UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 3, 2015

Coeur Mining, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-8641 |

|

82-0109423 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

104 S. Michigan Ave., Suite 900

Chicago, Illinois 60603

(Address of Principal Executive Offices)

(312) 489-5800

(Registrant’s telephone number, including area code)

N/A

(Former Name or

Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2 below):

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

Amendment to Agreement and Plan of Merger

On

March 3, 2015, Coeur Mining, Inc. (“Coeur”), Hollywood Merger Sub, Inc. (“Merger Sub”), a wholly-owned subsidiary of Coeur, Paramount Gold and Silver Corp. (“Paramount”) and Paramount Nevada Gold Corp., a

wholly-owned subsidiary of Paramount (“SpinCo”), entered into an Amendment to Agreement and Plan of Merger (the “Amendment”) to the previously disclosed Agreement and Plan of Merger, dated as of December 16, 2014 (the

“Merger Agreement”), by and among Coeur, Merger Sub, Paramount and SpinCo. Pursuant to the Merger Agreement, Merger Sub will merge with and into Paramount, with Paramount surviving as the wholly-owned subsidiary of Coeur (the

“Merger”). Pursuant to the Amendment, the condition to closing that each of Coeur and Paramount shall have received a written opinion from their respective counsel to the effect that the Merger will qualify as a “reorganization”

within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), was amended so that the condition now requires that the parties shall have received a written opinion to the effect that the Merger

should qualify as a “reorganization” within the meaning of Section 368(a) of the Code. In addition, the maturity of the promissory note providing for a loan from Coeur to Paramount at the closing of the Merger was increased from one

year to five years. Other than expressly modified pursuant to the Amendment, the Merger Agreement remains in full force and effect.

The foregoing

description of the Amendment is not a complete description of all of the parties’ rights and obligations under the Merger Agreement or the Amendment. The above description is subject to, and qualified in its entirety by reference to the Merger

Agreement, which was filed as Exhibit 2.1 to the Current Report on Form 8-K filed with the United States Securities and Exchange Commission (the “SEC”) by Coeur on December 18, 2014, and the Amendment, which is filed as Exhibit 2.1

hereto and is incorporated herein by reference.

Additional Information and Where to Find It

The proposed transaction will be submitted to Coeur’s stockholders for their consideration. In connection with the proposed transaction, Coeur will file

with the SEC a registration statement on Form S-4 that will include a joint proxy statement of Coeur and Paramount that also constitute a prospectus of Coeur. In addition, SpinCo, a subsidiary of Paramount, will file a registration statement on Form

S-1 that will constitute a prospectus of SpinCo. Investors and security holders are urged to read the joint proxy statement and registration statements/prospectuses and any other relevant documents filed with the SEC, because they contain important

information. Investors and security holders may obtain a free copy of the joint proxy statement/prospectus and other documents that Coeur and Paramount filed with the SEC at the SEC’s website at www.sec.gov. In addition, these documents may be

obtained from Coeur free of charge by directing a request to investors@coeur.com, or from Paramount free of charge by directing a request to ctheo@paramountgold.com.

Participants in Solicitation

Coeur, Paramount, and

certain of their respective directors and executive officers may be deemed to be participants in the proposed transaction under the rules of the SEC. Investors and security holders may obtain information regarding the names, affiliations and

interests of Coeur’s directors and executive officers in Coeur’s Annual Report on Form 10-K for the year ended December 31, 2014, which was filed with the SEC on February 20, 2015, and its proxy statement for its 2014 Annual

Meeting, which was filed with the SEC on March 31, 2014. Information regarding the names, affiliations and interests of Paramount’s directors and executive officers may be found in Paramount’s Annual Report on Form 10-K for the year

ended June 30, 2014, which was filed with the SEC on September 9, 2014, and its definitive proxy statement for its 2014 Annual Meeting, which was filed with the SEC on October 24, 2014. These documents can be obtained free of charge

from the sources listed above. Additional information regarding the interests of these individuals will also be included in the joint proxy statement/prospectus regarding the proposed transaction.

