UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014.

OR

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 001-33528

OPKO Health, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

Delaware | | 75-2402409 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

|

|

4400 Biscayne Blvd., Miami, FL 33137

(Address of Principal Executive Offices) (Zip Code) |

|

(Registrant’s Telephone Number, Including Area Code): (305) 575-4100

|

|

|

| | |

Securities registered pursuant to section 12(b) of the Act: |

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, $.01 par value per share | | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the Registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

(in Rule 12b-2 of the Exchange Act) (Check one): | | |

Large accelerated filer | ý | Accelerated filer | o |

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No ý

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, as of the last business day of the registrant’s most recently completed second fiscal quarter was: $2,114,172,075.

As of February 20, 2015, the registrant had 451,627,482 shares of Common Stock outstanding.

Documents Incorporated by Reference

Portions of the registrant’s definitive proxy statement for its 2015 Annual Meeting of Stockholders are incorporated by reference in Items 10, 11, 12, 13, and 14 of Part III of this Annual Report on Form 10-K.

TABLE OF CONTENTS

|

| | | |

| Page |

Part I. | | |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

Part II. | | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

Part III. | | |

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions and Director Independence | |

Item 14. | Principal Accounting Fees and Services | |

Part IV. | | |

Item 15. | | |

Signatures | | |

Certifications | | |

EX-21 | | |

EX-23.1 | | |

EX-31.1 | | |

EX-31.2 | | |

EX-32.1 | | |

EX-32.2 | | |

EX-101. INS XBRL Instance Document | |

EX-101.SCH XBRL Taxonomy Extension Schema Document | |

EX-101.CAL XBRL Taxonomy Extension Calculation Linkbase Document | |

EX-101.DEF XBRL Taxonomy Extension Definition Linkbase Document | |

EX-101.LAB XBRL Taxonomy Extension Label Linkbase Document | |

EX-101.PRE XBRL Taxonomy Extension Presentation Linkbase Document | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 (“PSLRA”), Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements about our expectations, beliefs or intentions regarding our product development efforts, business, financial condition, results of operations, strategies or prospects. You can identify forward-looking statements by the fact that these statements do not relate strictly to historical or current matters. Rather, forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements. These factors include those described below and in “Item 1A-Risk Factors” of this Annual Report on Form 10-K. We do not undertake an obligation to update forward-looking statements. We intend that all forward-looking statements be subject to the safe-harbor provisions of the PSLRA. These forward-looking statements are only predictions and reflect our views as of the date they are made with respect to future events and financial performance.

Risks and uncertainties, the occurrence of which could adversely affect our business, include the following:

| |

• | We have a history of operating losses and we do not expect to become profitable in the near future. |

| |

• | Our technologies are in an early stage of development and are unproven. |

| |

• | Our business is substantially dependent on our ability to develop, launch and generate revenue from our pharmaceutical and diagnostic programs. |

| |

• | Our research and development activities, or that of our investees, may not result in commercially viable products. |

| |

• | The timing and expenditures associated with the build-up of pre-launch inventory and capacity expansion. |

| |

• | The results of previous clinical trials may not be predictive of future results, and our current and planned clinical trials may not satisfy the requirements of the United States (“U.S.”) Food and Drug Administration (“FDA”) or other non-U.S. regulatory authorities. |

| |

• | We may require substantial additional funding, which may not be available to us on acceptable terms, or at all. |

| |

• | We may finance future cash needs primarily through public or private offerings, debt financings or strategic collaborations, which may dilute your stockholdings in the Company. |

| |

• | If our competitors develop and market products that are more effective, safer or less expensive than our future product candidates, our commercial opportunities will be negatively impacted. |

| |

• | The regulatory approval process is expensive, time consuming and uncertain and may prevent us or our collaboration partners from obtaining approvals for the commercialization of some or all of our product candidates. |

| |

• | Failure to recruit and enroll patients for clinical trials may cause the development of our product candidates to be delayed. |

| |

• | Even if we obtain regulatory approvals for our product candidates, the terms of approvals and ongoing regulation of our products may limit how we manufacture and market our product candidates, which could materially impair our ability to generate anticipated revenues. |

| |

• | We may not meet regulatory quality standards applicable to our manufacturing and quality processes. |

| |

• | Even if we receive regulatory approval to market our product candidates, the market may not be receptive to our products. |

| |

• | The loss of Phillip Frost, M.D., our Chairman and Chief Executive Officer, could have a material adverse effect on our business and product development. |

| |

• | If we fail to attract and retain key management and scientific personnel, we may be unable to successfully develop or commercialize our product candidates. |

| |

• | In the event that we successfully evolve from a company primarily involved in development to a company also involved in commercialization, we may encounter difficulties in managing our growth and expanding our operations successfully. |

| |

• | If we fail to acquire and develop other products or product candidates, at all or on commercially reasonable terms, we may be unable to diversify or grow our business. |

| |

• | We have no experience manufacturing our pharmaceutical product candidates other than at one of our Israeli facilities, and at our Mexican, and Spanish facilities, and we have no experience in manufacturing our diagnostic product candidates. We will therefore likely rely on third parties to manufacture and supply our pharmaceutical and diagnostics product candidates, and we would need to meet various standards to satisfy FDA regulations in order to manufacture on our own. |

| |

• | We currently have no pharmaceutical or diagnostic marketing, sales or distribution capabilities other than in Chile, Mexico, Spain, and Uruguay for sales in those countries and our active pharmaceutical ingredients (“APIs”) business in Israel, and the sales force for our laboratory business based in Nashville, Tennessee. If we are unable to develop our sales and marketing and distribution capability on our own or through collaborations with marketing partners, we will not be successful in commercializing our pharmaceutical and diagnostic product candidates. |

| |

• | Certain elements of our business are dependent on the success of ongoing and planned phase 3 clinical trials for Alpharen (Fermagate Tablets), and hGH-CTP. |

| |

• | Independent clinical investigators and contract research organizations that we engage to conduct our clinical trials may not be diligent, careful or timely. |

| |

• | The success of our business is dependent on the actions of our collaborative partners. |

| |

• | Our exclusive worldwide agreement with Pfizer Inc. (“Pfizer”) is important to our business. If we do not successfully develop hGH-CTP and/or Pfizer does not successfully commercialize hGH-CTP, our business could be adversely affected. |

| |

• | If we are unable to obtain and enforce patent protection for our products, our business could be materially harmed. |

| |

• | If we are unable to protect the confidentiality of our proprietary information and know-how, the value of our technology and products could be adversely affected. |

| |

• | We rely heavily on licenses from third parties. |

| |

• | We license patent rights to certain of our technology from third-party owners. If such owners do not properly maintain or enforce the patents underlying such licenses, our competitive position and business prospects will be harmed. |

| |

• | Our commercial success depends significantly on our ability to operate without infringing the patents and other proprietary rights of third parties. |

| |

• | Adverse results in material litigation matters or governmental inquiries could have a material adverse effect upon our business and financial condition. |

| |

• | If our products have undesirable effects on patients, we could be subject to litigation or product liability claims that could impair our reputation and have a material adverse effect upon our business and financial condition. |

| |

• | Medicare prescription drug coverage legislation and future legislative or regulatory reform of the health care system may adversely affect our ability to sell our products or provide our services profitably. |

| |

• | Failure to obtain and maintain regulatory approval outside the U.S. will prevent us from marketing our product candidates abroad. |

| |

• | We may not have the funding available to pursue acquisitions. |

| |

• | Acquisitions may disrupt our business, distract our management, may not proceed as planned, and may also increase the risk of potential third party claims and litigation. |

