- Achieved record Q4 oil production

exceeding company guidance

- Generated U.S. oil production growth of

82 percent in Q4 year over year

- Increased proved oil reserves to

highest level in company history

- Maintained excellent financial strength

and liquidity

- Reiterated 2015 oil production growth

outlook of 20 to 25 percent

- Decreased 2015 E&P capital budget

by 20 percent

Devon Energy Corporation (NYSE:DVN) today reported net earnings

for the full-year 2014 of $1.6 billion, or $3.93 per common share

($3.91 per diluted share). This compares to a net loss of $20

million in 2013, or $0.06 per common share ($0.06 per diluted

share).

Devon generated cash flow from operations of $6.0 billion in

2014, a 10 percent increase compared to 2013. Including $5.1

billion of cash received from the sale of non-core assets, the

company’s total cash inflows for the year exceeded $11 billion.

For the fourth quarter of 2014, Devon’s core earnings totaled

$343 million, or $0.84 per common share ($0.83 per diluted share).

The company reported a net loss of $408 million, or $1.01 per

common share ($1.01 per diluted share) in the fourth quarter.

“Devon delivered another exceptional performance in the fourth

quarter, rounding out an outstanding year for the company,

including a significant repositioning of the portfolio,” said John

Richels, president and CEO. “Production from our top-tier asset

portfolio exceeded guidance for all products, proved oil reserves

reached a record level and our midstream business increased

profitability to an all-time high.

“We expect to sustain operational momentum in 2015 with the

significant improvements we have seen in our completion designs and

a capital program focused on development drilling,” said Richels.

“With strong results from our enhanced completions and a focus on

core development areas, we expect growth in oil production to be

between 20 and 25 percent in 2015, even with a projected reduction

of approximately 20 percent in E&P capital spending compared to

2014.”

Repositioned Portfolio Exceeds Production

Expectations

Total production from Devon’s retained assets averaged 664,000

oil-equivalent barrels (Boe) per day during the fourth quarter of

2014. This result exceeded the company’s guidance range by 9,000

Boe per day and represents a 20 percent increase compared to the

fourth quarter of 2013. This high-margin growth increased liquids

production to 57 percent of the company’s retained asset mix in the

fourth quarter.

Devon also delivered record oil production of 239,000 barrels

per day in the fourth quarter. This result exceeded the top end of

the company’s guidance range and represents a 48 percent increase

compared to the fourth quarter of 2013. The most significant growth

came from the company’s U.S. operations, where oil production

increased a substantial 82 percent for the quarter year over

year.

The strong growth in U.S. oil production during the quarter was

largely attributable to prolific well results from the company’s

world-class Eagle Ford assets. Net production in the Eagle Ford

averaged 98,000 Boe per day in the fourth quarter, a 100 percent

increase compared to Devon’s first month of ownership in March

2014. The company also achieved another quarter of strong

production growth in the Permian Basin. Led by outstanding results

from Devon’s Delaware Basin assets, total Permian Basin production

increased to 98,000 Boe per day in the fourth quarter, a 14 percent

increase compared to the year-ago period.

In Canada, net oil production from the company’s heavy-oil

projects increased to a record high of 93,000 barrels per day in

the fourth quarter. This strong result exceeded the top end of

Devon’s guidance range by 5,000 barrels per day and represents a 15

percent increase in production compared to the fourth quarter of

2013. This growth was driven by the continued ramp-up of the

company’s newest heavy-oil facility, Jackfish 3, which exited the

year averaging 13,000 barrels per day.

Reserves from Retained Assets Grow; Oil Reserves Climb to

Record Levels

Devon’s estimated proved reserves totaled 2.8 billion

oil-equivalent barrels on Dec. 31, 2014, a 7 percent increase in

reserves compared to the company’s retained asset portfolio in

2013. At year-end, proved oil reserves reached a record 895 million

barrels.

The most significant reserve growth came from Devon’s U.S.

operations, where oil reserves from retained properties increased

65 percent year over year to 351 million barrels. The substantial

growth in U.S. oil reserves is largely attributable to the

company’s Eagle Ford acquisition and its Delaware Basin operations.

During the year, the company’s U.S. drilling programs added 94

million barrels of light-oil reserves through successful drilling

(extensions and discoveries). This represents a replacement rate of

approximately 200 percent of the light oil produced during

2014.

Overall, the company’s reserve life index (proved reserves

divided by annual production from retained properties) remained at

approximately 12 years, and its proved undeveloped reserves

accounted for only 25 percent of proved reserves.

