UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 10, 2015

LYONDELLBASELL INDUSTRIES N.V.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| The Netherlands |

|

001-34726 |

|

98-0646235 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

|

|

| 1221 McKinney St.,

Suite 300

Houston, Texas USA

77010 |

|

4th Floor, One Vine Street

London The United

Kingdom W1J0AH |

|

Delftseplein 27E

3013AA Rotterdam

The Netherlands |

(Addresses of principal executive offices)

|

|

|

|

|

| (713) 309-7200 |

|

+44 (0) 207 220 2600 |

|

+31 (0)10 275 5500 |

(Registrant’s telephone numbers, including area codes)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 |

Entry into a Material Definitive Agreement; Item 8.01 Other Events |

LyondellBasell

Industries N.V. (the “Company”) has entered into an Amended and Restated Nomination Agreement (the “Amendment”), dated March 10, 2015, with AI International Chemicals S.à.R.L., an affiliate of Access Industries

(“Access”). The Amendment amends and restates the Nomination Agreement, dated April 30, 2010, entered into between the Company and Access (the “Original Agreement”), a copy of which was filed as Exhibit 4.5 to the

Company’s Amendment No. 2 to Form 10 July 26, 2010.

The Amendment was entered into to clarify the share ownership

Access must have to allow it to nominate individuals to the Company’s Supervisory Board. The Original Agreement stated that Access had the right to nominate one individual to the Supervisory Board as long as it owned five percent (5%) or

more of the Company’s issued share capital; two individuals as long as it owned twelve percent (12%) or more of issued share capital; and three individuals as long as it owned eighteen percent (18%) or more of issued share capital.

The Amendment clarifies that the percentage of shares owned by Access in determining its nomination rights is based on Access’ percentage of the Company’s voting shares and therefore uses the term “outstanding shares” rather than

“issued share capital,” which could include shares held by the Company in treasury in addition to shares outstanding.

Two of

the current eleven members of the Company’s Supervisory Board, Stephen F. Cooper and Robin Buchanan, were nominated by Access pursuant to the Original Agreement. Based on the number of Company’s shares currently outstanding and the number

of shares currently held by Access, it has the right to nominate a third director pursuant to the Amendment.

The foregoing is a summary

of the material terms of the Amendment. Reference should be made to the full text of the Original Agreement and the Amendment, which is filed herewith as Exhibit 10.1, for a complete understanding of its terms.

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

| 10.1 |

|

Amended and Restated Nomination Agreement dated March 10, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the

undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

LYONDELLBASELL INDUSTRIES N.V. |

|

|

|

|

| Date: March 16, 2015 |

|

|

|

By: |

|

/s/ Jeffrey A. Kaplan |

|

|

|

|

|

|

Jeffrey A. Kaplan |

|

|

|

|

|

|

Executive Vice President |

Exhibit Index

|

|

|

| 10.1 |

|

Amended and Restated Nomination Agreement dated March 10, 2015 |

Exhibit 10.1

AMENDED AND RESTATED

NOMINATION AGREEMENT

between

AI

INTERNATIONAL CHEMICALS S.A R.L.

and

LYONDELLBASELL INDUSTRIES N.V.

In relation to

the nomination of the

members of the Supervisory Board

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

| 1. |

|

DEFINITIONS AND INTERPRETATION |

|

|

2 |

|

|

|

1.1 |

|

Definitions |

|

|

2 |

|

|

|

1.2 |

|

Interpretation |

|

|

3 |

|

|

|

1.3 |

|

Appendices |

|

|

3 |

|

| 2. |

|

ARTICLES OF ASSOCIATION |

|

|

5 |

|

| 3. |

|

SUPERVISORY BOARD REGULATIONS |

|

|

4 |

|

| 4. |

|

SUPERVISORY BOARD NOMINATIONS |

|

|

4 |

|

| 5. |

|

SUPERVISORY BOARD COMMITTEES |

|

|

4 |

|

| 6. |

|

DURATION |

|

|

5 |

|

| 7. |

|

MISCELLANEOUS |

|

|

5 |

|

|

|

7.1 |

|

Invalid Provisions |

|

|

5 |

|

|

|

7.2 |

|

Amendment |

|

|

5 |

|

|

|

7.3 |

|

Entire Agreement |

|

|

5 |

|

|

|

7.4 |

|

No Implied Waiver; No Forfeit of Rights |

|

|

5 |

|

|

|

7.5 |

|

No Rescission |

|

|

6 |

|

|

|

7.6 |

|

No Assignment |

|

|

6 |

|

|

|

7.7 |

|

Resignation of Members for Cause |

|

|

6 |

|

|

|

7.8 |

|

Resignation of Director Nominees |

|

|

6 |

|

|

|

7.9 |

|

Nomination of Additional Director Nominees |

|

|

7 |

|

|

|

7.10 |

|

Appointment Pending General Meeting of Shareholders |

|

|

7 |

|

|

|

7.11 |

|

Calling General Meeting |

|

|

8 |

|

|

|

7.12 |

|

Choice of Law |

|

|

8 |

|

|

|

7.13 |

|

Disputes |

|

|

8 |

|

NOMINATION AGREEMENT

THE UNDERSIGNED:

