As filed with the U.S. Securities and Exchange Commission on February 12, 2015.

Registration No. 333-200874

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

IMMUNOCELLULAR

THERAPEUTICS, LTD.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

2834 |

|

93-1301885 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

23622 Calabasas Road, Suite 300

Calabasas, California 91302

(818) 264-2300

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Andrew Gengos

ImmunoCellular Therapeutics, Ltd.

23622 Calabasas Road, Suite 300

Calabasas, California 91302

(818) 264-2300

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

| Glen Y. Sato

Cooley LLP 3175 Hanover

Street Palo Alto, California 94304

(650) 843-5000 |

|

John D. Hogoboom

Lowenstein Sandler LLP 65

Livingston Avenue Roseland, New Jersey 07068

(973) 597-2500 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration

statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box. ¨

If this form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

If this form is a post-effective amendment filed pursuant to Rule

462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. x (File No. 333-200874)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

This post-effective amendment shall become effective upon filing with the Securities and Exchange

Commission in accordance with Rule 462(d) under the Securities Act of 1933, as amended.

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 (this “Amendment”) relates to the Registrant’s Registration Statement on Form S-1 (File

No. 333-200874), as amended, declared effective on February 11, 2015, by the Securities and Exchange Commission. The Registrant is filing this Amendment for the sole purpose of replacing Exhibit 5.1 to the Registration Statement. This

Amendment does not modify any provision of Part I or Part II of the Registration Statement other than Item 16(a) of Part II as set forth below.

PART II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item 16. Exhibits and Financial Statement Schedules

(a) Exhibits.

See Exhibit Index immediately following the

signature page.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant has duly caused this

Post-Effective Amendment No. 1 to Registration Statement to be signed on its behalf by the undersigned, in Calabasas, California, on this 12th day of February, 2015.

|

|

|

| IMMUNOCELLULAR THERAPEUTICS, LTD. |

|

|

| By: |

|

/s/ Andrew Gengos |

|

|

Andrew Gengos President and Chief Executive

Officer |

Pursuant to the requirements of the Securities Act, this amendment to registration statement has been

signed by the following persons on behalf of the registrant and in the capacities and on the dates indicated:

|

|

|

|

|

| Signature |

|

Title |

|

Date |

|

|

|

| /s/ Andrew Gengos

Andrew Gengos |

|

President, Chief Executive Officer and Director |

|

February 12, 2015 |

|

|

|

| /s/ David Fractor

David Fractor |

|

Principal Financial and Accounting Officer |

|

February 12, 2015 |

|

|

|

| * Richard

Chin, M.D. |

|

Director |

|

February 12, 2015 |

|

|

|

| * Gary S.

Titus |

|

Director |

|

February 12, 2015 |

|

|

|

| * John S. Yu,

M.D. |

|

Director |

|

February 12, 2015 |

|

|

|

| *By: |

|

/s/ Andrew Gengos |

|

|

Andrew Gengos Attorney-in-fact |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 1.1 |

|

Form of Underwriting Agreement** |

|

|

| 2.1 |

|

Agreement and Plan of Reorganization dated as of May 5, 2005, as amended, among Patco Industries Subsidiary, Inc., William C. Patridge, and Spectral Molecular Imaging, Inc., as amended on June 30,

2005, September 26, 2005 and January 20, 2006. (1) |

|

|

| 3.1 |

|

Amended and Restated Certificate of Incorporation of ImmunoCellular Therapeutics, Ltd. (2) |

|

|

| 3.2 |

|

Certificate of Amendment of Amended and Restated Certificate of Incorporation of ImmunoCellular Therapeutics, Ltd. (2) |

|

|

| 3.3 |

|

Certificate of Amendment of Amended and Restated Certificate of Incorporation of ImmunoCellular Therapeutics, Ltd. (3) |

|

|

| 3.4 |

|

Certificate of Amendment of the Amended and Restated Certificate of Incorporation. (28) |

|

|

| 3.5 |

|

Amended and Restated Bylaws of ImmunoCellular Therapeutics, Ltd. (23) |

|

|

| 3.6 |

|

Amendment to the Amended and Restated Bylaws of ImmunoCellular Therapeutics, Ltd. (31) |

