Three Month Results As Reported Daily Revenue Recognition

- Net revenue increased 5.1% to $336.7 million

- Adjusted EBITDA increased 3.8% to $150.6 million

Three Month Results Pro Forma Monthly Revenue Recognition

- Pro forma adjusted net revenue increased 4.4% to $329.2

million

- Pro forma adjusted EBITDA increased 3.5% to $143.1 million

Lamar Advertising Company (Nasdaq:LAMR), a leading owner and

operator of outdoor advertising and logo sign displays, announces

the Company's operating results for the fourth quarter and year

ended December 31, 2014.

"We are pleased with our fourth quarter results, particularly

the acceleration in our billing," said Lamar chief executive, Sean

Reilly. "We are also pleased with our 2015 first quarter revenue

pacings to date. Last year we completed our REIT conversion and

delivered full-year AFFO of $4.08 per share, the midpoint of our

previously provided guidance."

Fourth Quarter Highlights

- Same-unit digital billing grew 4.4%

- Local sales on billboards increased 4.2%

- Pro forma monthly analog poster revenue grew 4%

- Paid quarterly dividend of $0.84 per share

Fourth Quarter Results

Lamar reported net revenues of $336.7 million for the fourth

quarter of 2014 versus $320.4 million for the fourth quarter of

2013, a 5.1% increase. Operating income for the fourth quarter of

2014 was $88.5 million as compared to $63.8 million for the same

period in 2013. Lamar recognized net income of $207.9 million for

the fourth quarter of 2014 compared to net income of $10.2 million

for same period in 2013. The increase in net income reflects a one

time income tax benefit of $120.1 million related to the write off

of a substantial portion of the Company's deferred tax liabilities

as a result of its conversion to a real estate investment trust.

Net income per basic and diluted share was $2.18 per share and

$0.11 per share for the three months ended December 31, 2014 and

2013, respectively.

Adjusted EBITDA for the fourth quarter of 2014 was $150.6

million versus $145.0 million for the fourth quarter of 2013, a

3.8% increase.

Free Cash Flow for the fourth quarter of 2014 was $100.2 million

as compared to $85.0 million for the same period in 2013, a 17.9%

increase.

For the fourth quarter of 2014, Funds From Operations, or FFO,

was $136.8 million versus $86.0 million for the same period of

2013, an increase of 59.1%. Adjusted Funds From Operations, or

AFFO, for fourth quarter of 2014 was $117.3 million compared to

$99.0 million for the same period in 2013, an 18.5% increase.

Diluted AFFO per share, was $1.23 per share and $1.04 per share for

the three months ended December 31, 2014 and 2013,

respectively.

Q4 Pro Forma Results

Pro forma adjusted net revenue for the fourth quarter of 2014

(recognized on a monthly basis) was $329.2 million. This reflects a

4.4% increase over pro forma adjusted net revenue for the fourth

quarter of 2013. Pro forma adjusted EBITDA increased 3.5% as

compared to pro forma adjusted EBITDA for the fourth quarter of

2013. Pro forma adjusted net revenue and pro forma adjusted EBITDA

include adjustments to the 2013 period for acquisitions and

divestitures for the same time frame as actually owned in the 2014

period. Pro forma adjusted net revenue and pro forma adjusted

EBITDA in the 2013 period and adjusted net revenue and Adjusted

EBITDA in the 2014 period have been adjusted to reflect revenue

recognition on a monthly basis over the term of each advertising

contract. See "Reconciliation of Reported Basis to Pro Forma

Basis", which provides reconciliations to GAAP for adjusted and pro

forma measures.

Twelve Months Results

Lamar reported net revenues of $1.29 billion for the twelve

months ended December 31, 2014 versus $1.25 billion for the same

period in 2013, a 3.3% increase. Operating income for the twelve

months ended December 31, 2014 was $278.7 million as compared to

$223.4 million for the same period in 2013. Adjusted EBITDA for the

twelve months ended December 31, 2014 was $558.0 million versus

$545.1 million for the same period in 2013, a 2.4% increase. In

addition, Lamar recognized net income of $253.5 million for the

twelve months ended December 31, 2014 as compared to net income of

$40.1 million for the same period in 2013. The increase in net

income reflects a one time income tax benefit of $120.1 million

related to the write off of a substantial portion of the Company's

deferred tax liabilities as a result of its conversion to a real

estate investment trust. Net income per basic and diluted share was

$2.66 per share and $0.42 per share for the twelve months ended

December 31, 2014 and 2013, respectively.