Non-Solicitation

A registration statement relating to

the securities to be issued by Coeur in the proposed transaction will be filed with the SEC, and Coeur will not issue, sell or accept offers to buy such securities prior to the time such registration

statement becomes effective. This communication shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of such securities, in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior to appropriate registration or qualification under the securities laws of such jurisdiction.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

No. |

|

Description |

|

|

| Exhibit 2.1 |

|

Amendment to Agreement and Plan of Merger, dated as of March 3, 2015, among Coeur Mining, Inc., Hollywood Merger Sub, Inc., Paramount Gold and Silver Corp. and Paramount Nevada Gold Corp. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

COEUR MINING, INC. |

|

|

|

|

| Date: March 6, 2015 |

|

|

|

By: |

|

/s/ Peter C. Mitchell |

|

|

|

|

Name: |

|

Peter C. Mitchell |

|

|

|

|

Title: |

|

Senior Vice President and Chief Financial Officer |

Exhibit Index

|

|

|

| Exhibit

No. |

|

Description |

|

|

| Exhibit 2.1 |

|

Amendment to Agreement and Plan of Merger, dated as of March 3, 2015, among Coeur Mining, Inc., Hollywood Merger Sub, Inc., Paramount Gold and Silver Corp. and Paramount Nevada Gold Corp. |

Exhibit 2.1

AMENDMENT TO AGREEMENT AND PLAN OF MERGER (this “Amendment”), dated as of March 3, 2015, between COEUR MINING,

INC., a Delaware corporation (“Parent”), HOLLYWOOD MERGER SUB, INC., a Delaware corporation and a wholly-owned Subsidiary of Parent (“Merger Sub”), PARAMOUNT GOLD AND SILVER CORP., a Delaware corporation (the

“Company”), and PARAMOUNT NEVADA GOLD CORP., a British Columbia corporation and a wholly-owned Subsidiary of the Company (“SpinCo”).

RECITALS

WHEREAS,

reference is made to the Agreement and Plan of Merger, dated December 16, 2014, among Parent, Merger Sub, the Company and SpinCo (the “Merger Agreement”; terms used but not defined herein shall have the meanings assigned to

them in the Merger Agreement);

WHEREAS, pursuant to Section 7.5 of the Merger Agreement, this Merger Agreement may be amended,

modified or supplemented at any time prior to the Effective Time;

WHEREAS, the Effective Time has not yet occurred;

WHEREAS, the parties desire to make certain amendments to the Merger Agreement as described in this Amendment;

NOW, THEREFORE, in consideration of the premises, and of the covenants and agreements contained herein, and intending to be legally bound

hereby, Parent, Merger Sub, the Company and SpinCo hereby agree as follows:

AGREEMENT

SECTION 1.1 Amendment to Section 6.2. Section 6.2(f) of the Merger Agreement is hereby replaced in its entirety by the

following:

“(f) Tax Opinion. Parent shall have received two written tax opinions of Gibson, Dunn & Crutcher LLP, tax

counsel to Parent (or such other nationally recognized tax counsel reasonably satisfactory to Parent), one dated as of the date the Form S-4 is declared effective and the second dated as of the Closing Date, in each case based on the facts,

representations, assumptions and exclusions set forth or described therein, to the effect that the Merger should qualify as a “reorganization” within the meaning of Section 368(a) of the Code. In rendering each such opinion, such

counsel shall be entitled to rely upon representation letters from each of Parent and the Company, in each case, in form and substance reasonably satisfactory to such counsel.”

SECTION 1.2 Amendment to Section 6.3. Section 6.3(e) of the Merger Agreement is hereby replaced in its entirety by the

following:

“(e) Tax Opinion. The Company shall have received two written tax opinions of LeClairRyan, A Professional

Corporation, tax counsel to the Company (or such other nationally recognized tax counsel reasonably satisfactory to the Company), one dated as of the date the Form S-4 is declared effective and the second dated as of the Closing Date, in each case

based on the facts, representations, assumptions and exclusions set forth or described therein, to the effect that the Merger should qualify as a “reorganization” within the meaning of Section 368(a) of the Code. In rendering each

such opinion, such counsel shall be entitled to rely upon representation letters from each of the Company and Parent, in each case, in form and substance reasonably satisfactory to such counsel.”

