UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________________

FORM 8-K

______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2015

______________________________

|

| | | | |

LIFEVANTAGE CORPORATION (Exact name of registrant as specified in its charter) |

______________________________

|

| | | | |

Colorado | | 001-35647 | | 90-0224471 |

(State or other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

9785 S. Monroe Street, Suite 300, Sandy, UT 84070 |

(Address of Principal Executive Offices and Zip Code) |

| | | | |

Registrant’s telephone number, including area code: (801) 432-9000 |

______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

| |

|

| |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On February 2, 2015, LifeVantage Corporation (the “Company”) issued a press release announcing that, on that date, following mutual agreement with the Board of Directors of the Company, Douglas C. Robinson resigned from his role as President, Chief Executive Officer and Director effective immediately. On February 13, 2015, Mr. Robinson entered into a Separation Agreement and General Release with the Company (the “Agreement”). The Agreement became effective February 13, 2015; provided, however, in accordance with federal law the Agreement provides Mr. Robinson the right to rescind the Agreement within seven (7) days of the Agreement’s effective date. The period during which Mr. Robinson could rescind the Agreement ends on February 20, 2015.

The Agreement contains provisions relating to, among other things, confidentiality, non-disparagement, return of company property, and a general release of claims in favor of the Company. After it has become effective, the Agreement obligates the Company to pay severance to Mr. Robinson in an aggregate amount equal to $565,000, the amount of his base salary as of the date his employment terminated. The severance payments will be made in substantially equal monthly installments over the twelve month period following the date his employment terminated. The Agreement also provides that Mr. Robinson will provide consulting services to the Company on an as needed basis for up to six months following the date his employment terminated.

The description of the Agreement contained in this Item 5.02 is qualified in its entirety by reference to the actual Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

|

| | | |

Exhibit No. |

| | Description |

10.1 |

| | Separation Agreement and General Release between LifeVantage Corporation and Douglas C. Robinson effective February 13, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| |

Date: February 20, 2015 | LIFEVANTAGE CORPORATION By: /s/ Rob Cutler Name: Rob Cutler Title: General Counsel |

SEPARATION AGREEMENT AND GENERAL RELEASE

This Separation Agreement and General Release (“Agreement”) is entered into by and between Douglas C. Robinson (“Employee”) and LifeVantage Corporation, a Colorado corporation (the “Company” or “Employer”) (together the “Parties”), in consideration for and as condition precedent to Employer providing the separation benefits to Employee as set forth below. It is understood and agreed that Employer is not obligated to provide any such separation benefits under the terms of the Amended Employment Agreement (as defined below) and that Employer is providing such separation benefits as a direct result of Employee’s willingness to agree to the terms hereof. Certain terms, not otherwise defined herein, shall have the meaning ascribed to them in the Amended Employment Agreement.

In order for this Agreement to become effective, Employee must deliver to Employer (to the attention of Michelle Oborn, VP Human Resources at 9785 S. Monroe Street, Suite 300, Sandy, UT 84070) this properly signed and dated Agreement before 5:00 pm Mountain Time on February 23, 2015 (21 days from Termination Date as defined below) or else it will be irrevocably determined that Employee has decided to not execute this Agreement and this Agreement shall be of no force or effect. This Agreement will become effective only if it has been timely executed by the Employee and the revocation period has expired without revocation by Employee as set forth in Section 12(d) below. By signing below and timely delivering a signed Agreement to Employer, Employee acknowledges and agrees to each of the following terms and conditions:

RECITALS

A.Employee was an employee of the Company and most recently served as its President and Chief Executive Officer, pursuant to an amended and restated employment agreement with the Company with an effective date of March 25, 2014 (the “Amended Employment Agreement”).

B.Employee and Employer mutually agreed to terminate Employee’s employment with Employer, which termination was effective on February 2, 2015 (the “Termination Date”).

C.Notwithstanding such mutual agreement to terminate Employee’s employment with Employer and in consideration of Employee’s timely signature on this Agreement and lapse of the revocation period prescribed herein without revocation of Employee’s signature, Employer shall provide the compensation as set forth in Section 7(c) of the Amended Employment Agreement.

