UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 16, 2015

OMEROS CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Washington |

|

001-34475 |

|

91-1663741 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

201 Elliott Avenue West

Seattle, Washington 98119

(Address of principal executive offices, including zip code)

(206) 676-5000

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operation and Financial Condition.

On March 16, 2015, Omeros Corporation issued a press release announcing financial results for the three months and year ended December 31,

2014. A copy of such press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information in this

Current Report on Form 8-K, including the exhibit hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or

Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the United States Securities and Exchange Commission

made by Omeros Corporation, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press release dated March 16, 2015 relating to Omeros’ financial results for the three months and year ended December 31, 2014. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| OMEROS CORPORATION |

|

|

| By: |

|

/s/ Gregory A. Demopulos |

|

|

Gregory A. Demopulos, M.D. |

|

|

President, Chief Executive Officer, and Chairman of the Board of Directors |

Date: March 16, 2015

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press release dated March 16, 2015 relating to Omeros’ financial results for the three months and year ended December 31, 2014. |

Exhibit 99.1

Omeros Corporation Reports Fourth Quarter and Year-End 2014 Financial Results

— 4Q 2014 net loss of $20.7 million, or $0.61 per share —

SEATTLE, WA – March 16, 2015 – Omeros Corporation (NASDAQ: OMER), a biopharmaceutical company committed to discovering, developing and

commercializing small-molecule and protein therapeutics for large-market as well as orphan indications targeting inflammation, coagulopathies and disorders of the central nervous system, today announced recent highlights and developments as well as

financial results for the fourth quarter and year ended December 31, 2014, which include:

| |

• |

|

Net loss in 4Q 2014 of $20.7 million or $0.61 per share and, for the full year of 2014, a net loss of $73.7 million or $2.22 per share |

| |

• |

|

Operating expenses in 4Q 2014 were $20.2 million including $4.2 million of non-cash expenses and, for the full year of 2014, were $70.5 million including non-cash expenses of $11.7 million |

| |

• |

|

Center for Medicare and Medicaid Services (CMS) granted FDA-approved Omidria™ (phenylephrine and ketorolac injection) 1%/0.3% transitional pass-through reimbursement status in October 2014, effective

January 1, 2015 |

| |

• |

|

Closed equity financing in February 2015, receiving $79.1 million in net proceeds |

“2014 was a year of

many important achievements for Omeros, transitioning us from a solely R&D to a commercial company with FDA’s approval of Omidria,” said Gregory A. Demopulos, M.D., chairman and chief executive officer of Omeros. “Receipt of

pass-through status from CMS, we expect, will accelerate our commercial success. The controlled launch of Omidria began in February and the feedback from those surgeons using Omidria has been uniformly positive. The broad launch of Omidria is

planned for early April, which will coincide nicely with the product’s increased visibility at the annual meeting of the American Society of Cataract and Refractive Surgery later that month. Our pipeline programs also made substantial progress,

most notably resulting in positive preliminary data in the Phase 2 clinical trial evaluating OMS721, our proprietary MASP-2 antibody currently in development for the treatment of TMAs.”

Fourth Quarter and Recent Highlights

| |

• |

|

CMS granted Omidria pass-through reimbursement status, effective January 1, 2015. Pass-through status allows for separate payment for new drugs and other medical technologies that meet well-established criteria

specified by federal regulations governing Medicare spending. Omeros expects pass-through to remain in effect until December 31, 2017, near which time CMS will evaluate utilization of Omidria and will re-assess its reimbursement status. CMS has set

the reimbursement rate for Omidria under Medicare Part B at the product’s wholesale acquisition cost (WAC) of $465 plus six percent (6%) per single-use vial for the second and third quarters of 2015 after which the rate will be based on average

selling price (ASP) plus six percent (6%). Based on Omeros’ discussions with CMS, the company expects this pass-through reimbursement to be effective as of January 1, 2015. |

| |

• |

|

Continued preparations for the full-scale U.S. launch of Omidria in early April 2015, which was preceded in February by a controlled product launch targeting all regions across the U.S. Activities included deploying

additional field sales representatives, bringing the total number of representatives to 40, developing distribution and access strategy, publishing product advertisements in trade journals and building a presence at key ophthalmologic conferences

and within the ophthalmic surgery community. |

| |

• |

|

Announced that the company had completed dosing of the low-dose cohort of patients in its Phase 2 clinical trial evaluating the efficacy and safety of OMS721, the lead human monoclonal antibody for the company’s

mannan-binding lectin-associated serine protease-2 (MASP-2) program, in treating thrombotic microangiopathies (TMAs), including atypical hemolytic uremic syndrome (aHUS). All patients in this study cohort received OMS721 and improvements were

observed across TMA disease markers. Experts in this disease field, including the study investigators, believe that the patients’ improvements were clinically meaningful and directly related to treatment with OMS721. Based on the clinical

