Current Report Filing (8-k)

February 24 2015 - 2:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 24, 2015

NETLIST, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-33170 |

|

95-4812784 |

|

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

175 Technology Drive, Suite 150

Irvine, California 92618

(Address of principal executive offices, including zip code)

(949) 435-0025

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 8.01. Other Events.

On February 24, 2015, Netlist, Inc. (the “Company”) completed its previously announced registered firm commitment underwritten public offering (the “Offering”) of shares of the Company’s common stock, par value $0.001 per share (“Common Stock”). In the Offering, the Company issued and sold to Craig-Hallum Capital Group LLC (the “Underwriter”) 8,846,154 shares of Common Stock pursuant to an underwriting agreement (the “Underwriting Agreement”), dated as of February 19, 2015, by and between the Company and the Underwriter, at a price of $1.209 per share, including 1,153,846 shares resulting from the Underwriter’s exercise in full of its option to purchase additional shares of Common Stock to cover over-allotments. The price per share to the public in the offering was $1.30 per share. The Company estimates net proceeds from the Offering to be approximately $10.4 million, after deducting underwriting discounts and commissions and estimated offering expenses.

On February 24, 2015, the Company issued a press release announcing the completion of the Offering. A copy of the press release is filed as Exhibit 99.1 to this report and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

99.1 |

|

Press Release of Netlist, Inc., dated February 24, 2015 |

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NETLIST, INC. |

|

|

|

|

|

|

|

Dated: February 24, 2015 |

By: |

/s/ Gail M. Sasaki |

|

|

|

Gail M. Sasaki

Vice President and Chief Financial Officer |

2

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release of Netlist, Inc., dated February 24, 2015 |

3

Exhibit 99.1

NETLIST, INC. ANNOUNCES CLOSING OF UNDERWRITTEN PUBLIC OFFERING OF COMMON STOCK

- Net Proceeds Expected to be Approximately $10.4 Million -

IRVINE, CA — February 24, 2015 — Netlist, Inc. (“Netlist” or the “Company”) (NASDAQ: NLST), a leading provider of high performance and hybrid memory solutions for the cloud computing and storage markets, announced today that it has closed its previously-announced underwritten public offering of 8,846,154 common shares at a price to the public of $1.30 per share. The number of shares Netlist sold in the offering includes the underwriter’s full exercise of its over-allotment option of 1,153,846 common shares. Netlist estimates net proceeds from the offering to be approximately $10.4 million, after deducting underwriting discounts and commissions and estimated offering expenses. Netlist intends to use the proceeds from the offering for general corporate purposes.

Craig-Hallum Capital Group LLC acted as sole underwriter of the offering.

A shelf registration statement relating to these securities was previously filed with, and declared effective by, the U.S. Securities and Exchange Commission on October 18, 2011. A preliminary prospectus supplement related to the offering was filed with the U.S. Securities and Exchange Commission on February 18, 2015. A final prospectus supplement related to the offering was filed with the U.S. Securities and Exchange Commission on February 19, 2015. Copies of the final prospectus supplement and accompanying prospectus for offering may be obtained by contacting Craig-Hallum Capital Group LLC, 222 South Ninth Street, Suite 350, Minneapolis, MN 55402, phone number 612-334-6300, email: prospectus@chlm.com. An electronic copy of the final prospectus supplement and accompanying prospectus relating to the offering is available on the website of the U.S. Securities and Exchange Commission at www.sec.gov.

This announcement shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any offer or sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.

About Netlist:

Netlist, Inc. designs and manufactures high-performance, logic-based memory subsystems for server and storage applications for cloud computing. Netlist’s flagship products include NVvault® and EXPRESSvault™ family of hybrid memory products that significantly accelerate system performance and provide mission critical fault tolerance, HyperCloud®, a patented memory technology that breaks traditional performance barriers, and a broad portfolio of industrial Flash and specialty memory subsystems including VLP (very low profile) DIMMs and Planar-X RDIMMs. Netlist has steadily invested in and grown its worldwide IP portfolio, which now includes 88 issued and pending patents in the areas of high performance memory and hybrid memory technologies.

Netlist develops technology solutions for customer applications in which high-speed, high-capacity, small form factor and efficient heat dissipation are key requirements for system memory. These customers include OEMs and hyperscale datacenter operators that design and build servers, storage systems and high-performance computing clusters, engineering workstations and telecommunications equipment. Founded in 2000, Netlist is headquartered in Irvine, CA with manufacturing facilities in Suzhou, People’s Republic of China. Learn more at www.netlist.com.

Safe Harbor Statement:

This news release contains forward-looking statements regarding future events and the future performance of Netlist. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expected or projected. These risks and uncertainties include, but are not limited to, risks associated with the launch and commercial success of our products, programs and technologies; the success of product partnerships; continuing development, qualification and volume production of EXPRESSvault™, NVvault™, HyperCloud® and VLP Planar-X RDIMM; the timing and magnitude of the anticipated decrease in sales to our key customer; our ability to leverage our NVvault™ technology in a more diverse customer base; the rapidly-changing nature of technology; risks associated with intellectual property, including patent infringement litigation against us as well as the costs and unpredictability of litigation over infringement of our intellectual property and the possibility of our patents being reexamined by the United States Patent and Trademark office; volatility in the pricing of DRAM ICs and NAND; changes in and uncertainty of customer acceptance of, and demand for, our existing products and products under development, including uncertainty of and/or delays in product orders and product qualifications; delays in the Company’s and its customers’ product releases and development; introductions of new products by competitors; changes in end-user demand for technology solutions; the Company’s ability to attract and retain skilled personnel; the Company’s reliance on suppliers of critical components and vendors in the supply chain; fluctuations in the market price of critical components; evolving industry standards; and the political and regulatory environment in the People’s Republic of China. Other risks and uncertainties are described in the Company’s annual report on Form 10-K filed on March 18, 2014, and subsequent filings with the U.S. Securities and Exchange Commission made by the Company from time to time. Except as required by law, Netlist undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

|

Company Contact: |

Brainerd Communicators, Inc. |

|

Gail M. Sasaki |

Mike Smargiassi (investors) |

|

Chief Financial Officer |

Sharon Oh (media) |

|

(949) 435-0025 |

NLST@braincomm.com |

|

|

(212) 986-6667 |

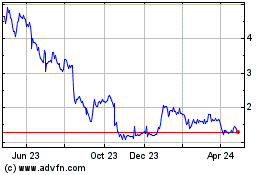

Netlist (QB) (USOTC:NLST)

Historical Stock Chart

From Mar 2024 to Apr 2024

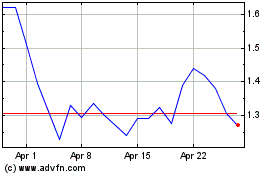

Netlist (QB) (USOTC:NLST)

Historical Stock Chart

From Apr 2023 to Apr 2024