UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 12, 2015

|

Alnylam

Pharmaceuticals, Inc.

|

|

(Exact

Name of Registrant as Specified in Charter)

|

|

Delaware

|

001-36407

|

77-0602661

|

|

(State

or Other Jurisdiction

of

Incorporation)

|

(Commission

File

Number)

|

(IRS Employer

Identification No.)

|

|

300

Third Street, Cambridge, MA

|

02142

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (617) 551-8200

|

Not applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the

appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2.

below):

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On February 12, 2015, Alnylam Pharmaceuticals, Inc. announced its

financial results for the quarter and year ended December 31, 2014. The

full text of the press release issued in connection with the

announcement is furnished as Exhibit 99.1 to this Current Report on Form

8-K.

The information in this Form 8-K (including Exhibit 99.1) shall not be

deemed "filed" for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the "Exchange Act"), or otherwise subject to the

liabilities of that section, nor shall it be deemed incorporated by

reference in any filing under the Securities Act of 1933, as amended, or

the Exchange Act, except as expressly set forth by specific reference in

such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following exhibit relating to Item 2.02 shall be deemed to be

furnished, and not filed:

99.1 Press Release dated February 12, 2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

Date: February 12, 2015

|

ALNYLAM

PHARMACEUTICALS, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ Michael P. Mason

|

|

|

|

|

Michael P. Mason

|

|

|

|

|

Vice President, Finance and Treasurer

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

|

|

99.1

|

|

Press Release dated February 12, 2015

|

|

Exhibit 99.1

Alnylam

Pharmaceuticals Reports Fourth Quarter and Full Year 2014 Financial

Results and Highlights Recent Period Progress

–

Introduced Pipeline Growth Strategy for RNAi Therapeutics in Three

Strategic Therapeutic Areas, or “STArs,” and Launched “Alnylam 2020”

Guidance for Advancement and Commercialization of RNAi Therapeutics –

–

Presented Positive Data from Multiple Clinical Programs, Including

Initial Evidence of Potential Disease Modifying Effects with Patisiran

and ALN-AT3 –

–

Advanced Revusiran into ENDEAVOUR Phase 3 Trial and Added Three New

Programs into Clinical Stages –

–

Maintained Strong Balance Sheet with $882 Million in Cash and Expects to

End 2015 with Greater than $1.2 Billion in Cash –

CAMBRIDGE, Mass.--(BUSINESS WIRE)--February 12, 2015--Alnylam

Pharmaceuticals, Inc. (Nasdaq: ALNY), a leading RNAi therapeutics

company, today reported its consolidated financial results for the

fourth quarter and full year 2014, and highlighted recent progress in

advancing its pipeline.

“Alnylam made excellent progress in the fourth quarter of 2014 and the

recent period, as we continued advancing RNAi therapeutics in clinical

studies. Amongst other highlights, we reported clinical data from our

patisiran and ALN-AT3 programs showing what we believe to be early

evidence for the translation of RNAi-mediated knockdown into potential

clinical benefit for patients. We also executed on our pipeline goals,

with strong enrollment in our patisiran APOLLO Phase 3 study and

advancement of revusiran into our ENDEAVOUR Phase 3 trial. In addition,

we filed three Clinical Trial Applications for ALN-PCSsc, ALN-CC5, and

ALN-AS1, and have initiated Phase 1 studies for two of those programs,”

said John Maraganore, Ph.D., Chief Executive Officer of Alnylam.

“Alnylam also introduced its pipeline growth strategy and new guidance.

Specifically, Alnylam intends to advance its pipeline in three Strategic

Therapeutic Areas, or ‘STArs’ – Genetic Medicines, Cardio-Metabolic

Disease, and Hepatic Infectious Disease – where we believe there are

significant opportunities for RNAi therapeutics as high impact

medicines. Further, with ‘Alnylam 2020’ we have launched new guidance

that marks our expected transition from a late-stage clinical

development company to a multi-product commercial-stage company with a

sustainable development pipeline – a profile that we believe has rarely

been achieved in the biopharmaceutical industry.”

