UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31,

2014

or

[_] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number 001-33997

KANDI TECHNOLOGIES GROUP,

INC.

(Exact name of registrant as specified in its charter)

| Delaware |

90-0363723 |

| (State or other jurisdiction of incorporation |

(I.R.S. Employer Identification No.) |

| or organization) |

|

Jinhua City Industrial Zone

Jinhua, Zhejiang

Province

People's Republic of China

Post Code

321016

(Address of principal executive offices) (Zip Code)

(86-579) 82239856

(Registrant's

telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Common Stock, Par Value $0.001 Per Share |

NASDAQ Global Select Market

|

| (Title of each class) |

(Name of exchange on which registered)

|

Securities Registered Pursuant to Section 12(g) of the Act:

None.

1

Indicate by check mark if the registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

[_] No [X]

Indicate by check mark if the registrant is not required to

file reports pursuant to Section 13 or 15(d) of the Act.

Yes

[_] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes

[X] No [_]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Website, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of

Regulations S-T (§232.405 of this chapter) during the preceding 12 months (or

for such shorter period that the registrant was required to submit and post such

files).

Yes [X] No [_]

Indicate by check mark if disclosure of delinquent filers

pursuant to Item 405 of Regulation S-K is not contained herein, and will not be

contained, to the best of registrant's knowledge, in definitive proxy or

information statements incorporated by reference in Part III of this Form 10-K

or any amendment to this Form 10-K. [_]

Indicate by check mark whether the registrant is a large

accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,”

“accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the

Exchange Act.

| Large accelerated filer [_] |

Accelerated

filer [X] |

| Non-accelerated filer [_] |

Smaller reporting company [_] |

| (Do not check if a smaller reporting company) |

|

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

Yes

[_] No [X]

The aggregate market value of voting common stock held by

non-affiliates of the registrant as of June 30, 2014, the last business day of

the registrant's second fiscal quarter, was approximately $400,034,259.

The number of shares of common stock outstanding as of March 9,

2015 was 46,284,855.

DOCUMENTS INCORPORATED BY REFERENCE:

None.

2

TABLE OF CONTENTS

3

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains

certain forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. These include statements about our expectations,

beliefs, intentions or strategies for the future, which we indicate by words or

phrases such as “anticipate,” “expect,” “intend,” “plan,” “will,” “we believe,”

“our company believes,” “management believes” and similar language. These

forward-looking statements are based on our current expectations and are subject

to certain risks, uncertainties and assumptions, including those set forth in

the discussion under Item 1, “Business”, Item 1A, “Risk Factors” and Item 7,

“Management's Discussion and Analysis of Financial Condition and Results of

Operations.” Our actual results may differ materially from results anticipated

in these forward-looking statements. We base our forward-looking statements on

information currently available to us, and we assume no obligation to update

them. In addition, our historical financial performance is not necessarily

indicative of the results that may be expected in the future and we believe such

comparisons cannot be relied upon as indicators of future performance.

Although we believe that the expectations reflected in the

forward looking statements are reasonable, we cannot guarantee future results,

levels of activity, performance or achievements. Except as required by

applicable law, including the securities laws of the United States, we do not

intend to update any of the forward-looking statements to conform these

statements to actual results.

4

PART I

Except as otherwise indicated by the context, references in

this Annual Report to “we,” “us,” “our,” “Kandi,” or the “Company” are to the

combined businesses of Kandi Technologies Group, Inc. and its subsidiaries.

Item 1. Business Introduction

Our Core Business

Before the year 2013, the Company had been mainly engaged in the design, production and distribution of the off-road vehicle products. Due to various market factors and the environment with positive government supports, starting from the year 2013, the Company gradually shifted its main focus towards the development on pure electric vehicles (which we refer to as “EVs” in this report). For the year ended December 31, 2014, the majority of the Company’s revenue and profit were generated from EV parts and EV products.

The Market for Electric Vehicles

Business Environment and Policy

Research and development of major EV technology projects in

China began in 2001. Driven by two central government five-year plans for

scientific and technological research as well as by the Olympics, World Expo and

the “1000 cars in 10 cities” demonstration platform, the Chinese electric

automobile sector was officially born, which brings a positive basis for EV

business.

With the growing consumer demand for motor vehicles in China many cities are experiencing severe problems from environmental pollution. At the same time, with the lack of the efficient traffic planning, major Chinese cities are crippled by traffic congestion. Thus, major cities, such as Beijing, Shanghai, Guangzhou, Hangzhou, have begun to implement various policies restricting the purchase and usage of traditional cars. We expect that more cities will have no choices but to adopt similar policies in the future.

To improve the environment of the urban areas, the China Central Government, along with many municipalities, has been introducing numerous supporting policies that encouraged the usage and adoption of EVs, including subsidies, tax exemptions, special treatment of tag and license. Among these policies, the most significant development involved the availability of subsidies from central and local government for the sale of EVs. The process of receiving government subsidies is as follows: manufacturers receive central government subsidies through application and sell the EVs to local dealers at a discounted price, reflecting the deduction of the central government subsidy from the normal sale price. Local dealers then establish their retail price based upon the prevailing purchase price from the manufacturers, then deduct the local government subsidy from the retail price before selling the EVs to consumers. Through these steps, consumers receive both subsidies from the central and local governments when they purchase EVs.

Because the central and local government subsidies are disclosed to the public and all the subsidies are reviewed and verified by the respective governments, consumers know what subsidies they will receive along with the price they expect to pay for EVs. Therefore, even though dealers can sell vehicles at prices established at their discretion, programs are designed to assure that consumers receive the entire benefit from both subsidies. This allows for full disclosure for consumers in the costs associated with purchasing EVs, along with the added benefits of the respective subsidies.

Issues confronting the market

Although the basis for the EV industry in China has already been established, the development of Chinese EV industry is still ongoing due to five major obstacles towards extensive commercialization of EVs and the full development of the EV market in China, These obstacles include the comparatively higher cost of EVs, compared with traditional automobiles, the shorter driving range between battery charges, long charging times for standard EV batteries, the limited infrastructure of EV charging facilities, and EV battery attenuation and maintenance.

5

Our Solutions and Growth Strategy

To resolve these key market issues, given the economic and population growth in China, we believe there is an opportunity for a new business model. Kandi has been advocating, and through the Service Company, as defined below, implemented the “Micro Public Transportation” model, or MPT (the “EV-Share Program”), which provides a shared pure EV transportation platform that has not been previously afforded to urban residents. While it is less expensive than standard taxis. MPT is designed as a new business model for public transportation that maximizes the advantages of our existing EV products and technologies, and further stimulates the expansion of the EVs markets to urban communities. Since its inception, the “Micro Public Transportation” model has made impressive progress, and received great recognition and support from government officials, the end users, and our business partners throughout of China. In order to smoothly move the MPT concept forward, Kandi Electric Vehicles Group Co., Ltd., our 50/50 joint venture with Geely Automobile Holdings Ltd. ( the “JV Company”) participated in the establishing of Zhejiang ZuoZhongYou Electric Vehicle Service Co., Ltd. (the “Service Company”), of which the JV Company has a 19% of ownership interest. As of the end of 2014, the EV-Share Program had been launched, through the Service Company, in nine cities including Hangzhou, Shanghai, Chengdu, Nanjing, Guangzhou, Wuhan, Changsha, Changzhou and Rugao.