| |

• | We may encounter difficulties in integrating acquired businesses. |

| |

• | Non-U.S. governments often impose strict price controls, which may adversely affect our future profitability. |

| |

• | Political and economic instability in Europe and Latin America and political, economic, and military instability in Israel or neighboring countries could adversely impact our operations. |

| |

• | We are subject to fluctuations in currency exchange rates in connection with our international businesses. |

| |

• | We have a large amount of goodwill and other intangible assets as a result of acquisitions and a significant write-down of goodwill and/or other intangible assets would have a material adverse effect on our reported results of operations and net worth. |

| |

• | Our business may become subject to legal, economic, political, regulatory and other risks associated with international operations. |

| |

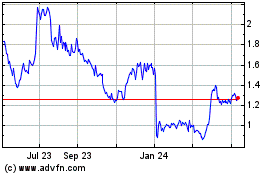

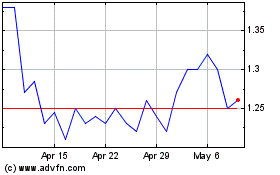

• | The market price of our Common Stock may fluctuate significantly. |

| |

• | The conversion and redemption features of our January 2013 convertible senior notes due in 2033 are classified as embedded derivatives and may continue to result in volatility in our financial statements, including having a material impact on our result of operations and recorded derivative liability. |

| |

• | We have previously reported a material weakness in our internal control over financing reporting which may cause investors and stockholders to lose confidence in our financial reporting. |

| |

• | Directors, executive officers, principal stockholders and affiliated entities own a significant percentage of our capital stock, and they may make decisions that you may not consider to be in your best interests or in the best interests of our stockholders. |

| |

• | Compliance with changing regulations concerning corporate governance and public disclosure may result in additional expenses. |

| |

• | If we are unable to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as they apply to us, or our internal controls over financial reporting are not effective, the reliability of our financial statements may be questioned and our Common Stock price may suffer. |

| |

• | We may be unable to maintain our listing on the New York Stock Exchange (“NYSE”), which could cause our stock price to fall and decrease the liquidity of our Common Stock. |

| |

• | Future issuances of Common Stock and hedging activities may depress the trading price of our Common Stock. |

| |

• | Provisions in our charter documents and Delaware law could discourage an acquisition of us by a third party, even if the acquisition would be favorable to you. |

| |

• | We do not intend to pay cash dividends on our Common Stock in the foreseeable future. |

PART I

Unless the context otherwise requires, all references in this Annual Report on Form 10-K to the “Company”, “OPKO”, “we”, “our”, “ours”, and “us” refer to OPKO Health, Inc., a Delaware corporation, including our wholly-owned subsidiaries.

OVERVIEW

We are a multi-national biopharmaceutical and diagnostics company that seeks to establish industry-leading positions in large and rapidly growing medical markets by leveraging our discovery, development and commercialization expertise and our novel and proprietary technologies. We are developing a range of solutions to diagnose, treat and prevent various conditions, including point-of-care tests, laboratory developed tests (“LDTs”), and proprietary pharmaceuticals and vaccines. We plan to commercialize these solutions on a global basis in large and high growth markets, including emerging markets.

All product or service marks appearing in type form different from that of the surrounding text are trademarks or service marks owned, licensed to, promoted or distributed by OPKO, its subsidiaries or affiliates, except as noted. All other trademarks or services marks are those of their respective owners.

We own established pharmaceutical platforms in Chile, Spain, Mexico, and Uruguay which generate revenue and which we expect to facilitate future market entry for our products currently in development. We own a specialty active pharmaceutical ingredients (“APIs”) manufacturer in Israel, which we expect may facilitate the development of our pipeline of molecules and compounds for our proprietary products. In the U.S., we own OPKO Lab, a laboratory certified under the Clinical Laboratory Improvement Amendments of 1988, as amended (“CLIA”), that operates as a full-service medical laboratory with a urologic focus and serves as the commercial platform for the U.S. launch of the 4Kscore test, our next generation prostate cancer test and the only blood test that accurately identifies risk for aggressive prostate cancer.

In March 2014, we began selling the 4Kscore test domestically through our CLIA-accredited laboratory in Nashville. In addition, we launched sales of the 4Kscore test in Europe in September 2014 and in Mexico in January 2015. The 4Kscore test measures the blood plasma levels of four different prostate-derived kallikrein proteins: Total PSA, Free PSA, Intact PSA and Human Kallikrein-2 (“hK2”). These biomarkers are combined with a patient’s age, Digital Rectal Exam (“DRE”) status (nodule / no nodule), and prior negative biopsy status (yes / no) using a proprietary algorithm to calculate the risk (probability) of finding an aggressive prostate cancer defined as Gleason Score 7 or higher prostate cancer. Recent data has also demonstrated potential that a high score using the 4Kscore test is associated with an increased risk of developing metastatic prostate cancer. The panel of biomarkers included in the OPKO 4Kscore is the result of more than a decade of research by scientists in Europe and the U.S. Extensive studies have shown that the use of this novel panel of kallikrein biomarkers and algorithm may not only improve the accuracy of identifying aggressive cancer, but may also reduce the number of unnecessary prostate biopsies by 50% or more and avoid diagnosis of indolent prostate cancer that can lead to over treatment with surgery or radiation. It is estimated that the 4Kscore test can provide $2-4 billion in healthcare savings in the U.S. each year.

The 4Kscore test is designed to be used as a reflex test after a finding of an abnormal DRE or elevated PSA, but before performing a prostate biopsy. There are approximately 1 million biopsies being performed annually in the U.S., with 80% of the results indicating no cancer or a low-grade, indolent form of prostate cancer. The test was developed by OPKO Lab and validated in a prospective, blinded study of 1,012 men in collaboration with 26 urology centers across the U.S. Results showed that the 4Kscore test was highly accurate for predicting the presence of high-grade cancer (Gleason score 7 or higher) prior to prostate biopsy. The full data from the blinded, prospective U.S. clinical validation study was presented at the AUA Annual Meeting in Orlando, FL on May 18, 2014 at Plenary Session and published in the online edition of European Urology in October 2014.

Our Claros1 immunoassay instrument system provides rapid, high performance blood test results and enables complex tests to be run in point-of-care settings. The instrument, a novel microfluidics-based system consisting of a credit card-sized disposable test cassette that works with a small desktop analyzer, can provide high performance, central laboratory-grade blood test results within minutes and permit the transition of complex immunoassays and other tests from the centralized reference laboratory to the physician’s office or hospital nurses’ station. We expect this point-of-care instrument system to provide near-term commercialization opportunities through the transition of existing laboratory-based tests, including prostate specific antigen (“PSA”), testosterone and vitamin D, to our point-of-care system.

We intend to submit our application to the Food and Drug Administration (the “FDA”) for clearance of a testosterone diagnostic test for our point-of-care system in the second half of 2015. We also intend to seek European certification related to

health, safety and environmental legislation, also known as a CE Marking (“CE Mark”) for the test in Europe at approximately the same time. We expect to begin marketing the testosterone test in the U.S. and Europe in 2016.

We have already obtained a CE Mark for our point-of-care diagnostic test for PSA using our system in Europe. We intend to update our CE Mark to reflect recent product improvements and launch the PSA test in Europe in 2016. We intend to submit our application to the FDA for pre-marketing authorization (“PMA”) of the PSA test in the first quarter of 2016.

We are also presently working to add additional tests for our point-of-care system, including vitamin D and Lyme Disease, and we believe that there are many more applications for the technology, including infectious disease, cardiology, women’s health, and companion diagnostics.