Free Cash Flow for the twelve months ended December 31, 2014

increased 11.2% to $337.7 million as compared to $303.6 million for

the same period in 2013.

For the twelve months ended December 31, 2014, FFO was $372.7

million versus $322.5 million for the same period of 2013, a 15.6%

increase and AFFO for the twelve months ended December 31, 2014 was

$388.5 million compared to $346.2 million for the same period in

2013, a 12.2% increase. Diluted AFFO per share increased to $4.08

per share as compared to $3.65 per share in the comparable period

in 2013.

Please refer to "Use of Non GAAP Financial Measures" for

definitions of Adjusted EBITDA, Free Cash Flow, Funds From

Operations, Adjusted Funds From Operations, Diluted AFFO per share

and outdoor operating income. For additional information, including

reconciliations to GAAP measures, please refer to the unaudited

selected financial information and supplemental schedules.

Liquidity

As of December 31, 2014, Lamar had $354.2 million in total

liquidity that consisted of $328.2 million available for borrowing

under its revolving senior credit facility and approximately $26.0

million in cash and cash equivalents.

Recent Events

Distributions. On December 30, 2014, Lamar made its third

quarterly dividend distribution of $0.84 per share, or a total of

approximately $80.2 million, to common stockholders of record on

December 22, 2014. For the year ended December 31, 2014, Lamar's

distributions to common stockholders were $2.50 per share in the

aggregate.

Stock Repurchase Program. In December 2014, Lamar announced that

its board of directors authorized the repurchase of up to $250

million of the Company's Class A common stock.

REIT Conversion. As part of its reorganization to qualify as a

real estate investment trust for U.S. federal income tax purposes

for the taxable year commencing January 1, 2014, Lamar merged with

and into its wholly owned subsidiary Lamar Advertising REIT Company

on November 18, 2014.

Guidance

In connection with our conversion to a REIT, Lamar does not

intend to provide quarterly pro forma revenue guidance for future

periods, as it has in the past. As a REIT, we plan to provide

annual guidance for Adjusted Funds From Operations, a widely

recognized metric of operating performance for REITs. We anticipate

AFFO for fiscal year 2015 will be between $417 million and $427

million, representing growth of approximately 7.5% to 10.0% over

2014. This equates to full year AFFO per share of $4.34 to $4.45.

Projected 2015 net income will be between $243 million and $253

million, or $2.53 to $2.64 per share.

Forward Looking Statements

This press release contains forward-looking statements,

including statements regarding guidance for fiscal year 2015 and

sales trends. These statements are subject to risks and

uncertainties that could cause actual results to differ materially

from those projected in these forward-looking statements. These

risks and uncertainties include, among others: (1) our significant

indebtedness; (2) the state of the economy and financial markets

generally and the effect of the broader economy on the demand for

advertising; (3) the continued popularity of outdoor advertising as

an advertising medium; (4) our need for and ability to obtain

additional funding for operations, debt refinancing or

acquisitions; (5) our ability to continue to qualify as a REIT and

maintain our status as a REIT; (6) the regulation of the outdoor

advertising industry by federal, state and local governments; (7)

the integration of companies that we acquire and our ability to

recognize cost savings or operating efficiencies as a result of

these acquisitions; (8) changes in accounting principles, policies

or guidelines; (9) changes in tax laws applicable to REITs or in

the interpretation of those laws; (10) our ability to renew

expiring contracts at favorable rates; (11) our ability to

successfully implement our digital deployment strategy; and (12)

the market for our Class A common stock. For additional information

regarding factors that may cause actual results to differ

materially from those indicated in our forward-looking statements,

we refer you to the risk factors included in Item 1A of our Annual

Report on Form 10-K for the year ended December 31, 2013, as

supplemented by any risk factors contained in our Quarterly Reports

on Form 10-Q. We caution investors not to place undue reliance on

the forward-looking statements contained in this document. These

statements speak only as of the date of this document, and we

undertake no obligation to update or revise the statements, except

as may be required by law.

