Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

February 24 2015 - 11:51AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No.# 333-198515

PRICING TERM SHEET

Dated February 24, 2015

THE PRICELINE GROUP INC.

Offering of

€1,000,000,000 aggregate principal amount of

1.800% Senior Notes due 2027

The information in this pricing term sheet supplements The Priceline Group Inc.’s preliminary prospectus supplement, dated February 24, 2015 (the “Preliminary Prospectus Supplement”), and supersedes the information in the Preliminary Prospectus Supplement to the extent inconsistent with the information in the Preliminary Prospectus Supplement. In all other respects, this term sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement. Terms used herein but not defined herein shall have the respective meanings as set forth in the Preliminary Prospectus Supplement.

|

Issuer: |

|

The Priceline Group Inc. |

|

|

|

|

|

Trade Date: |

|

February 24, 2015. |

|

|

|

|

|

Settlement Date: |

|

March 3, 2015. |

|

|

|

|

|

Maturity Date: |

|

March 3, 2027. |

|

|

|

|

|

Notes: |

|

1.800% Senior Notes due 2027 (the “Notes”). |

|

|

|

|

|

Aggregate Principal Amount Offered: |

|

€1,000,000,000 aggregate principal amount of Notes. |

|

|

|

|

|

Reference EUR Midswap: |

|

12-year Mid-Swaps. |

|

|

|

|

|

Reference EUR Midswap Rate: |

|

0.853%. |

|

|

|

|

|

Spread to EUR Midswap: |

|

95 basis points. |

|

|

|

|

|

Reoffer Yield: |

|

1.803%. |

|

|

|

|

|

Price to Public (Issue Price): |

|

99.968% of principal amount. |

|

|

|

|

|

Government Security: |

|

DBR 0.500% due February 15, 2025. |

|

|

|

|

|

Government Security Price and Yield: |

|

101.13% / 0.384%. |

|

|

|

|

|

Spread to Government Security: |

|

141.9 basis points. |

|

|

|

|

|

Gross Proceeds: |

|

€999,680,000. |

|

|

|

|

|

Underwriting Commission: |

|

40 basis points. |

|

|

|

|

|

Net Proceeds to Issuer (before expenses): |

|

€995,680,000. |

|

|

|

|

|

Annual Interest Rate: |

|

1.800% per annum. |

|

|

|

|

|

Interest Payment: |

|

Annually on March 3, commencing on March 3, 2016. |

|

|

|

|

|

Format: |

|

SEC Registered. |

|

|

|

|

|

Clearing: |

|

There will be a global note deposited with a common depository for Euroclear or Clearstream. |

|

Listing: |

|

The Priceline Group Inc. intends to apply to list the Notes on the New York Stock Exchange. |

|

|

|

|

|

Make-Whole Call: |

|

Callable at the greater of (i) 100% of the aggregate principal amount of the Notes to be redeemed; and (ii) the sum of the present values of the remaining scheduled payments for principal and interest on the notes, not including any portion of the payments of interest accrued as of such redemption date, discounted to such redemption date on an annual basis at the Comparable Government Bond Rate (as defined in the Preliminary Prospectus Supplement), plus 25 basis points, in each case plus accrued and unpaid interest. |

|

|

|

|

|

Par Call: |

|

Callable three months prior to the maturity date of the notes at 100% of the principal amount of the notes (par), plus accrued and unpaid interest thereon to but excluding the date of redemption. |

|

|

|

|

|

Day Count Fraction: |

|

ACTUAL/ACTUAL (ICMA), following, unadjusted. |

|

|

|

|

|

Denominations: |

|

€100,000 and any integral multiple of €1,000 in excess thereof. |

|

|

|

|

|

Stabilization: |

|

ICMA/FCA. |

|

|

|

|

|

CUSIP Number: |

|

741503AV8. |

|

|

|

|

|

ISIN Number: |

|

XS1196503137. |

|

|

|

|

|

Joint Active Book-Running Managers: |

|

Deutsche Bank AG, London Branch

Goldman, Sachs & Co. |

|

|

|

|

|

Joint Passive Book-Running Managers: |

|

Citigroup Global Markets Limited

Wells Fargo Securities, LLC

Merrill Lynch International

J.P. Morgan Securities PLC |

The Issuer has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (the “SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and the other documents the Issuer has filed with the SEC for more complete information about the Issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling Deutsche Bank AG, London Branch at 1-800-503-4611 or Goldman, Sachs & Co. at 1-866-471-2526.

You should rely on the information contained or incorporated by reference in the Preliminary Prospectus Supplement, as supplemented by this final pricing term sheet in making an investment decision with respect to the Notes.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy securities nor shall there be any sale of these securities in any jurisdiction in which such

solicitation or sale would be unlawful prior to registration or qualification of these securities under the laws of any such jurisdiction.

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

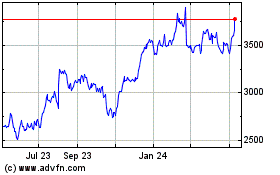

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Apr 2023 to Apr 2024