Today, cities in China face four critical challenges in the traffic environment, including pollution, traffic congestion, insufficient parking space and growing scarcity of energy supplies, which are mainly the result of ever growing volume of gas-powered automobiles. One solution to solve these problems is to create cleaner and more affordable public transportation to urban residents. Currently, subway and bus transport are the most abundant public transportation options available. In this regard, the Company advocates the EV-Share Program to reduce the total number of private cars in use, which will improve environmental conditions, ease traffic congestion, alleviate parking availability, and reduce the reliance and use of fossil fuels.

Besides the zero-emission benefit, the EV-Share Program combines the advantages of city taxis, resident vehicular transport, rental cars and traditional mass transportation, along with the benefits of the availability of the vertical automatic charging/parking garage and the street-level service stations. It is a seamless transportation tool in all dimensions for urban public transportation, designed to greatly improve the efficiency of urban EV usage, while easing traffic congestion, allowing for greater parking resources. Additionally, it will likely to promote the fast adoption of the pure EVs among Chinese consumers as MPT enables consumers to rent pure EVs on a short-term hourly base or lease them on the long-term base, without concerns on the costs and issues associated with owning and maintaining EVs individually.

The EV-Share Program is supported by a network of charging/parking stations, which provides charging, maintenance and battery recycling facilities. The stations locate at airports, train stations, hotels, business centers, selected residential areas and other strategic locations close to city public transportation network . A centralized tracking system allows the service provider of EV-Share Program to keep a close watch at the status and precise location of each vehicle. In addition to the short-term rental and long term leasing options to consumers described above, the Service Company also offers long-term leasing options to large enterprises, government entities and residential communities so they can use pure EVs for extended periods of time (the “Long-term Leasing Program”). In 2014, we have greatly benefited from the success of various MPT initiatives in China, especially the short-term hourly rental and the Long-term Leasing Program.

6

Our Organizational Structure

The Company was incorporated under the laws of the State of

Delaware on March 31, 2004. The Company changed its name from Stone Mountain

Resources, Inc. to Kandi Technologies, Corp. on August 13, 2007. On December 21,

2012, the Company changed its name to Kandi Technologies Group, Inc.

Headquartered in the Jinhua city, Zhejiang Province, China, the Company’s primary business operations are the design, development, manufacturing and commercialization of electric vehicles, electric vehicle parts and off-road vehicles, which are distributed in China and global markets. The Company conducts its primary business operations through its wholly-owned subsidiary, Zhejiang Kandi Vehicles Co., Ltd. (“Kandi Vehicles”) and the partial and wholly-owned subsidiaries of Kandi Vehicles. As part of its strategic objective to become a leader in EV market in China, the Company focuses on fuel efficient, pure EV parts manufacturing with a particular emphasis on expanding its market share in China.

The Company's organizational chart is as follows:

* The box with dotted-line border represents the entity that

has ceased operation and was dissolved in July 2014.

Operating Subsidiaries:

Pursuant to relevant agreements executed in January 2011, Kandi

Vehicles is entitled to 100% of the economic benefits, voting rights and

residual interests (100% profits and loss absorption rate) of Jinhua Kandi New

Energy Vehicles Co., Ltd. (“Kandi New Energy”). Kandi New Energy currently holds

vehicle production rights (license) on manufacturing Kandi brand electric

utility vehicles (”Special-purpose Vehicles”) and the production rights (license) on manufacturing battery packs used in Kandi

brand EVs.

Jinhua Three Parties New Energy Vehicles Service Co., Ltd.

(“Jinhua Service”) was formed as a joint venture, by and among our wholly-owned

subsidiary, Kandi Vehicles, the State Grid Power Corporation and Tianneng Power

International. The Company, indirectly through Kandi Vehicles, had a 30%

ownership interest in Jinhua Service. As of September 30, 2014, Jinhua Service

ceased its operations and was dissolved.

In April 2012, pursuant to a share exchange agreement, the

Company acquired 100% of Yongkang Scrou Electric Co, Ltd. (“Yongkang Scrou”), a

manufacturer of parts for automobile and electric vehicle, including EV drive

motors, EV controllers, air conditioners and other electrical products.

As a part of our EV business strategy, we believe we need more

production resources to timely and efficiently satisfy the market demands. In

March 2013, pursuant to a joint venture agreement (the “JV Agreement”) entered

into between Kandi Vehicles and Shanghai Maple Guorun Automobile Co., Ltd.

(“Shanghai Guorun”), a 99%-owned subsidiary of Geely Automobile Holdings Ltd.

(“Geely”), the parties established Zhejiang Kandi Electric Vehicles Co., Ltd.

(the “JV Company”) to develop, manufacture and sell EVs and related auto parts,

and to invest in other companies with related or similar business. Each of Kandi

Vehicles and Shanghai Guorun has a 50% ownership interest in the JV Company. In

March 2014, the JV Company changed its name to Kandi Electric Vehicles Group

Co., Ltd. At present, the JV Company is a holding company with products that are

manufactured by its subsidiaries.

In March 2013, Kandi Vehicles formed Kandi Electric Vehicles

(Changxing) Co., Ltd. (“Kandi Changxing”) in the Changxing (National) Economic

and Technological Development Zone. Kandi Changxing is engaged in the production

of EVs. In the fourth quarter of 2013, Kandi Vehicles entered into an ownership

transfer agreement with JV Company pursuant to which Kandi Vehicles transferred 100% of its ownership in Kandi Changxing to the JV

Company. The Company, indirectly through its 50% ownership interest in the JV

Company, has a 50% economic interest in Kandi Changxing.

7

In April 2013, Kandi Electric Vehicles (Wanning) Co., Ltd.

(“Kandi Wanning”) was formed in Wanning City of Hainan Province by Kandi

Vehicles and Kandi New Energy. Kandi Vehicles has a 90% ownership in Kandi

Wanning, and Kandi New Energy has the remaining 10% interest. However, by

contract, Kandi Vehicles is, effectively, entitled to 100% of the economic

benefits, voting rights and residual interests (100% profits and losses) of

Kandi Wanning. Hainan Province is planned as an international tourism island by

the Chinese government and there is a high possibility that all non-EV vehicles

will be banned from use within the province. Therefore, the Company believes EV

business has a great potential growth rate in Hainan province. To capture this

opportunity, the Company signed an agreement with Wanning city government and

invested a total of RMB 1 billion to develop a factory in Wanning with an annual

production of 100,000 EVs. Currently, this project is expected to launch its

trial production by 2015.

In July 2013, Zhejiang ZuoZhongYou Electric Vehicle Service Co., Ltd. (the “Service Company”) was formed. The Service Company is engaged in various pure EV leasing businesses including the EV-Share Program. The JV Company has a 19% ownership interest in the Service Company. The Company, indirectly through its 50% ownership interest in the JV Company, has a 9.5% economic interest in the Service Company.