|

|

| 3.7 |

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation of ImmunoCellular Therapeutics, Ltd. (38) |

|

|

| 4.1 |

|

Form of Common Stock Certificate for ImmunoCellular Therapeutics, Ltd. (5) |

|

|

| 4.2 |

|

Warrant dated December 3, 2009 issued by ImmunoCellular Therapeutics, Ltd. to Socius Capital Group, LLC d/b/a Socius Life Sciences Capital Group, LLC (20) |

|

|

| 4.3 |

|

Amended Certificate of Designations of Preferences, Rights and Limitations of Series A Preferred Stock dated May 2, 2010. (21) |

|

|

| 4.4 |

|

Form of Warrant issued to participants in the March 2010 private placement to purchase shares of common stock of ImmunoCellular Therapeutics, Ltd. (21) |

|

|

| 4.5 |

|

Form of Warrant issued to participants in the May 2010 private placement to purchase shares of common stock of ImmunoCellular Therapeutics, Ltd. (22) |

|

|

| 4.6 |

|

Warrant dated May 2, 2010 for 1,350,000 shares issued by ImmunoCellular Therapeutics, Ltd. to Socius CG II, Ltd. (21) |

|

|

| 4.7 |

|

Form of Warrant issued to participants in the February 2011 private placement to purchase shares of common stock of ImmunoCellular Therapeutics, Ltd. (24) |

|

|

| 4.8 |

|

Form of Warrant issued to participants in the January 13, 2012 underwritten public offering. (29) |

|

|

| 4.9 |

|

Form of Warrant to purchase shares of common stock ** |

|

|

| 4.10 |

|

Form of Pre-Funded Warrant to purchase shares of common stock** |

|

|

| 5.1 |

|

Opinion of Cooley LLP |

|

|

| 10.1 |

|

Amended and Restated 2006 Equity Incentive Plan of ImmunoCellular Therapeutics, Ltd. (28) |

|

|

| 10.2 |

|

Form of Non-Qualified Stock Option Agreement for the 2006 Equity Incentive Plan of ImmunoCellular Therapeutics, Ltd. (12) |

|

|

| 10.3 |

|

Form of Incentive Stock Option Agreement for the 2006 Equity Incentive Plan of ImmunoCellular Therapeutics, Ltd. (12) |

|

|

| 10.4 |

|

Exclusive License Agreement dated as of November 17, 2006 between Cedars-Sinai Medical Center and ImmunoCellular Therapeutics, Ltd.† (8) |

|

|

| 10.5 |

|

First Amendment to Exclusive License Agreement dated as of June 16, 2008, between Cedars-Sinai Medical Center and ImmunoCellular Therapeutics, Ltd.† (9) |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.6 |

|

Stock Purchase Agreement dated as of November 17, 2006 between Cedars-Sinai Medical Center and ImmunoCellular Therapeutics, Ltd. (8) |

|

|

| 10.7 |

|

Registration Rights Agreement dated as of November 17, 2006 between Cedars-Sinai Medical Center and ImmunoCellular Therapeutics, Ltd. (8) |

|

|

| 10.8 |

|

Securities Purchase Agreement dated as of November 17, 2006 between Dr. John Yu and ImmunoCellular Therapeutics, Ltd. (8) |

|

|

| 10.9 |

|

Agreement dated as of November 17, 2006 between Dr. John Yu and ImmunoCellular Therapeutics, Ltd. (8) |

|

|

| 10.10 |

|

Nonqualified Stock Option Agreement dated as of November 17, 2006 between Dr. John Yu and ImmunoCellular Therapeutics, Ltd. (8) |

|

|

| 10.11 |

|

Registration Rights Agreement dated as of November 17, 2006 between Dr. John Yu and ImmunoCellular Therapeutics, Ltd. (8) |

|

|

| 10.12 |

|

Agreement dated as of February 14, 2008 between Molecular Discoveries, LLC and ImmunoCellular Therapeutics, Ltd. (11) |

