UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

February 26, 2015

|

OPKO Health, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

001-33528

|

75-2402409

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

4400 Biscayne Blvd., Miami, Florida

|

|

33137

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

(305) 575-4100

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On February 27, 2015, OPKO Health, Inc., a Delaware corporation (the “Company”) issued a press

release announcing operating and financial highlights for the quarter and full year ended December

31, 2014. A copy of the press release is attached hereto as Exhibit 99.1.

The information included herein and in Exhibit 99.1 shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934 (“Exchange Act”) or otherwise subject to the

liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference

in such a filing.

Item 7.01 Regulation FD Disclosure.

On February 26, 2015, the Company issued a press release announcing that it will hold a

conference call to provide a business update and discuss its fourth quarter and full year 2014

financial and operating results. A copy of the press release is attached hereto as Exhibit 99.2.

The information included herein and in Exhibit 99.2 shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934 (“Exchange Act”) or otherwise subject to the

liabilities of that section, nor shall it be deemed incorporated by reference in any filing under

the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference

in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| |

|

|

| Exhibit No.

|

|

Description |

|

|

|

|

99.1

99.2

|

|

Press Release of the Company dated February 27, 2015

Press Release of the Company dated February 26, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

OPKO Health, Inc.

|

|

|

|

|

|

|

|

March 2, 2015

|

|

By:

|

|

Adam Logal

|

|

|

|

|

|

|

|

|

|

|

|

Name: Adam Logal

|

|

|

|

|

|

Title: Senior Vice President-Chief Financial Officer

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release of the Company February 27, 2015

|

|

99.2

|

|

Press Release of the Company dated February 26, 2015

|

OPKO Announces Fourth Quarter Operating and Financial Results

| |

• |

|

Pfizer Collaboration Agreement for Long Acting Human Growth Hormone Closed in

January 2015; OPKO Received $295 Million of $570 Million Total Potential Up Front and

Milestone Payments |

| |

• |

|

RayaldeeTM New Drug Application (NDA) Submission Planned for Q1 2015 |

| |

• |

|

Positive Rayaldee Phase 3 Clinical Trial Results Presented at American Society of

Nephrologists Meeting |

| |

• |

|

Clinical Trial for Rayaldee as Adjunctive Cancer Therapy Began in Q4 2014 |

| |

• |

|

Marketing for 4Kscore® Blood Test to Identify Risk of Aggressive Prostate Cancer in the

US and Europe Began During 2014 and in Mexico in January 2015 |

| |

• |

|

Two Papers Supporting 4Kscore Blood Test in European Urology Published |

| |

• |

|

Rolapitant™ NDA Submitted by OPKO Licensee, TESARO; Accepted for Review by FDA with a

PDUFA date of September 5, 2015; OPKO Received $5 Million of $121 Million Total Potential

Up Front and Milestone Payments |

| |

• |

|

Investigational New Drug (IND) Application for Long Acting Factor VIIa-CTP for

Hemophilia Filed and Accepted in Q1 2015 |

| |

• |

|

Clinical Studies for Long Acting Oxyntomodulin for Obesity and Diabetes Expected to

Begin During 2015 |

MIAMI—(BUSINESS WIRE)— OPKO Health, Inc. (NYSE:OPK), a multi-national biopharmaceutical and

diagnostics company, today reported operating and financial results for its fourth quarter ended

December 31, 2014.

Business Highlights

| |

• |

|

Pfizer Collaboration Agreement for Long Acting Human Growth Hormone Closed in January

2015; OPKO Received Up-Front Payments totaling $295 million for global commercialization

rights to hGH-CTP: In connection with the collaboration, OPKO received upfront payments of

$295 million and will receive an additional $275 million upon achievement of development

related milestones. In addition, OPKO will receive initial royalty payments upon the

commercialization of hGH-CTP for Adult growth hormone deficiency (GHD). Upon the launch of

hGH-CTP for Pediatric GHD, the royalties will transition to gross profit sharing among all

indications for both hGH-CTP and Pfizer’s Genotropin®. OPKO will lead clinical development

and will be responsible for funding the development programs for Adult and Pediatric GHD

and growth failure in children born small for gestational age (SGA). Pfizer will be

responsible for all development costs for additional indications as well as all

post-marketing studies. In addition, Pfizer will fund the commercialization activities for

all indications and lead the manufacturing activities covered by the global development

plan. |

| |

• |

|

End of Phase 2 Meeting for hGH-CTP for Pediatric GHD Scheduled for Q1 2015; Adult Phase