In November 2013, Zhejiang Kandi Electric Vehicles Jinhua Co.,

Ltd. (“Kandi Jinhua”) was formed by the JV Company. The JV Company has 100%

ownership interest in Kandi Jinhua, and the Company, indirectly through its 50%

ownership interest in the JV Company, has a 50% economic interest in Kandi

Jinhua. According to the terms of the JV Agreement, except the JV Company and

its subsidiaries, Kandi Vehicle and its subsidiaries are not allowed to

manufacture pure EVs. However, Kandi New Energy holds the production rights

(license) on manufacturing of Special-purpose Vehicles. Therefore, it is

necessary to establish Kandi Jinhua, which is in charge of the Special-purpose

Vehicle business and entitles to use Kandi New Energy’s Special-purpose Vehicle

production rights (license).

In November 2013, Zhejiang JiHeKang Electric Vehicle Sales Co.,

Ltd. (“JiHeKang”) was formed by the JV Company and is engaged in car sales

business. The JV Company has 100% ownership interest in JiHeKang, and the

Company, indirectly through its 50% ownership interest in the JV Company, has a

50% economic interest in JiHeKang.

In December 2013, the JV Company entered into an ownership

transfer agreement with Shanghai Guorun pursuant to which the JV Company

acquired 100% ownership of Kandi Electric Vehicles (Shanghai) Co., Ltd. (“Kandi

Shanghai”). As a result, Kandi Shanghai is a wholly-owned subsidiary of the JV

Company, and the Company, indirectly through its 50% ownership interest in the

JV Company, has a 50% economic interest in Kandi Shanghai.

In January 2014, Zhejiang Kandi Electric Vehicles Jiangsu Co.,

Ltd. (“Kandi Jiangsu”) was formed by the JV Company. The JV Company has 100%

ownership interest in Kandi Jiangsu, and the Company, indirectly through its 50%

ownership interest in the JV Company, has a 50% economic interest in Kandi

Jiangsu.

Our Products

General

For the years ended December 31, 2014, 2013 and 2012, our

products include EV parts, EV products, and off-road vehicles including ATVs,

utility vehicles (“UTVs”), go-karts, and others. According to our market

research on consumer demand trends, we have adjusted our production line

strategically and continued to develop and manufacture new EV products in an

effort to meet market demands and better serve our customers.

8

| |

|

Year Ended December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| |

|

Unit |

|

|

Sales |

|

|

Unit |

|

|

Sales |

|

|

Unit |

|

|

Sales |

|

| EV parts |

|

102,236 |

|

$ |

116,431,310 |

|

|

51,588 |

|

$ |

1,724,031 |

|

|

93,881 |

|

$ |

3,517,237 |

|

| EV products |

|

3,758 |

|

|

33,978,619 |

|

|

4,694 |

|

|

46,619,203 |

|

|

3,915 |

|

|

19,034,936 |

|

| Off-Road Vehicles |

|

25,746 |

|

|

19,819,078 |

|

|

55,516 |

|

|

46,192,811 |

|

|

50,252 |

|

|

41,961,497 |

|

| Total |

|

131,740 |

|

$ |

170,229,006 |

|

|

111,798 |

|

$ |

94,536,045 |

|

|

148,048 |

|

$ |

64,513,670 |

|

EV Parts

During the year ended December 31, 2014, our revenues from the sale of EV parts were $116,431,310. We sold our EV parts mostly to the JV Company for manufacturing of the EV products. We started the EV parts business to the JV Company in the first quarter of 2014 and achieved significant growth during the year. Among the total EV parts sales to the JV Company for the year ended December 31, 2014, approximately 83% or the majority of the sales were related to the sales of battery packs. Due to various Chinese auto industry regulations, we hold the necessary production license to manufacture battery packs to be exclusively used in the EVs manufactured by the JV Company under the Kandi brand. Approximately 6% of the sales were related to the sales of EV controllers. Approximately 5% of the sales were related to the sales of air conditioning units. Approximately 4% of the sales were related to the sales of EV drive motors, and the remaining 2% were related to the sales of body parts and other auto parts.

EV Products

We continued to sell EV products during the year of 2014. Our revenues from the sale of EV products for the fiscal year of 2014 were $33,978,619, a decrease of $12,640,584 or 27.1% from $46,619,203 for the year ended December 31, 2013, representing a 19.9% of reduction in unit sales. The decrease in the sales volume was due to a JV Agreement signed in 2013 which required us to gradually transfer our EVs production and distribution business to the JV Company.

Off-Road Vehicles

During the year ended December 31, 2014, our revenues from the

sale of the off-road vehicles declined by $26,373,733, or 57.1%, to $19,819,078

from $46,192,811 for the year ended December 31, 2013, The decrease was

primarily due to the rearrangement of our product portfolio for more efficient

use of resources to capture more sales opportunities in the fast-growing EV

market in China.

The following table shows the breakdown of Kandi's revenues

from its customers by geographic markets:

9

| |

|

Year Ended December 31 |

|

| |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

|

Sales Revenue |

|

|

Percentage |

|

|

Sales

Revenue |

|

|

Percentage |

|

|

Sales

Revenue |

|

|

Percentage |

|

| North America |

$ |

2,900,789 |

|

|

2% |

|

$ |

6,906,807 |

|

|

7% |

|

$ |

7,243,257 |

|

|

11% |

|

| Europe and other regions |

|

5,729,035 |

|

|

3% |

|

|

2,394,948 |

|

|

3% |

|

|

1,639,990 |

|

|

3% |

|

| China |

|

161,599,182 |

|

|

95% |

|

|

85,234,290 |

|

|

90% |

|

|

55,630,423 |

|

|

86% |

|

| Total |

|

170,229,006 |

|

|

100% |

|

|

94,536,045 |

|

|

100% |

|

|

64,513,670 |

|

|

100% |

|

Recent Development Activities

In November 2014, SMA7002BEV05, the first Mid-tier Luxury Pure

Electric Vehicle developed by JV Company was approved by the Ministry of Industry

and Information Technology of the People's Republic of China ("MIIT") according

to No. 69 public announcement of MIIT. The SMA7002BEV05 model is among the

latest vehicles on the lists of the approved vehicle products (“MITT” No. 266)

and the recommended models for energy saving & new energy vehicle

demonstration and promotion in China (“MITT” No. 63). As a result, purchasers of

such EV will now be the ultimate beneficiaries to receive all levels of national

and local subsidies and incentives. The approval of SMA7002BEV05 is an

indication of our beginning to enter the field of the middle and high level pure

vehicle products. We believe that our diversified products will meet the

market's growing demands and secure our leading position in manufacturing pure

electric vehicle products in China.

In December 2014, Kandi Vehicles signed a purchase contract

with Zhejiang Tianneng Energy Technology Co, Ltd ("Tianneng Energy Technology")

for a one-year supply of TNL-ITR18650-2200P lithium batteries starting in

January 2015. Kandi Vehicle's purchase amount is committed to be no less than

RMB 260 million or approximately $42.6 million in 2015. Management believes

Tianneng Energy Technology's lithium battery is a great addition and will help

Kandi to achieve a better performance for EVs.