Operations Report

For additional details on Devon’s core and emerging assets,

please refer to the company’s fourth-quarter 2014 Operations Report

at www.devonenergy.com. Highlights from the operations report

include:

- Prolific Q4 results, increasing type

curve for Eagle Ford

- Improved completion design delivers

excellent results in Delaware Basin

- Ramp-up exceeds expectations at

Jackfish 3

- High-rate development wells from

Cana-Woodford

Upstream Revenue Increases 16 Percent; Midstream Profit

Rises

Revenue from oil, natural gas and natural gas liquids sales

totaled $9.9 billion in 2014, a 16 percent increase compared to

2013. The growth in revenue was attributable to the company’s

significant increase in U.S. light-oil production. This high-margin

growth increased oil sales to 60 percent of Devon’s total upstream

revenues during the year.

In the fourth quarter, upstream revenue was $2.1 billion, a 3

percent decrease compared to the fourth quarter of 2013. Cash

settlements related to the company’s oil and natural gas hedges

increased revenue by $4.23 per Boe in the fourth quarter of 2014,

partially offsetting lower realized oil and natural gas liquids

prices. At Dec. 31, 2014, Devon’s attractive commodity hedges had a

fair market value of nearly $2.0 billion.

The company’s marketing and midstream business also delivered

excellent results in 2014, with operating profits reaching an

all-time high of $852 million, a 66 percent increase compared to

2013. The year-over-year increase in operating profit was largely

driven by growth from EnLink Midstream.

Cash Operating Costs Decline

The company’s successful cost containment efforts resulted in

lease operating expenses (LOE), the largest cash cost, of $9.29 per

Boe in the fourth quarter. LOE was 5 percent below the low end of

Devon’s guidance range and 2 percent lower than the third quarter

of 2014. The company’s significant scale in core plays coupled with

a consistent focus on efficient operations continues to position

Devon as a low-cost producer.

Production and property taxes were $108 million in the quarter,

essentially flat compared to the fourth quarter of 2013. Compared

to the previous quarter, lower commodity prices drove a decline in

production and property taxes of 23 percent.

Net financing costs totaled $167 million in the fourth quarter

of 2014, an increase of 50 percent compared to the year-ago

quarter. The higher financing costs were due to a $48 million

charge attributable to the early redemption of $1.9 billion in

senior notes.

General and administrative expenses totaled $252 million in the

fourth quarter of 2014. This compares with $157 million in the

fourth quarter of 2013. The year-over-year increase resulted from

the consolidation of EnLink Midstream and higher employee-related

costs.

Depreciation, depletion and amortization expense (DD&A)

amounted to $14.89 per Boe in the fourth quarter. For the

full-year, DD&A was $13.51 per Boe and compares to a rate of

$10.99 in 2013. The increase in DD&A rate was primarily

attributable to the company’s Eagle Ford acquisition and EnLink

Midstream transaction.

Devon incurred a $1.9 billion non-cash impairment of goodwill in

the fourth quarter of 2014. The goodwill was recorded more than a

decade ago and was related to an acquisition comprised almost

entirely of conventional gas assets in Canada that Devon no longer

owns. This non-cash impairment was related to the recent drop in

oil prices.

Full-year 2014 income tax expense was $2.4 billion, or 58

percent of pre-tax earnings. This unusually high tax rate resulted

principally from the goodwill impairment charge that lowered

pre-tax earnings but did not impact the company’s full-year tax

obligations. Excluding this impairment charge and other

non-recurring items, Devon’s income tax rate was 35 percent of

adjusted pre-tax earnings for the full year.

Balance Sheet and Liquidity Remain Strong

Devon’s financial position remains exceptionally strong with

investment-grade credit ratings and cash balances of $1.5 billion

at the end of the fourth quarter. During the quarter, the company

redeemed $1.9 billion in senior notes, completing the debt

repayment plan associated with its portfolio transformation. At

Dec. 31, the company’s net debt, excluding non-recourse EnLink

obligations, totaled $7.8 billion.

2015 Outlook: Production Guidance Unchanged; E&P Capital

Reduced 20 Percent

Detailed forward-looking guidance for the first quarter and full

year of 2015 is provided later in the release. A notable component

of this outlook is Devon’s 2015 E&P capital budget of $4.1 to

$4.4 billion. This level of investment implies around a 20 percent

decline in E&P spending compared to 2014 and is designed to

better balance capital expenditures with expected cash inflows.

Even with reduced E&P capital investment in 2015, the

company’s production growth outlook remains unchanged. With

significant improvements in completion design and a capital program

focused on development drilling, Devon expects to deliver oil

production growth of 20 to 25 percent year over year on a retained

property basis. This production outlook is driven by balanced oil

growth in both the U.S. and Canada.

Non-GAAP Reconciliations

Pursuant to regulatory disclosure requirements, Devon is

required to reconcile non-GAAP financial measures to the related

GAAP information (GAAP refers to general accepted accounting

principles). Core earnings and net debt are non-GAAP financial

measures referenced within this release. Reconciliations of these

non-GAAP measures are provided later in this release.

