UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 26, 2015

ORGANOVO HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Commission

File Number: 001-35996

|

|

|

| Delaware |

|

27-1488943 |

| (State or other jurisdiction

of incorporation) |

|

(I.R.S. Employer

Identification No.) |

6275 Nancy Ridge Dr.,

San Diego, California 92121

(Address of principal executive offices, including zip code)

(858) 224-1000

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure |

On February 26, 2015, Organovo Holdings, Inc. (the “Company”)

issued a letter from Keith Murphy, its President and Chief Executive Officer, addressed to the Company’s shareholders and providing an update on the Company’s business strategy (the “Shareholder Letter”). A copy of the

Shareholder Letter is attached hereto as Exhibit 99.1, and incorporated herein by reference.

The information furnished on or with this Form 8-K

(including the Shareholder Letter) shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference into

any other filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except as expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits |

|

|

|

|

|

| 99.1 |

|

Shareholder Letter, dated February 26, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

ORGANOVO HOLDINGS, INC. |

|

|

|

|

| Date: February 26, 2015 |

|

|

|

|

|

/s/ Keith Murphy |

|

|

|

|

|

|

Keith Murphy |

|

|

|

|

|

|

Chief Executive Officer and President |

Exhibit Index

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Shareholder Letter, dated February 26, 2015. |

Exhibit 99.1

Organovo Holdings, Inc.

6275 Nancy Ridge Dr.

San Diego, CA 92121

February 26, 2015

Dear Fellow Shareholder,

It’s always a pleasure when I get to provide an update on Organovo, because of our steady and exciting movement forward. Our progress has recently been

recognized by Organovo being named as one of FastCompany’s Top 10 Most Innovative Companies of 2015 in Health Care (http://goo.gl/WmKuMd) and covered in an article in the Wall Street Journal (http://goo.gl/jSGLLm).

As you know, most importantly, we reported in February 2015 the first ever revenues from a 3D Bioprinted commercial tissue, our exVive3D Liver, Bioprinted Human Tissue. The liver has a nice tailwind behind it, and we believe it has a strong

commercial future in front of it. As we’ve said before, we believe that as we penetrate the toxicology market, the liver product and service will grow into the tens of millions in annual revenue, and has $100M+ revenue potential in the future

as we pursue diligent sales and marketing efforts over time (inside of a total addressable market of over $1B). We believe we’re on the way to building a strong profit center in research tissues for Organovo, which will expand with our launch

of 3D bioprinted kidney tissues in 2016. But, the most important thing that the successful launch of this first product represents, in our opinion, is a validation of our 3D Bioprinting platform overall.

When we started Organovo, we knew that we had tremendous potential for scientific impact. I’ve said before that for each of the many tissues we’ve

attempted, our results have indicated that we are achieving biology that shows a better replication of native tissue than what has come before. This comes from positioning human cells in architecturally directed ways in dense, three-dimensional

living tissues. However, having now crossed over to commercializing our first tissue, and having seen additional positive results in the other tissues we’re working with, we feel like we’ve now crossed a threshold of validation. We are

ready to do more, and it makes sense for us to raise our bet that our 3D Bioprinting technology can unlock tremendous long-term shareholder value.

What

does this mean in regard to our strategy? To us, it means that it justifies an even greater investment in more applications of our platform in 3D bioprinting technology. We believe that we have de-risked the platform, and that this justifies pushing

new efforts. Our continued scientific wins justify a bigger bet.

To date, our internal spending has been focused on programs in liver, kidney, oncology

and therapeutic tissues, such as our blood vessel project. This path provides us with access to some large markets, but we believe that we can enhance long-term shareholder value by expanding our focus. If we elect to do so, we have the opportunity,

with an expanded focus, to seek to:

| |

• |

|

Grow revenues from our commercial research tissues faster. The revenue growth of liver and kidney (after 2016 launch) will be driven by demonstration

of new applications. For |

©Copyright 2015, Organovo Holdings, Inc.

| |

each tissue, we’re starting in basic toxicology testing – but these tissues can be used in many ways. We can build data, and access new customer segments faster with focused spending.