As of the end of 2014, our EV-Share Program has been expanded to 9 cities including Hangzhou, Shanghai, Chengdu, Nanjing, Guangzhou, Wuhan, Changsha, Changzhou, and Rugao. This program is an innovative business model aimed at promoting and popularizing the use of EVs in China. Since its inception, the program has generated significant public interest, and received key recognitions and endorsements from consumers as well as the government agencies. It also includes a variety of the Long-term Leasing Program, ideal for those companies, government entities and residential communities. As of the end of 2014, there had been a total of 14,398 Kandi EVs delivered to our customers. Leveraging the success of the EV-Share Program, Kandi has built a solid foundation to be recognized as the one of the leaders in the pure EV market in China.

On January 14, 2015, we announced that the first 60 Kandi Brand EVs were delivered to launch an innovative EV business model, which we called “Mini Police Car” Program. The EVs are the first time used by Hangzhou Uptown Public Security Bureau to facilitate performance of community safety patrols, population permit patrols, fire safety inspections, as well as other police duties. The Mini Police Car offers the advantage for police to quick access into these congested areas and small alleyways to carry out its duties. Kandi equips these EVs with the necessary police equipment, firefighting apparatuses, emergency kits, and other related equipment. In addition to our successful EV sharing program catering to average Chinese consumers, we hope to explore more EV growth opportunities in the area of fleet sales and leasing to large business and government entities in China in the future.

From January 23 to 25, 2015, the 2014 Global New Energy Auto Conference was held in Tianjin China. More than 700 people attended this conference, including government officers, scholars, auto industry experts, ecommerce companies, electric vehicles users, industry investors, technical development personnel, media and others. During the conference, Mr. Hu Xiaoming, our Chairman and CEO, was granted the sole award for “Innovator of Annual Green Auto ”.

10

On January 31 2015, Mr. Hu Xiaoming, our Chairman and CEO, visited Shenzhen Chuangming Battery Technology Co., LTD. (“Chuangming”), which engages in research and development, production and distribution in the field of Lithium ion battery. Both parties had a friendly detailed discussion on how to apply the high performance battery No. 18650 from Chuangming on Kandi’s EVs and align with the intention of cooperation. The visit for Mr. Hu is to seek the partner for high performance battery for Kandi’s EV products, and secure the supply of EV’s battery for future mass EVs production.

On February 15, 2015, the management of the JV Company made a decision to add the direct-selling operation to its business for the sale of pure EVs, in addition to the current fleet sale model. The JV Company has made good progress in selling EV products to the Service Company, which operates various leasing options including short-term rental and the Long-term Leasing Program. We believe the EV-Share Program will continue to be the main business growth driver for the JV Company. Meanwhile, in line with the growing direct market demand from end users, the JV Company will begin to explore direct selling option. A new pure EV product, JL7001BEV03, or Cyclone, developed by the JV Company will be mainly directly sold to the end users. Up to date, Cyclone has passed the required technical inspection and tests from various regulated agencies in China, including National Passenger Car Quality Supervision and Inspection Centre. The Company also filed the final application of the product public announcement with China’s MIIT and expect the application to be approved within the next two months. “Cyclone” is a five-door, four-seat vehicle equipped with a newly developed triple element lithium ion battery, with a comfortable seating area and reliable safety conditions. Cyclone utilizes a central control system that features both touch screen and conventional buttons, and it has also achieved multiple domestic automobile leading standards. The participated launch of Cyclone will further strengthen the leading position of the JV Company in the new energy automobile industry. As the JV Company gears up to sell EVs direct to end users this year, we believe that the JV Company will have great advantages in both fleet sales and direct sales markets.

Sales and Distribution

The Company has three main products: electric vehicle products, electric vehicle parts and off-road vehicles in year 2014. According to the JV Agreement with Geely, we will be gradually transferring the production of the EV products to the JV Company, and continue to share the 50% economic benefits share from the JV Company. Besides EVs, Kandi focuses on the design, production and distribution of EVs parts, which has demonstrated significant growth in 2014. Additionally, Kandi still continued to produce and sell the off-road vehicles, which is our traditional products.

Customers

As of December 31, 2014, our major customers, in the aggregate,

accounted for 71% of our sales. Currently, the Company is developing new

business partners and clients for our products to reduce our dependence on

existing customers and focusing the new business development efforts on our pure

EV business.

The Company's major customers, each of whom accounted for more

than 10% of our consolidated revenue, were as follows:

11

|

|

Sales |

|

|

Accounts Receivable and Amount Due from JV Company,

Net (1) |

|

| |

|

Year |

|

|

Year |

|

|

Year |

|

|

|

|

|

|

|

|

|

|

| |

|

Ended |

|

|

Ended |

|

|

Ended |

|

|

|

|

|

|

|

|

|

|

| |

|

December, |

|

|

December, |

|

|

December, |

|

|

December |

|

|

December |

|

|

December |

|

| |

|

31, |

|

|

31, |

|

|

31, |

|

|

31, |

|

|

31, |

|

|

31, |

|

| Major Customers |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Kandi Electric Vehicles (Changxing) Co.,

Ltd. |

|

38% |

|

|

- |

|

|

- |

|

|

17% |

|

|

- |

|

|

- |

|

| Kandi Electric Vehicles (Shanghai) Co., Ltd. |

|

23% |

|

|

- |

|

|

- |

|

|

16% |

|

|

- |

|

|

- |

|

| Shanghai Maple Auto Co., Ltd. |

|

10% |

|

|

23% |

|

|

- |

|

|

3% |

|

|

47% |

|

|

- |

|

| |

(1) |

The balance at December 31, 2014 didn’t include the

one-year entrusted loan of $24,376,371 that Kandi Vehicle lent to the JV

Company. |

Sources of Supply

All the raw materials are purchased from the suppliers. The

major parts of our products are mainly manufactured by Kandi. Other components

and parts that are needed are purchased from third-party suppliers. Kandi does

not have, and does not anticipate having, any difficulty in obtaining required

materials from its suppliers. In reaching this determination, we considered our

current contracts and our current business relationships with our suppliers.

The Company's material suppliers, each of whom accounted for

more than 10% of our total purchases, were as follows:

| |

|

Purchases |

|

|

Accounts Payable |

|

| |

|

Year |

|

|

Year |

|

|

Year |

|

|

|

|

|

|

|

|

|

|

| |

|

Ended |

|

|

Ended |

|

|

Ended |

|

|

|

|

|

|

|

|

|

|

|

|

December, 31, |

|

|

December, 31, |

|

|

December, 31, |

|

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

| Major Suppliers |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Zhejiang New Energy Auto System Co., Ltd. |

|

31% |

|

|

33% |

|

|

26% |

|

|

12% |

|

|

12% |

|

|

- |

|

| Shandong Henyuan New Energy Tech Co., Ltd. |

|

25% |

|

|

- |

|

|

- |

|

|

32% |

|

|

- |

|

|

- |

|

| Zhongju (Tianjin) New Energy Investment

Co., Ltd. |

|

11% |

|

|

- |

|

|

- |

|

|

29% |

|

|

- |

|

|

- |

|

12

Competitors

Our EV business faces the competition from two parts, one is the competition with traditional vehicles and the other is the competition from other EVs manufacturers.