Our product pipeline also includes several pharmaceutical compounds and technologies in research and development for a broad range of indications and conditions.

In the third quarter of 2014, we announced successful top-line results from two identical randomized, double-blind, placebo-controlled, multi-site phase 3 trials of Rayaldee (CTAP101), our vitamin D prohormone to treat secondary hyperparathyroidism (“SHPT”) in patients with stage 3 or 4 chronic kidney disease (“CKD”) and vitamin D insufficiency. Vitamin D insufficiency often arises in CKD due to the abnormal upregulation of CYP24, an enzyme that destroys vitamin D and its metabolites. Studies in CKD patients have demonstrated that available over-the-counter and prescription vitamin D products cannot reliably raise blood vitamin D prohormone levels and effectively treat SHPT. Rayaldee was shown in the studies to effectively and safely treat SHPT and the underlying vitamin D insufficiency in pre-dialysis patients. A New Drug Application ("NDA") submission to the FDA is planned for the first quarter of 2015.

In addition to SHPT in CKD patients, we also are developing Rayaldee for other indications, and in August 2014, announced the submission of an Investigational New Drug application (“IND”) to the FDA to evaluate Rayaldee as an adjunctive therapy for the prevention of skeletal-related events in patients with bone metastases undergoing anti-resorptive therapy. We commenced a phase 1 dose escalation study in the fourth quarter of 2014 in breast and prostate cancer patients with bone metastases who are receiving anti-resorptive therapy. The study will evaluate safety, markers of mineral metabolism and tumor progression.

We are also developing Alpharen (Fermagate Tablets), a new and potent non-absorbed phosphate binder to treat hyperphosphatemia in dialysis patients. Alpharen has been shown to be safe and effective in treating hyperphosphatemia in phase 2 and 3 trials in CKD patients undergoing chronic hemodialysis. Hyperphosphatemia contributes to soft tissue mineralization and affects approximately 90% of dialysis patients. Dialysis patients require ongoing phosphate binder treatment to maintain normal serum phosphorus levels.

The CKD patient population is large and growing as a result of obesity, hypertension and diabetes, representing a significant market opportunity. We intend to develop Rayaldee (CTAP101) and Alpharen (Fermagate Tablets) to constitute part of the foundation for a new and markedly improved standard of care for CKD patients having SHPT and/or hyperphosphatemia.

In August 2013, we acquired OPKO Biologics, formerly PROLOR Biotech, Inc., a biopharmaceutical company focused on developing and commercializing longer-acting proprietary versions of already approved therapeutic proteins utilizing a platform technology known as Carboxyl Terminal Peptide (“CTP”) technology.

Our most advanced product in development using the platform technology is a long-acting version of human growth hormone, known as hGH-CTP, for the long-term treatment of children and adults with growth failure due to inadequate secretion of endogenous growth hormone (a $3.0 billion market opportunity growing 5% annually).

In December 2014, we entered into an exclusive worldwide agreement with Pfizer Inc. (“Pfizer”) for the development and commercialization of our hGH-CTP for the treatment of growth hormone deficiency (“GHD”) in adults and children, as well as for the treatment of growth failure in children born small for gestational age (“SGA”). In connection with the transaction, we granted Pfizer an exclusive license to commercialize hGH-CTP worldwide, and we received non-refundable and non-creditable upfront payments of $295 million and are eligible to receive up to an additional $275 million upon the achievement of certain regulatory milestones. In addition, we are eligible to receive initial royalty payments associated with the commercialization of hGH-CTP for Adult GHD. Upon the launch of hGH-CTP for Pediatric GHD, the royalties will transition to regional, tiered gross profit sharing for both hGH-CTP and Pfizer’s Genotropin®.

Pursuant to our agreement with Pfizer, we will lead the clinical activities for the hGH-CTP program and will be responsible for funding the development programs for the key indications, which includes Adult and Pediatric GHD and Pediatric SGA. Pfizer will be responsible for all development costs for additional indications as well as all post-marketing

studies. In addition, Pfizer will fund the commercialization activities for all indications and lead the manufacturing activities covered by the global development plan.

The hGH-CTP product has been shown in a phase 2 clinical trial to have the potential to reduce the required dosing frequency of human growth hormone from the current standard of one injection per day to a single weekly injection. hGH-CTP is currently in a global phase 3 trial in adults and a global phase 2 trial in children and has orphan drug designation in the U.S. and Europe for both adults and children with GHD.

Factor VIIa-CTP is our novel, long-acting recombinant Factor VIIa which also utilizes CTP technology to extend circulatory half-life without the use of polymers, encapsulation techniques, or nanoparticles. Currently, Factor VIIa therapy is available only as an intravenous (IV) formulation which, due to Factor VIIa’s short half-life, requires multiple infusions to treat a bleeding episode. Pre-clinical studies of intravenous and subcutaneous formulations of our product in hemophilic animal models demonstrated its duration of action and significantly increased survival. In January 2015, we submitted an IND to the FDA to conduct a Phase 2a study of Factor VII-CTP for the treatment of bleeding episodes in hemophilia A or B patients with inhibitors to Factor VIII or Factor IX. Factor VII-CTP has been granted orphan status in the U.S. and Europe.

In addition to hGH-CTP and Factor VII-CTP, our internal product development program is currently focused on extending the circulatory half life of oxyntomodulin. Oyxntomodulin, a natural appetite suppressor, is a peptide hormone secreted by the intestine following food intake that induces satiety when it reaches the brain. Oxyntomodulin activates both the glucagon-like peptide-1 receptor (GLP1R) and glucagon receptor (GCGR) and has been found to decrease food intake and body weight as well as lower glucose in overweight human volunteers.

The clinical utility of oxyntomodulin has been limited mostly because of its short circulating half life. We are developing a long-acting oxyntomdulin, GLP-1/glucagon dual receptor agonist comprising oxyntomodulin linked at its N-terminus to polyethylene glycol (PEG) linear chain through a proprietary bi-functional hydrolysable linker. Administration of the conjugate into the blood results in slow release of the authentic, non-modified natural oxyntomodulin. Our preclinical studies have shown that a single weekly injection of our compound in development significantly inhibited food intake and reduced body weight in obese and diabetic animal models, as well as improving the lipid profile by reducing cholesterol levels in obese and diabetic mice. In addition, the studies demonstrated improved glycemic control by inducing glucose dependent insulin secretion and by reducing fat, two biological effects related to type II diabetes. We expect to initiate a phase 1 study of our compound in the second half of 2015.

We believe that our up-regulating oligonucleotide therapeutics technology, or AntagoNAT, has the potential to create new drugs for the treatment of a wide variety of illnesses, including cancer, heart disease, metabolic disorders and a range of genetic disorders. We have a variety of therapeutic agents for respiratory disorders in clinical development, including products for asthma, chronic obstructive pulmonary disease (“COPD”), and chronic cough.

In addition to these development programs, we have pharmaceutical businesses in Chile, Spain, Mexico, Israel, and Uruguay.

We have a highly experienced management team that we believe has demonstrated an ability to successfully build and manage pharmaceutical businesses. Based on their experience in the industry, we believe that our management team has extensive development, regulatory and commercialization expertise and relationships that provide access to commercial opportunities.

GROWTH STRATEGY

We expect our future growth to come from leveraging our proprietary technology and development strengths, and opportunistically pursuing complementary, accretive, or strategic acquisitions and investments.