Use of Non-GAAP Financial Measures

The Company has presented the following measures that are not

measures of performance under accounting principles generally

accepted in the United States of America (GAAP): Adjusted EBITDA,

Free Cash Flow, Funds From Operations, Adjusted Funds From

Operations, (AFFO), Diluted AFFO per share, adjusted pro forma

results and outdoor operating income. Adjusted EBITDA is defined as

net income before income tax expense (benefit), interest expense

(income), gain (loss) on extinguishment of debt and investments,

non-cash compensation, depreciation and amortization and gain on

disposition of assets. Free Cash Flow is defined as Adjusted EBITDA

less interest, net of interest income and amortization of financing

costs, current taxes, preferred stock dividends and total capital

expenditures. Funds From Operations is defined as net income before

real estate depreciation and amortization, gains or loss from

disposition of real estate assets and investments and an adjustment

to eliminate non‑controlling interest, which is the definition used

by the National Association of Real Estate Investment Trusts

(NAREIT). Adjusted Funds From Operations is defined as Funds From

Operations adjusted for straight‑line (revenue) expense,

stock‑based compensation expense, non‑cash tax expense (benefit),

non‑real estate related depreciation and amortization, amortization

of deferred financing and debt issuance costs, loss on

extinguishment of debt, non-recurring, infrequent or unusual losses

(gains), less maintenance capital expenditures and an adjustment

for non‑controlling interest. Diluted AFFO per share is defined as

AFFO divided by the weighted average diluted common shares

outstanding. Outdoor operating income is defined as operating

income before corporate expenses, non‑cash compensation,

depreciation and amortization and gain on disposition of assets.

These measures are not intended to replace financial performance

measures determined in accordance with GAAP and should not be

considered alternatives to operating income, net income, cash flows

from operating activities, or other GAAP figures as indicators of

the Company's financial performance or liquidity. The Company's

management believes that Adjusted EBITDA, Free Cash Flow, Funds

From Operations, Adjusted Funds From Operations, Diluted AFFO per

share, Adjusted pro forma results and Outdoor operating income are

useful in evaluating the Company's performance and provide

investors and financial analysts a better understanding of the

Company's core operating results. The pro forma acquisition

adjustments are intended to provide information that may be useful

for investors when assessing period to period results. Management

also deems the presentation of monthly revenue recognition useful

to allow investors to see the impact of an immaterial change to its

revenue recognition policy and to provide pro forma results that

are comparable with prior periods and in line with the Company's

historical presentation of market guidance. Our presentation

of these non-GAAP measures, including AFFO and FFO, may not be

comparable to similarly titled measures used by similarly situated

companies. See "Supplemental Schedules—Unaudited Reconciliation of

Non-GAAP Measures" and "Supplemental Schedules—Unaudited REIT

Measures and Reconciliations to GAAP Measures," which provides a

reconciliation of each of these measures to the most directly

comparable GAAP measure.

Conference Call Information

A conference call will be held to discuss the Company's

operating results on Wednesday, February 25, 2015 at 8:00 a.m.

central time. Instructions for the conference call and Webcast

are provided below:

| Conference

Call |

| |

|

| All Callers: |

1-334-323-0520 or

1-334-323-9871 |

| Pass Code: |

Lamar |

| |

|

| Replay: |

1-334-323-0140 or

1-877-919-4059 |

| Pass Code: |

19157472 |

| |

Available through Wednesday, March 4,

2015 at 11:59 p.m. eastern time |

| |

|

| Live Webcast: |

www.lamar.com |

| |

|

| Webcast Replay: |

www.lamar.com |

| |

Available through Wednesday, March 4, 2015 at

11:59 p.m. eastern time |

General Information

Lamar Advertising Company is a leading outdoor advertising

company currently operating over 150 outdoor advertising companies

in 44 states, Canada and Puerto Rico, logo businesses in 23 states

and the province of Ontario, Canada and over 60 transit advertising

franchises in the United States, Canada and Puerto Rico.