In terms of the competition with the traditional vehicle manufacturers, many competitors are larger and have greater financial resources. But the traditional automobile companies face many urban traffic challenges, including urban pollution, traffic congestion, insufficient parking space and energy crisis., which gives us great opportunities for EVs’ development. The government grants great support and issues favorable policies to promote EVs development, which is a clear evidence for EVs growth. We believe electric vehicle industry in China has many years of great potential growth ahead.

Within electric vehicle market itself, the competitions are fierce as we have to compete with many domestic and global EV manufactures with greater brand recognition and financial resources. However, being one of the earliest companies to engage in the research, production and distribution of electric vehicles, we believe we have the advantage on the technology, innovation on the vehicle business operation and distribution channel. In particular, the innovative EV-Share Program, or MPT model we have been advocating, is different from our competitors’ offering, and has been well received by the government and the end users. This business model, along with our continuous efforts on research and development as well as strategic alliance, shall help us to build competitive advantages over other EV manufacturers.

Intellectual Property and Licenses

Our success depends, at least in part, on our ability to

protect our core technology and intellectual property. We rely on a combination

of patents, patent applications, trademarks, copyright and trade secret

protection laws in China and other jurisdictions, as well as confidentiality

procedures and contractual provisions to protect our intellectual property and

our brand. As of December 31, 2014, we had 26 issued patents, 2 issued software

copyrights and 6 pending patent applications with Chinese patent authority

related to electrical vehicle products, electrical vehicle parts and off-road

vehicle products. Under the PRC Patent Law, an invention patent is valid for a

term of 20 years and a utility or design patent is valid for a term of 10 years.

Our patents are valid for 10 years. In addition, we are authorized to use the

trademark of “Kandi” and we are the owner of the trademark of “JASSCOL”. We

intend to continue to file additional patent applications with respect to our

technology.

Employees

As of December 31, 2014, excluding the contractors, Kandi had a

total of 516 full-time employees as compared to 430 full-time employees on

December 31, 2013, of which 328 employees are production personnel, 14 employees

are sales personnel, 44 employees are research and development personnel, and

130 employees are administrative personnel. None of our employees are covered by

collective bargaining agreements. We consider our relationships with our

employees to be good. We also employ consultants on an as needed basis.

Pure Electric Vehicles Subsidies

Currently, there are two subsidies from central and local governments for the pure EVs in China – one from each of the central and local governments. The ultimate beneficiary for these subsidies is the consumer and the actual prices that consumers pay reflect the deduction of both subsidies.

a) The central government provides a subsidy to manufacturers

paid in advance quarterly upon application and approval and settled annually.

After selling product to dealers, manufacturers can submit subsidy payment

applications with invoices and other supporting documents at the end of each

quarter to the requisite central government agencies through their regional

offices. After the review and approval by the agencies, the central government

makes advance subsidy payments to the manufacturers. At the end of the year, the

final subsidy amounts are verified, reconciled according to the number of

vehicles actually sold to consumers and settled on an annual basis.

b) Pursuant to the requirement of the central government, the

local governments provide a subsidy to consumers who purchase EVs by a price

reduction from the dealer. After the consumer purchases an EV at a reduced

selling price from the dealer, the dealer submits a subsidy application to the

local government, including a consumer authorization letter for subsidy

application, consumer personal I.D., EV Vehicle License, EV purchase invoice

and other required documents and requests reimbursement (to the dealer) for the

local government subsidy.

13

Environmental and Safety Regulation

Emissions

Our products are all subject to international laws and

emissions related regulations, including regulations and related standards

established by China Environmental Protection Agency, the United States

Environmental Protection Agency (“EPA”), the California Air Resources Board

(“CARB”), Europe and Canada.

All Kandi's products comply with all applicable emissions

standards and regulations in China Environmental Protection Agency, the United

States and internationally, the California Air Resources Board (“CARB”), Europe

and Canada. However, we are unable to predict the ultimate impact of standards

and regulations adopted in the future or proposed regulations on Kandi and its

business.

Use regulation

The sale and use of products must be subject to the "Traffic

Law" and relevant laws & regulations in China. National, State, and federal

laws and regulations have been promulgated, or are under consideration, that

impact the use or manner of use of Kandi's products. Certain states and local

authorities have adopted, or are considering the adoption of, legislation and

local ordinances which restrict the use of ATVs and off-road vehicles to

specified hours and locations. The federal government also has restricted the

use of ATVs and off-road vehicles in some national parks and federal lands. In

several instances, the restriction has been a complete ban on the recreational

use of these vehicles. Kandi is unable to predict the outcome of such actions or

the possible effect on its business. Kandi believes that its off-road vehicle

business would be no more adversely affected than those of its competitors by

the adoption of any such pending laws or regulations.

Product Safety and Regulation

Safety Regulation

The U.S. federal government and individual states have adopted,

or are considering the adoption of, laws and regulations relating to the use and

safety of Kandi's products. The federal government is the primary regulator of

product safety. The Consumer Product Safety Commission (“CPSC”) has federal

oversight over product safety issues related to ATVs and off-road vehicles. The

National Highway Transportation Safety Administration (“NHTSA”) has federal

oversight over product safety issues related to on-road motorcycles.

In August 2008, the Consumer Product Safety Improvement Act

(the “Act”) was passed. The Act requires all manufacturers and distributors who

import into or distribute ATVs within the United States to comply with the

ANSI/SVIA safety standards, which were previously voluntary. The Act also

requires the same manufacturers and distributors to have ATV action plans filed

with the CPSC that are substantially similar to the voluntary action plans that

were previously in effect. Kandi currently complies with the ANSI/SVIA

standards.

Kandi's motorcycles are subject to federal vehicle safety

standards administered by NHTSA. Kandi's motorcycles are also subject to various

state vehicle safety standards. Kandi believes that its motorcycles comply with

safety standards applicable to motorcycles.

Kandi's products are also subject to international safety

standards in places where it sells its products outside the United States. Kandi

believes that its motorcycles and EVs comply with applicable safety standards in

the United States and internationally.

14

Principal Executive Offices

Our principal executive office is located in the Jinhua City

Industrial Zone in Jinhua, Zhejiang Province, PRC, 321016 and our telephone

number is (86-579) 82239856.

Item 1A. Risk Factors.

You should carefully consider the risks described below

together with all of the other information included in this report before making

an investment decision with regard to our securities. The statements contained

in or incorporated into this Annual Report that are not historic facts are

forward-looking statements that are subject to risks and uncertainties that

could cause actual results to differ materially from those set forth in or

implied by forward-looking statements. If any of the following risks actually

occurs, our business, financial condition or results of operations could be

harmed. In that case, the trading price of our common stock could decline, and

you may lose all or part of your investment.

Risks Relating to Our Business

Our future growth is dependent upon consumers’

willingness to adopt EVs.

Our growth is highly dependent upon the adoption by consumers

of, and we are subject to a risk of any reduced demand for, alternative fuel

vehicles in general and EVs in particular. The market for alternative fuel

vehicles (including EVs) is relatively new, rapidly evolving, characterized by

rapidly changing technologies, price competition, additional competitors,

evolving government regulation and industry standards, frequent new vehicle

announcements and changing consumer demands and behaviors. If the market for EVs

in China does not develop as we expect or develops more slowly than we expect,

our business, prospects, financial condition and operating results will be

harmed.

