UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under

the Securities Exchange Act of 1934

(Amendment No. 6)

HPEV, Inc.

(Name of Issuer)

Common Stock, $0.001 par

value per share

(Title of Class of Securities)

404273 10 4

(CUSIP Number)

Jay A. Palmer

Spirit Bear Limited

1470 1st Avenue -

No. 4A

New York, NY 10075

Tel.: 212-717-5424

(Name, Address and Telephone Number

of Person

Authorized to Receive Notices and Communications)

January 28, 2015

(Date of Event Which Requires Filing

of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. o

Note: Schedules filed in paper format

shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties

to whom copies are to be sent.

* The remainder of this cover page

shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder

of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of

1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

| |

|

|

|

|

CUSIP No. 404273104

|

|

13D |

|

Page 2 of 5 Pages

|

| |

|

|

|

|

| |

|

|

|

|

| 1. |

|

NAMES OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Spirit Bear Limited

EIN 27-1347181

|

|

|

| 2. |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ¨

(b) ¨ |

|

|

| 3. |

|

SEC USE ONLY

|

|

|

| 4. |

|

SOURCE OF FUNDS (see instructions)

OO

|

|

|

| 5. |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ¨ |

|

|

| 6. |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

|

| |

|

|

|

|

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE VOTING POWER

14,491,054

|

| |

8. |

|

SHARED VOTING POWER

|

| |

9. |

|

SOLE DISPOSITIVE POWER

14,491,054

|

| |

10. |

|

SHARED DISPOSITIVE POWER

|

| |

|

|

|

|

| 11. |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

14,491,054

|

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) ¨ |

|

|

| 13. |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

23.21%

|

|

|

| 14. |

|

TYPE OF REPORTING PERSON*

CO

|

|

|

Item 1. Security and Issuer

This Amendment No. 6 (this “Schedule

13D/A”) amends and supplements the statement on Schedule 13D originally filed with the Securities and Exchange Commission

(the “SEC”) on December 21, 2012, as amended by Amendment No. 1 to Schedule 13D filed with the SEC on February 8, 2013,

Amendment No. 2 to Schedule 13D filed with the SEC on April 24, 2013, Amendment No. 3 to Schedule 13D filed with the SEC on August

22, 2013, Amendment No. 4 to Schedule 13D filed with the SEC on August 23, 2014, and Amendment No. 5 to Schedule 13D filed with

the SEC on February 9, 2015 (collectively, the “Schedule 13D”), with respect to the common stock, par value $0.001

per share (the “Common Stock”), of HPEV, Inc. (the “Issuer”). Except as otherwise provided herein, all

Items of the Schedule 13D remain unchanged.

Item

4. Purpose of Transaction

Item 4 is hereby amended to add the following:

This Schedule 13D/A is being filed solely for the purpose of

filing as Exhibit 99.1 the January 28, 2015, Settlement and Release Agreement that was reported on Amendment No. 5.

Item 7. Material to Be Filed as Exhibits

Exhibit 99.1 Settlement and Release Agreement, dated January

28, 2015, between HPEV, Inc., and Spirit Bear Limited, and its Assignees.

SIGNATURE

After reasonable inquiry,

and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: March 12, 2015

SPIRIT BEAR LIMITED

By: /s/ Jay A. Palmer

Jay

A. Palmer, President

Exhibit 99.1

This document is confidential and pursuant

to settlement negotiations of disputed claims and is governed by NRS 42.105 and FRE 408

SETTLEMENT AND RELEASE AGREEMENT

This Settlement and

Release Agreement (this “Agreement”) shall be effective as of January 28, 2015 (the “Effective Date”)

by and between SPIRIT BEAR LIMITED (“Spirit Bear”) and its Assignees, as such term is defined hereinafter in the final

recital, and HPEV, INC. (“HPEV”); each of Spirit Bear and HPEV, individually a “Party” or

collectively, the “Parties”.

WHEREAS,

Spirit Bear and HPEV are parties to that certain Securities Purchase Agreement, dated as of December 14, 2012 (the “Purchase

Agreement”), pursuant to which, among other things, Spirit Bear was issued preferred stock and warrants;

WHEREAS, the

Parties are involved in the following lawsuits (collectively, the “Lawsuits”): (i) HPEV, Inc. v. Spirit Bear

Limited, Palmer and Olins 14-cv-9175 (PGG) (S.D.N.Y.); (ii) HPEV, Inc. v. Spirit Bear Limited 13-cv-01548 (JAD) (GWF) (D. Nev.),

(iii) Hassett v. Palmer, et al., Index No. 14-004473 (NY Sup. Ct. Nassau Cnty.); (iv) Manhattan Transfer Registrar Company v. HPEV,

Inc. and Michael Kahn 14-cv-6418 (ADS) (SIL) (E.D.N.Y.) (the “Interpleader Action”), and (v) Palmer, et al. v. HPEV,

Inc. (Clark Cnty. Distr. Ct., NV, Case No. A-14-703641-B, Dept. XXV);

WHEREAS, the

HPEV, Inc. v. Spirit Bear Limited 13-cv-01548 (JAD) (GWF) (D. Nev.) lawsuit includes various shareholder derivative claims which

Spirit Bear has filed on behalf of HPEV and its shareholders (the “Shareholder Derivative Claims);

WHEREAS,

the Parties wish to enter into this Agreement to resolve with finality all issues related to and arising directly and indirectly

from said Purchase Agreement as well as any and all disputes, claims and allegations of whatever nature among the Parties and their

respective affiliates, specifically including but not limited to the Lawsuits and the Shareholder Derivative Claims (all together,

the “Dispute”);

WHEREAS,

the Parties have negotiated a settlement agreement applicable to the Shareholder Derivative Claims attached hereto as Exhibit

A which requires court approval;

WHEREAS,

without any admission of liability or fault, the Parties each desire to memorialize their agreement to settle the Dispute in its

entirety and fully and finally release and settle all claims and/or counterclaims which were or could have been asserted in the

Lawsuits (providing separately for the Shareholder Derivative Claims as addressed in Exhibit A hereto) as well as any other existing

or potential claims among them, and to dismiss the Lawsuits with prejudice (providing separately for the Shareholder Derivative

Claims as addressed in Exhibit A hereto), in order to avoid the continued expense, uncertainties and distraction of litigation,

and therefore, through their authorized representatives have agreed to settle all matters that were or could have been asserted,

all as set forth herein below; and

WHEREAS,

for purposes of this Agreement, the Assignees of Spirit Bear include all holders of any interest in shares (common or preferred),

warrants, or any other interest in HPEV obtained from or through Spirit Bear, specifically including Michael Kahn (“Kahn”),

Robert Knoll (“Knoll”), Laurel Brown (“Brown”), Jay Palmer, Ray Adams (“Adams”), and Leonora

Lorenzo (“Lorenzo”), and the entities owned or controlled in whole or in part by each or any of them; but specifically

excluding Bruce W. Jaeger and any entities owned or controlled in whole or in part by him, as well as any and all parties that

acquired shares that Spirit Bear, Adams, Kahn, and Lorenzo sold in the public market for such shares.