SECTION 1.3 Amendment to Section 5.8. Section 5.8 of the Merger Agreement is hereby

amended by adding the following as a new paragraph (g):

“(g) Parent, Merger Sub, and the Company hereby agree that they shall treat

the Merger as a reorganization within the meaning of Section 368(a) of the Code, unless otherwise required by applicable Law.”

SECTION 1.4 Amendment to Exhibit A. Section 1 of Exhibit A to the Merger Agreement (Form of Promissory Note) is hereby replaced in

its entirety by the following:

“1. Maturity. The principal of this Note, together with accrued interest and any fees, expenses

or other amounts payable under this Note, shall be due and payable in full on the five-year anniversary of the date hereof (the “Maturity Date”); provided, however, that earlier repayment in full of this Note may be

required upon or after the occurrence of an Event of Default as provided in Sections 6 and 7. Notwithstanding anything to the contrary in this Note (if anything), this Note shall be pre-payable in whole or in part from time to time or at any time at

the option of the Borrower.”

SECTION 1.5 No Other Changes. Except as set forth above in Sections 1.1 through 1.4, all other

terms and conditions of the Merger Agreement shall remain in full force and effect, and are not modified hereby in any respect.

SECTION

1.6 Entire Agreement. This Amendment constitutes the entire agreement, and supersedes all prior written agreements, arrangements, communications and understandings and all prior and contemporaneous oral agreements, arrangements,

communications and understandings among the parties with respect to the subject matter hereof.

SECTION 1.7 Governing Law. This

Amendment and all disputes or controversies arising out of or relating to this Agreement or the transactions contemplated hereby shall be governed by, and construed in accordance with, the internal laws of the State of Delaware, without regard to

the laws of any other jurisdiction that might be applied because of the conflicts of laws principles of the State of Delaware.

SECTION

1.8 Waiver of Jury Trial. EACH OF THE PARTIES TO THIS AMENDMENT HEREBY IRREVOCABLY WAIVES ALL RIGHT TO A TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM ARISING OUT OF OR RELATING TO THIS AMENDMENT OR THE TRANSACTIONS CONTEMPLATED

HEREBY.

SECTION 1.9 Counterparts. This Amendment may be executed in two or more counterparts, all of which shall be considered one

and the same instrument and shall become effective when one or more counterparts have been signed by each of the parties and delivered to the other party. Delivery of an executed counterpart of this Amendment by facsimile or other electronic image

scan transmission shall be effective as delivery of an original counterpart hereof.

[The remainder of this page is intentionally left

blank; signature page follows.]

2

IN WITNESS WHEREOF, the parties have caused this Amendment to be executed as of the date first

written above by their respective officers thereunto duly authorized.

|

|

|

|

|

| PARAMOUNT GOLD AND SILVER CORP., |

|

|

| By: |

|

/s/ Christopher Crupi |

|

|

Name: |

|

Christopher Crupi |

|

|

Title: |

|

President and Chief Executive Officer |

|

| PARAMOUNT NEVADA GOLD CORP., |

|

|

| By: |

|

/s/ Christopher Crupi |

|

|

Name: |

|

Christopher Crupi |

|

|

Title: |

|

President and Chief Executive Officer |

|

| COEUR MINING, INC., |

|

|

| By: |

|

/s/ Mitchell J. Krebs |

|

|

Name: |

|

Mitchell J. Krebs |

|

|

Title: |

|

President and Chief Executive Officer |

|

| HOLLYWOOD MERGER SUB, INC., |

|

|

| By: |

|

/s/ Mitchell J. Krebs |

|

|

Name: |

|

Mitchell J. Krebs |

|

|

Title: |

|

President |

[SIGNATURE PAGE TO AMENDMENT

TO MERGER AGREEMENT]

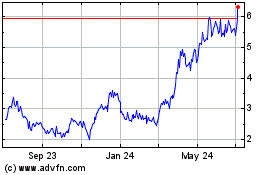

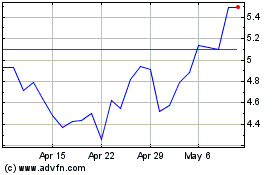

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Apr 2023 to Apr 2024