| LAMAR ADVERTISING COMPANY AND

SUBSIDIARIES |

| CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS |

| (UNAUDITED) |

| (IN THOUSANDS, EXCEPT SHARE AND

PER SHARE DATA) |

| |

| |

Three months ended |

Twelve months ended |

| |

December 31, |

December 31, |

| |

2014 |

2013 |

2014 |

2013 |

| |

|

|

|

|

| Net revenues |

$ 336,696 |

$ 320,352 |

$ 1,287,060 |

$ 1,245,842 |

| |

|

|

|

|

| Operating expenses (income) |

|

|

|

|

| Direct advertising expenses |

115,096 |

109,962 |

453,269 |

436,844 |

| General and administrative expenses |

55,575 |

52,880 |

219,792 |

213,087 |

| Corporate expenses |

15,434 |

12,468 |

55,966 |

50,763 |

| Non-cash compensation |

8,133 |

1,829 |

24,120 |

24,936 |

| Depreciation and amortization |

55,185 |

81,087 |

258,435 |

300,579 |

| Gain on disposition of assets |

(1,191) |

(1,710) |

(3,192) |

(3,804) |

| |

248,232 |

256,516 |

1,008,390 |

1,022,405 |

| Operating income |

88,464 |

63,836 |

278,670 |

223,437 |

| |

|

|

|

|

| Other expense (income) |

|

|

|

|

| Interest income |

(3) |

(44) |

(102) |

(165) |

| Loss on extinguishment of debt |

— |

14,345 |

26,023 |

14,345 |

| Other-than-temporary impairment of

investment |

— |

— |

4,069 |

— |

| Interest expense |

24,482 |

34,013 |

105,254 |

146,277 |

| |

24,479 |

48,314 |

135,244 |

160,457 |

| Income before income tax expense |

63,985 |

15,522 |

143,426 |

62,980 |

| Income tax (benefit) expense |

(143,898) |

5,336 |

(110,092) |

22,841 |

| |

|

|

|

|

| Net income |

207,883 |

10,186 |

253,518 |

40,139 |

| Preferred stock dividends |

92 |

92 |

365 |

365 |

| Net income applicable to common stock |

$ 207,791 |

$ 10,094 |

$ 253,153 |

$ 39,774 |

| |

|

|

|

|

| Earnings per share: |

|

|

|

|

| Basic earnings per share |

$ 2.18 |

$ 0.11 |

$ 2.66 |

$ 0.42 |

| Diluted earnings per share |

$ 2.18 |

$ 0.11 |

$ 2.66 |

$ 0.42 |

| |

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

| - basic |

95,454,224 |

94,697,622 |

95,218,083 |

94,387,230 |

| - diluted |

95,522,205 |

95,091,780 |

95,284,126 |

94,745,515 |

| OTHER DATA |

|

|

|

|

| Free Cash Flow Computation: |

|

|

|

|

| Adjusted EBITDA |

$ 150,591 |

$ 145,042 |

$ 558,033 |

$ 545,148 |

| Interest, net |

(23,325) |

(30,656) |

(100,375) |

(131,445) |

| Current tax expense |

(3,281) |

(1,339) |

(12,045) |

(4,092) |

| Preferred stock dividends |

(92) |

(92) |

(365) |

(365) |

| Total capital expenditures |

(23,697) |

(27,973) |

(107,573) |

(105,650) |

| Free cash flow |

$ 100,196 |

$ 84,982 |

$ 337,675 |

$ 303,596 |

| |

|

|

|

|

| OTHER DATA (continued): |

|

|

|

|

| |

|

|

|

|

| |

|

|

December 31, |

December 31, |

| Selected Balance Sheet Data: |

|

|

2014 |

2013 |

| Cash and cash equivalents |

|

|

$ 26,035 |

$ 33,212 |

| Working capital |

|

|

$ 47,803 |

$ 36,705 |

| Total assets |

|

|

$ 3,318,818 |

$ 3,401,618 |

| Total debt (including current

maturities) |

|

|

$ 1,899,895 |

$ 1,938,802 |

| Total stockholders' equity |

|

|

$ 981,466 |

$ 932,946 |

| |

|

|

|

|

| |

Three months ended |

Twelve months ended |

| |

December 31, |

December 31, |

