UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended December 31, 2014

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-33958

_______________________________________________________

Galena Biopharma, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________________________

|

| | |

Delaware | | 20-8099512 |

(State of incorporation) | | (I.R.S. Employer Identification No.) |

4640 SW Macadam Ave., Suite 270, Portland, OR 97239

(Address of principal executive office) (Zip code)

Registrant’s telephone number: (855) 855-4253

|

| | |

Securities registered pursuant to Section 12(b) of the Exchange Act: |

| | |

Title of Each Class | | Name of Exchange on Which Registered |

Common Stock, $0.0001 Par Value per Share | | The NASDAQ Capital Market |

| | |

Securities registered pursuant to Section 12(b) of the Exchange Act: |

| None | |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes ý No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. o Yes ý No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ý Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o Yes ý No

Indicate by check mark whether the registrant has submitted electronically and posted on it corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for any such shorter time that the registrant was required to submit and post such files). ý Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check one):

|

| | | | | | |

Large accelerated filer | | o | | Accelerated filer | | ý |

Non-accelerated filer | | o | (Do not check if a smaller reporting company) | Smaller reporting company | | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): o Yes ý No

Based on the closing price of the Registrant's common stock as reported on the NASDAQ Capital Market, the aggregate market value of the Registrant's common stock held by non-affiliates on June 30, 2014 (the last business day of the Registrant's most recently completed second fiscal quarter) was approximately $359,479,000.

As of February 28, 2015, Galena Biopharma, Inc. had outstanding 133,702,578 shares of common stock, $0.0001 par value per share, exclusive of treasury shares.

EXPLANATORY NOTE

Galena Biopharma, Inc. ("Galena") is filing this Amendment No. 1 on Form 10-K/A (this "Amendment") to its Annual Report on Form 10-K (the "Original Filing"), which was filed with the Securities and Exchange Commission on March 5, 2015, for the sole purpose of (1) amending Item 9A (Controls and Procedures) of the Original Filing by inserting the inadvertently omitted signature of Moss Adams LLP on the Report of Independent Registered Public Accounting Firm that is contained in Item 9A, (2) amending Item 9B (Other Information) of the Original Filing by inserting the inadvertently omitted word "None" in response to the disclosure required by Item 9B of Form 10-K, and (3) amending the consent of Moss Adams LLP (Exhibit 23.1) to state that its report on Galena's financial statements is dated March 5, 2015, rather than March 3, 2015 as stated in the Original Filing.

This Amendment, which does not contain new financial statements, also contains new certifications in accordance with Rule 13a-14(a) of the Securities Exchange Act of 1934, as amended, and a new Exhibit Index that reflects the filing of these certifications and the consent of Moss Adams LLP.

Except as described above, no changes have been made to the Original Filing and this Amendment does not modify, amend or update in any way any of the financial statements or other information contained in the Original Filing. This Amendment does not reflect events that may have occurred subsequent to the Original Filing date of March 5, 2015.

ITEM 9A. CONTROLS AND PROCEDURES

Evaluation of Disclosure Controls and Procedures

Rule 13a-15(e) under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), defines the term “disclosure controls and procedures” as those controls and procedures designed to ensure that information required to be disclosed by a company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission rules and forms and that such information is accumulated and communicated to the company’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Our Chief Executive Officer and Chief Financial Officer have evaluated the effectiveness of the design and operation of our disclosure controls and procedures (as defined under Rules 13a-15(e) and 15d-15(e) promulgated under the Securities Exchange Act of 1934, as amended) as of the end of the period covered by this report. Based upon that evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that our disclosure controls and procedures are effective.

Evaluation of Disclosure Controls and Procedure Management’s report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rule 13a-15(f). Under the supervision and with the participation of our management, including our Chief Executive Officer and Principal Accounting Officer, we conducted evaluations of the effectiveness of our internal control over financial reporting based on the framework in Internal Control-Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Based on our evaluations under the framework in Internal Control-Integrated Framework (2013) issued by the COSO, our Chief Executive Officer and Chief Financial Officer concluded that our internal control over financial reporting was effective as of December 31, 2014.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

This annual report includes an attestation report of the company’s registered public accounting firm regarding internal control over financial reporting.