The unavailability, reduction or elimination of

government and economic incentives could have a material adverse effect on our

business, financial condition, operating results and prospects.

Chinese government has made significant efforts in actively

advocating the development of new energy vehicles to reach production and sales

targets of 0.5 million New Energy Vehicles (NEVs) by 2015 and 5 million NEVs by

2020. We received support from the local and central government of the PRC from

time to time. Any reduction, elimination or discriminatory application of

government subsidies and economic incentives because of policy changes, the

reduced need for such subsidies and incentives due to the customer base of our

EVs, fiscal tightening or other reasons may result in the diminished

competitiveness of the alternative fuel vehicle industry generally or our EVs in

particular. This could materially and adversely affect the growth of the

alternative fuel automobile markets and our business, prospects, financial

condition and operating results.

Our growth depends in part on the availability and amounts of

government subsidies and economic incentives for alternative fuel vehicles

generally and performance EVs specifically. For example, purchasers of three

models of Kandi brand EVs are eligible to receive purchase tax exemption at the

amount of 10% of the vehicle’s total purchase price during the three-year period

from September 1, 2014. Purchasers of Kandi's SMA7000BEV and SMA7001BEV models

are the ultimate beneficiaries, on a per car basis, the national government

subsidy of RMB 47,500.00 (Approximately $7,738.00) and the local government

subsidy of RMB 47,500.00 (Approximately $7,738.00) from provincial government

and municipal government combined at both Chengdu (Sichuan province) and Nanjing

(Jiangsu province). Additionally, these two vehicle models also qualify for free

license plates in Shanghai. The license plates in Shanghai are auctioned to the

public at an average price between RMB70,000.00 to RMB80,000.00 ($11,410.00 to

$13,040.00) per license plate. While we believe the latest tax exemption, along

with a series of government incentives and subsidies, may have a very positive

impact on the sales of Kandi Brand EVs in China going forward, we cannot assure

you it is always the case. In the event such favored policy and treatment

discontinue, our business outlook and financial conditions could be negatively

impacted.

15

Developments in alternative technologies or improvements

in the internal combustion engine may materially adversely affect the demand for our EVs.

Significant developments in alternative technologies, such as

advanced diesel, ethanol, fuel cells or compressed natural gas, or improvements

in the fuel economy of the internal combustion engine, may materially and

adversely affect our business and prospects in ways we do not currently

anticipate. Any failure by us to develop new or enhanced technologies or

processes, or to react to changes in existing technologies, could materially

delay our development and introduction of new and enhanced EVs, which could

result in the loss of competitiveness of our vehicles, decreased revenue and a

loss of market share to competitors.

If we are unable to keep up with advances in electric

vehicle technology, we may suffer a decline in our competitive position.

We may be unable to keep up with changes in EV technology and,

as a result, may suffer a decline in our competitive position. Any failure to

keep up with advances in EV technology would result in a decline in our

competitive position which would materially and adversely affect our business,

prospects, operating results and financial condition. Our research and

development efforts may not be sufficient to adapt to changes in EV technology.

As technologies change, we plan to upgrade or adapt our vehicles and introduce

new models in order to continue to provide vehicles with the latest technology,

in particular battery cell technology. However, our vehicles may not compete

effectively with alternative vehicles if we are not able to source and integrate

the latest technology into our vehicles. For example, we do not manufacture

battery cells, which makes us dependent upon other suppliers of battery cell

technology for our battery packs.

Our business depends substantially on the continuing

efforts of our executive officers, and our business may be severely disrupted if

we lose their services.

Our future success depends substantially on the continued

services of our executive officers, especially our CEO and Chairman of the Board

of Directors, Mr. Hu Xiaoming. We do not maintain key man life insurance on any

of our executive officers. If any of our executive officers are unable or

unwilling to continue in their present positions, we may not be able to replace

them readily, if at all. Therefore, our business may be severely disrupted, and

we may incur additional expenses to recruit and retain new officers. In

addition, if any of our executive officers joins a competitor or forms a

competing company, we may lose some of our customers.

We may be subject to product liability claims, or recalls

which could be expensive, damage our reputation and result in a diversion of

management resources.

We may be subject to lawsuits resulting from injuries

associated with the use of the vehicles that we sells or produces. We may incur

losses relating to these claims or the defense of these claims. There is a risk

that claims or liabilities will exceed our insurance coverage. In addition, we

may be unable to retain adequate liability insurance in the future.

We may also be required to participate in recalls involving our

vehicles, if any prove to be defective, or we may voluntarily initiate a recall

or make payments related to such claims as a result of various industry or

business practices or the need to maintain good customer relationships. Such a

recall would result in a diversion of resources. While we do maintain product

liability insurance, we cannot assure you that it will be sufficient to cover

all product liability claims, that such claims will not exceed our insurance

coverage limits or that such insurance will continue to be available on

commercially reasonable terms, if at all. Any product liability claim brought

against us could have a material adverse effect on our results of operations.

We retain certain personal information about our

customers and may be subject to various privacy and consumer protection laws.

We and our operating companies use our vehicles’ electronic

systems to log information about each vehicle’s condition, performance and use

in order to aid us in providing customer service, including vehicle diagnostics,

repair and maintenance, as well as to help us collect data regarding our

customers’ charge time, battery usage, mileage and efficiency habits and to

improve our vehicles. We also collect information about our customers through

our website, at our stores and facilities, and via telephone.

16

Our customers may object to the processing of this data, which

may negatively impact our ability to provide effective customer service and

develop new vehicles and products. Collection and use of our customers’ personal

information in conducting our business may be subject to national and local laws

and regulations in the PRC, and such laws and regulations may restrict our

processing of such personal information and hinder our ability to attract new

customers or market to existing customers. We may incur significant expenses to

comply with privacy, consumer protection and security standards and protocols

imposed by law, regulation, industry standards or contractual obligations.

Although we take steps to protect the security of our customers’ personal

information, we may be required to expend significant resources to comply with

data breach requirements if third parties improperly obtain and use the personal

information of our customers or we otherwise experience a data loss with respect

to customers’ personal information. A major breach of our network security and

systems could have serious negative consequences for our businesses and future

prospects, including possible fines, penalties and damages, reduced customer

demand for our vehicles, and harm to our reputation and brand.

Our business will be adversely affected if we are unable

to protect our intellectual property rights from unauthorized use or

infringement by third parties.

Any failure to adequately protect our proprietary rights could

result in weakening or loss of such rights, which may allow our competitors to

offer similar or identical products or use identical or confusingly similar

branding, potentially resulting in the loss of some of our competitive

advantage, a decrease in our revenue and an attribution of potentially lower

quality products to us, which would adversely affect our business, prospects,

financial condition and operating results. Our success depends, at least in

part, on our ability to protect our core technology and intellectual property.

To accomplish this, we rely on a combination of patents, patent applications,

trade secrets, including know-how, employee and third party nondisclosure

agreements, copyright protection, trademarks, intellectual property licenses and

other contractual rights to establish and protect our proprietary rights in our

technology. We have also received from third parties patent licenses related to

manufacturing our vehicles.