Conference Call Webcast and Supplemental Earnings

Materials

Please note that as soon as practicable today, Devon will post

additional information, consisting of an operations report and

management commentary with associated slides, to its website at

www.devonenergy.com. The company’s fourth-quarter 2014 conference

call will be held at 10 a.m. Central (11 a.m. Eastern) on

Wednesday, Feb. 18, 2015, and will serve primarily as a forum for

analyst and investor questions and answers.

Forward-Looking Statements

This press release includes "forward-looking statements" as

defined by the Securities and Exchange Commission (SEC). Such

statements are those concerning strategic plans, expectations and

objectives for future operations. All statements, other than

statements of historical facts, included in this press release that

address activities, events or developments that the company

expects, believes or anticipates will or may occur in the future

are forward-looking statements. Such statements are subject to a

number of assumptions, risks and uncertainties, many of which are

beyond the control of the company. Statements regarding future

drilling and production are subject to all of the risks and

uncertainties normally incident to the exploration for and

development and production of oil and gas. These risks include, but

are not limited to, the volatility of oil, natural gas and NGL

prices; uncertainties inherent in estimating oil, natural gas and

NGL reserves; the extent to which we are successful in acquiring

and discovering additional reserves; unforeseen changes in the rate

of production from our oil and gas properties; uncertainties in

future exploration and drilling results; uncertainties inherent in

estimating the cost of drilling and completing wells; drilling

risks; competition for leases, materials, people and capital;

midstream capacity constraints and potential interruptions in

production; risk related to our hedging activities; environmental

risks; political changes; changes in laws or regulations; our

limited control over third parties who operate our oil and gas

properties; our ability to successfully complete mergers,

acquisitions and divestitures; and other risks identified in our

Form 10-K and our other filings with the SEC. Investors are

cautioned that any such statements are not guarantees of future

performance and that actual results or developments may differ

materially from those projected in the forward-looking statements.

The forward-looking statements in this press release are made as of

the date of this press release, even if subsequently made available

by Devon on its website or otherwise. Devon does not undertake any

obligation to update the forward-looking statements as a result of

new information, future events or otherwise.

The SEC permits oil and gas companies, in their filings with the

SEC, to disclose only proved, probable and possible reserves that

meet the SEC's definitions for such terms, and price and cost

sensitivities for such reserves, and prohibits disclosure of

resources that do not constitute such reserves. This release

may contain certain terms, such as resource potential

and exploration target size. These estimates are by their

nature more speculative than estimates of proved, probable and

possible reserves and accordingly are subject to substantially

greater risk of being actually realized. The SEC guidelines

strictly prohibit us from including these estimates in filings with

the SEC. U.S. investors are urged to consider closely the

disclosure in our Form 10-K, available at www.devonenergy.com. You

can also obtain this form from the SEC by calling 1-800-SEC-0330 or

from the SEC’s website at www.sec.gov.

About Devon Energy

Devon Energy Corp. (NYSE: DVN) is a leading independent energy

company engaged in finding and producing oil and natural gas. Based

in Oklahoma City and included in the S&P 500, Devon operates in

several of the most prolific oil and natural gas plays in the U.S.

and Canada with an emphasis on a balanced portfolio. The company is

the second-largest oil producer among North American onshore

independents. For more information, please visit

www.devonenergy.com.

DEVON ENERGY CORPORATION

FINANCIAL AND OPERATIONAL

INFORMATION

Quarter Ended Year Ended

PRODUCTION NET OF ROYALTIES December 31, December

31, 2014 2013 2014 2013

Oil / Bitumen (MBbls/d) United States 146 80 127 73 Canada

93 81 82 79 Retained assets 239 161 209 152 Divested assets - 16 5

16 Total Oil / Bitumen 239 177 214 168

Natural Gas (MMcf/d)

United States 1,684 1,639 1,662 1,658 Canada 23 28 23 28 Retained

assets 1,707 1,667 1,685 1,686 Divested assets 3 661 235 707 Total

Natural Gas 1,710 2,328 1,920 2,393

Natural Gas Liquids

(MBbls/d) United States 141 114 132 107 Divested assets - 18 7

19 Total Natural Gas Liquids 141 132 139 126

Oil Equivalent

(Mboe/d) United States 567 467 536 456 Canada 97 86 86 85

Retained assets 664 553 622 541 Divested assets 1 143 51 152 Total

Oil Equivalent 665 696 673 693

KEY OPERATING STATISTICS BY

REGION Quarter Ended December 31, 2014 Avg.