“Alnylam continues to maintain a very strong balance sheet, ending 2014

with approximately $882 million in cash,” said Michael Mason, Vice

President, Finance & Treasurer. “We also further strengthened our

balance sheet earlier this year with a public offering and concurrent

private placements from Genzyme that resulted in net proceeds of

approximately $567 million. This financing results in a balance sheet

that allows us to invest in a broad pipeline of RNAi therapeutics across

all three STArs, which we believe should enable us to achieve our

‘Alnylam 2020’ guidance. As for financial guidance this year, we expect

to end 2015 with greater than $1.2 billion in cash.”

Fourth Quarter 2014 and Recent Significant Corporate Highlights

-

Introduced pipeline growth strategy for RNAi therapeutics in three

Strategic Therapeutic Areas (STArs): Genetic Medicines, with a broad

pipeline of RNAi therapeutics for the treatment of rare diseases;

Cardio-Metabolic Disease, with a pipeline of RNAi therapeutics toward

genetically validated, liver-expressed disease targets for unmet needs

in dyslipidemia, hypertension, non-alcoholic steatohepatitis (NASH),

and type 2 diabetes; and Hepatic Infectious Disease, with a pipeline

of RNAi therapeutics that address the major global health challenges

of hepatic infectious diseases.

-

Launched “Alnylam 2020” Guidance for advancement and intended

commercialization of RNAi Therapeutics. Specifically, by the end of

2020, Alnylam expects to achieve a company profile with 3 marketed

products, 10 RNAi therapeutic clinical programs – including 4 in late

stages of development – across its 3 STArs.

-

Advanced pipeline programs in Genetic Medicine STAr.

-

Advanced investigational RNAi therapeutic programs for the

treatment of transthyretin (TTR)-mediated amyloidosis (ATTR).

-

Continued enrollment in APOLLO Phase 3 study of patisiran in

ATTR patients with Familial Amyloidotic Polyneuropathy (FAP)

-

Reported positive six-month clinical data from patisiran Phase

2 open-label extension (OLE) study, showing tolerability,

sustained TTR knockdown, and promising initial evidence for

potential stabilization of neuropathy progression.

-

Initiated ENDEAVOUR Phase 3 study with revusiran. ENDEAVOUR is

a randomized, double-blind, placebo-controlled, global study

designed to evaluate the efficacy and safety of revusiran in

ATTR patients with Familial Amyloidotic Cardiomyopathy (FAC).

-

Presented positive initial Phase 2 data with revusiran, with

up to 98.2% knockdown of serum TTR; revusiran administration

was found to be generally well tolerated in patients with

advanced cardiac disease.

-

Initiated Phase 2 OLE study with revusiran to evaluate

tolerability and clinical activity with long-term dosing for

up to two years.

-

Reported positive initial results from Phase 1 trial of ALN-AT3,

including initial evidence for the potential correction of the

hemophilia phenotype with an up to 334% increase in thrombin

generation and marked improvement in whole blood clotting.

-

Initiated Phase 1/2 trial with ALN-CC5. The trial is being

conducted initially in normal human volunteers, and then in

patients with paroxysmal nocturnal hemoglobinuria (PNH).

-

Filed Clinical Trial Application (CTA) to initiate a Phase 1 trial

with ALN-AS1 in acute intermittent porphyria (AIP) patients who

are asymptomatic “high excreters” (ASHE), and then in AIP patients

who experience recurrent porphyria attacks.

-

Expanded Genetic Medicine pipeline with ALN-GO1, an

investigational RNAi therapeutic targeting glycolate oxidase (GO)

in development for the treatment of Primary Hyperoxaluria Type 1

(PH1).

-

Advanced pipeline programs in Cardio-Metabolic Disease STAr

-

Initiated Phase 1 trial with ALN-PCSsc in normal human volunteers

with elevated LDL-C at baseline.

-

Advanced pipeline programs in Hepatic Infectious Disease STAr

-

Selected Development Candidate (DC) for ALN-HBV, showing an up to

3.9 log10 knockdown of hepatitis surface antigen

(HBsAg) after a single subcutaneous dose in a rodent model of HBV

infection.

-

Expanded Hepatic Infectious Disease pipeline with ALN-HDV for

Hepatitis Delta Virus (HDV) infection and ALN-PDL for chronic

liver infections.