We have under development a broad and diversified portfolio of diagnostic tests, vaccines, small molecules, and biologics targeting a broad range of unmet medical needs. We intend to continue to leverage our proprietary technology and our strengths in all phases of research and development to further develop and commercialize our portfolio of proprietary pharmaceutical and diagnostic products. In support of our strategy, we intend to:

| |

• | obtain requisite regulatory approval and compile clinical data for our most advanced product candidates; |

| |

• | develop a focused commercialization capability both internationally and in the U.S.; and |

| |

• | expand into other medical markets that provide significant opportunities and that we believe are complementary to and synergistic with our business. |

We have and expect to continue to be opportunistic and to pursue complementary or strategic acquisitions, licenses and investments. Our management team has significant experience in identifying, executing and integrating these transactions. We expect to use well-timed, carefully selected acquisitions, licenses and investments to continue to drive our growth, including:

| |

• | Products and technologies. We intend to continue to pursue product and technology acquisitions and licenses that will complement our existing businesses and provide new product and market opportunities, improve our growth, enhance our profitability, leverage our existing assets, and contribute to our own organic growth. |

| |

• | Commercial businesses. We intend to continue to pursue acquisitions of commercial businesses that will both drive our growth and provide geographically diverse sales and distribution opportunities, particularly outside of the U.S. |

| |

• | Early stage investments. We have and may continue to make investments in early stage companies that we perceive to have valuable proprietary technology and significant potential to create value for OPKO as a shareholder. |

CORPORATE INFORMATION

We were originally incorporated in Delaware in October 1991 under the name Cytoclonal Pharmaceutics, Inc., which was later changed to eXegenics, Inc. (“eXegenics”). On March 27, 2007, we were part of a three-way merger with Froptix Corporation (“Froptix”), a research and development company, and Acuity Pharmaceuticals, Inc. (“Acuity”), a research and development company. On June 8, 2007, we changed our name to OPKO Health, Inc.

Our shares are publicly traded on the NYSE under the ticker “OPK”. Effective as of August 2013, our stock also began trading on the Tel Aviv Stock Exchange. Our principal executive offices are located in leased office space in Miami, Florida. We lease office and lab space in Jupiter, Florida and Miramar, Florida, and Nes Ziona, Israel, which is where our molecular diagnostics research and development, oligonucleotide research and development and CTP research and development operations are based, respectively. We lease office, manufacturing, and warehouse space in Woburn, Massachusetts for our point-of-care diagnostics business, and in Nesher, Israel for our API business. We lease laboratory and office space in Nashville, Tennessee, Burlingame, California, and Miramar, Florida for our CLIA-certified laboratory business, and we lease office space in Bannockburn, Illinois, and Markham, Ontario for our pharmaceutical business directed to CKD. Our Chilean and Uruguayan operations are located in leased offices and warehouse facilities in Santiago and Montevideo, respectively. Our Mexican operations are based in owned offices, an owned manufacturing facility, and a leased warehouse facility in Guadalajara and in leased offices in Mexico City. Our Spanish operations are based in owned offices in Barcelona, in an owned manufacturing facility in Banyoles and a leased warehouse facility in Palol de Revardit. Our Brazilian operations are located in leased offices in Sao Paulo.

We currently manage our operations in two reportable segments, pharmaceutical and diagnostics. The pharmaceutical segment consists of two operating segments, our (i) pharmaceutical research and development segment, which is focused on the research and development of pharmaceutical products and vaccines, and (ii) the pharmaceutical operations we acquired in Chile, Spain, Mexico, Israel, Uruguay and Brazil. The diagnostics segment consists of two operating segments, our (i) pathology operations we acquired through the acquisition of OPKO Lab and (ii) point-of-care and molecular diagnostics operations. There are no significant inter-segment sales. We evaluate the performance of each segment based on operating profit or loss. There is no inter-segment allocation of interest expense and income taxes.

CURRENT PRODUCT CANDIDATES AND RELATED MARKETS

Diagnostics

4Kscore

We began selling the 4Kscore in the U.S. in March 2014 and in Europe and Mexico in September 2014 and January 2015, respectively. The 4Kscore measures the blood plasma levels of four different prostate-derived kallikrein proteins: Total PSA, Free PSA, Intact PSA and Human Kallikrein-2 (“hK2”). These biomarkers are then combined with a patient’s age, DRE status (nodule / no nodule), and prior negative biopsy status (yes / no) using a proprietary algorithm to calculate the risk (probability) of finding a Gleason Score 7 or higher prostate cancer.

The OPKO 4Kscore was developed by OPKO Lab and validated in 2014 in a prospective, blinded study of 1,012 men in collaboration with 26 urology centers across the U.S. Results showed that the 4Kscore test was highly accurate for predicting the presence of high-grade cancer (Gleason score 7 or higher) prior to prostate biopsy. The full data from the blinded, prospective U.S. clinical validation study were presented at the AUA Annual Meeting in Orlando, FL on May 18, 2014 at Plenary Session and published in the online edition of European Urology in October 2014.

The clinical data presented at the AUA annual meeting included 1,012 men scheduled for prostate biopsy. Patients were enrolled regardless of their PSA, age, DRE result, or primary versus repeat biopsy status, and represent contemporary practice in the U.S. The results demonstrated the ability of the 4Kscore test to discriminate between men with high-grade, aggressive prostate cancer and those men who had no findings of cancer or had low-grade or indolent form of the disease. The discrimination, measured by Area Under the Curve (“AUC”) analysis, was 0.82 and was significantly higher than previously developed tests. Furthermore, the 4Kscore test demonstrated excellent risk calibration, indicating the accuracy of the result for an individual patient. The high value of AUC and the excellent risk calibration make the 4Kscore result valuable information for the shared decision-making between the urologist and patient on whether or not to perform a prostate biopsy, potentially reducing biopsies by more than 50%. Although quite specific to the prostate gland, PSA is not specific for prostate cancer. As a result, in the U.S., an estimated 750,000 men receive unnecessary prostate biopsies annually as a result of PSA testing. We believe that our novel 4Kscore test should yield significantly greater accuracy and should provide us with a unique opportunity to greatly improve the value of prostate cancer screening.

The four kallikrein panel of biomarkers utilized in the 4Kscore test is based on over a decade of research conducted by scientists at Memorial Sloan-Kettering Cancer Center and leading European institutions. Investigators at the University of Malmo, Sweden, University of Turku, Finland and Memorial Sloan Kettering Cancer Center, New York, have also demonstrated that an algorithm integrating these biomarkers along with patient data can predict prostate biopsy results, and that the use of this algorithm to determine whether to biopsy can reduce the number of prostate biopsies performed by over fifty percent (50%), avoiding the frequent complications from biopsies of pain, bleeding, and infection, which sometimes require hospitalization.

In December 2012, we completed the acquisition of OPKO Lab, our CLIA-certified laboratory with several phlebotomy sites throughout the U.S. and an experienced national sales force calling primarily on urologists. In addition to continuing to operate as a full-service medical laboratory specializing in urologic pathology, OPKO Lab provides us with the commercial platform to support the U.S. commercial launch of the 4Kscore for the detection of prostate cancer as an LDT.

Point-of-Care Diagnostics

In October 2011, we acquired Claros Diagnostics, Inc. (“OPKO Diagnostics”), which developed a novel diagnostic instrument system that provides rapid, high performance blood test results and enables tests to be run in point-of-care settings. The instrument, a microfluidics-based diagnostic test system consisting of a credit card-sized disposable test cassette that works with a small but sophisticated desktop analyzer, provides high performance quantitative blood test results within minutes and permits the transition of complex immunoassays and other tests from the centralized reference laboratory to the physician’s office or hospital nurses station. The technology only requires a finger stick drop of blood introduced into the test cassette which can simultaneously run multiple tests (multiplex) on the single droplet of blood.