|

|

| 10.13 |

|

Registration Rights Agreement dated as of April 14, 2008, between Molecular Discoveries, LLC and ImmunoCellular Therapeutics, Ltd. (15) |

|

|

| 10.14 |

|

Agreement dated as of August 1, 2008 between Dr. Cohava Gelber and ImmunoCellular Therapeutics, Ltd. (17) |

|

|

| 10.15 |

|

Second Amendment dated August 1, 2009 to Exclusive License Agreement dated as of November 17, 2006 between Cedars-Sinai Medical Center and ImmunoCellular Therapeutics, Ltd. (19) |

|

|

| 10.16 |

|

Preferred Stock Purchase Agreement dated as of December 3, 2009 between ImmunoCellular Therapeutics, Ltd. and Socius Capital Group, LLC d/b/a Socius Life Sciences Capital Group, LLC. (20) |

|

|

| 10.17 |

|

Agreement dated March 1, 2010 between Dr. John Yu and ImmunoCellular Therapeutics, Ltd. (25) |

|

|

| 10.18 |

|

Securities Purchase Agreement dated March 11, 2010 between participants in the March 2010 private placement and ImmunoCellular Therapeutics, Ltd. (22) |

|

|

| 10.19 |

|

Form of Registration Rights Agreement dated as of March 29, 2010 between participants in the March 2010 private placement and ImmunoCellular Therapeutics, Ltd. (21) |

|

|

| 10.20 |

|

Modification Agreement dated May 2, 2010 among Socius CG II, Ltd., Socius Life Sciences Capital Group, LLC and ImmunoCellular Therapeutics, Ltd. (21) |

|

|

| 10.21 |

|

Third Amendment dated March 26, 2010 to Exclusive License Agreement dated as of November 17, 2006 between Cedars-Sinai Medical Center and ImmunoCellular Therapeutics, Ltd. (21) |

|

|

| 10.22 |

|

Securities Purchase Agreement dated May 12, 2010 between participants in the May 2010 private placement and ImmunoCellular Therapeutics, Ltd. (22) |

|

|

| 10.23 |

|

Form of Registration Rights Agreement between participants in the May 2010 private placement and ImmunoCellular Therapeutics, Ltd. (22) |

|

|

| 10.24 |

|

Purchase Agreement, dated as of February 22, 2011, by and between the ImmunoCellular Therapeutics, Ltd. and each investor named therein. (24) |

|

|

| 10.25 |

|

Registration Rights Agreement, dated as of February 22, 2011, by and among ImmunoCellular Therapeutics, Ltd. and the investors named therein. (24) |

|

|

| 10.26 |

|

Exclusive Sublicense Agreement dated May 28, 2010 between Targepeutics, Inc. and ImmunoCellular Therapeutics, Ltd. † (26) |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.27 |

|

Sponsored Research and Vaccine Production Agreement dated January 1, 2011 between The Trustees of the University of Pennsylvania and ImmunoCellular Therapeutics, Ltd. † (26) |

|

|

| 10.28 |

|

Placement agent agreement dated March 30, 2010 between Gilford Securities Incorporated and ImmunoCellular Therapeutics, Ltd. (26) |

|

|

| 10.29 |

|

Placement agent agreement dated April 7, 2010 between Scarsdale Equities LLC and ImmunoCellular Therapeutics, Ltd. (26) |

|

|

| 10.30 |

|

Consulting Agreement dated October 1, 2010 between JFS Investments and ImmunoCellular Therapeutics, Ltd. (26) |

|

|

| 10.31 |

|

Advisory services agreement dated October 1, 2010 between Garden State Securities Inc. and ImmunoCellular Therapeutics, Ltd. (26) |

|

|

| 10.32 |

|

Co-placement Agents Agreement dated January 31, 2011 among Summer Street Research Partners, Dawson James Securities, Inc. and ImmunoCellular Therapeutics, Ltd. (26) |

|

|

| 10.33 |

|

Agreement dated as of March 13, 2011 between Dr. John Yu and ImmunoCellular Therapeutics, Ltd. (27) |

