Current Report Filing (8-k)

March 16 2015 - 1:11PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of Report: March 11, 2015

(Date of earliest event reported)

STEVEN

MADDEN, LTD.

(Exact Name of Registrant as Specified in Charter)

| |

|

|

|

|

| Delaware |

|

000-23702 |

|

13-3588231 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 52-16

Barnett Avenue, Long Island City, New York 11104 |

| (Address

of Principal Executive Offices) (Zip Code) |

| |

Registrant’s

telephone number, including area code: (718) 446-1800

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

|

| o |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| o |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| o |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| o |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. |

Departure of

Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers. |

(e) On March 11, 2015, Steven Madden, Ltd. (the "Company") entered into an employment agreement with Robert Schmertz, the Company's Brand Director (the "Schmertz Employment Agreement"). The Schmertz Employment Agreement, the full text of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference, replaces an employment agreement with Mr. Schmertz that expired by its terms on December 31, 2014. Pursuant to the Schmertz Employment Agreement, Mr. Schmertz will continue to serve as Brand Director of the Company for a term commencing on March 9, 2015 and expiring on December 31, 2016, unless sooner terminated in accordance with the Schmertz Employment Agreement. Mr. Schmertz will receive an annual salary of $761,250 and a monthly car allowance of $1,500 during the term of the Schmertz Employment Agreement. In addition, pursuant to the Schmertz Employment Agreement, within two weeks of the execution of the Schmertz Employment Agreement, Mr. Schmertz will receive an award of 20,000 shares of the Company's common stock, $0.0001 per share, subject to certain restrictions (the "Restricted Common Stock"), issued under the Steven Madden, Ltd, 2006 Stock Incentive Plan, as amended. The Restricted Common Stock will vest in three substantially equal annual installments commencing on the third anniversary of the grant date. Additional compensation and bonuses, if any, are at the absolute discretion of the Company's Board of Directors.

The Company may terminate the Schmertz Employment Agreement with or without Cause (as such terms are defined therein). In the event that the Company terminates the Schmertz Employment Agreement for Cause, Mr. Schmertz would be entitled to receive only his accrued and unpaid base salary through the date of termination. In the event that Mr. Schmertz's employment is terminated by the Company without Cause, Mr. Schmertz would be entitled to receive payment of his annual salary, payable at regular payroll intervals, from the date of termination through the remainder of the term. In addition, if Mr. Schmertz's employment is terminated by the Company without Cause during the period commencing 30 days prior to a Change of Control (as such term is defined in the Schmertz Employment Agreement) and ending 180 days after a Change of Control, he would be entitled to receive an amount equal to the lesser of (i) three times the average amount of total compensation actually received by him during the preceding three calendar years and (ii) the maximum amount that is tax deductible to the Company under Section 280G of the Internal Revenue Code, such amount to be in lieu of, and not in addition to, any other payments to which he would be entitled in the event of the termination of his employment.

The foregoing description of the Schmertz Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Employment Agreement filed as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

| |

|

| Item 9.01. |

Financial Statements

and Exhibits. |

| Exhibit |

Description |

| |

|

| 10.1 |

Employment Agreement, dated March 11, 2015, between the Company and Robert Schmertz |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated:

March 16, 2015

| |

|

|

| |

STEVEN

MADDEN, LTD. |

| |

|

| |

By: |

/s/

Edward R. Rosenfeld |

| |

|

Edward R.

Rosenfeld |

| |

|

Chief Executive

Officer |

Exhibit 10.1

March 11, 2015

Dear Mr. Schmertz:

This letter

(the “Agreement”) will set forth below the terms and conditions of your employment with Steven Madden, Ltd. (the “Company”):

| 1. | Term

of Agreement. March 9, 2015 through December 31, 2016 unless sooner terminated in

accordance with Paragraph 7 of this Agreement (the “Term”). |

| 2. | Position.

Brand Director. You shall report to the Chief Executive Officer or such other person

as the Chief Executive Officer shall direct. You shall expend all of your working time

to the Company and shall devote your best efforts, energy and skills to the Company and

the promotion of its interests; you shall not take part in any activities detrimental

to the best interest of the Company. |

| 3. | Salary.