Production Gross Wells Operated Rigs at

(MBoe/d) Drilled December 31, 2014 Permian

Basin 98 80 18 Eagle Ford 98 78 3 Canadian Heavy Oil 97 78 11

Barnett Shale 201 14 - Anadarko Basin 100 30 5

Mississippian-Woodford Trend 20 53 2 Rockies 19 9 4 Other Assets 31

4 -

Retained Assets - Total 664 346 43 Divested assets 1 - -

Devon - Total 665 346 43

Year Ended

December 31, 2014 Avg. Production Gross Wells

(MBoe/d) Drilled Permian Basin 96 324 Eagle Ford 65

242 Canadian Heavy Oil 86 205 Barnett Shale 208 84 Anadarko Basin

94 130 Mississippian-Woodford Trend 20 236 Rockies 20 40 Other

Assets 33 5

Retained Assets - Total 622 1,266 Divested

assets 51 -

Devon - Total 673 1,266

PRODUCTION TREND 2013

2014 Quarter 4 Quarter 1 Quarter 2

Quarter 3 Quarter 4 Oil (MBbls/d)

Permian Basin 50 55 55 56 55 Eagle Ford - 11 40 46 60 Canadian

Heavy Oil 81 78 77 80 93 Barnett Shale 2 2 2 2 2 Anadarko Basin 9 9

11 10 10 Mississippian-Woodford Trend 8 10 9 10 9 Rockies 8 8 8 10

9 Other assets 3 2 3 2 1 Retained assets 161 175 205 216 239

Divested assets 16 15 4 3 - Total 177 190 209 219 239

Gas

(MMcf/d) Permian Basin 116 121 134 136 137 Eagle Ford - 22 86

107 126 Canadian Heavy Oil 28 19 23 26 23 Barnett Shale 995 931 932

896 878 Anadarko Basin 294 281 309 323 329 Mississippian-Woodford

Trend 19 28 28 32 31 Rockies 75 65 67 66 58 Other assets 140 140

135 130 125 Retained assets 1,667 1,607 1,714 1,716 1,707 Divested

assets 661 585 217 138 3 Total 2,328 2,192 1,931 1,854 1,710

NGL

(MBbls/d) Permian Basin 16 16 18 19 20 Eagle Ford - 3 10 14 18

Canadian Heavy Oil - - - - - Barnett Shale 56 55 55 54 53 Anadarko

Basin 27 29 31 34 34 Mississippian-Woodford Trend 3 5 5 6 6 Rockies

1 1 1 1 1 Other assets 11 10 10 10 9 Retained assets 114 119 130

138 141 Divested assets 18 16 6 5 - Total 132 135 136 143 141

Combined (MBoe/d) Permian Basin 86 91 95 98 98 Eagle Ford -

17 65 78 98 Canadian Heavy Oil 86 81 81 84 97 Barnett Shale 224 213

212 205 201 Anadarko Basin 85 85 93 98 100 Mississippian-Woodford

Trend 14 19 18 21 20 Rockies 21 20 21 22 19 Other assets 37 37 35

34 31 Retained assets 553 563 620 640 664 Divested assets 143 128

47 31 1 Total 696 691 667 671 665

BENCHMARK PRICES (average prices)

Quarter 4

December YTD FY2014 FY2013 FY2014

FY2013 Natural Gas ($/Mcf) - Henry Hub $ 4.04 $ 3.60 $ 4.43

$ 3.65 Oil ($/Bbl) - West Texas Intermediate (Cushing) $ 73.05 $

97.53 $ 93.01 $ 98.02

REALIZED PRICES Quarter

Ended December 31, 2014 Oil /Bitumen Gas

NGL Total (Per Bbl) (Per Mcf) (Per

Bbl) (Per Boe) United States $ 68.19 $ 3.53 $ 17.79 $

32.45 Canada (1) $ 45.71 $ 0.87 $ 54.32 $ 44.01

Realized price without hedges $ 59.46 $ 3.49 $ 17.75 $ 34.14 Cash

settlements $ 10.34 $ 0.20 $ 0.04 $ 4.23 Realized

price, including cash settlements $ 69.80 $ 3.69 $ 17.79

$ 38.37

Quarter Ended December 31, 2013 Oil

/Bitumen Gas NGL Total (Per Bbl)