-

Formed new agreement with Isis Pharmaceuticals, extending the

companies’ decade-long alliance to lead the development and

commercialization of RNA therapeutics.

-

Completed successful public offering of common stock, with concurrent

private placements from Genzyme, totaling $567 million in net proceeds.

-

Announced changes to Board of Directors and Management Team

-

Alnylam elected Michael W. Bonney to its Board of Directors.

-

Alnylam announces today certain promotions and appointments,

including:

-

Akshay Vaishnaw, M.D., Ph.D. to the position of Executive Vice

President of Research & Development and Chief Medical Officer

from the position of Executive Vice President, Chief Medical

Officer.

-

Rachel Meyers, Ph.D. to the position of Senior Vice President

of Research from the position of Vice President of Research &

RNAi Lead Development.

-

Kevin Fitzgerald, Ph.D. to the position of Vice President of

Research from the position of Senior Director of Research.

-

Pushkal Garg, M.D. to the position of Senior Vice President,

Clinical Development.

-

Eric Green to the position of Vice President, General Manager,

TTR Program.

-

Marcie Ruddy, M.D. to the position of Vice President, Drug

Safety & Pharmacovigilance.

-

In addition, Alnylam announced the planned departure of Laurence

Reid, Ph.D., who held the position of Senior Vice President, Chief

Business Officer.

Upcoming Events in Early and Mid-2015

-

Alnylam announces today that it plans to present 12-month OLE study

data with patisiran at the American Academy of Neurology 67th

Annual Meeting, being held April 18 – 25, 2015 in Washington, D.C., in

an oral presentation on Tuesday, April 21 at 1:30 p.m. ET.

-

The company also announces today that it plans to present additional

clinical results from the Phase 2 trial of revusiran at the American

College of Cardiology (ACC) 64th Annual Scientific Session

& Expo, being held March 14 – 16, 2015 in San Diego, California, in a

poster presentation on Sunday, March 15 at 1:30 p.m. PT (4:30 p.m. ET).

-

Also at the ACC meeting, Alnylam plans to present results of a natural

history study of patients with TTR cardiac amyloidosis in a meeting

with clinicians from the Association of Black Cardiologists on Sunday,

March 15.

-

In addition, during early and mid-2015, Alnylam plans to:

-

Present additional data from Phase 1 trial of ALN-AT3 in

development for the treatment of hemophilia and rare bleeding

disorders

-

Present initial data from the Phase 1/2 trial of ALN-CC5 in

development for the treatment of complement-mediated diseases

-

Initiate Phase 1 trial of ALN-AS1 in development for the treatment

of hepatic porphyrias

-

Present initial data from Phase 1 trial of ALN-PCSsc in

development for the treatment of hypercholesterolemia

-

File CTA for ALN-AAT in development for the treatment of alpha-1

antitrypsin (AAT) deficiency-associated liver disease

-

Select DC for ALN-GO1 in development for the treatment of PH1

Financials

Cash, Cash Equivalents and Total Marketable Securities

At December 31, 2014, Alnylam had cash, cash equivalents and total

marketable securities of $881.9 million, as compared to $350.5 million

at December 31, 2013.

In January 2015, Alnylam sold an aggregate of 5,447,368 shares of its

common stock through an underwritten public offering at a price to the

public of $95.00 per share. As a result of the offering, Alnylam

received aggregate net proceeds of approximately $496.4 million.

In January 2015, in connection with our public offering described above,

Genzyme exercised its right under the investor agreement between Alnylam

and Genzyme, to purchase, in concurrent private placements, 744,566

shares of common stock, at the public offering price of $95.00 per

share, resulting in proceeds to Alnylam of approximately $70.7 million.

The exercise of this right allowed Genzyme to maintain its current

ownership level of Alnylam common stock of approximately 12%.

Non-GAAP Net Loss

The non-GAAP net loss for the year ended December 31, 2014 was $139.6

million, or $1.88 per share on both a basic and diluted basis as

compared to a non-GAAP net loss of $89.2 million, or $1.45 per share on

both a basic and diluted basis for the prior year. The non-GAAP net loss

for the year ended December 31, 2014 excludes the $220.8 million charge

to in-process research and development expense in connection with the

purchase of the Sirna RNAi assets from Merck, described below.