There have been no changes in our internal controls over financial reporting during the fourth quarter of the year ended December 31, 2014 that have materially affected, or are reasonably likely to materially affect, our internal controls over financial reporting.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders

Galena Biopharma, Inc.

We have audited Galena Biopharma, Inc.’s (the “Company”) internal control over financial reporting as of December 31, 2014, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission. The Company’s management is responsible for maintaining effective internal control over financial reporting and for its assessment of the effectiveness of internal control over financial reporting, included in the accompanying Management Report on Internal Control over Financial Reporting. Our responsibility is to express an opinion on the Company’s internal control over financial reporting based on our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether effective internal control over financial reporting was maintained in all material respects. Our audit included obtaining an understanding of internal control over financial reporting, assessing the risk that a material weakness exists, and testing and evaluating the design and operating effectiveness of internal control based on the assessed risk. Our audit also included performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion.

A company’s internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A company’s internal control over financial reporting includes those policies and procedures that (1) pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the company; (2) provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the company; and (3) provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the company’s assets that could have a material effect on the financial statements.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

In our opinion, Galena Biopharma, Inc. maintained, in all material respects, effective internal control over financial reporting as of December 31, 2014, based on criteria established in Internal Control - Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Galena Biopharma, Inc. as of December 31, 2014 and 2013, and the consolidated statements of comprehensive loss, stockholders’ equity, and cash flows for the years then ended, and our report dated March 5, 2015 expressed an unqualified opinion on those consolidated financial statements.

/s/ Moss Adams LLP

Portland, Oregon

March 5, 2015

ITEM 9B. OTHER INFORMATION

None.

ITEM 15. EXHIBITS

|

| | | |

Exhibit Number | | Description | |

| | | |

1.1 | | At Market Issuance Sales Agreement dated May 24, 2013 between Registrant and Maxim Group LLC.(31)

|

| | |

1.2 | | At Market Issuance Sales agreements dated May 24, 2013 between Registrant and MLV & Co. LLC.(31)

|

| | |

1.3 | | Underwriting Agreement dated as of September 13, 2013 by and between Galena Biopharma, Inc. and Oppenheimer & Co. Inc. as representative of the several underwriters named in Schedule I thereto. (1) |

| | | |

1.4 | | Underwriting Agreement dated as of April 5, 2012 by and between Galena Biopharma, Inc. and Roth Capital Partners, LLC, as representative of the several underwriters named therein.(22)

|

| | | |

1.5 | | Purchase Agreement dated as of December 18, 2012 by and between Galena Biopharma, Inc. and Piper Jaffray & Co.(20) |

| | | |

2.1 | | Unit Purchase Agreement, dated as of January 12, 2014, between Galena Biopharma, Inc. and Mills Pharmaceuticals, LLC.+(23) |

| | | |

3.1 | | Amended and Restated Certificate of Incorporation of Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation), as amended as of June 28, 2013.(2) |

| | | |

3.2 | | Certificate of Ownership and Merger.(12) |

| | |

3.3 | | Amended and Restated By-Laws of Galena Biopharma, Inc., as amended as of August 6, 2013. (2) |

| | |

4.1 | | Form of Warrant Agreement by and Galena Biopharma, Inc., Computershare Inc. and Computershare Trust Company, N.A. (1) |

| | |

4.2 | | Warrant No. A-1 in favor of J.P. Turner Partners, LP, dated August 7, 2008. (15) |

| | |

4.3 | | Form of Common Stock Purchase Warrant issued in August 2009.(16) |

| | |

4.4 | | Form of Common Stock Purchase Warrant issued in March 2010.(17) |

| | |

4.5 | | Form of Five-Year Common Stock Purchase Warrant issued in March 2011.(18) |

| | |

4.6 | | Form of Common Stock Purchase Warrant issued in April 2011.(19) |

| | |

4.7 | | Warrant No. 2012-1 in favor of Legend Securities, Inc. issued in February 2012.(4) |

| | |

4.8 | | Form of December 2012 Warrant.(20) |

| | |

4.9 | | Registration Rights Agreement, dated January 12, 2014, between Galena Biopharma, Inc. and each former owner of membership units of Mills Pharmaceuticals, LLC. (23) |

