Announces 2015 Total Planned Capital

Expenditures

Chesapeake Energy Corporation (NYSE:CHK) today reported

financial and operational results for the 2014 full year and fourth

quarter and announced details of its 2015 Outlook and capital

expenditure program. Highlights include:

- 2014 adjusted net income of $1.49

per fully diluted share and 2014 adjusted ebitda of $4.945

billion

- Average 2014 production of

approximately 706,000 boe per day, an increase of 9% year over

year, adjusted for asset sales

- Planned 2015 total capital

expenditures ranging from $4.0 to $4.5 billion

- Projected 2015 production growth of

3 – 5%, adjusted for asset sales

Doug Lawler, Chesapeake’s Chief Executive Officer, said, “2014

was a year of accomplishments for Chesapeake. Because of these

accomplishments and the progress we have made as a company in 2014,

Chesapeake is well positioned to remain strong and flexible in

2015. We have taken and continue to take appropriate steps not only

to weather the current difficult commodity price environment we

face today, but to thrive in it. Chesapeake became a much stronger

company in 2014, and we are looking forward to becoming even

stronger in 2015.”

2015 Capital Program and Production Outlook

Chesapeake is budgeting total capital expenditures (including

capitalized interest) of $4.0 – $4.5 billion for 2015. Using the

midpoint of the range, this represents a 26% reduction from the

company's 2014 capital expenditures before acquisitions of $5.8

billion, and a 37% reduction from the company’s 2014 total capital

expenditures of approximately $6.7 billion (reconciled in the

"Capital Spending and Cost Overview" section below). The company is

targeting 2015 production of 235 – 240 million barrels of oil

equivalent (mmboe), or average daily production of 645 – 655

thousand barrels of oil equivalent (mboe), which represents 3 – 5%

production growth after adjusting for 2014 asset sales. Of the 2015

projected production, approximately 39 – 40 mmboe is estimated to

be crude oil, 1,035 – 1,055 billion cubic feet (bcf) natural gas

and 23 – 24 mmboe natural gas liquids (NGL).

Chesapeake plans to operate 35 – 45 rigs in 2015, which

represents the company's lowest operated rig activity level since

2004 and a decrease of approximately 38% (using the midpoint of the

range) from an average of 64 rigs in 2014. The company intends to

spud approximately 790 gross operated wells and connect to sales

approximately 800 gross operated wells in 2015, a decrease from

approximately 1,175 and 1,150 wells, respectively, in 2014. The

table below compares the capital and rig counts allocated to the

company’s operating areas for 2015 and 2014:

2015E D&C 2014 D&C 2015E Avg.

2014 Avg. Capex Capex Operated Operated Allocation

Allocation Rigs Rigs Eagle Ford 35% 40% 12 –

14 20 Utica 25% 10% 3 – 5 8 Haynesville 13% 8% 7 – 8 8 Powder River

Basin: Niobrara & Upper Cretaceous 10% 5% 3 – 4 4 Mid-Continent

North: Mississippian Lime 5% 7% 7 – 8 9 Mid-Continent South 5% 8% 1

– 2 5 Marcellus 5% 11% 1 – 2 5 Other(a) 2% 11%

1 – 2 5 Totals 100% 100% 35 – 45 64

(a) For 2014, includes Marcellus South,

Barnett Shale and exploration wells.

2014 Full-Year Results

For the 2014 full year, Chesapeake reported net income available

to common stockholders of $1.273 billion, or $1.87 per fully

diluted share. Items typically excluded by securities analysts in

their earnings estimates increased net income available to common

stockholders for the 2014 full year by approximately $316 million

and are presented on Page 14 of this release. The primary component

of this increase was unrealized gains on the company's oil and

natural gas commodity derivatives, partially offset by the

redemption of all the outstanding preferred shares of a subsidiary.

Adjusting for these items, 2014 full-year adjusted net income

available to common stockholders was $957 million, or $1.49 per

fully diluted share, compared to adjusted net income available to

common stockholders of $965 million, or $1.50 per fully diluted

share, in the 2013 full year.

Adjusted ebitda was $4.945 billion for the 2014 full year,

compared to $5.016 billion for the 2013 full year. Operating cash

flow, which is defined as cash flow provided by operating

activities before changes in assets and liabilities, was $5.026

billion for the 2014 full year, compared to $4.958 billion for the

2013 full year.

Adjusted net income available to common stockholders, operating

cash flow, ebitda and adjusted ebitda are non-GAAP financial

measures. Reconciliations of these measures to comparable financial

measures calculated in accordance with generally accepted

accounting principles are provided on pages 13 – 17 of this

release.

Chesapeake’s daily production for the 2014 full year averaged

706,300 barrels of oil equivalent (boe), a year-over-year increase

of 9%, adjusted for asset sales. Average daily production consisted

of approximately 115,800 barrels (bbls) of oil, 3.0 bcf of natural

gas and 90,500 bbls of NGL. Adjusted for asset sales, 2014

full-year average daily oil production increased 7%, average daily

natural gas production increased 6% and average daily NGL

production increased 42%.

2014 Fourth Quarter Results

For the 2014 fourth quarter, Chesapeake reported net income

available to common stockholders of $586 million, or $0.81 per

fully diluted share. Items typically excluded by securities

analysts in their earnings estimates increased 2014 fourth quarter

net income by approximately $552 million on an after-tax basis. The

primary component of this increase was unrealized gains on oil and

natural gas commodity derivatives. Adjusting for these items, 2014

fourth quarter net income available to common stockholders was $34

million, or $0.11 per fully diluted share, which compares to

adjusted net income available to common stockholders of $161

million, or $0.27 per fully diluted share, in the 2013 fourth

quarter.

For the 2014 fourth quarter, Chesapeake reported adjusted ebitda

of $916 million, compared to $1.132 billion in the 2013 fourth

quarter. Operating cash flow was $873 million in the 2014 fourth

quarter, compared to $995 million in the 2013 fourth quarter. The

quarter-over-quarter decreases in adjusted ebitda and operating

cash flow were primarily the result of lower realized oil, natural

gas and NGL prices, partially offset by higher production

volumes.

Chesapeake’s daily production for the 2014 fourth quarter

averaged approximately 729,000 boe, a year-over-year increase of

12%, adjusted for asset sales. Average daily production in the 2014

fourth quarter consisted of approximately 121,200 bbls of oil, 3.1

bcf of natural gas and 97,600 bbls of NGL, which represent

year-over-year increases of 7%, 9% and 40% respectively, adjusted

for asset sales.

Strategic Transactions and Asset Sales Update

In the 2014 fourth quarter, the company received approximately

$5.1 billion of net proceeds from asset sales, most of which was

from the sale of certain assets in the southern Marcellus Shale and

a portion of the eastern Utica Shale assets that closed in December

2014. Also in the 2014 fourth quarter, the company entered into a

new five-year $4.0 billion senior unsecured syndicated revolving

credit facility. The new unsecured facility has investment

grade-like terms and allowed Chesapeake to release nearly $6.0

billion of proved reserve-based collateral.

