UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): February 26, 2015

|

Commission File Number: 000-50768

|

ACADIA Pharmaceuticals Inc.

|

(Exact name of small business issuer as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

061376651

(IRS Employer Identification No.)

|

11085 Torreyana Road #100, San Diego, California 92121

|

(Address of principal executive offices)

(Registrant's Telephone number)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2. below):

|

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 2.02 Results of Operations and Financial Condition.

On February 26, 2015, ACADIA Pharmaceuticals Inc. issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2014. A copy of this press release is furnished herewith as Exhibit 99.1. Pursuant to the rules and regulations of the Securities and Exchange Commission, such exhibit and the information set forth therein and in this Item 2.02 have been furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to liability under that section nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing regardless of any general incorporation language.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibit is furnished herewith:

99.1 Press release dated February 26, 2015

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ACADIA Pharmaceuticals Inc.

By: /s/ Glenn F. Baity

|

| |

|

Name: Glenn F. Baity

|

|

Title: EVP, General Counsel & Secretary

|

|

Exhibit No.

99.1

|

|

Description

Press release dated February 26, 2015

|

Exhibit 99.1

Contacts:

ACADIA Pharmaceuticals Inc.

Steve Davis, Executive Vice President,

Chief Financial Officer and Chief Business Officer

Lisa Barthelemy, Director of Investor Relations

(858) 558-2871

ACADIA PHARMACEUTICALS REPORTS FINANCIAL RESULTS FOR THE FOURTH QUARTER AND YEAR ENDED DECEMBER 31, 2014

SAN DIEGO, CA February 26, 2015 – ACADIA Pharmaceuticals Inc. (NASDAQ: ACAD), a biopharmaceutical company focused on the development and commercialization of innovative medicines that address unmet medical needs in neurological and related central nervous system disorders, today announced its financial results for the fourth quarter and year ended December 31, 2014.

ACADIA reported a net loss of $28.4 million, or $0.28 per common share, for the fourth quarter of 2014, compared to a net loss of $12.0 million, or $0.13 per common share, for the fourth quarter of 2013. The net losses for the fourth quarters of 2014 and 2013 included $4.6 million and $2.2 million, respectively, in non-cash, stock-based compensation expense. For the year ended December 31, 2014, ACADIA reported a net loss of $92.5 million, or $0.95 per common share, compared to a net loss of $37.9 million, or $0.44 per common share, for 2013. The net losses for 2014 and 2013 included $16.0 million and $5.7 million, respectively, in non-cash, stock-based compensation expense.

At December 31, 2014, ACADIA’s cash, cash equivalents, and investment securities totaled $322.5 million compared to $185.8 million at December 31, 2013. This increase was primarily due to net proceeds from sales of equity securities, including $196.8 million raised in a public offering in March 2014, offset in part by cash used to fund ACADIA’s operations.

“Our accomplishments in 2014, highlighted by NUPLAZIDTM receiving Breakthrough Therapy designation from the FDA, our strengthened balance sheet, and our commercial preparations, set the stage for a promising 2015,” said Uli Hacksell, Ph.D., Chief Executive Officer of ACADIA. “Importantly, we continue to advance our Parkinson’s disease psychosis program towards registration and remain on track to submit our New Drug Application to the FDA in the first quarter of 2015.”

“We have an important year ahead of us as we continue to add to our commercial capabilities and prepare for the planned launch of NUPLAZID in the United States. We also plan to initiate studies with pimavanserin where new therapies are greatly needed, including schizophrenia and sleep disturbances in Parkinson’s patients, as well as continuing our ongoing Phase II study with pimavanserin in Alzheimer’s disease psychosis. Additionally, we will prepare a Marketing Authorization Application for NUPLAZID for submission in Europe. In all, 2015 will be a pivotal year for ACADIA as we advance NUPLAZID towards commercialization in the United States and broaden the program into additional neurological and psychiatric indications for which there are large unmet medical needs.”

Research and development expenses increased to $18.2 million for the fourth quarter of 2014, including $1.7 million in stock-based compensation, from $7.9 million for the comparable quarter of 2013, including $791,000 in stock-based compensation. This increase was primarily due to an increase of $7.8 million in external service costs associated with the development of pimavanserin. Increases in costs associated with ACADIA’s expanded research and development organization, including $1.5 million in increased personnel costs and $948,000 in increased stock-based compensation expense, also contributed to the quarter-over-quarter increase.

