AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON FEBRUARY 24, 2015

REGISTRATION NO. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ENANTA PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

| Delaware |

|

04-3205099 |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 500 Arsenal Street, Watertown, MA |

|

02472 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

2012 Equity Incentive Plan

(Full title of the plan)

Jay R. Luly

President and Chief Executive Officer

Enanta Pharmaceuticals, Inc.

500 Arsenal Street

Watertown, Massachusetts 02472

(Name and address of agent for service)

(617) 607-0800

(Telephone number, including area code, of agent for service)

Copy to:

Stacie

S. Aarestad, Esq.

Locke Lord LLP

111 Huntington Avenue

Boston, Massachusetts 02199-7613

(617) 239-0100

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a

non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

| Non-accelerated filer |

|

¨ |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of each class of securities

to be registered |

|

Amount

to be

registered(1) |

|

Proposed

maximum offering

price per share(2) |

|

Proposed

maximum aggregate

offering price(2) |

|

Amount of

registration fee |

| Common Stock, $0.01 par value |

|

557,863 shares |

|

$33.34 |

|

$18,596,363.11 |

|

$2,160.90 |

| |

| |

| (1) |

This Registration Statement covers an aggregate of 557,863 shares of the Registrant’s Common Stock, par value $0.01 per share (the “Common Stock”), that may be issued pursuant to awards granted under the

Registrant’s 2012 Equity Incentive Plan. In addition, pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”) this Registration Statement also covers such additional shares of Common Stock as may be

issued to prevent dilution from stock splits, stock dividends and similar transactions. |

| (2) |

Pursuant to Rules 457(c) and 457(h)(1) under the Securities Act, the proposed maximum offering price per share and the maximum aggregate offering price for the shares have been calculated solely for the purpose of

computing the registration fee on the basis of the average high and low prices of the Common Stock as reported by the Nasdaq Global Select Market on February 17, 2015 to be $33.84 and $32.83, respectively. |

STATEMENT REGARDING INCORPORATION BY REFERENCE FROM EFFECTIVE

REGISTRATION STATEMENT

Pursuant to Instruction E to Form S-8, the Registrant incorporates by reference into this Registration Statement the entire contents of its

Registration Statements on Form S-8 and filed with the Securities and Exchange Commission on June 10, 2013 (File No. 333-189217) and December 18, 2013 (File No. 333-192935).

The number of shares of Common Stock, $0.01 par value per share, of the Company available for issuance under the Plan is subject to an

automatic annual increase on the first day of each fiscal year of the Company equal to the least of (i) 3% of the outstanding shares on such date, (ii) 2,088,167 shares of Common Stock, or (iii) an amount determined by the Board. This

Registration Statement registers the 557,863 additional shares of Common Stock resulting from the automatic annual increase for the fiscal year beginning October 1, 2014.

Part II

INFORMATION

REQUIRED IN THE REGISTRATION STATEMENT

See the Exhibit Index immediately following the signature page.

1

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Watertown, Commonwealth of Massachusetts, as of February 24,

2015.

|

|

|

| ENANTA PHARMACEUTICALS, INC. |

|

|

| By: |

|

/s/ Jay R. Luly, Ph.D. |

|

|

Jay R. Luly, Ph.D. |

|

|

President and Chief Executive Officer |

POWER OF ATTORNEY

We, the undersigned officers and directors of Enanta Pharmaceuticals, Inc., hereby severally constitute and appoint each of Jay R. Luly and

Paul J. Mellett, our true and lawful attorneys-in-fact, with full power to them in any and all capacities, to sign any and all amendments to this Registration Statement

on Form S-8 (including any post-effective amendments thereto), and to file the same, with exhibits thereto and other documents in connection therewith, with the

Securities and Exchange Commission, hereby ratifying and confirming all that each of said attorneys-in-fact may do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed below by the following persons in the

capacities and as of the dates indicated.

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ Jay R. Luly,

Ph.D. |

|

President and Chief Executive Officer and Director |

|

February 24, 2015 |

| Jay R. Luly, Ph.D. |

|

(Principal Executive Officer) |

|

|

|

|

|

| /s/ Paul J.

Mellett |

|

Chief Financial Officer |

|

February 24, 2015 |

| Paul J. Mellett |

|

(Principal Financial and Accounting Officer) |

|

|

|

|

|

| /s/ Ernst-Günter

Afting |

|

Director |

|

February 24, 2015 |

| Ernst-Günter Afting |

|

|

|

|

|

|

|

| /s/ Stephen Buckley,

Jr. |

|

Director |

|

February 24, 2015 |

| Stephen Buckley, Jr. |

|

|

|

|

|

|

|

| /s/ Bruce L. A.