results, a European investigator also has requested that Omeros provide extended access to OMS721 for compassionate use in patients with TMAs. This request is subject to approval by the applicable regulatory authority. |

| |

• |

|

Reported positive data in nonclinical studies of OMS721 or its derivative (1) in an ex vivo pathophysiologic system of aHUS for inhibition of thrombus formation and (2) in a well-established animal model of

stroke to reduce size of brain infarction and to protect against neurological deficits. |

| |

• |

|

Continued evaluation of data from a single nonclinical rat study in the company’s OMS824 program. Omeros is finalizing the package of nonclinical materials requested by the FDA to allow re-initiation of the OMS824

programs, and the company looks forward to re-activating enrollment in its Phase 2 clinical programs in the near future. |

| |

• |

|

Closed a public equity offering in February 2015 by which the company received net proceeds of approximately $79.1 million. |

Financial Results

For the quarter ended

December 31, 2014, Omeros reported a net loss of $20.7 million or $0.61 per share, including non-cash expenses of $4.2 million or $0.12 per share. This compares to a net loss of $1.8 million or $0.05 per share, including non-cash expenses of

$2.6 million or $0.09 per share, for the same period in 2013. The 2013 period includes a $12.5 million or $0.41 per share reduction of our net loss related to receiving a nonrecurring payment upon settlement of litigation. Excluding the litigation

settlement, the loss for the fourth quarter of 2013 would have been $14.3 million or $0.47 per share.

For the full year 2014, Omeros reported a net loss

of $73.7 million or $2.22 per share, including non-cash expenses of $11.7 million or $0.35 per share. This compares to a net loss of $39.8 million or $1.39 per share in 2013, including non-cash expenses of $10.6 million or $0.37 per share. Excluding

the litigation settlement, the 2013 net loss would have been $52.3 million or $1.83 per share.

Operating expenses for the three months ended

December 31, 2014 were $20.2 million compared to $14.1 million for the same period in 2013, an increase of $6.1 million. The increase was primarily related to preparing for the U.S. commercial launch of Omidria, to non-cash expenses related to

stock-based compensation, to increased employee costs and to the U.S. pediatric clinical trial evaluating Omidria, which began during 2014. These increased expenses were partially offset by lower clinical research and development expenses due to the

timing of clinical trials evaluating OMS824.

Operating expenses for the year ended December 31, 2014 were $70.5 million, an increase of $18.4 million

compared to $52.1 million in 2013. The 2014 increase related primarily to preparing for the U.S. commercial launch of Omidria, to clinical trials evaluating OMS824 and OMS721, to Phase 3 clinical trials for Omidria, and to increased employee costs

and non-cash expenses related to stock-based compensation. These increased expenses were partially offset by lower preclinical activity on the PDE7 program.

Revenue for the quarter ended December 31, 2014 was $180,000 compared to $169,000 for the same period in 2013. For the year ended December 31, 2014,

revenue was $539,000 compared to $1.6 million in 2013. The decrease for the full year 2014 was due to lower revenue recognized from the GPCR program funding agreements with Vulcan and LSDF, and the company will not recognize any additional revenue

under these agreements in future periods.

At December 31, 2014, the company had cash and cash equivalents and short-term investments of $6.9

million. In February 2015 the company sold 3,444,831 shares of common stock at a public offering price of $20.03 per share and sold pre-funded warrants to purchase up to 749,250 shares of common stock at a public offering price of $20.02 per warrant

share, each warrant share having an exercise price of $0.01. After deducting underwriting discounts and other offering expenses, Omeros received net proceeds of approximately $79.1 million.

2015 Guidance

For 2015, the company anticipates that

operating expenses will be in the $110 million to $120 million range with non-cash expenses of approximately $15 million. This guidance is largely based on the continued preparations for the full-scale U.S. launch of Omidria as well as the continued

development of the company’s product pipeline.

Conference Call Details

To access the live conference call via phone, please dial (844) 831-4029 from the United States and Canada or (920) 663-6278 internationally. The participant

passcode is 1480892. Please dial in approximately 10 minutes prior to the start of the call. A telephone replay will be available for one week following the call and may be accessed by dialing (855) 859-2056 from the United States and Canada or

(404) 537-3406 internationally. The replay passcode is 1480892.

To access the live and subsequently archived webcast of the conference call, go to the

Company’s website at www.omeros.com and go to “Events” under the Investors section of the website. Please connect to the website at least 15 minutes prior to the call to allow for any software download that may be necessary.