(Per Mcf) (Per Bbl) (Per Boe) United States $

96.04 $ 3.01 $ 27.51 $ 32.96 Canada (1) $ 48.50 $ 3.07 $

45.00 $ 35.74 Realized price without hedges $ 71.45 $ 3.02 $

28.73 $ 33.65 Cash settlements $ 3.33 $ 0.23 $ (0.19 ) $

1.59 Realized price, including cash settlements $ 74.78 $ 3.25

$ 28.54 $ 35.24

Year Ended December 31,

2014 Oil Gas NGL Total (Per

Bbl) (Per Mcf) (Per Bbl) (Per Boe) United

States $ 85.64 $ 3.92 $ 24.46 $ 37.96 Canada (1) $ 60.05 $ 3.64

$ 50.52 $ 53.11 Realized price without hedges $ 75.55

$ 3.90 $ 24.89 $ 40.33 Cash settlements $ 1.16 $ (0.05 ) $ 0.02

$ 0.22 Realized price, including cash settlements $ 76.71 $

3.85 $ 24.91 $ 40.55

Year Ended December

31, 2013 Oil Gas NGL Total (Per

Bbl) (Per Mcf) (Per Bbl) (Per Boe) United

States $ 94.52 $ 3.10 $ 25.75 $ 31.59 Canada (1) $ 57.18 $ 3.05

$ 46.17 $ 39.91 Realized price without hedges $ 74.41

$ 3.09 $ 27.33 $ 33.70 Cash settlements $ 0.90 $ 0.16 $ 0.01

$ 0.77 Realized price, including cash settlements $ 75.31 $

3.25 $ 27.34 $ 34.47

(1) The reported Canadian gas volumes include volumes that are

produced from certain of our leases and then transported to our

Jackfish operations where the gas is used as fuel. However, the

revenues and expenses related to this consumed gas are eliminated

in our consolidated financials.

CONSOLIDATED STATEMENTS OF

OPERATIONS (in millions, except per share amounts)

Quarter

Ended Year Ended December 31, December 31,

2014 2013

2014 2013 Oil, gas and NGL sales

$ 2,086 $ 2,155 $ 9,910 $ 8,522 Oil, gas and NGL derivatives 1,960

(96 ) 1,989 (191 ) Marketing and midstream revenues 1,949

565 7,667 2,066

Total operating revenues 5,995 2,624

19,566 10,397 Lease operating expenses

568 584 2,332 2,268 Marketing and midstream operating expenses

1,723 425 6,815 1,553 General and administrative expenses 252 157

847 617 Production and property taxes 108 108 535 461 Depreciation,

depletion and amortization 910 711 3,319 2,780 Asset impairments

1,953 16 1,953 1,976 Restructuring costs 2 4 46 54 Gains and losses

on asset sales - (2 ) (1,072 ) 9 Other operating items 19

30 93 112 Total

operating expenses 5,535 2,033

14,868 9,830 Operating income 460 591 4,698

567 Net financing costs 167 111 526 417 Other nonoperating items

2 5 113 1

Earnings from continuing operations before income taxes 291 475

4,059 149 Income tax expense 670 268

2,368 169 Net earnings (loss) (379 )

207 1,691 (20 ) Net earnings attributable to noncontrolling

interests 29 - 84

- Net earnings (loss) attributable to Devon $ (408 ) $ 207

$ 1,607 $ (20 ) Net earnings (loss) per

share attributable to Devon: Basic earnings (loss) from

discontinued operations per share $ (1.01 ) $ 0.51 $ 3.93 $ (0.06 )

Diluted earnings (loss) from continuing operations per share $

(1.01 ) $ 0.51 $ 3.91 $ (0.06 ) Weighted average

common shares outstanding: Basic 409 406 409 406 Diluted 409 407

411 406

CONSOLIDATED STATEMENTS OF

OPERATIONS (in millions)

Quarter Ended December 31, 2014

Devon U.S. & Canada EnLink

Eliminations Total Oil, gas and NGL sales $ 2,086 $ -

$ - $ 2,086 Oil, gas and NGL derivatives 1,960 - - 1,960 Marketing

and midstream revenues 1,141 995

(187 ) 1,949 Total operating revenues 5,187

995 (187 ) 5,995 Lease

operating expenses 568 - - 568 Marketing and midstream expenses

1,139 771 (187 ) 1,723 General and administrative expenses 222 30 -

252 Production and property taxes 100 8 - 108 Depreciation,

depletion and amortization 826 84 - 910 Asset impairments 1,953 - -

1,953 Restructuring costs 2 - - 2 Other operating items 19

- - 19 Total

operating expenses 4,829 893

(187 ) 5,535 Operating income 358 102 - 460 Net

financing costs 147 20 - 167 Other nonoperating items 9

(7 ) - 2 Earnings before

income taxes 202 89 - 291 Income tax expense 654

16 - 670 Net earnings

(loss) (452 ) 73 - (379 ) Net earnings attributable to

noncontrolling interests - 29 -

29 Net earnings (loss) attributable to Devon $

(452 ) $ 44 $ - $ (408 )

CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions)

Quarter Ended Year Ended December 31,

December 31, 2014 2013

2014 2013 Cash

flows from operating activities: Net earnings (loss) $ (379 ) $ 207

$ 1,691 $ (20 ) Adjustments to reconcile earnings (loss) from

continuing operations to net cash from operating activities:

Depreciation, depletion and amortization 910 711 3,319 2,780 Asset

impairments 1,953 16 1,953 1,976 Gains and losses on asset sales -

(2 ) (1,072 ) 9 Deferred income tax expense

1,091

278 1,891 97 Derivatives and other financial instruments (2,027 )