AGREEMENT

NOW THEREFORE, in consideration of the mutual covenants and conditions set forth below, and intending to be legally bound thereby, Employer and Employee covenant and agree as follows:

1.Effect of Termination. Employee and Employer acknowledge and agree that Employee is willingly terminating his duties with Employer and that as of the Termination Date, Employee shall be deemed to have immediately resigned from all positions as an officer and/or director with the Employer and with any of Employer’s affiliates or subsidiaries.

2.Severance Pay. In addition to any Accrued Pay due Employee for actual work performed up to and including the Termination Date, in consideration for Employee entering into this Agreement, Employee shall receive severance compensation as outlined in Section 7(c) of the Amended Employment Agreement (the “Severance Pay”). Pursuant to Section 7(c) of the Amended Employment Agreement, Employee will receive payments equal in the aggregate to $565,000 (the “Base Salary”), less all applicable withholdings. The payments shall be paid to Employee in cash, in substantially equal monthly installments payable over the twelve (12) month period following the Termination Date, provided, however, the first payment (in an amount equal to two (2) months (2/12) of Base Salary) shall be made on the sixtieth (60th) day following the Termination Date. As a condition to

receiving (and continuing to receive) the payments provided in this Section 2, Employee must: (a) within not later than twenty-one (21) days after the Termination Date, execute (and not revoke) and deliver to Employer this Agreement and (b) remain in full compliance with this Agreement. Employee shall not be entitled to accrue any employee benefits subsequent to the Termination Date.

3.Consulting Relationship. In consideration of the Severance Pay, Employee hereby agrees to provide consulting services on an as needed basis for up to six (6) months following the Termination Date (such six month period, the “Consulting Term”) in order to assist in promoting a smooth transition of his duties to employees designated by Employer’s Executive Vice Chairman or acting or then-current Chief Executive Officer. Employee agrees and understands that he will provide these consulting services as an independent contractor. Employee may provide these consulting services from his residence, unless requested by Employer’s Executive Vice Chairman or acting or then-current Chief Executive Officer, or his designee, to travel within the United States, or appear in the Employer's offices, in the ordinary course of completing assignments, which the Employer may assign with reasonable notice and expectations consistent with Employee's experience and expertise. Employer will reimburse Employee for all reasonable expenses incurred in performing his duties under this Agreement; provided that Employee has obtained prior approval from Employer’s Executive Vice Chairman or acting or then-current Chief Executive Officer or his designee for such expenses.

4. Litigation Cooperation. In addition to his transition support and other undertakings in this Agreement, Employee hereby agrees to cooperate voluntarily, as requested, in any of Employer’s legal matters now pending or that may be filed in the future, including but not limited to the pending litigation involving Jason Domingo and Nancy Leavitt. Employee’s cooperation includes but is not limited to making himself available for interviews with attorneys and for depositions, searching for, identifying and producing documents, electronic media and information, providing truthful testimony as a witness or in affidavits and participating in legal discovery at the request of Employer or its attorneys without the necessity of subpoenas or formal legal process. Employee agrees that, as requested by Employer’s Chief Executive Officer or his designee, Employee will travel within the United States to perform these duties. Employer shall give reasonable notice for any such travel. Employer will reimburse Employee for all reasonable expenses incurred in performing his duties under this paragraph 4; provided that Employee has obtained prior approval from Employer’s Chief Executive Officer or his designee for such expenses. Employee shall retain and shall not destroy or delete any documents, including electronic documents, text messages, e-mails, letters and other communications related to any pending or future legal matter until Employer notifies Employee that the legal matters have terminated and that Employee is then free to destroy such documents. Employee shall strictly maintain all information related to any pending or future legal matter related to Employer in confidence, including the information Employee provides to Employer or its counsel in connection with Employee’s agreement to cooperate. Employee shall not, without the express consent and direction from Employer or its counsel, disclose any attorney client communication, work product or other information related to any legal matter in which Employer is or may become involved. Employer shall not waive any applicable privilege related to the Employer, or Employee’s cooperation with Employer, except as expressly directed by Employer or its counsel.

5.Counsel for Employee. To the extent Employer determines that Employee should be represented by counsel in any legal matter related to Employer, Employer shall provide to Employee at Employer’s expense counsel of its choosing, to represent Employee. Employee may be represented in any such matter by the same counsel that is representing Employer provided such joint representation is allowed under applicable Rules of Professional Responsibility applicable to counsel.