Capital Spending and Cost Overview

Chesapeake’s drilling and completion capital expenditures during

the 2014 full year were approximately $4.5 billion, and capital

expenditures for the acquisition of unproved properties, geological

and geophysical costs, and other property, plant and equipment were

approximately $669 million, for a total of approximately $5.1

billion, compared to the company’s forecasted range of $5.0 – $5.4

billion. In addition, during 2014 the company invested

approximately $499 million to repurchase leased rigs and

compressors as part of its strategic initiative to reduce

complexity and future commitments, as well as to facilitate asset

sales and the spin-off of its oilfield services business. The

company also invested approximately $450 million as part of an

exchange of properties in the Powder River Basin. Total capital

investments, including capitalized interest of $637 million, were

approximately $6.7 billion in 2014, compared to approximately $7.8

billion in 2013, and is reconciled below. Chesapeake’s total

capital expenditures were approximately $1.8 billion in the 2014

fourth quarter compared to approximately $2.1 billion in the 2013

fourth quarter.

$ in millions 2013 2014

2015 Type of Cost Q4 FY

Q4 FY Outlook Drilling

and completion costs $ 1,151 $ 5,466 $ 1,370

$ 4,470 Other exploration and development costs and

PP&E 478 1,231 252

669

Subtotal planned capital

spending $ 1,629 $ 6,697 $

1,622 $ 5,139 $3,500 – 4,000

Capitalized interest 182 815 134 637 500 PRB property exchange — —

— 450 Sale leasebacks 262 266

25 499

Total capital

spending $ 2,073 $ 7,778 $

1,781 $ 6,725 $4,000 – 4,500

Chesapeake spud a total of 308 gross wells and connected 311

gross wells to sales during the 2014 fourth quarter, compared to

239 gross wells spud and 260 gross wells connected to sales during

the 2014 third quarter.

Chesapeake's focus on cost discipline continued to generate

reductions in costs associated with production and general and

administrative (G&A) expenses. Average production expenses

during the 2014 full year were $4.69 per boe, a decrease of 1% year

over year. G&A expenses (including stock-based compensation)

during the 2014 full year were $1.25 per boe, a decrease of 33%

year over year.

Average production expenses during the 2014 fourth quarter were

$5.07, an increase of 10% from the 2013 fourth quarter. G&A

expenses (including stock-based compensation) during the 2014

fourth quarter were $1.38 per boe, a decrease of 30% from the 2013

fourth quarter.

A summary of the company’s guidance for 2015 is provided in the

Outlook dated February 25, 2015, attached to this release as

Schedule "A” beginning on Page 18.

Total Proved Reserves

The company's December 31, 2014, proved reserves were 2.469

billion boe, an increase of 5% compared to year-end 2013 before

acquisitions and divestitures. In 2014, Chesapeake increased its

proved reserves by 448 mmboe for extensions and discoveries and 14

mmboe from acquisitions. The additions were offset by 362 mmboe as

the result of divestitures, 51 mmboe of net negative reserve

revisions and production of 258 mmboe. Chesapeake's proved

developed reserves as a percentage of total proved reserves

increased to 75% as of December 31, 2014, compared to 68% as of

December 31, 2013. Additional information on reserves changes can

be found on Page 10.

Operations Update

As described below, Chesapeake continues to improve on its

capital efficiency, cycle times and well cost reductions.

Southern Division

Eagle Ford Shale (South

Texas): Eagle Ford net production averaged

approximately 106 mboe per day (230 gross operated mboe per day)

during the 2014 fourth quarter, an increase of 4% sequentially. The

2014 average completed well cost (January – October) was

approximately $6.1 million with an average completed lateral length

of 5,900 feet and 19 frac stages, compared to an average completed

well cost of $6.9 million in 2013 with an average completed lateral

length of 5,850 feet and 18 frac stages. Wells in various stages of

completion or waiting on pipeline in the area have increased to 158

as of December 31, 2014, compared to 109 wells at December 31,

2013. The average peak production rate of the 123 wells that

commenced first production in the Eagle Ford during the 2014 fourth

quarter was approximately 850 boe per day.

Haynesville Shale (Northwest

Louisiana): Haynesville Shale net production

averaged approximately 592 million cubic feet of natural gas

equivalent (mmcfe) per day (910 gross operated mmcfe per day)

during the 2014 fourth quarter, an increase of 5% sequentially. The

2014 average completed well cost (January – October) was

approximately $8.4 million with an average completed lateral length

of 4,900 feet and 13 frac stages, compared to an average completed

well cost of $8.9 million in 2013 with an average completed lateral

length of 4,400 feet and 18 frac stages. The average peak

production rate of the 18 wells that commenced first production in

the Haynesville during the 2014 fourth quarter was approximately

13.4 mmcfe per day.

Mid-Continent North: Mississippian Lime

(Northern Oklahoma): Mississippian Lime net

production averaged approximately 28 mboe per day (72 gross

operated mboe per day) during the 2014 fourth quarter, an increase

of 4% sequentially. The 2014 average completed well cost (January –

October) was approximately $3.1 million with an average completed

lateral length of 4,500 feet, compared to an average completed well

cost of $3.5 million in 2013 with an average completed lateral

length of 4,500 feet. The average peak production rate of the 42

wells that commenced first production in the Mississippian Lime

during the 2014 fourth quarter was approximately 730 boe per

day.

Northern Division

Utica Shale (Eastern

Ohio): Utica net production averaged

approximately 100 mboe per day (180 gross operated mboe per day)

during the 2014 fourth quarter, an increase of 17% sequentially.

The 2014 average completed well cost (January – October) was

approximately $6.6 million with an average completed lateral length

of 6,000 feet and 27 frac stages, compared to an average completed

well cost of $6.7 million in 2013 with an average completed lateral

length of 5,150 feet and 17 frac stages. Wells in various stages of

completion or waiting on pipeline in the area decreased to 166 as

of December 31, 2014, compared to 195 at December 31, 2013. The

average peak production rate of the 51 wells that commenced first

production in the Utica during the 2014 fourth quarter was

approximately 1,280 boe per day.

Marcellus Shale (Northern

Pennsylvania): Northern Marcellus net production

averaged approximately 817 mmcfe per day (2.07 gross operated bcfe

per day) during the 2014 fourth quarter, a decrease of 7%

sequentially. The 2014 average completed well cost (January –

October) was approximately $7.3 million with an average completed

lateral length of 5,900 feet and 27 frac stages, compared to an

average completed well cost of $7.9 million in 2013 with an average

completed lateral length of 5,400 feet and 13 frac stages. Wells in

various stages of completion or waiting on pipeline in the area

increased to 117 as of December 31, 2014, compared to 112 at

December 31, 2013. The average peak production rate of the 25 wells

that commenced first production in the northern Marcellus during

the 2014 fourth quarter was approximately 15.2 mmcfe per day.

