Growth led by increased distribution,

diversification of global business model and improved brand

recognition

Jammin Java Corp. (d/b/a Marley Coffee) (JAMN)

(www.marleycoffee.com) ("Marley Coffee", "we, "us" and the

"Company"), the sustainably grown, ethically farmed and

artisan-roasted gourmet coffee company has issued the following

letter to its shareholders in connection with its preliminary

unaudited anticipated financial results for the three months ended

January 31, 2015 and the fiscal year ended January 31, 2015, as

described below.

Highlights

- Projected record revenue of $10

million, an increase of 65.7% compared to the prior year with a

$17-20 million forecast for revenue for the following fiscal year

(F16);

- Record Gross profit increase of ~236%

from a year ago;

- Global expansion

- Launch of ecommerce site and

subscription model;

- $1.5 million in short term capital

credit extensions; and

- Donated ~$83,000 to Waterwise Coffee

(www.waterwisecoffee.com) to clean up the rivers in Ethiopia, which

equals $0.01 from each RealCup sold during the last fiscal

year.

The following is a letter from our Chief

Executive Officer, Brent Toevs:

Dear Valued Shareholders,

It’s been a great year for Marley Coffee. Our goals last year

were to get to $10 million in revenue, improve our operational

efficiencies, establish a national presence, find first class

partners in key foreign markets and leverage the brand identity. We

believe we have accomplished all of these goals, laying the

groundwork for potential significant growth in the next few

years.

Marley Coffee is competing in a category dominated by behemoths

with multi-billion dollar balance sheets yet we have done a

tremendous job going head-to-head against these competitors because

we’ve stayed true to our principles as we’ve grown.

We continue to see strong growth in our top and bottom line

numbers as well as our ability to grow our business wherever coffee

is sold. Alongside our financials and our business strategy for the

upcoming year, we will also be going over an independent study we

did on our brand position in the marketplace.

Anticipated Results of Operations – Below are unaudited

anticipated financial results for the three months ended January

31, 2015 and the fiscal year ended January 31, 2015 as well as a

forecast for the upcoming fiscal year, which is February 1,

2015-January 1, 2016.

- Strong Revenue Growth - Our

revenue growth accelerated in fiscal 2015 compared to fiscal 2014.

Total revenue for the year ending January 31, 2015 is anticipated

to be approximately $10 million (compared to $6.0 million for the

year ended January 31, 2014), an increase of approximately $4

million or 66.7% from the prior year. What traditionally is our

weakest quarter (Q4), we saw a significant increase in revenue. We

anticipate revenue for the quarter ended January 31, 2015 of

approximately $3 million (compared to $1.5 million for the quarter

ended January 31, 2014), an increase of approximately $1.5 million

or 100% from the prior quarter.

- Increased Gross Profit - Cost of

sales for the year ended January 31, 2015 is anticipated to be

approximately $7.0 million alongside discounts and allowances of

$0.6 million, which is anticipated to give the company a gross

profit of approximately $2.4 million compared to a gross profit of

$0.7 million from a year ago, an increase in gross profit of

approximately ~236% from a year ago.

- Narrowing Losses – The objective

for the company is to continue narrowing its losses and get to

positive EBITDA before the end of the year. We anticipate reporting

a net loss of approximately $9.3 million for the year ended January

31, 2015 (compared to a net loss of $6.7 million for the year ended

January 31, 2014), provided that our short-term losses are

narrowing. We anticipate net losses of approximately $1.4 million

for the quarter ended January 31, 2015 (compared to a net loss of

$4.1 million for the quarter ended January 31, 2014).

- Operating Efficiency –

Operationally, we delivered the most efficient quarter to date. Our

quarter-over-quarter revenue growth (projected as a 100% increase)

has significantly outpaced our operating expenses, which shrank

compared to the fourth quarter from a year ago. We’ve built a

business on having strong gross margins and very little capital

expenditures. We also currently believe that we can scale our

operations up to $40 million in revenue without materially

increasing our staffing needs.

Projected Balance Sheet and Future Investments

- Run Rate - Cash on hand as of

January 31, 2015 was approximately $445,000. The company also had

assets of approximately $2.4 million and liabilities of

approximately $2.8 million.

- Investments/ Loans - Recently,

Mother Parkers Tea & Coffee Inc, the company’s largest

supplier, has verbally agreed to extend the company’s payment terms

from 30 days to 120 days, thus putting about $1.5M in free cash

flow back into the company in the near term at no additional costs.

Though this is a short-term measure, we believe that this will

allow the company to extend its run rate to over 12 months given

its current operating needs.

- Growth Capital - Every growth

company, like ours, needs additional capital to expand, but we want

to raise capital with the least shareholder dilution as possible.