| | |

4.10 | | Form of warrants granted on May 8, 2013 under the Loan and Security Agreement set forth as Exhibit 10.25.(21)

|

| | |

10.1 | | Form of Contingent Value Rights Agreement among Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation), Computershare Trust Company, N.A., Computershare Inc., and Robert E Kennedy, dated April 13, 2011.(3) |

| | |

10.2 | | First Amendment to Contingent Value Rights Agreement among Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation), Computershare Trust Company, N.A., Computershare Inc., and Robert E Kennedy, dated February 15, 2012.(4) |

| | |

10.3 | | Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation) Amended and Restated 2007 Incentive Plan.*(8) |

| | |

10.4 | | Amendment to Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation) Amended and Restated 2007 Incentive Plan.*(9) |

| | |

10.5 | | Form of Incentive Stock Option.*(10) |

| | |

10.6 | | Form of Non-qualified Stock Option.*(10) |

| | |

|

| | | |

10.7 | | Patent and Technology License Agreement, dated September 11, 2006, by and among the Board of Regents of the University of Texas System, the University of Texas M.D. Anderson Cancer Center, the Henry M. Jackson Foundation for the Advancement of Military Medicine, Inc., and Apthera, Inc. (formerly Advanced Peptide Therapeutics, Inc.).+(5)) |

| | |

10.8 | | Amendment No. 1 to Patent and Technology License Agreement, dated December 21, 2007, by and among the Board of Regents of the University of Texas System, the University of Texas M.D. Anderson Cancer Center, the Henry M. Jackson Foundation for the Advancement of Military Medicine, Inc., and Apthera, Inc. (formerly Advanced Peptide Therapeutics, Inc.).(5) |

| | |

10.9 | | Amendment No. 2 to Patent and Technology License Agreement, dated September 3, 2008, by and among the Board of Regents of the University of Texas System, the University of Texas M.D. Anderson Cancer Center, the Henry M. Jackson Foundation for the Advancement of Military Medicine, Inc., and Apthera, Inc. (formerly Advanced Peptide Therapeutics, Inc.).(5) |

| | |

10.10 | | Amendment No. 3 to Patent and Technology License Agreement, dated July 8, 2009, by and among the Board of Regents of the University of Texas System, the University of Texas M.D. Anderson Cancer Center, the Henry M. Jackson Foundation for the Advancement of Military Medicine, Inc., and Apthera, Inc. (formerly Advanced Peptide Therapeutics, Inc.).(5) |

| | |

10.11 | | Amendment No. 4 to Patent and Technology License Agreement, dated February 11, 2010, by and among the Board of Regents of the University of Texas System, the University of Texas M.D. Anderson Cancer Center, the Henry M. Jackson Foundation for the Advancement of Military Medicine, Inc., and Apthera, Inc. (formerly Advanced Peptide Therapeutics, Inc.).+(5) |

| | |

10.12 | | Amendment No. 5 to Patent and Technology License Agreement, dated January 10, 2011, by and among the Board of Regents of the University of Texas System, the University of Texas M.D. Anderson Cancer Center, the Henry M. Jackson Foundation for the Advancement of Military Medicine, Inc., and Apthera, Inc. (formerly Advanced Peptide Therapeutics, Inc.).+(5) |

| | |

10.13 | | Scientific Advisory Agreement between Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation) and George E. Peoples, Ph.D., dated May 1, 2011.(6) |

| | |

10.14 | | Exclusive License Agreement, dated as of July 11, 2011, by and among The Henry M. Jackson Foundation for the Advancement of Military Medicine, Inc., Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation) and its wholly-owned subsidiary, Apthera, Inc.+(5) |

| | |

10.15 | | Agreement and Plan of Merger by and among Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation), Diamondback Acquisition Corp., Apthera, Inc. and Robert E. Kennedy, in his capacity as the Stockholder Representative, dated March 31, 2011.(7) |

| | |

10.16 | | Exclusive License Agreement, dated effective as of September 16, 2011, by and among The Henry M. Jackson Foundation for the Advancement of Military Medicine, Inc., Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation), The Board of Regents of the University of Texas System and The University of Texas M.D. Anderson Cancer Center.+(11) |

