UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 4)

|

THE ALKALINE WATER COMPANY INC.

|

|

(Name of Issuer)

|

|

Common Stock, $0.001 Par Value

|

|

(Title of Class of Securities)

|

|

01643A 108

|

|

(CUSIP Number)

|

|

copy to:

Clark Wilson LLP

900 - 885 West Georgia Street

Vancouver, British Columbia, Canada V6C 3H1

Tel: 604.687.5700 Fax: 604.687.6314

|

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

|

|

February 26, 2015

|

|

(Date of Event which Requires Filing of this Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box [ ].

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See 240.13d-7(b) for other parties to whom copies are to be sent.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

Steven P. Nickolas

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

(a) [ ]

(b) [ ]

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

|

46,900,000(1)

|

|

|

8

|

SHARED VOTING POWER

|

|

|

Nil

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

46,900,000(1)

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

Nil

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

46,900,000 shares of common stock(1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

39.17% based on 119,720,825 issued and outstanding as of March 3, 2015.

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

IN

|

|

(1)

|

Consists of 6,600,000 stock options exercisable within 60 days, 21,500,000 shares of common stock owned by WiN Investments, LLC and 18,800,000 shares of common stock owned by Lifewater Industries, LLC. Steven P. Nickolas exercises voting and dispositive power with respect to the shares of common stock that are beneficially owned by WiN Investments, LLC and Lifewater Industries, LLC.

|

|

1

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

WiN Investments, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

(a) [ ]

(b) [ ]

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

Arizona

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

|

21,500,000(1)

|

|

|

8

|

SHARED VOTING POWER

|

|

|

Nil

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

21,500,000(1)

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

Nil

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

21,500,000 shares of common stock(1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

17.96% based on 119,720,825 issued and outstanding as of March 3, 2015.

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

OO

|

|

(1)

|

WiN Investments, LLC, a company controlled by Steven P. Nickolas, is the beneficial owner of 21,500,000 shares of common stock.

|

|

1

|

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

|

|

Lifewater Industries, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP*

|

|

(a) [ ]

(b) [ ]

|

|

3

|

SEC USE ONLY

|

|

|

|

4

|

SOURCE OF FUNDS (See Instructions)

|

|

OO

|

|

5

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(D) OR 2(E)

|

|

[ ]

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

Arizona

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH

|

7

|

SOLE VOTING POWER

|

|

|

18,800,000(1)

|

|

|

8

|

SHARED VOTING POWER

|

|

|

Nil

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

18,800,000(1)

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

Nil

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

18,800,000 shares of common stock(1)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions)

|

|

[ ]

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

15.70% based on 119,720,825 issued and outstanding as of March 3, 2015.

|

|

14

|

TYPE OF REPORTING PERSON (See Instructions)

|

|

OO

|

|

(1)

|

Lifewater Industries, LLC, a company controlled by Steven P. Nickolas, is the beneficial owner of 18,800,000 shares of common stock.

|

Item 1. Security and Issuer

This Statement relates to shares of common stock with $0.001 par value per share of The Alkaline Water Company Inc. (the “Issuer”). The principal executive offices of the Issuer are located at 7730 E. Greenway Road, Suite 203, Scottsdale, AZ 85260.

Item 2. Identity and Background

|

|

Steven P. Nickolas

WiN Investments, LLC (“WiN”)

Lifewater Industries, LLC (“Lifewater”)

(Steven P. Nickolas, WiN and Lifewater collectively referred to as the “Reporting Persons”)

|

|

(b)

|

Residence or business address:

|

|

|

Steven P. Nickolas – 14301 North 87 Street, Suite 301, Scottsdale, AZ 85260

WiN - 14301 North 87 Street, Suite 301, Scottsdale, AZ 85260

Lifewater - 14301 North 87 Street, Suite 301, Scottsdale, AZ 85260

|

|

(c)

|

Mr. Nickolas is Chairman, President, Chief Executive Officer and director of the Issuer and a citizen of the United States.