$761,250 per annum (paid in accordance with normal Company practice) from March 9, 2015

through December 31, 2016. |

| 4. | Discretionary

Bonuses. The Company may pay you a bonus in such amount, if any, and at such time

or times, as the Board of Directors may determine in its absolute discretion subject

to the Company’s ordinary payroll practice. |

| 5. | Car

Allowance. You shall receive a car allowance of $1,500 per month. |

| 6. | Restricted

Stock. Within two weeks of signing of this Agreement, you shall be granted 20,000

shares of restricted stock. The shares shall vest 33⅓ % on the third anniversary

of the grant date; 33⅓ % on the fourth anniversary of the grant date; and 33⅓

% on the fifth anniversary of the grant date. |

| (a) | Involuntary

Termination. The Company has the right to terminate your employment, on written notice

to you, at any time without Cause (as defined below). In the event the Company terminates

your employment without Cause, then the Term shall terminate immediately, and you shall

be entitled to receive only Salary payments described in Paragraph 3, at the regular

intervals of payment, from the date of termination through the date this Agreement would

have otherwise terminated but for the involuntary termination. |

| (b) | Voluntary

Termination by you or Termination for Cause. You shall have the right to terminate

your employment at any time for any reason (“Voluntary Termination”) and

the Company shall have the right to terminate your employment at any time for Cause,

on written notice to you, setting forth in reasonable detail the facts and circumstances

resulting in the Cause upon which such termination is based. In the event of a Voluntary

Termination or a termination by the Company for Cause, the Term shall terminate immediately

and you shall be entitled only to any accrued and unpaid Salary described in Paragraph

3 through the date of termination. For the purpose of this Agreement, Cause shall mean: |

| (i) | a

material breach by you of your material duties or obligations to the Company which is

not remedied to the reasonable satisfaction of the Company within ten (10) days after

the receipt by you of written notice of such breach from the Company; |

| (ii) | you

are convicted of, or enter a guilty or “no contest” plea with respect to

a felony or a crime of mural turpitude (whether or not a felony); |

| (iii) | you

have an alcohol or substance abuse problem, which in the reasonable opinion of the Company

materially interferes with your ability to perform your duties; |

| (iv) | any

act or acts of personal dishonesty, fraud, embezzlement, misappropriation or conversion

intended to result in your personal enrichment at the expense of the Company, or any

of its subsidiaries or affiliates, or any other material breach or violation of fiduciary

duty owed to the Company, or any of its subsidiaries or affiliates; |

| (v) | any

grossly negligent act or omission or any willful and deliberate misconduct by you that

results, or is likely to result, in material economic, or other harm, to the Company,

or any of its subsidiaries or affiliates; or |

| (vi) | you

violate or pay fines, suffer sanctions or injunctive relief relating to (whether or not

you are found to have violated) any federal or state securities laws, rules or regulations

or the rules and regulations of any stock exchange on which the Company is listed or

included. |

| (c) | Disability.

You shall be considered to be “Disabled” if, in the Company’s reasonable

opinion after receiving the written report of an independent physician selected by the

Company, you are incapable, due to mental or physical disability, of performing the essential

functions of your duties for a period of sixty (60) days (whether or not consecutive)

during any period of one hundred twenty (120) days. In the event you shall become Disabled

during the Term, the Company may terminate your employment and the Term and the Company

shall have no further obligation or liabilities to you, except (i) payment of accrued

and unpaid Salary described in Paragraph 3 through the date of termination plus (ii)

Salary payments described in Paragraph 3, at the regular intervals of payment for the

twelve (12) month period immediately subsequent to the date of your termination. |

| (d) | Death.

In the event of your death, your employment and the Term shall terminate immediately

and the Company shall have no further obligation or liabilities to you or your estate

except that your estate shall be entitled to receive (i) payment of accrued and unpaid