Carter |

|

Director |

|

February 24, 2015 |

| Bruce L. A. Carter |

|

|

|

|

|

|

|

| /s/ George

Golumbeski |

|

Director |

|

February 24, 2015 |

| George Golumbeski |

|

|

|

|

|

|

|

| /s/ Terry

Vance |

|

Director |

|

February 24, 2015 |

| Terry Vance |

|

|

|

|

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1 |

|

Restated Certificate of Incorporation of Enanta Pharmaceuticals, Inc. Previously filed as Exhibit 3.1 to the Registrant’s Current Report on Form 8-K filed with the SEC on March 28,

2013 (File No. 001-35839) and incorporated herein by reference. |

|

|

| 4.2 |

|

Amended and Restated Bylaws of Enanta Pharmaceuticals, Inc. Previously filed as Exhibit 3.2 to the Registrant’s Current Report on Form 8-K filed with the SEC on March 28, 2013 (File

No. 001-35839) and incorporated herein by reference. |

|

|

| 4.3 |

|

Specimen certificate evidencing shares of common stock of Enanta Pharmaceuticals, Inc. Previously filed as Exhibit 4.1 to the Registrant’s Registration Statement on Form S-1/A filed with the SEC on February 5, 2013

(File No. 333-184779) and incorporated herein by reference. |

|

|

| 5.1 |

|

Opinion of Locke Lord LLP. Filed herewith. |

|

|

| 23.1 |

|

Consent of PricewaterhouseCoopers LLP. Filed herewith. |

|

|

| 23.2 |

|

Consent of Locke Lord LLP. Included in the opinion filed as Exhibit 5.1. |

|

|

| 24.1 |

|

Power of Attorney. Included on the signature page hereto. |

|

|

| 99.1 |

|

2012 Equity Incentive Plan (As adjusted to reflect the application of the 1-for-4.31 reverse stock split of the Company’s common stock effected on March 1, 2013). Previously filed as Exhibit 10.16 to the Registrant’s

Annual Report on Form 10-K filed with the SEC on December 18, 2013 (File No. 001-35839) and incorporated herein by reference. |

Exhibit 5.1

February 24, 2015

Enanta Pharmaceuticals, Inc.

500 Arsenal Street

Watertown, MA 02472

| Re: |

Registration Statement on Form S-8 |

Ladies and Gentlemen:

We are furnishing this opinion in connection with the Registration Statement on Form S-8 (the “Registration Statement”) to be filed

on or about the date hereof with the Securities and Exchange Commission relating to 557,863 shares of Common Stock, $0.01 par value per share (the “Shares”), of Enanta Pharmaceuticals, Inc., a Delaware corporation (the

“Company”), that may be offered from time to time pursuant to the provisions of the Company’s 2012 Equity Incentive Plan (the “Plan”).

We have acted as your counsel in connection with the preparation of the Registration Statement and are familiar with the proceedings taken and

proposed to be taken by the Company in connection with the authorization, issuance and sale of the Shares. We have made such examination as we consider necessary to render this opinion.

Based upon the foregoing, it is our opinion that, when issued in accordance with the terms of the Plan and the options or other rights granted

thereunder, the Shares will be duly authorized, validly issued, fully paid and nonassessable.

The opinion expressed above is limited to

the Delaware General Corporation Law, including applicable provisions of the Delaware Constitution and reported judicial decisions interpreting Delaware General Corporation Law, and the federal laws of the United States.

We hereby consent to the use of our name in the Registration Statement and consent to the filing of this opinion with the Securities and

Exchange Commission as an exhibit to the Registration Statement.

|

| Very truly yours, |

|

| /s/ LOCKE LORD LLP |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated

December 11, 2014 relating to the financial statements, which appears in Enanta Pharmaceuticals, Inc.’s Annual Report on Form 10-K for the year ended September 30, 2014.

/s/ PricewaterhouseCoopers LLP

Boston, Massachusetts

February 24, 2015

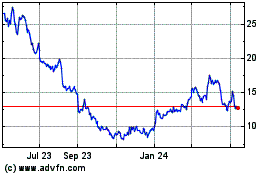

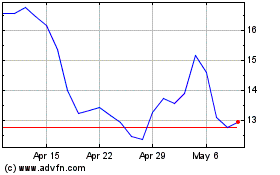

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Apr 2023 to Apr 2024