Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 27 2015 - 6:05AM

Edgar (US Regulatory)

Registration Statement No. 333-191953

Filed Pursuant to Rule 433

Supplementing the Preliminary

Prospectus Supplement

Dated February 26, 2015

(To Prospectus dated October 28, 2013)

Pricing Term Sheet

Fixed-Rate Notes due 2023, 2027 and 2035

The information in this pricing term sheet relates only to the offering of Notes (the “Notes Offering”) and should be read together with (i) the preliminary prospectus supplement dated February 26, 2015 relating to the Notes Offering, including the documents incorporated by reference therein, and (ii) the related base prospectus dated October 28, 2013, each filed pursuant to Rule 424(b) under the Securities Act of 1933, as amended, Registration Statement No. 333-191953.

|

Issuer: |

|

The Coca-Cola Company |

|

Security: |

|

0.75% Notes due 2023

1.125% Notes due 2027 |

|

|

|

1.625% Notes due 2035 |

|

Offering Format: |

|

SEC Registered |

|

Principal Amount: |

|

€1,500,000,000 of 2023 Notes

€1,500,000,000 of 2027 Notes |

|

|

|

€1,500,000,000 of 2035 Notes |

|

Maturity Date: |

|

March 9, 2023 for 2023 Notes

March 9, 2027 for 2027 Notes |

|

|

|

March 9, 2035 for 2035 Notes |

|

Coupon: |

|

0.75% per year for 2023 Notes

1.125% per year for 2027 Notes |

|

|

|

1.625% per year for 2035 Notes |

|

Price to Public: |

|

99.776% of principal amount for 2023 Notes

99.023% of principal amount for 2027 Notes |

|

|

|

99.594% of principal amount for 2035 Notes |

|

Yield to Maturity: |

|

0.779% for 2023 Notes

1.213% for 2027 Notes |

|

|

|

1.649% for 2035 Notes |

|

Spread to Benchmark Security: |

|

+66.3 bps for 2023 Notes

+91.4 bps for 2027 Notes |

|

|

|

+89.8 bps for 2035 Notes |

|

Benchmark Security: |

|

DBR 1.500% due February 15, 2023 for 2023 Notes

DBR 0.500% due February 15, 2025 for 2027 Notes |

|

|

|

DBR 4.750% due July 4, 2034 for 2035 Notes |

|

Benchmark Security Yield: |

|

0.086% for 2023 Notes

0.299% for 2027 Notes |

|

|

|

0.751% for 2035 Notes |

|

Benchmark Security Price: |

|

111.21% for 2023 Notes

101.97% for 2027 Notes |

|

|

|

171.73% for 2035 Notes |

|

Mid-Swap Yield: |

|

0.499% for 2023 Notes

0.783% for 2027 Notes |

|

|

|

1.069% for 2035 Notes |

|

Spread to Mid-Swap Yield: |

|

+28 bps for 2023 Notes

+43 bps for 2027 Notes |

|

|

|

+58 bps for 2035 Notes |

|

Interest Payment Dates: |

|

Annually on March 9, commencing March 9, 2016 for the 2023 Notes, the 2027 Notes and the 2035 Notes |

|

Make-Whole Call: |

|

At any time prior to December 9, 2022 at a discount rate of Comparable Government Bond Rate plus 10 bps for 2023 Notes

At any time prior to December 9, 2026 at a discount rate of Comparable Government Bond Rate plus 15 bps for 2027 Notes |

|

|

|

At any time prior to December 9, 2034 at a discount rate of Comparable Government Bond Rate plus 15 bps for 2035 Notes |

|

Par Call: |

|

On or after December 9, 2022, for the 2023 notes, December 9, 2026 for the 2027 notes and December 9, 2034 for the 2035 notes (three months prior to the maturity date of the 2023 notes, the 2027 notes or the 2035 notes, as applicable), we may redeem in whole or in part the 2023 notes, the 2027 notes or the 2035 notes, as applicable, at any time or from time to time, at our option, at a redemption price equal to 100% of the principal amount of the applicable notes being redeemed, plus accrued and unpaid interest on the principal amount being redeemed to, but excluding, |

|

|

|

the redemption date. |

|

Use of Proceeds: |

|

The Coca-Cola Company expects to use the net proceeds from the offering to fund the repayment or redemption of its 5.350% Notes due 2017 and 4.875% Notes due 2019, to pay related fees and expenses, including redemption premiums, to repay its 0.750% Notes due March 13, 2015, to repay commercial paper and for general corporate purposes, which may include working capital, capital expenditures, acquisitions of or investments in businesses or assets, redemption and repayment of short-term or long-term debt and purchases of our common stock. Pending application of the net proceeds, we may temporarily invest the net proceeds in short-term marketable securities. While we currently anticipate that we will use the net proceeds of the offering as described above, we may reallocate the net proceeds depending upon market and other conditions in effect at the time to repay other outstanding indebtedness and for general corporate purposes. |

|

Day Count Convention: |

|

ACTUAL/ACTUAL (ICMA) |

|

Trade Date: |

|

February 26, 2015 |

|

Settlement Date: |

|

March 9, 2015 (T+7) |

|

Listing: |

|

The Coca-Cola Company intends to apply to list the notes on the New York Stock Exchange |

|

ISIN/Common Code/CUSIP: |

|

XS1197832915/119783291/191216BN9 for 2023 Notes

XS1197833053/119783305/191216BP4 for 2027 Notes |

|

|

|

XS1197833137/119783313/191216BQ2 for 2035 Notes |

|

Denominations: |

|

€100,000 and integral multiples of €1,000 in excess thereof |

|

Expected Ratings*: |

|

Aa3 by Moody’s Investors Service, Inc.

AA by Standard & Poor’s Ratings Services

A+ by Fitch Ratings |

|

Underwriters: |

|

Bookrunners:

Barclays Bank PLC

HSBC Bank plc

Merrill Lynch International

Morgan Stanley & Co. International plc

Co-Managers: |

|

|

|

Santander

Standard Chartered Bank

U.S. Bancorp Investments, Inc. |

|

Stabilization: |

|

Stabilization/FCA |

*Note: A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time.

The issuer has filed a registration statement (including a prospectus) with the U.S. Securities and Exchange Commission (SEC) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering.

You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Barclays Bank PLC at +44 (0) 20 7516 7548, HSBC Bank plc at +1-866-811-8049, Merrill Lynch International at +1-800-294-1322 or Morgan Stanley & Co. International plc at +1-866-718-1649.

Any legends, disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of this communication having been sent via Bloomberg or another system.

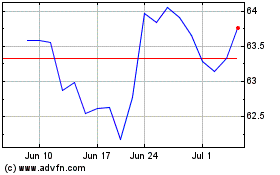

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024