UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 10, 2015

|

WISDOM HOMES OF AMERICA, INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

000-51225

|

|

43-2041643

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

500 North Northeast Loop 323

Tyler, TX 75708

(Address of principal executive offices) (zip code)

(800) 727-1024

(Registrant’s telephone number, including area code)

SEARCHCORE, INC.

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 1 – Registrant’s Business and Operations

Item 1.01. Entry into a Material Definitive Agreement.

On December 31, 2012, the Company entered into a Securities Purchase Agreement by and among it, on the one hand, and Sportify, Inc., a Nevada corporation, and its shareholders, Sabas Carrillo (“Carrillo”), an individual, and James Pakulis (“Pakulis”), an individual and one of the Company’s officers and directors, on the other hand. Pursuant to this agreement, upon the closing of the transaction, the Company purchased 100% of the issued and outstanding equity interests of Sportify in exchange for (a) the cancellation of a previous Secured Promissory Note issued to Sportify, entered into on or about August 22, 2012, and with an outstanding principal balance of Two Hundred Eighty Five Thousand Dollars ($285,000) and (b) Two Hundred Fifteen Thousand Dollars ($215,000) represented by promissory notes in the original principal amount of One Hundred Sixty One Thousand Two Hundred Fifty Dollars ($161,250) to Pakulis and Fifty Six Thousand Seven Hundred Fifty Dollars ($53,750) to Carrillo. The closing took place on December 31, 2012.

On July 11, 2013, the Company entered into a First Amendment to Promissory Note with each of Pakulis and Carrillo to extend the date that it would begin making payments thereunder from June 30, 2013, to September 30, 2013, and extended the maturity date of the notes by a corresponding six months.

On November 8, 2013, effective as of September 30, 2013, the Company entered into a Second Amendment to Promissory Note with each of Pakulis and Carrillo to extend the date that it will begin making payments thereunder from September 30, 2013, to December 31, 2013, and extended the maturity date of the notes by a corresponding six months.

On March 19, 2014, effective as of December 31, 2013, the Company entered into a Third Amendment to Promissory Note with Pakulis to extend the date that it will begin making payments thereunder from December 31, 2013, to January 1, 2015, and extended the maturity date of the note by a corresponding twelve months.

On March 10, 2015, effective as of December 31, 2014, the Company entered into a Fourth Amendment to Promissory Note with Pakulis to extend the date that it will begin making payments thereunder from January 1, 2015, to January 1, 2017, and extended the maturity date of the note to December 15, 2018.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

10.1(1)

|

Carrillo Promissory Note dated December 31, 2012.

|

| |

|

|

10.2(1)

|

Pakulis Promissory Note dated December 31, 2012.

|

| |

|

|

10.3(2)

|

First Amendment to Promissory Note with Sabas Carrillo dated July 11, 2013.

|

| |

|

|

10.4(2)

|

First Amendment to Promissory Note with James Pakulis dated July 11, 2013.

|

| |

|

|

10.5(3)

|

Second Amendment to Promissory Note with Sabas Carrillo dated November 8, 2013.

|

| |

|

|

10.6(3)

|

Second Amendment to Promissory Note with James Pakulis dated November 8, 2013.

|

| |

|

|

10.7(4)

|

Third Amendment to Promissory Note with James Pakulis dated March 19, 2014, and effective December 31, 2013.

|

| |

|

|

10.8

|

Fourth Amendment to Promissory Note with James Pakulis dated March 10, 2015, and effective December 31, 2014.

|

_________

(1) Incorporated by reference from our Registration Statement on Form 10 dated January 29, 2013, and filed with the Commission on January 30, 2013.

(2) Incorporated by reference from our Current Report on Form 8-K dated July 11, 2013, and filed with the Commission on July 15, 2013.

(3) Incorporated by reference from our Quarterly Report on Form 10-Q dated September 30, 2013, and filed with the Commission on November 13, 2013.

(4) Incorporated by reference from our Current Report on Form 8-K dated March 24, 2014, and filed with the Commission on April 2, 2014.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Wisdom Homes of America, Inc.

|

|

| |

|

|

|

|

Dated: March 11, 2015

|

|

/s/ James Pakulis

|

|

| |

By:

|

James Pakulis

|

|

| |

Its:

|

President and Chief Executive Officer

|

|

4

EXHIBIT 10.8

FOURTH AMENDMENT TO

PROMISSORY NOTE

This Fourth Amendment to Promissory Note (this “Amendment”) is entered into on March 10, 2015 and is effective as of December 31, 2014, by and between Wisdom Homes of America, Inc., f/k/a SearchCore, Inc., a Nevada corporation (the “Company”) and James Pakulis, an individual (the “Holder”).

RECITALS

WHEREAS, Company and Holder are parties to that certain Promissory Note dated December 31, 2012, in the original principal amount of One Hundred Sixty One Thousand Two Hundred Fifty Dollars ($161,250) (the “Original Note”); and

WHEREAS, Company and Holder desire to amend and restate Section 2 of the Original Note and amend the Maturity Date, effective as of December 31, 2014, as set forth herein.

NOW, THEREFORE, for good and adequate consideration, the receipt and sufficiency of which is hereby acknowledged, the Company and Holder agree as follows:

AGREEMENT

1. Section 2 of the Original Note is restated in its entirety as follows:

“2. PAYMENT OF THE NOTE. The Principal Amount of this Note shall be paid by the Company as follows:

(a) The Company shall pay the Holder Thirty Seven Thousand Five Hundred Dollars ($37,500) on January 1, 2017; and

(b) The Company shall make twenty three (23) equal monthly installments of principal and interest of Five Thousand Seven Hundred Twenty One Dollars and Eight Cents ($5,721.08) beginning February 15, 2017, and continuing on the 15th of each month thereafter.

If any payment of principal or interest under this Note shall not be made within ten (10) business days when due, a late charge of ten percent (10%) of the outstanding payment amount may be charged by Holder for the purpose of defraying the expenses incident to handling such delinquent payments. Such late charge represents a reasonable sum considering all of the circumstances existing on the date of this Note and represents a fair and reasonable estimate of the costs that will be sustained by Holder due to the failure of Company to make timely payments.”

2. The “Maturity Date” of the Original Note shall, pursuant to this Amendment, be December 15, 2018.

3. Other than as set forth herein, the terms and conditions of the Original Note shall remain in full force and effect.

[remainder of page intentionally left blank; signature page to follow]

In witness whereof, Company and Holder have executed this Agreement on the date first written above.

|

“Holder”

|

|

“Company”

|

|

|

|

|

|

|

|

|

|

|

Wisdom Homes of America, Inc.

|

|

|

|

|

a Nevada corporation

|

|

|

|

|

|

|

|

|

|

/s/ James Pakulis

|

|

|

/s/ James Pakulis

|

|

|

By:

|

James Pakulis, an individual

|

|

By:

|

James Pakulis

|

|

|

|

|

Its:

|

President and Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Munjit Johal

|

|

|

|

|

By:

|

Munjit Johal

|

|

|

|

|

Its:

|

Chief Financial Officer

|

|

2

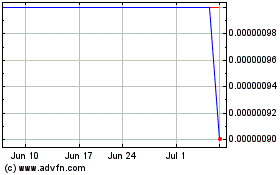

Wisdom Homes of America (CE) (USOTC:WOFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

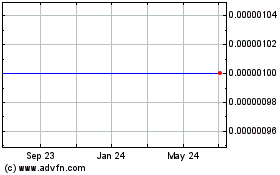

Wisdom Homes of America (CE) (USOTC:WOFA)

Historical Stock Chart

From Apr 2023 to Apr 2024