|

|

| 10.34 |

|

Patent License Agreement, effective February 10, 2012, among The Trustees of the University of Pennsylvania and ImmunoCellular Therapeutics, Ltd.†(30) |

|

|

| 10.35 |

|

Exclusive License Agreement, effective February 16, 2012, between the Johns Hopkins University and ImmunoCellular Therapeutics, Ltd.†*(30) |

|

|

| 10.36 |

|

Office Lease dated July 1, 2012 between Regent Business Centers and ImmunoCellular Therapeutics, Ltd. (32) |

|

|

| 10.37 |

|

Form of Warrant issued to participants in the October 18, 2012 underwritten public offering.(33) |

|

|

| 10.38 |

|

Employment Agreement dated December 3, 2012 between Andrew Gengos and ImmunoCellular Therapeutics, Ltd. (34) |

|

|

| 10.39 |

|

Form of Stock Option Grant Notice for the 2006 Equity Incentive Plan of ImmunoCellular Therapeutics, Ltd.(34) |

|

|

| 10.40 |

|

Controlled Equity OfferingSM Sales Agreement dated April 18, 2013 between ImmunoCellular Therapeutics, Ltd. and Cantor Fitzgerald & Co. (35) |

|

|

| 10.41 |

|

Form of Indemnity Agreement between ImmunoCellular Therapeutics, Ltd. and each of its directors and executive officers. (36) |

|

|

| 10.42 |

|

Office Lease dated May 13, 2013 between Calabasas/Sorrento Square, LLC and ImmunoCellular Therapeutics, Ltd. (37) |

|

|

| 10.43 |

|

Master Services Agreement dated September 1, 2010 between Averion International Corp. and ImmunoCellular Therapeutics, Ltd. (37) |

|

|

| 10.44 |

|

Employment Agreement dated August 19, 2013 between Anthony Gringeri and ImmunoCellular Therapeutics, Ltd. (39) |

|

|

| 10.45 |

|

Amendment No. 1 to the Exclusive License Agreement between the Johns Hopkins University and ImmunoCellular Therapeutics, Ltd. † (39) |

|

|

| 10.46 |

|

Amended and Restated 2006 Equity Incentive Plan of ImmunoCellular Therapeutics, Ltd. (39) |

|

|

| 10.47 |

|

Amendment No. 1 to Amended and Restated 2006 Equity Incentive Plan of ImmunoCellular Therapeutics, Ltd. (39) |

|

|

| 10.48 |

|

Form of Stock Option Grant Notice for the 2006 Equity Incentive Plan of ImmunoCellular Therapeutics, Ltd. (39) |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.49 |

|

Master Services Agreement dated February 19, 2014 between Aptiv Solutions, Inc. and ImmunoCellular Therapeutics, Ltd. (40) |

|

|

| 23.1 |

|

Consent of Marcum LLP.** |

|

|

| 23.2 |

|

Consent of Cooley LLP (included in Exhibit 5.1) |

|

|

| 24.1 |

|

Power of Attorney** |

| † |

Certain portions of the exhibit have been omitted based upon a request for confidential treatment filed by us with the Securities and Exchange Commission. The omitted portions of the exhibit have been separately filed

by us with the Securities and Exchange Commission. |

| (1) |

Previously filed by us on January 26, 2006 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (2) |

Previously filed by us on November 3, 2006 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (3) |

Previously filed by us on May 9, 2007 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (4) |

Previously filed by us on February 6, 2006 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (5) |

Previously filed by us on February 12, 2007 as an exhibit to our Registration Statement on Form SB-2, File No. 333-140598, and incorporated herein by reference. |

| (6) |

Previously filed by us on May 1, 2007 as an exhibit to our Registration Statement on Form SB-2, File No. 333-142480, and incorporated herein by reference. |

| (7) |

Previously filed by us on July 12, 2007 as an exhibit to our Registration Statement on Form SB-2, File No. 333-144521, and incorporated herein by reference |

| (8) |

Previously filed by us on November 22, 2006 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (9) |

