Saudi Arabia and UAE together imported more than Western Europe

combined; Russia exported $10 billion worth of defence equipment in

2014

IHS Inc. (NYSE:IHS), the leading global source of critical

information and insight, today released its annual Global Defence

Trade Report, which examines trends in the global defence market

across 65 countries and is based upon 40,000 defence programme

deliveries from IHS Aerospace, Defence & Security’s Markets

Forecast database.

In 2014, global defence trade increased for the sixth straight

year to $64.4 billion, up from $56.8 billion. “Defence trade rose

by a landmark 13.4 percent over the past year,” said Ben Moores,

senior defence analyst at IHS Aerospace, Defence & Security.

“This record figure has been driven by unparalleled demand from the

emerging economies for military aircraft and an escalation of

regional tensions in the Middle East and Asia Pacific.”

Highlights from the IHS Global Defence Trade Report:

- Saudi Arabia topped India to become the

largest defence market for US;

- The US supplied one-third of all

exports and was the main beneficiary of growth;

- Saudi Arabia and UAE imported more than

all of Western Europe;

- China is now the third largest importer

of defence equipment, up from fifth;

- South Korea is the rising star of Asia

Pacific exports;

- Despite a record 2014, Russian defence

exports are set to drop;

- Saudi Arabia, Indonesia, Sweden and

Nigeria are the UK’s top trading partners.

One out of every seven dollars spent on defence imports will

be spent by Saudi Arabia

In 2014, Saudi Arabia replaced India as the largest importer of

defence equipment worldwide and took the top spot as the number one

trading partner for the US.

“Growth in Saudi Arabia has been dramatic and, based on previous

orders, these numbers are not going to slow down,” Moores said.

Already the largest importer of weapons, Saudi Arabian imports

increased by 54 percent between 2013 and 2014 and, based on planned

deliveries, imports will increase by 52 percent to $9.8 billion in

2015. One out of every seven dollars spent on defence imports in

2015 will be spent by Saudi Arabia.

$110 billion in opportunities in Middle East

“When we look at the likely export addressable opportunities at

a global level for the defence industry, five of the 10 leading

countries are from the Middle East,” Moores said. “The Middle East

is the biggest regional market and there are $110 billion in

opportunities in coming decade.”

Saudi Arabia and UAE together imported $8.6 billion in defence

systems in 2014, more than the imports of Western Europe combined.

The biggest beneficiary of the strong Middle Eastern market remains

the US, with $8.4 billion worth of Middle Eastern exports in 2014,

compared to $6 billion in 2013.

The second tier of exporters to the Middle East is led by the

United Kingdom with $1.9 billion, the Russian Federation with $1.5

billion, France with $1.3 billion and Germany with $1 billion.

China and South Korea stand out in Asia Pacific

In 2014, China jumped from the world’s fifth to the third

largest defence importer.

“China continues to require military aerospace assistance from

Russia and its total defence procurement budget will continue to

rise very quickly,” said Paul Burton, Director of Defence Industry

& Budgets at IHS Aerospace, Defence & Security.

IHS forecasts that fast-emerging exporter South Korea will

become a regional leader in the coming decade. Some $35 billion in

new contracts will come online within the next decade and the South

Korean defence industry is forecast to win $6 billion in new

business within East Asia. South Korea looks set to be the rising

star of the Asia Pacific defence industry.

Russia had record year, but a perfect storm awaits

Russia exported $10 billion in 2014, an increase of 9 percent

from 2013. China was the largest recipient of equipment ($2.3

billion) followed by India ($1.7 billion), and Venezuela and

Vietnam (each $1 billion).

After years of sales growth, Russian industry exports now face

challenging times. A drop off in exports is forecast for 2015 as

major programs draw to a close, a trend that could be accelerated

by sanctions.

Furthermore, falls in the oil price are set to have a

devastating impact on some lead Russian clients who are vulnerable

to low oil prices, such as Venezuela and Iran. This problem is

compounded as Chinese industry becomes increasingly less dependent

on Russian technology.

The Data

Top Defence Importers Top

Defence Importers 2013

2014 1. India 1. Saudi Arabia 2.

Saudi Arabia 2. India 3. UAE

3. China 4. Taiwan

4. UAE 5. China 5. Taiwan 6. Indonesia

6. Australia 7. South Korea

7. South Korea 8. Egypt

8. Indonesia 9. Australia 9.

Turkey 10. Singapore 10. Pakistan

Top Defence Exporters

Top Defence Exporters 2013

2014 1. United States

1.United States 2. Russian Federation

2. Russian Federation 3. France 3.

France 4. UK 4. UK 5. Germany

5. Germany 6. Israel

6. Italy 7. China 7. Israel 8.

Italy 8. China 9. Sweden

9. Spain 10. Canada 10.

Canada

Top Company

Exporters Top Company Exporters 2013

2014 1. Boeing

1. Boeing 2. Raytheon 2.

Lockheed Martin 3. Lockheed Martin 3.

Raytheon 4. Airbus Group 4. Airbus

Group 5. UAC 5. UAC 6. BAE Systems

6. Russian Helicopters 7. Thales

7. United Tech Corp 8. United Tech Corp

8. BAE Systems 9. UralvagonZavod

9. Thales 10. Russian Helicopters

10. Finmeccanica

About the Global Defence Trade Report

The report was created using the IHS Aerospace, Defence &

Security Markets Forecast database, a publicly sourced global

forecasting tool that tracks current and future programs from the

bottom up, looking at deliveries and funds released to industry

rather than budgets. The study covers production, R&D, logistic

support and service revenues where there is an export.

The entire market is covered except for munitions and small

arms. Anything under 57mm caliber has not been included in this

study. The study only tracked programs with a primarily military

function, removing homeland security and Intelligence programs.

Constant US dollars are used as the study’s base. For additional

information visit: www.ihs.com/jmf

About IHS

(www.ihs.com)

IHS (NYSE:IHS) is the leading source of insight, analytics and

expertise in critical areas that shape today’s business landscape.

Businesses and governments in more than 150 countries around the

globe rely on the comprehensive content, expert independent

analysis and flexible delivery methods of IHS to make high-impact

decisions and develop strategies with speed and confidence. IHS has

been in business since 1959 and became a publicly traded company on

the New York Stock Exchange in 2005. Headquartered in Englewood,

Colorado, USA, IHS is committed to sustainable, profitable growth

and employs about 8,800 people in 32 countries around the

world.

IHS is a registered trademark of IHS Inc. All other company and

product names may be trademarks of their respective owners. © 2015

IHS Inc. All rights reserved.

Photos/Multimedia Gallery Available:

http://www.businesswire.com/multimedia/home/20150307005019/en/

News Media Contact:IHS Inc.Amanda Russo+44 208 276 4727 |

+44 781 460 3420Amanda.Russo@ihs.comorIHS Inc.Press Team+1 303 305

8021press@ihs.com@IHS_News

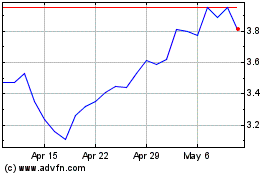

IHS (NYSE:IHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

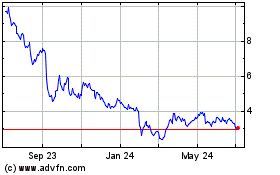

IHS (NYSE:IHS)

Historical Stock Chart

From Apr 2023 to Apr 2024