70 (2,070 ) 135 Cash settlements on derivatives and financial

instruments 305 130 104 277 Other noncash charges 100 114 457 309

Net change in working capital (716 ) (194 ) 50 (298 ) Change in

long-term other assets (306 ) 38 (421 ) 10 Change in long-term

other liabilities 32 69 79

161 Net cash from operating activities

963

1,437 5,981 5,436

Cash flows from investing activities: Capital expenditures

(1,975 ) (1,539 ) (6,988 ) (6,758 ) Acquisitions of property,

equipment and businesses (207 ) - (6,462 ) - Proceeds from property

and equipment divestitures (82 ) 103 5,120 419 Purchases of

short-term investments - - - (1,076 ) Redemptions of short-term

investments - - - 3,419 Redemptions of long-term investments - - 57

- Other 2 (86 ) 89 (3 )

Net cash from investing activities (2,262 ) (1,522 )

(8,184 ) (3,999 ) Cash flows from financing

activities: Proceeds from borrowings of long-term debt, net of

issuance costs 1,182 2,233 5,340 2,233

Net short-term debt borrowings

(repayments)

933 (295 ) (385 ) (1,872 ) Long-term debt repayments (2,924 ) -

(7,189 ) - Proceeds from stock option exercises 1 2 93 3 Proceeds

from issuance of subsidiary units 338 - 410 - Dividends paid on

common stock (99 ) (89 ) (386 ) (348 ) Distributions to

noncontrolling interests (48 ) - (235 ) - Other

2

(1 ) (2 ) 4 Net cash from

financing activities

(615

) 1,850 (2,354 ) 20 Effect of

exchange rate changes on cash (14 ) (19 ) (29

) (28 ) Net change in cash and cash equivalents (1,928 )

1,746 (4,586 ) 1,429 Cash and cash equivalents at beginning

of period 3,408 4,320 6,066

4,637 Cash and cash equivalents at end

of period $ 1,480 $ 6,066 $ 1,480 $ 6,066

CONSOLIDATED BALANCE SHEETS (in millions)

December

31, December 31, Current assets:

2014

2013 Cash and cash equivalents $ 1,480

$ 6,066 Accounts receivable 1,959 1,520 Derivatives, at fair value

1,993 75 Income taxes receivable 522 89 Other current assets

544 255 Total current assets 6,498

8,005 Property and equipment, at cost: Oil and

gas, based on full cost accounting: Subject to amortization 75,738

73,995 Not subject to amortization 2,752 2,791

Total oil and gas 78,490 76,786 Midstream and other

9,695 6,195 Total property and equipment, at

cost 88,185 82,981 Less accumulated depreciation, depletion and

amortization (51,889 ) (54,534 ) Property and

equipment, net 36,296 28,447 Goodwill

6,303 5,858 Other long-term assets 1,540 567

Total assets $ 50,637 $ 42,877 Current

liabilities: Accounts payable 1,400 1,229 Revenues and royalties

payable 1,193 786 Short-term debt 1,432 4,066 Deferred income taxes

730 19 Other current liabilities 1,180 555

Total current liabilities 5,935 6,655

Long-term debt 9,830 7,956 Asset retirement obligations

1,339 2,140 Other long-term liabilities 948 834 Deferred income

taxes 6,244 4,793 Stockholders' equity: Common Stock 41 41

Additional paid-in capital 4,088 3,780 Retained earnings 16,631

15,410 Accumulated other comprehensive earnings 779

1,268 Total stockholders' equity attributable to

Devon 21,539 20,499 Noncontrolling interests 4,802

- Total stockholders' equity 26,341

20,499 Total liabilities and stockholders' equity $

50,637 $ 42,877 Common shares outstanding 409 406

CAPITAL EXPENDITURES (in millions)

Quarter Ended

December 31, 2014 U.S. Canada Total

Exploration $ 105 $ 6 $ 111 Development 1,243 224

1,467 Exploration and development capital $ 1,348 $ 230 $

1,578 Capitalized G&A 108 Capitalized interest 13 Acquisitions

10 Devon midstream capital 37 Other capital 40 Total (1) $

1,786 (1) Excludes $479 million attributable to EnLink.

Year Ended December 31, 2014 U.S.

Canada Total Exploration $ 292 $ 40 $ 332 Development

4,115 908 5,023 Exploration and development

capital $ 4,407 $ 948 $ 5,355 Capitalized G&A 376 Capitalized

interest 45 Eagle Ford, Cana and other acquisitions 6,376 Devon

midstream capital 312 Other capital 125 Total (1) $ 12,589

(1) Excludes $970 million attributable to EnLink.