NOW,

THEREFORE, in consideration of the promises and the mutual covenants and agreements hereinafter set forth and for other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereto agree as follows:

| 1.1-1 | Spirit Bear, Kahn, Knoll, Brown and Lorenzo hereby agree to irrevocably sell to HPEV, or any assignee

or designee of HPEV, all the shares of common and preferred stock (collectively, the “Shares”) each directly

or indirectly owns, or has assigned, if any, in HPEV (as enumerated below) for a purchase price of Fifty One and One-Half cents

($0.5150) per share, multiplied by Eight Million Twenty Eight Thousand Three Hundred Eighty-Five (8,028,385) shares, being equal

in the aggregate to Four Million One Hundred Thirty-Four Thousand Six Hundred Eighteen Dollars ($4,134,618.00) (the “Purchase

Funds”). The Purchase Funds shall be deposited by HPEV (or its designee) to a trust account administered by HPEV’s

counsel; and Eight Million Twenty Eight Thousand Three Hundred Eighty-Five (8,028,385) Shares shall be delivered by Spirit Bear

(and its assignees) to Spirit Bear’s counsel. Upon confirmation by respective counsels for HPEV and Spirit Bear that the

Purchase Funds and Shares all have been received in full, each and both shall deposit the Purchase Funds and the Shares, respectively,

into escrow with a common escrow agent agreeable to the Parties (the date of the deposit into escrow of the Purchase Funds and

of the Shares being referred to hereinafter as the “Escrow Funding Date”, which date shall be not later than fifty

(50) days following the Effective Date, subject to Section 1.5), which escrow agent shall be and hereby is instructed to deliver

to Spirit Bear, in care of its counsel Bailey Kennedy to such account as Bailey Kennedy shall designate, Seventy Percent (70.00%)

of the Purchase Funds, being equal to Two Million Eight Hundred Ninety-Four Thousand Two Hundred Thirty-Three Dollars ($2,894,233.00)

(the “Initial Purchase Funds”), and to deliver Seventy Percent (70%) of the Shares, being equal to Five Million Six

Hundred Nineteen Thousand Eight Hundred Seventy (5,619,870) shares to HPEV, subject to Paragraph 2.5 herein, upon both of the following

conditions: |

| (a) | The clearing of the Purchase Funds into the escrow agent’s account; and |

| | | |

| | (b) | Receipt of the Shares by

the escrow agent, signature medallion guaranteed and duly endorsed in blank or accompanied by stock powers duly executed in blank

or other instruments of transfer in form and substance reasonably satisfactory to the transfer agent of HPEV. |

| 1.1-2 | The date upon which the escrow agent confirms that both of the foregoing conditions are satisfied

such that the instruction to the escrow agent to deliver the Initial Purchase Funds and Initial Shares is effective immediately,

and upon which same date it shall initiate the delivery of the Initial Purchase Funds and the Initial Shares, shall be the “Initial

Payment Date”. |

| 1.1-3 | The amount of Thirty Percent (30.00%) of the Purchase Funds, being equal to One Million Two Hundred

Forty Thousand Three Hundred Eighty-Five Dollars ($1,240,385.00) (the “Completion Purchase Funds”), shall be retained

in escrow pending dismissal of the Shareholder Derivative Claims; the amount of Thirty Percent (30.00%) of the Shares, being equal

to Two Million Four Hundred Eight Thousand Five Hundred Fifteen (2,408,515) shares (the “Completion Shares”), shall

be retained in escrow pending dismissal of the Shareholder Derivative Claims; and the Parties shall seek to obtain dismissal of

the Shareholder Derivative Claims, as provided for in Paragraph 2.5 hereof. |

| 1.1-4 | If HPEV does not remit the Purchase Funds in full to the escrow agent by the Escrow Funding Date,

this Agreement shall terminate, subject to the provisions of only Paragraph 1.5 herein, and Spirit

Bear, Kahn, Knoll, Brown, and Lorenzo shall thereafter retain ownership of the Shares, and Spirit Bear and Lorenzo shall thereafter

retain ownership of their respective warrants. |

| 1.1-5 | Spirit Bear, Kahn, Knoll, Brown, and Lorenzo represent that each has no ownership or other interest

in any equity of HPEV, directly or indirectly, other than as enumerated in Section 1.0 of this Agreement. The summary in Table

1.1-5 and Table 1.2-1 of this Agreement is an accurate tabulation by each (of Spirit Bear, Kahn, Knoll, Brown, and Lorenzo) of

its total interest in HPEV, with which summary HPEV agrees for purposes of this Agreement. The Parties hereby stipulate that such

tabulation shall supersede any other summary known or unknown, in existence as of the Effective Date. From and after the Closing

Date, Spirit Bear and its Assignees agree that they shall have no right, economic, voting or otherwise, with respect to the Shares

except as provided for in this Agreement. |

| Common Shares |

|

|

| Spirit Bear - Preferred yet to be converted |

7,000,000 |

|

| Spirit Bear - Common Shares |

500,000 |

|

| Michael Kahn Common Shares |

216,018 |

|

| Leonora Lorenzo Common Shares |

190,871 |

|

| Robert Knoll - shares remaining after warrant execution |

81,055 |

|

| Laurel Brown - shares remaining after warrant execution |

40,441 |

|

| Total: |

8,028,385 |

|

| 1.1-6 | Upon the entry of an order of dismissal as to the Shareholder Derivative Claims, the escrow agent

shall and hereby is instructed to deliver the Completion Purchase Funds to Spirit Bear, and to deliver the Completion Shares to

HPEV. The date upon which the Completion Purchase Funds clear into Spirit Bear’s account shall be the “Closing Date”.

In the event that an order of dismissal as to the Shareholder Derivative Claims is not entered within ninety (90) days following

the Effective Date (the “Derivative Claim Pending Period”), then, absent agreement by the Parties to further extend

the Derivative Claim Pending Period, each Party shall at that time and thereafter have the right, on ten (10) days’ advance

written notice to the other, to declare the Closing Date void (the effective date of which shall be the “Closing Void Date”),

in which case the escrow agent shall and hereby is instructed to deliver the Completion Purchase Funds to HPEV and to deliver the

Completion Shares to Spirit Bear, all other terms of this Agreement remaining in full force and effect. In such event, any dates,

deadlines, or conditions defined in this Agreement in reference to the Closing Date shall instead be defined by the Closing Void

Date. |

| 1.1-7 | Spirit Bear represents that neither it nor its Assignees have made an assignment of any interest

in any of the Shares or in any warrants to Carrie Dwyer, Donica Holt, or Robert Olins, and acknowledges that HPEV is relying upon

such representation in entering into this Agreement. |

| 1.2-1 | Spirit Bear and Lorenzo will, within three (3) business days following the Effective Date, deliver

their respective warrants to Spirit Bear’s counsel, and HPEV will, within three (3) business days following the Effective

Date, deliver new warrants (identical to the existing warrants except as to the issue date and expiration date; and, with respect

to the Series C warrants only, also except as to the strike price), as set forth hereinafter in Table 1.2-1, to HPEV’s counsel

(it being agreed that Spirit Bear does not have a signed original warrant agreement reflecting the 500,000 RRA Penalty Warrants).