Salary described in Paragraph 3 through the date of termination plus (ii) Salary payments

described in Paragraph 3, at the regular intervals of payment for the twelve (12) month

period immediately subsequent to the date of your death. |

| (e) | Change

of Control. The term “Change of Control”, as used herein, shall mean

when any person or group (excluding the Company or any of its affiliates) becomes the

beneficial owner of securities representing 50% or more of the combined voting power

of the Company’s then outstanding securities. If, during the period commencing

30 days prior to a Change of Control and ending 180 days after a Change of Control, you

are terminated by the Company other than for Cause, you are entitled to receive an amount

equal to the lesser of (i) the average amount of total compensation actually received

by you for the preceding three calendar years multiplied by 3 or (ii) the maximum amount

which is tax deductible to the Company under Internal Revenue Code Section 280G. The

foregoing shall be in lieu of, and not in addition to, any other payments or compensation

you would otherwise be entitled to hereunder as a result of your termination. |

| (f) | Termination

Payment. Provided the Company makes the payments required under this Agreement that

are attributable to the termination of your employment, such payments shall be in full

and complete satisfaction and release of any and all claims you or your beneficiaries,

estate or legal representatives may have against the Company and/or its subsidiaries

or affiliates hereunder. Notwithstanding anything contained in this Agreement, the Company

shall have no obligation to make any payment to you under this Agreement unless and until

you execute and deliver to the Company a general release from any and all liability and

all applicable periods of time have expired such that the Company shall irrevocably be

entitled to enjoy the benefits of the aforementioned release. |

| 8. | Non-Solicitation/Non-Competition

Agreement. You recognize that the services to be performed by you hereunder are special

and unique you acknowledge that the restrictions set forth in this Paragraph 8 and in

Paragraphs 9, 10 and 11 of this Agreement are fair and reasonable. In consideration of

the compensation granted herein, you agree that, through December 31, 2017, you shall

not, directly or indirectly, anywhere in the United States, whether individually or as

a principal officer, employee, partner, member, director or agent of, or consultant for,

any person or entity: (i) become employed by, an owner of, or otherwise affiliated with,

or furnish services to, any business that competes with the Company, (ii) solicit any

business from any customers of the Company, or (iii) hire, offer to hire, entice away,

or in any manner persuade or attempt to persuade any employee of the Company to discontinue

his/her employment with the Company or any other party that has a business relationship

with the Company to discontinue his/her/its business relationship with the Company. |

| 9. | Discoveries.

You agree to disclose promptly in writing to the Board of Directors of the Company all

ideas, processes, methods, devices, business concepts, inventions, improvements, discoveries,

know-how and other creative achievements (hereinafter referred to collectively as “Discoveries”)

to the extent such Discoveries have been reduced to practice, in whole or in part, whether

or not the same or any part thereof is capable of being patented, trademarked, copyrighted,

or otherwise protected, which you, while employed by the Company, conceive, make, develop,

acquire or reduce to practice, whether acting alone or with others and whether during

or after usual working hours, and which are related to the Company’s business or

interests, or are used or usable by the Company, or arise out of or in connection with

the duties performed by you. You hereby transfer and assign to the Company all right,

title and interest in and such Discoveries that are conceived, made, developed, acquired

or reduced to practice during your employment with the Company, including any and all

domestic and foreign copyrights and patent and trademark rights therein and any renewals

thereof. On request of the Company, You will, without any additional compensation, from

time to time during, and after the expiration or termination of, the Term, execute such

further instruments (including applications for copyrights, patents, trademarks and assignments

thereof) and do all such other acts and things as may be deemed necessary or desirable

by the Company to protect and/or enforce its rights in respect of such Discoveries. All

reasonable expenses incurred by you in complying with the Company’s request and

all expenses of filing or prosecuting any patent, trademark or copyright application

shall be borne by the Company, but you shall cooperate in filing and/or prosecuting any

such application. |

| 10. | Covenant

Not to Disclose. You covenant and agree that you will not at any time during or after

the Term, reveal, divulge or make known to any person (other than (i) to the Company,

or (ii) in the regular course of business of the Company) or use for your own account

any confidential or proprietary records, data, processes, ideas, methods, devices, business

concepts, inventions, discoveries, know-how, trade secrets or any other confidential

or proprietary information whatsoever (the “Confidential Information”) previously

possessed or used by the Company or any of its subsidiaries or affiliates, (whether or

not developed, devised or otherwise created in whole or in part by your efforts) and

made known to you by reason of your employment by or affiliation with the Company. You

further covenant and agree that you shall retain all such knowledge and information which

you shall acquire or develop respecting such Confidential Information in trust for the

sole benefit of the Company and its successors and assigns. Additionally, you agree that

all right, title and interest in and to any discoveries, processes, ideas, methods and/or

business concepts that you develop during the Term relating to the business of the Company