COSTS INCURRED

Total (in millions)

Year Ended December 31,

2014 2013 Property acquisition costs: Proved

properties $ 5,210 $ 22 Unproved properties 1,177 216 Exploration

costs 322 595 Development costs 5,463 5,089

Costs

Incurred $ 12,172 $ 5,922

United States Year Ended December 31,

2014 2013 Property acquisition costs: Proved

properties $ 5,210 $ 19 Unproved properties 1,176 213 Exploration

costs 270 443 Development costs 4,400 3,838

Costs

Incurred $ 11,056 $ 4,513

Canada Year Ended December 31, 2014

2013 Property acquisition costs: Proved properties $

— $ 3 Unproved properties 1 3 Exploration costs 52 152 Development

costs 1,063 1,251

Costs Incurred $

1,116 $ 1,409

RESERVES RECONCILIATION Total Oil / Bitumen

Gas NGL Total (MMBbls)

(Bcf) (MMBbls)

(MMBoe) As of December 31, 2013:

Proved developed 361 8,459 491 2,262 Proved

undeveloped 476 849 84

701

Total Proved 837

9,308 575

2,963 Revisions due to prices (38) 236 8 9

Revisions other than price (19) (295) 2 (65) Extensions and

discoveries 107 343 47 211 Purchase of reserves 132 457 57 265

Production (78) (701) (51) (246) Sale of reserves (46) (1,661) (60)

(383)

As of December 31, 2014:

Proved developed 415 6,984 486 2,065 Proved undeveloped 480

703 92 689

Total Proved 895 7,687

578 2,754

United States Oil / Bitumen Gas

NGL Total (MMBbls)

(Bcf) (MMBbls)

(MMBoe) As of December 31, 2013:

Proved developed 194 7,707 468 1,947 Proved

undeveloped 35 843 84

258

Total Proved 229

8,550 552

2,205 Revisions due to prices (1) 191 7 38

Revisions other than price (38) (299) 2 (86) Extensions and

discoveries 94 335 47 197 Purchase of reserves 132 457 57 265

Production (48) (660) (50) (207) Sale of reserves (17) (923) (37)

(207)

As of December 31, 2014:

Proved developed 255 6,948 486 1,900 Proved undeveloped 96

703 92 305

Total Proved 351 7,651

578 2,205

Canada Oil / Bitumen Gas

NGL Total (MMBbls)

(Bcf) (MMBbls)

(MMBoe) As of December 31, 2013:

Proved developed 167 752 23 315 Proved undeveloped

441 6 —

443

Total Proved 608

758 23

758 Revisions due to prices (37) 45 1 (29) Revisions other

than price 19 4 — 21 Extensions and discoveries 13 8 — 14 Purchase

of reserves — — — — Production (30) (41) (1) (39) Sale of reserves

(29) (738) (23) (176)

As of December 31, 2014:

Proved developed 160 36 — 165 Proved undeveloped 384

— —

384

Total Proved 544 36

— 549

NON-GAAP FINANCIAL MEASURES

The United States Securities and Exchange Commission has adopted

disclosure requirements for public companies such as Devon

concerning Non-GAAP financial measures. (GAAP refers to generally

accepted accounting principles). The Company must reconcile the

Non-GAAP financial measure to related GAAP information.

CORE EARNINGS(in millions)

Devon’s reported net earnings include items of income and

expense that are typically excluded by securities analyst in their

published estimates of the company’s financial results. Devon

believes these non-GAAP measures facilitate comparisons of its

performance to earnings estimates published by securities analysts.

Devon also believes these non-GAAP measures can facilitate

comparisons of its performance between periods and to the

performance of its peers. The following tables summarize the

effects of these items on fourth-quarter and total-year 2014

earnings.

Quarter Ended December

31, 2014 Before-Tax After-Tax Net loss

attributable to Devon (GAAP) $ (408 ) Asset impairments 1,953 1,948

Fair value changes in financial instruments and foreign currency

(1,721 ) (1,086 ) Gain on asset sales and related repatriation -

(143 ) Early retirement of debt 48 31 Restructuring costs 2

1 Core earnings attributable to Devon (Non-GAAP) $ 343

Diluted share count 411 Core diluted earnings per share

attributable to Devon (Non-GAAP) $ 0.83

Year Ended December 31, 2014 Before-Tax

After-Tax Net earnings attributable to Devon (GAAP) $

1,607 Asset impairments 1,953 1,948 Fair value changes in financial

instruments and foreign currency (1,945 ) (1,231 ) Gain on asset

sales and related repatriation (955 ) (421 ) Investment in EnLink

deferred income tax - 48 Restructuring costs 46 35 Early retirement

of debt 48 31 Core earnings attributable to Devon

(Non-GAAP) $ 2,017 Diluted share count 411 Core diluted

earnings per share attributable to Devon (Non-GAAP) $ 4.91

NET DEBT(in millions)

Devon defines net debt as debt less cash and cash equivalents as

presented in the following table. Devon believes that netting these

sources of cash against debt provides a clearer picture of the

future demands on cash to repay debt.