6.Communications. Employee hereby agrees that any communications, written or oral, regarding his service at Employer and his departure therefrom shall be wholly consistent with messaging provided by Employer. Employer will provide Employee with a reasonable opportunity to participate in the development of such messaging. Employee agrees that he will not proactively communicate with investors, employees or distributors regarding his departure, but will respond appropriately to any inquiries with respect thereto.

7.Release and Covenant Not to Sue. In exchange for the Severance Pay described in paragraph 2 above, to the fullest extent permitted by applicable law, Employee hereby fully and forever unconditionally releases and discharges Employer, all of its past, present and future parent, subsidiary, affiliated and related corporations,

their predecessors, successors and assigns, together with their divisions and departments, and all past or present officers, directors, employees, insurers, attorneys and agents of any of them (hereinafter referred to collectively as "Releasees"), and Employee covenants not to sue or assert against Releasees in any forum, for any purpose, any or all claims, administrative complaints, demands, actions and causes of action, of every kind and nature whatsoever, whether at law or in equity, and both negligent and intentional, arising from or in any way related to Employee's employment or separation from Employer, based in whole or in part upon any act or omission, occurring on or before the date of this general release, without regard to Employee's present actual knowledge of the act or omission, which Employee may now have, or which he, or any person acting on Employee's behalf may at any future time have or claim to have, including specifically, but not by way of limitation, matters which may arise at common law or under federal, state or local laws, including but not limited to the Fair Labor Standards Act, the Employee Retirement Income Security Act, the National Labor Relations Act, Title VII of the Civil Rights Act of 1964, the Age Discrimination in Employment Act, the Americans with Disabilities Act, the Equal Pay Act, the Family and Medical Leave Act, the Utah Labor Code and any other state or federal laws, excepting only any claim for worker's compensation, unemployment compensation, COBRA rights, and any vested rights under any ERISA benefit plan. Employee does not waive or release any rights arising after the date of execution of this Agreement. Employee further agrees that he will not in any manner encourage, counsel, participate in or otherwise assist any other party in the presentation or prosecution of any disputes, differences, grievances, claims, charges or complaints by any third party against any of the Releasees, unless Employee is legally required to participate in any such matter pursuant to an enforceable subpoena or other court order to do so. Employee also agrees both to immediately notify the Employer’s Board of Directors upon receipt of any such subpoena or court order, and to furnish, within three (3) business days of its receipt, a copy of such subpoena or other court order to the Employer’s Board of Directors. If approached by anyone for counsel or assistance in the presentation or prosecution of any disputes, differences, grievances, claims, charges, or complaints against any of the Releasees, Employee shall state no more than that Employee cannot provide any counsel or assistance.

8.Protection of Confidential Information. Employee hereby acknowledges that Employee remains subject to and agrees to abide by any and all existing duties and obligations respecting confidential and/or proprietary information of Employer, including any Confidentiality Agreement as referenced in Section 9 of the Amended Employment Agreement.

9.Confidentiality of Agreement. Employee agrees to keep the facts and terms of this Agreement confidential, except Employee may disclose the substance of this Agreement to his spouse, legal counsel, and financial or tax advisor, upon condition that such persons be advised by Employee of employee's confidentiality obligations hereunder and advise such persons that any disclosure by them will be deemed a disclosure by Employee.

10.Return of Company Property. Employee represents that he has returned to Employer, and has not retained, all of Employer's property, including documents, data (and any copies thereof), equipment, computer equipment, video equipment, audio equipment and cameras of any nature and in whatever medium, including all Employer data, files and images that are stored on Employee’s personal computers and equipment. Employee also represents that he has returned to Employer any building key(s), security cards, credit cards and any information he has regarding the Employer's practices, procedures, trade secrets, customer or distributor lists or employee lists. Employee understands and agrees that any outstanding expense reports that Employee intends to complete must be submitted to Employer within thirty (30) days of the Termination Date.

11.Non-Disparagement: Employee hereby acknowledges and agrees to not make or publish any negative or disparaging comments whatsoever about Employer, its products or services, or any of its directors, officers, employees, or agents, except as expressly required by applicable law. This obligation includes verbal or written statements made by or caused to be published by Employee in any forum or through any medium, including every electronic medium.