3 Clinical Trial Continues to Advance: OPKO will present twelve month data from its

ongoing Phase 2 clinical trial for pediatric GHD at the 97th Annual Meeting of the

Endocrine Society (ENDO) on March 5th, 2015 in San Diego, California. |

| |

• |

|

Rayaldee Met Primary Endpoints in Both Pivotal Phase 3 Trials; NDA Submission planned

for Q1 2015: OPKO announced successful top-line results from both of its pivotal Phase 3

trials with Rayaldee. These trials were identical randomized, double-blind,

placebo-controlled, multi-site studies intended to establish the safety and efficacy

of Rayaldee as a new treatment for secondary hyperparathyroidism (SHPT) in patients with

stage 3 or 4 chronic kidney disease (CKD) and vitamin D insufficiency. OPKO plans to submit

a NDA in the first quarter of 2015. |

| |

• |

|

Rayaldee Results Presented at American Society of Nephrologists Meeting: Rayaldee Phase

3 trial data was presented in a late-breaking clinical presentation entitled “ Safety and

Efficacy of Modified-release Calcifediol for Secondary Hyperparathyroidism in Patients with

Stage 3 or 4 CKD and Vitamin D Insufficiency “ on November 15, 2014 during the American

Society of Nephrology meeting in Philadelphia, PA. |

| |

• |

|

Clinical Trial for Rayaldee as Adjunctive Cancer Therapy Initiated in Q4 2014: OPKO

initiated a clinical trial to evaluate Rayaldee as an adjunctive therapy for the prevention

of skeletal-related events (SREs) in breast and prostate cancer patients with bone

metastases undergoing anti-resorptive therapy during the fourth quarter of 2014. |

| |

• |

|

IND for Long Acting Factor VIIa-CTP for Hemophilia Filed and Accepted: In January 2015,

OPKO submitted an IND to Initiate a Phase 2a Trial for its Long-Acting Coagulation Factor

VIIa-CTP to Treat Hemophilia. Clinical trials are expected to commence shortly. |

| |

• |

|

Clinical Studies for Long Acting Oxyntomodulin for Obesity and Diabetes Expected to

Begin During 2015: OPKO expects to commence studies for its long acting Oxyntomodulin for

diabetes and obesity in the second half of 2015. |

| |

• |

|

Launched 4Kscore Test in US, Europe and Mexico; Adoption of 4Kscore Test Continues to

Grow: OPKO launched the 4Kscore Test in the US and Europe in 2014, and in Mexico in

January 2015. OPKO also expects to launch the 4Kscore Test in additional Latin America

markets through its subsidiaries during 2015. OPKO is working to obtain reimbursement for

the 4Kscore Test by payers in the U.S. and abroad and expects adoption to rapidly increase

once reimbursement is received. |

| |

• |

|

Announced Publication of 20 Year Outcome Study for Lethal Prostate Cancer

Using Kallikrein Biomarkers in 4Kscore Test: A team of researchers from Memorial Sloan

Kettering Cancer Center and several leading European institutions published results in the

journal European Urology concluding that the four kallikrein panel of biomarkers utilized

in the OPKO 4Kscore® Test (Total PSA, Free PSA, Intact PSA and hK2) accurately identify men

more likely to develop distant prostate cancer metastases, and men with a low 4Kscore were

shown to have a very low risk of developing metastatic prostate cancer in the 5-10 year

timeframe a <2% risk in a 20-year follow up period. |

| |

• |

|

Rolapitant NDA Filing Submitted in September and Accepted for Review by FDA in November:

OPKO’s partner, TESARO, submitted a NDA to the FDA for approval of oral rolapitant, an

investigational neurokinin-1 (NK-1) receptor antagonist in development for the prevention

of chemotherapy-induced nausea and vomiting (CINV). The NDA is supported by data from four

controlled studies covering a spectrum of patients receiving chemotherapy that commonly

causes nausea and vomiting. The top-line results of three of the Phase 3 studies were

previously announced by TESARO and were presented in detail at the American Society for

Clinical Oncology (ASCO) annual meeting in June 2014. On November 5, 2014, TESARO announced

the FDA accepted its NDA filing for rolapitant, with a PDUFA date of September 5, 2015,

which triggered a milestone payment of $5 million to OPKO under its license agreement with

TESARO. |

“We accomplished a number of important objectives during 2014,” said Phillip Frost, M.D.,

Chairman and CEO. “The completion of the Pfizer transaction rounded out a watershed year for

OPKO that saw us report two successful Phase 3 clinical trials for Rayaldee, successful

validation of the 4Kscore Test and subsequent launch of the 4Kscore Test in the US and Europe.