The Parties’ respective counsels shall then, by the fourth (4th) business day following the Effective Date, exchange

warrant documents for delivery to HPEV and to Spirit Bear and Lorenzo, respectively. The warrant positions of Spirit Bear and Lorenzo

as of the Effective Date shall be as follows, without regard to the existence or possession of earlier-issued warrants (all of

which shall be deemed void as of the date new warrants are delivered pursuant to this Section): |

| Warrants |

Quantity |

Strike Price |

Expiration Date |

| Series A – Spirit Bear |

1,800,000 |

$0.35 |

1/29/2017 |

| Series B – Spirit Bear |

1,800,000 |

$0.50 |

1/29/2017 |

| Series C – Spirit Bear |

1,800,000 |

$0.50 |

1/29/2017 |

| Series A – Lorenzo |

200,000 |

$0.35 |

1/29/2017 |

| Series B – Lorenzo |

200,000 |

$0.50 |

1/29/2017 |

| Series C – Lorenzo |

200,000 |

$0.50 |

1/29/2017 |

| Penalty Warrants |

1,091,054 |

$0.35 |

12/14/2015 |

| RRA Penalty Warrants |

500,000 |

$0.35 |

1/29/2017 |

| 1.2-2 | In the event that either Party shall not deliver its (or both Parties shall not deliver their)

warrants to counsel within three (3) business days following the Effective Date, this Agreement shall terminate, and Spirit Bear

(as well as Kahn, Knoll, Brown, and Lorenzo) shall thereafter retain ownership of the Shares, and Spirit Bear and Lorenzo shall

thereafter retain ownership of their respective warrants. |

| 1.2-3 | With respect to the 1,091,054 Penalty Warrants owned by Spirit Bear, HPEV agrees that said warrants

shall expire on December 14, 2015; with respect to the 500,000 RRA Penalty Warrants owned by Spirit Bear, HPEV agrees that said

warrants shall expire on January 29, 2017. |

| 1.2-4 | Subject to Section 1.3 herein and the quantities, strike prices, and expriation dates specified

above in this Section 1.2, Spirit Bear shall be entitled to exercise at its discretion the 1,091,054 Penalty Warrants and/or the

500,000 RRA Penalty Warrants in accordance with the terms of said warrants, and to sell the shares issuable upon the due exercise

of the 1,091,054 Penalty Warrants and/or the 500,000 RRA Penalty Warrants in an amount not to exceed (i) the volume restrictions

under Rule 144 on a quarterly basis, and with the further limitation of (ii) not more than Twenty Thousand (20,000) shares per

day. |

| 1.2-5A | In the event that HPEV shall not electronically deliver to Spirit Bear and/or Lorenzo any or all

shares in connection with a warrant exercise within three (3) trading days (as provided for in the warrant agreements), subject

to only the exceptions in 1.2-5A(i) through 1.2-5A(iii) of this Section 1.2-5A, HPEV shall weekly pay to Spirit Bear and/or Lorenzo

damages per day equal to the product of (1) the quantity of warrants that Spirit Bear and/or Lorenzo shall have elected to exercise,

multiplied by (2) Two Cents ($0.02). Spirit Bear and Lorenzo shall be entitled to enforce these obligations of HPEV by injunctive

relief and/or specific performance without posting a bond. The obligation to pay the foregoing damages to Spirit Bear and/or Lorenzo

as provided in this Section is expressly conditioned on the absence of an impediment to HPEV’s strict compliance with this

Section resulting from either (i) regulatory action (whether a formal action or any written letter of instruction) by an entity

of competent jurisdiction, evidenced in writing and delivered to Spirit Bear’s counsel; (ii) force majeure; or (iii)

the failure by Spirit Bear and/or Lorenzo to provide a completed Notice of Exercise form (as included in the warrant agreements,

a copy of which is annexed hereto as Exhibit B) containing the information required therein. |

| | |

| 1.2-5B. | Force Majeure |

| (i) | HPEV shall have the burden of proof with respect to any claim of force majeure and HPEV

shall notify counsel for Spirit Bear by telephone, or such other method as shall be most practicable (using the contact information

in Section 3.6 hereof), within twelve (12) hours following the beginning of an occurrence of force majeure. |

| (ii) | In the event that electronic delivery of shares in connection with the exercise of warrants

under this agreement shall not be possible due to an event of force majeure, Spirit Bear and/or Lorenzo may direct

HPEV and/or its transfer agent that certificates for the shares due to them be physically delivered, to such address or

addresses as Spirit Bear and/or Lorenzo shall at that date provide, by overnight courier. In the event that Spirit Bear

and/or Lorenzo shall direct next-day physical delivery of share certificates and the certificates shall not be received on

the first (1st) business day following the date upon which such instructions were given, HPEV shall begin to pay

damages (as provided in paragraph 1.2-5A hereof) to Spirit Bear and/or Lorenzo commencing on the third (3rd)

business day following the date upon which Spirit Bear and/or Lorenzo shall direct HPEV to make overnight delivery and shall

continue to be incurred and paid until the date upon which the certificates shall be received by Spirit Bear and/or

Lorenzo. |

| 1.2-6 | Series A, B, and C Warrants |

| 1.2-6A | The Parties and Lorenzo expressly acknowledge and agree that the Series A, B, and C warrants (collectively,

the “Warrants”) shall not be exercised until after December 31, 2015, nor shall Spirit Bear and/or Lorenzo be entitled

to sell, transfer, dispose of or otherwise encumber the Warrants until after December 31, 2015. From January 1, 2016, until December

31, 2016, (the “Warrant Exercise Period”) Spirit Bear and Lorenzo shall (subject to the provisions of Section 1.3 hereof)

be entitled to exercise the Warrants at their discretion (provided, however, that neither Spirit Bear nor Lorenzo (including their

assignees) shall each submit more than one exercise notice in any calendar week) with the following restrictions, to sell the shares

issuable upon the due exercise of the Warrants in an amount not to exceed (i) the volume restrictions under Rule 144 on a quarterly

basis and the further limitation of (ii) not more than Thirty Thousand (30,000) shares per day. |

| 1.2-6B | From and after January 1, 2017, Spirit Bear and/or Lorenzo, if either or both still owns any of

the Warrants or underlying shares resulting from the exercise of the Warrants, will not be limited in exercising such Warrants

or selling such resulting shares, subject to applicable securities laws and regulations. |

| 1.3-1 | Spirit Bear and Lorenzo hereby each grants to OLP Holdings, Inc. (including its successors and

assignees, hereinafter “OLP”) an irrevocable right of first offer, effective throughout the Warrant Exercise Period,

to purchase, subject to the exercise and sale rights of Spirit Bear and Lorenzo under Sections 1.2 and 1.3 hereof, any and all