The investment litmus test for most beverage companies is that it

generates a dollar for every dollar it has raised. Last year the

company raised $2.5 million and the year before that it raised ~$5

million (the company converted debt into equity, thus producing ~$5

million in free cash during 2014). We anticipate that we have

generated ~$10 million in revenue this year and about $16 million

over the last 2 years, which we believe shows a favorable return on

the investments when comparing revenue to funding raised. The key

in the coming year is to continue executing our plan and exciting

the overall market to raise shareholder value.

Fiscal Year End 2016 Guidance and Projections

- Our revenue expectations for fiscal

2016 still are ~$17-20 million, of which we believe most of the

growth will be in the back half of the year. We expect Q1 and Q2

revenues to come in around $3.5 million for the first quarter and

second quarter of fiscal 2016, but expect to see those numbers

increase significantly in the third and fourth quarters of fiscal

2016 as we continue grow our accounts and launch our previously

announced EcoCup campaign (recyclable compatible cartridges, for

use in most models of Keurig®'s K-Cup brewing system) in the second

half of the year.

- We expect gross profit margins to stay

between 25-30%.

- We anticipate losses narrowing even

further in the first quarter of fiscal 2016 and our goal is to show

positive EBITDA by end of year.

- Senior management will continue to take

most of their compensation via equity conserving available cash for

operations.

Business Growth

The company is still organized around our three pillars of

growth, which are domestic, international and ecommerce.

For the last year, we’ve been laying the foundation for our

continued growth. Here are the main areas we think will move the

needle this year.

- Domestic grocery sales – Our

objective is to build deeper relationships and improve turn rates

within our existing customers while continuing to expand into key

accounts. We have some new accounts, which we are excited about and

which should be launching in early Summer. We ended the year in

approximately 7,500 stores with an average of 5.2 products per

store in the United States.

- eCommerce subscription model –

https://shop.marleycoffee.com/subscriptions/ recently launched and

is starting to gain traction. We have been testing multiple

initiatives to keep our site “sticky” for consumers.

- International - The

International Coffee Organization recently reported that it expects

global coffee demand to rise 25% by 2021. We believe that we are in

a strong position to capitalize on that growth and our goal is to

continue finding top-tier operators like the ones we have in Korea,

Chile and the United Kingdom.

- Mother Parkers Tea & Coffee

Inc has helped launched Marley Coffee in Canada into

approximately 2,000 stores with an average of 5 items per store as

well. They have also added Marley Coffee to their foodservice

portfolio, positioning it as their premium offering in this

channel.

- Our UK partners will be launching a

biodegradable Nespresso compatible this Spring, which should help

push their grocery and away from home business.

- South Korea - This remains the

most exciting new market for the Company. We have several

initiatives that have launched or are launching this year. Being

successful here has the potential to echo throughout Asia and we

believe our success in South Korea will be a springboard to getting

meaningful distribution elsewhere in the region, especially

China.

- EcoCup launch – EcoCup's success

is built on the critical premise that it doesn’t require consumers

to change their behavior. They continue to purchase and use the

product as in the past but with a more sustainable end-of-life

option. This remains the biggest launch for the company in fiscal

2016 and we expect to start shipping product in August.From a

product adoption curve perspective, people using Keurig®'s K-Cup

and compatible brewing systems are in the early adopter phase, with

a base of about 20% household penetration. We believe one of the

key factors in getting this into mass-market adoption at the 40%

penetration levels will be making a truly sustainable product. We

believe EcoCups will be a key driver for the category bringing in

new users into the single serve while making a meaningful step in

the right direction towards sustainability.

Brand Study

In an independent study conducted in January 2015 by Global

Research Partners, Marley Coffees out as a brand with amazing

promise and consumer relevance, which has effectively translated

limited awareness into trial, repeat and advocacy. Out of a dozen

top tier brands that were studied, including multi-billion dollar

premium coffee brands, and premium national-specialty brands, the

study shows that Marley Coffee is doing THE BEST job of converting

trial into favorite brand status, AND ranked Marley Coffee the

highest for word-of-mouth advocacy conversion with Global Research

Partners reporting that 82% of consumers who have tried the brand

recommend it to someone else.

Global Research Partners’ Data also verified Marley Coffee as a

unique brand with the opportunity to drive new consumers to the

premium coffee. According to the research, relative to the average

category consumer, our drinkers are slightly younger and a bit more

affluent with larger households. Additionally, the data indicated

that the majority of Marley Coffee consumers are interested in

natural, organic & GMO-free products and are more likely than

the general premium coffee consumers to shop for LOHAS (lifestyles

of health and sustainability) products, reaffirming our belief in

EcoCup as a key driver for growth. Clean water initiatives also

ranked high as a purchase driver among all target groups (unaware,

aware and current users) when asked specifically about Marley

Coffee, further confirming WaterWise as a clear differentiator

among the competition and a strong driver of purchase intent.