General and administrative expenses increased to $10.4 million for the fourth quarter of 2014, including $2.9 million in stock-based compensation, from $4.3 million for the comparable quarter of 2013, including $1.4 million in stock-based compensation. This increase was due to a $2.1 million increase in external service costs largely related to ACADIA’s commercial preparations for the planned launch of NUPLAZID. Also contributing to the quarter-over-quarter increase in general and administrative expenses was a $1.7 million increase in personnel expenses largely related to ACADIA’s preparations for the planned launch of NUPLAZID, as well as a $1.5 million increase in stock-based compensation expense.

ACADIA anticipates that the level of cash used in its operations will increase in future periods in order to fund its work related to the New Drug Application (NDA) submission and review and commercial activities for NUPLAZID, and its ongoing and planned development activities for pimavanserin for other indications. ACADIA currently expects that its cash, cash equivalents, and investment securities will be sufficient to fund its planned operations at least into the second half of 2016.

2014 Highlights

NUPLAZID (pimavanserin)

|

|

·

|

FDA granted Breakthrough Therapy designation to NUPLAZID for the treatment of Parkinson’s disease psychosis (PDP).

|

|

|

·

|

Conducted successful pre-NDA meetings with the FDA for NUPLAZID.

|

|

|

·

|

FDA provisionally accepted the trade name “NUPLAZID”™ for pimavanserin.

|

|

|

·

|

Presented caregiver burden data from Phase III PDP program at the 10th Annual International Congress of Non-Motor Dysfunctions in Parkinson’s Disease and Related Disorders.

|

|

|

·

|

Continued to enroll patients in the ongoing Phase II study with pimavanserin in Alzheimer’s disease psychosis.

|

|

|

·

|

Advanced commercial preparations for the planned launch of NUPLAZID, comprising extensive market research, foundational access and reimbursement research, national and regional scientific advisory boards, pricing analysis, sales force sizing, and adding to the leadership of the commercial team.

|

Business and Other

|

|

·

|

Completed a public offering of common stock raising net proceeds of $196.8 million.

|

|

|

·

|

Appointed Steve Davis as Executive Vice President, Chief Financial Officer and Chief Business Officer.

|

Conference Call and Webcast Information

ACADIA management will review its fourth quarter financial results and development programs via conference call and webcast later today at 5:00 p.m. Eastern Time. The conference call may be accessed by dialing 866-825-1709 for participants in the U.S. or Canada and 617-213-8060 for international callers (reference passcode 61156625). A telephone replay of the conference call may be accessed through March 12, 2015 by dialing 888-286-8010 for callers in the U.S. or Canada and 617-801-6888 for international callers (reference passcode 58941986). The conference call also will be webcast live on ACADIA’s website, www.acadia-pharm.com, under the investors section and will be archived there until March 12, 2015.

About ACADIA Pharmaceuticals

ACADIA is a biopharmaceutical company focused on the development and commercialization of innovative medicines to address unmet medical needs in neurological and related central nervous system disorders. ACADIA has a pipeline of product candidates led by NUPLAZID (pimavanserin), for which we have reported positive Phase III trial results in Parkinson’s disease psychosis and which has the potential to be the first drug approved in the United States for this disorder. Pimavanserin is also in Phase II development for Alzheimer’s disease psychosis and has successfully completed a Phase II trial in schizophrenia. ACADIA also has clinical-stage programs for chronic pain and glaucoma in collaboration with Allergan, Inc. All product candidates are small molecules that emanate from internal discoveries. ACADIA maintains a website at www.acadia-pharm.com, to which we regularly post copies of our press releases as well as additional information and through which interested parties can subscribe to receive e-mail alerts.