| |

2014 |

2013 |

2014 |

2013 |

| Selected Cash Flow Data: |

|

|

|

|

| Cash flows provided by operating

activities |

$ 149,325 |

$ 100,021 |

$ 452,529 |

$ 394,705 |

| Cash flows used in investing activities |

$ (33,061) |

$ (34,826) |

$ (163,997) |

$ (191,869) |

| Cash flows used in financing activities |

$ (117,529) |

$ (213,902) |

$ (294,315) |

$ (227,195) |

| |

|

|

|

|

| SUPPLEMENTAL SCHEDULES |

| UNAUDITED RECONCILIATIONS OF

NON-GAAP MEASURES |

| (IN THOUSANDS) |

| |

| |

Three months ended |

Twelve months ended |

| |

December 31, |

December 31, |

| Reconciliation of Free Cash Flow to Cash

Flows Provided by Operating Activities: |

2014 |

2013 |

2014 |

2013 |

| |

|

|

|

|

| Cash flows provided by operating

activities |

$ 149,325 |

$ 100,021 |

$ 452,529 |

$ 394,705 |

| Changes in operating assets and

liabilities |

(23,850) |

14,111 |

(969) |

20,940 |

| Total capital expenditures |

(23,697) |

(27,973) |

(107,573) |

(105,650) |

| Preferred stock dividends |

(92) |

(92) |

(365) |

(365) |

| Other |

(1,490) |

(1,085) |

(5,947) |

(6,034) |

| Free cash flow |

$ 100,196 |

$ 84,982 |

$ 337,675 |

$ 303,596 |

| |

|

|

|

|

| |

|

|

|

|

| Reconciliation of Adjusted EBITDA to Net

Income: |

|

|

|

|

| Adjusted EBITDA |

$150,591 |

$145,042 |

$558,033 |

$545,148 |

| Less: |

|

|

|

|

| Non-cash compensation |

8,133 |

1,829 |

24,120 |

24,936 |

| Depreciation and amortization |

55,185 |

81,087 |

258,435 |

300,579 |

| Gain on disposition of assets |

(1,191) |

(1,710) |

(3,192) |

(3,804) |

| Operating Income |

88,464 |

63,836 |

278,670 |

223,437 |

| |

|

|

|

|

| |

|

|

|

|

| Less: |

|

|

|

|

| Interest income |

(3) |

(44) |

(102) |

(165) |

| Loss on extinguishment of debt |

— |

14,345 |

26,023 |

14,345 |

| Other-than-temporary impairment of

investment |

— |

— |

4,069 |

— |

| Interest expense |

24,482 |

34,013 |

105,254 |

146,277 |

| Income tax (benefit) expense |

(143,898) |

5,336 |

(110,092) |

22,841 |

| Net income |

$ 207,883 |

$ 10,186 |

$ 253,518 |

$ 40,139 |

| |

|

|

|

|

| |

|

|

|

|

| Capital expenditure detail by category: |

|

|

|

|

| Billboards - traditional |

$ 6,765 |

$ 2,024 |

$ 25,829 |

$ 21,295 |

| Billboards - digital |

11,726 |

15,268 |

53,536 |

50,233 |

| Logo |

2,202 |

4,025 |

9,747 |

11,182 |

| Transit |

116 |

114 |

425 |

168 |

| Land and buildings |

1,166 |

3,435 |

8,668 |

9,471 |

| Operating Equipment |

1,722 |

3,107 |

9,368 |

13,301 |

| Total capital expenditures |

$ 23,697 |

$ 27,973 |

$ 107,573 |

$ 105,650 |

| |

|

|

|

|

| SUPPLEMENTAL SCHEDULES |

| UNAUDITED RECONCILIATIONS OF

NON-GAAP MEASURES |

| (IN THOUSANDS) |

| |

| |

Three months ended |

|

| |

December 31, |

|

| |

2014 |

2013 |

% Change |

| Reconciliation of Reported Basis to Pro

Forma(a) Basis: |

|

|

|

| Net revenue (daily basis) |

$ 336,696 |

$ 320,352 |

5.1% |

| Conversion from daily to monthly |

(7,483) |

(7,005) |

|

| Adjusted net revenue |

$ 329,213 |

$ 313,347 |

5.1% |

| Acquisitions and divestitures |

— |

2,103 |

|

| Pro forma adjusted net revenue (monthly

basis) |

$ 329,213 |

