UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 3, 2015

CHENIERE ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-16383 |

|

95-4352386 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 700 Milam Street

Suite 1900 Houston,

Texas |

|

77002 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (713) 375-5000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

On March 3, 2015, Cheniere Energy, Inc. issued a press

release announcing the pricing of an offering of its 4.25% Convertible Senior Notes due 2045. A copy of the press release is attached as Exhibit 99.1 to this report and incorporated herein by reference.

The information included in this Item 7.01 of this Current Report on Form 8-K shall not be deemed “filed” under the Securities

Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as may be expressly set forth by specific reference to this Item 7.01 in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

d) Exhibits

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 23.1 |

|

Consent of KPMG LLP. |

|

|

| 99.1 |

|

Press Release, dated March 3, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

CHENIERE ENERGY, INC. |

|

|

|

|

|

| Date: |

|

March 3, 2015 |

|

|

|

By: |

|

/s/ Michael J. Wortley |

|

|

|

|

|

|

Name: |

|

Michael J. Wortley |

|

|

|

|

|

|

Title: |

|

Senior Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 23.1 |

|

Consent of KPMG LLP. |

|

|

| 99.1 |

|

Press Release, dated March 3, 2015. |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

The Board of Directors and Stockholders

Cheniere Energy, Inc.:

We consent to the reference to our firm under the heading “Experts” in the registration statement (No. 333-181190) on Form S-3 and prospectus

supplement related to the registration of Convertible Senior Notes due 2045.

/s/ KPMG LLP

Houston, Texas

March 3, 2015

Exhibit 99.1

CHENIERE ENERGY, INC. NEWS RELEASE

Cheniere Announces Pricing of Registered Direct Offering of $625 Million of Convertible Notes

Houston, Texas – March 3, 2015 - Cheniere Energy, Inc. (“Cheniere”) (NYSE MKT: LNG) announced today that it has priced an offering

of Cheniere’s 4.25% Convertible Senior Notes due 2045 (the “Convertible Notes”) through an SEC registered direct offering. The aggregate principal amount of the offering was $625 million. The Convertible Notes will bear interest at a

rate of 4.25% per annum, paid semi-annually in arrears, and will mature on March 15, 2045. Prior to December 15, 2044, the Convertible Notes will be convertible upon the occurrence of certain conditions, and on and after such date

will become freely convertible. The Convertible Notes will be convertible into the common stock of Cheniere at an initial conversion price of $138.38 per share, which represents approximately 170% of the last reported sale price of the common stock

of Cheniere on Tuesday, March 3, 2015. Under certain conditions, Cheniere may have the ability to terminate the conversion rights of all or part of the Convertible Notes. In addition, after March 15, 2020, Cheniere may elect to redeem all

or part of the notes at a redemption price equal to the accreted amount of the notes to be redeemed, plus any accrued and unpaid interest up to but excluding the redemption date.

The net proceeds to Cheniere from the offering of the Convertible Notes, net of any original issue discount, are expected to be approximately $500 million,

before transaction fees and expenses. The net proceeds will be used by Cheniere for general corporate purposes.

Closing is expected to occur

March 9, 2015 subject to customary closing conditions. Concurrently with closing, Cheniere will have entered into a base indenture and a supplemental indenture pursuant to which the Notes will be issued.

Lazard Frères & Co. LLC acted as placement agent in connection with the offering of the Convertible Notes.

About Cheniere Energy, Inc.

Cheniere Energy, Inc. is a

Houston-based energy company primarily engaged in LNG-related businesses, and owns and operates the Sabine Pass LNG terminal and Creole Trail Pipeline in Louisiana. Cheniere is pursuing related business opportunities both upstream and downstream of

the Sabine Pass LNG terminal. Through its subsidiary, Cheniere Energy Partners, L.P., Cheniere is developing a liquefaction project at the Sabine Pass LNG terminal adjacent to the existing regasification facilities for up to six Trains, each of

which is expected to have a nominal production capacity of approximately 4.5 mtpa. Construction has begun on Trains 1 through 4 at the Sabine Pass Liquefaction Project. Cheniere has also initiated a project to develop liquefaction facilities near

Corpus Christi, Texas. The Corpus Christi Liquefaction Project is being designed for up to three Trains, with expected aggregate nominal production capacity of approximately 13.5 mtpa of LNG, three LNG storage tanks with capacity of approximately

10.1 Bcfe and two LNG carrier docks. Commencement of construction for the Corpus Christi Liquefaction Project is subject, but not limited, to obtaining regulatory approvals, entering into long-term customer contracts sufficient to underpin financing

of the project, obtaining financing, and Cheniere making a final investment decision. Cheniere believes that LNG exports from the Corpus Christi Liquefaction Project could commence as early as 2018.

This press release contains certain statements that may include “forward-looking statements” within the meanings of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are “forward-looking statements.” Included among “forward-looking

statements” are, among other things, statements regarding Cheniere’s business strategy, plans and objectives, including the use of proceeds from the offering. Although Cheniere believes that the expectations reflected in these

forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Cheniere’s actual results could differ materially from those anticipated in these forward-looking

statements as a result of a variety of factors, including those discussed in Cheniere’s periodic reports that are filed with and available from the Securities and Exchange Commission. You should not place undue reliance on these forward-looking

statements, which speak only as of the date of this press release. Other than as required under the securities laws, Cheniere does not assume a duty to update these forward-looking statements.

CONTACTS:

Investors: Randy Bhatia: 713-375-5479 Christina Burke: 713-375-5104

Media: Faith Parker: 713-375-5663

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

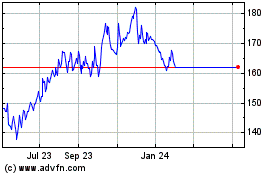

Cheniere Energy (AMEX:LNG)

Historical Stock Chart

From Apr 2023 to Apr 2024