Forward-Looking Statements

Statements in this press release that are not strictly historical in nature are forward-looking statements. These statements include but are not limited to statements related to the timing of the submission of an NDA for NUPLAZID (pimavanserin) for the treatment of PDP; the potential for pimavanserin to be the first drug approved in the United States for PDP and the potential timing of such approval, if approved at all; the potential outlook for 2015 and the activities planned to be undertaken in the next year; ACADIA’s plans to explore NUPLAZID (pimavanserin) in indications other than PDP and to file a Marketing Authorization Application in Europe; ACADIA’s future cash usage, including the areas of such usage, and the cash runway; ACADIA’s ongoing pre-commercial activities and plans to commercially launch NUPLAZID; and the progress, timing and results of ACADIA’s drug discovery and development programs, either alone or with a partner, including the progress and expected timing of clinical trials, including planned trials for pimavanserin. These statements are only predictions based on current information and expectations and involve a number of risks and uncertainties. Actual events or results may differ materially from those projected in any of such statements due to various factors, including the risks and uncertainties inherent in drug discovery, development, approval, and commercialization, and collaborations with others, and the fact that past results of clinical trials may not be indicative of future trial results. For a discussion of these and other factors, please refer to ACADIA’s filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. This caution is made under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. All forward-looking statements are qualified in their entirety by this cautionary statement and ACADIA undertakes no obligation to revise or update this press release to reflect events or circumstances after the date hereof, except as required by law.

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended

December 31,

|

|

|

Years Ended

December 31,

|

|

| |

|

2014

|

|

|

2013

|

|

|

2014 (1)

|

|

|

2013 (1)

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Collaborative revenues

|

|

$ |

47 |

|

|

$ |

37 |

|

|

$ |

120 |

|

|

$ |

1,145 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development (includes stock-based compensation of $1,739, $791, $5,191, and $2,208, respectively)

|

|

|

18,182 |

|

|

|

7,926 |

|

|

|

60,602 |

|

|

|

26,722 |

|

|

General and administrative (includes stock-based compensation of $2,906, $1,383, $10,848, and $3,503, respectively)

|

|

|

10,420 |

|

|

|

4,276 |

|

|

|

32,748 |

|

|

|

12,720 |

|

|

Total operating expenses

|

|

|

28,602 |

|

|

|

12,202 |

|

|

|

93,350 |

|

|

|

39,442 |

|

|

Loss from operations

|

|

|

(28,555 |

) |

|

|

(12,165 |

) |

|

|

(93,230 |

) |

|

|

(38,297 |

) |

|

Interest income, net

|

|

|

189 |

|

|

|

116 |

|

|

|

755 |

|

|

|

349 |

|

|

Net loss

|

|

$ |

(28,366 |

) |

|

$ |

(12,049 |

) |

|

$ |

(92,475 |

) |

|

$ |

(37,948 |

) |

|

Net loss per common share, basic and diluted

|

|

$ |

(0.28 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.95 |

) |

|

$ |

(0.44 |

) |

|

Weighted average common shares outstanding, basic and diluted

|

|

|

99,850 |

|

|

|

90,947 |

|

|

|

97,248 |

|

|

|

85,715 |

|

|

(1)

|

The condensed consolidated statements of operations for the years ended December 31, 2014 and 2013 have been derived from the financial statements but do not include all of the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements.

|

ACADIA PHARMACEUTICALS INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

(Unaudited)

| |

|

December 31,

2014 (1)

|

|

|

December 31,

2013 (1)

|

|

| |

|

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

Cash, cash equivalents, and investment securities

|

|

$ |

322,486 |

|

|

$ |

185,790 |

|

|

Prepaid expenses, receivables and other current assets

|

|

|

2,132 |

|

|

|

2,570 |

|

|

Total current assets

|

|

|

324,618 |

|

|

|

188,360 |

|

|

Other non-current assets

|

|

|

840 |

|

|

|

758 |

|

|

Total assets

|

|

$ |

325,458 |

|

|

$ |

189,118 |

|

|

Liabilities and stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Total liabilities

|

|

$ |

15,969 |

|

|

$ |

6,987 |

|

|

Stockholders’ equity

|

|

|

309,489 |

|

|

|

182,131 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

325,458 |

|

|

$ |

189,118 |

|

|

(1)

|

The condensed consolidated balance sheets at December 31, 2014 and 2013 have been derived from the financial statements at such date but do not include all of the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements.

|

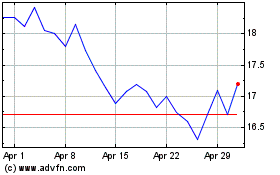

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Mar 2024 to Apr 2024

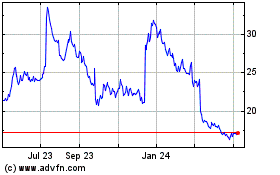

Acadia Pharmaceuticals (NASDAQ:ACAD)

Historical Stock Chart

From Apr 2023 to Apr 2024