In addition, we progressed many of our earlier stage programs, particularly our long acting

Factor VII and Oxyntomodulin, that have the potential to make significant contributions to the

healthcare system and the quality of life of patients,” Dr. Frost continued.

Financial Highlights

We believe that OPKO’s cash and cash equivalents of $96.9 million at December 31, 2014, together

with the $295.0 million in upfront payments from Pfizer received in 2015, provide OPKO with

adequate liquidity to continue development of its product candidates.

Pharmaceutical product revenue for the three months ended December 31, 2014 increased to $18.5

million compared to $17.5 million for the 2013 period. This increase was principally the result of

increased revenue from OPKO’s active pharmaceutical ingredient business at FineTech. Total revenue

for the three months ended December 31, 2014 was $25.5 million compared to $20.7 million for the

2013 period. The increase in total revenue was the result of the 2014 period including a $5.0

million payment from TESARO for the acceptance of the NDA for rolapitant.

Net loss for the three months ended December 31, 2014 was $53.0 million, compared to $16.8 million

in the comparable period of 2013. During the three months ended December 31, 2014, OPKO recorded

increased expense associated with its derivative instruments of $14.4 million, principally related

to the derivative liability associated with the increased value of its Senior 2033 Notes. Further,

the three months ended December 31, 2013 benefited from the exit from a strategic investment,

resulting in an $18.9 million gain in that period. OPKO continued to increase its investment in

research and development activities during the three months ended December 31, 2014 related to its

ongoing Phase 3 programs for Rayaldee and hGH-CTP. As a result, OPKO’s spending on research and

development increased $2.4 million to $25.8 million for the three months ended December 31, 2014

from $23.4 million for the three months ended December 31, 2013.

For the year ended December 31, 2014, pharmaceutical product revenue increased approximately 13% to

$77.0 million compared to $68.2 million for the 2013 period. The increase in pharmaceutical

product revenue was principally the result of increased revenue from FineTech, OPKO Health Europe

and OPKO Mexico. Total revenue for the year ended December 31, 2014 was $91.1 million compared to

$96.5 million for the 2013 period. Total revenue for the year ended December 31, 2013 included

non-cash, non-recurring revenue of $12.5 million related to OPKO’s transaction with RXi

Pharmaceuticals partially offset by increased pharmaceutical product revenue and the milestone

payment from TESARO.

Net loss for the year ended December 31, 2014 was $171.7 million compared to $114.8 million for

2013. OPKO’s increased investment in research and development activities principally related to

its Phase 3 programs for Rayaldee and hGH-CTP, as well as incurred costs associated with the

clinical validation study for the 4Kscore, the Claros 1 Analyzer point of care diagnostic platform

and earlier stage development programs. As a result, OPKO’s investment in research and development

increased $29.7 million to $83.6 million for the year ended December 31, 2014 from $53.9 million

for the year ended December 31, 2013. As a result of the successful achievement of the primary

efficacy and safety endpoints for the Rayaldee Phase 3 clinical trials, the valuation for

contingent consideration payable to the sellers of Cytochroma increased significantly during the

year ended December 31, 2014 resulting in $17.5 million of increased contingent consideration

expense. In addition, net loss for the year ended December 31, 2014 included a non-recurring

in-process research and development expense of $12.1 million due to a write-off of in-process

research and development expense in connection with the acquisition of Inspiro and a payment to

Merck in connection with the NDA filing by TESARO for rolapitant. The year ended December 31, 2013

included $12.5 million of non-cash income related to the RXi transaction and a $29.9 million gain

realized from the successful exit of a strategic investment.

About OPKO Health, Inc.

We are a multi-national biopharmaceutical and diagnostics company that seeks to establish

industry-leading positions in large and rapidly growing medical markets by leveraging our

discovery, development and commercialization expertise and our novel and proprietary technologies.

This press release contains “forward-looking statements,” as that term is defined under the

Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by

words such as “expects,” “plans,” “projects,” “will,” “may,” “anticipates,” “believes,” “should,”

“intends,” “estimates,” and other words of similar meaning, including statements regarding expected

financial performance, continued revenue growth and our ability to build a profitable business,

whether we have sufficient liquidity to fund development of our product candidates and operations,

our product development effort and the expected benefits of our products, including whether our

ongoing and future Phase 3 clinical trials will be completed on a timely basis or at all and

whether the data from any of our trials will support approval, validation and/or reimbursement for

our products, the expected timing for launch of our products in development, including Rayaldee and

hGH-CTP, the expected timing of our clinical trials, enrollment in clinical trials, and disclosure

of results for the trials, our ability to market and sell any of our products in development,

including Rayaldee, the 4Kscore, and hGH-CTP, our ability to launch sales of the 4Kscore Test in