We intend to submit our application to the FDA for clearance of a testosterone diagnostic test for our point-of-care system in the second half of 2015. We also intend to seek a CE Mark for the test in Europe at approximately the same time. We expect to begin marketing the testosterone test in the U.S. and Europe in 2016.

We have already obtained a CE Mark for our point-of-care diagnostic test for PSA using this system in Europe. We intend to update our CE Mark to reflect recent product improvements and launch the PSA test in Europe in 2016. We intend to submit our PMA application to the FDA for the PSA test in the first quarter of 2016.

We are also presently working to add additional tests for our point-of-care system, including Lyme Disease and vitamin D, and we believe that there are many more applications for the technology, including infectious disease, cardiology, women’s health, and companion diagnostics.

Molecular Diagnostics

In June 2009, we acquired exclusive, worldwide rights from the University of Texas Southwestern to an innovative platform technology for the rapid identification of molecules or immunobiomarkers that may be useful in the creation of accurate, easy-to-use diagnostic tests as well as the development of vaccines and highly targeted therapeutic agents for immune system-driven diseases. The technology is based on an innovative method for the identification in small blood samples of disease-specific antibodies that can serve as diagnostic biomarkers for various diseases. We jointly own patent applications covering certain aspects of the technology and hold an exclusive license to the technology. After gaining extensive experience with the technology in the field of commercial diagnostic tests, we have concluded that other opportunities in the life science tools area may be a more promising use of the platform technology and are actively exploring the best way to realize the platform’s potential.

Pharmaceutical Business

We presently have several pharmaceutical compounds and technologies in research and development for a broad range of indications and conditions. Our product development candidates are in various stages of development and include the following:

Renal Products

In March 2013, we acquired Cytochroma Inc. (“Cytochroma” or “OPKO Renal”), a clinical stage specialty pharmaceutical company focused on developing and commercializing proprietary products to treat vitamin D insufficiency, hyperphosphatemia and SHPT associated with CKD, a condition characterized by progressive decline in renal function. CKD is classified in five stages — mild (stage 1) to severe (stage 5) disease. Our two lead renal products are Rayaldee (CTAP101), a vitamin D prohormone to treat SHPT in patients with stage 3 or 4 CKD and vitamin D insufficiency, and Alpharen (Fermagate Tablets), a new and potent non-absorbed phosphate binder to treat hyperphosphatemia in Stage 5 patients on chronic hemodialysis.

We announced successful top-line results from two pivotal phase 3 trials of Rayaldee in the third quarter of 2014. These trials were identical randomized, double-blind, placebo-controlled, multi-site studies intended to establish the safety and efficacy of Rayaldee as a new treatment for SHPT in patients with stage 3 or 4 CKD and vitamin D insufficiency. Vitamin D insufficiency arises in CKD due to the abnormal upregulation of CYP24, an enzyme that destroys vitamin D and its metabolites. Studies in CKD patients have demonstrated that currently available over-the-counter and prescription vitamin D products cannot reliably raise blood vitamin D prohormone levels and effectively treat SHPT, a condition commonly associated with CKD in which the parathyroid glands secrete excessive amounts of parathyroid hormone (“PTH”). Prolonged elevation of blood PTH causes excessive calcium and phosphorus to be released from bone, leading to elevated serum calcium and phosphorus levels, softening of the bones (osteomalacia) and calcification of vascular and renal tissues. SHPT affects 40-82% of patients with stage 3 or 4 CKD and approximately 95% of patients with stage 5.

The completed pivotal trials for Rayaldee successfully met all primary efficacy and safety endpoints. The primary efficacy endpoint was a responder analysis in which “responder” was defined as any treated subject who demonstrated an average 30% decrease in PTH from pre-treatment baseline during the last six weeks of the 26-week treatment period. A significantly higher response rate was observed with Rayaldee which steadily increased with treatment duration. The response rate with Rayaldee was similar in CKD stages 3 and 4. Safety and tolerability data were comparable in both treatment groups. Patients completing the two pivotal trials were treated, at their election, for an additional six months with Rayaldee during an open-label extension study. A new drug application (“NDA”) submission to the FDA is planned for the first quarter of 2015.

In addition to SHPT in CKD patients, we also are developing Rayaldee for other indications, and in August 2014, announced the submission of an IND to the FDA to evaluate Rayaldee as an adjunctive therapy for the prevention of skeletal-related events in patients with bone metastases undergoing anti-resorptive therapy. We commenced a phase 1 dose escalation study in the fourth quarter of 2014 in breast and prostate cancer patients with bone metastases who are receiving anti-resorptive therapy. The study will evaluate safety, markers of mineral metabolism and tumor progression.

Our phosphate binder, Alpharen (Fermagate Tablets), has been shown to be safe and effective in treating hyperphosphatemia in phase 2 and 3 trials in stage 5 CKD patients undergoing chronic hemodialysis. Hyperphosphatemia, or elevated serum phosphorus, is common in dialysis patients and tightly linked to the progression of SHPT. The kidneys provide the primary route of excretion for excess phosphorus absorbed from ingested food. As kidney function worsens, serum phosphorus levels increase and directly stimulate PTH secretion. Stage 5 CKD patients must reduce their dietary phosphate intake and usually require regular treatment with phosphate binding agents to lower serum phosphorus to meet the recommendations of the National Kidney Foundation’s Clinical Practice Guidelines that serum phosphorus levels should be maintained at or below 5.5 mg/dL. Hyperphosphatemia contributes to soft tissue mineralization and affects approximately 90% of dialysis patients. Dialysis patients require ongoing phosphate binder treatment to maintain controlled serum phosphorus levels.

We believe the CKD patient population is large and growing as a result of obesity, hypertension and diabetes; therefore this patient population represents a significant market opportunity. According to the National Kidney Foundation, CKD afflicts over 26 million people in the U.S., including more than 20 million patients with stage 3 or 4 CKD. In stage 5, kidney function is minimal to absent and patients require regular dialysis or a kidney transplant for survival. An estimated 71-97% of CKD patients have vitamin D insufficiency which can lead to SHPT and its debilitating consequences. CKD continues to be associated with poor outcomes, reflecting the inadequacies of the current standard of care. Vitamin D insufficiency, hyperphosphatemia and SHPT, when inadequately treated, are major contributors to poor CKD outcomes. We intend to develop Rayaldee (CTAP101) and Alpharen (Fermagate Tablets) to constitute part of the foundation for a new and markedly improved standard of care for CKD patients having SHPT and/or hyperphosphatemia.

OPKO Biologics

In August 2013, we acquired OPKO Biologics, formerly PROLOR Biotech, Inc., a biopharmaceutical company focused on developing and commercializing longer-acting proprietary versions of already approved therapeutic proteins utilizing a patented platform technology. The technology uses a short, naturally-occurring amino acid sequence (peptide) that has the effect of slowing the removal from the body of the therapeutic protein to which it is attached. This CTP can be readily attached to a wide array of existing therapeutic proteins, stabilizing the therapeutic protein in the bloodstream and extending its life span without additional toxicity or loss of desired biological activity. We are using the CTP technology to develop new, proprietary versions of certain existing therapeutic proteins that have longer life spans than therapeutic proteins without CTP. We believe that our products will have greatly improved therapeutic profiles and distinct market advantages.