WiN is a limited liability company organized under the laws of the State of Arizona and engaged in the investment and development of water related technology. Mr. Nickolas is the manager of WiN.

Lifewater is a limited liability company organized under the laws of the State of Arizona and engaged in the investment and development of water related technology. Mr. Nickolas is the manager of Lifewater.

|

|

(d)

|

None of Steven P. Nickolas and the managers of Win and Lifewater has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanours).

|

|

(e)

|

None of Steven P. Nickolas and the managers of Win and Lifewater has, during the last five years, been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

Item 3. Source and Amount of Funds or Other Considerations

Effective February 26, 2015, Lifewater transferred 1,500,000 shares of common stock to Byrne United S.A., BVI (“Byrne”) pursuant to a transfer agreement dated February 12, 2015 which served as an inducement for Byrne to enter into a loan agreement dated February 12, 2015 between Lifewater and Byrne pursuant to which Byrne loaned $300,000 to Lifewater.1

1 As security for the loan agreement, Lifewater also entered into a stock pledge agreement dated February 12, 2015 pursuant to which Lifewater granted a security interest in favor of Byrne for 1,500,000 shares of common stock.

Item 4. Purpose of Transaction

The Reporting Persons transferred the securities of the Issuer as an inducement to enter into a loan agreement.

As of the date hereof, except as described above, the Reporting Persons do not have any plans or proposals which relate to or would result in:

| |

•

|

The acquisition by any person of additional securities of the Issuer, or the disposition of securities of the Issuer;

|

| |

|

|

| |

•

|

An extraordinary corporate transaction, such as a merger, reorganization or liquidation, involving the Issuer or any of its subsidiaries;

|

| |

|

|

| |

•

|

A sale or transfer of a material amount of assets of the Issuer or any of its subsidiaries;

|

| |

|

|

| |

•

|

Any change in the present board of directors or management of the Issuer, including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the board;

|

| |

|

|

| |

•

|

Any material change in the present capitalization or dividend policy of the Issuer;

|

| |

|

|

| |

•

|

Any other material change in the Issuer's business or corporate structure, including but not limited to, if the Issuer is a registered closed-end investment company, any plans or proposals to make any changes in its investment policy for which a vote is required by Section 13 of the Investment Company Act of 1940;

|

| |

|

|

| |

•

|

Changes in the Issuer's charter, bylaws or instruments corresponding thereto or other actions which may impede the acquisition of control of the issuer by any person;

|

| |

|

|

| |

•

|

Causing a class of securities of the Issuer to be delisted from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national securities association;

|

| |

|

|

| |

•

|

A class of equity securities of the Issuer becoming eligible for termination of registration pursuant to Section 12(g)(4) of the Act; or

|

| |

|

|

| |

•

|

Any action similar to any of those enumerated above.

|

Item 5. Interest in Securities of the Issuer

|

(a)

|

The aggregate number and percentage of common stock of the Issuer beneficially owned by Steven P. Nickolas is 46,900,000 shares, or approximately 39.17% of outstanding common stock of the Issuer, based on 119,720,825 shares of common stock outstanding as of the date of this statement.

The aggregate number and percentage of common stock of the Issuer beneficially owned by WiN is 21,500,000 shares, or approximately 17.96% of outstanding common stock of the Issuer, based on 119,720,825 shares of common stock outstanding as of the date of this statement.

The aggregate number and percentage of common stock of the Issuer beneficially owned by Lifewater is 18,800,000 shares, or approximately 15.70% of outstanding common stock of the Issuer, based on 119,720,825 shares of common stock outstanding as of the date of this statement.

|

| |

|

|

(b)

|

Steven P. Nickolas has the sole power to vote or direct the vote, and to dispose or direct the disposition of 46,900,000 shares of common stock of the Issuer.

|

| |

|

|

(c)

|

The response to Item 3 is responsive to this Item.

|

| |

|

|

(d)

|

Not applicable

|

| |

|

|

(e)

|

Not applicable

|

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Except as set forth above or set forth in the exhibits, there are no contracts, arrangements, understandings or relationships between the Reporting Persons and any other person with respect to any securities of the Issuer.