Powder River Basin (PRB): Niobrara and

Upper Cretaceous (Wyoming): PRB net production

averaged approximately 18 mboe per day (27 gross operated mboe per

day) during the 2014 fourth quarter, an increase of 20%

sequentially, and, adjusted on an absolute basis to include the

property exchange transaction with RKI Exploration &

Production, an increase of 29% sequentially. The 2014 average

completed well cost (January – October) was approximately $9.1

million per well with an average completed lateral length of 5,100

feet and 18 frac stages, compared to an average completed well cost

of $10.1 million per well in 2013 with an average completed lateral

length of 5,050 feet and 15 frac stages. Wells in various stages of

completion or waiting on pipeline in the area decreased to 38 as of

December 31, 2014, compared to 57 wells at December 31, 2013. The

average peak production rate of the 13 wells that commenced first

production in the Powder River Basin during the 2014 fourth quarter

was approximately 1,670 boe per day.

Key Financial and Operational Results

The table below summarizes Chesapeake’s key financial and

operational results during the 2014 fourth quarter and 2014 full

year and compares them to results in prior periods.

Three Months Ended Full Year Ended

12/31/14 09/30/14 12/31/13

12/31/14 12/31/13 Oil equivalent production

(in mmboe) 67.1 66.8 61.2 257.8 244.4 Oil production (in mmbbls)

11.2 10.9 10.2 42.3 41.1 Average realized oil price ($/bbl)(a)

76.40 84.81 89.58 82.76 92.53 Oil as % of total production 17 16 17

16 17 NGL production (in mmbbls) 9.0 8.8 5.9 33.1 20.9 Average

realized NGL price ($/bbl)(a) 13.11 22.95 31.76 21.27 27.87 NGL as

% of total production 13 13 9 13 8 Natural gas production (in bcf)

281.6 282.0 270.5 1,095.0 1,094.6 Average realized natural gas

price ($/mcf)(a) 1.72 2.09 1.90 2.36 2.23 Natural gas as % of total

production 70 71 74 71 75 Production expenses ($/boe) (5.07 ) (4.47

) (4.62 ) (4.69 ) (4.74 ) Production taxes ($/boe) (0.70 ) (0.94 )

(0.91 ) (0.90 ) (0.94 ) General and administrative costs ($/boe)(b)

(1.23 ) (0.72 ) (1.79 ) (1.07 ) (1.62 ) Stock-based compensation

($/boe) (0.15 ) (0.18 ) (0.19 ) (0.18 ) (0.24 ) DD&A of natural

gas and liquids properties ($/boe) (10.53 ) (10.31 ) (10.53 )

(10.41 ) (10.59 ) DD&A of other assets ($/boe) (0.56 ) (0.55 )

(1.32 ) (0.90 ) (1.28 ) Interest expense ($/boe)(a) (0.56 ) (0.16 )

(0.86 ) (0.63 ) (0.65 ) Marketing, gathering and compression net

margin ($ in millions)(c) (39 ) (7 ) 9 (11 ) 98 Oilfield services

net margin ($ in millions)(c) — — 52 115 159 Operating cash flow ($

in millions)(d) 873 1,293 995 5,026 4,958 Operating cash flow

($/boe) 13.01 19.37 16.27 19.50 20.26 Adjusted ebitda ($ in

millions)(e) 916 1,236 1,132 4,945 5,016 Adjusted ebitda ($/boe)

13.66 18.52 18.51 19.18 20.52 Net income available to common

stockholders ($ in millions) 586 169 (159 ) 1,273 474 Earnings per

share – diluted ($) 0.81 0.26 (0.24 ) 1.87 0.73 Adjusted net income

available to common stockholders ($ in millions)(f) 34 251 161 957

965 Adjusted earnings per share – diluted ($) 0.11 0.38 0.27 1.49

1.50

(a) Includes the effects of realized gains

(losses) from hedging, but excludes the effects of unrealized gains

(losses) from hedging.

(b) Excludes expenses associated with

stock-based compensation and restructuring and other termination

costs.

(c) Includes revenue and operating

expenses and excludes depreciation and amortization of other

assets.

(d) Defined as cash flow provided by operating activities before

changes in assets and liabilities. (e) Defined as net income before

interest expense, income taxes and depreciation, depletion and

amortization expense, as adjusted to remove the effects of certain

items detailed on Page 17. (f) Defined as net income available to

common stockholders, as adjusted to remove the effects of certain

items detailed on Page 14.

2014 Full-Year and Fourth Quarter Financial and Operational

Results Conference Call Information

A conference call to discuss this release has been scheduled for

Wednesday, February 25, 2015, at 9:00 am EST. The telephone number

to access the conference call is 913-312-1469 or toll-free

888-601-3877. The passcode for the call is 2873261.

We encourage those who would like to participate in the call to

place calls between 8:50 and 9:00 am EST. For those unable to

participate in the live conference call, a replay will be available

for audio playback at 2:00 pm EST on Wednesday, February 25, 2015,

and will run through 2:00 pm EST on Wednesday, March 11, 2015. The

number to access the conference call replay is 719-457-0820

or toll-free 888-203-1112. The passcode for the replay is

2873261. The conference call will also be webcast live on

Chesapeake’s website at www.chk.com and a replay will be available

following the call.

Chesapeake Energy Corporation (NYSE:CHK) is the

second-largest producer of natural gas and the 11th largest

producer of oil and natural gas liquids in the U.S.

Headquartered in Oklahoma City, the company's operations are

focused on discovering and developing its large and geographically

diverse resource base of unconventional oil and natural gas assets

onshore in the U.S. The company also owns substantial

marketing and compression businesses. Further information is

available at www.chk.com where Chesapeake routinely

posts announcements, updates, events, investor information,

presentations and news releases.

This news release and the accompanying Outlook include

"forward-looking statements” within the meaning of Section 27A

of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934. Forward-looking statements are

statements other than statements of historical fact. They include

statements that give our current expectations or forecasts of

future events, production, production growth and well connection

forecasts, estimates of operating costs, planned development

drilling and expected drilling cost reductions, capital

expenditures, expected efficiency gains, anticipated asset sales

and proceeds to be received therefrom, projected cash flow and

liquidity, business strategy and other plans and objectives for

future operations, and the assumptions on which such statements are

based. Although we believe the expectations and forecasts reflected

in the forward-looking statements are reasonable, we can give no

assurance they will prove to have been correct. They can be

affected by inaccurate or changed assumptions or by known or

unknown risks and uncertainties.