The protection provided by the patent laws is and will be

important to our future opportunities. However, such patents and agreements and

various other measures we take to protect our intellectual property from use by

others may not be effective for various reasons, including the following:

- our pending patent applications may not result in the issuance of patents;

- our patents, if issued, may not be broad enough to protect our commercial

endeavors;

- the patents we have been granted may be challenged, invalidated or

circumvented because of the pre-existence of similar patented or unpatented

technology or for other reasons;

- the costs associated with obtaining and enforcing patents, confidentiality

and invention agreements or other intellectual property rights may make

aggressive enforcement impracticable; and

- current and future competitors

may independently develop similar technology, duplicate our vehicles or design

new vehicles in a way that circumvents our intellectual property.

Existing trademark and trade secret laws and confidentiality

agreements afford only limited protection. In addition, the laws of some foreign

countries do not protect our proprietary rights to the same extent as do the

laws of the United States, and policing the unauthorized use of our intellectual

property is difficult.

We may need to defend ourselves against patent or

trademark infringement claims, which may be time-consuming and would cause us to

incur substantial costs.

Companies, organizations or individuals, including our

competitors, may hold or obtain patents, trademarks or other proprietary rights

that would prevent, limit or interfere with our ability to make, use, develop,

sell or market our vehicles or components, which could make it more difficult

for us to operate our business. From time to time, we may receive inquiries from

holders of patents or trademarks regarding their proprietary rights.

Companies holding patents or other intellectual property rights may bring suits

alleging infringement of such rights or otherwise assert their rights and seek

licenses. In addition, if we are determined to have infringed upon a third

party’s intellectual property rights, we may be required to do one or more of

the following:

17

- cease selling, incorporating or using vehicles or offering goods or

services that incorporate or use the challenged intellectual property;

- pay substantial damages;

- obtain a license from the holder of the infringed intellectual property

right, which license may not be available on reasonable terms or at all; or

- redesign our vehicles or other goods or services.

In the event of a successful claim of infringement against us

and our failure or inability to obtain a license to the infringed technology or

other intellectual property right, our business, prospects, operating results

and financial condition could be materially adversely affected. In addition, any

litigation or claims, whether or not valid, could result in substantial costs

and diversion of resources and management attention.

We may also face claims that our use of technology licensed or

otherwise obtained from a third party infringes the rights of others. In such

cases, we may seek indemnification from our licensors/suppliers under our

contracts with them. However, indemnification may be unavailable or insufficient

to cover our costs and losses, depending on our use of the technology, whether

we choose to retain control over conduct of the litigation, and other factors.

Our vehicles make use of lithium-ion battery cells, which

could catch fire or vent smoke and flame. This may lead to additional concerns,

about the batteries used in automotive applications.

The battery pack in our EV products makes use of lithium-ion

cells. We also currently intend to make use of lithium-ion cells in battery

packs on any future vehicles we may produce. On rare occasions, lithium-ion

cells can rapidly release the energy they contain by venting smoke and flames in

a manner that can ignite nearby materials as well as other lithium-ion cells.

Extremely rare incidents of laptop computers, cell phones and EV battery packs

catching fire have focused consumer attention on the safety of these cells.

These events have raised concerns about the batteries used in

automotive applications. To address these questions and concerns, a number of

cell manufacturers are pursuing alternative lithium-ion battery cell chemistries

to improve safety. We may have to

recall our vehicles or participate in a recall of a vehicle that contains our

battery packs, and redesign our battery packs, which would be time consuming and

expensive. Also, negative public perceptions regarding the suitability of

lithium-ion cells for automotive applications or any future incident involving

lithium-ion cells such as a vehicle or other fire, even if such incident does

not involve us, could seriously harm our business.

In addition, we store a significant number of lithium-ion cells

at our manufacturing facility. Any mishandling of battery cells may cause

disruption to the operation of our facilities. While we have implemented safety

procedures related to the handling of the cells, there can be no assurance that

a safety issue or fire related to the cells would not disrupt our operations.

Such damage or injury would likely lead to adverse publicity and potentially a

safety recall. Moreover, any failure of a competitor’s EV, may cause indirect

adverse publicity for us and our EVs. Such adverse publicity would negatively

affect our brand and harm our business, prospects, financial condition and

operating results.

18

Compliance with environmental regulations can be

expensive, and noncompliance with these regulations may result in adverse

publicity and potentially significant monetary damages and fines.

Our business operations generate noise, waste water, gaseous

byproduct and other industrial waste. We are required to comply with all

national and local regulations regarding protection of the environment. We are

in compliance with current environmental protection requirements and have all

necessary environmental permits to conduct our business. However, if more

stringent regulations are adopted in the future, the costs of compliance with

these new regulations could be substantial. Additionally, if we fail to comply

with present or future environmental regulations, we may be required to pay

substantial fines, suspend production or cease operations. Any failure by us to

control the use of, or to adequately restrict the unauthorized discharge of,

hazardous substances could subject us to potentially significant monetary

damages and fines or suspensions to our business operations. Certain laws,

ordinances and regulations could limit our ability to develop, use, or sell our

products.

The electric vehicle industry is highly competitive, and

we are subject to risks relating to competition that may adversely affect our

performance.

The electric vehicle industry is highly competitive, and our

continued success depends upon our ability to compete effectively in markets

that contain many competitors, some of which have significantly greater

financial, marketing and other resources than we have. Competition may affect

our pricing structures, potentially causing us to lower our prices, which may

adversely impact our profits. New or existing competition that uses a business

model that is different from our business model may put pressure on us to change

our model so that we can remain competitive.

Our high concentration of sales to relatively few

customers may result in significant impact our liquidity, business, results of

operations and financial condition.

As of December 31, 2014 and 2013, our top five customers, in

the aggregate, accounted for 84% and 67%, respectively, of our sales and

accounts receivable. Due to the concentration of sales to relatively few

customers, loss of one or more of these customers will have relatively high

impact on our operational results.

Our business is subject to the risk of supplier

concentrations.

We depend on a limited number of suppliers for the sourcing of

major components and parts and principal raw materials. For the years ended

December 31, 2014 and 2013, the top two suppliers accounted for 57% and 65% of

our purchases, respectively. As a result of this concentration in our supply

chain, our business and operations would be negatively affected if any of our

key suppliers were to experience significant disruption affecting the price,

quality, availability or timely delivery of their products. The partial or

complete loss of these suppliers, or a significant adverse change in our

relationship with any of these suppliers, could result in lost revenue, added

costs and distribution delays that could harm our business and customer

relationships. In addition, concentration in our supply chain can exacerbate our

exposure to risks associated with the termination by key suppliers of our

distribution agreements or any adverse change in the terms of such agreements,

which could have a negative impact on our revenues and profitability.

Our facilities or operations could be damaged or

adversely affected as a result of disasters or unpredictable events.

Our headquarters and facilities are located in several cities

in China such as Jinhua, Yongkang and Wanning. If major disasters such

as earthquakes, fires, floods, hurricanes, wars, terrorist attacks, computer

viruses, pandemics or other events occur, or our information system or

communications network breaks down or operates improperly, our headquarters and

production facilities may be seriously damaged, or we may have to stop or delay

production and shipment of our products. We may incur expenses relating to such

damages, which could have a material adverse impact on our business, operating

results and financial condition.