A, B, and C Warrants then still owned by Spirit Bear and/or Lorenzo, at the Values and during the time periods set forth below

in Table 1.3. |

| 1.3-2 | During the Warrant Exercise Period, Spirit Bear and Lorenzo shall, at least three (3) business

days prior to exercising any of the Series A, B and/or C warrants as provided for in Section 1.2 hereof, deliver a Notice of Intent

to exercise Warrants (“Intent Notice”) to OLP. The Intent Notice shall set forth the specific series and quantity of

warrants which Spirit Bear and/or Lorenzo intends to exercise. OLP may elect to purchase the Warrants so designated, in full or

in part, during the three (3) business days following its receipt of the Intent Notice (the “Election Period”), at

a price equal to the Value stated below in Table 1.3, calculated on a pro-rata basis for the number of warrants to be purchased.

Upon (i) written notice by OLP that it will not elect to purchase some or any portion of said designated Warrants, or (ii) the

expiration of the Election Period without an affirmative written notice from OLP and the payment in full by OLP of the purchase

price within the three (3) business days next following the Election Period, Spirit Bear and/or Lorenzo shall have the right to

exercise the Warrants outlined in the Intent Notice and to sell the underlying shares consistent with the quantity limitations

specified in this Agreement. Any effort by Spirit Bear and/or Lorenzo to exercise warrants without first providing to OLP the right

of first offer specified in this paragraph shall be null, void, and of no legal effect, with any associated costs borne by Spirit

Bear. |

| 1.3-3 | It is the intent of the Parties that any attempt by Spirit Bear and/or Lorenzo to transfer or encumber

any A, B, and C Warrants other than as specifically permitted by Sections 1.2 and 1.3 of this Agreement (including the foregoing

limitations on volume, timing, and right of first offer) be void and ineffective, without regard to the knowledge or good faith

of the transferee or beneficiary thereof; Spirit Bear and Lorenzo agree to indemnify HPEV as against any person or entity claiming

any right or interest pursuant to an action not permitted by this Agreement. Spirit Bear and Lorenzo further each acknowledges

that HPEV is authorized to deny the exercise of warrants and/or to place "stop orders" on its books to prevent any transfer

of shares by Spirit Bear and/or Lorenzo inconsistent with this Agreement. |

| 1.3-4 | Spirit Bear and Lorenzo hereby grant to OLP an irrevocable call option during the Warrant Exercise

Period to purchase any and all Warrants owned by Spirit Bear and/or Lorenzo at a price equal to the Value and under the time scenarios

stated below in Table 1.3, calculated on a pro-rata basis for the number of warrants to be purchased. |

Table 1.3

| |

|

Number of Warrants |

Exercise

Price |

Agreed

Premium |

Value |

| If called by: |

3/31/2016 |

|

|

|

|

| |

Series A Warrants |

2,000,000 |

$0.35 |

1.00 |

$2,000,000 |

| |

Series B & C Warrants |

4,000,000 |

$0.50 |

0.85 |

$3,400,000 |

| |

|

|

Total Purchase Price: |

$5,400,000 |

| If called by: |

6/30/2016 |

|

|

|

|

| |

Series A Warrants |

2,000,000 |

$0.35 |

1.25 |

$2,500,000 |

| |

Series B & C Warrants |

4,000,000 |

$0.50 |

1.10 |

$4,400,000 |

| |

|

|

Total Purchase Price: |

$6,900,000 |

| |

|

|

|

|

|

| |

|

Number of Warrants |

Exercise

Price |

Agreed

Premium |

Value |

| If called by: |

9/30/2016 |

|

|

|

|

| |

Series A Warrants |

2,000,000 |

$0.35 |

1.50 |

$3,000,000 |

| |

Series B & C Warrants |

4,000,000 |

$0.50 |

1.35 |

$5,400,000 |

| |

|

|

Total Purchase Price: |

$8,400,000 |

| |

|

|

|

|

|

| If called by: |

12/31/2016 |

|

|

|

|

| |

Series A Warrants |

2,000,000 |

$0.35 |

1.75 |

$3,500,000 |

| |

Series B & C Warrants |

4,000,000 |

$0.50 |

1.60 |

$6,400,000 |

| |

|

|

Total Purchase Price: |

$9,900,000 |

| 1.4 | Spirit Bear agrees that, as of the Initial Payment Date, it shall have no further rights to appoint

nominees to the Board of Directors of HPEV under the Securities Purchase Agreement, the Bylaws of HPEV, or otherwise. |

| |

|

If the deposit into escrow of

the total amount of the Purchase Funds is not completed by fifty (50) days following the Effective Date, for reasons not attributable

to a lack of diligence on the part of HPEV, then HPEV shall have the right to postpone the Escrow Funding Date by a period not

to exceed ten (10) business days (the “Escrow Funding Extension Period”), to enable completion of the payment of the

total amount of the Purchase Funds contemplated by Section 1.1, in which case the Escrow Funding Date shall be postponed to the

date upon which the Purchase Funds shall be deposited into escrow (the “Postponed Escrow Funding Date”), provided

such date be not later than ten (10) business days following the Escrow Funding Date originally anticipated hereunder. In the

event that the total amount of the Purchase Funds shall not be deposited into escrow (as provided for in Section 1.1 hereof) by

the Postponed Escrow Funding Date, this Agreement shall terminate, and Spirit Bear, Kahn, Knoll, Brown, and Lorenzo shall thereafter

retain ownership of the Shares, and Spirit Bear and Lorenzo shall thereafter retain ownership of their warrants. |

| 1.6-1 | HPEV shall, by not later than ten (10) business days following the Initial Payment Date, file (and

do all that it can to perfect as necessary or appropriate) a new S-1 Registration Statement covering only the Completion Shares

and the Warrant Shares [as hereinafter defined below in subparagraph 1.6-1(i)], and shall take all such actions consistent with

this Agreement as shall be required of it to have such registration statement declared effective by the SEC (recognizing that the

SEC is not subject to the control of HPEV) as soon as possible (including, but not limited to, submitting a request for acceleration

of effectiveness at the earliest possible date) and thereafter to maintain the same in effect continuously and at all times subject

to the approval of the SEC, recognizing that the SEC is not subject to the control of HPEV, for so long as: |

(i) Spirit Bear shall own any (a)