There are two existing biopharmaceuticals on the market that currently utilize CTP technology. The first product is human chorionic gonadotropin (hCG), of which CTP is naturally a part. Besides being present normally in high amounts during pregnancy, it is also given therapeutically to women or men as a fertility treatment (sold by Merck-Serono, Merck & Co. and Ferring). The second product is ELONVA® (FSH-CTP), which is approved for marketing in Europe. The data from the clinical use of these two products give us confidence that the CTP technology may be able to address the major problems faced by the other attempted approaches to increase protein lifespan. Clinical data from these products reassure us that CTP can be used safely and that it is effective in extending the serum lifetime and activity. We are now the exclusive licensee for the utilization of CTP technology in all therapeutic proteins, peptides and their modified forms except for human FSH, LH, TSH and hCG.

Our lead product candidate utilizing CTP, hGH-CTP, is a recombinant human growth hormone product under development for the treatment of GHD, which is a pituitary disorder resulting in short stature in children and other physical ailments in both children and adults.

In December 2014, we entered into an exclusive worldwide agreement with Pfizer for the development and commercialization of hGH-CTP for the treatment of GHD in adults and children, as well as for the treatment of growth failure in children born SGA. In connection with the transaction, we granted Pfizer an exclusive license to commercialize hGH-CTP worldwide, and we received non-refundable and non-creditable upfront payments of $295 million and are eligible to receive up to an additional $275 million upon the achievement of certain regulatory milestones. In addition, we are eligible to receive initial royalty payments associated with the commercialization of hGH-CTP for Adult GHD. Upon the launch of hGH-CTP for Pediatric GHD, the royalties will transition to regional, tiered gross profit sharing for both hGH-CTP and Pfizer’s Genotropin®.

Pursuant to our agreement with Pfizer, we will lead the clinical development activities for the hGH-CTP program and will be responsible for funding the development programs for the key indications, which includes Adult and Pediatric GHD and Pediatric SGA. Pfizer will be responsible for all development costs for additional indications as well as all post-marketing studies. In addition, Pfizer will fund the commercialization activities for all indications and lead the manufacturing activities covered by the global development plan.

GHD occurs when the production of growth hormone, secreted by the pituitary gland, is disrupted. Since growth hormone plays a critical role in stimulating body growth and development, and is involved in the production of muscle protein and in the breakdown of fats, a decrease in the hormone affects numerous body processes. hGH is used for the long-term treatment of children and adults with inadequate secretion of endogenous growth hormone. The primary indications it treats in children are GHD, kidney disease, Prader-Willi Syndrome and Turner’s Syndrome. In adults, the primary indications are replacement of endogenous growth hormone and the treatment of AIDS-induced weight loss. Patients using hGH receive daily injections six or seven times a week. This is particularly burdensome for pediatric patients. We believe a significant market opportunity exists for a longer-lasting version of hGH that would require fewer injections.

hGH-CTP is currently in a global phase 3 trial in adults and a global phase 2 trial in children and has orphan drug designation in the U.S. and Europe for both adults and children with GHD.

In addition to hGH-CTP, we are focused on products extending the life span of Factor VIIa (hemophilia) using the CTP technology. In February 2013, the FDA granted orphan drug designation to our longer-acting version of clotting Factor VIIa, Factor VIIa-CTP, for the treatment of bleeding episodes in patients with hemophilia A or B with inhibitors to Factor VIII or Factor IX. These patients are currently being treated by commercially-available Factor VIIa, with estimated 2013 worldwide sales of $1.7 billion. Currently, Factor VIIa therapy is available only as an intravenous (IV) formulation which, due to Factor VIIa’s short half-life, requires multiple infusions to treat a bleeding episode. In addition, frequent infusions are onerous when used as preventative prophylactic therapy, especially for children. Pre-clinical studies of IV and subcutaneous formulations of our product in hemophilic animal models demonstrated its duration of action and significantly increased survival. In January 2015, we submitted an IND to the FDA to conduct a Phase 2a study of Factor VIIa-CTP for the treatment of bleeding episodes

in hemophilia A or B patients with inhibitors to Factor VIII or Factor IX. Factor VIIa-CTP has been granted orphan designation in Europe as well as the U.S.

We believe that the CTP technology may also be broadly applicable to other best-selling therapeutic proteins in the market and provide several key advantages over our competitor’s existing products: significant reduction in the number of injections required to achieve the same or superior therapeutic effect from the same dosage; faster commercialization with greater chance of success and lower costs than those typically associated with a new therapeutic protein; and manufacturing using industry-standard biotechnology-based protein production processes.

In addition to hGH-CTP and Factor VII-CTP, our internal product development program is currently focused on extending the circulatory half life of oxyntomodulin. Oyxntomodulin, a natural appetite suppressor, is a peptide hormone secreted by the intestine following food intake that induces satiety when it reaches the brain. Oxyntomodulin activates both the glucagon-like peptide-1 receptor (GLP1R) and glucagon receptor (GCGR) and has been found to decrease food intake and body weight as well as lower glucose in overweight human volunteers.

We believe oxyntomodulin has potential to be a safe, long term therapy for obese and diabetes type II patients, representing significant market opportunities. More than 380 million are living with diabetes worldwide, of which approximately 90% have type II diabetes. According to the World Health Organization, there are more than 500 million severely overweight or obese people.

The clinical utility of oxyntomodulin has been limited mostly because of its short circulating half life. We are developing a long-acting oxyntomdulin comprising oxyntomodulin linked at its N-terminus to polyethylene glycol (PEG) linear chain through a proprietary bi-functional hydrolysable linker. Administration of the conjugate into the blood results in slow release of the authentic, non-modified natural oxyntomodulin. Our preclinical studies have shown that a single weekly injection of our compound in development significantly inhibited food intake and reduced body weight in obese and diabetic animal models, as well as improving the lipid profile by reducing cholesterol levels in obese and diabetic mice.

We expect to initiate a phase 1 study of our compound in the second half of 2015.

APIs

In December 2011, we acquired FineTech Pharmaceutical, Ltd. (“FineTech”), an Israeli company that develops and produces high value, high potency specialty APIs. Through its FDA registered facility in Nesher, Israel, FineTech currently manufactures commercial APIs for sale or license to pharmaceutical companies in the U.S., Canada, Europe and Israel. We believe that FineTech’s significant know-how and experience with analytical chemistry and organic syntheses, together with its production capabilities, may play a valuable role in the development of our pipeline of proprietary molecules and compounds for diagnostic and therapeutic products, while providing revenues and profits from its existing API business.

Oligonucleotide Therapeutics

In January 2011, we acquired CURNA, Inc. (“CURNA”), a privately-held company based in Jupiter, Florida, engaged in the discovery of new drugs for the treatment of a wide variety of illnesses, including cancer, heart disease, metabolic disorders and a range of genetic anomalies. CURNA’s broad platform technology utilizes a short, single strand oligonucleotide and is based on the up-regulation of protein production through interference with non-coding RNA’s, or natural antisense. This strategy contrasts with established approaches which down-regulate protein production. CURNA has designed a novel type of therapeutic modality, termed AntagoNAT, and has initially demonstrated this approach for up-regulation of several therapeutically relevant proteins in in vitro and animal models. We believe that this short, single strand oligonucleotide can be delivered intravenously or subcutaneously without the drug delivery or cell penetration complications typically associated with double stranded siRNA therapeutics. CURNA has identified and developed compounds which increase the production of over 80 key proteins involved in a large number of individual diseases. We have ongoing pre-clinical studies for several of these compounds, with an initial focus on orphan diseases including Dravet Syndrome, Rett Syndrome and MPS-1.