| 1. |

AI INTERNATIONAL CHEMICALS S.À R.L., a société à responsabilité limitée or limited liability company organized under the laws of Luxembourg, with Registre de

Commerce et des Sociétés (R.C.S.) identification number Luxembourg B144098 (and formerly known as “AI International Finance S.à r.l.”), c/o Citadel Administration SA, 15-17, avenue Gaston Diderich, L-1420

Luxembourg, hereinafter referred to as “Investor”; |

| 2. |

LYONDELLBASELL INDUSTRIES N.V., a public limited liability company (naamloze vennootschap) incorporated under the laws of the Netherlands with its corporate seat at Rotterdam (registered office: Weena 737,

3013AM Rotterdam, the Netherlands), registered with the Chamber of Commerce with number 24473890, hereinafter referred to as “LBI” and together with Investor as “Parties”. |

RECITALS

| A. |

The Investor and LBI are a party to that certain equity commitment agreement dated December 11, 2009 by and among AI International Chemicals S.à r.l. (as successor in interest to AI LBI Investments

LLC) (“Access”), Ares Corporate Opportunities Fund III, L.P. (“Ares”), LeverageSource (Delaware), LLC (“Apollo”), LBI and the other parties signatory thereto (as amended from time to time,

the “Equity Commitment Agreement”). |

| B. |

The Investor, together with its Affiliates, directly or indirectly holds shares of LBI. |

| C. |

Pursuant to this Agreement, the Investor shall as from issuance of the shares be entitled to nominate one, two or three (as the case may be) individuals to be appointed as members of the Supervisory Board.

|

| D. |

If at any time during the term of this Agreement the Investor becomes a Three Director Investor, then so long as the Investor remains a Three Director Investor, at least one member of the Supervisory Board

nominated by the Investor shall be entitled to serve on each Committee to the extent not prohibited by law or by any then applicable stock exchange rules or listing requirements and in accordance with Clause 5.1. |

1

HEREBY AGREE AS FOLLOWS:

| |

1. |

DEFINITIONS AND INTERPRETATION |

|

|

|

| Affiliate |

|

with respect to any person, any other person that, directly or indirectly, through one or more intermediaries, controls, or is controlled by, or is under common control with, such person. For purposes of this definition, the

terms “control,” “controlling,” “controlled by” and “under common control with,” as used with respect to any person, means the possession, directly or indirectly, of the power to direct the management and

policies of a person, whether through the ownership of voting securities, by contract or otherwise. For the avoidance of doubt, with respect to the Investor, “Affiliate” shall include all investment funds managed or controlled by the

Investor or the Investor’s Affiliates. |

|

|

| Agreement |

|

this Nomination Agreement |

|

|

| Articles |

|

the Articles of Association of LBI as in effect from time to time. |

|

|

| Business Day |

|

any day other than (a) a Saturday, (b) a Sunday, (c) any day on which commercial banks in New York, New York or The Netherlands are required or authorized to close by law or executive order and (d) the Friday after

Thanksgiving. |

|

|

| Clause |

|

a clause in this Agreement |

|

|

| Committees |

|

the committees of the Supervisory Board (e.g., Audit, Compensation, Nominating and Governance, and Health Safety and Environmental) |

|

|

| Equity Commitment Agreement |

|

has the meaning set forth in the recitals of this Agreement |

|

|

| Investor |

|

has the meaning attributed in the heading of this Agreement |

|

|

| LBI |

|

has the meaning attributed in the heading of this Agreement |

|

|

| One Director Investor |

|

the Investor, if entitled to nominate one member of the Supervisory Board pursuant to Clause 4.1 of this Agreement |

2

|

|

|

|

|

| Outstanding Shares |

|

the number of shares outstanding as defined under Dutch law and specifically not including shares that are held in treasury. The percentage ownership required for Investor to be a One, Two or Three Director Investor under this