| | |

10.17 | | Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation) Employee Stock Purchase Plan.*(13) |

| | |

10.18 | | License Agreement, effective as of April 30, 2009, between Kwangdong Pharmaceutical Co., Ltd. and Apthera, Inc.+(4) |

| | |

10.19 | | Amendment No. 1 to License Agreement, dated as of January 13, 2012, by and among Apthera, Inc., Kwangdong Pharmaceutical Co., Ltd., and Galena Biopharma, Inc.(4) |

| | |

10.20 | | Amendment to Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation) Amended and Restated 2007 Incentive Plan.*(27) |

| | |

10.21 | | Amendment to Galena Biopharma, Inc. (formerly RXi Pharmaceuticals Corporation) Amended and Restated 2007 Incentive Plan.*(28) |

| | |

10.22 | | License and Supply Agreement, effective December 3, 2012, between Galena Biopharma, Inc. and ABIC Marketing Limited, a subsidiary of Teva Pharmaceuticals.+(6) |

| | |

10.23 | | Asset Purchase Agreement dated March 15, 2013 between Galena Biopharma, Inc. and Orexo AB.+(21) |

| | |

10.24 | | License Agreement dated March 15, 2013 between Galena Biopharma, Inc. and Orexo AB.(21) |

| | |

10.25 | | Loan and Security Agreement dated May 8, 2013 among Galena Biopharma, Inc., Apthera, Inc., Oxford Finance LLC and the Lenders listed on Schedule 1.1 thereto.(21) |

| | |

|

| | | |

10.26 | | Lease between Galena Biopharma, Inc. and Cameron Oregon properties LLC and Lucas Oregon Properties, LLC for Suite 270 in the Willamette Wharf Building at 4640 Macadam Avenue in Portland, Oregon dated April 25, 2013.(2) |

| | |

10.27 | | License and Development Agreement, dated January 13, 2014, between Galena Biopharma, Inc. and Dr. Reddy’s Laboratories, Ltd.+(23) |

| | |

10.28 | | Exclusive License Agreement, dated as of December 20, 2013, between Mills Pharmaceuticals, LLC and BioVascular, Inc.+(23) |

| | |

10.29 | | Employment letter agreement, effective May 1, 2014, between Galena Biopharma, Inc. and Ryan M. Dunlap.*(26) |

| | |

10.30 | | License and Supply Agreement dated as of July 17, 2014 between Galena Biopharma, Inc. and MonoSol Rx, LLC.+(25) |

| | |

10.31 | | Employment Agreement, dated September 16, 2014, between Galena Biopharma, Inc. and Mark W. Schwartz, Ph.D.*(24) |

| | |

10.32 | | Employment Agreement, dated July 28, 2014, between Galena Biopharma, Inc. and Margaret Kivinski.*(29) |

| | |

10.33 | | Purchase Agreement, dated as of November 18, 2014, by and between Galena Biopharma, Inc. and Lincoln Park Capital Fund, LLC.(30) |

| | |

14.1 | | Code of Ethics and Conduct.(14) |

| | |

21.1 | | Subsidiaries of the Registrant.(23) |

| | |

23.1 | | Consent of Moss Adams LLP, Independent Registered Public Accounting Firm.** |

| | |

23.2 | | Consent of BDO USA LLP, Independent Registered Public Accounting Firm.(32) |

| | |

31.1 | | Sarbanes-Oxley Act Section 302 Certification of Mark W. Schwartz, Ph.D.** |

| | |

31.2 | | Sarbanes-Oxley Act Section 302 Certification of Ryan M. Dunlap.** |

| | |

32.1 | | Sarbanes-Oxley Act Section 906 Certification of Mark W. Schwartz, Ph.D., and Ryan M. Dunlap.(32) |

| | |

| | |

101.INS | | XBRL Instance Document.(32) |

| | |

101.SCH | | XBRL Taxonomy Extension Schema.(32) |

| | |

101.CAL | | XBRL Taxonomy Extension Calculation.(32) |

| | |

101.DEF | | XBRL Taxonomy Extension Definition.(32) |

| | |

101.LAB | | XBRL Taxonomy Extension Label.(32) |

| | |

101.PRE | | XBRL Taxonomy Extension Presentation.(32) |

| | | |

101.PRE | | XBRL Taxonomy Extension Presentation.(32) | |

__________________________

| |

(1) | Previously filed as an Exhibit to the Company’s Form 8-K filed on September 13, 2013 (File No. 001-33958) and incorporated herein by reference. |