19

If we fail to maintain an effective system of internal

controls, we may not be able to accurately report our financial results or

prevent fraud. As a result, current and potential shareholders could lose

confidence in our financial reporting, which would harm our business and the

trading price of our stock.

Effective internal controls are necessary for us to provide

reliable financial reports and effectively prevent fraud. As directed by Section

404 of the Sarbanes-Oxley Act of 2002, or SOX 404, the SEC adopted rules

requiring public companies to include a report of management on our internal

controls over financial reporting in their annual reports.

Despite of our recent efforts in improving our internal control

procedures and remediating the material weakness, we cannot provide assurance

that we will not fail to achieve and maintain an effective internal control

environment on an ongoing basis, which may cause investors to lose confidence in

our reported financial information and have a material adverse effect on the

price of our common stock.

The audit report included in this Annual Report was

prepared by auditors who are not inspected by the Public Company Accounting

Oversight Board and, as a result, you are deprived of the benefits of such

inspection

The independent registered public accounting firm that issues

the audit reports included in our annual reports filed with the SEC, as auditors

of companies that are traded publicly in the United States and a firm registered

with the Public Company Accounting Oversight Board (United States), or the

“PCAOB”, is required by the laws of the United States to undergo regular

inspections by the PCAOB to assess its compliance with the laws of the United

States and professional standards. Because our auditors are located in the PRC,

a jurisdiction where the PCAOB is currently unable to conduct inspections

without the approval of the PRC authorities, our auditors are not currently

inspected by the PCAOB.

Inspections of other firms that the PCAOB has conducted outside

China have identified deficiencies in those firms' audit procedures and quality

control procedures, which may be addressed as part of the inspection process to

improve future audit quality. The inability of the PCAOB to conduct inspections

in China prevents the PCAOB from regularly evaluating our auditor's statements,

audits and quality control procedures. As a result, investors may be deprived of

the benefits of PCAOB inspections.

The inability of the PCAOB to conduct inspections of auditors

in China makes it more difficult to evaluate the effectiveness of our auditor's

quality control and audit procedures as compared to auditors outside of China

that are subject to PCAOB inspections. Investors may lose confidence in our

reported financial information and procedures and the quality of our financial

statements.

Risks Related to Doing Business in China

The economy of China had experienced unprecedented

growth. This growth has slowed in the recent years, and if the growth of the

economy continues to slow or if the economy contracts, our financial condition

may be materially and adversely affected.

The rapid growth of the PRC economy had historically resulted

in widespread growth opportunities in industries across China. This growth has

slowed in the recent years. As a result of the global financial crisis and the

inability of enterprises to gain comparable access to the same amounts of

capital available in past years, there may be an adverse effect on the business

climate and growth of private enterprise in the PRC. An economic slowdown could

have an adverse effect on our sales and may increase our costs. Further, if

economic growth continues to slow, and if, in conjunction, inflation is allowed

to proceed unchecked, our costs would likely increase, and there can be no

assurance that we would be able to increase our prices to an extent that would

offset the increase in our expenses.

In addition, a tightening of the labor markets in our

geographic region may result in fewer qualified applicants for job openings in

our facilities. Further, higher wages, related labor costs and other increasing

cost trends may negatively impact our results.

Changes in political and economic conditions may affect

our business operations and profitability.

Since our business operations are primarily located in China,

our business operations and financial position are subject, to a significant

degree, to the economic, political and legal developments in China.

20

While the Chinese government has not halted its economic reform

policy since 1978, any significant adverse changes in the social, political and

economic conditions of China may fundamentally impact China's economic reform

policies, and thus the Company's operations and profits may be adversely

affected.

Uncertainties with respect to the Chinese legal system

could have a material adverse effect on us and may restrict the level of legal

protections to foreign investors.

China's legal system is based on statutory law. Unlike the

common law system, statutory law is based primarily on written statutes.

Previous court decisions may be cited as persuasive authority but do not have a

binding effect. Since 1979, the PRC government has been promulgating and

amending the laws and regulations regarding economic matters, such as corporate

organization and governance, foreign investment, commerce, taxation and trade.

However, since these laws and regulations are relatively new, and the PRC legal

system continues to rapidly evolve, the interpretation of many laws, regulations

and rules is not always uniform and enforcement of these laws, regulations and

rules involves uncertainties, which may limit legal protections available to us.

In addition, any litigation in China may be protracted and may

result in substantial costs and diversion of resources and management's

attention. The legal system in China cannot provide investors with the same

level of protection as in the U.S. The Company is governed by laws and

regulations generally applicable to local enterprises in China. Many of these

laws and regulations were recently introduced and remain experimental in nature

and subject to changes and refinements. Interpretation, implementation and

enforcement of the existing laws and regulations can be uncertain and

unpredictable and therefore may restrict the legal protections available to

foreign investors.

Changes in Currency Conversion Policies in China may have

a material adverse effect on us.

Renminbi (“RMB”) is still not a freely exchangeable currency.

Since 1998, the State Administration of Foreign Exchange of China has

promulgated a series of circulars and rules in order to enhance verification of

foreign exchange payments under a Chinese entity's current account items, and

has imposed strict requirements on borrowing and repayments of foreign exchange

debts from and to foreign creditors under the capital account items and on the

creation of foreign security in favor of foreign creditors.

This may complicate foreign exchange payments to foreign

creditors under the current account items and thus may affect the ability to

borrow under international commercial loans, the creation of foreign security,

and the borrowing of RMB under guarantees in foreign currencies. Moreover, the

value of RMB may become subject to supply and demand, which could be largely

impacted by international economic and political environments. Any fluctuations

in the exchange rate of RMB could have an adverse effect on the operational and

financial condition of the Company and its subsidiaries in China.

You may experience difficulties in effecting service of

legal process, enforcing foreign judgments or bringing original actions based on

United States or foreign laws against us, our management or the experts named in

the prospectus.

We conduct substantially all of our operations in China and

almost all of our assets are located in China. In addition, almost all of our

senior executive officers reside in China. As a result, it may not be possible

to effect service of process on our senior executive officers within the United

States or elsewhere outside China, including with respect to matters arising

under U.S. federal securities laws or applicable state securities laws.

Moreover, our PRC counsel has advised us that the PRC does not have treaties

with the United States or many other countries providing for the reciprocal

recognition and enforcement of court orders and final judgments.

Risks Relating to Ownership of Our Securities

Our stock price may be volatile, which may result in

losses to our shareholders.

The stock markets have experienced significant price and

trading volume fluctuations, and the market prices and trading volumes of companies listed on the NASDAQ Global Market and the NASDAQ

Global Select Market have been volatile. Although our stock was listed on the

NASDAQ Global Market and upgraded to the NASDAQ Global Select Market on January

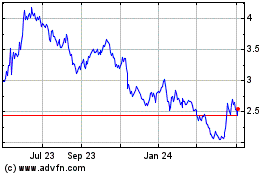

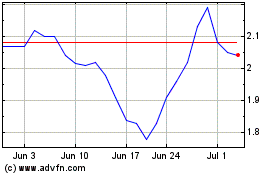

2, 2014, the trading price of our common stock is likely to be volatile and