Factors that could cause actual results to differ materially

from expected results include those described under "Risk Factors”

in Item 1A of our annual report on Form 10-K and any updates to

those factors set forth in Chesapeake's subsequent Quarterly

Reports on Form 10-Q or Current Reports on Form 8-K (available at

http://www.chk.com/investors/sec-filings). These risk factors

include the volatility of oil, natural gas and NGL prices;

write-downs of our oil and natural gas carrying values due to

declines in prices; the availability of operating cash flow and

other funds to finance reserve replacement costs; our ability to

replace reserves and sustain production; uncertainties inherent in

estimating quantities of oil, natural gas and NGL reserves and

projecting future rates of production and the amount and timing of

development expenditures; our ability to generate profits or

achieve targeted results in drilling and well operations; leasehold

terms expiring before production can be established; commodity

derivative activities resulting in lower prices realized on oil,

natural gas and NGL sales; the need to secure derivative

liabilities and the inability of counterparties to satisfy their

obligations; adverse developments or losses from pending or future

litigation and regulatory proceedings, including royalty claims;

the limitations our level of indebtedness may have on our financial

flexibility; charges incurred in response to market conditions and

in connection with actions to reduce financial leverage and

complexity; drilling and operating risks and resulting liabilities;

effects of environmental protection laws and regulation on our

business; legislative and regulatory initiatives further regulating

hydraulic fracturing; our need to secure adequate supplies of water

for our drilling operations and to dispose of or recycle the water

used; federal and state tax proposals affecting our industry;

potential OTC derivatives regulation limiting our ability to hedge

against commodity price fluctuations; impacts of potential

legislative and regulatory actions addressing climate change;

competition in the oil and gas exploration and production industry;

a deterioration in general economic, business or industry

conditions; negative public perceptions of our industry; limited

control over properties we do not operate; pipeline and gathering

system capacity constraints and transportation interruptions; cyber

attacks adversely impacting our operations; and interruption in

operations at our headquarters due to a catastrophic event.

In addition, disclosures concerning the estimated contribution

of derivative contracts to our future results of operations are

based upon market information as of a specific date. These market

prices are subject to significant volatility. Our production

forecasts are also dependent upon many assumptions, including

estimates of production decline rates from existing wells and the

outcome of future drilling activity. Expected asset sales may not

be completed in the time frame anticipated or at all. We caution

you not to place undue reliance on our forward-looking statements,

which speak only as of the date of this news release, and we

undertake no obligation to update any of the information provided

in this release or the accompanying Outlook, except as required by

applicable law.

CHESAPEAKE ENERGY CORPORATION CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS ($ in millions, except

per share data) (unaudited)

Three Months Ended Year Ended

December 31, December 31, 2014

2013 2014 2013 REVENUES:

Oil, natural gas and NGL $ 2,369 $ 1,608 $ 8,180 $ 7,052 Marketing,

gathering and compression 2,681 2,689 12,225 9,559 Oilfield

services — 244 546

895 Total Revenues 5,050 4,541

20,951 17,506

OPERATING

EXPENSES: Oil, natural gas and NGL production 340 282 1,208

1,159 Production taxes 47 56 232 229 Marketing, gathering and

compression 2,720 2,680 12,236 9,461 Oilfield services — 193 431

736 General and administrative 93 121 322 457 Restructuring and

other termination costs (5 ) 45 7 248 Provision for legal

contingencies 134 — 234 —

Oil, natural gas and NGL depreciation,

depletion and amortization

706 644 2,683 2,589 Depreciation and amortization of other assets

38 80 232 314 Impairments of fixed assets and other 14 203 88 546

Net (gains) losses on sales of fixed assets 3

(12 ) (199 ) (302 ) Total Operating Expenses

4,090 4,292 17,474 15,437

INCOME FROM OPERATIONS 960 249

3,477 2,069

OTHER INCOME

(EXPENSE): Interest expense (7 ) (63 ) (89 ) (227 ) Losses on

investments (7 ) (189 ) (80 ) (226 ) Net gain (loss) on sales of

investments — — 67 (7 ) Losses on purchases of debt (2 ) (123 )

(197 ) (193 ) Other income 10 7

22 26 Total Other Expense (6 )

(368 ) (277 ) (627 )

INCOME (LOSS) BEFORE INCOME

TAXES 954 (119 ) 3,200

1,442

INCOME TAX EXPENSE (BENEFIT): Current

income taxes 13 13 47 22 Deferred income taxes 273

(58 )

1,097

526 Total Income Tax Expense (Benefit)

286 (45 ) 1,144 548

NET INCOME (LOSS) 668 (74 ) 2,056 894 Net income

attributable to noncontrolling interests (29 ) (42 )

(139 ) (170 )

NET INCOME (LOSS) ATTRIBUTABLE TO

CHESAPEAKE 639 (116 ) 1,917

724 Preferred stock dividends (43 ) (43 ) (171 ) (171

) Redemption of preferred shares of a subsidiary — — (447 ) (69 )

Earnings allocated to participating securities (10 )

— (26 ) (10 )

NET INCOME (LOSS) AVAILABLE

TO COMMON STOCKHOLDERS $ 586 $ (159 ) $ 1,273 $

474

EARNINGS (LOSS) PER COMMON SHARE: Basic $ 0.89

$ (0.24 ) $ 1.93 $ 0.73 Diluted $ 0.81

$ (0.24 ) $ 1.87 $ 0.73

WEIGHTED AVERAGE COMMON

AND COMMON EQUIVALENT SHARES OUTSTANDING (in millions): Basic

660 656 659 653

Diluted 773 656 772

653

CHESAPEAKE ENERGY

CORPORATION CONDENSED CONSOLIDATED BALANCE SHEETS ($

in millions) (unaudited)

December 31, December 31,

2014 2013 Cash and cash

equivalents $ 4,108 $ 837 Other current assets 3,360

2,819 Total Current Assets 7,468 3,656

Property and equipment, (net) 32,515 37,134 Other assets 768

992 Total Assets $ 40,751 $ 41,782 Current

liabilities $ 5,863 $ 5,515 Long-term debt, net of discounts 11,154

12,886 Other long-term liabilities 1,344 1,834 Deferred income tax

liabilities 4,185 3,407 Total Liabilities

22,546 23,642 Preferred stock 3,062 3,062

Noncontrolling interests 1,302 2,145 Common stock and other

stockholders’ equity 13,841 12,933 Total Equity

18,205 18,140 Total Liabilities and Equity $

40,751 $ 41,782 Common Shares Outstanding (in millions)

663 664

CHESAPEAKE ENERGY

CORPORATION CAPITALIZATION ($ in millions)

(unaudited)

December 31, December 31,

2014 2013 Total debt, net of

unrestricted cash $ 7,427 $ 12,049 Preferred stock 3,062 3,062

Noncontrolling interests(a) 1,302 2,145 Common stock and other

stockholders’ equity 13,841 12,933

Total $ 25,632 $ 30,189 Total net debt to

capitalization ratio 29 % 40 %

(a) Includes third-party ownership as

follows:

CHK Cleveland Tonkawa, L.L.C. $ 1,015 $ 1,015 Chesapeake

Granite Wash Trust 287 314 CHK Utica, L.L.C. — 807 Other —

9 Total $ 1,302 $ 2,145

CHESAPEAKE ENERGY CORPORATION ROLL-FORWARD OF

PROVED RESERVES 12 MONTHS ENDED DECEMBER 31, 2014

(unaudited)

Mmboe(a) Beginning balance, December 31, 2013

2,678 Production (258 ) Acquisitions 14 Divestitures (362 )

Revisions - changes to previous estimates (78 ) Revisions - price

27 Extensions and discoveries 448 Ending balance,

December 31, 2014 2,469 Proved reserves growth

rate before acquisitions and divestitures 5 % Proved reserves

growth rate after acquisitions and divestitures (8 )% Proved

developed reserves 1,864 Proved developed reserves percentage 75 %

PV-10 ($ in millions)(a) $ 22,012

(a) Reserve volumes and PV-10 value estimated using SEC reserve

recognition standards and pricing assumptions based on the trailing

12-month average first-day-of-the-month prices as of December 31,

2014, of $4.35 per mcf of natural gas and $94.98 per bbl of oil,

before field differential adjustments.

