MMMW Receives 100 kW Solar Project Letter of Intent from RMTN with Innovative Financing Plan

February 26 2015 - 9:09AM

InvestorsHub NewsWire

Mass Megawatts Wind Power, Inc. receives 100 kW

Solar Project Letter Of Intent from Rocky Mountain Ayre, Inc., A

Publicly Traded Company, with Innovative Financing

Plan

WORCESTER, MA.

-- February 26, 2015 -- InvestorsHub NewsWire -- Mass

Megawatts Wind Power, Inc. (OTCQB:MMMW)

today announced that it has received a letter of intent from Rocky

Mountain Ayre, Inc. (OTC:RMTN)

to purchase a 100 kW solar tracking power system for

$300,000. This represents the largest pending order, to-date

for the company’s patent-pending, Solar-Power Tracking

System (STS).

The deal is expected to apply an innovative

financing approach that utilizes a partnership flip to benefit tax

equity investors over the initial years of the project, and then

transfers (or flips) interest to the developer for the remainder of

the useful-life of the system. What’s rather unique here is

that the developer, as a public entity, can realize an

almost-immediate financial return as stock appreciation and capital

gains are driven by the valuation of the expected, future income

from the solar project. This provides a significant advantage

over non-public entities that would typically require the

developer to wait until ownership control actually flips, several

years later, before receiving compensation. Publically traded

companies with its stock appreciation from the anticipated solar

project revenue, also have the ability to raise equity through

secondary offerings to fund additional solar development which can

accelerate capital gains further, creating a cycle of continuous

growth.

In partnership flips, the developer

and tax equity investor form a joint-venture partnership and the

allocation of profits, cash, and tax benefits flip between the

parties during the life of the partnership. Flips allow the

developer to invest alongside tax equity investors to retain a

residual interest in the system after installation, and they allow

the transfer of most tax benefits to the tax investor. They also

allow the developer to regain near 100% ownership of the assets at

nominal cost after all the tax benefits have been used by the tax

investor. When the developer is structured as a public

entity, the value

of expected future income can be realized immediately through stock

appreciation and capital gains to realize a rate of return in the

near-term verses waiting for ownership control to transfer several

years later. Also, capital gains are typically taxed at a

lower rate as compared to ordinary operating income.

The STS is a complete solar-power system

designed to automatically adjust the position of solar panels

throughout the day to receive an optimal level of direct

sunlight. This improves solar-power generation by 28% with

only a 5 to 10% increase in cost.

The Mass Megawatts STS utilizes a revolutionary,

patent-pending framework that significantly reduces the torque

required to adjust the position of its solar panels throughout the

day. Unlike other tracking technologies that apply a

vertical, up-and-down motion, the STS rotates the solar panels into

position using a horizontal motion anchored at the base of each

solar unit. The amount of torque needed to accomplish the

tracking movement is minimal, and can be accomplished with a

simpler, lower-cost design.

Starting at 6.25 kW rated units, a Mass

Megawatts STS system is appropriate for ground-level, residential

and business sites, as well as, commercial, roof-top

installations. Mass Megawatts coordinates all aspects of

system delivery, including permitting, installation, and working to

obtain any available tax incentives. They monitor the

performance of each system, and provide a full, performance

guarantee.

With its patent pending, Solar Tracking System,

Wind Electric Power Generation system, only approximately 55

million shares issued and outstanding and very little debt, Mass

Megawatts believes it is well positioned to ramp-up production in

the shorter term while expanding its infrastructure to support

mass-production goals in the longer term.

This press release contains forward-looking

statements that could be affected by risks and uncertainties. Among

the factors that could cause actual events to differ materially

from those indicated herein are: the failure of Mass Megawatts Wind

Power, also known as Mass Megawatts Windpower, to achieve or

maintain necessary zoning approvals with respect to the location of

its power developments; the ability to remain competitive; to

finance the marketing and sales of its electricity; general

economic conditions; and other risk factors detailed in periodic

reports filed by Mass Megawatts Wind Power. Additionally, Mass

Megawatts Wind Power stock quote and Mass Megawatts stock price may

be impacted by global condition. Mass Megawatts Wind Power Inc.

expected and anticipated positive and negative impact on the Mass

Megawatts stock price and the MMMW

stock quote.

Product information and sales inquiries can be

made through the contact page at www.massmegawatts.com

, the company’s website.

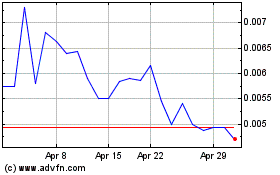

Mass Megawatts Wind Power (PK) (USOTC:MMMW)

Historical Stock Chart

From Mar 2024 to Apr 2024

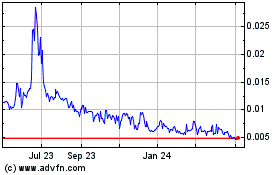

Mass Megawatts Wind Power (PK) (USOTC:MMMW)

Historical Stock Chart

From Apr 2023 to Apr 2024