About Omeros Corporation

Omeros is a

biopharmaceutical company committed to discovering, developing and commercializing small-molecule and protein therapeutics for large-market as well as orphan indications targeting inflammation, coagulopathies and disorders of the central nervous

system. Derived from its proprietary PharmacoSurgery® platform, the company’s first drug product, Omidria™ (phenylephrine and ketorolac injection) 1%/0.3%, has been approved by the

FDA for use during cataract surgery or intraocular lens replacement (ILR) to maintain pupil size by preventing intraoperative miosis (pupil constriction) and to reduce postoperative ocular pain. Omeros is completing preparations for a planned

full-scale U.S. product launch in early April 2015. Omidria is currently under review for marketing approval by the European Medicines Agency. Omeros has six clinical-stage development programs focused on: complement-related thrombotic

microangiopathies; Huntington’s disease, schizophrenia, and cognitive impairment; addictive and compulsive disorders; and preventing problems associated with surgical procedures. In addition, Omeros has a proprietary GPCR platform, which is

making available an unprecedented number of new GPCR drug targets and corresponding compounds to the pharmaceutical industry for drug development.

Forward-Looking Statements

This press release contains

forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, which are subject to the “safe harbor” created by those sections for such

statements. All statements other than statements of historical fact are forward-looking statements, which are often indicated by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,”

“goal,” “intend,” “look forward to,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions.

Forward-looking statements are based on management’s beliefs and assumptions and on information available to management only as of the date of this press release. Omeros’ actual results could differ materially from those anticipated in

these forward-looking statements for many reasons, including, without limitation, risks associated with Omeros’ ability to begin broad U.S. commercial sales of Omidria™ (OMS302) in early April 2015, Omeros’ ability to

obtain regulatory approval for its Marketing Authorization Application in the EU for the commercialization of Omidria, Omeros’ unproven preclinical and clinical development activities,

regulatory oversight, product commercialization, intellectual property claims, competitive developments, litigation, and the risks, uncertainties and other factors described under the heading “Risk Factors” in the company’s Annual

Report on Form 10-K filed with the Securities and Exchange Commission on March 16, 2015. Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements, and the company assumes no

obligation to update these forward-looking statements, even if new information becomes available in the future.

Contact:

Erin Cox

Omeros Corporation

Investor and Media Relations

206.676.5036

ecox@omeros.com

OMEROS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

December 31, |

|

|

Twelve Months Ended

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| |

|

(unaudited) |

|

|

|

|

|

|

|

| Revenue |

|

$ |

180 |

|

|

$ |

169 |

|

|

$ |

539 |

|

|

$ |

1,600 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

11,750 |

|

|

|

10,186 |

|

|

|

47,946 |

|

|

|

36,297 |

|

| Selling, general and administrative |

|

|

8,405 |

|

|

|

3,885 |

|

|

|

22,601 |

|

|

|

15,819 |

|

| Total operating expenses |

|

|

20,155 |

|

|

|

14,071 |

|

|

|

70,547 |

|

|

|

52,116 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(19,975 |

) |

|

|

(13,902 |

) |

|

|

(70,008 |

) |

|

|

(50,516 |

) |

| Litigation settlement |

|

|

— |

|

|

|

12,500 |

|

|

|

— |

|

|

|

12,500 |

|

| Investment income |

|

|

2 |

|

|

|

2 |

|

|

|

12 |

|

|

|

12 |

|

| Interest expense |

|

|

(915 |

) |

|

|

(598 |

) |

|

|

(3,470 |

) |

|

|

(2,366 |

) |

| Other income (expense), net |

|

|

175 |

|

|

|

153 |

|

|

|

(207 |

) |

|

|

574 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(20,713 |

) |

|

$ |

(1,845 |

) |

|

$ |

(73,673 |

) |

|

$ |

(39,796 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss per share |

|

$ |

(0.61 |

) |

|

$ |

(0.05 |

) |

|

$ |

(2.22 |

) |

|

$ |

(1.39 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares used to compute basic and diluted net loss per share |

|

|

34,101,139 |

|

|

|

30,289,041 |

|

|

|

33,234,294 |

|

|

|

28,560,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OMEROS CORPORATION

CONSOLIDATED CONDENSED BALANCE SHEET DATA

(In thousands)

|

|

|

|

|

|

|

|

|

| |

|

December 31,

2014 |

|

|

December 31,

2013 |

|

| Cash and cash equivalents and short-term investments |

|

$ |

6,886 |

|

|

$ |

14,101 |

|

| Total assets |

|

|

11,090 |

|

|

|

16,535 |

|

| Total notes payable |

|

|

32,709 |

|

|

|

20,498 |

|

| Total current liabilities |

|

|

18,431 |

|

|

|

11,873 |

|

| Accumulated deficit |

|

|

(328,046 |

) |

|

|

(254,373 |

) |

| Total shareholders’ equity (deficit) |

|

|

(42,654 |

) |

|

|

(18,384 |

) |

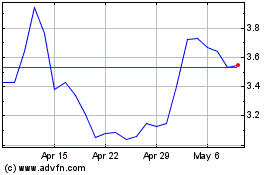

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Mar 2024 to Apr 2024

Omeros (NASDAQ:OMER)

Historical Stock Chart

From Apr 2023 to Apr 2024