Completion Shares, (b) Warrants, Penalty Warrants and/or RRA Penalty Warrants or (c) shares derived from Warrants, Penalty Warrants

and/or RRA Penalty Warrants (all such warrants and underlying shares identified in (b) and (c) being referred to herein, irrespective

of the holder, as “Warrant Shares”);

(ii) Lorenzo shall own any Completion

Shares, Warrants or Warrant Shares; and/or

(iii) Kahn, Knoll, or Brown shall

own any Completion Shares.

| 1.6-2 | In the event that HPEV shall fail to maintain in effect a registration statement covering the Completion

Shares and the Warrant Shares at all times insofar as required by Section 1.6-1 (recognizing that the SEC is not subject to the

control of HPEV), HPEV shall daily pay to Spirit Bear, Kahn, Knoll, Brown, and Lorenzo damages per day equal to the product of

(1) the sum of the quantity of Completion Shares plus the quantity of Warrant Shares owned by Spirit Bear, Kahn, Knoll, Brown,

and Lorenzo multiplied by (2) Two Cents ($0.02). In addition, Spirit Bear, Kahn, Knoll, Brown, and Lorenzo shall be entitled to

enforce this obligation of HPEV by injunctive relief and/or specific performance without posting a bond. |

| 2.0 | FURTHER OBLIGATIONS OF THE PARTIES AND ASSIGNEES |

| 2.1-1 | Holdover Board of Directors members Palmer, Holt and Dwyer (the “SBL Holdover Directors”)

shall each tender his or her written resignation from the HPEV Board of Directors within ten (10) days following the Effective

Date, which resignation shall state that it is effective as of the Initial Payment Date. The SBL Holdover Directors shall deliver

their resignations to Spirit Bear’s counsel to be held in escrow until the Initial Payment Date, at which time they shall

be delivered to HPEV through its counsel or as otherwise directed. The obligations of this paragraph shall be enforceable by injunctive

relief or specific performance without bond as against the SBL Holdover Directors. |

| 2.2-1 | Nothing in this Agreement shall constitute (1) an admission of liability, wrongdoing or responsibility

by either Party, or (2) any agreement by either Party as to the validity of any of the positions advanced by the other Party in

connection with the Dispute. Rather, each Party expressly denies such liability, wrongdoing or responsibility. |

| 2.2-2 | Neither this Agreement nor any part of it may be used in any way against either Party except in

an action to enforce, or seek damages for the breach of, this Agreement. |

| 2.3-1 | Release of Spirit Bear. As of the Initial Payment Date, HPEV and its officers, directors,

members, managers, equity owners, agents, representatives, heirs and direct and indirect affiliates and their respective successors

and assigns (collectively, the “HPEV Releasors”) irrevocably and unconditionally release, forever discharge, covenant

not to sue, indemnify and hold harmless Spirit Bear and its employees, stockholders, officers, directors, agents, counsel, representatives

and direct and indirect affiliates and respective successors and assigns, and all persons, firms, corporations, and organizations

acting on their behalf (collectively referred to as the “Spirit Bear Related Persons”) of and from any and all actions,

causes of actions, suits, debts, charges, demands, complaints, claims, administrative proceedings, liabilities, obligations, promises,

judgments, agreements, controversies, collection efforts, damages and expenses (including but not limited to compensatory, punitive

or liquidated damages, attorney’s fees and other costs and expenses incurred), of any kind or nature whatsoever, in law or

equity, whether presently known or unknown (collectively, the “Claims”), solely excepting any action to enforce this

Agreement and/or seek damages under this Agreement pursuant to Section 3.2, which HPEV and/or any of the HPEV Releasors ever had

for, upon, or by reason of any matter, cause, or thing whatsoever from the beginning of time against Spirit Bear or any of the

Spirit Bear Related Persons. Without limiting the foregoing, HPEV and the HPEV Releasors each jointly and severally expressly acknowledge

that its release provided for in this Section 2.3 is intended to include in its effect, without limitation, all Claims which have

arisen and of which it knows, does not know, should have known, had reason to know, suspects to exist or might exist in its favor

at the time of the signing, including, without limitation, any Claims relating directly or indirectly to Spirit Bear, including,

without limitation any and all actions which have been or could have been brought against Spirit Bear or any Spirit Bear Related

Person as a result of the Securities Purchase Agreement, the Dispute, the Lawsuits or any other matter directly or indirectly among

HPEV or any HPEV Related Person and Spirit Bear or any Spirit Bear Related Person, and that this release shall extinguish all such

Claims. This release shall be binding upon each of HPEV and each HPEV Releasor and their respective partners, officers, directors,

stockholders, employees, agents, representatives, personal representatives, heirs, assigns, successors and affiliates, and shall

inure to the benefit of Spirit Bear and each of the respective Spirit Bear Related Persons. |

| 2.3-2 | Release of HPEV. As of the Initial Payment Date, Spirit Bear and its officers, directors,

members, managers, equity owners, agents, representatives, heirs and direct and indirect affiliates, including its Assignees, and

their respective successors and assigns (collectively, the “Spirit Bear Releasors”) irrevocably and unconditionally

release, forever discharge, covenant not to sue, indemnify and hold harmless HPEV and its employees, stockholders, officers, directors,

agents, counsel, representatives and direct and indirect affiliates and respective successors and assigns, and all persons, firms,

corporations, and organizations acting on their behalf (collectively referred to as the “HPEV Related Persons”) of

and from any and all Claims, solely excepting any action to enforce this Agreement and/or seek damages under this Agreement pursuant

to Section 3.2, which Spirit Bear and/or any of the Spirit Bear Releasors ever had for, upon, or by reason of any matter, cause,

or thing whatsoever from the beginning of time against HPEV or any of the HPEV Related Persons, specifically including but not

limited to the following: |

(a) any

and all derivative claims and to the extent permissible by law the Shareholder Derivative Claims addressed in Exhibit A hereto;

(b) any

claims associated with the negative pledge held by Spirit Bear assignee Jaeger; and

(c) any

actual or threatened claims for indemnification.

| | Without limiting the foregoing, Spirit Bear and the Spirit Bear Releasors each jointly and severally

expressly acknowledge that its release provided for in this Section 2.3 is intended to include in its effect, without limitation,

all Claims which have arisen and of which it knows, does not know, should have known, had reason to know, suspects to exist or

might exist in its favor at the time of the signing, including, without limitation, any Claims relating directly or indirectly

to HPEV, including, without limitation any and all actions which have been or could have been brought against HPEV or any HPEV

Related Person as a result of the Securities Purchase Agreement, the Dispute, the Lawsuits or any other matter directly or indirectly

among Spirit Bear or any Spirit Bear Releasor and HPEV or any HPEV Related Person, and that this release shall extinguish all such

Claims, including the Shareholder Derivative Claims. This release shall be binding upon each of Spirit Bear and each Spirit Bear

Releasor and their respective partners, officers, directors, stockholders, employees, agents, representatives, personal representatives,

heirs, assigns, successors and Assignees, and shall inure to the benefit of HPEV and each of the respective HPEV Related Persons. |

|

|

Upon the Initial Payment Date,

HPEV and Spirit Bear, and the assignees and representatives of each, agree to dismiss (or, as with respect to the Interpleader

Action, cause to be dismissed) with prejudice the Lawsuits (including to the extent permissible by law the Shareholder Derivative

Claims as addressed in Exhibit A), each Party to bear its own costs, expenses and attorneys’ fees in connection therewith.