Previously filed by us on August 14, 2008 as an exhibit to our Quarterly Report on Form 10-Q and incorporated herein by reference. |

| (10) |

Previously filed by us on September 14, 2007 as an exhibit to our Registration Statement on Form SB-2/A, File No. 333-144521 and incorporated herein by reference. |

| (11) |

Previously filed by us on March 25, 2008 as an exhibit to our Annual Report on Form 10-KSB and incorporated herein by reference. |

| (12) |

Previously filed by us on November 9, 2007 as an exhibit to our Registration Statement on Form S-8, File No. 333-147278, and incorporated herein by reference. |

| (13) |

Previously filed by us on November 6, 2007 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (14) |

Previously filed by us on April 2, 2007 as an exhibit to our Annual Report on Form 10-KSB and incorporated herein by reference. |

| (15) |

Previously filed by us on April 16, 2008 as an exhibit to our Registration Statement on Form S-1, File No. 333-150277, and incorporated herein by reference. |

| (16) |

Previously filed by us on November 13, 2008 as an exhibit to our Quarterly Report on Form 10-Q and incorporated herein by reference. |

| (17) |

Previously filed by us on March 30, 2009 as an exhibit to our Annual Report on Form 10-K and incorporated herein by reference. |

| (18) |

Previously filed by us on August 14, 2009 as an exhibit to our Quarterly Report on Form 10-Q and incorporated herein by reference. |

| (19) |

Previously filed by us on November 13, 2009 as an exhibit to our Quarterly Report on Form 10-Q and incorporated herein by reference. |

| (20) |

Previously filed by us on December 7, 2009 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (21) |

Previously filed by us on May 12, 2010 as an exhibit to our Registration Statement on Form S-1 to SB-2, File No. 333-144521 and incorporated herein by reference. |

| (22) |

Previously filed by us on May 18, 2010 as an exhibit to our Quarterly Report on Form 10-Q and incorporated herein by reference. |

| (23) |

Previously filed by us on January 11, 2011 as an exhibit to our Registration Statement on Form S-8, File No. 333-171652 and incorporated herein by reference. |

| (24) |

Previously filed by us on February 25, 2011 as an exhibit to our current report on Form 8-K and incorporated herein by reference. |

| (25) |

Previously filed by us on March 31, 2010 as an exhibit to our Annual Report on Form 10-K and incorporated herein by reference. |

| (26) |

Previously filed by us on March 31, 2011 as an exhibit to our Annual Report on Form 10-K and incorporated herein by reference. |

| (27) |

Previously filed by us on August 18, 2011 as an exhibit to our Quarterly Report on Form 10-Q and incorporated herein by reference. |

| (28) |

Previously filed by us on November 14, 2011 as an exhibit to our Quarterly Report on Form 10-Q and incorporated herein by reference. |

| (29) |

Previously filed by us on January 10, 2012 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (30) |

Previously filed by us on March 21, 2012 as an exhibit to our Annual Report on Form 10-K and incorporated herein by reference. |

| (31) |

Previously filed by us on May 25, 2012 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (32) |

Previously filed by us on August 14, 2012 as an exhibit to our Quarterly Report on Form 10-Q and incorporated herein by reference. |

| (33) |

Previously filed by us on October 19, 2012 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (34) |

Previously filed by us on March 11, 2013 as an exhibit to our Annual Report on Form 10-K and incorporated herein by reference. |

| (35) |

Previously filed by us on April 18, 2013 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (36) |

Previously filed by us on May 10, 2013 as an exhibit to our Quarterly Report on Form 10-Q and incorporated herein by reference. |

| (37) |

Previously filed by us on August 8, 2013 as an exhibit to our Quarterly Report on Form 10-Q and incorporated herein by reference. |

| (38) |

Previously filed by us on September 24, 2013 as an exhibit to our Current Report on Form 8-K and incorporated herein by reference. |

| (39) |

Previously filed by us on November 7, 2013 as an exhibit to our Quarterly Report on Form 10-Q and incorporated herein by reference. |

| (40) |

Previously filed by us on March 14, 2014 as an exhibit to our Annual Report on Form 10-K and incorporated herein by reference. |

Exhibit 5.1

Glen Y. Sato

T: +1 650 843 5502

gsato@cooley.com

February 12, 2015

ImmunoCellular Therapeutics, Ltd.