are, and shall remain the property of the Company, and you hereby assign to the Company

any right, title and interest you might otherwise claim therein. |

| 11. | Business

Materials, Covenant to Report. All written materials, records and documents made

by you or coming into your possession concerning the business or affairs of the Company

shall be the sole property of the Company and, upon the termination or expiration of

your employment with the Company or upon the request of the Company at any time, you

shall promptly deliver the same to the Company and shall retain no copies thereof. You

agree to render to the Company such reports of your activities or activities of others

under your direction during the Term as the Company may request. |

| 12. | Governing

Law; Injunctive Relief. |

| 12.1 | The validity, interpretation,

and performance of this Agreement shall be controlled by and construed under the laws of the State of New York, excluding choice

of law rules thereof. |

| 12.2 | You

acknowledge and agree that, in the event you shall violate any of the restrictions of

Paragraphs 8, 9, 10 or 11 hereof, the Company will be without an adequate remedy at law

and will therefore be entitled to enforce such restrictions by temporary or permanent

injunctive or mandatory relief in any court of competent jurisdiction without the necessity

of proving damages or posting a bond or other security, and without prejudice to any

other remedies which it may have at law or in equity. Each of you and the Company acknowledges

and agrees that, in addition to any other state having proper jurisdiction, any such

relief may be sought in, and for such purpose each of you and the Company consents to

the jurisdiction of, the courts of the State of New York. |

| 13. | Assignment.

This Agreement, as it relates to your employment, is a personal contract and your rights

and interests hereunder may not be sold, transferred, assigned, pledged or hypothecated. |

| 14. | Notices.

Any and all notices or other communications or deliveries required or permitted to be

given or made pursuant to any of the provisions of this Agreement shall be deemed to

have been duly given or made for all purposes when hand delivered or sent by certified

or registered mail, return receipt requested and postage prepaid, overnight mail or courier,

or facsimile, addressed, if to the Company, at the Company’s offices, Attn: President,

and if to you, at the address of your personal residence as maintained in the Company’s

records, or at such other address as any party shall designate by notice to the other

party given in accordance with this Paragraph 14. |

| 15. | Entire

Agreement. This Agreement represents the entire understanding and agreement between

the parties hereto with respect to the subject matter hereof, supersedes all prior agreements

between such parties with respect to the subject matter hereof, and cannot be amended,

supplemented or modified orally, but only by an agreement in writing signed by the party

against whom enforcement of any such amendment, supplement or modification is sought. |

| 16. | Execution

in Counterparts; Signatures; Severability. This Agreement may be executed in counterparts,

each of which shall be deemed to be an original, but all of which together shall constitute

one and the same instrument. Facsimile or electronic mail signatures hereon shall constitute

original signatures. If any provisions of this Agreement as applied to any part or to

any circumstance shall be adjudged by a court to be invalid or unenforceable, the same

shall in no way affect any other provision of this Agreement, the application of such

provision in any other circumstances or the validity or enforceability of this Agreement. |

| 17. | Representation

by Counsel; Interpretation. Each party acknowledges that it has been represented

by counsel or has had the opportunity to be represented by counsel in connection with

this Agreement and the transactions contemplated by this Agreement. Accordingly, any

rule or law or any legal decision that would require interpretation of any claimed ambiguities

in this Agreement against the party that drafted it has no application and is expressly

waived by such parties. The provisions of this Agreement shall be interpreted in a reasonable

manner to effect the intent of the parties hereto. |

| |

STEVEN MADDEN, LTD. |

|

| |

|

|

| Signature: |

By: |

/s/ Edward R. Rosenfeld |

|

| |

|

Edward R. Rosenfeld, CEO |

|

| |

|

|

| Counter-signature: |

/s/ Robert Schmertz |

|

| |

Robert Schmertz |

|

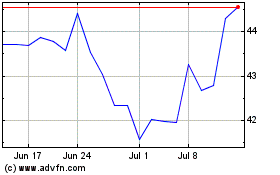

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Mar 2024 to Apr 2024

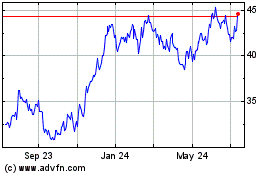

Steven Madden (NASDAQ:SHOO)

Historical Stock Chart

From Apr 2023 to Apr 2024