| |

(2) | Previously filed as an Exhibit to the Company’s Form 10-Q filed on August 9, 2013 (File No. 001-33958) and incorporated herein by reference. |

| |

(3) | Previously filed as an Exhibit to the Company’s Form 8-K filed on April 14, 2011 (File No. 001-33958) and incorporated by reference herein. |

| |

(4) | Previously filed as an Exhibit to the Company’s Form 10-K filed on March 28, 2012 (File No. 001-33958) and incorporated by reference herein. |

| |

(5) | Previously filed as an Exhibit to the Company’s Form 10-Q filed on August 15, 2011 (File No. 001-33958) and incorporated by reference herein. |

| |

(6) | Previously filed as an Exhibit to the Company’s Form 10-K filed on March 12, 2013 (File No. 001-33958) and incorporated by reference herein. |

| |

(7) | Previously filed as an Exhibit to the Company’s Form 8-K filed on April 5, 2011 (File No. 001-33958) and incorporated by reference herein. |

| |

(8) | Previously filed as Annex A to the Company’s Proxy Statement on Schedule 14A filed on April 23, 2010 (File No. 001-33958) and incorporated by reference herein. |

| |

(9) | Previously filed as Annex A to the Company’s Proxy Statement on Schedule 14A filed on May 31, 2011 (File No. 001-33958) and incorporated by reference herein. |

| |

(10) | Previously filed as an Exhibit to the Company’s Registration Statement on Form S-1 filed on October 30, 2007 (File No. 333-147009) and incorporated by reference herein. |

| |

(11) | Previously filed as an Exhibit to the Company’s Form 8-K filed on September 21, 2011 (File No. 001-33958) and incorporated by reference herein. |

| |

(12) | Previously filed as an Exhibit to the Company’s Form 8-K filed on September 26, 2011 (File No. 001-33958) and incorporated by reference herein. |

| |

(13) | Previously filed as Annex B to the Company's Proxy Statement on Schedule 14A, filed on April 23, 2010 (File No. 001-33958) and incorporated by reference herein. |

| |

(14) | Previously filed as an Exhibit to the Company’s Form 10-K filed on April 15, 2008 (File No. 001-33958) and incorporated by reference herein. |

| |

(15) | Previously filed as an Exhibit to the Company’s Form 10-Q filed on November 14, 2008 (File No. 001-33958) and incorporated by reference herein. |

| |

(16) | Previously filed as an Exhibit to the Company’s Form 8-K filed on July 31, 2009 (File No. 001-33958) and incorporated by reference herein. |

| |

(17) | Previously filed as an Exhibit to the Company’s Form 8-K filed on March 23, 2010 (File No. 001-33958) and incorporated by reference herein. |

| |

(18) | Previously filed as an Exhibit to the Company’s Form 8-K filed on March 1, 2011 (File No. 001-33958) and incorporated by reference herein. |

| |

(19) | Previously filed as an Exhibit to the Company’s Form 8-K filed on April 15, 2011 (File No. 001-33958) and incorporated by reference herein. |

| |

(20) | Previously filed as an Exhibit to the Company’s Form 8-K filed on December 19, 2012 (File No. 001-33958) and incorporated by reference herein. |

| |

(21) | Previously filed as an Exhibit to the Company’s Form 10-Q filed on May 9, 2013 (File No. 001-33958) and incorporated by reference herein. |

| |

(22) | Previously filed as an Exhibit to the Company’s Form 8-K filed on April 5, 2012 (File No. 001-33958) and incorporated by reference herein. |

| |

(23) | Previously filed as an Exhibit to the Company’s Form 10-K filed on March 17, 2014 (File No. 001-33958) and incorporated by reference herein. |

| |

(24) | Previously filed as an Exhibit to the Company’s Form 8-K filed on September 18, 2014 (File No. 001-33958) and incorporated by reference herein. |