December 31,

2014 2013 Total debt (GAAP) $ 11,262 $ 12,022

Adjustments: Cash and cash equivalents 1,480 6,066

Net debt (Non-GAAP) $ 9,782 $ 5,956

PRODUCTION GUIDANCE Quarter 1 Full Year

Low High Low High Oil and

bitumen (MBbls/d) United States 150 155 150 155 Canada 100 105

100 105 Total 250 260 250 260

Natural gas (MMcf/d) United

States 1,600 1,650 1,550 1,600 Canada 20 20 20 20 Total 1,620 1,670

1,570 1,620

Natural gas liquids (MBbls/d) United States 130

135 126 132

Total Boe (MBoe/d) United States 547 565 534 554

Canada 103 108 103 108 Total 650 673 637 662

PRICE REALIZATIONS GUIDANCE Quarter 1 Full

Year Low High Low High Oil

and bitumen - % of WTI United States 83 % 93 % 85 % 95 % Canada 46

% 56 % 55 % 65 % Natural gas - % of Henry Hub 83 % 93 % 83 % 93 %

NGL - realized price $ 9 $ 14 $ 8 $ 18

OTHER GUIDANCE ITEMS Quarter 1 Full Year ($

millions, except Boe)

Low High Low High

Marketing & midstream operating profit $ 180 $ 210 $ 860

$ 920 Lease operating expenses per Boe $ 9.60 $ 10.20 $ 9.70 $

10.30 General & administrative expenses per Boe $ 4.00 $ 4.30 $

3.75 $ 4.25 Production and property taxes as % of upstream sales

7.1 % 8.1 % 6.7 % 7.7 % Depreciation, depletion and amortization

per Boe $ 14.75 $ 15.75 $ 15.25 $ 16.25

Other operating items

$

20

$

25

$

80

$

100

Net financing costs $ 110 $ 130 $ 440 $ 500 Current income tax rate

5.0

% 10.0 %

5.0

% 10.0 % Deferred income tax rate

25.0

%

30.0

%

25.0

%

30.0

% Total income tax rate

30.0

%

40.0

%

30.0

%

40.0

% Net earnings attributable to noncontrolling interests $ —

$ 20 $ 50 $ 100

CAPITAL EXPENDITURES

GUIDANCE Quarter 1 Full Year (in millions)

Low High Low High Exploration

and development $

1,300

$

1,400

$ 4,100 $ 4,400 Capitalized G&A and interest 100

120 400 500 Total oil and gas

1,400

1,520

4,500 4,900 Midstream (1) 50 70 110 160 Corporate and

other 30 40 100 150 Devon capital

expenditures $

1,480

$

1,630

$ 4,710 $ 5,210 (1) Excludes capital expenditures related to

EnLink.

COMMODITY HEDGES Oil

Commodity Hedges Price Swaps Price Collars

Call Options Sold Period

Volume(Bbls/d)

WeightedAveragePrice ($/Bbl)

Volume(Bbls/d)

WeightedAverage FloorPrice ($/Bbl)

WeightedAverageCeiling Price($/Bbl)

Volume(Bbls/d)

WeightedAverage Price($/Bbl)

Q1-Q4 2015 107,203 $ 91.07 31,500 $ 89.67 $ 97.84 28,000 $ 116.43

Q1-Q4 2016 - $ - - $ - $ - 18,500

$

103.11

Oil Basis Swaps Period Index Volume

(Bbls/d)

Weighted Average Differential toWTI

($/Bbl)

Q1-Q4 2015 Western Canadian Select 31,682 $(17.42)

Natural Gas Commodity Hedges Price Swaps Price

Collars Call Options Sold Period

Volume(MMBtu/d)

WeightedAverage Price($/MMBtu)

Volume(MMBtu/d)

WeightedAverage FloorPrice($/MMBtu)

WeightedAverageCeiling Price($/MMBtu)

Volume(MMBtu/d)

WeightedAverage Price($/MMBtu)

Q1-Q4 2015 250,000 $ 4.32 328,452 $ 4.05 $ 4.36 550,000 $ 5.09

Q1-Q4 2016 - $ - - $ - $ - 400,000 $ 5.00

Devon’s oil derivatives settle against the average of the prompt

month NYMEX West Texas Intermediate futures price. Devon’s natural

gas derivatives settle against the Inside FERC first of the month

Henry Hub index.

Devon Energy CorporationInvestor ContactsHoward Thill,

405-552-3693Scott Coody, 405-552-4735Shea Snyder,

405-552-4782Media ContactJohn Porretto, 405-228-7506

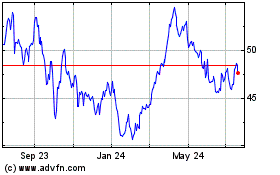

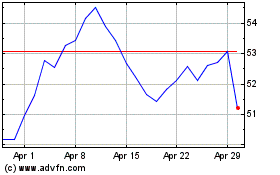

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Devon Energy (NYSE:DVN)

Historical Stock Chart

From Apr 2023 to Apr 2024