Item 7. Material to Be Filed as Exhibits

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Dated: March 3, 2015

|

/s/ Steven P. Nickolas

Signature

|

| |

Steven P. Nickolas

|

|

Dated: March 3, 2015

|

WIN INVESTMENTS, LLC

/s/ Steven P. Nickolas

Authorized Signatory – Steven P. Nickolas

|

| |

|

|

Dated: March 3, 2015

|

LIFEWATER INDUSTRIES, LLC

/s/ Steven P. Nickolas

Authorized Signatory – Steven P. Nickolas

|

| |

|

The original statement shall be signed by each person on whose behalf the statement is filed or his authorized representative. If the statement is signed on behalf of a person by his authorized representative (other than an executive officer or general partner of this filing person), evidence of the representative’s authority to sign on behalf of such person shall be filed with the statement, provided, however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the statement shall be typed or printed beneath his signature.

Attention: Intentional misstatements or omissions of fact constitute Federal criminal violations (See 18 U.S.C. 1001).

TRANSFER AGREEMENT

|

BETWEEN:

|

LIFEWATER INDUSTRIES, LLC

|

|

|

_____________________________________________

|

(the “Borrower”)

|

|

_____________________________________________

|

A. The Borrower is the beneficial owner of approximately an aggregate of 20,300,000 shares of The Alkaline Water Company Inc. (the “Company”);

B. In consideration of the Purchaser providing a loan (the “Loan”) to the Borrower, the Borrower has agreed to transfer 1,500,000 shares (the “Securities”) of the Company to the Lender on the terms and conditions hereinafter set forth in this Agreement.

THEREFORE, in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration (the receipt and sufficiency of which are hereby acknowledged by each of the parties), the parties covenant and agree as follows:

1.1 On the basis of the representations and warranties of the parties to this Agreement and subject to the terms and conditions of this Agreement, the Borrower hereby transfers to the Lender the Securities.

1.2 The closing of the transfer of the Securities (the “Closing”) by the Borrower to the Lender will take place on the date of the Closing of the Loan or such other date as may be agreed to by the parties hereto (the “Closing Date”).

1.3 On the Closing Date, the Borrower will deliver to the Company’s lawyers, the following documents:

|

(a)

|

certificates representing the Securities together with instructions to re-register the Securities in the name of the Lender; and

|

|

(b)

|

all other documents and instruments as the Lender may reasonably require.

|

|

2.

|

Representations and Warranties

|

2.1 The Borrower represents and warrants to the Lender (which representations and warranties shall survive the closing of the transactions contemplated in this Agreement), with the intent that the Lender will rely thereon in entering into this Agreement and in concluding the transfer of the Securities as contemplated herein, that:

|

(a)

|

the securities have been duly authorized and validly issued, fully paid and non-assessable and the Borrower is the beneficial and registered owner of the Securities free and clear of all liens, charges and encumbrances of any kind whatsoever. Upon consummation of the transactions contemplated by this Agreement, the Lender shall own the Securities free and clear of all liens, charges and encumbrances of any kind whatsoever;

|

|

(b)

|

the Borrower is an Arizona limited liability company duly organized, validly existing and in good standing under the State of Arizona;

|

|

(c)

|

there are no written instruments, buy-sell agreements, registration rights or agreements, voting agreements or other agreements by and between or among the Borrower or any other person, imposing any restrictions upon the transfer, prohibiting the transfer of or otherwise pertaining to the Securities or the ownership thereof;

|

|

(d)

|

the Borrower has the power and capacity and good and sufficient right and authority to enter into this Agreement on the terms and conditions set forth in this Agreement and to transfer the legal and beneficial title and ownership of the Securities to the Lender;

|

|

(e)

|

no person, firm, corporation or entity of any kind has or will have any agreement or option or any right capable at any time of becoming an agreement to:

|

|

(i)

|

purchase or otherwise acquire the Securities; or

|

|

(ii)