| |

(25) | Previously filed as an Exhibit to the Company’s Form 10-Q filed on August 11, 2014 (File No. 001-33958) and incorporated by reference herein. |

| |

(26) | Previously filed as an Exhibit to the Company’s Form 10-Q filed on May 6, 2014 (File No. 001-33958) and incorporated by reference herein. |

| |

(27) | Previously filed as Annex A to the Company’s Proxy Statement on Schedule 14A filed on April 30, 2012 (File No. 001-33958) and incorporated by reference herein. |

| |

(28) | Previously filed as Annex B to the Company’s Proxy Statement on Schedule 14A filed on April 29, 2013 (File No. 001-33958) and incorporated by reference herein. |

| |

(29) | Previously filed as an Exhibit to the Company’s Form 10-Q filed on November 5, 2014 (File No. 001-33958) and incorporated by reference herein. |

| |

(30) | Previously filed as an Exhibit to the Company’s Form 8-K filed on November 20, 2014 (File No. 001-33958) and incorporated by reference herein. |

| |

(31) | Previously filed as an Exhibit to the Company’s Registration Statement on Form S-3 filed on May 24, 2013 (File No. 333-188849) and incorporated by reference herein. |

| |

(32) | Previously filed as an Exhibit to the Company’s Form 10-K filed on March 5, 2015 (File No. 001-33958) and incorporated by reference herein. |

| |

* | Indicates a management contract or compensatory plan or arrangement. |

| |

+ | This exhibit was filed separately with the Commission pursuant to an application for confidential treatment. The confidential portions of the exhibit have been omitted and have been marked by an asterisk. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | |

| GALENA BIOPHARMA, INC. |

| | | |

| By: | | /s/ Mark W. Schwartz |

| | | |

| | | Mark W. Schwartz, Ph.D. |

| | | President and Chief Executive Officer |

| | | |

| | | Date: March 10, 2015 |

| | | |

| By: | | /s/ Ryan M. Dunlap |

| | | |

| | | Ryan M. Dunlap |

| | | Vice President, Chief Financial Officer |

| | | |

| | | Date: March 10, 2015 |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in the Registration Statements on Form S-3 (No. 333-174076, 333-188847, 333-188849, 333-182505, 333-181589, 333-195260 and 333199517), Form S-3MEF (No. 333-185526) and Form S-8 (No. 333-151154, 333-153847, 333-175763, 333-174819, 333-183300, 333-182578 and 333-190540) of our report dated March 5, 2015, relating to the consolidated financial statements of Galena Biopharma, Inc., and the effectiveness of internal control over financial reporting of Galena Biopharma, Inc., appearing in this Annual Report (Form 10-K) for the year ended December 31, 2014.

/s/ Moss Adams

Portland, Oregon

March 5, 2015

Exhibit 31.1

CERTIFICATION OF CHIEF EXECUTIVE OFFICER

PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Mark W. Schwartz, certify that:

1. I have reviewed this Annual Report on Form 10-K/A of Galena Biopharma, Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

Dated: March 10, 2015

|

| |

| /s/ Mark W. Schwartz |

| Mark W. Schwartz |

| President and Chief Executive Officer |

Exhibit 31.2

CERTIFICATION OF PRINCIPAL FINANCIAL AND ACCOUNTING OFFICER

PURSUANT TO SECTION 302 OF THE SARBANES-OXLEY ACT OF 2002

I, Ryan M. Dunlap, certify that:

1. I have reviewed this Annual Report on Form 10-K/A of Galena Biopharma, Inc.;

2. Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4. The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a) Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b) Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c) Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d) Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5. The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a) All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

Dated: March 10, 2015

|

| |

| /s/ Ryan M. Dunlap |

| Ryan M. Dunlap |

| Vice President, Chief Financial Officer |

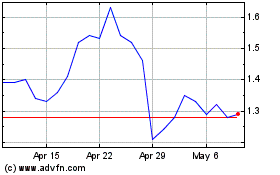

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

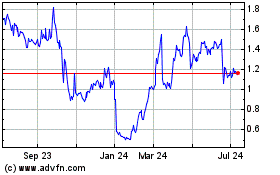

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2023 to Apr 2024