The Parties hereby stipulate and agree that as of the Effective Date, to the fullest extent of their ability, any and all discovery

or other deadlines in or associated with the Lawsuits are and shall be treated as stayed or held in abeyance until such time as

the Lawsuits are dismissed, all discovery (including third-party discovery) is and shall be withdrawn, and that they shall make

any such court filings as are appropriate in furtherance of effecting a complete standstill of all litigation related to the Lawsuits;

and, with the exception that both parties recognize that HPEV has filed with the United States Securities and Exchange Commission

(the “SEC”) Preliminary Proxy Statements dated December 24, 2014, and January 21, 2015, in which notice for a shareholders’

meeting has been provided, no annual meeting or special meeting of the shareholders shall be publicly noticed, scheduled or held,

or any action of any nature taken by HPEV (including its management, management directors, advisory board members, and all HPEV

Related Persons) with respect to the filing with the SEC of a Definitive Proxy Statement and/or the composition of the HPEV Board

of Directors, until, at the earliest, the day after the Initial Payment Date. Further, upon execution of this Agreement, HPEV agrees

to suspend the notice and timing of such shareholders’ meeting until the earlier of (i) seventy (70) days after the Effective

Date or (ii) the Initial Payment Date, regardless of a demand from any shareholder , specifically including Mark Hodowanec, for

an earlier meeting. |

| 2.5 | The Parties agree to seek to obtain a complete dismissal of all Shareholder Derivative Claims.

The Parties agree to execute, implement, and submit for court approval the settlement agreement attached hereto as Exhibit A, and

to request and do all other acts and things required to obtain dismissal of the Shareholder Derivative Claims. In the event that

the settlement agreement attached as Exhibit A is not approved by the court, then the Parties shall work in good faith to obtain

a dismissal of the Shareholder Derivative Claims through whatever means are available to them, both Parties to share equally in

any resulting additional cost associated with such means. |

| 2.6 | Each of the Parties agrees that (i) it shall not make any public disparaging statements regarding

the other; (ii) the text of any press release or other disseminated announcement or explanation of this settlement (other than

regulatory filings, which are provided for under (iii) hereof) shall be mutually agreed to in writing prior to its release, dissemination

or publication; (iii) and so long as the Spirit Bear Holdover Directors shall be members of the HPEV Board of Directors, any portion

of public filings with the SEC addressing this settlement (but no other portion of any public filing with the SEC) shall require

the approval of a majority of the voting members of the HPEV Board of Directors; provided, however, that if a majority of the voting

members of the HPEV Board of Directors are unable to agree on language in a public filing with the SEC specifically addressing

this settlement, then the language below in Section 2.6(a) may be used without separate approval by the HPEV Board of Directors

or otherwise, and in any event the.portion of such filing not directly addressing this settlement shall not be impacted or conditioned

in any way by this Section 2.6. |

| (a) | Absent approval of settlement-related language by a majority of the HPEV Board of Directors as

specified above in this Section 2.6, the Company may, and agrees to, describe the settlement using the following language: “The

Company has reached an agreement with Spirit Bear Limited and its affiliates and assignees (“Spirit Bear”) which, upon

the purchase by HPEV of certain specified securities held by Spirit Bear on a date and at an amount specified in the agreement,

would permanently resolve, settle, dismiss, and release all actual and potential claims among them (except for breaches under the

settlement agreement itself, if any were to arise) without liability therefor, including provisions for the orderly separation

of Spirit Bear and persons associated with Spirit Bear from influence, control, or oversight as to the operations of the Company.” |

| | This Agreement is binding on the Parties, including their respective Releasors, and their respective

successors, heirs, legal representatives, and assigns. Each Party represents to the other that the Party is the sole owner of the

claims, causes of action, and/or rights released herein by the Party, and no such claims, causes of action, and/or rights, or any

part thereof, have been assigned or conveyed. The undersigned representative for each Party certifies that he or it is fully authorized

by the Party whom he or it represents and such Party’s Releasors specifically including its affiliates to enter into the

terms and conditions of this Agreement and to commit fully and bind such Party and its Releasors (specifically including its affiliates)

according to the provisions hereof. |

|

3.2 |

Governing Law and Forum |

| | This Agreement, including all matters of construction, validity and performance, shall be governed

by, and construed in accordance with, the laws of New York without giving effect to the choice of law or conflicts of law provisions

thereof. The Parties hereby consent to the non-exclusive jurisdiction of the state and federal courts of the State of New York

for enforcement of this Agreement, resolution of any dispute, claim, or liability of any sort arising from or related to this Agreement

or any matter addressed by this Agreement, including the Lawsuits. |

| | This Agreement may be executed in counterparts, each of which shall be deemed an original, but

all of which together shall constitute one and the same instrument. Electronically scanned signatures (such as PDFs) shall be considered

original signatures for all purposes. |

| | This Agreement reflects the entire agreement and understanding between the Parties, the HPEV Releasors,

and the Spirit Bear Releasors with respect to the settlement contemplated here, and supersedes any and all other prior and contemporaneous

negotiations, correspondence, understandings and agreements between the Parties, whether oral or written, regarding such subject

matter. No agreements altering or supplementing the terms hereof may be made except by means of a written document, explicitly

referencing this Agreement, signed by the duly authorized representatives of the Parties. |

|

3.5 |

Construction and Joint Preparation. |

| | This Agreement shall be construed to effectuate the mutual intent of the Parties. The Parties and

their counsels have cooperated in the drafting and preparation of this Agreement, and this Agreement therefore shall not be construed

against any Party by virtue of its role as the drafter thereof. No drafts of this Agreement shall be offered by any Party, nor

shall any draft be admissible in any proceeding, to explain or construe this Agreement. The headings contained in this Agreement

are intended for convenience of reference only and are not intended to be a part of or to affect the meaning or interpretation

of this Agreement. |

|

3.6 |

Notices. |

|

|

Spirit Bear’s counsel for

receipt of notices and other performance as specified in this Agreement shall be:

Joseph A. Liebman, Esq.