Asthma and COPD

In May 2010, we acquired worldwide rights to a novel heparin-derived oligosaccharide which has significant potential in treating asthma and COPD. Over 22 million people in the U.S. live with asthma, including nearly 6 million children. Additionally, there are more than 12 million people in the U.S. who have COPD. Currently available therapies often include unwanted side effects and may have limited efficacy. We believe that our product may have an improved efficacy and side effect profile. Our initial studies have demonstrated anti-inflammatory and anti-allergic activity when administered orally or inhaled with inhalers or nebulizers in sheep and mice asthma models. We have also successfully completed human feasibility studies in asthma.

To complement our portfolio of respiratory products, we acquired in 2014 Inspiro Medical Ltd., a medical device firm developing a new platform to deliver small molecule drugs like corticosteroids and beta agonists or larger molecules to treat respiratory disease. Inspiro’s Inspiromatic is a “smart” easy-to-use dry powder inhaler with several advantages over existing devices. In a First In Man double blinded clinical study conducted in 30 asthmatic children comparing Inspiromatic to a market leading dry powder inhaler, Inspiromatic demonstrated superior pulmonary delivery of the active drug.

NK-1 Program

In November 2009, we acquired rolapitant and other neurokinin-1 (“NK-1”) assets from Schering Plough Corporation. In December 2010, we exclusively out-licensed the development, manufacture and commercialization of our lead NK-1 candidate, rolapitant, to TESARO, Inc. (“TESARO”). Rolapitant, a potent and selective competitive antagonist of the NK-1 receptor, had successfully completed phase 2 clinical testing for prevention of chemotherapy induced nausea and vomiting, or CINV, and post-operative induced nausea and vomiting. In December 2013, TESARO also announced successful achievement of the primary endpoint in each of two phase 3 trials of rolapitant for prevention of CINV. TESARO submitted its NDA to the FDA for approval of oral rolapitant in September 2014. Under the terms of the license, we are eligible to receive up-front and milestone payments of up to $121 million, double digit tiered royalties on sales of licensed product, as well as a share of future profits from the commercialization of licensed products in Japan, and an option to market the products in Latin America. In addition, we acquired an equity position in TESARO.

Commercial Operations

We also intend to continue to leverage our global commercialization expertise to pursue acquisitions of commercial businesses that will both drive our growth and provide geographically diverse sales and distribution opportunities, particularly outside of the U.S. At a time of slowing pharmaceutical sales growth in many mature countries, the expansion in many emerging markets has led to higher sales growth rates and an increasing contribution to the industry’s global performance. As a result, we expect that emerging markets will continue to be a growing part of our business strategy, contributing both attractive revenue growth and cash flow to support our development programs.

In January 2014 and February 2013, we completed the acquisitions of Laboratorio Arama de Uruguay Limitada (“OPKO Uruguay Ltda.”), an Uruguayan entity domiciled in Montevideo, and Silcon Comércio, Importacao E Exportacao de Produtos Farmaceuticos e Cosmeticos Ltda. (“OPKO Brazil”), a Brazilian entity domiciled in Sao Paulo, respectively. OPKO Uruguay Ltda. and OPKO Brazil will expand our presence in Latin America and complement the business activities of our operations in Chile and Mexico, as well as facilitate future market entry for our products in development.

In December 2012, we completed the acquisition of OPKO Lab, a Nashville-based CLIA-certified laboratory with several phlebotomy sites throughout the U.S. and an experienced national sales force calling primarily on urologists. In addition to continuing to operate as a full-service medical laboratory specializing in urologic pathology, OPKO Lab provides us with a commercial platform to support the U.S. commercial launch of the 4Kscore as an LDT and may be helpful in speeding the development and introduction of other important tests.

In August 2012, we completed the acquisition of Farmadiet Group Holding, S.L. (“OPKO Health Europe”), a Spanish company with 20 years of experience engaged in the development, manufacture, marketing, and sale of pharmaceutical, nutraceutical, and veterinary products in Europe.

In April 2012, we completed the acquisition of ALS Distribuidora Limitada (“ALS”), a privately-held Chilean pharmaceutical company engaged in the business of importation, commercialization and distribution of pharmaceutical products for private markets in Chile. ALS started operations in 2009 as the exclusive product distributor of Arama Laboratorios y Compañía Limitada (“Arama”), a company with more than 20 years of experience in the pharmaceutical products market. In connection with the transaction, OPKO acquired all of the product registrations and trademarks previously owned by Arama, as well as the Arama name.

In February 2010, we completed the acquisition of Pharmacos Exakta S.A. de C.V. (“Exakta-OPKO”), a Mexican pharmaceutical business engaged in the manufacture, marketing, sale, and distribution of ophthalmic and other pharmaceutical products to private and public customers in Mexico. Exakta-OPKO manufacturers and sells products primarily in the generics market in Mexico, although it has recently increased its focus on the development of proprietary products as well.

In October 2009, we completed the acquisition of Pharma Genexx, S.A. (“OPKO Chile”). OPKO Chile markets, sells and distributes pharmaceutical and natural products to the private, hospital, pharmacy and public institutional markets in Chile for a wide range of indications, including, cardiovascular products, vaccines, antibiotics, gastro-intestinal products, and hormones, among others.

Strategic Investments

We have and may continue to make investments in other early stage companies that we perceive to have valuable proprietary technology and significant potential to create value for OPKO as a shareholder. At December 31, 2014, we also hold investments in Zebra Biologics, Inc. (“Zebra”), a biotechnology company focused on the discovery and development of biosuperior antibody therapeutics and complex drugs, ARNO Therapeutics, Inc., a clinical stage company focused on the development of oncology drugs, OAO Pharmsynthez, a Russian pharmaceutical company traded on the Moscow Stock Exchange, RXi Pharmaceuticals Corporation, a biotechnology company focused on discovering, developing and commercializing innovative therapies using RNA-targeted technologies, SciVac Ltd, an Israeli company that produces a third-generation hepatitis B vaccine, Cocrystal Pharma, Inc., a biotechnology company developing new treatments for viral diseases, ChromaDex Corporation, a provider of proprietary ingredients and products for the dietary supplement, food and beverage, animal health, cosmetic and pharmaceutical industries, Neovasc Inc. (“Neovasc”), a publicly-traded medical technology company, Sevion Therapeutics, Inc., a biopharmaceutical company which discovers and develops entirely new therapeutic classes for the treatment of cancer and immunological diseases, and Non-Invasive Monitoring Systems, Inc., a company engaged in the research, development, manufacturing and marketing of a line of motorized, non-invasive, whole body, periodic acceleration platforms.

Instrumentation Business

In October 2011, we completed the sale of our ophthalmic instrumentation business to OPTOS, Inc., a subsidiary of Optos plc.

RESEARCH AND DEVELOPMENT EXPENSES

During the years ended December 31, 2014, 2013, and 2012, we incurred $83.6 million, $53.9 million, and $19.5 million, respectively, of research and development expenses related to our various product candidates. During the years ended December 31, 2014 and 2013, our research and development expenses primarily consisted of OPKO Renal and OPKO Biologics development programs including expenses related to the ongoing phase 3 clinical trials for Rayaldee (CTAP101) and the development of hGH-CTP. During the year ended December 31, 2012, our research and development expenses primarily consisted of our molecular diagnostic programs and activities related to the development programs acquired from OPKO Diagnostics and CURNA.

INTELLECTUAL PROPERTY

We believe that technology innovation is driving breakthroughs in healthcare. We have adopted a comprehensive intellectual property strategy which blends the efforts to innovate in a focused manner with the efforts of our business development activities to strategically in-license intellectual property rights. We develop, protect, and defend our own intellectual property rights as dictated by the developing competitive environment. We value our intellectual property assets and believe we have benefited from early and insightful efforts at understanding diagnostics, as well as the disease and the molecular basis of potential pharmaceutical intervention.