GAAP Net Loss

The net loss according to GAAP for the fourth quarter of 2014 was $21.4

million, or $0.28 per share on both a basic and diluted basis (including

$13.4 million, or $0.17 per share of non-cash stock-based compensation

expense), as compared to a net loss of $32.4 million, or $0.51 per share

on both a basic and diluted basis (including $5.4 million, or $0.09 per

share of non-cash stock-based compensation expense), for the same period

in the previous year. For the year ended December 31, 2014, the net loss

was $360.4 million, or $4.85 per share (including $33.1 million, or

$0.45 per share of non-cash stock-based compensation expense), as

compared to a net loss of $89.2 million, or $1.45 per share (including

$20.7 million, or $0.34 per share of non-cash stock-based compensation

expense), for the same period in the previous year. The increase in net

loss for the year ended December 31, 2014 compared to the prior year

resulted primarily from a $220.8 million charge to in-process research

and development expense in connection with the purchase of the Sirna

RNAi assets from Merck, described below.

Revenues

Revenues were $24.0 million for the fourth quarter of 2014, as compared

to $10.8 million for the same period last year. Revenues for the fourth

quarter of 2014 included $8.8 million in revenues from the company’s

collaboration with Monsanto, $6.9 million of revenues related to the

company’s collaboration with The Medicines Company, $5.5 million of

revenues from the company’s alliance with Takeda Pharmaceuticals Company

Limited, and $2.8 million of revenues from research reagent licenses and

other sources. Revenues were $50.6 million for the year ended December

31, 2014, as compared to $47.2 million for the prior year. Revenues for

the year ended December 31, 2014 included $22.0 million of revenues

related to the company’s collaboration with Takeda, $15.0 million of

revenues related to the company’s collaboration with Monsanto, $10.8

million of revenues related to the company’s collaboration with The

Medicines Company, and $2.8 million of revenues from research reagent

licenses and other sources.

Research and Development Expenses

Research and development (R&D) expenses were $55.5 million in the fourth

quarter of 2014, which included $8.2 million of non-cash stock-based

compensation, as compared to $32.1 million in the fourth quarter of

2013, which included $3.3 million of non-cash stock-based compensation.

R&D expenses were $190.2 million for the year ended December 31, 2014,

which included $18.2 million of non-cash stock-based compensation, as

compared to $113.0 million for the prior year, which included $14.4

million of non-cash stock-based compensation. The increase in R&D

expenses for the quarter and year ended December 31, 2014 as compared to

the prior year periods was due primarily to additional expenses

associated with the significant advancement of certain of the company’s

clinical and pre-clinical programs. The company expects that R&D

expenses will increase significantly in 2015 as it continues to advance

and expand its pipeline across its three STArs.

In-Process Research and Development Expense

In 2014, the company incurred a $220.8 million charge to in-process

research and development expense in connection with the purchase of the

Sirna RNAi assets from Merck. In future periods, there will be no

additional charges recorded to in-process research and development

related to this purchase of the Sirna RNAi assets from Merck.

General and Administrative Expenses

General and administrative (G&A) expenses were $14.2 million in the

fourth quarter of 2014, which included $5.2 million of non-cash

stock-based compensation, as compared to $8.3 million in the fourth

quarter of 2013, which included $2.1 million of non-cash stock-based

compensation. G&A expenses were $44.5 million for the year ended

December 31, 2014, which included $14.8 million of non-cash stock-based

compensation, as compared to $27.2 million in 2013, which included $6.3

million of non-cash stock-based compensation. G&A expenses for the

quarter and year ended December 31, 2014 as compared to the prior year

periods increased due primarily to an increase in non-cash stock-based

compensation expenses. In addition, consulting and professional services

increased during the year ended December 31, 2014 as compared to the

prior year related to general business activities and certain

professional services. The company expects that G&A expenses will

increase slightly in 2015.