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF PV-10 ($ in millions)

(unaudited)

December 31, December 31, 2014

2013 Standardized measure of discounted future

net cash flows $ 17,133 $ 17,390 Discounted future cash flows for

income taxes 4,879 4,286 Discounted future net cash

flows before income taxes (PV-10) $ 22,012 $ 21,676

PV-10 is discounted (at 10%) future net cash flows before income

taxes. The standardized measure of discounted future net cash flows

includes the effects of estimated future income tax expenses and is

calculated in accordance with Accounting Standards Codification

Topic 932. Management uses PV-10 as one measure of the value of the

company's current proved reserves and to compare relative values

among peer companies without regard to income taxes. We also

understand that securities analysts and rating agencies use this

measure in similar ways. While PV-10 is based on prices, costs and

discount factors which are consistent from company to company, the

standardized measure is dependent on the unique tax situation of

each individual company.

The company’s PV-10 and standardized measure were calculated

using the following prices, before field differentials: $4.35 per

mcf of natural gas and $94.98 per bbl of oil as of December 31,

2014, and $3.67 per mcf of natural gas and $96.82 per bbl of oil as

of December 31, 2013, before field differential adjustments.

CHESAPEAKE ENERGY CORPORATION

SUPPLEMENTAL DATA - OIL, NATURAL GAS AND NGL PRODUCTION, SALES

AND INTEREST EXPENSE (unaudited)

Three Months Ended

Twelve Months Ended December 31,

December 31, 2014 2013 2014 2013

Net Production: Oil (mmbbl) 11.2 10.2 42.3 41.1 Natural gas

(bcf) 281.6 270.5 1,095.0 1,094.6 NGL (mmbbl) 9.0 5.9 33.1 20.9 Oil

equivalent (mmboe) 67.1 61.2 257.8 244.4

Oil, natural gas

and NGL Sales ($ in millions): Oil sales $ 749 $ 937 $ 3,682 $

3,911 Oil derivatives – realized gains (losses)(a) 103 (19 ) (185 )

(108 ) Oil derivatives – unrealized gains (losses)(a) 505

116 859 280 Total

Oil Sales 1,357 1,034 4,356

4,083 Natural gas sales 453 498 2,777

2,430 Natural gas derivatives – realized gains (losses)(a) 30 17

(191 ) 9 Natural gas derivatives – unrealized gains (losses)(a)

411 (127 ) 535 (52 )

Total Natural Gas Sales 894 388

3,121 2,387 NGL sales 118

186 703 582 Total NGL

Sales 118 186 703

582 Total Oil, Natural Gas and NGL Sales $ 2,369 $

1,608 $ 8,180 $ 7,052

Average Sales

Price – excluding gains (losses) on derivatives: Oil ($ per

bbl) $ 67.16 $ 91.46 $ 87.13 $ 95.17 Natural gas ($ per mcf) $ 1.61

$ 1.84 $ 2.54 $ 2.22 NGL ($ per bbl) $ 13.11 $ 31.76 $ 21.27 $

27.87 Oil equivalent ($ per boe) $ 19.68 $ 26.49 $ 27.78 $ 28.33

Average Sales Price – including realized gains (losses)

on derivatives: Oil ($ per bbl) $ 76.40 $ 89.58 $ 82.76 $ 92.53

Natural gas ($ per mcf) $ 1.72 $ 1.90 $ 2.36 $ 2.23 NGL ($ per bbl)

$ 13.11 $ 31.76 $ 21.27 $ 27.87 Oil equivalent ($ per boe) $ 21.67

$ 26.44 $ 26.32 $ 27.92

Interest Expense ($ in

millions): Interest(b) $ 40 $ 56 $ 173 $ 169 Derivatives –

realized (gains) losses(c) (2 ) (3 ) (12 ) (9 ) Derivatives –

unrealized (gains) losses(c) (31 ) 10

(72 ) 67 Total Interest Expense $ 7 $ 63

$ 89 $ 227

(a) Realized gains and losses include the

following items: (i) settlements of nondesignated derivatives

related to current period production revenues, (ii) prior period

settlements for option premiums and for early-terminated

derivatives originally scheduled to settle against current period

production revenues, and (iii) gains and losses related to de-

designated cash flow hedges originally designated to settle against

current period production revenues. Unrealized gains and losses

include the change in fair value of open derivatives scheduled to

settle against future period production revenues offset by amounts

reclassified as realized gains and losses during the period.

Although we no longer designate our derivatives as cash flow hedges

for accounting purposes, we believe these definitions are useful to

management and investors in determining the effectiveness of our

price risk management program.

(b) Net of amounts capitalized.

(c) Realized (gains) losses include

settlements related to the current period interest accrual and the

effect of (gains) losses on early termination trades. Unrealized

(gains) losses include changes in the fair value of open interest

rate derivatives offset by amounts reclassified to realized (gains)

losses during the period.

CHESAPEAKE ENERGY CORPORATION

CONDENSED CONSOLIDATED CASH FLOW DATA ($ in millions)

(unaudited)

December 31, December 31, THREE

MONTHS ENDED: 2014 2013

Beginning cash $ 90 $ 987

Cash

provided by operating activities 829 1,028

Cash flows from investing activities: Drilling

and completion costs on proved and unproved properties(a) (1,367 )

(1,117 ) Acquisition of proved and unproved properties(b) (280 )

(211 ) Sales of proved and unproved properties 5,082 668 Geological

and geophysical costs (29 ) (17 ) Cash paid to purchase leased rigs

and compressors (25 ) (262 ) Additions to other property and

equipment (26 ) (71 ) Proceeds from sales of other assets 39 126

Additions to investments (3 ) (36 ) Other 1 —

Total cash provided by (used in) investing activities

3,392 (920 )

Cash used in financing

activities (203 ) (258 )

Change in cash and

cash equivalents 4,018 (150 )

Ending

cash $ 4,108 $ 837

(a) Includes capitalized interest of $9

million and $15 million for the three months ended December 31,

2014 and 2013, respectively.

(b) Includes capitalized interest of $120

million and $163 million for the three months ended December 31,

2014 and 2013, respectively.

December 31, December 31,

TWELVE MONTHS ENDED: 2014 2013

Beginning cash $ 837 $ 287

Cash provided by operating activities 4,634

4,614

Cash flows from investing

activities: Drilling and completion costs on proved and

unproved properties(a) (4,534 ) (5,552 ) Acquisition of proved and

unproved properties(b) (1,279 ) (974 ) Sales of proved and unproved

properties 5,781 3,409 Geological and geophysical costs (47 ) (52 )

Cash paid to purchase leased rigs and compressors (499 ) (266 )

Additions to other property and equipment (227 ) (706 ) Proceeds

from sales of other assets 1,003 922 Additions to investments (17 )

— Proceeds from sales of investments 239 71 Decrease in restricted

cash 37 — Other (3 ) 181

Total cash

provided by (used in) investing activities 454

(2,967 )

Cash used in financing activities

(1,817 ) (1,097 )

Change in cash and cash

equivalents 3,271 550

Ending

cash $ 4,108 $ 837

(a) Includes capitalized interest of $39

million and $62 million for the twelve months ended December 31,

2014 and 2013, respectively.