|

require the Borrower to sell, transfer, assign, pledge, charge, mortgage or in any other way dispose of or encumber any of the Securities other than under this Agreement;

|

|

(f)

|

this Agreement and all other documents required to be executed and delivered by the Borrower have been duly, or will when executed and delivered be duly, executed and delivered by the Borrower, and constitute the legal, valid and binding obligations of the Borrower, enforceable against the Borrower in accordance with their terms, subject to laws of general application relating to bankruptcy, insolvency, the relief of debtors, specific performance, injunctive relief and other equitable remedies;

|

|

(g)

|

the entering into of this Agreement and the transactions contemplated hereby do not result in the violation of any of the terms and provisions of any law applicable to, or the constating documents of, the Borrower or of any agreement, written or oral, to which the Borrower may be a party or by which the Borrower is or may be bound;

|

|

(h)

|

no governmental, administrative or other third party consents or approvals are required by or with respect to the Borrower in connection with the execution and delivery of this Agreement or the consummation of the transactions contemplated hereby;

|

|

(i)

|

there are no actions, suits, claims, investigations or other legal proceedings pending or, to the knowledge of the Borrower, threatened against or by the Borrower that challenge or seek to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement;

|

|

(j)

|

the Borrower is not an “underwriter” (as such term is defined in Section 2(11) of the 1933 Act) of any securities of the Company; and

|

|

(k)

|

the Borrower has not taken any action which would impose any obligation or liability to any person for finder’s fees, agent’s commissions or like payments in connection with the execution and delivery of this Agreement or the consummation of the transactions contemplated hereby.

|

2.2 The Lender represents and warrants to the Borrower (which representations and warranties shall survive the closing of the transactions contemplated in this Agreement), with the intent that the Borrower will rely thereon in entering into this Agreement and in concluding the transfer of the Securities as contemplated herein, that it:

|

(a)

|

is not a U.S. Person (as such term is defined in Regulation S of the 1933 Act) and is not acquiring the Securities for the account or benefit of, directly or indirectly, any U.S. Person;

|

|

(b)

|

is outside the United States when receiving and executing this Agreement;

|

|

(c)

|

understands and agrees that the Securities have not been registered under the 1933 Act, or under any state securities or “blue sky” laws of any state of the United States, and, unless so registered, may not be offered or sold in the United States or, directly or indirectly, to U.S. Persons, except in accordance with the provisions of Regulation S, pursuant to an effective registration statement under the 1933 Act, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the 1933 Act and in each case only in accordance with any applicable securities laws;

|

|

(d)

|

is acquiring the Securities as principal for investment only and not with a view to resale or distribution and, in particular, the Lender has no intention to distribute either directly or indirectly any of the Securities in the United States or to U.S. Persons, except in compliance with the registration provisions of the 1933 Act or an exemption therefrom;

|

|

(e)

|

acknowledges that the Lender has not acquired the Securities as a result of, and will not itself engage in, any “directed selling efforts” (as defined in Regulation S) in the United States in respect of any of the Securities which would include any activities undertaken for the purpose of, or that could reasonably be expected to have the effect of, conditioning the market in the United States for the resale of any of the Securities provided, however, that the Lender may sell or otherwise dispose of any of the Securities pursuant to registration of any of the Securities (or the underlying shares of common stock) pursuant to the 1933 Act and any applicable state securities laws or under an exemption from such registration requirements and as otherwise provided herein;

|

|

(f)

|

the Lender has the power and capacity and good and sufficient right and authority to enter into this Agreement on the terms and conditions set forth in this Agreement;

|

|

(g)

|

this Agreement and all other documents required to be executed and delivered by the Lender have been duly, or will when executed and delivered be duly, executed and delivered by the Lender, and constitute the legal, valid and binding obligations of the Lender, enforceable against the Lender in accordance with their terms, subject to laws of general application relating to bankruptcy, insolvency, the relief of debtors, specific performance, injunctive relief and other equitable remedies;

|

|

(h)