Benefit from (Provision for) Income Taxes

The company had a benefit from income taxes of $22.1 million for the

fourth quarter of 2014 as compared to a provision for income taxes of

$3.0 million for the fourth quarter of 2013. The company’s benefit from

income taxes was $40.2 million for the year ended December 31, 2014, as

compared to $2.7 million for the prior year. The increase during the

quarter and year ended December 31, 2014 as compared to the prior year

periods was due primarily to the corresponding income tax expense

associated with the increase in the value of our investment in Regulus,

as well as the difference between the value of stock and the cash

proceeds received from Genzyme for the issuance of our common stock. The

corresponding income tax expense has been recorded in other

comprehensive income and additional paid-in capital, respectively.

Investment in Regulus Therapeutics

The company accounts for its investment in Regulus at fair value by

adjusting the value to reflect fluctuations in Regulus’ stock price each

reporting period. At December 31, 2014, the fair market value of the

company’s investment in Regulus was $94.6 million as compared to $45.5

million at December 31, 2013.

2015 Financial Guidance

Alnylam expects that its cash, cash equivalents, and total marketable

securities balance will be greater than $1.2 billion at December 31,

2015.

Conference Call Information

Management will provide an update

on the company, discuss fourth quarter and 2014 results, and discuss

expectations for the future via conference call on Thursday, February

12, 2015 at 4:30 p.m. ET. To access the call, please dial

877-312-7507 (domestic) or 631-813-4828 (international) five minutes

prior to the start time and refer to conference ID 82620462. A replay of

the call will be available beginning at 7:30 p.m. ET on February 12,

2015. To access the replay, please dial 855-859-2056 (domestic) or

404-537-3406 (international), and refer to conference ID 82620462.

About RNAi

RNAi (RNA interference) is a revolution in biology,

representing a breakthrough in understanding how genes are turned on and

off in cells, and a completely new approach to drug discovery and

development. Its discovery has been heralded as “a major scientific

breakthrough that happens once every decade or so,” and represents one

of the most promising and rapidly advancing frontiers in biology and

drug discovery today which was awarded the 2006 Nobel Prize for

Physiology or Medicine. RNAi is a natural process of gene silencing that

occurs in organisms ranging from plants to mammals. By harnessing the

natural biological process of RNAi occurring in our cells, the creation

of a major new class of medicines, known as RNAi therapeutics, is on the

horizon. Small interfering RNA (siRNA), the molecules that mediate RNAi

and comprise Alnylam's RNAi therapeutic platform, target the cause of

diseases by potently silencing specific mRNAs, thereby preventing

disease-causing proteins from being made. RNAi therapeutics have the

potential to treat disease and help patients in a fundamentally new way.

About GalNAc Conjugates and Enhanced Stabilization Chemistry (ESC)

GalNAc Conjugates

GalNAc-siRNA conjugates are a proprietary

Alnylam delivery platform and are designed to achieve targeted delivery

of RNAi therapeutics to hepatocytes through uptake by the

asialoglycoprotein receptor. Alnylam’s Enhanced Stabilization Chemistry

(ESC) GalNAc-conjugate technology enables subcutaneous dosing with

increased potency, durability, and a wide therapeutic index, and is

being employed in several of Alnylam’s genetic medicine programs,

including programs in clinical development.

About LNP Technology

Alnylam has licenses to Tekmira LNP

intellectual property for use in RNAi therapeutic products using LNP

technology.

About Alnylam Pharmaceuticals

Alnylam is a biopharmaceutical

company developing novel therapeutics based on RNA interference, or

RNAi. The company is leading the translation of RNAi as a new class of

innovative medicines. Alnylam’s pipeline of investigational RNAi

therapeutics is focused in 3 Strategic Therapeutic Areas (STArs):