(b) Includes capitalized interest of $553

million and $734 million for the twelve months ended December 31,

2014 and 2013, respectively.

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF ADJUSTED NET INCOME AVAILABLE TO COMMON

STOCKHOLDERS ($ in millions, except per share data)

(unaudited)

December 31,

September 30, December 31, THREE MONTHS ENDED:

2014 2014 2013

Net income available to common stockholders $ 586 $ 169 $

(159 )

Adjustments, net of tax(a):

Unrealized (gains) losses on derivatives (663 ) (378 ) 13

Restructuring and other termination costs (3 ) (9 ) 28 Impairments

of fixed assets and other 10 9 126 Net (gains) losses on sales of

fixed assets 2 (53 ) (7 ) Losses on purchases of debt and

extinguishment of other financing 2 — 76 Losses on investments — —

84 Provision for legal contingencies 94 61 — Other 6 5 — Redemption

of preferred shares of a subsidiary(a) — 447

—

Adjusted net income available to common

stockholders(b) $ 34 $ 251 $ 161 Preferred stock

dividends 43 43 43 Earnings allocated to participating securities

10 3 —

Total adjusted net income attributable to Chesapeake

$ 87 $ 297 $ 204

Weighted average

fully diluted shares outstanding

(in millions)(c)

775 776 767

Adjusted earnings per share assuming

dilution(b) $ 0.11 $ 0.38 $ 0.27

(a) All adjustments to net income available to common

stockholders reflected net of tax other than the redemption of

preferred shares of a subsidiary.

(b) Adjusted net income and adjusted earnings per share assuming

dilution are not measures of financial performance under GAAP, and

should not be considered as an alternative to net income available

to common stockholders or diluted earnings per share. Adjusted net

income available to common stockholders and adjusted earnings per

share assuming dilution exclude certain items that management

believes affect the comparability of operating results. The company

believes these adjusted financial measures are a useful adjunct to

earnings calculated in accordance with accounting principles

generally accepted in the United States (GAAP) because:

(i) Management uses adjusted net income

available to common stockholders to evaluate the company's

operational trends and performance relative to other oil and

natural gas producing companies.

(ii) Adjusted net income available to common

stockholders is more comparable to earnings estimates provided by

securities analysts.

(iii) Items excluded generally are one-time

items or items whose timing or amount cannot be reasonably

estimated. Accordingly, any guidance provided by the company

generally excludes information regarding these types of items.

(c) Weighted average fully diluted shares outstanding include

shares that were considered antidilutive for calculating earnings

per share in accordance with GAAP.

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF ADJUSTED NET INCOME AVAILABLE TO COMMON

STOCKHOLDERS ($ in millions, except per share data)

(unaudited)

December 31, December 31, TWELVE

MONTHS ENDED: 2014 2013

Net income available to common stockholders $ 1,273 $ 474

Adjustments, net of tax(a): Unrealized

gains on derivatives (941 ) (100 ) Restructuring and other

termination costs 4 154 Impairments of fixed assets and other 57

341 Net gains on sales of fixed assets (128 ) (187 ) Impairments of

investments 3 6 Net (gain) loss on sales of investments (43 ) 5

Losses on purchases of debt and extinguishment of other financing

126 120 Losses on investments — 84 Provision for legal

contingencies 150 — Other 9 (1 ) Redemption of preferred shares of

a subsidiary(a) 447 69

Adjusted net

income available to common stockholders(b) $ 957

$ 965 Preferred stock dividends 171 171 Earnings

allocated to participating securities 26 10

Total adjusted net income attributable to

Chesapeake $ 1,154 $ 1,146

Weighted

average fully diluted shares outstanding (in

millions)(c) 776 765

Adjusted earnings per

share assuming dilution(b) $ 1.49 $ 1.50

(a) All adjustments to net income available to common

stockholders reflected net of tax other than the redemption of

preferred shares of a subsidiary.

(b) Adjusted net income available to common stockholders and

adjusted earnings per share assuming dilution exclude certain items

that management believes affect the comparability of operating

results. The company believes these adjusted financial measures are

a useful adjunct to earnings calculated in accordance with

accounting principles generally accepted in the United States

(GAAP) because:

(i) Management uses adjusted net income

available to common stockholders to evaluate the company's

operational trends and performance relative to other oil and

natural gas producing companies.

(ii) Adjusted net income available to common

stockholders is more comparable to earnings estimates provided by

securities analysts.

(iii) Items excluded generally are one-time

items or items whose timing or amount cannot be reasonably

estimated. Accordingly, any guidance provided by the company

generally excludes information regarding these types of items.

(c) Weighted average fully diluted shares outstanding include

shares that were considered antidilutive for calculating earnings

per share in accordance with GAAP.

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF OPERATING CASH FLOW AND EBITDA ($ in

millions) (unaudited)

December

31, September 30, December 31, THREE MONTHS

ENDED: 2014 2014 2013

CASH PROVIDED BY OPERATING ACTIVITIES $ 829 $ 1,184 $

1,028 Changes in assets and liabilities 44 109

(33 )

OPERATING CASH FLOW(a) $ 873

$ 1,293 $ 995

December 31, September 30, December 31,

THREE MONTHS ENDED: 2014 2014

2013 NET INCOME $ 668 $ 692 $ (74 )

Interest expense 7 17 63 Income tax expense (benefit) 286 437 (45 )

Depreciation and amortization of other assets 38 37 80 Oil, natural

gas and NGL depreciation, depletion and amortization 706

688 644

EBITDA(b)

$ 1,705 $ 1,871 $ 668

December 31, September 30, December

31, THREE MONTHS ENDED: 2014

2014 2013 CASH PROVIDED BY OPERATING

ACTIVITIES $ 829 $ 1,184 $ 1,028 Changes in assets and

liabilities 44 109 (33 ) Interest expense, net of unrealized gains

(losses) on derivatives 38 11 53 Oil, natural gas and NGL

derivative gains (losses), net 1,049 564 (13 ) Cash receipts

(payments) on oil, natural gas and NGL derivative settlements, net

(88 ) 34 30 Stock-based compensation — (19 ) (20 ) Restructuring

and other termination costs (3 ) 42 (11 ) Impairments of fixed

assets and other (14 ) (15 ) (166 ) Net gains (losses) on sales of

fixed assets (2 ) 86 12 Losses on investments (7 ) (27 ) (189 )

Provision for legal contingencies (134 ) (100 ) — Losses on

purchases of debt and extinguishment of other financing (2 ) — (3 )

Other items (5 ) 2 (20 )

EBITDA(b) $ 1,705 $ 1,871 $ 668

(a) Operating cash flow represents net cash provided by

operating activities before changes in assets and liabilities.

