Liquidmetal® Technologies, Inc. (OTCQB: LQMT), the

leading developer of amorphous alloys and composites, reported

results for the fiscal year ended December 31, 2014.

FY 2014 Operational Highlights

- Introduced a Certified Liquidmetal

Alloy from Materion

- Paul Hauck joined the Company as VP of

Sales

- Settled arbitration with Visser

Precision Cast in the best interest of shareholders

- Set up a $30M Equity Line of

Credit

- Opened up the Liquidmetal Manufacturing

Center of Excellence in Rancho Santa Margarita, Ca.

- Booked the Company’s first production

order with Miltner Adams

Management Commentary

“2014 represented another significant milestone in the evolution

of Liquidmetal as we made the shift from a pure technology company

to a full-service Sales, Marketing, Engineering, and Manufacturing

supplier with the opening of our Manufacturing Center of Excellence

and the acceptance of our first commercial production order from

the Miltner Adams company for a custom-designed knife.” Said Tom

Steipp, President and CEO.

2014 Financial Summary

In 2014, the company generated $603 thousand in revenue as it

continued to focus on the development of prototype and commercial

parts for its customers and partnering with licensees on the

development of the Company’s technology and production

processes.

Selling, marketing, general and administrative expense was $7.5

million in 2014 compared to $5.2 million in 2013. The increase was

primarily due to additional compensation expenses associated with

new personnel to support our sales and business development efforts

as we continue to aggressively expand our sales and marketing

presence within our current markets.

Research and development expense was $1.6 million in 2014

compared to $1.2 million in 2013. The increase from the prior year

was mainly due to additional headcount to support the build out of

the Company’s material and process development efforts.

Cash totaled $10.0 million at December 31, 2014, as compared to

$2.1 million at December 31, 2013.

Conference Call

Liquidmetal Technologies management will hold a conference call

later today (March 4th, 2015) to discuss these results. The

Company’s President and CEO Tom Steipp and CFO Tony Chung will host

the call starting at 4:30 p.m. Eastern time. A question and answer

session will follow management’s presentation.

Date: Wednesday, March 4th, 2015Time: 4:30

p.m. Eastern time (1:30 p.m. Pacific time)Dial-In Number:

1-888-481-2844International: 1-719-457-1035Conference ID:

3705802

The conference call will be broadcast simultaneously and

available for replay via the investor section of the Company's

website at www.liquidmetal.com.

Please call the conference telephone number 5-10 minutes prior

to the start time. An operator will register your name and

organization.

A replay of the call will be available after 7:30 p.m. Eastern

time on the same day through March 11th, 2015.

Toll-Free Replay Number:

1-888-203-1112International Replay Number: 1-719-457-0820Replay PIN

Number: 3705802

About Liquidmetal Technologies

Rancho Santa Margarita, California-based Liquidmetal

Technologies, Inc. is the leading developer of bulk alloys and

composites that utilize the performance advantages offered by

amorphous alloy technology. Amorphous alloys are unique materials

that are distinguished by their ability to retain a random

structure when they solidify, in contrast to the crystalline atomic

structure that forms in ordinary metals and alloys. Liquidmetal

Technologies is the first company to produce amorphous alloys in

commercially viable bulk form, enabling significant improvements in

products across a wide array of industries. For more information,

go to www.liquidmetal.com.

Forward-Looking Statement

This press release contains "forward-looking statements,"

including but not limited to statements regarding the advantages of

Liquidmetal's amorphous alloy technology, scheduled manufacturing

of customer parts and other statements associated with

Liquidmetal's technology and operations. These statements are based

on current expectations of future events. If underlying assumptions

prove inaccurate or unknown risks or uncertainties materialize,

actual results could vary materially from Liquidmetal's

expectations and projections. Risks and uncertainties include,

among other things; customer adoption of Liquidmetal's technologies

and successful integration of those technologies into customer

products; potential difficulties or delays in manufacturing

products incorporating Liquidmetal's technologies; Liquidmetal's

ability to fund its current and anticipated operations; the ability

of third party suppliers and manufacturers to meet customer product

requirements; general industry conditions; general economic

conditions; and governmental laws and regulations affecting

Liquidmetal's operations. Additional information concerning these

and other risk factors can be found in Liquidmetal's public

periodic filings with the U.S. Securities and Exchange Commission,

including the discussion under the heading "Risk Factors" in

Liquidmetal's 2014 Annual Report on Form 10-K.