Genetic Medicines, with a broad pipeline of RNAi therapeutics for the

treatment of rare diseases; Cardio-Metabolic Disease, with a pipeline of

RNAi therapeutics toward genetically validated, liver-expressed disease

targets for unmet needs in cardiovascular and metabolic diseases; and

Hepatic Infectious Disease, with a pipeline of RNAi therapeutics that

address the major global health challenges of hepatic infectious

diseases. In early 2015, Alnylam launched its “Alnylam 2020” guidance

for the advancement and commercialization of RNAi therapeutics as a

whole new class of innovative medicines. Specifically, by the end of

2020, Alnylam expects to achieve a company profile with 3 marketed

products, 10 RNAi therapeutic clinical programs – including 4 in late

stages of development – across its 3 STArs. The company’s demonstrated

commitment to RNAi therapeutics has enabled it to form major alliances

with leading companies including Merck, Medtronic, Novartis, Biogen

Idec, Roche, Takeda, Kyowa Hakko Kirin, Cubist, GlaxoSmithKline,

Ascletis, Monsanto, The Medicines Company, and Genzyme, a Sanofi

company. In addition, Alnylam holds an equity position in Regulus

Therapeutics Inc., a company focused on discovery, development, and

commercialization of microRNA therapeutics. Alnylam scientists and

collaborators have published their research on RNAi therapeutics in over

200 peer-reviewed papers, including many in the world’s top scientific

journals such as Nature, Nature Medicine, Nature Biotechnology, Cell,

New England Journal of Medicine, and The Lancet. Founded in

2002, Alnylam maintains headquarters in Cambridge, Massachusetts. For

more information about Alnylam’s pipeline of investigational RNAi

therapeutics, please visit www.alnylam.com.

Alnylam Forward Looking Statements

Various statements in this

release concerning Alnylam’s future expectations, plans and prospects,

including without limitation, Alnylam’s expectations regarding its

“Alnylam 2020” guidance, Alnylam’s views with respect to the potential

for RNAi therapeutics, including patisiran, revusiran, ALN-AT3, ALN-CC5,

ALN-PCSsc, ALN-AS1, ALN-AAT, ALN-HBV, and ALN-GO1, its expectations with

respect to the timing, execution, and success of its clinical and

pre-clinical trials, the expected timing of regulatory filings,

including its plan to file IND or IND equivalent applications and/or

initiate clinical trials for ALN-AS1 and ALN-AAT, , its expectations

regarding reporting of data from its clinical and pre-clinical studies,

including its studies for patisiran, revusiran, ALN-AT3, ALN-CC5, and

ALN-PCSsc, as well as other research programs and technologies, its

plans regarding commercialization of RNAi therapeutics, and Alnylam’s

expected cash position as of December 31, 2015, constitute

forward-looking statements for the purposes of the safe harbor

provisions under The Private Securities Litigation Reform Act of 1995.

Actual results may differ materially from those indicated by these

forward-looking statements as a result of various important factors,

including, without limitation, Alnylam’s ability to manage operating

expenses, Alnylam’s ability to discover and develop novel drug

candidates and delivery approaches, successfully demonstrate the

efficacy and safety of its drug candidates, the pre-clinical and

clinical results for its product candidates, which may not be replicated

or continue to occur in other subjects or in additional studies or

otherwise support further development of product candidates, actions of

regulatory agencies, which may affect the initiation, timing and

progress of clinical trials, obtaining, maintaining and protecting

intellectual property, Alnylam’s ability to enforce its patents against

infringers and defend its patent portfolio against challenges from third

parties, obtaining regulatory approval for products, competition from

others using technology similar to Alnylam’s and others developing

products for similar uses, Alnylam’s ability to obtain additional

funding to support its business activities and establish and maintain

strategic business alliances and new business initiatives, Alnylam’s

dependence on third parties for development, manufacture, marketing,

sales and distribution of products, the outcome of litigation, and

unexpected expenditures, as well as those risks more fully discussed in

the “Risk Factors” filed with Alnylam’s most recent Quarterly Report on

Form 10-Q filed with the Securities and Exchange Commission (SEC) and in

other filings that Alnylam makes with the SEC. In addition, any

forward-looking statements represent Alnylam’s views only as of today

and should not be relied upon as representing its views as of any

subsequent date. Alnylam explicitly disclaims any obligation to update

any forward-looking statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALNYLAM PHARMACEUTICALS, INC.