Consider how broadly genomic sequencing is used, and that each customer segment had to be addressed separately with a value proposition. Our liver, for example, can find many uses in academic biological research, separate from pharma toxicity

studies. |

| |

• |

|

Own some of our own drug candidates. Rather than only partner with pharma for royalties on drug candidates, in certain areas we can invest in identifying our own drug candidates and retain more of their value for

Organovo. In addition, we believe that this type of activity will itself drive more pharma deals, too – by a faster demonstration that we can be successful in identifying drug candidates that move forward to the clinic. We would still expect to

do more partnering deals with pharma, of course - each deal we do increases the validation of what we’re doing and the number of things we can work on with available capital. |

| |

• |

|

Build on our bioprinting technology leadership. We have the ability to build on our technical leadership in this field by pursuing faster improvements in our bioprinting technologies – but that comes with

investment, not with sitting on one’s laurels. We can seek to take leaps forward from a technical perspective with the right focused spending. For instance, we could elect to develop commercial instruments for sale into various biological

research fields. |

As I am Organovo’s largest shareholder, and each of our Directors and Officers has a strong equity interest, we are

all highly aligned with you in the goal of building long-term shareholder value. We know that we need to put Organovo in the right position to maximally capture the commercial markets for bioprinting, before others have the opportunity to impact our

first mover advantage. We take lessons from our history, as well as the history of other companies, in thinking about growing Organovo. Each time we’ve undertaken a major financing to date, we’ve used the proceeds to tremendous results.

Our first $3M in angel financing, which diluted us by almost 33%, took us from a company valued at practically zero to a company valued at about $24M. Our $15M financing round, which diluted us by more than 40%, took us from that $24M level to about

$200M. And our $46M financing round, which diluted us by about 13%, took us from $200M to today’s $500M market cap. If Organovo had only one asset to drive through clinical trials we might feel differently, because the total achievable size of

the pie would be fixed. But in our case, we believe we can grow the pie significantly by investing in new areas. Our goal is take steps that turn into wins for you, the shareholder. We invite you to join us in seeking those wins… because the

data we’ve achieved to date, in liver, in kidney, in oncology and in other areas, makes us more confident than ever that we can reach them.

Sincerely,

/s/ Keith Murphy

Keith Murphy

Chairman, CEO and President

Organovo Holdings, Inc.

©Copyright 2015, Organovo Holdings, Inc.

Safe Harbor Statement

Any statements contained in this letter that do not describe historical facts constitute forward-looking statements as that term is defined in the Private

Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding the market opportunities and sizes for our tissues, the estimated time for the launch of our kidney tissue, the benefits

and market potential of our bioprinting platform technology and our business plans and strategies. Any forward-looking statements contained in this letter are based on current expectations, but are subject to a number of risks and uncertainties. The

factors that could cause our actual future results to differ materially from our current expectations include, but are not limited to, the risks and uncertainties relating to the Company’s ability to develop, market and sell products and

services based on its technology; the expected benefits and efficacy of the Company’s products, services and technologies; the market acceptance of the Company’s products, services and technologies; and the Company’s business,

research, product and service development, regulatory approval, marketing and distribution plans and strategies. These and other factors are identified and described in more detail in our filings with the Securities and Exchange Commission (SEC),

including our quarterly report on Form 10-Q filed with the SEC on February 6, 2015, as well as our other filings with the SEC. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this

letter. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to reflect actual results, later events or circumstances

or to reflect the occurrence of unanticipated events.

©Copyright 2015, Organovo Holdings, Inc.

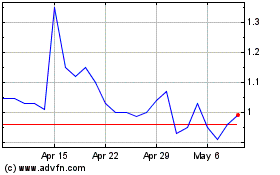

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

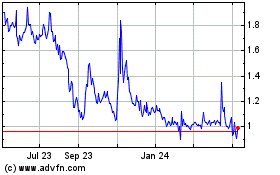

Organovo (NASDAQ:ONVO)

Historical Stock Chart

From Apr 2023 to Apr 2024