LIQUIDMETAL TECHNOLOGIES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS (in thousands, except par

value and share data) December 31,

December 31, 2014

2013 ASSETS

Current assets: Cash $ 10,009 $ 2,062 Trade accounts

receivable, net of allowance for doubtful accounts 83 215 Prepaid

expenses and other current assets 374 412

Total current assets $ 10,466 $ 2,689 Property and

equipment, net 1,118 249 Patents and trademarks, net 669 764 Other

assets 31 401

Total assets $

12,284 $ 4,103

LIABILITIES AND

SHAREHOLDERS' EQUITY (DEFICIT)

Current liabilities: Accounts payable 155 361 Accrued

liabilities 705 710 Convertible note, net of debt discount - -

Embedded conversion feature liability - -

Total current liabilities $ 860 $ 1,071

Long-term liabilities Warrant liabilities 2,005 4,921 Other

long-term liabilities 856 856

Total

liabilities $ 3,721 $ 6,848 Shareholders' equity

(deficit): Preferred Stock, $0.001 par value; 10,000,000 shares

authorized; 0 shares issued and outstanding at December 31, 2014

and December 31, 2013, respectively - - Common stock, $0.001 par

value; 700,000,000 shares authorized; 464,482,819 and 375,707,190

shares issued and outstanding at December 31, 2014 and December 31,

2013, respectively 464 376 Warrants 18,179 18,179 Additional

paid-in capital 200,610 182,832 Accumulated deficit (210,636 )

(204,090 ) Non-controlling interest in subsidiary (54 )

(42 )

Total shareholders' equity (deficit) $ 8,563 $

(2,745 )

Total liabilities and shareholders'

equity (deficit) $ 12,284 $ 4,103

LIQUIDMETAL TECHNOLOGIES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS and COMPREHENSIVE LOSS

(in thousands, except share and per share data)

Years Ended December 31,

2014

2013 Revenue Products $ 565 $

1,007 Licensing and royalties 38 19

Total revenue 603 1,026 Cost of revenue 483

774

Gross margin 120 252

Operating expenses Selling, marketing, general and administrative

7,463 5,157 Research and development 1,596

1,156

Total operating expenses 9,059

6,313

Operating loss (8,939 ) (6,061 )

Change in value of warrants, gain (loss) 2,700 (2,155 ) Change in

value of embedded conversion feature liability, gain - 621 Debt

discount amortization expense (373 ) (6,504 ) Other income 30 -

Interest expense - (245 ) Interest income 24 5 Gain on

extinguishment of debt (Note 10) - 91

Loss before income taxes (6,558 ) (14,248 )

Income taxes - -

Net loss and

comprehensive loss (6,558 ) (14,248 ) Net loss

attributable to non-controlling interest 12 42

Net loss and comprehensive loss attributable to

Liquidmetal Technologies shareholders (6,546 )

(14,206 ) Per common share basic and diluted:

Net loss per common share attributable to Liquidmetal Technologies

shareholders, basic $ (0.01 ) $ (0.04 ) Net loss per common

share attributable to Liquidmetal Technologies shareholders,

diluted $ (0.01 ) $ (0.04 ) Number of weighted average

shares - basic 441,439,018 341,451,559

Number of weighted average shares - diluted 441,439,018

341,451,559

Liquidmetal Technologies, Inc.Otis BuchananMedia

Relations949-635-2120otis.buchanan@liquidmetal.com

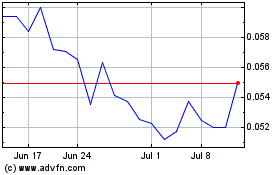

Liquidmetal Technologies (QB) (USOTC:LQMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

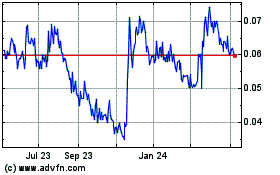

Liquidmetal Technologies (QB) (USOTC:LQMT)

Historical Stock Chart

From Apr 2023 to Apr 2024