Latin America and through our other subsidiaries, increased adoption rates for the 4Kscore by

Urologists in the U.S. and abroad, the timing for submission of an NDA by us for Rayaldee, whether

the 4Kscore will provide substantial benefits to patients and doctors by informing them of the risk

of a patient having a high-grade cancer and clarify the decision making process, whether the

4Kscore will reduce unnecessary biopsies, as well as other non-historical statements about our

expectations, beliefs or intentions regarding our business, technologies and products, financial

condition, strategies or prospects. Many factors could cause our actual activities or results to

differ materially from the activities and results anticipated in forward-looking statements. These

factors include those described in our Annual Reports on Form 10-K filed and to be filed with the

Securities and Exchange Commission and in our other filings with the Securities and Exchange

Commission, as well as the risks inherent in funding, developing and obtaining regulatory approvals

of new, commercially-viable and competitive products and treatments, that earlier clinical results

of effectiveness and safety may not be reproducible or indicative of future results, that the

4Kscore, Rayaldee, Rolapitant, hGH-CTP, and/or any of our compounds or diagnostic products under

development may fail, may not achieve the expected results or effectiveness and may not generate

data that would support the approval or marketing of products for the indications being studied or

for other indications, that currently available over-the-counter and prescription products, as well

as products under development by others, may prove to be as or more effective than our products for

the indications being studied. In addition, forward-looking statements may also be adversely

affected by general market factors, competitive product development, product availability, federal

and state regulations and legislation, the regulatory process for new products and indications,

manufacturing issues that may arise, patent positions and litigation, among other factors. The

forward-looking statements contained in this press release speak only as of the date the statements

were made, and we do not undertake any obligation to update forward-looking statements. We intend

that all forward-looking statements be subject to the safe-harbor provisions of the PSLRA.

OPKO Health, Inc.

Steve Rubin or Adam Logal (305) 575-4100

1

| |

|

|

|

|

|

|

|

|

OPKO Health, Inc. and Subsidiaries

|

|

|

|

|

Condensed Consolidated Balance Sheets

|

|

|

|

|

(unaudited)

(in millions) |

|

|

|

|

|

|

|

|

| |

|

As of |

|

|

December 31, 2014 |

|

December 31, 2013 |

|

|

|

|

|

|

|

|

|

Assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

96.9 |

|

|

$ |

185.8 |

|

Other current assets |

|

|

46.0 |

|

|

|

56.9 |

|

|

|

|

|

|

|

|

|

|

Total Current Assets |

|

|

142.9 |

|

|

|

242.7 |

|

In-process Research and Development and Goodwill |

|

|

1,017.4 |

|

|

|

1,019.7 |

|

Other assets |

|

|

107.4 |

|

|

|

129.1 |

|

|

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

1,267.7 |

|

|

$ |

1,391.5 |

|

|

|

|

|

|

|

|

|

|

Liabilities and Equity: |

|

|

|

|

|

|

|

|

Current liabilities |

|

$ |

83.1 |

|

|

$ |

91.8 |

|

2033 Senior Notes, net |

|

|

131.5 |

|

|

|

211.9 |

|

Other long-term liabilities |

|

|

217.3 |

|

|

|

214.8 |

|

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

|

431.9 |

|

|

|

518.5 |

|

Equity |

|

|

835.8 |

|

|

|

873.0 |

|

|

|

|

|

|

|

|

|

|

Total Liabilities and Equity |

|

$ |

1,267.7 |

|

|

$ |

1,391.5 |

|

|

|

|

|

|

|

|

|

|

2

| |

|

|

|

|

|

|

|

|

| OPKO Health, Inc. and Subsidiaries |

|

|

|

|

| Condensed Consolidated Statements of Operations |

|

|

|

|

| (unaudited) |

|

|

|

|

| (in millions, except per share data) |

|

|

|

|

| |

|

For the three months ended |

| |

|

December 31, |

|

|

| |

|

2014 |

|

2013 |

Revenues |

|

$ |

25.5 |

|

|

$ |

20.7 |

|

Costs and expenses |

|

|

58.0 |

|

|

|

56.6 |

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(32.5 |

) |

|

|

(35.9 |

) |

Other income and (expense), net |

|

|

(20.9 |

) |

|

|

21.5 |

|

|

|

|

|

|

|

|

|

|

Loss before income taxes and investment losses |

|

|

(53.4 |

) |

|

|

(14.4 |

) |

Benefit from (provision for) income taxes |

|

|

1.0 |

|

|

|

0.6 |

|

|

|

|

|

|

|

|

|

|

Loss before investment losses |

|

|

(52.4 |

) |

|

|

(13.8 |

) |

Loss from investments in investees |

|

|

(1.1 |

) |

|

|

(3.6 |

) |

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(53.5 |

) |

|

|

(17.4 |

) |

Less: Net loss attributable to non-controlling interests |

|

|

(0.5 |

) |

|

|

(0.6 |

) |

Preferred stock dividend |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common shareholders |