|

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

INCOME (LOSS)

|

|

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

Three Months Ended

December 31,

|

|

|

|

Year Ended

December 31,

|

|

|

|

|

|

2014

|

|

|

2013

|

|

|

|

2014

|

|

|

2013

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues from collaborators

|

|

|

|

$

|

24,019

|

|

|

$

|

10,847

|

|

|

|

$

|

50,561

|

|

|

$

|

47,167

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development (1)

|

|

|

|

|

55,546

|

|

|

|

32,106

|

|

|

|

|

190,249

|

|

|

|

112,957

|

|

In-process research and development

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

220,766

|

|

|

|

—

|

|

General and administrative (1)

|

|

|

|

|

14,185

|

|

|

|

8,333

|

|

|

|

|

44,526

|

|

|

|

27,152

|

|

Total operating expenses

|

|

|

|

|

69,731

|

|

|

|

40,439

|

|

|

|

|

455,541

|

|

|

|

140,109

|

|

Loss from operations

|

|

|

|

|

( 45,712)

|

|

|

|

(29,592)

|

|

|

|

|

(404,980)

|

|

|

|

(92,942)

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

|

|

780

|

|

|

|

285

|

|

|

|

|

2,559

|

|

|

|

1,069

|

|

Other income (expense)

|

|

|

|

|

1,452

|

|

|

|

(29)

|

|

|

|

|

1,817

|

|

|

|

(47)

|

|

Total other income

|

|

|

|

|

2,232

|

|

|

|

256

|

|

|

|

|

4,376

|

|

|

|

1,022

|

|

Loss before income taxes

|

|

|

|

|

(43,480)

|

|

|

|

(29,336)

|

|

|

|

|

(400,604)

|

|

|

|

(91,920)

|

|

Benefit from (provision for) income taxes

|

|

|

|

|

22,091

|

|

|

|

(3,021)

|

|

|

|

|

40,209

|

|

|

|

2,695

|

|

Net loss

|

|

|

|

$

|

(21,389)

|

|

|

$

|

(32,357)

|

|

|

|

$

|

(360,395)

|

|

|

$

|

(89,225)

|

|

Net loss per common share - basic and diluted

|

|

|

|

$

|

(0.28)

|

|

|

$

|

(0.51)

|

|

|

|

$

|

(4.85)

|

|

|

$

|

(1.45)

|

|

Weighted average common shares used to compute basic and diluted net

loss per common share

|

|

|

|

|

76,957

|

|

|

|

62,909

|

|

|

|

|

74,278

|

|

|

|

61,551

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

|

$

|

(21,389)

|

|

|

$

|

(32,357)

|

|

|

|

$

|

(360,395)

|

|

|

$

|

(89,225)

|

|

Unrealized gain (loss) on marketable securities, net of tax

|

|

|

|

|

35,091

|

|

|

|

(7,451)

|

|

|

|

|

31,127

|

|

|

|

4,055

|

|

Reclassification adjustment for realized gain on marketable

securities included in net loss

|

|

|

|

|

(1,514)

|

|

|

|

—

|

|

|

|

|

(2,081)

|

|

|

|

—

|

|

Comprehensive income (loss)

|

|

|

|

$

|

12,188

|

|

|

$

|

(39,808)

|

|

|

|

$

|

(331,349)

|

|

|

$

|

(85,170)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Non-cash stock-based compensation expenses included in

operating expenses are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

|

$

|

8,214

|

|

|

$

|

3,277

|

|

|

|

$

|

18,233

|

|

|

$

|

14,369

|

|

General and administrative

|

|

|

|

|

5,224

|

|

|

|

2,129

|

|

|

|

|

14,828

|

|

|

|

6,334

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALNYLAM PHARMACEUTICALS, INC.

|

|

UNAUDITED GAAP TO NON-GAAP RECONCILIATION: NET LOSS AND NET LOSS

PER SHARE

|

|

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31,

|

|

|

|

Year Ended

December 31,

|

|

|

|

|

|

2014

|

|

|

2013

|

|

|

|

2014

|

|

|

2013

|

|

GAAP net loss

|

|

|

|

$

|

(21,389)

|

|

|

$

|

(32,357)

|

|

|

|

$

|

(360,395)

|

|

|

$

|

(89,225)

|

|

Adjustment:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

In-process research and development

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

220,766

|

|

|

|

—

|

|

Non-GAAP net loss

|

|

|

|

$

|

(21,389)

|

|

|

$

|

(32,357)

|

|

|

|

$

|

(139,629)

|

|

|

$

|

(89,225)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss per common share - basic and diluted

|

|

|

|

$

|

(0.28)

|

|

|

$

|

(0.51)

|

|

|

|

$

|

(4.85)

|

|

|

$

|

(1.45)

|

|

Adjustment (as detailed above)