$ 315,450 |

4.4% |

| |

|

|

|

| Reported direct advertising and G&A

expenses |

$ 170,671 |

$ 162,842 |

4.8% |

| Acquisitions and divestitures |

— |

1,865 |

|

| Pro forma direct advertising and G&A

expenses |

$ 170,671 |

$ 164,707 |

3.6% |

| |

|

|

|

| Outdoor operating income (daily basis) |

$ 166,025 |

$ 157,510 |

5.4% |

| Conversion from daily to monthly |

(7,483) |

(7,005) |

|

| Adjusted outdoor operating income |

$ 158,542 |

$ 150,505 |

5.3% |

| Acquisitions and divestitures |

— |

238 |

|

| Pro forma adjusted outdoor operating income

(monthly basis) |

$ 158,542 |

$ 150,743 |

5.2% |

| |

|

|

|

| Reported corporate expenses |

$ 15,434 |

$ 12,468 |

23.8% |

| Acquisitions and divestitures |

— |

— |

|

| Pro forma corporate expenses |

$ 15,434 |

$ 12,468 |

23.8% |

| |

|

|

|

| Adjusted EBITDA (daily basis) |

$ 150,591 |

$ 145,042 |

3.8% |

| Conversion from daily to monthly |

(7,483) |

(7,005) |

|

| Adjusted EBITDA (monthly basis) |

$ 143,108 |

$ 138,037 |

3.7% |

| Acquisitions and divestitures |

— |

238 |

|

| Pro forma adjusted EBITDA (monthly

basis) |

$ 143,108 |

$ 138,275 |

3.5% |

| |

|

|

|

| (a) Pro forma adjusted net

revenue, direct advertising and general and administrative

expenses, outdoor operating income, corporate expenses and Adjusted

EBITDA include adjustments to 2013 for acquisitions and

divestitures for the same time frame as actually owned in

2014. Pro forma adjusted net revenue, outdoor operating income

and Adjusted EBITDA have also been adjusted to reflect revenue

recognition on a monthly basis in both the 2013 and 2014

periods. |

| |

| |

Three months ended |

| |

December 31, |

| |

2014 |

2013 |

| Reconciliation of

Outdoor Operating Income to Operating Income: |

|

| Outdoor operating income |

$ 166,025 |

$ 157,510 |

| Less: Corporate expenses |

15,434 |

12,468 |

| Non-cash compensation |

8,133 |

1,829 |

| Depreciation and amortization |

55,185 |

81,087 |

| Plus: Gain on disposition of assets |

1,191 |

1,710 |

| Operating income |

$ 88,464 |

$ 63,836 |

| |

|

|

| SUPPLEMENTAL SCHEDULES |

| UNAUDITED REIT MEASURES |

| AND RECONCILIATIONS TO GAAP

MEASURES |

| (IN THOUSANDS, EXCEPT SHARE AND

PER SHARE DATA) |

| |

| Adjusted Funds From

Operations |

| |

|

|

|

|

| |

Three months ended |

Twelve months ended |

| |

December 31, |

December 31, |

| |

2014 |

2013 |

2014 |

2013 |

| |

|

|

|

|

| Net income |

$ 207,883 |

$ 10,186 |

$ 253,518 |

$ 40,139 |

| Depreciation and amortization related to

advertising structures |

50,533 |

76,256 |

241,294 |

283,424 |

| Gain from disposition of real estate

assets |

(1,762) |

(575) |

(2,681) |

(1,949) |

| One time adjustment to taxes related to

REIT conversion |

(120,081) |

— |

(120,081) |

— |

| Adjustment for minority interest –

consolidated affiliates |

264 |

125 |

695 |

915 |

| Funds From Operations |

$ 136,837 |

$ 85,992 |

$ 372,745 |

$ 322,529 |

| Straight-line expense |

(472) |

(163) |

(841) |

(1,212) |

| Stock-based compensation expense |

8,133 |

1,829 |

24,120 |

24,936 |

| Non-cash tax (benefit) expense |

(27,098) |

3,997 |

(2,056) |

18,749 |

