entirety by reference to the full text of the Exchange Agreement, Option Agreement, as amended and the Assignment

Agreement, copies of which are filed with this Current Report on Form 8-K and incorporated by reference into this Item 2.01.

From and after the Closing Date, our primary operations consist

of the business and operations of 171. In the Transaction, or reverse acquisition, the Registrant is the accounting

acquiree and 171 is the accounting acquirer. The financial statements subsequent to the date of the Transaction are

presented as a continuation of 171. Accordingly, we are presenting the financial statements of 171 as set forth

in Exhibit 99.1 and certain pro forma financial information as set forth in Exhibit 99.2 of this Current Report on Form 8-K. Further,

we disclose information about the business, financial condition, and management of 171 in this Current Report on Form 8-K.

2.02 Results of Operations and

Financial Condition

Development Stage Company

DESCRIPTION OF BUSINESS

Overview

Trimax Yachts is a joint venture of

large yacht manufacturing companies. We are mainly engaged in the design of yacht, yacht parts, sales and after-sales service.

Trimax Yachts employs the most technically advanced and professional design and manufacturing team. We provide customized solution

to develop personalized yachts with inclusion of repair from seaman to captain, daily maintenance.

Trimax yacht company production

facility covers an area of 300 acres, has a ling and wide plant, two room thermostat, includes room paint workshop and other hardware

facilities. We employ imported CNC machine tools from Japan and a have full set of metal processing workshop. We have more than

five years of yacht exporting experience. Our yachts were exported to Australia, Norway, USA, Germany and many other countries.

We employ technical team from Taiwan, Malaysia, USA and uses perfect technology for production. Our expert team stays in direct

contact with existing customers.

In summary these are exclusive luxury

yachts being assembled in China by a manufacturer with over 300 employees and a $30 million dollar facility. Trimax Yachts will

be offered in the USA CANADA and EU marketplace under the brand name Trimax Yachts. TMXN plans to offer 30 to 100 foot yachts under

following brand names:

Trimax Corp Inc. is dedicated to

becoming a reputable yacht manufacturer and sales company in Spain (and EU generally), Miami and Canada. Our strong

business ethics, experience, enthusiasm, and professional culture will ensure our continues growth in revenues, profit and

wealth generation for all stakeholders.

Trimax Yachts’s mission is to

provide customers with uncompromising service and support for all of their boat/yacht purchasing needs.

Trimax China built yachts will be offered

in the USA CANADA and EU marketplace under the brand name Trimax Yachts. TMXN plans to offer 30 to 100 foot yachts on those markets

and it’s objective is to become the leading Yacht manufacturer and sales company in the mentioned markets with a big share

of the market.

TIME SHARE YACHTS AND WATERCRAFTS

All business and operational matters

are done through the Canadian company (Operating Subsidiary) 171 Canada is a Canadian based, value added water craft development

(VAD) company.

Timeshare ownership is a business concept

that has been around for a long time. It is a method of ownership where several people can own a share in an expensive asset,

such as a watercraft. Owners (Investors) choose a timeshare approach to investment, when they do not want to spend the amount

of money required to own the entire asset. Also, the owners do not want all of the risk or hassle, which accompanies ownership

of the entire asset. 171 has pioneered the use of timeshare ownership applied to a specific class of asset, the luxury watercraft

and the luxury villas real estate market.

For the watercrafts timeshare ownership we offer Canada’s first timeshare watercraft

experience. The ultimate experience for boat and watercraft timeshare ownership in South Central Ontario communities! Our watercrafts

are less than 45 feet in length. They are within the financial reach of an ordinary consumer and an ordinary type vacationer.

Timeshare ownership splits the cost of purchasing the asset and managing the asset across a set of owners. Because an independent

professional handles management, the timeshare owners are free to enjoy themselves and be removed from the management responsibilities.

Each owner is free to use his/her share of the asset according to the terms of the purchase. 171 applied the timeshare ownership

concept to luxury watercrafts because most watercraft owners only use their watercraft several weeks a year and the costs to acquire

and maintain a watercraft are immense. Under the 171 Program, Timeshare ownership is perfect for watercraft owners who want the

watercraft experience with no hassles and no waste of their hard earned capital. We have owners in the 171 Program who own 10%

of a watercraft through to 70%. Many purchase 10% of a watercraft for their personal use and another 10% for business use including

entertaining, corporate retreats, chartering, and hosting clients.

To compare the two options we can use

the following table based on a $75,000 30’ - 35’ boat:

Five-year cost advantage of purchasing

a 171 share compared to sole ownership can be as high as $15,000

For 2015 season we are offering timeshare

ownership of our 48 foot Fairmount . The yacht sails from the island of Ibiza only in 2015. Starting in 2016 the Fairmount will

sail from Dania Spain.

For the 2016 season Trimax will offer

a Azimut 48 Fly bridge. The Azimut will sail from Ibiza Spain.

2.05 Costs

Associated with Exit or Disposal Activities

The Company incurred costs

in the amount of $400,000.

3.02 Unregistered

Sales of Equity Securities

EMRY Group Inc. 35,000,000 shares

3.03 Material

Modification to Rights of Security Holders

35,000,000 shares non Dilatable

4.02 Non-Reliance

on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review

Non audited 2010 statements and subsequent

voluntary filings may require restatement or deregistration.

5.01 Changes

in Control of Registrant

July 2012 resignation of Gordon Lee

and all Directors and Officers Appointment Michael Arnkvarn CEO Zoran Cvetojevic Chairman

5.02 Departure

of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers

On April 13, 2013, Mr. David

Solomon was appointed to the Board of Directors, however, on May 9, 2013 due to the untimely and sudden passing away of David

Solomon, the board held a vote to remove Mr. David Solomon as a Board of Director and an officer.

Effective May 9, 2013, Trimax Corporation

accepted the interim appointment of Mr. Zoran Cvetojevic as the Company’s Secretary, Officer and Director.

There are no family relationships between

any of the new officers and directors.

5.03 Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year

The

Company authorized 10,000 shares of Convertible Class A preferred shares. Convertible

1-10,000 to Common shares. 10,000 common to 1 Class A preferred share super voting rights.

8.01 Other

Events

Address of business

Trimax maintains 2 offices. Canada (fresh water timeshare watercraft

sales) and Spain (salt water timeshare yacht sales)

1 Hobin Street

Stittsville, ONT K2S 1B2

Canada

Avenida Lepanto 37 Bajo

Dch

Unidad # 14

Benitachell, Alicante

03726

Spain

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Trimax Corp |

| |

|

| |

By: |

/s/ Zoran Cvetojevic |

| |

|

Zoran Cvetojevic

Chairman |

Dated

March 18, 2015

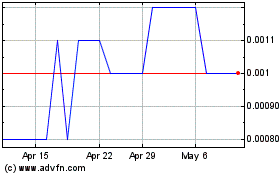

Trimax (PK) (USOTC:TMXN)

Historical Stock Chart

From Mar 2024 to Apr 2024

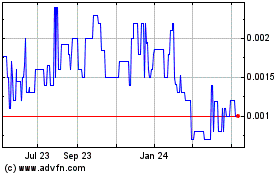

Trimax (PK) (USOTC:TMXN)

Historical Stock Chart

From Apr 2023 to Apr 2024