|

the entering into of this Agreement and the transactions contemplated hereby do not result in the violation of any of the terms and provisions of any law applicable to, or the constating documents of, the Lender or of any agreement, written or oral, to which the Lender may be a party or by which the Lender is or may be bound;

|

|

(i)

|

the Purchaser has not taken any action which would impose any obligation or liability to any person for finder’s fees, agent’s commissions or like payments in connection with the execution and delivery of this Agreement or the consummation of the transactions contemplated hereby;

|

|

(j)

|

no governmental, administrative or other third party consents or approvals are required by or with respect to the Lender in connections with the execution and delivery of this Agreement or the consummation of the transactions contemplated hereby;

|

|

(k)

|

there are no actions, suits, claims, investigations or other legal proceedings pending or, to the knowledge of the Lender, threatened against or by the Lender that challenge or seek to prevent, enjoin or otherwise delay the transactions contemplated by this Agreement;

|

|

(l)

|

it has had access to all of the books and records of the Company and accordingly agrees that it is familiar with and has access to information regarding the Company similar to information that would be available in a registration statement filed by the Company under the 1933 Act;

|

|

(m)

|

it (i) has adequate net worth and means of providing for its current financial needs and possible personal contingencies, (ii) has no need for liquidity in this investment, and (iii) is able to bear the economic risks of an investment in the Securities for an indefinite period of time; and

|

|

(n)

|

the Lender is not acquiring the Securities as a result of any form of general solicitation or general advertising including advertisements, articles, notices or other communications published in any newspaper, magazine or similar media or broadcast over radio, or television, or any seminar or meeting whose attendees have been invited by general solicitation or general advertising.

|

2.3 In this Agreement, the term “U.S. Person” shall have the meaning ascribed thereto in Regulation S.

3.1 The Borrower shall indemnify the Lender and hold the Lender harmless against and in respect of any and all losses, liabilities, damages, obligations, claims, encumbrances, costs, expenses (including, without limitation, reasonable attorney’s fees) incurred by the Lender resulting from any breach of any representations, warranty, covenant or agreement made by the Borrower herein.

4.1 There are no representations, warranties, collateral agreements, or conditions except as herein specified.

5.1 Each party to this Agreement will be responsible for all of its own expenses, legal and other professional fees, disbursements, and all other costs incurred in connection with the negotiation, preparation, execution, and delivery of this Agreement and all documents and instruments relating hereto and the consummation of the transactions contemplated hereby.

6.1 This Agreement will be governed by and construed in accordance with the law of the State of Nevada.

7.1 The parties to this Agreement hereby agree to execute and deliver all such further documents and instruments and do all acts and things as may be necessary or convenient to carry out the full intent and meaning of and to effect the transactions contemplated by this Agreement.

8.1 Delivery of an executed copy of this Agreement by electronic facsimile transmission or other means of electronic communication capable of producing a printed copy will be deemed to be execution and delivery of this Agreement as of the date set forth on page one of this Agreement.

9.1 This Agreement may be executed in any number of counterparts, each of which, when so executed and delivered, shall constitute an original and all of which together shall constitute one instrument.

IN WITNESS WHEREOF the parties hereto have duly executed this Agreement as of February 12, 2015.

LIFEWATER INDUSTRIES, LLC

Per: /s/ Steven P. Nickolas

Authorized Signatory

Name: Steven P. Nickolas

Title:

BYRNE UNITED S.A.

Per: /s/ Roland Waldvogel

Authorized Signatory

Name: Roland Waldvogel

Title:

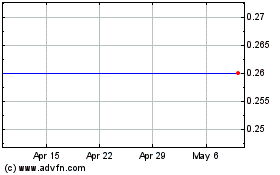

Alkaline Water (NASDAQ:WTER)

Historical Stock Chart

From Mar 2024 to Apr 2024

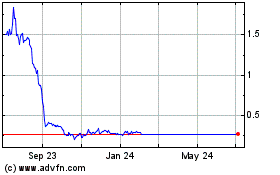

Alkaline Water (NASDAQ:WTER)

Historical Stock Chart

From Apr 2023 to Apr 2024