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

2.97

|

|

|

|

—

|

|

Non-GAAP net loss per common share - basic and diluted

|

|

|

|

$

|

(0.28)

|

|

|

$

|

(0.51)

|

|

|

|

$

|

(1.88)

|

|

|

$

|

(1.45)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use of Non-GAAP Financial Measures

The company supplements its condensed consolidated financial statements

presented on a GAAP basis by providing additional measures that are

considered “non-GAAP” financial measures under applicable SEC rules.

These non-GAAP financial measures are not prepared in accordance with

generally accepted accounting principles in the United States (GAAP) and

should not be viewed in isolation or as a substitute for GAAP net loss

and basic and diluted net loss per common share.

The company evaluates items on an individual basis, and considers both

the quantitative and qualitative aspects of the item, including (i) its

size and nature, (ii) whether or not it relates to the company’s ongoing

business operations, and (iii) whether or not the company expects it to

occur as part of its normal business on a regular basis. In the year

ended December 31, 2014, the company’s Non-GAAP net loss and Non-GAAP

net loss per common share – basic and diluted financial measures

excludes the in-process research and development expense of $220.8

million related to the purchase of the Sirna RNAi assets from Merck. The

company believes that the exclusion of this item provides management and

investors with supplemental measures of performance that better reflect

the underlying economics of the company’s business. In addition, the

company believes the exclusion of this item is important in comparing

current results with prior period results and understanding projected

operating performance. Management uses these non-GAAP financial measures

to establish budgets and operational goals and to manage the company’s

business.

|

|

|

ALNYLAM PHARMACEUTICALS, INC.

|

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

|

|

(In thousands, except share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

December 31,

|

|

|

|

|

|

2014

|

|

|

|

2013

|

|

Cash, cash equivalents and total marketable securities

|

|

|

|

$ 881,929

|

|

|

|

$ 350,472

|

|

Billed and unbilled collaboration receivables

|

|

|

|

39,937

|

|

|

|

4,248

|

|

Prepaid expenses and other current assets

|

|

|

|

9,739

|

|

|

|

3,910

|

|

Deferred tax assets

|

|

|

|

31,667

|

|

|

|

—

|

|

Property and equipment, net

|

|

|

|

21,740

|

|

|

|

16,448

|

|

Investment in equity securities of Regulus Therapeutics Inc.

|

|

|

|

94,583

|

|

|

|

45,452

|

|

Total assets

|

|

|

|

$ 1,079,595

|

|

|

|

$ 420,530

|

|

Accounts payable and accrued expenses

|

|

|

|

$ 38,791

|

|

|

|

$ 20,056

|

|

Deferred tax liabilities

|

|

|

|

31,667

|

|

|

|

—

|

|

Total deferred revenue

|

|

|

|

66,854

|

|

|

|

126,090

|

|

Total deferred rent

|

|

|

|

6,016

|

|

|

|

4,037

|

|

Total stockholders’ equity (77.2 million and 63.7 million common

shares issued and outstanding and at December 31, 2014 and December

31, 2013, respectively)

|

|

|

|

936,267

|

|

|

|

270,347

|

|

Total liabilities and stockholders' equity

|

|

|

|

$ 1,079,595

|

|

|

|

$ 420,530

|

|

|

|

|

|

|

|

|

|

|

This selected financial information should be read in conjunction with

the consolidated financial statements and notes thereto included in

Alnylam’s Annual Report on Form 10-K which includes the audited

financial statements for the year ended December 31, 2013.

CONTACT:

Alnylam Pharmaceuticals, Inc.

Cynthia Clayton,

617-551-8207

Vice President, Investor Relations and Corporate

Communications

or

Michael Mason, 617-551-8327

Vice President,

Finance and Treasurer

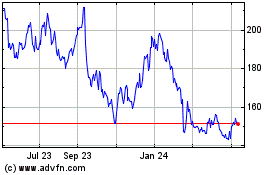

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Apr 2023 to Apr 2024