12.Non-Competition and Non-Solicitation. Employee hereby acknowledges and agrees to abide by any and all existing duties and obligations regarding non-competition and solicitation of Employer’s employees, independent distributors, customers and consultants, including those set forth in Section 14 of the Amended

Employment Agreement.

13.Obligation to Honor Covenants in the Amended Employment Agreement. Employee acknowledges and agrees that Employee remains bound by and is obligated to honor and fulfill all of Employee’s covenants and obligations in the Amended Employment Agreement, without regard to whether such covenants and obligations are rehearsed or referenced in this Agreement, including, without limitation the covenants delineated in Sections 14 and 15 of the Amended Employment Agreement.

14.Compliance with Older Workers Benefits Protections Act.

a. Employer hereby advises Employee in writing, and Employee acknowledges and represents that Employee is hereby advised to consult with an attorney of his own choice prior to executing this Agreement. Employee acknowledges and represents that Employee has had the opportunity to consult with an attorney before signing this Agreement, and Employee either has done so, or has voluntarily chosen not to consult with an attorney. Employee acknowledges and represents that this Agreement is written in a manner which is understandable and that this Agreement is entered into under Employee’s own free will and without duress or coercion from any person or entity.

b. Employee acknowledges and agrees that the release of claims under the Age Discrimination in Employment Act contained in this Agreement is given by Employee in exchange for consideration provided by this Agreement which is in addition to anything of value to which Employee would otherwise be entitled without this Agreement. Employee does not waive any rights or claims that may arise after the execution date of this Agreement.

c. Employer hereby informs Employee in writing, and Employee acknowledges and represents that Employee has been informed that Employee has twenty-one (21) days within which to consider this Agreement and that this Agreement will remain available for acceptance by Employee for this twenty-one day period, commencing on the date this Agreement is provided to Employee, as indicated in the first paragraph of this Agreement. Employee may accept this Agreement by signing the Agreement and returning it to the attention of Michelle Oborn, VP Human Resources, at 9785 S. Monroe Street, Suite 300, Sandy, UT 84070 within the 21-day consideration period.

d. Employer hereby informs Employee in writing, and Employee acknowledges and represents that Employee has been informed that Employee has the right to rescind this Agreement for a period of seven (7) days following the date upon which Employee executes this Agreement. Should Employee choose to exercise this right, Employee agrees that any such notice must be provided to and received by Employer in writing prior to lapse of the seven-day revocation period. Any such revocation must be in writing and delivered by certified mail to Michelle Oborn, VP Human Resources, at 9785 S. Monroe Street, Suite 300, Sandy, UT 84070.

e. It is understood and agreed by the Parties hereto that if Employee timely exercises Employee’s right of revocation, Employer shall have no obligations to Employee whatsoever under the Amended Employment Agreement or this Agreement and that all of the obligations, representations and warranties made by Employer in this Agreement shall be null and void.

GENERAL PROVISIONS

15.Compliance with Code Section 409A. This Agreement is intended to comply with the applicable requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”) and shall be limited, construed and interpreted in a manner so as to comply therewith. Each payment made pursuant to any provision of this Agreement shall be considered a separate payment and not one of a series of payments for purposes of Code Section 409A. While it is intended that all payments and benefits provided under this Agreement to Employee will be exempt from or comply with Code Section 409A, Employer makes no representation or covenant to ensure that the payments under this Agreement are exempt from or compliant with Code Section 409A. Employer will have no liability to Employee or any other party if a payment or benefit under this Agreement is challenged by any taxing

authority or is ultimately determined not to be exempt or compliant. In addition, if upon the Termination Date, Employee is then a “specified employee” (as defined in Code Section 409A), then solely to the extent necessary to comply with Code Section 409A and avoid the imposition of taxes under Code Section 409A, Employer shall defer payment of “nonqualified deferred compensation” subject to Code Section 409A payable as a result of and within six (6) months following the Termination Date until the earlier of (i) the first business day of the seventh (7th) month following the Termination Date or (ii) ten (10) days after Employer receives written confirmation of Employee’s death. Any such delayed payments shall be made without interest.