23622 Calabasas Road, Suite

300

Calabasas, California 91302

Ladies and Gentlemen:

We have acted as counsel to ImmunoCellular Therapeutics, Ltd., a Delaware corporation, (the “Company”), in connection with the filing

of a Post-Effective Amendment No. 1 to a registration statement (No. 333-200874) on Form S-1 (the “Registration Statement”) with the Securities and Exchange Commission pursuant to Rule 462(d) of Regulation C under the

Securities Act of 1933, including a related prospectus filed with the Registration Statement (the “Prospectus”), covering an underwritten public offering of up to 26,650,000 shares of the Company’s common stock, par

value $0.0001 per share (the “Shares”), and warrants (the “Warrants”) to purchase up to 18,655,000 shares of common stock (the “Warrant Shares”). The Shares, the Warrants and

the Warrant Shares are to be sold by the Company as described in the Registration Statement.

In connection with this opinion, we have examined and relied

upon (a) the Registration Statement and the related Prospectus, (b) the Company’s Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws, each as currently in effect, and (c) the originals or copies

certified to our satisfaction of such other documents, records, certificates, memoranda and other instruments as we deem necessary or appropriate to enable us to render the opinion expressed below. We have assumed the genuineness and authenticity of

all documents submitted to us as originals, and the conformity to originals of all documents submitted to us as copies thereof. As to certain factual matters, we have relied upon certificates of officers of the Company and have not sought to

independently verify such matters.

Our opinion is expressed only with respect to the federal laws of the United States of America, the General

Corporation Law of the State of Delaware and, as to the Warrants constituting valid and legally binding obligations of the Company, solely with respect to the laws of the State of New York. We express no opinion as to whether the laws of any

particular jurisdiction apply and no opinion to the extent that the laws of any jurisdiction other than those identified above are applicable to the subject matter hereof. We are not rendering any opinion as to compliance with any federal or state

antifraud law, rule or regulation relating to securities, or to the sale or issuance thereof.

On the basis of the foregoing, and in reliance thereon, we

are of the opinion (i) that the Shares, when sold in accordance with the Registration Statement and the Prospectus, will be validly issued, fully paid and nonassessable, (ii) provided that the Warrants have been duly executed and delivered

by the Company and duly delivered to the purchasers thereof against payment therefor, the Warrants, when issued and sold as contemplated in the Registration Statement and the Prospectus will be valid and legally binding obligations of the Company,

enforceable

Immunocellular Therapeutics, Ltd.

Page Two

against the Company in accordance with their terms, except as enforcement thereof may be limited by bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium or other similar laws

relating to or affecting creditors’ rights generally and by general equitable principles and limitations on availability of equitable relief, including specific performance (regardless of whether such enforceability is considered in a

proceeding at law or in equity), and (iii) the Warrant Shares, when issued and paid for in accordance with the terms of the Warrants and as contemplated by the Registration Statement and the Prospectus, will be validly issued, fully paid and

nonassessable.

We consent to the reference to our firm under the caption “Legal Matters” in the Prospectus included in the Registration

Statement and to the filing of this opinion as an exhibit to the Registration Statement. This opinion is expressed as of the date hereof, and we disclaim any undertaking to advise you of any subsequent changes in the facts stated or assumed herein

or of any subsequent changes in applicable law.

Sincerely,

Cooley LLP

/s/ Glen Y. Sato

Glen Y. Sato

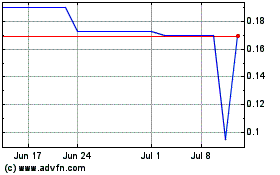

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Mar 2024 to Apr 2024

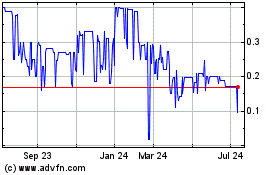

EOM Pharmaceutical (PK) (USOTC:IMUC)

Historical Stock Chart

From Apr 2023 to Apr 2024