Bailey Kennedy, LLP

8984 Spanish Ridge Avenue

Las Vegas, NV 89148

Telephone: 1-702-853-0750

Email: jliebman@baileykennedy.com

HPEV’s counsel for receipt

of notices and other performance as specified in this Agreement shall be:

David Lubin

David Lubin & Associates,

PLLC

108 S. Franklin Avenue, Suite

10

Valley Stream, NY 11580

Telephone: 1-516-887-8200

Email: david@dlubinassociates.com

|

| 3.7 | Further Assurances. From time to time, the Parties agree to do such further

acts and things and to execute and deliver such additional agreements and instruments as may be necessary to give effect to the

purposes of this Agreement and the Parties’ agreement and understandings hereunder. |

| 3.8 | Neither the failure nor any delay on the part of any Party to exercise any

right, remedy, power, or privilege under this Agreement shall operate as a waiver of that right, remedy, power, or privilege. No

waiver of any right, remedy, power, or privilege with respect to any particular occurrence shall be construed as a waiver of such

right, remedy, power, or privilege with respect to any other occurrence. |

| 3.9 | In any action or proceeding to enforce the terms of this Agreement, or to

redress any violation of this Agreement, the prevailing party shall be entitled to recover as damages (in addition to any damages

awarded) its attorney’s fees and costs incurred, whether or not the action is reduced to judgment. For the purposes of this

provision, the “prevailing party” shall be that party who has been successful with regard to the main issue, even if

that party did not prevail on all the issues. |

IN WITNESS WHEREOF, the Parties

have each caused this Agreement to be executed by their duly authorized respective representatives.

| |

SPIRIT BEAR LIMITED |

|

|

HPEV INC. |

| |

|

|

|

|

| By: |

/s/ Jay Palmer |

|

By: |

/s/ Timothy Hassett |

| Name: |

Jay Palmer |

|

Name: |

Timothy Hassett |

| Title: |

President |

|

Title: |

CEO |

| |

|

|

|

|

| |

SPIRIT BEAR LIMITED

Representative |

|

|

HPEV INC. |

| |

|

|

|

|

| By: |

/s/ Robert Alan Olins |

|

By: |

/s/ Theodore Banzhaf |

| Name: |

Robert Alan Olins |

|

Name: |

Theodore Banzhaf |

| |

|

|

Title: |

President |

| |

|

|

|

|

| |

ROBERT ALAN OLINS

Individually |

|

|

HPEV INC. |

| |

|

|

|

|

| By: |

/s/ Robert Alan Olins |

|

By: |

/s/ Quentin D. Ponder |

| Name: |

Robert Alan Olins |

|

Name: |

Quentin D. Ponder |

| |

|

|

Title: |

CFO |

| |

|

|

|

|

| |

SPIRIT BEAR LIMITED

Representative |

|

|

HPEV INC. |

| |

|

|

|

|

| By: |

/s/ Carrie Dwyer |

|

By: |

/s/ Judson Bibb |

| Name: |

Carrie Dwyer |

|

Name: |

Judson Bibb |

| Title: |

HPEV Director |

|

Title: |

Vice President and Secretary |

| |

|

|

|

|

| |

SPIRIT BEAR LIMITED

Representative |

|

|

MARK HODOWANEC

Individually (solely as to § 2.4) |

| |

|

|

|

|

| By: |

/s/ Donica Holt |

|

By: |

/s/ Mark Hodowanec |

| Name: |

Donica Holt |

|

Name: |

Mark Hodowanec |

| Title: |

HPEV Director |

|

|

|

| |

|

|

|

|

| |

SPIRIT BEAR LIMITED

Assignee |

|

|

OLP Holdings, Inc.

Representative |

| |

|

|

|

|

| By: |

/s/ Robert Knoll |

|

By: |

/s/ Bhavin Shah |

| Name: |

Robert Knoll |

|

Name: |

Bhavin Shah |

| |

|

|

Title: |

|

| |

SPIRIT BEAR LIMITED

Assignee |

| |

|

| By: |

/s/ Laurel Brown |

| Name: |

Laurel Brown |

| |

|

| |

|

| |

SPIRIT BEAR LIMITED

Assignee |

| |

|

| By: |

/s/ Leonora Lorenzo |

| Name: |

Leonora Lorenzo |

| |

|

| |

|

| |

SPIRIT BEAR LIMITED

Assignee |

| |

|

| By: |

/s/Michael Kahn |

| Name: |

Michael Kahn |

| |

|

| |

SPIRIT BEAR LIMITED

Assignee |

| |

|

| By: |

/s/ Ray Adams |

| Name: |

Ray Adams |

| |

|

EXHIBIT A

DERIVATIVE ACTION SETTLEMENT AGREEMENT

WHEREAS, the

parties acknowledge that Spirit Bear has filed a Third Party Claim against Third-Party Defendants Timothy J. Hassett ("Hassett"),

Quentin D. Ponder (“Ponder”), Judson W. Bibb III (“Bibb”), Theodore H. Banzhaf (“Banzhaf”),

Mark M. Hodowanec ("Hodowanec"), and nominal Counterdefendant HPEV (“SBL Derivative Action”) (collectively

Hassett, Ponder and Bibb are sometimes hereinafter referred to as “Management Directors”).

WHEREAS, in

the SBL Derivative Action, Spirit Bear has filed the action “derivatively on behalf of HPEV against the company's managing

officers and directors for issuing equity or debt without authority and for taking unauthorized and excessive compensation.”

[See Case 2:13-cv-01548-JAD-GWF, Dkt 119, paragraph 5].

WHEREAS Hodowanec

has been dismissed from the SBL Derivative Action based upon a lack of personal jurisdiction over him.

WHEREAS it

is the intent of the parties through the Settlement and Release Agreement to which this Derivative Action Settlement Agreement

is attached as Exhibit A (the “DA Settlement Agreement”) to settle all actions and claims by and among them

including but not limited to the SBL Derivative Action.

WHEREAS the

parties acknowledge that Fed.R.Civ.P. 23.1(c) provides as follows: “A derivative action may be settled, voluntarily dismissed,

or compromised only with the court's approval. Notice of a proposed settlement, voluntary dismissal, or compromise must be given

to shareholders or members in the manner that the court orders.”

WHEREAS Spirit

Bear’s claims for relief in the SBL Derivative Action allege two principal wrongdoings by HPEV and its management including

the Management Directors: i.e. (1) that management took unauthorized and excessive compensation and (2) management issued debt

or equity without authority.

WHEREAS HPEV

and the Third Party Defendants deny the allegations.

WHEREAS HPEV’s

claims for relief against Spirit Bear seek, among other things, a declaratory judgment from the Court that all executive compensation

has been duly authorized and all debt or equity issued by HPEV was properly authorized.

WHEREAS Spirit

Bear further made a demand upon HPEV to rescind the management compensation and the allegedly unauthorized debt or equity issuances

and Spirit Bear alleges that the Management Directors of HPEV wrongfully denied this demand.