Agreement will be based solely on the outstanding shares and not the issued share capital. |

|

|

| Parties |

|

has the meaning attributed in the heading of this Agreement |

|

|

| Supervisory Board |

|

the supervisory board of LBI |

|

|

| Termination Date |

|

has the meaning attributed in Clause 6.1 |

|

|

| Three Director Investor |

|

the Investor, if entitled to nominate at least three members of the Supervisory Board pursuant to Clause 4.3 of this Agreement |

|

|

| Two Director Investor |

|

the Investor, if entitled to nominate two members of the Supervisory Board pursuant to Clause 4.2 of this Agreement |

In this Agreement, unless the context dictates otherwise:

| |

1.2.1 |

the masculine gender shall include the feminine and the neuter and vice versa; |

| |

1.2.2 |

references to a person shall include a reference to any individual, company, association, partnership or joint venture; |

| |

1.2.3 |

references to “include” and “including” shall be treated as references to “include without limitation “or “including without limitation”; |

| |

1.2.4 |

the headings are for identification only and shall not affect the interpretation of this Agreement; |

| |

1.2.5 |

references to “Clauses” and “paragraphs” are to clauses and paragraphs of this Agreement. |

| 2. |

ARTICLES OF ASSOCIATION |

| 2.1 |

No amendment which adversely affects the nomination rights of the Investor set forth in Clause 4 and which has the effect of materially reducing the likelihood that the Investor’s nominee is elected to the

Supervisory Board shall be made to the Articles without prior written approval of the Investor. |

3

| 3. |

SUPERVISORY BOARD REGULATIONS |

| 3.1 |

LBI shall not take any action to cause the Supervisory Board to make any amendment to the internal rules of procedure of the Supervisory Board which adversely affects the nomination rights of the Investor set forth in

Clause 4 and which has the effect of materially reducing the likelihood that the Investor’s nominee is elected to the Supervisory Board without prior written approval of the Investor. |

| 4. |

SUPERVISORY BOARD NOMINATIONS |

| 4.1 |

In the event the Investor, together with its Affiliates, holds directly or indirectly 5% or more, but less than 12%, of the Outstanding Shares of LBI, LBI shall use its reasonable best efforts to cause the

Supervisory Board to take all required action to make the appointments by the Supervisory Board in accordance with Article 12.4 of the Articles and the binding nominations by the Supervisory Board in accordance with Article 12.2 of the Articles for

the appointment of members of the Supervisory Board in such a way that at least one of the members of the Supervisory Board shall be a person nominated by the Investor. |

| 4.2 |

In the event the Investor, together with its Affiliates, holds directly or indirectly 12% or more, but less than 18%, of the Outstanding Shares of LBI, LBI shall use its reasonable best efforts to cause

the Supervisory Board to take all required action to make the appointments by the Supervisory Board in accordance with Article 12.4 of the Articles and the binding nominations by the Supervisory Board in accordance with Article 12.2 of the Articles

for the appointment of members of the Supervisory Board in such a way that at least two of the members of the Supervisory Board shall be persons nominated by the Investor. |

| 4.3 |

In the event the Investor, together with its Affiliates, holds directly or indirectly 18% or more of the Outstanding Shares of LBI, LBI shall use its reasonable best efforts to cause the Supervisory Board to take all

required action to make the appointments by the Supervisory Board in accordance with Article 12.4 of the Articles and the binding nominations by the Supervisory Board in accordance with Article 12.2 of the Articles for the appointment of members of

the Supervisory Board in such a way that at least three of the members of the Supervisory Board shall be persons nominated by the Investor. |

| 5. |

SUPERVISORY BOARD COMMITTEES |

| 5.1 |

If at any time during the term of this Agreement the Investor becomes a Three Director Investor, then so long as the Investor remains a Three Director

Investor, at least one member of the Supervisory Board nominated by the Investor shall be entitled to serve on each Committee to the extent not prohibited by law or by any then applicable stock exchange rules or listing requirements. Each member of

the Supervisory Board nominated by the Investor to serve on any such Committee shall disclose any conflict of interest to the other members of such Committee and with respect to any matter in which such member has or reasonably could be

|

4

| |

expected to have a conflict of interest (as determined by the other members of such Committee or the other members of the Supervisory Board in their sole discretion) the member shall be recused

and not receive information or participate in discussions, deliberations, or decision-making processes related to such matter. |

| 6.1 |

Except with respect to the provisions of this Agreement that expressly survive the Termination Date (defined below), this Agreement is entered into for an indefinite period of time and shall terminate as of the date on

which the Investor, together with its Affiliates, holds directly or indirectly less than 5% of the Outstanding Shares of LBI (the “Termination Date”). Within three Business Days after the Termination Date the Investor shall notify