16.No Admission. The Parties expressly agree and acknowledge that this Agreement cannot be construed as an admission of or evidence of wrongdoing with respect to the termination of Employee, nor is it an admission of or evidence that Employee or any employee of Employer is other than an at-will employee.

17.Non-Assignment of Rights. Employee warrants that he has not assigned or transferred any right or claim described in the general release above.

18.No Reliance on Extraneous Information. Employee acknowledges that, in signing this Agreement, Employee is not relying on any information provided to Employee by Employer, nor is Employee relying upon Employer to provide any information other than as contained in this Agreement.

19.Modification. No provision of this Agreement shall be amended, waived or modified except by an instrument in writing signed on the Company’s behalf by its Chairman of the Board of Directors and by Employee.

20.Voluntary Execution. Employee hereby represents that Employee has read and understands the contents of this Agreement, that no representations other than those contained herein have been made to induce Employee or to influence Employee to execute this Agreement, but that Employee executes this Agreement knowingly and voluntarily, after having been advised to seek independent legal counsel of Employee's own choosing.

21.Severability. If any provision of this Agreement is held to be invalid, illegal, or unenforceable by any court of competent jurisdiction for any reason, the invalid or unenforceable portion shall be deemed severed from this Agreement and the balance of this Agreement shall remain in full force and effect and be enforceable in accordance with the non-severed provisions of this Agreement.

22.Integration. This Agreement contains the entire agreement and supersedes all prior agreements between the Parties relating to the subject matter hereto. This Agreement shall not be amended or otherwise modified in any manner except in a writing executed by the Parties hereto. The Parties further acknowledge that they are not relying on any information or representations other than those recited in this Agreement.

23.Rights of Non-Parties. All persons or entities against whom claims are released or waived by this Agreement are either party to or intended beneficiaries of this Agreement and shall have the same right and ability to enforce the release or waiver provided by this Agreement as though a party and signatory hereto.

24.Governing Law; Arbitration. This Agreement shall be subject to the same provisions of governing law and arbitration as set forth in Section 11 of the Amended Employment Agreement. Employee hereby acknowledges and agrees to the exclusive jurisdiction of the courts located in the State of Utah for any matter related to this Agreement or the Package and agrees that in all cases, this Agreement shall be interpreted according to the laws of the State of Utah, without regards to conflict of laws provisions.

25.Attorney's Fees. In any action to interpret or enforce the terms of this Agreement, the prevailing Party shall be entitled to recover its costs, including reasonable attorney's fees, in addition to any other relief to which such Party may be entitled.

26.Binding Against Heirs. This Agreement is binding upon the Parties hereto and their heirs, successors and assigns.

27.Non-Waiver. No failure to exercise or enforce or delay in exercising or enforcing, or partial exercise or enforcement of, any right, obligation or commitment under this Agreement shall constitute a waiver thereof, nor shall it preclude any other or further exercise or enforcement of any right, obligation or commitment under this Agreement.

28.Signature by Counterparts. This Agreement may be executed in one or more counterpart(s), each of which shall be valid and enforceable as an original signature as though all original signatures had been obtained on the signature page of this Agreement.

29.Facsimile or Electronic Signatures. A fully executed facsimile or electronic copy and/or photocopy of this Agreement is legally enforceable and binding the same as the original Agreement.

30.Incorporation of Recitals. The recitals set forth on page 1 hereof are hereby made a part of this Agreement and are incorporated by this reference.

ACCEPTED AND AGREED:

Douglas C. Robinson:

/s/ Douglas C. Robinson

Date: February 13, 2015

LIFEVANTAGE CORPORATION:

/s/ Garry Mauro

Garry Mauro, Chairman of the Board of Directors

Date: ______________________________

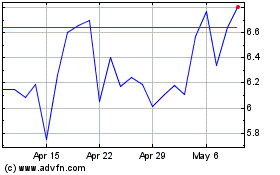

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

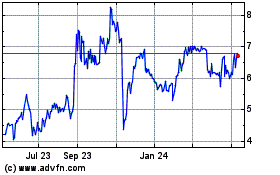

Lifevantage (NASDAQ:LFVN)

Historical Stock Chart

From Apr 2023 to Apr 2024