Throughout fiscal 2016, we plan to continue to embrace loyal

users, begin to convert more users of competitive products and

bring new consumers to the category. Preliminary plans include

activating a 6-8 major market sampling tour starting in late Spring

and a PR push to drive awareness via mainstream consumer media and

tapping into passionate Marley Coffee drinkers to introduce the

brand to their friends and family. We believe we have proven

consistently that once consumers find us, Marley Coffee is a brand

that excites, resonates and stands out. We believe we have a clear

path to reach consumers to create success.

Conclusion

Coffee is growing both domestically and abroad. In the category,

there have been lots of investments in specialty brands as well as

M&A activity. Though we may not be as large as some of our

well-established multi-billion dollar competitors, we are growing

and the key for us is building on our story and foundation.

As we grow our business globally or to other business verticals,

we will always adhere to the principles that got us here in the

first place, which is to provide great tasting, sustainable coffee

with a philanthropic mission. This is the way we’ve been able to

successfully compete and delineate ourselves against the big brands

out there and that’s the way we’ll move forward.

As Warren Buffet always says, the first rule of investing in a

company is to ask if the business is understandable. Our objective

and our action plan is very clear and we believe, with our

management team and brand, we have the assets to succeeding

globally in the upcoming years.

About Jammin Java Corp., d/b/a Marley Coffee

Marley Coffee (corporate name Jammin Java Corp.) is a US-based

company that provides premium, artisan roasted coffee to the

grocery, retail, online, service, hospitality, office coffee

service and big box store industry. Under its exclusive licensing

agreement with 56 Hope Road, the company continues to develop its

coffee lines under the Marley Coffee brand. The company is a fully

reporting company quoted on the OTCQB under the symbol "JAMN".

Learn more at www.MarleyCoffee.com or visit the Investor Relations

section at Investor.MarleyCoffee.com.

Join us on Facebook at http://www.facebook.com/MarleyCoffee, or

follow us on Twitter at http://twitter.com/marleycoffee, where we

post information that's material and non-material about the

company.

Forward-Looking Statement

This Press Release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended and Section 21E of the Securities Exchange Act of 1934, as

amended (the "Acts"). In particular, the words "believe," "may,"

"could," "should," "expect," "anticipate," "estimate," "project,"

"propose," "plan," "intend," and similar conditional words and

expressions are intended to identify forward-looking statements and

are subject to the safe harbor created by these Acts. Any

statements made in this news release about an action, event or

development, are forward-looking statements. Such forward looking

statements include, but are not limited to our preliminary

anticipated results of operations and balance sheet totals for the

three months and year ended January 31, 2015, and as of January 31,

2015, which remain subject to review, audit and revision by our

independent auditors. Such statements are based upon assumptions

that in the future may prove not to have been accurate and are

subject to significant risks and uncertainties. Such statements are

subject to a number of assumptions, risks and uncertainties, many

of which are beyond the control of the company. These risks and

others are included from time to time in documents we file with the

Securities and Exchange Commission ("SEC"), including but not

limited to, our Form 10-Ks, Form 10-Qs and Form 8-Ks. Other unknown

or unpredictable factors also could have material adverse effects

on our future results. Accordingly, you should not place undue

reliance on these forward-looking statements. Although the company

believes that the expectations reflected in the forward-looking

statements are reasonable, it can give no assurance that its

forward-looking statements will prove to be correct. Investors are

cautioned that any forward-looking statements are not guarantees of

future performance and actual results or developments may differ

materially from those projected. The forward-looking statements in

this press release are made as of the date hereof. The company

takes no obligation to update or correct its own forward-looking

statements, except as required by law or those prepared by third

parties that are not paid by the company. The company's SEC filings

are available at http://www.sec.gov.

Media:Havas FormulaJessica Weeg,

212-219-0321Weeg@formulapr.com

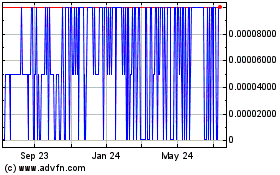

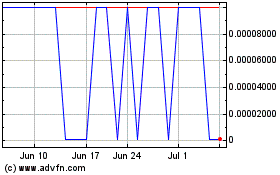

Jammin Java (PK) (USOTC:JAMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jammin Java (PK) (USOTC:JAMN)

Historical Stock Chart

From Apr 2023 to Apr 2024