WHEREAS upon

a proper demand under Article II, Section 3 of HPEV’s bylaws, HPEV intends to hold a Special Meeting of Shareholders to elect

successor directors to Jay Palmer, Carrie Dwyer and Donica Holt.

WHEREAS Palmer,

Dwyer and Holt were Spirit Bear designees to the HPEV Board and the Management Directors have reported that Palmer, Dwyer, and

Holt failed to receive a majority vote of the shareholders at the Annual Meeting on January 13, 2014, which meeting and election

are deemed unauthorized by Spirit Bear.

WHEREAS the

United States District Court, District of Nevada has declared that Palmer, Dwyer and Holt serve as “holdover directors”

until their successors are elected, until they resign, or until they are removed.

WHEREAS three

nominees have been chosen by the Management Directors to run for three director positions on the HPEV Board: Christopher McKee

(“McKee”), Richard J. “Dick” Schul (“Schul”), and Donald Bowman (“Bowman”).

WHEREAS Spirit

Bear on December 19, 2014 submitted its own nominees for the HPEV Board of Directors.

WHEREAS McKee,

Schul and Bowman, if elected, will constitute “Independent Directors” (for the purposes of this Derivative Settlement

Agreement only) who have no stake in the outcome of the litigation between HPEV and Spirit Bear;

WHEREAS the

“Independent Directors,” using their sound business judgment, will be able to evaluate the merits of SBL’s allegations

set forth in the SBL Derivative Action and to determine HPEV’s proper business response thereto based upon that evaluation.

NOW THEREFORE for

good and valuable consideration the receipt of which is hereby acknowledged and the mutual promises, performances, covenants and

agreements of the parties, the parties, intending to be legally bound, agree as follows:

| 1. | Stipulation and Order to Dismiss, With Prejudice |

The parties hereby

agree to file a Stipulation and Order to Dismiss, With Prejudice, the SBL Derivative Action, subject to the approval of the Court

to the terms of this Settlement Agreement.

| 2. | Formation of Independent Directors Committee |

Upon completion of

the Special Meeting of Shareholders to be noticed following the Initial Payment Date in the Settlement and Release Agreement, in

part, to elect successor directors for Palmer, Dwyer and Holt, the parties agree that the Independent Directors elected thereat

shall form an Independent Directors Committee (“IDC”).

| 3. | IDC Review of Spirit Bear’s Derivative Claims |

The IDC shall review

the merits of Spirit Bear’s Derivative Claims as set forth in the SBL Derivative Action. Exercising their sound business

judgment, the IDC shall determine the appropriate corporate response of HPEV to the claims for relief raised in the SBL Derivative

Action. The IDC shall have the sole and absolute discretion to take any appropriate responsive action including but not limited

to (a) ratification of any and all actions previously undertaken under the authority of the Board; (b) filing a lawsuit against

any and all Management Directors setting forth similar or identical claims as those set forth in the SBL Derivative Action; (c)

settling, with or without litigation, any and all claims HPEV may have against any and all Management Directors on terms and conditions

they deem in the best interest of HPEV; and/or (d) taking such other action as they determine is in the best interest of HPEV.

IDC action shall be deemed valid and enforceable if undertaken pursuant to a majority vote of the Independent Directors although

the number of IDC members may not be a quorum of all directors of HPEV.

| 4. | Unanimous Director Approval of Formation of IDC |

The signatures below

of the Management Directors (Hassett, Ponder and Bibb) and the holdover directors (Palmer, Dwyer and Holt) constitute the unanimous

written consent of the current directors of HPEV to establish the IDC and to give them such authority as is set forth herein. To

the extent a court of competent jurisdiction determines that any amendment(s) to the bylaws is required to establish the IDC and

to give them the authority set forth herein, this consent shall be further construed as a vote to amend the bylaws to so provide.

| 5. | Spirit Bear Release Extends to Derivative Claims |

The release of HPEV

by Spirit Bear and its Assignees as set forth in the Settlement and Release Agreement includes any and all claims that Spirit Bear

has asserted in a derivative capacity for and on behalf of HPEV in the SBL Derivative Action. Spirit Bear agrees that it has waived

and released any and all such claims against the released parties, including but not limited to the Third Party Defendants in the

SBL Derivative Action, regardless of what action, if any, the IDC chooses to take as a result of the authority it is granted herein.

The intent of this provision is to prevent Spirit Bear from being deemed a proper party to refile a new derivative action based

upon the actions of the IDC in the event Spirit Bear disagrees with the actions approved by the IDC in handling the allegations

set forth in the SBL Derivative Action and a court should construe this language accordingly.

| 6. | Notice to Shareholders: Cooperation |

The parties agree

to cooperate in good faith to obtain court approval of the settlement of the SBL Derivative Action. Such cooperation includes but

is not limited to providing such notice to shareholders of this Settlement Agreement as is necessary pursuant to Fed. R. Civ.P.

23.1(c) and/or as the Court directs.

IN WITNESS WHEREOF, the undersigned

have each caused this DA Settlement Agreement to be executed by their duly authorized respective representatives.

| |

SPIRIT BEAR LIMITED |

|

|

HPEV INC. |

| |

|

|

|

|

| By: |

/s/ Jay Palmer |

|

By: |

/s/ Timothy Hassett |

| Name: |

Jay Palmer |

|

Name: |

Timothy Hassett |

| Title: |

President |

|

Title: |

CEO and Director |

| |

|

|

|

|

| |

HPEV INC. |

|

|

HPEV INC. |

| |

|

|

|

|

| By: |

/s/ Jay Palmer |

|

By: |

/s/ Theodore Banzhaf |

| Name: |

Jay Palmer |

|

Name: |

Theodore Banzhaf |

| Title: |

Director |

|

Title: |

President |

| |

|

|

|

|

| |

HPEV INC. |

|

|

HPEV INC. |

| |

|

|

|

|

| By: |

/s/ Carrie Dwyer |

|

By: |

/s/ Quentin D. Ponder |

| Name: |

Carrie Dwyer |

|

Name: |

Quentin D. Ponder |

| Title: |

Director |

|

Title: |

CFO and Director |

| |

|

|

|

|

| |

HPEV INC. |

|

|

HPEV INC. |

| |

|

|

|

|

| By: |

/s/ Donica Holt |

|

By: |

/s/ Judson Bibb |

| Name: |

Donica Holt |

|

Name: |

Judson Bibb |

| Title: |

Director |

|

Title: |

Vice President, Secretary, and Director |

| |

|

|

|

|

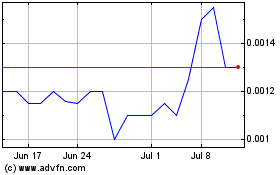

Cool Technologies (PK) (USOTC:WARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cool Technologies (PK) (USOTC:WARM)

Historical Stock Chart

From Apr 2023 to Apr 2024