We actively seek, when appropriate and available, protection for our products and proprietary information by means of U.S. and foreign patents, trademarks, trade secrets, copyrights, and contractual arrangements. Patent protection in the pharmaceutical and diagnostic fields, however, can involve complex legal and factual issues. There can be no assurance that any steps taken to protect such proprietary information will be effective.

Because the patent positions of pharmaceutical, biotechnology, and diagnostics companies are highly uncertain and involve complex legal and factual questions, the patents owned and licensed by us, or any future patents, may not prevent other companies from developing similar or therapeutically equivalent products or ensure that others will not be issued patents that may prevent the sale of our products or require licensing and the payment of significant fees or royalties. Furthermore, to the extent that any of our future products or methods are not patentable, that such products or methods infringe upon the patents of third parties, or that our patents or future patents fail to give us an exclusive position in the subject matter claimed by those patents, we will be adversely affected. We may be unable to avoid infringement of third party patents and may have to obtain a license, defend an infringement action, or challenge the validity of the patents in court. A license may be unavailable on terms and conditions acceptable to us, if at all. Patent litigation is costly and time consuming, and we may be unable to prevail in any such patent litigation or devote sufficient resources to even pursue such litigation.

LICENSES AND COLLABORATIVE RELATIONSHIPS

Our strategy is to develop a portfolio of product candidates through a combination of internal development, acquisition, and external partnerships. Collaborations are key to our strategy and we continue to build relationships and forge partnerships in various areas where unmet medical need and commercial opportunities exist. In December 2014, we entered into an exclusive agreement with Pfizer for the development and commercialization of our long-acting hGH-CTP for the treatment of GHD in adults and children, as well as for the treatment of growth failure in children born small for gestational age. Previously, we (or entities we have acquired) have completed strategic licensing transactions with the University of Texas Southwestern Medical Center at Dallas, the President and Fellows of Harvard College, Academia Sinica, The Scripps Research Institute, TESARO, INEOS Healthcare, Arctic Partners, and Washington University, among others.

COMPETITION

The pharmaceutical and diagnostic industries are highly competitive and require an ongoing, extensive search for technological innovation. The industries are characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary products. They also require, among other things, the ability to effectively discover, develop, test and obtain regulatory approvals for products, as well as the ability to effectively commercialize, market and promote approved products.

We intend to leverage our technological innovation and proprietary position to effectively compete in the pharmaceutical and biopharmaceutical markets. We are seeking to commercialize our 4Kscore product in the U.S. in a laboratory setting and to capitalize on near-term commercialization opportunities for our proprietary diagnostic point-of-care system by transitioning laboratory-based tests, including the 4Kscore, PSA, vitamin D, and testosterone, to our point-of-care system. Numerous companies, however, including major pharmaceutical companies, specialty pharmaceutical companies and specialized biotechnology companies, are engaged in the development, manufacture and marketing of pharmaceutical products competitive with those that we intend to commercialize ourselves and through our partners. Competitors to our diagnostics business and laboratory business are many and include major diagnostic companies, reference laboratories, molecular diagnostic firms, universities and research institutions.

Most of these companies have substantially greater financial and other resources, larger research and development staffs and more extensive marketing and manufacturing organizations than ours. This enables them, among other things, to make greater research and development investments and efficiently utilize their research and development costs, as well as their marketing and promotion costs, over a broader revenue base. This also provides our competitors with a competitive advantage in connection with the highly competitive product acquisition and product in-licensing process, which may include auctions in which the highest bidder wins. Our competitors may also have more experience and expertise in obtaining marketing approvals from the FDA and other regulatory authorities. In addition to product development, testing, approval, and promotion, other competitive factors in the pharmaceutical industry include industry consolidation, product quality and price, product technology, reputation, customer service, and access to technical information.

Our ability to commercialize our pharmaceutical and diagnostic test product candidates and compete effectively will depend, in large part, on:

| |

• | our ability to meet all necessary regulatory requirements to advance our product candidates through clinical trials and the regulatory approval process in the U.S. and abroad; |

| |

• | the perception by physicians and other members of the health care community of the safety, efficacy, and benefits of our products compared to those of competing products or therapies; |

| |

• | our ability to manufacture products we may develop on a commercial scale; |

| |

• | the effectiveness of our sales and marketing efforts; |

| |

• | the willingness of physicians to adopt a new diagnostic or treatment regimen represented by our technology; |

| |

• | our ability to secure reimbursement for our product candidates, |

| |

• | the price of the products we may develop and commercialize relative to competing products; |

| |

• | our ability to accurately forecast and meet demand for our product candidates if regulatory approvals are achieved; |

| |

• | our ability to develop a commercial scale infrastructure either on our own or with a collaborator, which would include expansion of existing facilities, including our manufacturing facilities, development of a sales and distribution network, and other operational and financial systems necessary to support our increased scale; |

| |

• | our ability to maintain a proprietary position in our technologies; and |

| |

• | our ability to rapidly expand the existing information technology infrastructure and configure existing operational, manufacturing, and financial systems (on our own or with third party collaborators) necessary to support our increased scale, which would include existing or additional facilities and or partners. |

GOVERNMENT REGULATION

The U.S. government regulates healthcare through various agencies, including but not limited to the following: (i) the FDA, which administers the Federal Food, Drug and Cosmetic Act (“FDCA”), as well as other relevant laws; (ii) the Centers for Medicare & Medicaid Services (“CMS”), which administers the Medicare and Medicaid programs; (iii) the Office of Inspector General (“OIG”), which enforces various laws aimed at curtailing fraudulent or abusive practices, including by way of example, the Anti-Kickback Statute, the Physician Self-Referral Law, commonly referred to as the Stark law, the Anti-Inducement Law, the Civil Money Penalty Law, and the laws that authorize the OIG to exclude healthcare providers and others from participating in federal healthcare programs; and (iv) the Office of Civil Rights, which administers the privacy aspects of the Health Insurance Portability and Accountability Act of 1996. All of the aforementioned are agencies within the Department of Health and Human Services (“HHS”). Healthcare is also provided or regulated, as the case may be, by the Department of Defense through its TriCare program, the Department of Veterans Affairs, especially through the Veterans Health Care Act of 1992, the Public Health Service within HHS under Public Health Service Act § 340B (42 U.S.C. § 256b), the Department of Justice through the Federal False Claims Act and various criminal statutes, and state governments under the Medicaid and other state sponsored or funded programs and their internal laws regulating all healthcare activities.

The testing, manufacture, distribution, advertising, and marketing of drug and diagnostic products and medical devices are subject to extensive regulation by federal, state, and local governmental authorities in the U.S., including the FDA, and by similar agencies in other countries. Any drug, diagnostic, or device product that we develop must receive all relevant regulatory approvals or clearances, as the case may be, before it may be marketed in a particular country.

Drug Development

The regulatory process, which includes overseeing preclinical studies and clinical trials of each pharmaceutical compound to establish its safety and efficacy and confirmation by the FDA that good laboratory, clinical, and manufacturing practices were maintained during testing and manufacturing, can take many years, requires the expenditure of substantial resources, and gives larger companies with greater financial resources a competitive advantage over us. Delays or terminations of clinical trials that we undertake would likely impair our development of product candidates. Delays or terminations could result from a number of factors, including stringent enrollment criteria, slow rate of enrollment, size of patient population, having to compete with other clinical trials for eligible patients, geographical considerations, and others.