|

$ |

(53.0 |

) |

|

$ |

(16.8 |

) |

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share |

|

$ |

(0.12 |

) |

|

$ |

(0.04 |

) |

|

|

|

|

|

|

|

|

|

| |

|

For the year ended December 31, |

|

|

|

2014 |

|

|

|

2013 |

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

91.1 |

|

|

$ |

96.5 |

|

Costs and expenses |

|

|

236.9 |

|

|

|

176.1 |

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(145.8 |

) |

|

|

(79.6 |

) |

Other income and (expense), net |

|

|

(25.2 |

) |

|

|

(24.6 |

) |

|

|

|

|

|

|

|

|

|

Loss before income taxes and investment losses |

|

|

(171.0 |

) |

|

|

(104.2 |

) |

Benefit from (provision for) income taxes |

|

|

(0.0 |

) |

|

|

(1.7 |

) |

|

|

|

|

|

|

|

|

|

Loss before investment losses |

|

|

(171.0 |

) |

|

|

(105.9 |

) |

Loss from investments in investees |

|

|

(3.6 |

) |

|

|

(11.4 |

) |

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(174.6 |

) |

|

|

(117.3 |

) |

Less: Net loss attributable to non-controlling interests |

|

|

(2.9 |

) |

|

|

(2.9 |

) |

Preferred stock dividend |

|

|

— |

|

|

|

(0.4 |

) |

|

|

|

|

|

|

|

|

|

Net loss attributable to common shareholders |

|

$ |

(171.7 |

) |

|

$ |

(114.8 |

) |

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share |

|

$ |

(0.41 |

) |

|

$ |

(0.32 |

) |

|

|

|

|

|

|

|

|

|

3

OPKO to Announce Fourth Quarter and Full Year 2014 Financial Results on February 27, 2015

MIAMI – February 26, 2015 — OPKO Health, Inc. (NYSE:OPK) will announce fourth quarter and

full year 2014 financial results on Friday, February 27, after the close of the U.S. financial

markets. OPKO’s senior management will host a conference call and live audio webcast to provide a

business update and discuss its results in greater detail at 8:30 a.m. ET on Monday, March 2, 2015.

The conference call will be available via phone and webcast. The conference call dial-in

information is listed below. To access the webcast, please log on to the OPKO website at

www.opko.com at least 15 minutes prior to the start of the call to ensure adequate time for any

software downloads that may be required. A link to the live webcast is also included below.

CONFERENCE CALL & WEBCAST INFORMATION:

WHEN: Monday, March 2, 2015, 8:30 a.m. ET

DOMESTIC & CANADA DIAL-IN: (877) 407-0789

INTERNATIONAL DIAL-IN: (201) 689-8562

LIVE WEBCAST LINK: http://public.viavid.com/index.php?id=113407

For those unable to participate in the conference call or webcast, a replay will be available

beginning March 2, 2015 at 11:30 a.m. ET until April 2, 2015 at 11:59 p.m. ET. To access the

replay, dial (877) 870-5176 or (858) 384-5517. The replay passcode is 13602859

The replay can also be accessed for 30 days on OPKO’s website at www.opko.com.

About OPKO Health, Inc.

OPKO is a multinational biopharmaceutical and diagnostics company that seeks to establish industry

leading positions in large, rapidly growing markets by leveraging its discovery, development and

commercialization expertise and novel and proprietary technologies.

Contacts:

Adam Logal

305-575-4100

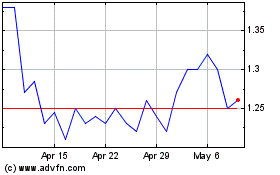

Opko Health (NASDAQ:OPK)

Historical Stock Chart

From Mar 2024 to Apr 2024

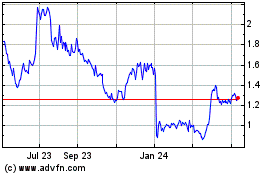

Opko Health (NASDAQ:OPK)

Historical Stock Chart

From Apr 2023 to Apr 2024