Operating cash flow is presented because management believes it is

a useful adjunct to net cash provided by operating activities under

GAAP. Operating cash flow is widely accepted as a financial

indicator of an oil and natural gas company's ability to generate

cash that is used to internally fund exploration and development

activities and to service debt. This measure is widely used by

investors and rating agencies in the valuation, comparison, rating

and investment recommendations of companies within the oil and

natural gas exploration and production industry. Operating cash

flow is not a measure of financial performance under GAAP and

should not be considered as an alternative to cash flows from

operating, investing or financing activities as an indicator of

cash flows, or as a measure of liquidity.

(b) Ebitda represents net income before interest expense, income

taxes, and depreciation, depletion and amortization expense. Ebitda

is presented as a supplemental financial measurement in the

evaluation of our business. We believe that it provides additional

information regarding our ability to meet our future debt service,

capital expenditures and working capital requirements. This measure

is widely used by investors and rating agencies in the valuation,

comparison, rating and investment recommendations of companies.

Ebitda is also a financial measurement that, with certain

negotiated adjustments, is reported to our lenders pursuant to our

bank credit agreements and is used in the financial covenants in

our bank credit agreements. Ebitda is not a measure of financial

performance under GAAP. Accordingly, it should not be considered as

a substitute for net income, income from operations or cash flow

provided by operating activities prepared in accordance with

GAAP.

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF OPERATING CASH FLOW AND EBITDA ($ in

millions) (unaudited)

December 31, December 31,

TWELVE MONTHS ENDED: 2014 2013

CASH PROVIDED BY OPERATING ACTIVITIES $ 4,634 $ 4,614

Changes in assets and liabilities 392 344

OPERATING CASH FLOW(a) $ 5,026 $ 4,958

December 31, December 31, TWELVE

MONTHS ENDED: 2014 2013

NET INCOME $ 2,056 $ 894 Interest expense 89 227 Income tax

expense 1,144 548 Depreciation and amortization of other assets 232

314 Oil, natural gas and NGL depreciation, depletion and

amortization 2,683 2,589

EBITDA(b) $ 6,204 $ 4,572

December

31, December 31, TWELVE MONTHS ENDED:

2014 2013 CASH PROVIDED BY OPERATING

ACTIVITIES $ 4,634 $ 4,614 Changes in assets and liabilities

392 344 Interest expense, net of unrealized gains (losses) on

derivatives 161 159 Oil, natural gas and NGL derivative gains

(losses), net 1,018 129 Cash receipts on oil, natural gas and NGL

derivative settlements, net 264 91 Stock-based compensation (59 )

(98 ) Restructuring and other termination costs 15 (175 )

Impairments of fixed assets and other (58 ) (483 ) Net gains on

sales of fixed assets 199 302 Provision for legal contingencies

(234 ) — Losses on investments (80 ) (229 ) Net gain (loss) on

sales of investments 67 (7 ) Losses on purchases of debt and

extinguishment of other financing (63 ) (40 ) Other items

(52 ) (35 )

EBITDA(b) $ 6,204 $ 4,572

(a) Operating cash flow represents net cash provided by

operating activities before changes in assets and liabilities.

Operating cash flow is presented because management believes it is

a useful adjunct to net cash provided by operating activities under

GAAP. Operating cash flow is widely accepted as a financial

indicator of an oil and natural gas company's ability to generate

cash which is used to internally fund exploration and development

activities and to service debt. This measure is widely used by

investors and rating agencies in the valuation, comparison, rating

and investment recommendations of companies within the oil and

natural gas exploration and production industry. Operating cash

flow is not a measure of financial performance under GAAP and

should not be considered as an alternative to cash flows from

operating, investing or financing activities as an indicator of

cash flows, or as a measure of liquidity.

(b) Ebitda represents net income before interest expense, income

taxes, and depreciation, depletion and amortization expense. Ebitda

is presented as a supplemental financial measurement in the

evaluation of our business. We believe that it provides additional

information regarding our ability to meet our future debt service,

capital expenditures and working capital requirements. This measure

is widely used by investors and rating agencies in the valuation,

comparison, rating and investment recommendations of companies.

Ebitda is also a financial measurement that, with certain

negotiated adjustments, is reported to our lenders pursuant to our

bank credit agreements and is used in the financial covenants in

our bank credit agreements. Ebitda is not a measure of financial

performance under GAAP. Accordingly, it should not be considered as

a substitute for net income, income from operations or cash flow

provided by operating activities prepared in accordance with

GAAP.

CHESAPEAKE ENERGY CORPORATION

RECONCILIATION OF ADJUSTED EBITDA ($ in millions)

(unaudited)

December 31,

September 30, December 31, THREE MONTHS ENDED:

2014 2014 2013

EBITDA $ 1,705 $ 1,871 $ 668

Adjustments:

Unrealized (gains) losses on oil, natural gas and NGL derivatives

(916 ) (622 ) 11 Restructuring and other termination costs (5 ) (14

) 45 Impairments of fixed assets and other 14 15 203 Net (gains)

losses on sales of fixed assets 3 (86 ) (12 ) Net loss on sales of

investments — — 136 Losses on purchases of debt and extinguishment

of other financing 2 — 123 Provision for legal contingencies 134

100 — Net income attributable to noncontrolling interests (29 ) (30

) (42 ) Other 8 2 —

Adjusted EBITDA(a) $ 916 $ 1,236

$ 1,132

December

31, December 31, TWELVE MONTHS ENDED:

2014 2013 EBITDA $ 6,204 $ 4,572

Adjustments: Unrealized gains on oil, natural gas and

NGL derivatives (1,394 ) (228 ) Restructuring and other termination

costs 7 248 Impairments of fixed assets and other 88 550 Net gains

on sales of fixed assets (199 ) (302 ) Losses on investments 5 146

Net (gain) loss on sales of investments (67 ) 7 Losses on purchases

of debt and extinguishment of other financing 197 193 Provision for

legal contingencies 234 — Net income attributable to noncontrolling

interests (139 ) (170 ) Other 9 —

Adjusted EBITDA(a) $ 4,945 $ 5,016

(a) Adjusted ebitda excludes certain items that management

believes affect the comparability of operating results. The company

believes these non-GAAP financial measures are a useful adjunct to

ebitda because:

(i) Management uses adjusted ebitda to

evaluate the company's operational trends and performance relative

to other oil and natural gas producing companies.

(ii) Adjusted ebitda is more comparable to

estimates provided by securities analysts.

(iii) Items excluded generally are one-time

items or items whose timing or amount cannot be reasonably

estimated. Accordingly, any guidance provided by the company

generally excludes information regarding these types of items.

Accordingly, adjusted EBITDA should not be

considered as a substitute for net income, income from operations

or cash flow provided by operating activities prepared in

accordance with GAAP.

SCHEDULE "A” CHESAPEAKE ENERGY CORPORATION

MANAGEMENT’S OUTLOOK AS OF FEBRUARY 25, 2015

Chesapeake periodically provides

management guidance on certain factors that affect the company’s

future financial performance.