| Non-real estate related depreciation and

amortization |

4,652 |

4,831 |

17,141 |

17,155 |

| Amortization of deferred financing and

debt issuance costs |

1,154 |

3,313 |

4,777 |

14,667 |

| Loss on extinguishment of debt |

— |

14,345 |

26,023 |

14,345 |

| Loss from other-than-temporary impairment

of investment |

— |

— |

4,069 |

— |

| Capitalized expenditures—maintenance |

(5,658) |

(15,043) |

(56,820) |

(64,073) |

| Adjustment for minority interest –

consolidated affiliates |

(264) |

(125) |

(695) |

(915) |

| |

|

|

|

|

| Adjusted Funds From Operations |

$ 117,284 |

$ 98,976 |

$ 388,463 |

$ 346,181 |

| Divided by weighted average diluted

shares outstanding |

95,522,205 |

95,091,780 |

95,284,126 |

94,745,515 |

| Diluted AFFO per share |

$ 1.23 |

$ 1.04 |

$ 4.08 |

$ 3.65 |

| |

|

|

|

|

| SUPPLEMENTAL SCHEDULES |

| UNAUDITED REIT MEASURES |

| AND RECONCILIATIONS TO GAAP

MEASURES |

| (IN THOUSANDS, EXCEPT SHARE AND

PER SHARE DATA) |

| |

| Projected Adjusted Funds From

Operations |

| |

| |

Year ended December 31,

2015 |

| |

Low |

High |

| |

|

|

| Net income |

$ 243,000 |

$ 253,000 |

| Depreciation and amortization related to

advertising structures |

186,000 |

186,000 |

| Gain from disposal of real estate

assets |

(3,000) |

(3,000) |

| Adjustment for minority interest -

consolidated affiliates |

900 |

900 |

| Funds From Operations |

$ 426,900 |

$ 436,900 |

| |

|

|

| Straight-line expense |

1,000 |

1,000 |

| Stock-based compensation expense |

25,000 |

25,000 |

| Non-cash tax (benefit) expense |

(1,000) |

(1,000) |

| Non-real estate related depreciation and

amortization |

16,000 |

16,000 |

| Amortization of debt issuance fees |

5,000 |

5,000 |

| Capitalized expenditures—maintenance |

(55,000) |

(55,000) |

| Adjustment for minority interest -

consolidated affiliates |

(900) |

(900) |

| |

|

|

| Adjusted Funds From Operations |

$ 417,000 |

$ 427,000 |

| |

|

|

| |

|

|

| Weighted average diluted shares

outstanding (1) |

96,000,000 |

96,000,000 |

| |

|

|

| Diluted earnings per share |

$ 2.53 |

$ 2.64 |

| |

|

|

| Diluted AFFO per share |

$ 4.34 |

$ 4.45 |

| |

|

|

| (1) The weighted average diluted

shares outstanding does not assume the repurchase of shares under

the Company's previously announced stock repurchase program, which

may be made from time to time by the Company's management based on

its evaluation of market conditions and other factors. |

|

|

| The guidance provided above is

based on a number of assumptions that management believes to be

reasonable and reflect our expectations as of February

2015. Actual results may differ materially from these

estimates as a result of various factors, and we refer to the

cautionary language regarding "forward looking" statements included

in the press release when considering this information. |

CONTACT: Buster Kantrow

Director of Investor Relations

(225) 926-1000

bkantrow@lamar.com

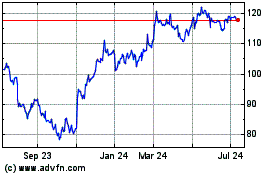

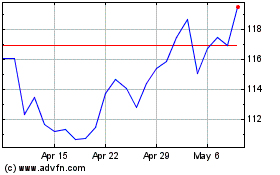

Lamar Advertising (NASDAQ:LAMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lamar Advertising (NASDAQ:LAMR)

Historical Stock Chart

From Apr 2023 to Apr 2024