LBI and, promptly following the written request of the Nominating and Governance Committee of the Supervisory Board, shall cause the nominee or nominees of the Investor, as applicable, to execute and deliver a written resignation which shall be

effective with respect to LBI and shall not permit any such nominee or nominees to revoke any such resignation. |

In the event that a provision of this Agreement is null and void or

unenforceable (either in whole or in part), the remainder of this Agreement shall continue to be effective to the extent that, given this Agreement’s substance and purpose, such remainder is not inextricably related to the null and void or

unenforceable provision. The Parties shall make every effort to reach agreement on a new clause whose effect differs as little as possible from the null and void or unenforceable provision, taking into account the substance and purpose of this

Agreement.

No amendment to this Agreement shall have any force or effect unless it is in

writing and signed by both Parties.

This Agreement contains the entire agreement between the Parties with

respect to the subject matter covered hereby and supersedes all earlier agreements and understandings, whether oral, written or otherwise, between Parties.

| 7.4 |

No Implied Waiver; No Forfeit of Rights |

| |

a. |

Any waiver under this Agreement must be given by notice to that effect. |

5

| |

b. |

If the Investor does not exercise any right under this Agreement, this shall not be deemed to constitute a forfeit of any such rights (rechtsverwerking). |

To the extent permitted by law, the Parties hereby waive their rights

under Articles 6:265 to 6:272 inclusive of the Civil Code to rescind (ontbinden), or demand in legal proceedings the total or partial rescission (ontbinding) of this Agreement or to nullify this Agreement because of error

(dwaling).

Investor may assign this Agreement in whole but not in part to any of its

Affiliates. Except for such assignments to Affiliates, the Investor may not transfer or assign this Agreement or any of its rights hereunder. Any transfer or assignment in violation of this Agreement shall be null and void and of no force and

effect.

| 7.7 |

Resignation of Members for Cause |

| |

7.7.1 |

In the event that the Supervisory Board resolves that a member of the Supervisory Board should resign for Cause, such member shall and, in case such member is a nominee of the Investor, the Investor shall cause such

member to, promptly execute and deliver an irrevocable resignation which shall be effective with respect to LBI. |

| |

7.7.2 |

For the purpose of this Clause 7.7, “Cause” shall mean in respect to any member of the Supervisory Board: (A) indictment, conviction, guilty plea or plea of no lo contendere to, or confession

of guilt of a felony or criminal act involving moral turpitude during such member’s term; (B) willful misconduct or gross negligence in the performance or intentional non-performance of member’s duties to LBI or any of its

subsidiaries; (C) commission of a fraudulent or illegal act (including, without limitation, misappropriation, embezzlement or similar conduct) in respect of LBI or any of its Affiliates, customers or subsidiaries or (D) material breach of

any LBI policy or any other misconduct that causes material harm to LBI, its Affiliates, customers or subsidiaries, or its or their respective business reputations. |

| 7.8 |

Resignation of Director Nominees |

Without prejudice to Clause 7.7, in the event

that (i) a Three Director Investor becomes a Two Director Investor, (ii) a Three Director Investor becomes a One Director Investor, or (iii) a Two Director Investor becomes a One Director Investor (in each case, because such Investor,

together with its Affiliates, ceases to hold directly or indirectly the requisite amount of the Outstanding Shares of LBI set forth in Clause 4 of this Agreement), such Investor shall notify LBI within three Business Days of such event and,

promptly following the written request of the Nominating and Governance Committee of the Supervisory Board, shall cause one or more of the nominees of the Investor, as applicable, to execute and deliver a resignation which shall

6

be effective with respect to LBI on the date of such resignation and shall not permit any such nominee or nominees to revoke any such resignation.

| 7.9 |

Nomination of Additional Director Nominees |

In the event that (i) a One Director

Investor becomes a Two Director Investor, (ii) a One Director Investor becomes a Three Director Investor, (iii) a Two Director Investor becomes a Three Director Investor (in each case, because such Investor, together with its Affiliates,

acquires directly or indirectly the requisite amount of the Outstanding Shares of LBI set forth in Clause 4 of this Agreement), or (iv) a nominee of the Investor on the Supervisory Board resigns his position or otherwise terminates his

membership on the Supervisory Board, such Investor shall notify LBI within three Business Days of such event and, as soon as commercially practicable following the written request of the Investor, LBI shall use its reasonable best efforts to cause

the Supervisory Board to take all of the actions that are necessary to ensure that the Investor is able to nominate to the Supervisory Board the number of members indicated in Clause 4 of this Agreement so that the relevant nominee is, or nominees

are, appointed to the Supervisory Board within the shortest possible period of time (including, for the avoidance of doubt, the increase of the number of Supervisory Board members, the appointment of additional independent Supervisory Board members

to ensure compliance with applicable listing standards, and the appointment of the Investor’s nominee in accordance with Clause 7.11); provided, however, that the failure of such Investor to so notify LBI within three