Year Ending 12/31/2015 Adjusted Production Growth(a) 3% - 5%

Absolute Production Liquids - mbbls 62 – 64 Oil - mbbls 39 – 40

NGL(b) - mbbls 23 – 24 Natural gas - bcf 1,035 – 1,055 Total

absolute production - mmboe 235 – 240 Absolute daily rate - mboe

645 – 655 Estimated Realized Hedging Effects(c) (based on 2/23/15

strip prices): Oil - $/bbl $19.94 Natural gas - $/mcf $0.31

Estimated Basis/Gathering/Marketing/Transportation Differentials to

NYMEX Prices: Oil - $/bbl $7.00 – 9.00 NGL - $/bbl $48.00 – 52.00

Natural gas - $/mcf $1.70 – 1.90 Fourth quarter MVC estimate ($ in

millions) ($180) – (200) Operating Costs per Boe of Projected

Production: Production expense $4.50 – 5.00 Production taxes $0.45

– 0.55 General and administrative(d) $1.45 – 1.55 Stock-based

compensation (noncash) $0.20 – 0.25 DD&A of natural gas and

liquids assets $10.50 – 11.50 Depreciation of other assets $0.60 –

0.70 Interest expense(e) $1.00 – 1.10 Other ($ millions):

Marketing, gathering and compression net margin(f) ($40 – 60) Net

income attributable to noncontrolling interests and other(g) ($30 –

50) Book Tax Rate 37% Capital Expenditures ($ in millions)(h)

$3,500 – 4,000 Capitalized Interest ($ in millions) $500 Total

Capital Expenditures ($ in millions) $4,000 – 4,500

(a) Based on 2014 production of 622 mboe/day adjusted for 2014

sales and the potential sale of Cleveland Tonkawa assets in

2015.

(b) Assumes ethane recovery in the Utica to fulfill Chesapeake’s

pipeline commitments, no ethane recovery in the Powder River Basin

and partial ethane recovery in the Mid-Continent and Eagle

Ford.

(c) Includes expected settlements for commodity derivatives

adjusted for option premiums. For derivatives closed early,

settlements are reflected in the period of original contract

expiration.

(d) Excludes expenses associated with stock-based

compensation.

(e) Excludes unrealized gains (losses) on interest rate

derivatives.

(f) Includes revenue and operating expenses and excludes

depreciation and amortization of other assets

(g) Net income attributable to noncontrolling interests of

Chesapeake Granite Wash Trust and CHK Cleveland Tonkawa L.L.C.

(h) Includes capital expenditures for drilling and completion,

acquisition of unproved properties, geological and geophysical

costs and other property and plant and equipment

Oil, Natural Gas and NGL Hedging Activities

Chesapeake enters into oil, natural gas and NGL derivative

transactions in order to mitigate a portion of its exposure to

adverse changes in market prices. Please see the quarterly reports

on Form 10-Q and annual reports on Form 10-K filed by Chesapeake

with the SEC for detailed information about derivative instruments

the company uses, its quarter-end and year-end derivative positions

and accounting for oil, natural gas and NGL derivatives.

As of January 31, 2015, the company had downside protection on

approximately 43% of its projected 2015 oil production at an

average price of $93.39 per bbl of which 11% is hedged under collar

arrangements with upside to an average NYMEX price of $90/bbl and

exposure below an average NYMEX price of $80/bbl. Approximately 43%

of the company's projected 2015 natural gas production had downside

protection at an average price of $4.21 per thousand cubic feet of

natural gas, of which 20% is hedged under collar arrangements with

upside to an average NYMEX price of $4.29/mcf and exposure below an

average NYMEX price of $3.37/mcf.

The company’s crude oil hedging positions as of January 31,

2015, were as follows:

Open Crude Oil Swaps; Gains (Losses) from Closed Crude

Oil Trades and Call Option Premiums

Total Gains from Closed Trades Avg.

NYMEX and Premiums for Open Swaps Price of Call Options

(mbbls) Open Swaps ($ in millions) Q1 2015 3,834 $

94.07 $ 50 Q2 2015 3,041 94.49 61 Q3 2015 2,868 94.82 62 Q4 2015

2,714 95.15 63 Total 2015 12,457

$ 94.58 $ 236 Total 2016 – 2022 — — $

117

Crude Oil Three-Way Collars

Open

Avg. NYMEX Avg. NYMEX Avg. NYMEX Collars Sold Put Bought Put

Sold Call (mbbls) Price Price

Price Q1 2015 1,080 $ 80.00 $ 90.00 $ 98.94 Q2 2015 1,092 80.00

90.00 98.94 Q3 2015 1,104 80.00 90.00 98.94 Q4 2015 1,104

80.00 90.00 98.94 Total

2015 4,380 $ 80.00 $ 90.00 $ 98.94

Crude Oil Net Written Call Options

Call Options Avg. NYMEX

(mbbls) Strike Price Q1 2015 1,485 $ 100.00 Q2

2015 3,349 91.89 Q3 2015 3,386 91.89 Q4 2015 3,386

91.89 Total 2015 11,606 $ 92.93 Total 2016 –

2017 24,220 $ 100.07

The company’s natural gas hedging positions as of January 31,

2015, were as follows:

Open Natural Gas Swaps; Gains (Losses) from Closed

Natural Gas Trades and Call Option Premiums

Total Gains (Losses) from Closed

Trades Avg. NYMEX and Premiums for Open Swaps Price of Call Options

(bcf) Open Swaps ($ in millions) Q1 2015 81 $

4.53 $ (39 ) Q2 2015 53 3.95 (30 ) Q3 2015 52 3.94 (31 ) Q4 2015 52

3.94 (31 ) Total 2015 238 $ 4.14

$ (131 ) Total 2016 – 2022 37 $ 3.95 $ (187 )

Natural Gas Three-Way Collars

Avg. NYMEX Avg. NYMEX Avg. NYMEX Open Collars Sold Bought

Sold Call (bcf) Put Price Put Price

Price Q1 2015 100 $ 3.36 $ 4.42 $ 4.65 Q2 2015 35 3.38 4.17

4.37 Q3 2015 36 3.38 4.17 4.37 Q4 2015 36 3.38

4.17 4.37 Total 2015 207

$ 3.37 $ 4.29 $ 4.51

Natural Gas Net

Written Call Options

Call Options Avg. NYMEX (bcf)

Strike Price Total 2016 – 2020 193 $ 9.92

Natural Gas Basis Protection Swaps

Volume Avg. NYMEX

(bcf) plus/(minus) Q1 2015 28 $ 1.28 Q2 2015 8 (0.34 ) Q3

2015 8 (0.33 ) Q4 2015 8 (0.33 ) Total 2015

52 $ 0.55 Total 2016 - 2022 8 $

(1.02 )

Chesapeake Energy CorporationInvestor Relations:Brad Sylvester,

CFA, 405-935-8870ir@chk.comorMedia Relations:Gordon Pennoyer,

405-935-8878media@chk.com

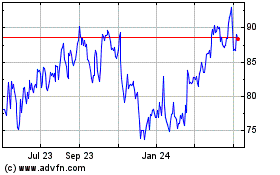

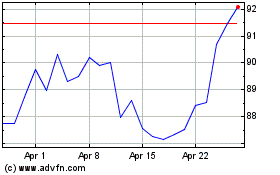

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024