Business Days shall not affect such Investor’s rights to appoint members of the Supervisory Board pursuant to this Agreement. For the avoidance of doubt, if the appointment of the Investor’s nominee(s) pursuant to this Clause 7.9

would cause the Supervisory Board to fail to have a majority of independent members under the applicable listing standards, the appointment of such Investor’s nominee(s) may be delayed for up to ninety (90) days in order to select and

appoint a sufficient number of independent Supervisory Board members so that, upon the appointment of such Investor nominee(s), the Supervisory Board will be comprised of a majority of independent members.

| 7.10 |

Appointment Pending General Meeting of Shareholders |

As soon as practicable after the

date on which the right to nominate one or more members to the Supervisory Board arises, the Investor shall submit to LBI all personal details LBI reasonably requires in connection with the appointment of a Supervisory Board member. Following such

submission, LBI shall use its reasonable best efforts to cause the Supervisory Board to take all of the actions to appoint the relevant nominee or nominees as soon as practicable to the Supervisory Board in accordance with the provisions of

Article 2:143 of the Civil Code and Article 12.4 of the Articles, which appointment shall terminate on the date of the next general meeting of shareholders of LBI, on which date the relevant nominee or nominees shall be nominated for

(re)appointment to the Supervisory Board. If any Investor nominee, for any reason, is not appointed to the Supervisory Board during a general meeting of the shareholders of LBI, the Investor shall as soon as practicable put forward a nominee who

shall be appointed to the Supervisory Board by the Supervisory Board in accordance with the

7

provisions of Article 2:143 of the Civil Code and Article 12.4 of the Articles, which appointment shall terminate on the date of the then following general meeting of shareholders of

LBI, on which date an Investor nominee shall be nominated for appointment to the Supervisory Board.

| 7.11 |

Calling General Meeting |

In the event the Investor, together with its Affiliates, holds

directly or indirectly 5% or more of the Outstanding Shares of LBI, the Investor can require the Supervisory Board to call (and LBI shall use its reasonable best efforts to cause to occur) a general meeting of shareholders at the shortest

practicable notice in the event the ability to appoint an additional member of the Supervisory Board pursuant to Clauses 7.9 and 7.10 above would be frustrated by the fact that by doing so the Supervisory Board would need to exceed the 1/3

limit laid down in Article 2:143 of the Civil Code and Article 12.4 of the Articles.

This Agreement shall be exclusively governed by and construed in

accordance with the laws of the Netherlands, without regard to any conflict of law rules under Dutch private international law.

All disputes arising in connection with this Agreement shall be finally

settled in accordance with the arbitration rules of the Netherlands Arbitration Institute (NAI). The arbitral tribunal shall be composed of three (3) arbitrators: one selected by LBI, one selected by the Investor and the third agreed upon by

the first two selected arbitrators. The place of arbitration shall be Amsterdam. The arbitral procedures shall be conducted in the English language. Consolidation of the arbitral proceedings with other arbitral proceedings pending in the

Netherlands, as provided in Article 1046 of the Netherlands Code of Civil Procedure, is excluded.

8

Signed on this day of March, 2015.

LYONDELLBASELL INDUSTRIES N.V.

|

|

|

| By: |

|

/s/ Jeffrey A. Kaplan |

| Name: |

|

Jeffrey A. Kaplan |

| Title: |

|

Executive Vice President & Chief Legal Officer |

9

AI INTERNATIONAL CHEMICALS S.À R.L.

|

|

|

| By: |

|

/s/ Alejandro Moreno /s/ Corinne Néré |

| Name: |

|

Alejandro Moreno/Corinne Néré |

| Title: |

|

Class A Manager/Class B Manager |

10

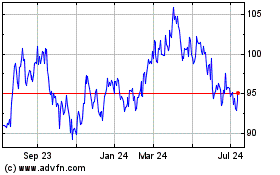

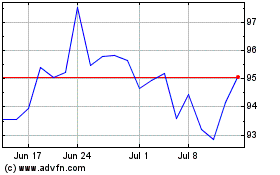

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Mar 2024 to Apr 2024

LyondellBasell Industrie... (NYSE:LYB)

Historical Stock Chart

From Apr 2023 to Apr 2024